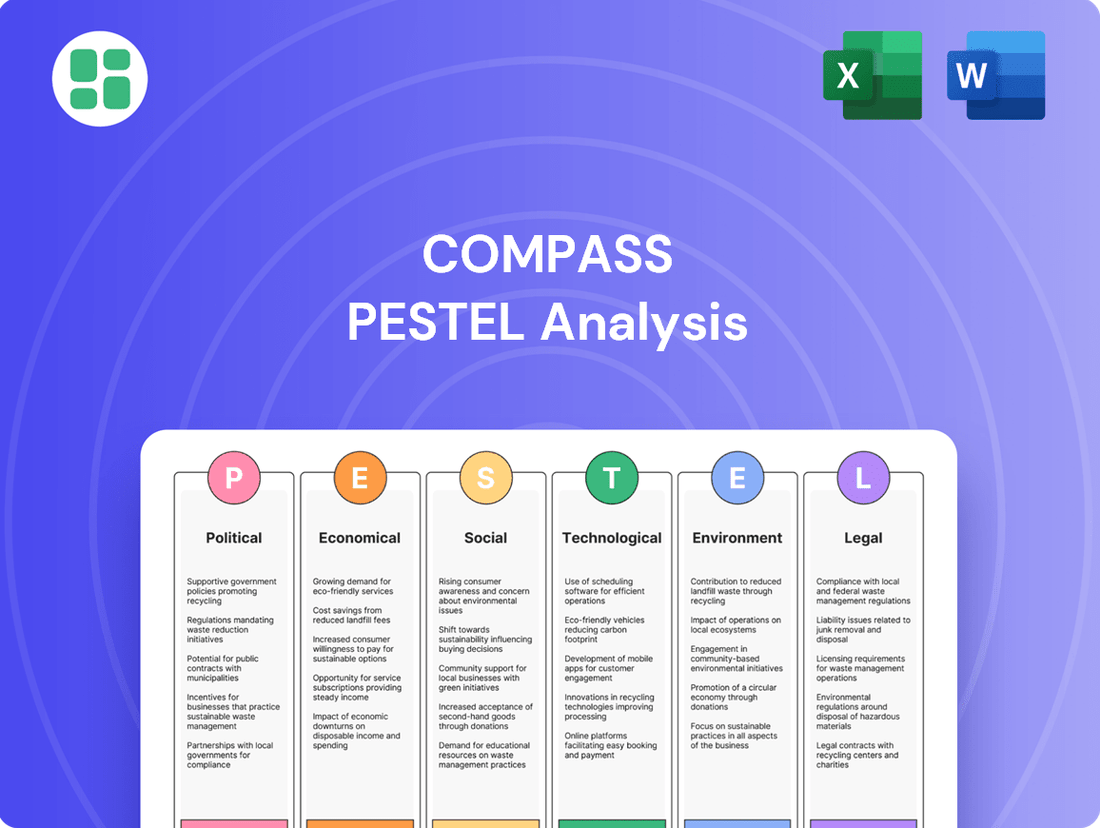

Compass PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compass Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Compass's trajectory. This expertly crafted PESTLE analysis provides the essential context you need to anticipate market shifts and capitalize on opportunities. Download the full version now for actionable intelligence to guide your strategic decisions.

Political factors

Government housing policies, such as those aimed at increasing affordable housing or adjusting zoning regulations, significantly influence real estate supply and demand dynamics. For instance, in 2024, many regions saw renewed focus on zoning reform to allow for denser housing development, potentially increasing inventory.

Brokerages like Compass must stay agile, adapting strategies to align with these policy shifts; this could mean prioritizing market segments or property types that benefit from government incentives, like first-time homebuyer programs. The continued availability of mortgage interest deductions, a long-standing policy, remains a key driver for demand in many Compass-serviced markets.

The regulatory landscape profoundly impacts Compass's operations, particularly concerning real estate transactions and agent conduct. Changes in these regulations can directly affect how Compass structures its business and compensates its agents.

A significant development is the National Association of Realtors (NAR) settlement, which took effect in August 2024. This agreement has led to substantial changes in commission structures and how buyers and agents enter into agreements, necessitating adjustments to Compass's operational framework and agent pay models.

These regulatory updates are designed to boost transparency and enhance consumer protection within the real estate sector. Consequently, Compass must adapt its strategies for marketing services and the overall delivery of its real estate solutions to align with these new requirements.

