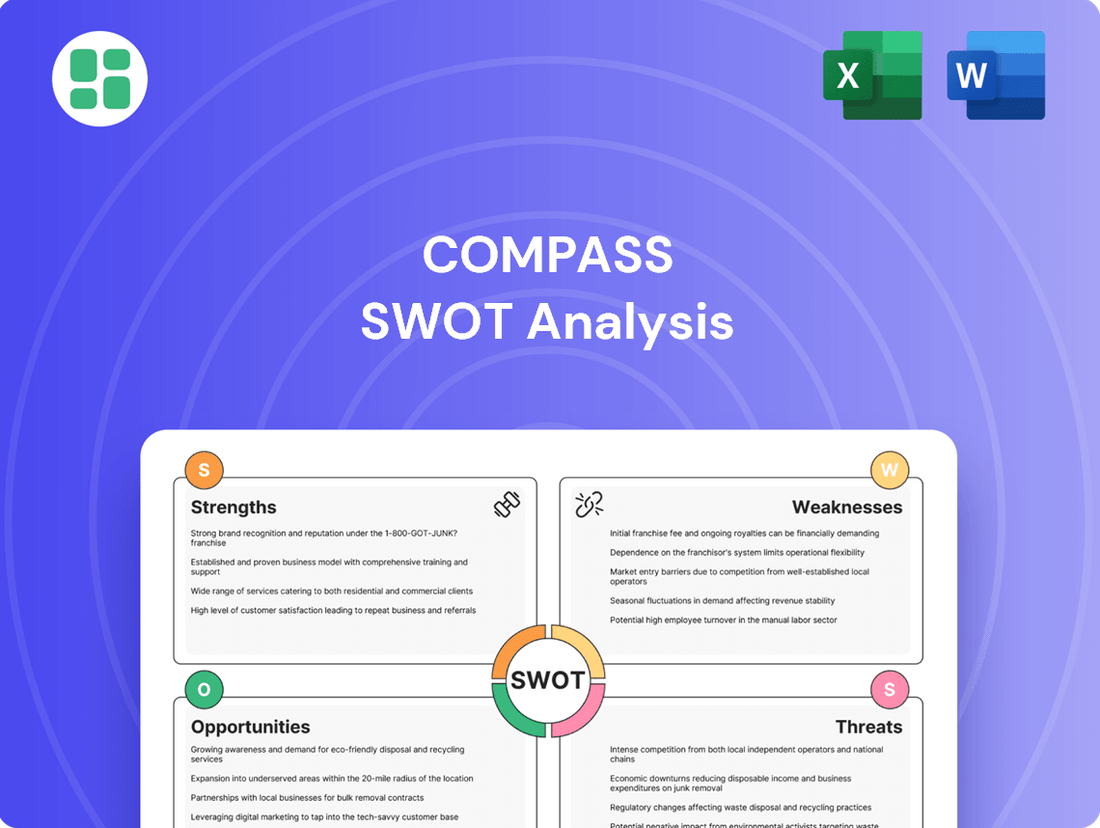

Compass SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compass Bundle

Unlock the full strategic potential of Compass with our comprehensive SWOT analysis. Discover detailed insights into their competitive advantages, potential market challenges, and untapped opportunities. This in-depth report is your key to understanding their position and planning for future success.

Strengths

Compass boasts a proprietary, cloud-native software service that covers the entire real estate process, from the first client interaction to the final closing. This integrated platform, which includes mobile apps, combines customer relationship management, marketing, client service, and brokerage operations, significantly boosting agent efficiency and improving the client journey.

The company's commitment to technological advancement is evident in its substantial investments, particularly in AI-driven capabilities. The recent integration of OpenAI's API further solidifies Compass's position as a frontrunner in real estate technology, offering innovative solutions to its agents and clients.

Compass has built a robust and expanding network of real estate professionals. By the second quarter of 2025, the company saw a significant 23.3% year-over-year increase in principal agents, reaching a total of 20,965. This growth underscores their success in attracting new talent to their platform.

The company also excels in keeping its agents, demonstrating a strong agent retention. In Q2 2025, Compass achieved an impressive 97.5% quarterly principal agent retention rate. This high retention signifies the effectiveness of their agent-centric model, which provides substantial support and attractive commission opportunities, fostering loyalty among their top-performing agents.

Compass has effectively captured a larger piece of the real estate pie, even when the overall market faced headwinds. In the second quarter of 2025, their market share climbed to an impressive 6.09%, a notable jump from the previous year.

