Comvita Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comvita Bundle

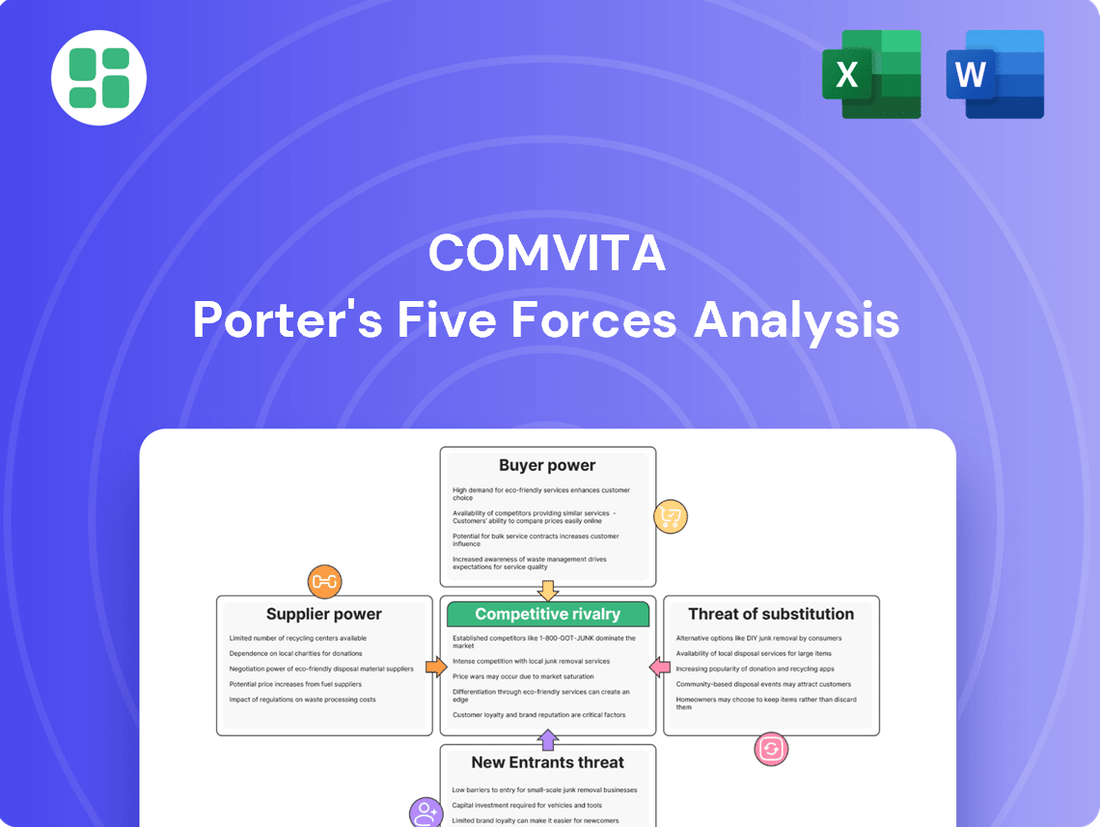

Comvita, a leader in the health and wellness sector, faces a dynamic competitive landscape shaped by several key forces. Understanding the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for strategic planning. This brief overview only scratches the surface of these intricate relationships.

Unlock the full Porter's Five Forces Analysis to explore Comvita’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the knowledge to navigate this complex industry.

Suppliers Bargaining Power

The bargaining power of suppliers in the New Zealand honey industry, especially for Manuka honey, is significantly influenced by the concentration of beekeepers. This concentration means a smaller group of suppliers holds sway over the raw material.

Data from 2019 onwards indicates a concerning trend: beekeeping enterprises have seen a 15% annual decline, and hive numbers have dropped by 10% each year. This shrinking supplier base suggests an increasing ability for beekeepers to negotiate better terms with honey processors like Comvita, as the demand for their product remains high.