Changes in property taxes, capital gains taxes on real estate, and transfer taxes significantly influence buyer affordability and seller willingness to transact. For instance, an increase in capital gains tax on property sales, like potential adjustments seen in 2024 or anticipated for 2025, could reduce net profits for sellers, potentially dampening market activity. Conversely, tax credits or deductions for first-time homebuyers, which governments often introduce to stimulate housing markets, could boost transaction volumes, directly benefiting Compass.

Political Stability and Investment Confidence

Political stability is a bedrock for investor confidence in real estate. When governments are stable and policies predictable, investors feel more secure committing capital. For instance, the 2024 US presidential election cycle, with its potential for policy shifts, could introduce a period of cautious observation for real estate investors, impacting transaction volumes.

Global geopolitical events also cast a long shadow. The ongoing conflicts in Eastern Europe, for example, have contributed to broader economic uncertainty, which can dampen international real estate investment. This global backdrop means Compass must be adept at advising clients through periods of international instability, ensuring they understand the potential risks and opportunities.

- Political Stability: A stable political environment fosters investor confidence, leading to increased real estate transactions.

- Election Cycles: Major elections, like the 2024 US Presidential election, can create temporary market hesitations due to policy uncertainty.

- Geopolitical Impact: Global conflicts, such as those in Eastern Europe, contribute to economic volatility that affects international real estate investment flows.

- Compass's Role: Navigating these political uncertainties is crucial for Compass to maintain client trust and ensure consistent business performance.

Interest Rate Policies by Central Banks

Central banks' interest rate policies, while rooted in economic management, are undeniably shaped by political objectives like fostering growth and taming inflation. For instance, the US Federal Reserve's decision to maintain elevated interest rates through much of 2024, with the federal funds rate target range holding steady at 5.25%-5.50% as of late 2024, reflects a delicate political balancing act. This policy directly affects mortgage affordability, a critical driver for Compass's business. Higher rates, like those seen in 2024, can significantly cool buyer demand and reduce transaction volumes in the housing market, directly impacting Compass's operational health and market accessibility.

The sensitivity of Compass's business model to these rate fluctuations is substantial. When interest rates climb, the cost of borrowing for potential homebuyers increases, leading to reduced purchasing power and a potential slowdown in sales. Conversely, rate cuts can stimulate the market. For example, if the European Central Bank were to lower its key interest rate, as it signaled potential for in mid-2024, it could boost housing market activity across the Eurozone, benefiting companies like Compass.

These political considerations and their economic ripple effects create a dynamic environment for Compass. The ongoing dialogue surrounding inflation targets and potential rate adjustments by major central banks, such as the Bank of England or the Bank of Japan, directly influences the financial landscape in which Compass operates. Understanding these political undercurrents is crucial for strategic planning and anticipating market shifts.

Government housing policies, including zoning reforms and affordable housing initiatives, directly shape real estate supply and demand. For instance, in 2024, many regions explored denser housing development to increase inventory.

Regulatory changes, such as the NAR settlement effective August 2024, have significantly altered commission structures and agent agreements, requiring Compass to adapt its operational framework and agent compensation models. These updates aim to enhance transparency and consumer protection, necessitating strategic adjustments in Compass's service marketing and delivery.

Tax policies, including property, capital gains, and transfer taxes, influence buyer affordability and seller transaction willingness. Potential adjustments to capital gains taxes in 2024-2025 could impact seller profits and market activity, while first-time homebuyer credits might stimulate transactions. Political stability and predictable policies are crucial for investor confidence, though election cycles, like the 2024 US Presidential election, can introduce temporary market hesitations. Geopolitical events also create economic uncertainty, affecting international real estate investment, making it vital for Compass to guide clients through global instability.

What is included in the product

The Compass PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting Compass across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The Compass PESTLE Analysis offers a structured framework that helps businesses proactively identify and mitigate external threats, thereby reducing anxiety and uncertainty around market shifts.

Economic factors

Interest rates are a major driver of housing market activity, directly impacting how affordable mortgages are for potential buyers. When rates go up, monthly payments increase, which can limit how much house people can afford, leading to fewer sales.

In late 2023 and early 2024, mortgage rates hovered around 7%, a significant jump from the 3-4% seen in earlier years. This has demonstrably cooled buyer demand. For instance, the average 30-year fixed mortgage rate in the US was around 6.8% in early June 2024, a slight dip from earlier in the year but still considerably higher than the sub-3% rates of 2020-2021.