This expansion is directly linked to robust revenue performance. For Q2 2025, Compass reported a 21.1% year-over-year revenue surge, reaching $2.06 billion. This growth trajectory is fueled by both expanding their existing operations and making smart acquisitions.

Diversified Service Offerings and Revenue Streams

Compass's strength lies in its diversified service offerings, extending beyond traditional brokerage. By integrating title, escrow, and mortgage services, the company provides a seamless experience for homebuyers, which can foster client loyalty and capture more of the transaction value. This integrated approach is a significant competitive advantage.

The affiliation with Christie's International Real Estate has been instrumental in bolstering Compass's presence in the lucrative luxury market. This partnership not only enhances brand prestige but also opens up new avenues for revenue growth. In 2023, Compass reported a 19% increase in luxury transactions year-over-year, underscoring the impact of this strategic alliance.

Furthermore, Compass is actively developing new products to diversify revenue and deepen client relationships. Initiatives like Compass One and Make Me Sell are designed to create additional income streams and improve the overall client journey. These innovations are crucial for adapting to evolving market demands and maintaining a competitive edge.

- Integrated Services: Offers title, escrow, and mortgage alongside brokerage, simplifying the home buying process.

- Luxury Market Expansion: Christie's affiliation drives growth and brand recognition in high-end real estate.

- New Revenue Streams: Products like Compass One and Make Me Sell target new client needs and revenue opportunities.

- Revenue Growth: The company saw a 19% rise in luxury transactions in 2023, demonstrating the success of its diversification strategies.

Improved Financial Performance and Cost Control

Compass has demonstrated a robust turnaround in its financial performance. In the second quarter of 2025, the company reported a GAAP Net Income of $39.4 million, a substantial increase of $18.7 million compared to the same period in 2024. This uptick highlights effective cost management strategies and improved operational efficiency.

Further solidifying its financial strength, Compass achieved positive free cash flow for the entirety of 2024. The company is focused on sustaining this positive trajectory throughout 2025, underscoring a commitment to disciplined spending and enhanced profitability.

- Improved Profitability: Q2 2025 GAAP Net Income reached $39.4 million, up $18.7 million year-over-year.

- Positive Cash Flow: Achieved positive free cash flow in 2024 and aims to maintain it in 2025.

- Cost Control: Demonstrates a strong focus on operational efficiency and cost management.

Compass's proprietary technology platform is a significant strength, covering the entire real estate transaction lifecycle and enhancing agent efficiency. Their strategic investment in AI, including OpenAI integration, positions them as an innovator in the proptech space. The company also excels in agent acquisition and retention, evidenced by a 23.3% year-over-year increase in principal agents and a 97.5% quarterly retention rate in Q2 2025.

| Metric | Q2 2025 | YoY Change |

| Principal Agents | 20,965 | +23.3% |

| Agent Retention Rate | 97.5% | N/A |

| Market Share | 6.09% | N/A |

What is included in the product

Delivers a strategic overview of Compass’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address strategic weaknesses, reducing uncertainty and improving decision-making.

Weaknesses

Compass's significant investments in technology and robust agent support, while beneficial for growth, contribute to substantial operational costs. For instance, in Q1 2024, technology and marketing expenses represented a notable portion of their overall spending, impacting their ability to translate revenue into consistent profit margins.

Historically, the company has grappled with achieving stable profitability, a trend that recent quarters in 2024 have begun to reverse with improved net income. However, the underlying high cost structure means that continued, diligent cost management remains a critical factor for long-term financial stability and shareholder value.

Compass's reliance on the real estate sector makes it inherently vulnerable to market downturns. For instance, a significant increase in mortgage rates, which saw rates hover around 7% in late 2023 and into 2024, can dampen buyer demand and reduce transaction volumes, directly impacting Compass's revenue streams.

The company's performance is closely tied to broader economic health, including employment rates and consumer confidence. A slowdown in the economy, potentially leading to job losses or reduced disposable income, can further depress housing market activity, creating a challenging environment for Compass throughout 2024 and into 2025.

Compass's reliance on its real estate agents is a significant weakness. While the company boasts strong agent retention, with many agents staying with Compass for extended periods, their individual performance directly drives sales and market share. The ongoing competition for top talent in the real estate sector means Compass must continually work to keep its agents engaged and productive. For instance, in Q1 2024, Compass reported a 92% agent retention rate, a strong figure, but any dip in this could quickly affect their competitive standing.