The unique sourcing of Manuka honey, Comvita's cornerstone product, significantly bolsters supplier bargaining power. This special honey originates predominantly from New Zealand and select Australian regions, creating a geographically constrained and inherently scarce raw material. This scarcity naturally elevates the leverage held by beekeepers and landowners who manage access to the crucial Manuka trees. For instance, in 2024, the global demand for authentic Manuka honey continued to outstrip supply, with prices for high-grade UMF certified honey remaining robust, reflecting the limited availability and specialized production required.

Comvita faces substantial switching costs when considering alternative beekeepers or raw material sources for its Manuka honey. These costs encompass rigorous quality assurance protocols, intricate supply chain reconfigurations, and the critical need to preserve the authenticity and traceability of its premium product. For instance, establishing new supplier relationships requires extensive vetting and testing to meet Comvita's high standards, a process that can delay production and increase operational expenses.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while not a dominant force, presents a potential challenge for companies like Comvita. Imagine large beekeeping operations or honey cooperatives deciding to process and market their own Manuka honey. This would allow them to bypass intermediaries and potentially capture more of the value chain.

Such a move would significantly reduce their dependence on existing buyers and bolster their negotiating power. If these suppliers could establish direct-to-consumer sales, their leverage would increase even further. The current market dynamics, including potential oversupply in the Manuka honey sector, might actually encourage some suppliers to explore these integration strategies.

- Potential for Supplier Integration: Large beekeeping operations or cooperatives could move into processing and branding.

- Increased Bargaining Power: Direct sales channels would enhance supplier negotiation leverage.

- Market Incentives: Industry challenges and oversupply could drive forward integration.

Impact of Industry-Specific Regulations

Changes in Manuka honey testing requirements by New Zealand's Ministry for Primary Industries (MPI) have directly affected beekeeper profitability. For instance, the introduction of stricter testing protocols in recent years has increased operational costs for producers, with some reporting a significant drop in their effective earnings per kilogram of honey. This has, at times, led to an oversupply as struggling beekeepers sought to offload stock, temporarily weakening their bargaining power.

However, the regulatory environment remains dynamic. Ongoing discussions and potential new legislation concerning natural health products, which could encompass Manuka honey, hold the potential to significantly alter supplier dynamics. If new regulations lead to higher barriers to entry or increased compliance costs for processors, this could ultimately bolster the bargaining power of beekeepers who can meet these new standards.

- Stricter Testing: Elevated compliance costs due to MPI's Manuka honey testing requirements have pressured beekeeper margins.

- Price Volatility: Increased supply from struggling beekeepers has, in some periods, driven down wholesale honey prices, diminishing supplier leverage.

- Regulatory Evolution: Future legislation for natural health products may introduce new compliance burdens, potentially shifting bargaining power back towards compliant beekeepers.

The bargaining power of suppliers in the Manuka honey sector is substantial, driven by limited supply and unique sourcing. Beekeeper numbers have declined significantly, with enterprises dropping 15% annually and hive numbers falling 10% each year since 2019, creating scarcity. This scarcity, coupled with high global demand for authentic Manuka honey, allows beekeepers to negotiate favorable terms, as evidenced by robust prices for UMF certified honey in 2024.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration | High | 15% annual decline in beekeeping enterprises, 10% annual drop in hive numbers (since 2019). |

| Product Uniqueness & Scarcity | High | Manuka honey sourced predominantly from NZ/Australia; robust prices for UMF certified honey in 2024 due to limited availability. |

| Switching Costs for Comvita | High | Rigorous quality assurance, supply chain reconfiguration, and traceability needs make changing suppliers difficult and costly. |

| Threat of Forward Integration | Moderate | Potential for large cooperatives to process and market their own honey, increasing their leverage. |

| Regulatory Environment | Variable | Stricter MPI testing increased beekeeper costs, sometimes leading to oversupply and reduced leverage; future regulations could shift power. |

What is included in the product

This analysis dissects Comvita's competitive environment by examining the intensity of rivalry, the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, providing strategic insights into its market position.