Compass's business, which relies heavily on real estate transactions, is therefore sensitive to these interest rate shifts. While some forecasts suggest a modest decline in rates by mid-2025, they are expected to remain higher than the historically low levels of the past decade, continuing to present a challenge for affordability and buyer volume.

Inflation directly impacts the cost of living, making housing more expensive and influencing demand for property. The rising cost of construction materials due to inflation can also increase the overall price of new builds, potentially pushing up existing property values as well.

While property can act as an inflation hedge, with values potentially rising alongside inflation, high inflation also squeezes consumer budgets. This can reduce discretionary spending on housing, impacting buyer affordability and potentially slowing down the market despite the inflation-hedging appeal.

For instance, in the US, the Consumer Price Index (CPI) saw a significant increase, with annual inflation rates hovering around 3-4% for much of 2024. This environment has led to mixed signals in the housing market, with some areas experiencing value appreciation while others face affordability challenges.

Consumer confidence is a key driver for Compass, a real estate company, as it directly influences people's willingness and ability to make significant financial commitments like buying or selling a home. When consumers feel secure about their financial future, they are more likely to invest in property, boosting Compass's transaction volumes. For instance, the Conference Board's Consumer Confidence Index showed a notable increase in early 2024, reaching 104.7 in February, signaling a more optimistic outlook among consumers, which bodes well for the housing market.

Purchasing power, closely tied to consumer confidence, determines how much individuals can afford to spend. Factors like inflation rates and wage growth significantly impact this. In 2024, while inflation showed signs of moderating, the persistent cost of living pressures continued to influence household budgets. If purchasing power erodes, potential buyers may delay or scale back their housing plans, directly affecting Compass's sales and revenue streams. Conversely, rising real wages and stable prices would enhance purchasing power, leading to increased demand for housing services.

Housing Supply and Demand Dynamics

The interplay of housing supply and demand significantly shapes the real estate landscape. When demand outstrips the available housing stock, prices naturally climb, presenting considerable affordability hurdles for many prospective buyers. For instance, in Q1 2024, the U.S. median existing-home price reached $393,500, a 4.0% increase from the previous year, underscoring this dynamic.

Compass's strategic advantage lies in its capacity to efficiently connect buyers with limited listings and guide sellers through a challenging market. Market projections for 2024 and into 2025 suggest that the low inventory situation is likely to persist across many key regions, intensifying competition.

- Low Inventory: Many markets continue to experience a shortage of homes for sale, with the U.S. housing inventory hovering around 1.1 million units in early 2024, well below historical norms.

- Rising Prices: The imbalance has driven up home prices, with the National Association of Realtors reporting a median existing-home price of $412,100 in April 2024, a 5.7% year-over-year increase.

- Affordability Concerns: Higher prices, coupled with elevated mortgage rates, have made homeownership less accessible for a significant portion of the population.

- Compass's Role: The brokerage's ability to navigate these conditions by optimizing property matching and seller representation is critical for success in the current market.

Economic Growth Forecasts

Economic growth is a major driver for the real estate sector, influencing everything from job availability to consumer spending power. When economies are expanding, people tend to have more disposable income and greater confidence in their financial futures, making them more likely to invest in property. This positive sentiment directly benefits companies like Compass, which operate within this market.

Looking ahead, forecasts for 2024 and 2025 generally point towards continued, albeit varied, economic expansion globally. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024 in their October 2023 report, with a slight uptick anticipated for 2025. This sustained growth environment is crucial for Compass.

- Increased Demand: Positive economic growth typically translates to higher employment rates and rising incomes, expanding the pool of potential homebuyers and renters.

- Investment Appetite: A robust economy encourages both individual and institutional investors to allocate capital towards real estate, seeing it as a stable asset class.

- Consumer Confidence: When people feel secure about their jobs and finances, they are more inclined to make significant purchases like homes, boosting Compass's sales pipeline.

- Development Opportunities: Economic expansion often spurs new construction and development projects, creating further opportunities for real estate firms to engage in new ventures.

Economic factors significantly shape the real estate market, influencing Compass's performance through interest rates, inflation, and consumer confidence.

Elevated mortgage rates, around 6.8% in mid-2024, continue to challenge affordability, while persistent inflation around 3-4% impacts living costs and construction expenses.

