Compass Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compass Group Bundle

Compass Group's strengths lie in its global reach and diversified service offerings, but understanding its vulnerabilities and the competitive landscape is crucial for strategic planning. Our comprehensive SWOT analysis delves into these areas, providing a clear roadmap for navigating the food and support services industry.

Want to truly grasp Compass Group's market position and future potential? Purchase the complete SWOT analysis to unlock actionable insights, expert commentary, and an editable format perfect for investors, analysts, and strategic decision-makers.

Strengths

Compass Group’s global market leadership is undeniable, operating in over 40 countries and solidifying its position as a top player in contract foodservice and support services. This vast reach grants them substantial purchasing power, translating into better deals with suppliers and driving down operational costs. For instance, in fiscal year 2023, Compass Group reported revenues of £30.1 billion, showcasing the sheer scale of their operations and their ability to leverage this size for competitive advantage.

Compass Group's strength lies in its remarkably diverse sector portfolio and client base. They cater to a broad spectrum of industries, including business and industry, education, healthcare, sports and leisure, and defense. This wide reach across different economic segments, from corporate catering to school lunches and hospital food services, significantly reduces their vulnerability to sector-specific downturns.

This diversification is a key risk mitigation strategy, ensuring more stable and consistent revenue streams even when certain industries face economic headwinds. For instance, while the sports and leisure sector might experience seasonal fluctuations, demand in healthcare and education remains relatively constant, providing a solid revenue floor.

As of their fiscal year ending September 30, 2023, Compass Group reported revenues of £30.1 billion, a testament to the breadth of their operations. This broad market penetration allows them to leverage economies of scale and cross-sell services, further solidifying their market position.

Compass Group has showcased impressive financial results, with organic revenue increasing by 11.3% in the first half of fiscal year 2024, reaching £16.5 billion. This growth, coupled with a 15.8% rise in operating profit to £1.0 billion, highlights the effectiveness of their strategy.

The company's strategic approach, combining organic expansion with targeted acquisitions, continues to bolster its market position. For instance, their acquisition of CH&CO in the UK in late 2023 expanded their catering capabilities and client base, reinforcing their growth trajectory.

High Client Retention and New Business Wins

Compass Group demonstrates exceptional client loyalty, with a retention rate consistently exceeding 96%. This robust figure underscores deep client satisfaction and provides a stable foundation for recurring revenue streams.

The company is also effectively capitalizing on market expansion, evidenced by its success in securing substantial new contracts. A significant portion of this new business originates from first-time outsourcing clients, highlighting a growing demand for Compass Group's services in untapped market segments.

Key performance indicators for the fiscal year ending September 30, 2023, reflect this strength:

- Client Retention: Maintained above 96%, demonstrating consistent service quality and client trust.

- New Business Wins: First-time outsourcing contributed a notable percentage to overall new contract acquisitions, indicating strong market penetration.

- Revenue Growth: Driven by both retention and new client acquisition, contributing to overall financial performance.

Commitment to Sustainability and Technology

Compass Group demonstrates a strong commitment to sustainability, actively investing in initiatives like reducing food waste and aiming for net-zero emissions by 2050. This focus aligns with increasing demand from clients and consumers for environmentally conscious operations. For instance, in fiscal year 2023, the company reported a 12% reduction in food waste intensity compared to their 2018 baseline.

Leveraging technology is another key strength, with Compass Group integrating digital innovation to boost efficiency and customer satisfaction. This includes advancements in data analytics for better forecasting and personalized service offerings. The company's digital transformation efforts are designed to drive growth and maintain a competitive edge in the evolving service industry.

- Sustainability Investment: Targeting net-zero emissions by 2050 and reducing food waste.

- Technological Integration: Enhancing operational efficiency and customer experience through digital innovation.

- Market Alignment: Responding to growing client and consumer demand for eco-friendly practices.

- Data-Driven Operations: Utilizing analytics for improved forecasting and personalized services.

Compass Group’s extensive global presence, operating in over 40 countries, provides significant economies of scale and purchasing power, contributing to cost efficiencies. Their diverse portfolio across sectors like healthcare, education, and business services mitigates risks associated with individual market downturns. The company's financial performance in the first half of fiscal year 2024, with organic revenue up 11.3% to £16.5 billion and operating profit rising 15.8% to £1.0 billion, underscores the effectiveness of its diversified strategy.

| Strength | Description | Supporting Data (FY23/H1 FY24) |

|---|---|---|

| Global Market Leadership | Extensive operations in over 40 countries | FY23 Revenue: £30.1 billion |

| Diversified Sector Portfolio | Caters to healthcare, education, defense, sports & leisure, etc. | Reduced vulnerability to sector-specific downturns |

| Strong Financial Performance | Consistent revenue growth and profitability | H1 FY24 Organic Revenue Growth: 11.3% H1 FY24 Operating Profit Growth: 15.8% |

| High Client Retention | Demonstrates client satisfaction and loyalty | Client Retention Rate: >96% |

What is included in the product

Offers a full breakdown of Compass Group’s strategic business environment, detailing its strengths in global reach and operational efficiency, weaknesses in labor dependency, opportunities in emerging markets and sustainability, and threats from competition and economic downturns.