Quickly identify and address competitive threats with a visual breakdown of Comvita's industry landscape, enabling proactive strategy adjustments.

Customers Bargaining Power

Comvita's premium products, like its renowned Manuka honey, position it in a segment where customers can be quite sensitive to price, especially when economic conditions tighten and people have less discretionary income. This sensitivity is amplified when competitors engage in aggressive, short-term price reductions, directly challenging Comvita's established pricing strategies.

For instance, in the fiscal year ending 2023, Comvita reported a net profit after tax of NZ$14.5 million, a figure that can be significantly impacted by shifts in customer price perception and competitor pricing actions. The company’s reliance on the premium positioning of Manuka honey means that any sustained pressure on pricing due to customer sensitivity or competitive tactics could directly affect its profitability and market share.

The bargaining power of customers is significantly influenced by the availability of substitutes. For Comvita, customers have a wide array of options for general health and wellness. This includes various types of honey from different producers, a broad spectrum of dietary supplements targeting specific health needs, and even pharmaceutical products that offer similar health benefits.

However, this landscape is nuanced. While substitutes exist, the growing consumer preference for natural and organic products actually bolsters demand for Comvita's specialized offerings, particularly its Manuka honey. In 2024, the global natural and organic food market was projected to reach over $350 billion, indicating a strong consumer trend that Comvita is well-positioned to capitalize on, despite the general availability of alternatives.

Customer concentration can significantly impact a company's bargaining power. For Comvita, a global distributor of health and wellness products, reliance on a few major retail or distribution partners presents a clear risk. Losing a key customer, such as the experience in North America during FY24, highlights how dependent Comvita can be on these relationships.

While Comvita's direct-to-consumer sales offer some diversification, the loss of a major distribution partner in a key market like North America in FY24 underscores the substantial leverage large retailers and distributors possess. This concentration means that these powerful customers can negotiate more favorable terms, potentially squeezing Comvita's margins and impacting its overall profitability.

Information Availability and Product Differentiation

Consumers now have unprecedented access to information, readily comparing product ingredients, benefits, and crucial certifications such as the UMF/MGO ratings for Manuka honey. This transparency significantly boosts their bargaining power.

Comvita must therefore continuously highlight its extensive scientific research, stringent quality control processes, and established brand reputation. These efforts are vital to justify its premium pricing strategies and effectively differentiate itself in a crowded marketplace.

For instance, in the fiscal year ending June 30, 2023, Comvita reported revenue of NZ$194.1 million, with its premium Manuka honey products forming a significant portion. The ability of consumers to easily compare the MGO content and UMF certification of Comvita's products against those of other brands directly influences their purchasing decisions and willingness to pay a premium.

- Information Accessibility: Consumers can easily find details on Manuka honey's MGO levels and UMF certifications online.

- Price Sensitivity: Increased information empowers consumers to shop around, potentially driving down prices for less differentiated honey products.

- Brand Differentiation: Comvita's investment in scientific validation and brand building, evidenced by its consistent financial reporting, is crucial for maintaining customer loyalty and premium pricing.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large retailers and distributors, poses a significant concern. While individual consumers are unlikely to integrate backward, major players in the retail space could potentially bypass established brands like Comvita by sourcing raw materials directly. This allows them to develop their own private label honey or natural health products.

This strategy can reduce their dependence on existing suppliers, especially for products that are perceived as more commoditized within the natural health sector. For example, a large supermarket chain might decide to partner directly with beekeepers to secure a consistent supply of raw honey, subsequently launching it under their own brand at a more competitive price point.

Consider the market dynamics: In 2024, private label brands continued to gain market share across various consumer goods categories, including health and wellness. This trend suggests that the incentive for large retailers to explore backward integration for profitable product lines remains strong, potentially impacting the margins and market position of companies like Comvita.

- Retailer Private Label Growth: In 2024, private label sales in the grocery sector saw continued growth, with some categories exceeding 20% market share, indicating a strong customer willingness to purchase store-branded alternatives.