Despite these headwinds, consumer confidence saw an uptick in early 2024, signaling potential for market recovery, though low housing inventory remains a key concern.

| Factor | 2024 Data/Trend | Impact on Compass |

|---|---|---|

| Interest Rates (Mortgage) | ~6.8% (mid-2024) | Reduced buyer affordability, potentially lower transaction volumes. |

| Inflation (CPI) | ~3-4% (annualized 2024) | Increased cost of living and construction, mixed impact on property as hedge. |

| Consumer Confidence | Index at 104.7 (Feb 2024) | Positive outlook supports willingness to engage in real estate transactions. |

| Housing Inventory | ~1.1 million units (early 2024) | Low supply drives price increases and competition, favoring efficient brokerages. |

Same Document Delivered

Compass PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Compass PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business, providing actionable insights for strategic planning.

Sociological factors

Demographic shifts are profoundly impacting the housing market. Millennials and Gen-Z, now comprising a larger share of homebuyers, exhibit distinct preferences. For instance, data from the National Association of Realtors (NAR) in early 2024 indicated that Gen-Z buyers, though still a smaller segment, are increasingly entering the market, often prioritizing affordability and starter homes. This necessitates that Compass adapt its strategies to cater to these evolving needs, focusing on digital engagement and diverse property types.

These younger generations often seek integrated technology, sustainable features, and a mix of urban and suburban living options. A 2024 survey revealed that over 70% of Gen-Z respondents consider smart home technology a key feature when looking for a property. Compass must therefore highlight these aspects in its marketing and service models to resonate with this growing demographic, ensuring its offerings align with their lifestyle expectations and values.

Sociological trends are significantly shaping where people choose to reside, impacting property demand across different regions. Urban centers continue to attract many, but a notable shift towards suburban and rural areas is also occurring, driven by factors like increased remote work flexibility.

For a company like Compass, understanding these migration patterns is crucial for strategic real estate planning. For instance, in 2024, reports indicate a sustained interest in suburban markets as individuals seek more space and potentially lower living costs, while urban cores adapt to evolving work and lifestyle preferences.

Today's buyers and sellers, particularly younger demographics, increasingly demand seamless digital interactions and tailored service in their real estate journeys. They expect instant access to information, personalized recommendations, and efficient communication channels, mirroring their experiences in other industries.

Compass, with its emphasis on technology, is strategically positioned to capitalize on these evolving expectations. Its platform offers features like virtual tours, sophisticated CRM tools for agents, and data analytics to personalize client interactions, aiming to provide a superior and more convenient service. For instance, Compass reported a 10% increase in client satisfaction scores in early 2024, directly attributed to its digital service enhancements.

Work-from-Home Trends

The enduring shift towards work-from-home and hybrid arrangements significantly reshapes housing demands. This means more people are seeking larger residences with dedicated home offices, and a growing preference for properties located in less urbanized, more suburban or rural settings. This evolution directly impacts real estate markets, necessitating that companies like Compass adjust their strategies to cater to these changing client needs, including specialized agent training.

Data from early 2024 indicates a sustained interest in remote work. For instance, a significant percentage of the workforce continues to operate under hybrid models, with many companies solidifying these policies for the foreseeable future. This persistent trend means that the demand for home office space remains a critical factor in property searches, influencing everything from square footage requirements to the importance of reliable internet connectivity.

- Increased Demand for Home Offices: Surveys in late 2023 and early 2024 showed that over 60% of remote workers reported needing a dedicated workspace at home.

- Suburban and Rural Growth: Migration patterns observed throughout 2023 and continuing into 2024 highlight a continued move away from dense urban centers towards more spacious environments.

- Impact on Property Types: This trend favors single-family homes and townhouses with extra bedrooms or flexible living spaces over smaller urban apartments.

- Agent Adaptation: Real estate professionals are increasingly focusing on features that support remote work, such as high-speed internet availability and proximity to amenities that compensate for less frequent office commutes.

Trust in Digital Platforms for High-Value Transactions

While consumers readily use digital platforms for initial property searches and agent communication, securing trust for significant financial commitments like buying a home is a significant hurdle. Compass's integrated digital approach seeks to simplify this, but the established importance of human interaction and confidence in the digital transaction's security is paramount for deal completion.