Offers a clear visualization of Compass Group's strategic landscape, highlighting key areas for improvement and leveraging strengths to mitigate weaknesses.

Weaknesses

Compass Group's reliance on a concentrated base of large contracts presents a notable weakness. A significant portion of its revenue streams are tied to a limited number of major clients, meaning the loss or renegotiation of even one substantial contract could lead to considerable revenue volatility. For instance, while specific client contract values are proprietary, the company's overall revenue growth can be disproportionately impacted by the success or failure of securing and retaining these key agreements.

While Compass Group boasts a diversified portfolio, its business and industry segment, a significant contributor to revenue, remains susceptible to economic downturns. During periods of economic contraction, companies often reduce discretionary spending, which can directly impact demand for outsourced food services. For instance, a slowdown in corporate hiring or a general belt-tightening by businesses could lead to lower catering volumes and reduced contract values for Compass Group.

As a labor-intensive business, Compass Group faces significant vulnerability to rising labor costs, directly impacting its profitability. For instance, in the fiscal year ending September 30, 2023, the company reported that wage inflation was a key factor influencing its cost structure.

Managing a workforce exceeding 550,000 employees globally presents complex challenges in recruitment, training, and retention. This vast and diverse workforce requires continuous investment in development and effective management strategies to ensure consistent service quality and operational efficiency across all regions.

Supply Chain Vulnerabilities and Inflationary Pressures

Compass Group's extensive global supply chain, while a strength in reach, also presents significant vulnerabilities. Disruptions stemming from geopolitical conflicts or unforeseen events can impact the availability and cost of essential food and operational inputs. For instance, the ongoing conflicts in Eastern Europe and global shipping challenges in 2024 have continued to exert upward pressure on commodity prices and transportation expenses, directly affecting companies like Compass Group.

These inflationary pressures on food and operational inputs pose a direct threat to profit margins. If the company cannot adequately pass on these increased costs through pricing initiatives, its profitability could be squeezed. In 2024, many businesses faced similar challenges, with rising energy and labor costs contributing to broader inflationary trends. Compass Group's ability to manage these rising procurement expenses through strategic sourcing and efficient logistics will be crucial for maintaining healthy margins.

- Global Supply Chain Exposure: Vulnerable to geopolitical instability and shipping disruptions, impacting input availability.

- Inflationary Impact: Rising costs for food, energy, and labor directly affect procurement expenses.

- Margin Squeeze Potential: Difficulty in passing on costs to clients can reduce profitability.

- Logistics Cost Increases: Higher transportation expenses add to overall operational overhead.

Operational Complexities in Diverse Geographies

Compass Group's extensive global footprint, spanning operations in over 40 countries, presents significant operational complexities. Navigating diverse regulatory frameworks, varying cultural norms, and distinct local market demands across these regions creates inherent challenges in maintaining uniform service standards and achieving optimal operational efficiency. For instance, in 2024, the company's diverse portfolio meant adapting to over a dozen different food safety regulations and labor laws, impacting supply chain management and staffing models.

These operational hurdles can lead to inconsistencies in service delivery and potentially dilute brand perception. The sheer scale of managing such a geographically dispersed business requires robust and adaptable systems.

- Regulatory Fragmentation: Compliance with differing legal and food safety standards in each country adds layers of complexity and cost.

- Cultural Nuances: Adapting service offerings and management styles to local cultural preferences is critical but challenging to standardize.

- Supply Chain Variability: Sourcing and logistics differ greatly across markets, impacting cost control and availability of goods.

- Talent Management: Recruiting, training, and retaining staff with diverse skill sets and cultural understanding across 40+ nations is a constant undertaking.

Compass Group's significant reliance on a few large contracts is a key weakness, as losing even one could cause substantial revenue fluctuations. The company's earnings are highly sensitive to the retention and acquisition of these major agreements.

The labor-intensive nature of Compass Group's operations makes it vulnerable to rising wage costs. For instance, the company highlighted wage inflation as a significant factor affecting its cost structure in fiscal year 2023, directly impacting profitability.

Managing a global workforce of over 550,000 employees presents ongoing challenges in recruitment, training, and retention, impacting service consistency and operational efficiency. This vast team requires continuous investment in development and effective management.

Compass Group's extensive global supply chain is exposed to disruptions from geopolitical events and shipping issues, which can affect the availability and cost of essential supplies. For example, ongoing global shipping challenges in 2024 have driven up commodity prices and transportation expenses.