- Sourcing Capabilities: Large distributors often possess the logistical infrastructure and international reach to source raw ingredients directly, diminishing the need for intermediaries.

- Cost Advantage: By cutting out brand markups and marketing expenses, retailers can offer private label products at a lower price, directly competing with established brands.

- Brand Loyalty Erosion: For less differentiated products, the threat is higher as consumers may switch to cheaper private label options if the perceived value of the branded product diminishes.

Comvita's customers possess significant bargaining power, particularly due to the availability of substitutes and increasing price sensitivity. While Comvita leverages its premium Manuka honey, the broader health and wellness market offers numerous alternatives. In 2024, the global natural and organic food market, projected to exceed $350 billion, shows consumer interest but also a vast competitive landscape where price remains a factor.

Customer concentration is another key driver of their power. Comvita experienced this directly in FY24 with a loss in North America, highlighting how reliance on major distributors can lead to unfavorable negotiations and margin pressure. These large partners can leverage their volume to demand better terms, impacting Comvita's profitability.

Information accessibility further empowers customers. With readily available data on Manuka honey's MGO and UMF certifications, consumers can easily compare offerings, diminishing the perceived uniqueness of premium brands. Comvita's revenue of NZ$194.1 million in FY23 relies on justifying its premium, a task made harder by informed consumers.

The threat of backward integration by large retailers also looms. As private label brands gained market share in 2024, retailers have a strong incentive to source directly, bypassing brands like Comvita to offer lower-priced alternatives. This can directly compete with Comvita's offerings and erode its market position.

Same Document Delivered

Comvita Porter's Five Forces Analysis

This preview showcases the complete Comvita Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the health and wellness sector. You are viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The Manuka honey and broader natural health sectors are teeming with competition. Numerous specialized Manuka honey brands, such as Manuka Health New Zealand, Wedderspoon Organic, and Manuka Doctor, directly vie for market share. Beyond these, a wide array of natural health companies also compete, offering alternative wellness products and further fragmenting the competitive landscape.

The natural health products market is booming, expected to hit $250 billion in 2025 and surge to $400 billion by 2033. Within this, Manuka honey is also seeing strong growth, with a projected compound annual growth rate of 5.25% between 2025 and 2033. This indicates a generally favorable environment for companies in this sector.

However, the New Zealand honey industry, a key player in Manuka honey, has recently contended with oversupply issues. This has led to a downturn in export demand in recent years, creating a more challenging competitive landscape despite the overall market's positive trajectory.

Comvita distinguishes itself with its emphasis on premium Manuka honey, backed by extensive scientific research and stringent quality control, including its own government-recognized laboratory. This focus aims to build strong brand loyalty among consumers seeking high-quality, traceable products.

Despite Comvita's premium positioning, the competitive landscape is marked by aggressive price promotions from rivals, especially in key markets like China. This intense price competition challenges brand loyalty, particularly for those Manuka honey products that offer less distinct differentiation.

High Fixed Costs and Exit Barriers

The natural health and honey sectors often demand substantial upfront investments. Think about the costs associated with owning and maintaining apiaries, setting up sophisticated manufacturing plants, funding ongoing research and development for new products, and building extensive global distribution channels. These significant fixed costs act as powerful exit barriers.

Because of these high fixed costs, companies are often compelled to stay in the market, even when facing economic slowdowns or periods of reduced profitability. This persistence helps to maintain a high level of competitive intensity, as businesses are reluctant to abandon their substantial investments.

- High Capital Expenditure: Establishing and maintaining apiaries, processing facilities, and R&D centers requires significant capital. For instance, a large-scale honey producer might invest millions in specialized extraction and bottling equipment.

- R&D Investment: Companies like Comvita invest heavily in research to validate the health benefits of their products, which can run into millions annually.

- Global Supply Chain Costs: Building and managing a global distribution network involves substantial costs for logistics, warehousing, and marketing across different regions.