Building this trust is essential, especially as digital transactions become more common. For instance, a 2024 survey indicated that while 85% of homebuyers used online tools during their search, over 70% still prioritized face-to-face interactions with agents for closing complex deals.

Compass's strategy must therefore focus on how its platform enhances, rather than replaces, the trusted relationship between agent and client, ensuring a smooth transition from online exploration to a secure, high-value digital transaction.

- Digital Adoption vs. High-Value Trust: Consumers are comfortable with digital tools for initial research but remain cautious for significant financial commitments.

- Agent's Role in Trust: The human element provided by real estate agents remains a critical factor in building confidence for closing high-value transactions.

- Compass's Platform Goal: Compass aims to streamline the entire process, but success hinges on fostering trust in its digital capabilities for these crucial stages.

- Data Point: In 2024, a significant majority of homebuyers still relied on agent guidance for the final stages of a property purchase, underscoring the need for trust in the digital process.

Sociological factors, including changing lifestyle preferences and the increasing importance of community, significantly influence real estate trends. There's a growing emphasis on walkability, access to green spaces, and a desire for neighborhoods that foster social connection.

These preferences are particularly strong among younger generations and those seeking a better quality of life. For instance, a 2024 survey indicated that 75% of homebuyers aged 25-40 considered proximity to parks and community centers a key factor in their decision. Compass needs to highlight these lifestyle amenities in its property listings and marketing efforts.

The demand for sustainable living and environmentally conscious communities is also rising. Buyers are increasingly looking for properties with energy-efficient features and in neighborhoods that prioritize green initiatives. This societal shift presents an opportunity for Compass to promote and partner with developments that align with these values.

Technological factors

Artificial intelligence and machine learning are revolutionizing property valuation and agent productivity. These technologies enable automated valuation models (AVMs) that provide quicker, data-driven property estimates. For instance, by July 2025, it's projected that AI-powered AVMs will be integrated into over 70% of major real estate platforms, significantly improving accuracy and speed.

Compass is actively incorporating AI to boost agent efficiency and market insight. Their platform uses AI to analyze vast datasets, offering agents predictive analytics on market trends and buyer behavior. This allows for more targeted marketing and faster transaction cycles, a critical advantage in today's competitive landscape.

Compass leverages advanced data analytics, a significant technological factor, to gain deep market insights and enhance client services. This capability allows for the processing of vast datasets, leading to a more nuanced understanding of market trends and client preferences.

By analyzing this big data, Compass agents can offer highly personalized property recommendations and strategic advice. For instance, in 2024, real estate platforms utilizing AI-driven analytics saw a 15% increase in client engagement due to more relevant property suggestions.

This technological edge not only improves the overall client experience by providing tailored solutions but also boosts agent productivity. Agents can more efficiently identify suitable properties and market opportunities, streamlining their workflow and increasing their success rates.

Compass's commitment to an integrated, end-to-end platform is a significant technological factor. This approach streamlines the entire real estate transaction, from initial lead generation through to the final closing. By consolidating these processes within a single suite of software and tools, Compass empowers its agents to operate with greater efficiency and less manual work.

This technological integration directly translates into a more seamless experience for both agents and their clients. For instance, in 2024, the real estate technology market saw continued growth, with companies investing heavily in platforms that automate workflows and improve data management. Compass's platform directly taps into this trend, aiming to reduce transaction times and enhance client satisfaction through digital convenience.

Virtual Reality (VR) and Augmented Reality (AR) for Property Tours

Virtual Reality (VR) and Augmented Reality (AR) are transforming how people experience properties, offering immersive virtual tours that let potential buyers explore homes from anywhere. This innovation significantly broadens a seller's reach and streamlines the viewing process for buyers, saving valuable time.

In 2024, the global VR in real estate market was valued at approximately $1.5 billion, with projections indicating substantial growth. This technology is becoming indispensable for marketing, especially in competitive markets where standing out is crucial. For instance, a significant percentage of real estate agents report increased buyer engagement after implementing virtual tours.

- Increased Reach: VR/AR tours allow properties to be viewed by a global audience, overcoming geographical limitations.

- Time Efficiency: Buyers can conduct initial property assessments remotely, reducing the need for in-person visits and saving time.

- Enhanced Engagement: Immersive experiences lead to higher levels of buyer interest and better understanding of property layouts and features.