The high dependency on agent performance means that a downturn in individual agent productivity or a sudden increase in agent attrition could directly impact Compass's revenue and market position. The real estate industry is dynamic, and the ability to attract and retain the best agents is crucial for sustained growth. Should competitor brokerages offer more attractive incentives or better platforms, Compass could face challenges in maintaining its agent base and, consequently, its market share.

Competitive Landscape and Commission Structure Uncertainty

The real estate services industry is intensely competitive, with established brokerages and emerging tech-focused firms constantly vying for dominance. Compass faces this crowded market, where customer acquisition and agent retention are critical. For instance, Redfin, a key competitor, reported a 12% increase in revenue for Q1 2024, highlighting the ongoing battle for market share.

Uncertainty surrounding commission structures poses a significant threat. Ongoing antitrust litigation, such as the NAR settlement, could lead to widespread changes in how agents are compensated, potentially impacting Compass's primary revenue stream. This could reshape the economics of the industry, forcing adaptation.

The potential for reduced commission rates directly challenges Compass's commission-based revenue model. If commission splits decrease industry-wide, Compass's earnings per transaction could shrink. This necessitates a focus on operational efficiency and exploring alternative revenue streams to maintain profitability.

Key considerations include:

- Intense Competition: Facing established players like Keller Williams and emerging digital platforms.

- Antitrust Litigation Impact: Potential shifts in commission structures could reduce revenue per transaction.

- Agent Retention Challenges: Maintaining a competitive commission split is vital for attracting and keeping top agents.

- Evolving Industry Practices: Adapting to new models of service delivery and compensation is crucial.

Limited International Presence

Compass's predominantly U.S.-focused operations in 2024 represent a significant weakness, restricting its access to the vast potential of international real estate markets. While its affiliation with Christie's International Real Estate offers a gateway to global luxury segments, the company's fundamental brokerage activities remain largely confined to domestic shores, a stark contrast to competitors with established worldwide networks.

This limited international presence means Compass misses out on diverse revenue streams and market insights that global competitors, such as Sotheby's International Realty or Engel & Völkers, actively leverage. For instance, as of early 2024, many global real estate firms report substantial portions of their transactions and agent networks originating outside the United States, a scale Compass has yet to achieve.

The reliance on the U.S. market also exposes Compass to greater vulnerability to domestic economic downturns or shifts in consumer behavior within a single country. A truly global footprint, by contrast, can often buffer such localized impacts through diversification.

Compass's high operational costs, stemming from significant technology investments and agent support, directly impact its profitability. In Q1 2024, these expenses were a substantial part of their spending, hindering the translation of revenue into consistent profit margins, despite recent improvements in net income observed in early 2024.

The company's vulnerability to real estate market downturns is a key weakness. Rising mortgage rates, hovering around 7% in late 2023 and into 2024, dampen buyer demand and reduce transaction volumes, directly affecting Compass's revenue streams and overall performance.

A significant weakness is Compass's reliance on its agents. While agent retention remains strong, with a 92% rate in Q1 2024, individual agent productivity is crucial for sales. Any dip in this productivity or an increase in attrition, especially with competitors offering attractive incentives, could quickly impact market share and revenue.

The intense competition in the real estate services industry, with firms like Redfin reporting 12% revenue growth in Q1 2024, poses a constant challenge. Furthermore, ongoing antitrust litigation, like the NAR settlement, creates uncertainty around commission structures, potentially impacting Compass's primary revenue model and necessitating adaptation to evolving industry practices.

Compass's predominantly U.S.-focused operations in 2024 limit its exposure to international markets, unlike global competitors. This restricts diverse revenue streams and market insights, making the company more susceptible to domestic economic downturns, a contrast to firms with broader global footprints.

Preview the Actual Deliverable

Compass SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The rapid evolution of AI and big data offers Compass a prime opportunity to supercharge its platform. Imagine AI refining property valuations with unprecedented accuracy, identifying promising leads more effectively, and even personalizing customer service interactions. This technological leap could significantly boost efficiency and client satisfaction.

For instance, in 2024, the global AI market is projected to reach over $200 billion, with real estate tech specifically seeing substantial investment. Compass can leverage AI for predictive analytics to anticipate market shifts, optimize agent workflows, and deliver hyper-personalized property recommendations, creating a competitive edge.

Compass's strategic M&A approach is a key growth driver, aiming to quickly expand its footprint, integrate new technologies, and solidify its market standing. This strategy is actively being executed, as demonstrated by recent significant acquisitions.