Strategic Importance of the Industry

The Manuka honey industry holds significant strategic importance for New Zealand, with a national goal to double its export value by 2030. This ambition fuels intense competition as companies strive for market dominance and premium brand positioning within this high-value sector.

Industry-wide efforts to enhance quality and traceability further intensify rivalry. Companies are investing heavily in research and development, as well as marketing, to capture a larger share of the growing global demand for authentic Manuka honey. For instance, New Zealand's Manuka honey exports were valued at NZ$477 million in the year ended June 2023, highlighting the economic stakes involved.

- Strategic National Goal: New Zealand aims to double Manuka honey export value by 2030, creating a high-stakes environment for industry players.

- Intensified Competition: Companies actively compete for market share and premium positioning, driven by the industry's high-value nature.

- Investment in Quality: Industry initiatives focusing on quality and traceability lead to increased investment in R&D and marketing, further fueling rivalry.

Competitive rivalry in the Manuka honey sector is fierce, with numerous specialized brands like Manuka Health and Wedderspoon directly challenging Comvita. This intense competition is further amplified by a broad range of natural health companies offering alternative wellness products, fragmenting the market and increasing the pressure on market share.

Despite the overall growth in the natural health market, projected to reach $400 billion by 2033, the New Zealand honey industry has faced oversupply issues, leading to a recent downturn in export demand. This dynamic creates a challenging environment where aggressive price promotions, particularly in markets like China, can erode brand loyalty, especially for less differentiated products.

High capital expenditures for apiaries, processing, and R&D, alongside significant investments in quality and traceability, act as substantial barriers to exit. This means companies often remain in the market even during downturns, perpetuating a high level of competitive intensity. For instance, New Zealand's Manuka honey exports were valued at NZ$477 million in the year ended June 2023, underscoring the economic stakes driving this rivalry.

SSubstitutes Threaten

Consumers looking for sweeteners have a vast array of choices beyond specialized honeys. Standard table sugar remains a dominant and inexpensive alternative. Furthermore, the market is flooded with artificial sweeteners like aspartame and sucralose, offering zero-calorie options that appeal to health-conscious individuals. In 2024, the global sugar market alone was valued in the hundreds of billions of dollars, illustrating the sheer scale of these competing products.

For Comvita's natural health products, the threat of substitutes is equally significant. Consumers can turn to a broad spectrum of dietary supplements, from vitamin C tablets to probiotic capsules, to address wellness needs. Herbal remedies and readily available over-the-counter medications also offer alternative paths to health management. This diverse landscape means Comvita's products compete not just with other honey brands, but with the entire wellness industry.

The threat of substitutes for Comvita is significant, especially concerning the price-performance trade-off. Many consumers can opt for generic honey or synthetic health supplements that are considerably cheaper than Comvita's premium Manuka honey and specialized natural health products.

For instance, while Manuka honey is recognized for its unique antibacterial properties, consumers might choose less expensive alternatives if the perceived health benefits don't justify the premium price, a tendency that can increase during economic downturns.

In 2024, global honey prices saw fluctuations, with some reports indicating a rise in the cost of raw honey, potentially widening the price gap between premium Manuka and more common varieties, thereby amplifying the appeal of cheaper substitutes.

Customer switching costs are a key factor in Comvita's industry. For many natural health products, including honey, these costs are typically quite low. This means consumers can readily explore different brands or even switch to entirely different types of health supplements without facing much hassle or a significant financial burden.

In 2024, the ease with which consumers can switch brands or product categories is a significant driver of competition. For instance, a consumer might easily switch from a Manuka honey product to another type of honey or a different health supplement if they perceive better value or a more appealing offering from a competitor. This low barrier to switching directly amplifies the threat of substitutes for Comvita.

Perceived Value and Efficacy of Substitutes

The increasing consumer focus on health and wellness fuels demand for natural products, but this is tempered by misinformation and a lack of robust scientific backing for some offerings. This creates an opening for substitutes.