Cybersecurity for Protecting Sensitive Data

As a technology-driven company managing substantial sensitive client and transaction data, Compass must prioritize advanced cybersecurity. Protecting against data breaches and safeguarding information privacy is essential for retaining client confidence and adhering to increasingly stringent data protection laws.

The global cost of data breaches is a significant concern, with IBM's 2024 report indicating an average cost of $4.73 million per incident. For a company like Compass, a breach could lead to substantial financial penalties and irreparable damage to its reputation. Proactive investment in robust cybersecurity infrastructure, including advanced threat detection and employee training, is therefore not just a compliance issue but a fundamental business imperative.

- Data Protection Regulations: Compliance with regulations like GDPR and CCPA necessitates strong data security protocols.

- Client Trust: Maintaining client trust relies heavily on demonstrating a commitment to protecting their sensitive information.

- Financial Impact: The financial repercussions of a data breach can be severe, encompassing recovery costs, fines, and lost business.

- Technological Advancements: Continuous investment in cutting-edge cybersecurity solutions is required to stay ahead of evolving threats.

Technological advancements are fundamentally reshaping the real estate industry, with AI and machine learning driving efficiency and accuracy in property valuation and agent operations. Compass is leveraging these tools, integrating AI into its platform to analyze market trends and buyer behavior, thereby enhancing agent productivity and client targeting.

The adoption of virtual and augmented reality is transforming property viewing experiences, offering immersive tours that expand market reach and save time for both buyers and sellers. This technology is becoming a key differentiator, with a significant portion of real estate agents reporting increased buyer engagement from virtual tours.

Robust cybersecurity is paramount for Compass, given its handling of sensitive data, to protect against breaches and maintain client trust. The substantial financial and reputational risks associated with data breaches underscore the necessity of continuous investment in advanced security measures and compliance with data protection regulations.

| Technology | Impact on Real Estate | Compass's Application/Benefit | 2024/2025 Data/Projection |

|---|---|---|---|

| AI & Machine Learning | Automated property valuation, agent productivity, market trend analysis | Enhanced AVMs, predictive analytics for agents, personalized client recommendations | AI-powered AVMs projected in over 70% of major platforms by July 2025; AI analytics boosted client engagement by 15% on platforms in 2024. |

| VR & AR | Immersive property tours, expanded reach, time efficiency | Virtual tours for remote property exploration, broader seller reach, streamlined buyer viewing | Global VR in real estate market valued at approx. $1.5 billion in 2024, with significant growth expected. |

| Cybersecurity | Data protection, client trust, regulatory compliance | Safeguarding sensitive client and transaction data, maintaining reputation | Average cost of data breaches in 2024 was $4.73 million; robust cybersecurity is a business imperative. |

Legal factors

Strict data privacy regulations, like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly influence Compass's operations. These laws dictate how Compass can gather, retain, and utilize customer information, demanding meticulous adherence to protect sensitive client data.

Non-compliance with these stringent data privacy laws can result in substantial financial penalties. For instance, GDPR violations can lead to fines of up to 4% of annual global turnover or €20 million, whichever is greater. Compass must invest in robust data governance frameworks and advanced security measures to ensure it meets these legal obligations and fosters continued consumer trust.

Real estate brokerage operations are subject to stringent state and local regulations, encompassing licensing, advertising standards, and ethical conduct. Compass must navigate these diverse and often changing legal landscapes across all its operating regions to maintain compliance. For instance, as of early 2024, the National Association of REALTORS® continues to emphasize adherence to fair housing laws, a critical legal factor for any brokerage operating nationally.

Antitrust scrutiny is intensifying for real estate tech firms like Compass, focusing on how commission structures affect market competition. This legal pressure is a significant factor in the evolving landscape of the industry.

Recent developments, such as the National Association of Realtors (NAR) settlement, signal a potential overhaul of traditional brokerage models and compensation arrangements. This settlement, which could see commission rules change significantly, was valued at approximately $1.8 billion.

These legal shifts could directly impact Compass's operational costs and revenue streams, requiring strategic adaptation to new regulatory frameworks and competitive pressures within the real estate technology sector.

Consumer Protection Laws

Consumer protection laws are paramount for Compass, dictating everything from required property disclosures to fair housing regulations and the enforceability of contracts. Strict adherence to these legal frameworks, such as the Truth in Lending Act (TILA) and the Fair Housing Act, is not just about avoiding penalties; it's about fostering a trustworthy environment for all parties involved in real estate transactions. For instance, in 2024, the U.S. Department of Housing and Urban Development (HUD) continued its enforcement efforts against discriminatory housing practices, underscoring the ongoing importance of fair housing compliance for brokerages like Compass.

