Comvita Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comvita Bundle

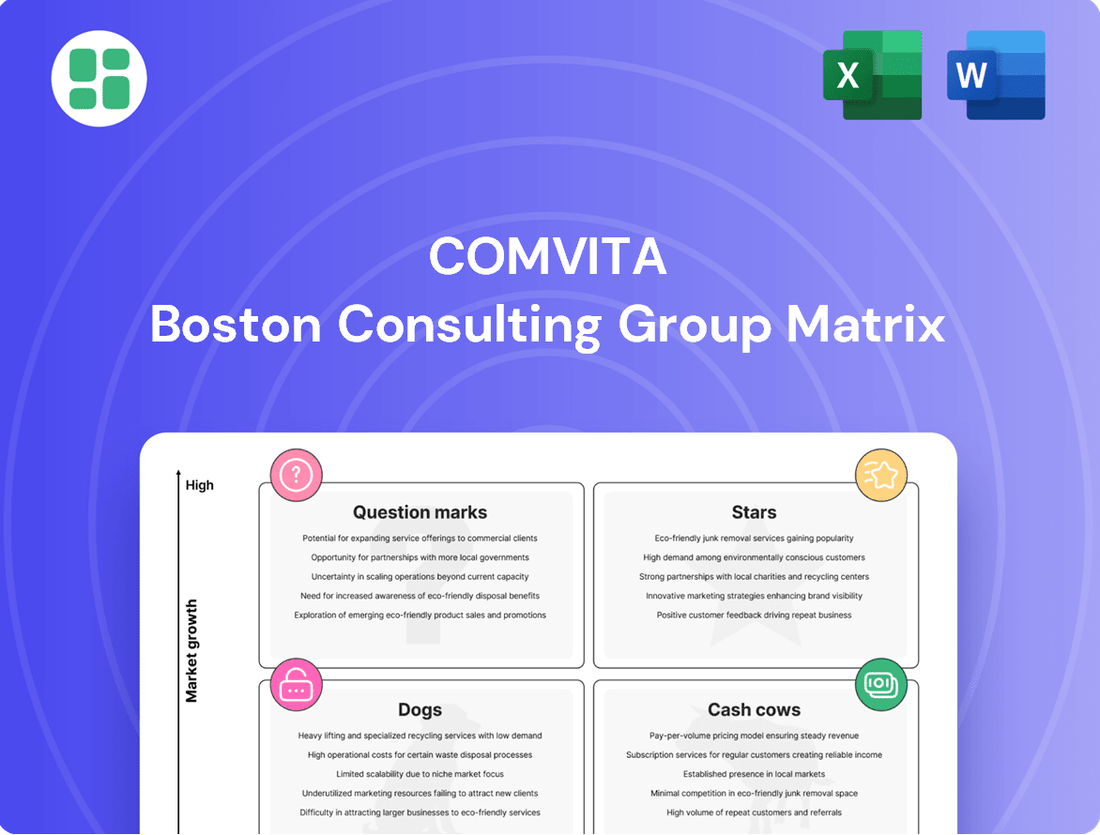

Curious about Comvita's product portfolio strength? This BCG Matrix preview highlights where their offerings sit in the market, but the full report unlocks the strategic insights you need to truly understand their competitive landscape.

Don't just see the quadrants, understand the implications. Purchase the complete Comvita BCG Matrix for a detailed breakdown of Stars, Cash Cows, Dogs, and Question Marks, along with actionable strategies to optimize your investments.

Unlock the full potential of Comvita's strategic positioning. The complete BCG Matrix provides the in-depth analysis and data-backed recommendations essential for making informed decisions and driving future growth.

Stars

Comvita's high UMF Manuka honey, especially UMF 15+ and higher, is a shining Star in their product lineup. This premium segment is booming globally. Consumers are increasingly recognizing the powerful health benefits, like its strong antibacterial and anti-inflammatory qualities. For example, the global Manuka honey market was valued at approximately USD 300 million in 2023 and is projected to grow significantly.

Manuka honey lozenges and throat sprays capitalize on Comvita's core strength in Manuka honey, offering convenient, health-oriented solutions. The market for natural remedies for colds, flu, and general immune support is experiencing robust growth, positioning these products favorably. Comvita's recent introduction of new Manuka Honey Lozenges underscores their commitment and strategic focus on this expanding category.

Comvita's Kids Health Range, featuring products like Kids Yummy Honey and soothing syrups, taps into a burgeoning market of parents prioritizing natural remedies for their children. This segment is experiencing robust growth, with parents increasingly looking for trusted, natural ingredients.