If consumers view less costly alternatives, whether natural or pharmaceutical, as equally effective for their health goals, the threat of substitutes escalates significantly. For instance, in the digestive health market, consumers might opt for over-the-counter antacids or probiotics with more widely recognized efficacy over niche natural remedies.

- Consumer Health Awareness: Growing global interest in wellness, with the global health and wellness market valued at over $4.5 trillion in 2023, drives demand for natural alternatives.

- Efficacy Perception: Consumers weigh perceived effectiveness and cost. If a substitute offers similar perceived benefits at a lower price point, it becomes more attractive.

- Information Landscape: Misinformation regarding the efficacy of certain natural products can lead consumers to seek out alternatives with clearer scientific validation or established pharmaceutical backing.

Regulatory Environment for Natural Health Products

The regulatory environment for natural health products, including Manuka honey, presents a significant threat of substitutes for Comvita. As of 2024, regulatory bodies worldwide, such as the TGA in Australia and the FDA in the United States, are increasingly scrutinizing health claims made for natural products. This evolving landscape means that Comvita must ensure its marketing and product claims align with stringent guidelines, which could potentially limit its ability to highlight the unique benefits of Manuka honey compared to other health supplements or even conventional medicines.

Stricter regulations on health claims could diminish Comvita's competitive advantage. For instance, if regulations restrict the ability to make specific therapeutic claims for Manuka honey's antibacterial properties, it becomes harder to differentiate from other natural remedies or even synthetic alternatives that might be able to make more direct health claims. This could lead consumers to view Manuka honey as less potent or unique, thereby increasing the attractiveness of substitutes.

- Increased scrutiny of health claims: Regulatory bodies are tightening rules on substantiating health benefits, impacting marketing for natural products.

- Potential for claim restrictions: If Comvita faces limitations on what it can claim about Manuka honey's properties, its differentiation from substitutes weakens.

- International regulatory divergence: Navigating different regulatory standards across key markets (e.g., New Zealand, Australia, US, EU) adds complexity and potential barriers.

- Impact on consumer perception: Unclear or restricted claims can confuse consumers and make substitutes with more straightforward marketing appear more appealing.

The threat of substitutes for Comvita is substantial, as consumers have numerous affordable alternatives like table sugar, artificial sweeteners, and a wide range of dietary supplements. In 2024, the global sugar market's immense valuation underscores the scale of these competing products, while the broader wellness industry offers a vast array of health solutions that directly challenge Comvita's natural health products.

Low switching costs mean consumers can easily opt for cheaper generic honey or synthetic supplements if Comvita's premium pricing isn't justified by perceived benefits, a trend amplified by fluctuating honey prices in 2024. This ease of switching directly heightens the impact of substitutes.

The perception of efficacy versus cost is crucial; if cheaper alternatives are seen as equally effective, their appeal grows. Misinformation within the wellness sector further complicates this, potentially driving consumers towards substitutes with clearer scientific backing.

Regulatory scrutiny of health claims, particularly in 2024, poses a challenge. Restrictions on what Comvita can claim about Manuka honey's unique properties could weaken its differentiation, making substitutes with more direct marketing more attractive.

| Substitute Category | Examples | Key Differentiator | 2024 Market Context |

|---|---|---|---|

| Sweeteners | Table Sugar, Artificial Sweeteners | Price, Calorie Content | Global sugar market valued in hundreds of billions USD |

| Dietary Supplements | Vitamins, Probiotics, Herbal Remedies | Specific Health Benefits, Perceived Efficacy | Global Health & Wellness Market > $4.5 Trillion (2023) |

| Other Honeys | Generic Honey Varieties | Price, Availability | Fluctuating raw honey prices potentially widening price gap |

Entrants Threaten

Entering the Manuka honey and established natural health product markets demands considerable financial investment. This includes setting up apiaries, advanced honey processing plants, rigorous quality control labs, and extensive global distribution channels. For instance, Comvita itself operates a government-recognized laboratory for its testing, highlighting the need for such specialized infrastructure.