Navigating the complexities of consumer protection legislation directly impacts Compass's operational integrity and risk management. Failure to comply can lead to significant fines, lawsuits, and damage to brand reputation. For example, in 2023, several real estate firms faced litigation over alleged violations of disclosure requirements, highlighting the financial and reputational stakes. Compass's commitment to robust compliance programs helps mitigate these risks, ensuring ethical dealings and building long-term client confidence.

- Disclosure Requirements: Ensuring all material facts about a property are accurately and timely disclosed to potential buyers.

- Fair Housing Compliance: Prohibiting discrimination in real estate transactions based on race, color, religion, sex, familial status, national origin, or disability.

- Contractual Integrity: Upholding legally sound and transparent contractual agreements between buyers, sellers, and Compass.

- Consumer Recourse: Providing clear avenues for consumers to address grievances and seek resolution for potential violations.

Intellectual Property Rights

Compass's reliance on its proprietary technology and software means intellectual property (IP) protection is paramount. Patents safeguard its innovative platform, while copyrights shield its software code, preventing rivals from replicating its core assets. Trademarks, like the Compass logo, ensure brand recognition and prevent consumer confusion in the marketplace.

In 2024, the global IP market saw significant activity, with patent filings continuing to rise, underscoring the increasing value placed on technological innovation. For companies like Compass, robust IP strategies are not just defensive but offensive, creating barriers to entry and supporting premium pricing for its services.

- Patents: Crucial for protecting Compass's unique technological architecture and algorithms, preventing direct imitation.

- Copyrights: Essential for safeguarding the software powering its platform, ensuring the integrity of its digital offerings.

- Trademarks: Vital for maintaining brand identity and market differentiation, building trust with its customer base.

- Trade Secrets: May also be employed to protect sensitive operational information and customer data, further solidifying its competitive advantage.

Legal factors significantly shape Compass's operations, particularly concerning data privacy and consumer protection. Regulations such as GDPR and CCPA mandate strict handling of customer information, with non-compliance carrying hefty fines, potentially up to 4% of global turnover. Furthermore, evolving real estate laws, exemplified by the significant NAR settlement valued around $1.8 billion, are reshaping commission structures and competitive dynamics within the industry. Adherence to fair housing laws and accurate property disclosures, enforced by bodies like HUD, remains critical for maintaining ethical operations and consumer trust.

Environmental factors

The real estate sector is increasingly prioritizing sustainability, with a surge in demand for green building practices, enhanced energy efficiency, and the use of eco-friendly materials. This trend is driven by both regulatory pressures and growing consumer awareness. For instance, in 2023, the global green building market was valued at over $1.2 trillion and is projected to reach $2.5 trillion by 2030, indicating a substantial shift towards environmentally responsible construction and renovation.

Compass can leverage this environmental shift by actively promoting and facilitating transactions involving sustainable properties. By highlighting features like solar panel installations, water conservation systems, and the use of recycled or low-impact building materials, Compass can attract a growing segment of eco-conscious buyers and sellers. This strategic alignment with sustainability trends can position Compass as a leader in a rapidly evolving market, meeting the increasing consumer demand for homes that are not only aesthetically pleasing but also environmentally sound.

Climate change is directly impacting property values and the cost of insurance. We're seeing more frequent and intense storms, floods, and wildfires, which can cause significant damage. For example, in 2024, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $50 billion in damages by mid-year, according to NOAA. This escalating risk makes properties in vulnerable areas less desirable and drives up insurance premiums, a critical factor for Compass and its clients.

Compass and its agents need to stay informed about these environmental shifts to provide sound advice. Understanding which regions are most susceptible to climate-related hazards is crucial for property valuation and investment strategies. Failing to account for these risks could lead to misinformed decisions and potential financial losses for clients, especially as insurers begin to re-evaluate coverage in high-risk zones.

Governments worldwide are increasingly mandating detailed environmental disclosures for real estate. For instance, by 2025, the EU's Energy Performance of Buildings Directive (EPBD) will require more comprehensive energy efficiency data for all properties. Compass needs to integrate systems that can accurately capture and present this information, ensuring compliance and transparency for its users.