The demand for natural children's health products is on an upward trajectory. Comvita is strategically expanding its offerings with innovations like the MGO 50+ Multifloral Manuka Honey specifically formulated for kids, demonstrating a commitment to this niche.

By continuing to invest in targeted marketing and expanding its distribution channels to reach this key demographic, Comvita is well-positioned to capture significant market share within this expanding health-conscious children's products market. For instance, the global natural and organic personal care market, which includes children's products, was valued at over $20 billion in 2023 and is projected to grow substantially.

Manuka Drops and Convenient Single-Serve Packs

Comvita's introduction of Manuka Drops and single-serve UMF 5+ Manuka Honey packs directly addresses the growing demand for convenient wellness solutions. These products are designed for consumers seeking on-the-go health benefits, expanding Manuka honey's appeal beyond its traditional uses.

This strategic move aims to capture new market segments by offering accessibility and ease of use. By integrating Manuka honey into daily routines and functional snacking, Comvita can drive increased consumption frequency.

- Market Penetration: The convenient packs allow Comvita to reach consumers who may not have previously incorporated Manuka honey into their daily lives due to perceived inconvenience.

- Product Diversification: Manuka Drops and single-serve packs represent an expansion of Comvita's product portfolio, targeting impulse buys and the growing functional food market.

- Accessibility: Offering UMF 5+ in smaller, more affordable single-serve units lowers the barrier to entry for new customers.

Strategic Regional Growth (e.g., North America)

Comvita's North American market is showing promising signs of expansion. Despite broader sales headwinds, the region experienced a robust 12% sales increase in the first half of fiscal year 2025. This growth was further bolstered by a significant customer acquisition in January 2025, demonstrating Comvita's ability to regain momentum in key markets.

The company is strategically prioritizing investments in North America, aiming to capitalize on this emerging growth opportunity. This focus is designed to capture a larger share of the market and solidify Comvita's presence. Continued dedication to this region could transform it into a substantial engine for future company growth.

- North American Sales Growth: 12% increase in HY FY25.

- Key Market Re-engagement: Major customer win in January 2025.

- Strategic Investment Focus: Active investment to increase market share.

- Growth Potential: North America poised to become a significant growth driver.

Comvita's high UMF Manuka honey, particularly UMF 15+ and above, represents a significant Star. The global Manuka honey market, valued at approximately USD 300 million in 2023, is experiencing robust growth driven by consumer awareness of its health benefits. This premium segment is a key revenue driver for Comvita.

Manuka honey lozenges and throat sprays are also Stars, leveraging Comvita's core expertise. The natural remedies market for immune support is expanding rapidly. Comvita's recent product innovations in this area highlight their strategic focus on these high-potential offerings.

Comvita's Kids Health Range, including specialized honey and syrups, taps into the growing demand for natural children's health products. The global natural and organic personal care market, which includes children's items, exceeded $20 billion in 2023. Comvita's targeted products like MGO 50+ Multifloral Manuka Honey for kids are well-positioned to capture this market.

The North American market is a developing Star for Comvita, showing strong growth with a 12% sales increase in the first half of fiscal year 2025. A significant customer acquisition in January 2025 further solidified this positive trend. Strategic investments in this region are expected to drive substantial future growth.

| Product Category | BCG Matrix Status | Key Growth Drivers | Recent Performance Data |

|---|---|---|---|

| High UMF Manuka Honey (UMF 15+) | Star | Increasing consumer awareness of health benefits, premiumization trend | Global Manuka honey market ~USD 300M (2023), growing |

| Manuka Honey Lozenges & Throat Sprays | Star | Demand for natural remedies, convenient health solutions | Comvita expanding product line |

| Kids Health Range | Star | Parental preference for natural ingredients, growing children's wellness market | Global natural/organic personal care market >$20B (2023), growing |

| North American Market | Star | Strategic investment, market re-engagement | 12% sales growth HY FY25, key customer acquisition Jan 2025 |

What is included in the product

The Comvita BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

A clear, visual BCG matrix for Comvita's portfolio helps identify underperforming products, easing the pain of resource misallocation.

Cash Cows

Core UMF 5+ and UMF 10+ Manuka honey are Comvita's established cash cows. These grades likely command a significant market share within the mature Manuka honey sector, generating reliable cash flow with comparatively modest marketing expenditures. For instance, in the fiscal year ending June 30, 2023, Comvita reported a 10% increase in their New Zealand Honey revenue, underscoring the consistent demand for these core products.