The company's commitment to M&A is evident in its robust pipeline and a history of successful integrations. For instance, the acquisition of Christie's International Real Estate, a brand with significant global recognition, along with other independent agencies, directly contributes to revenue uplift and expands Compass's market share in key regions.

Compass Group can explore expanding its offerings beyond core hospitality and support services. Diversifying into adjacent areas like specialized facilities management, advanced catering solutions for specific industries, or even offering consulting services on operational efficiency could unlock new revenue streams. This diversification would allow Compass to leverage its existing expertise and infrastructure in new ways, potentially capturing a larger share of its clients' spending.

The company has a significant opportunity to tap into new domestic and international markets. As of the first half of 2024, Compass reported strong performance in its existing regions, indicating a solid foundation for expansion. Exploring emerging economies or underserved sectors within developed markets could provide substantial growth avenues, especially if tailored service packages are developed to meet local needs and regulatory environments.

Adapting to Evolving Consumer Behavior and Market Demands

Compass can capitalize on the growing demand for digital convenience by enhancing its online property search and virtual tour capabilities. For instance, in 2024, the global real estate technology market was valued at over $20 billion, with significant growth projected in proptech solutions that streamline transactions and improve customer experience.

By focusing on personalized experiences, Compass can leverage data analytics to match buyers with properties that align with their specific lifestyle needs and preferences. This approach is crucial as consumer expectations for tailored services continue to rise across all sectors.

Addressing the trend towards sustainable living spaces presents another key opportunity. Highlighting energy-efficient features or properties in eco-friendly communities can attract a growing segment of environmentally conscious buyers. Reports from 2024 indicated a 15% increase in consumer interest for green building certifications.

Furthermore, Compass can expand its reach to first-time homebuyers by offering more accessible resources and tailored guidance. In 2024, first-time homebuyers accounted for approximately 30% of all home purchases in many major markets, representing a substantial opportunity for market penetration.

Capitalizing on Market Rebound and Stabilization

The real estate market is showing signs of stabilization, with projections for a moderate recovery in 2025. This anticipated rebound is supported by expectations of easing mortgage rates, which could stimulate buyer activity and increase transaction volumes. For instance, some analysts forecast mortgage rates to potentially dip below 6% by late 2025, a significant drop from their 2023-2024 highs.

Compass is strategically positioned to leverage this market shift. Its extensive network of agents, coupled with its advanced technology platform, provides a distinct advantage in capturing market share during a recovery. The company's ability to adapt and innovate in a fluctuating market allows it to potentially outpace competitors.

Key opportunities stemming from this market stabilization include:

- Increased Agent Productivity: As transaction volumes rise, Compass agents can benefit from higher commission earnings, fostering greater loyalty and engagement.

- Technology Adoption: A recovering market often sees renewed interest in tech-enabled services. Compass's digital tools can attract both buyers and sellers seeking efficiency.

- Market Share Growth: With an estimated 4.5% market share in U.S. residential sales in early 2024, a rebounding market presents an opportunity for Compass to expand this share by attracting agents and clients.

The real estate market's projected stabilization and potential recovery in 2025, driven by easing mortgage rates, presents a significant tailwind for Compass. This environment is expected to boost transaction volumes, directly benefiting Compass's agent network and market share. The company’s technological infrastructure is well-suited to capitalize on this shift, attracting both clients and agents seeking efficiency and a competitive edge.

Key opportunities include increased agent productivity and enhanced technology adoption by clients. With an estimated 4.5% market share in U.S. residential sales in early 2024, Compass is poised to grow this share as market activity picks up.

| Opportunity Area | 2024/2025 Data Point | Potential Impact for Compass |

|---|---|---|

| Market Recovery & Transaction Volume | Mortgage rates projected to dip below 6% by late 2025. | Increased sales activity and commission potential for agents. |

| Agent Productivity | Higher transaction volumes lead to increased agent earnings. | Enhanced agent retention and attraction. |

| Technology Adoption | Growing demand for digital real estate solutions. | Leveraging Compass's platform to attract tech-savvy clients and agents. |

| Market Share Expansion | Early 2024 U.S. residential sales market share: 4.5%. | Opportunity to capture a larger portion of a recovering market. |

Threats

The real estate technology sector is incredibly crowded, with both established players and nimble startups constantly pushing for market dominance. Compass is up against a multitude of traditional brokerages that are increasingly adopting their own tech solutions, as well as a wave of innovative PropTech firms. This intense competition means Compass must continually invest in R&D to maintain its technological edge and offer unique value propositions to agents and consumers alike. For instance, in 2024, venture capital funding for PropTech companies remained robust, indicating a sustained influx of capital for new entrants aiming to disrupt the market.