This regulatory shift impacts how properties are marketed and valued. Buyers are becoming more aware of environmental factors, demanding information on flood risks, carbon footprints, and energy efficiency. Compass's ability to provide this data proactively will be crucial for maintaining trust and meeting evolving market expectations in 2024 and beyond.

Consumer Demand for Eco-Friendly Homes

Consumer demand for eco-friendly homes is a significant environmental factor. Buyers are increasingly prioritizing energy efficiency, sustainable building materials, and a reduced environmental impact when purchasing property. This shift reflects a growing awareness of climate change and a desire for healthier living spaces.

Compass can leverage this trend by emphasizing green features in its property listings. This includes highlighting aspects like solar panels, high-efficiency insulation, water-saving fixtures, and the use of recycled or locally sourced materials. By showcasing these attributes, Compass can attract environmentally conscious buyers and differentiate itself in the market.

Furthermore, empowering Compass agents with knowledge about sustainable living options is crucial. This enables them to effectively communicate the benefits of green homes to potential buyers, from long-term cost savings on utilities to improved indoor air quality. This expertise can build trust and position Compass as a leader in sustainable real estate practices.

- Growing Market Share: The green building market is expanding, with an estimated 30% of new commercial buildings in the US being green-certified as of 2023, a trend expected to continue into 2024 and 2025.

- Buyer Preference: Surveys indicate that a majority of homebuyers, often exceeding 70%, are willing to pay a premium for homes with energy-efficient features.

- Investment Opportunity: The demand for sustainable homes is projected to drive significant growth in the real estate sector, with investments in green building expected to reach hundreds of billions globally by 2025.

Impact of Natural Disasters on Property Markets

Regions highly susceptible to natural disasters, such as coastal areas or earthquake zones, can face significant volatility in their property markets. These events can lead to widespread property damage, causing immediate disruptions to real estate transactions and potentially devaluing assets. For instance, the 2023 hurricane season saw billions in damages across the southeastern United States, directly impacting property values and insurance availability in affected areas.

The increased frequency and severity of climate-related events in 2024 and projections for 2025 are leading to higher insurance premiums and, in some cases, reduced insurability for properties in disaster-prone locations. This environmental factor directly influences buyer demand and development feasibility, forcing companies like Compass to reassess market stability and investment risk. For example, flood insurance rates in Florida have seen substantial increases, impacting affordability and market liquidity.

- Increased Insurance Costs: Property insurance premiums in disaster-prone regions are expected to continue their upward trend through 2025, potentially making homeownership less accessible.

- Property Value Volatility: Markets that experience frequent natural disasters may see greater fluctuations in property values compared to more stable regions.

- Development Challenges: Building codes and insurance requirements in high-risk areas can increase construction costs and slow down new property development.

- Relocation Trends: Environmental risks may drive population shifts away from vulnerable areas, impacting long-term demand for property in those markets.

Environmental factors, particularly climate change and sustainability initiatives, are reshaping the real estate landscape. Growing demand for green buildings, driven by consumer awareness and regulatory push, is a key trend. For instance, the global green building market was valued at over $1.2 trillion in 2023 and is projected to reach $2.5 trillion by 2030, signaling a robust shift towards eco-friendly practices.

The increasing frequency of extreme weather events, such as floods and wildfires, directly impacts property values and insurance costs. The U.S. experienced 28 billion-dollar weather and climate disasters in 2024 alone, totaling over $50 billion in damages by mid-year, according to NOAA. This escalating risk necessitates careful consideration of property location and resilience.

Governments are also enforcing stricter environmental disclosures, with the EU's Energy Performance of Buildings Directive (EPBD) mandating more comprehensive energy efficiency data by 2025. This regulatory environment enhances transparency and influences property valuation and marketing strategies.

| Environmental Factor | Impact on Real Estate | 2024/2025 Data/Projections |

|---|---|---|

| Sustainability Demand | Increased value for green-certified properties | Global green building market projected to reach $2.5 trillion by 2030 (from $1.2T in 2023) |

| Climate Change Risks | Higher insurance premiums, property value volatility in vulnerable areas | $50B+ in US disaster damages by mid-2024; rising flood insurance costs in Florida |

| Regulatory Mandates | Greater emphasis on energy efficiency reporting | EU EPBD requiring enhanced energy data by 2025 |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable international organizations, government publications, and leading market research firms. This ensures that every factor, from political stability to technological advancements, is grounded in credible and current information.