UMF 5+ Manuka honey, in particular, benefits from its widespread availability and accessible price point, positioning it as a foundational product for many consumers. This broad appeal ensures a steady sales volume, contributing significantly to Comvita's overall financial stability. The company's continued focus on these established grades reflects their role as dependable revenue generators.

Comvita's established Manuka honey presence in China, despite current economic headwinds, represents a significant cash cow. The company holds a commanding approximately 50% market share, solidifying its position as the leading Manuka honey brand in this crucial market.

While consumer sentiment in China has seen recent dips, Comvita's enduring market leadership points to a mature and robust revenue stream. This strong, established position historically generates substantial cash flow, underscoring its cash cow status within the BCG matrix.

Comvita's strategic focus is on stabilizing this vital market and effectively utilizing its established omni-channel capabilities. This approach aims to maintain and potentially grow its dominant share, ensuring continued strong cash generation from this mature segment.

Comvita's propolis products, such as oral sprays and lozenges, represent established offerings in the bee-related health sector. These are likely mature products, benefiting from stable demand and Comvita's strong brand presence in the natural health market.

The consistent cash flow generated by these propolis products is a significant advantage, supported by Comvita's extensive distribution networks. The company's history of donating these items also suggests a reliable and consistent supply chain.

Medihoney Wound Gel

Medihoney Wound Gel, a specialized medical-grade Manuka honey product, fits the Cash Cow quadrant of the BCG Matrix. It targets a niche but well-established market within the pharmaceutical and healthcare industries, where its proven efficacy for wound healing is highly valued.

This product likely commands a significant market share within its specific segment, contributing consistent, stable cash flows. While growth may be moderate, its established position ensures reliable revenue generation for Comvita.

- Market Position: High market share in the specialized wound care segment.

- Growth Rate: Moderate to low market growth, typical for established medical products.

- Cash Flow Generation: Generates substantial and stable cash flow due to its established demand and recognized efficacy.

- Strategic Implication: Funds can be reinvested into other business units or returned to shareholders.

Olive Leaf Extract (Established Market Presence)

Comvita's Olive Leaf Extract products reside in the natural health and supplement market. This segment, while not experiencing explosive growth, offers stable demand. Comvita benefits from a well-established market presence and robust distribution channels for these offerings.

These established products are key revenue generators, contributing consistent cash flow for Comvita. The company's strong brand recognition in the natural health space further solidifies its position.

- Market Segment: Natural Health and Supplements

- Growth Rate: Moderate

- Comvita's Position: Established market presence and distribution

- Financial Contribution: Consistent revenue and cash flow generation

Comvita's core UMF 5+ and UMF 10+ Manuka honey products are definitive cash cows. These grades, holding substantial market share in a mature sector, reliably generate cash with minimal marketing spend. For the fiscal year ending June 30, 2023, Comvita saw a 10% rise in New Zealand Honey revenue, confirming sustained demand for these foundational offerings.

The Chinese market for Comvita's Manuka honey, despite recent economic fluctuations, functions as a significant cash cow. With an approximate 50% market share, Comvita remains the dominant brand in this critical region, indicating a robust and mature revenue stream that historically provides substantial cash flow.

Comvita's propolis products, including oral sprays and lozenges, are established players in the bee-derived health sector. These products benefit from stable demand and Comvita's strong brand reputation, contributing consistent cash flow through extensive distribution networks.

Medihoney Wound Gel, a specialized medical-grade product, operates as a cash cow by serving a niche but established wound care market. Its recognized efficacy ensures a consistent and stable cash flow, with moderate growth typical for such established medical products.

Comvita's Olive Leaf Extract products are positioned within the natural health and supplements market. While this segment exhibits moderate growth, Comvita's established presence and distribution channels ensure these products act as consistent revenue generators and cash cows.

| Product Category | BCG Matrix Quadrant | Key Characteristics | Financial Contribution | Market Dynamics |

| UMF 5+/10+ Manuka Honey | Cash Cow | High market share, mature market, low marketing spend | Reliable, consistent cash flow | Mature market, stable demand |

| Manuka Honey (China Market) | Cash Cow | Dominant market share (approx. 50%), established brand | Substantial and stable cash generation | Mature market, economic headwinds impacting sentiment |

| Propolis Products | Cash Cow | Established offerings, strong brand presence | Consistent cash flow, stable demand | Natural health sector, extensive distribution |

| Medihoney Wound Gel | Cash Cow | Niche medical market, proven efficacy | Stable cash flows, moderate growth | Established medical product segment |

| Olive Leaf Extract Products | Cash Cow | Established presence, robust distribution | Consistent revenue and cash flow | Natural health/supplements, moderate growth |

Preview = Final Product

Comvita BCG Matrix

The Comvita BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report ready for your strategic planning. You're not looking at a mockup; this is the actual Comvita BCG Matrix file, complete with all insights and ready for immediate use upon acquisition. Once purchased, this comprehensive document will be yours to edit, present, or integrate into your business strategy without any further modifications required. It's designed to provide immediate value and clarity for your business decision-making processes.