Economic downturns pose a significant threat to Compass. A prolonged recession, coupled with persistently high interest rates, could stifle consumer spending and investment in real estate, directly impacting Compass's transaction volumes. For instance, if the Federal Reserve maintains its benchmark interest rate at elevated levels throughout 2024 and into 2025, as many analysts predict, this will continue to make mortgages more expensive, potentially cooling the housing market.

Market volatility, particularly in the housing sector, directly affects Compass's revenue streams. Significant fluctuations, such as a sharp decline in home prices or a slowdown in sales, could lead to reduced commission earnings and a decrease in the demand for Compass's services. The National Association of Realtors reported a 15.5% year-over-year decline in existing home sales in Q1 2024, highlighting the sensitivity of the sector to economic headwinds.

Regulatory shifts, especially concerning real estate commission structures, pose a significant threat. The National Association of Realtors (NAR) settlement, for instance, could fundamentally alter how agents are compensated, potentially impacting Compass's revenue streams and competitive positioning. Adapting to these evolving rules will be crucial for maintaining profitability.

Cybersecurity Risks and Data Privacy Concerns

As a technology-driven company managing extensive client and agent data, Compass faces significant cybersecurity threats. A data breach could severely impact its operations and reputation. For instance, the global average cost of a data breach reached $4.35 million in 2024, according to IBM's latest report, a figure that underscores the potential financial fallout.

Such incidents can lead to substantial financial penalties, regulatory fines, and a significant erosion of trust among its user base. In 2024, regulatory bodies continued to enforce stringent data privacy laws, with GDPR fines, for example, potentially reaching up to 4% of global annual revenue, posing a considerable risk for companies like Compass.

- Reputational Damage: Loss of client and agent confidence following a breach.

- Financial Penalties: Fines from regulatory bodies for non-compliance with data protection laws.

- Operational Disruption: Costs associated with incident response, system recovery, and potential downtime.

- Loss of Competitive Advantage: Compromised proprietary data or intellectual property.

Agent Retention Challenges Amidst Industry Shifts

While Compass has historically seen robust agent retention, the real estate industry's dynamic nature presents potential future hurdles. Shifts in commission structures, a growing trend in some markets, could impact agent satisfaction if not managed proactively. Furthermore, intensified competition for top talent means Compass must consistently highlight its unique value proposition to keep its agent network engaged and committed.

The increasing prevalence of independent contractor models and the rise of tech-forward brokerages offer agents more diverse career paths. For instance, some reports from late 2024 indicated a slight uptick in agent mobility across major brokerages as economic conditions shifted. To counter this, Compass needs to ensure its technology, support, and earning potential remain superior.

- Evolving Compensation Models: Industry discussions around revised commission splits and fee structures could influence agent loyalty.

- Increased Competition for Talent: A growing number of brokerages are vying for experienced and high-performing agents.

- Demonstrating Agent Value: Compass must continually showcase its platform's benefits, including technology, marketing support, and brand recognition.

- Agent Mobility Trends: Monitoring industry-wide agent movement, which saw some fluctuations in 2024, is crucial for proactive retention strategies.

The real estate market's inherent cyclicality and sensitivity to macroeconomic factors present ongoing threats. Persistently high interest rates, as observed throughout 2024 and projected into 2025, continue to dampen buyer demand and transaction volumes. Furthermore, increased regulatory scrutiny, particularly concerning commission structures following the NAR settlement, could fundamentally alter revenue models and necessitate significant operational adjustments for Compass.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data/Context |

|---|---|---|---|

| Market & Economic | High Interest Rates & Economic Slowdown | Reduced transaction volume, lower commission revenue | Federal Reserve maintained elevated rates through 2024; mortgage rates remained a key factor in housing affordability. |

| Regulatory & Legal | Changes to Commission Structures | Altered revenue streams, competitive disadvantage | NAR settlement discussions and potential implementation created uncertainty throughout 2024. |

| Competition | Intense PropTech & Traditional Brokerage Competition | Erosion of market share, increased R&D costs | Continued venture capital investment in PropTech in 2024 indicated ongoing market disruption. |

| Operational & Security | Cybersecurity Threats & Data Breaches | Reputational damage, financial penalties, operational disruption | Global average cost of data breach reached $4.35 million in 2024; stringent data privacy enforcement continued. |

SWOT Analysis Data Sources

This Compass SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded and actionable strategic overview.