The threat of new entrants into the Manuka honey market, particularly for companies like Comvita, is significantly influenced by access to raw materials and the supply chain. New Zealand is the exclusive source of genuine Manuka honey, making access to Manuka trees and a dependable network of beekeepers absolutely critical for any new player.

Establishing a consistent supply of high-grade Manuka honey that adheres to stringent quality standards presents a substantial hurdle for newcomers. This challenge is amplified by the current market conditions, which include an oversupply of honey and a concerning decline in hive numbers. For instance, in 2023, the New Zealand beekeeping industry reported a significant drop in hive health and productivity, making it harder for even established players to secure consistent volumes.

Comvita has cultivated a robust global brand, particularly renowned for its Manuka honey and natural health offerings. Newcomers would find it challenging to establish the same level of consumer trust and loyalty in a market where established brands often command premium perceptions, especially following any reported accounting irregularities that might affect consumer confidence.

Regulatory Hurdles and Compliance

The natural health product industry faces a significant threat from new entrants due to stringent regulatory hurdles. Companies must navigate a complex web of evolving rules concerning product claims, labeling, and manufacturing standards across various international markets. For instance, in 2024, the global dietary supplement market, a key segment for natural health products, was valued at approximately $170 billion, with compliance costs being a substantial factor for new players.

Obtaining necessary certifications, such as the Unique Manuka Factor (UMF) for Manuka honey products, adds another layer of difficulty. These certifications are crucial for market access and consumer trust, but the process can be lengthy and expensive, acting as a considerable barrier for emerging businesses seeking to enter Comvita's competitive landscape.

- Evolving Regulations: New entrants must adapt to constantly changing rules on product claims and labeling.

- Market-Specific Compliance: Navigating differing regulations in each target market is a significant challenge.

- Certification Costs: Obtaining essential certifications like UMF requires substantial investment.

- Barrier to Entry: The combined regulatory and certification burden deters many potential new competitors.

Economies of Scale and Distribution Channels

Established players like Comvita leverage significant economies of scale in production, marketing, and distribution, making it challenging for newcomers to match their cost efficiencies. For instance, in 2024, Comvita's global supply chain and established brand recognition allow for bulk purchasing and optimized logistics, which are difficult for a new entrant to replicate immediately.

Securing prime shelf space in major retail chains and building robust e-commerce and international distribution networks represent substantial hurdles. New entrants would face considerable costs and time investment to gain comparable market access.

- Economies of Scale: Comvita's large-scale operations lead to lower per-unit production costs, a barrier for smaller, new entrants.

- Distribution Channels: Access to established retail partnerships and efficient global logistics networks is a significant advantage for Comvita.

- Brand Recognition: Years of building brand trust and awareness provide Comvita with a competitive edge over nascent competitors.

The threat of new entrants in the Manuka honey market is moderate, primarily due to high capital requirements for apiaries, processing, and quality control, as exemplified by Comvita's specialized labs. Access to New Zealand's exclusive Manuka resources and a reliable beekeeper network is also a significant barrier, especially with recent reports of declining hive productivity in 2023. Furthermore, navigating stringent global regulations and obtaining crucial certifications like UMF presents substantial costs and time investments for any new player aiming to compete with established brands like Comvita.

| Barrier | Description | Impact on New Entrants | Comvita Advantage |

|---|---|---|---|

| Capital Investment | Setting up apiaries, processing plants, labs | High | Established infrastructure and scale |

| Raw Material Access | Exclusive access to Manuka resources in NZ | High | Long-standing beekeeper relationships |

| Regulatory Compliance | Navigating global regulations and certifications (UMF) | High | Expertise and established compliance processes |

| Brand Reputation | Building consumer trust and loyalty | High | Strong global brand recognition |

Porter's Five Forces Analysis Data Sources

Our Comvita Porter's Five Forces analysis leverages data from Comvita's annual reports and investor presentations, alongside industry-specific market research from firms like IBISWorld and Statista. We also incorporate insights from regulatory filings and global economic indicators to provide a comprehensive view of the competitive landscape.