Dogs

Within Comvita's diverse portfolio, certain niche honey blends and gourmet honey offerings might be classified as Dogs. These products operate in low-growth or highly saturated niche markets, struggling to capture significant market share. For instance, if a specific artisanal lavender honey blend, despite its premium positioning, shows minimal sales growth and faces intense competition from other specialty food producers, it could fall into this category.

These underperforming niche products often represent a drain on resources, including marketing spend and inventory management, without generating substantial returns. Comvita's 2024 financial reports, for example, might highlight specific gourmet lines that have seen declining sales or stagnant growth, indicating a need for strategic evaluation.

Discontinued or low-demand SKU variants within Comvita's product portfolio would be categorized as Dogs in the BCG Matrix. These are items that have seen a significant drop in consumer interest or have proven to be unprofitable, leading to their streamlining or complete removal from the market. For instance, Comvita has historically focused on optimizing its product offerings to enhance efficiency and profitability, a process that naturally involves phasing out underperforming SKUs.

Comvita's decision to close its UK and EU subsidiaries, moving to a distributor model, signals a strategic retreat from direct operations in these regions. This move is driven by financial challenges and a desire to simplify its global footprint.

Products that were heavily reliant on these now-closed direct sales channels in the UK and EU would likely be classified as Dogs. These are items that faced low growth and Comvita's own limited market share in these specific areas.

This divestment strategy aims to cut losses and reallocate resources to more promising markets. For instance, in 2024, Comvita reported a decline in European sales, prompting this operational restructuring.

Early Stage, Unsuccessful Diversification Attempts

Comvita's strategic evolution includes past ventures into diversification that didn't quite hit the mark. These were typically product lines outside their established strengths in bee products and olive leaf extract. For instance, attempts to expand into unrelated health supplements or personal care items struggled to find a solid footing in the market.

These initiatives often found themselves in stagnant or declining market segments with minimal market share, indicating a lack of strong product-market fit. The company's current strategic direction clearly prioritizes reinforcing its leadership in core bee-related categories, such as Manuka honey, where it holds significant brand equity and market presence.

- Past diversification efforts outside core bee and olive leaf extract products have been scaled back due to limited market traction.

- These ventures typically represented low-growth, low-market-share scenarios lacking robust product-market fit.

- Comvita's current strategy emphasizes strengthening its position in its core, high-value bee product segments.

High-Cost, Low-Volume Specialty Bee Products

High-Cost, Low-Volume Specialty Bee Products represent a potential challenge within Comvita's product portfolio, fitting into the question mark or even dog category of the BCG matrix. These are items that demand substantial investment, whether for unique sourcing methods or specialized processing, yet they cater to a niche audience. Consequently, their sales volume remains low, and they struggle to capture significant market share.

For instance, consider products like rare propolis extracts or highly specialized royal jelly formulations. These might require extensive research and development, coupled with limited availability of the raw materials, driving up production costs. In 2024, the global market for specialty bee products, while growing, is still relatively small compared to honey or standard propolis. For example, the market for propolis, a broader category, was valued at approximately USD 750 million in 2023, but highly specialized extracts within that would represent a fraction of this, with growth rates potentially lower than the overall market.

- High Investment, Low Return: These products necessitate significant capital expenditure for sourcing, extraction, and quality control, often without a guaranteed return due to limited consumer demand.

- Niche Market Appeal: The target audience for these specialty items is typically very small, comprising enthusiasts or those with specific health needs, restricting scalability.

- Profitability Concerns: Without achieving economies of scale, the high production costs can easily outweigh the revenue generated from low sales volumes, potentially leading to losses.

- Strategic Re-evaluation: Comvita might need to assess whether to divest these products, invest further to broaden their appeal, or find innovative ways to reduce costs and increase market penetration in 2024 and beyond.

Products categorized as Dogs within Comvita's portfolio are those with low market share in low-growth markets. These are often legacy products or those that failed to gain traction after diversification attempts. For instance, Comvita's 2024 financial performance may show specific niche honey varieties or discontinued product lines that are no longer contributing significantly to revenue and are consuming resources without generating adequate returns. These items require careful management, potentially leading to divestment or discontinuation to optimize the overall product mix and improve profitability.

Question Marks

Comvita's exploration into bee welfare and Manuka tree benefits signifies a move beyond traditional honey and propolis. This advanced research could lead to new product lines focusing on bee-derived compounds or sustainable ecosystem management.

If these nascent product lines emerge, they would likely be positioned as question marks within the BCG matrix. This is due to their presence in potentially high-growth health innovation sectors but with currently low market share, requiring significant investment to capture market potential.

Expansion into new geographic markets with low penetration, where Comvita currently has minimal brand recognition and distribution, would place its initial product sales in these regions as Question Marks. These markets represent a significant growth opportunity, but achieving market share necessitates substantial upfront investment in marketing, distribution, and establishing consumer trust.

For instance, in 2024, Comvita's strategic focus on emerging markets in Southeast Asia, such as Vietnam and Indonesia, exemplifies this approach. These regions exhibit a growing middle class with increasing disposable income and a rising interest in health and wellness products, aligning with Comvita's core offerings. The company's investment in building local partnerships and tailored marketing campaigns in these areas aims to overcome the initial low penetration and cultivate brand loyalty.

High-potency Manuka honey, especially UMF 20+ and above, represents a potential star product for Comvita. Its development for niche health applications like targeted therapies and advanced nutraceuticals taps into a rapidly expanding market. For instance, the global Manuka honey market was valued at approximately USD 460 million in 2023 and is projected to grow significantly, with high-potency varieties driving this expansion.

Sustainability-Driven Product Lines

Sustainability-driven product lines, such as Comvita's potential 'carbon-neutral honey' or products with unique eco-certifications, would likely be categorized as Stars or Question Marks within the BCG Matrix. These initiatives align with Comvita's significant investments in sustainability, including carbon neutrality goals and native tree planting. The market for genuinely sustainable products is experiencing robust growth, with global sustainable product sales projected to reach over $150 billion by 2024.

- Stars: If Comvita successfully launches and markets these products, capturing significant market share in a rapidly expanding eco-conscious consumer segment, they could emerge as Stars.

- Question Marks: Alternatively, if these new lines require substantial investment to build consumer awareness and adoption in a competitive market, they might initially be classified as Question Marks.

- Market Growth: The increasing consumer demand for ethically sourced and environmentally friendly products, evidenced by a 10% year-over-year growth in the sustainable goods sector, positions these potential product lines for significant upside.

Personal Care/Cosmetic Products with Manuka Honey Base (if limited market share)

Personal care and cosmetic products featuring a Manuka honey base, especially if Comvita holds a limited market share in this segment, would likely be classified as Question Marks within the BCG Matrix. The natural cosmetics market is indeed experiencing robust growth, with global sales projected to reach over $54 billion by 2027, indicating significant opportunity. However, Comvita's current smaller presence in this competitive space means these products require substantial investment in marketing and innovation to gain traction and potentially evolve into Stars.

- Market Position: Limited market share in the growing natural cosmetics sector.

- Growth Potential: High growth in the natural cosmetics market.

- Investment Needs: Significant investment required for marketing and product differentiation.

- Strategic Goal: To transition from Question Mark to Star through increased market penetration.

Question Marks for Comvita represent ventures with high growth potential but currently low market share. These are often new product categories or expansions into underdeveloped markets where significant investment is needed to build brand awareness and distribution. For instance, Comvita's foray into specialized bee venom products, targeting the premium wellness market, would likely start as a Question Mark. This sector, while growing, demands substantial R&D and marketing to compete effectively.

The company's strategic expansion into new international territories, where its brand recognition is minimal, also places these initial sales efforts in the Question Mark category. These markets offer substantial long-term growth prospects but require considerable upfront capital for market entry and consumer education. For example, Comvita's 2024 focus on building its presence in markets like South Korea, with its rapidly expanding health supplement sector, fits this profile. The success hinges on effectively navigating local regulations and consumer preferences.

These ventures require careful analysis to determine if they can capture sufficient market share to become Stars. Comvita's investment in these areas in 2024 is crucial for their future performance. The company must strategically allocate resources to nurture these nascent businesses, aiming to convert their high growth potential into market leadership.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.