What You See Is What You Get

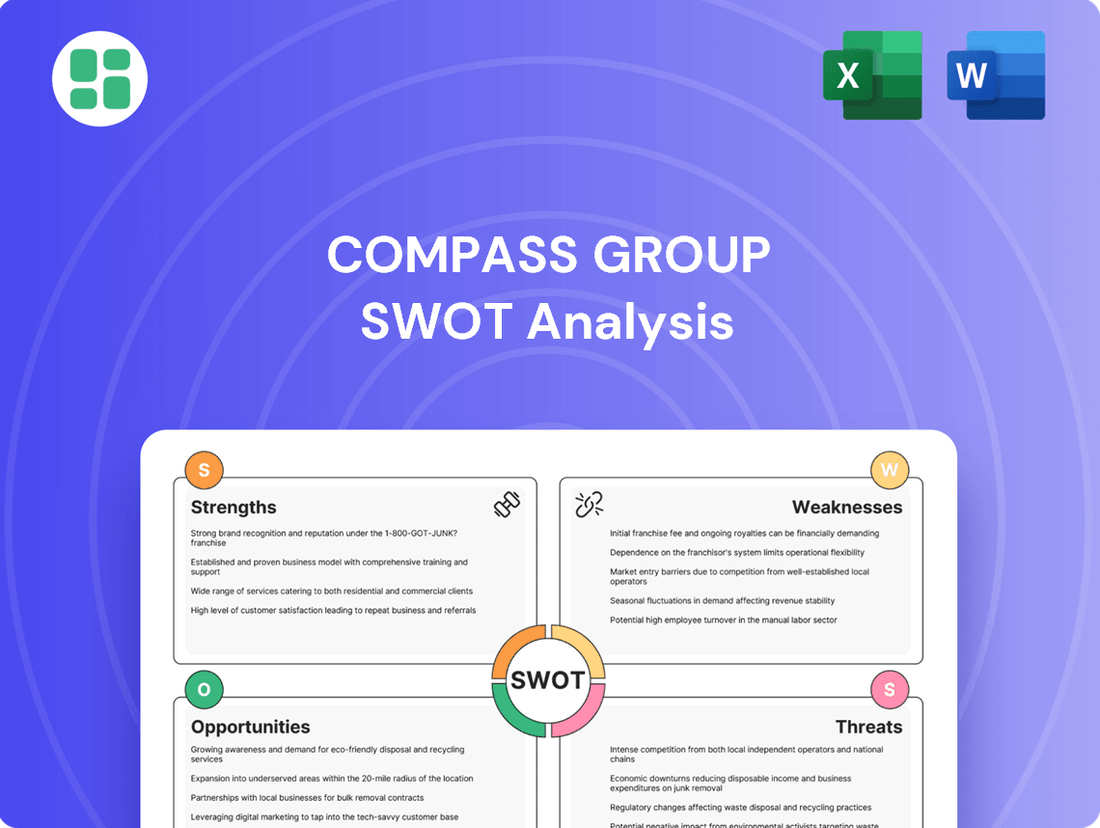

Compass Group SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document outlines Compass Group's Strengths, Weaknesses, Opportunities, and Threats, providing valuable strategic insights.

Opportunities

Compass Group sees a significant opportunity in the global food services market, which is experiencing structural growth. Currently, only about half of the addressable market outsources its food preparation, indicating substantial room for expansion.

The company is strategically positioned to benefit from this trend, with first-time outsourcing representing a considerable portion of its new business acquisitions. This highlights a strong demand for Compass Group's services from entities previously managing their food operations internally.

In fiscal year 2023, Compass Group reported revenue growth of 11.6% to £30.1 billion, with organic growth reaching 10.7%. This performance underscores their ability to capture new market share and expand their client base through outsourcing initiatives.

Compass Group is significantly boosting its operational efficiency and customer engagement by investing in digital tools, artificial intelligence, and automation. This strategic move aims to streamline processes and offer more personalized services, such as mobile ordering, directly enhancing the customer experience.

The company's dedicated entities, Compass Digital and Compass Digital Ventures, are at the forefront of these technological advancements. Their work is crucial in unlocking substantial cost savings and driving innovation across the group's diverse operations, positioning Compass for future growth in a rapidly evolving market.

Compass Group has a history of successfully integrating bolt-on acquisitions, which bolsters their specialized knowledge in specific sectors, broadens their service offerings, and strengthens their market position. For instance, in fiscal year 2023, the company completed several acquisitions that are expected to contribute positively to revenue growth and operational efficiency in the coming years.

A continued emphasis on acquiring high-quality businesses, especially within their established core markets, presents a significant opportunity to expedite expansion and refine their overall service portfolio. This strategic approach allows Compass Group to gain immediate market access and leverage existing infrastructure, thereby enhancing their competitive edge.

Growing Demand for Sustainable and Healthy Food Options

Consumers and clients are increasingly prioritizing sustainable sourcing, plant-based protein, and healthier menu choices. This shift represents a substantial growth opportunity for Compass Group. For instance, a 2024 report indicated that 65% of consumers are willing to pay more for sustainably sourced food.

Compass Group's existing commitments, such as their net-zero targets and initiatives to reduce food waste, directly address these evolving consumer preferences. Their focus on sustainable practices positions them favorably to capture market share in this growing segment.

Key opportunities stemming from this trend include:

- Expansion of plant-based offerings: Meeting the rising demand for vegetarian and vegan meals.

- Enhanced sustainable sourcing: Building stronger relationships with ethical and environmentally conscious suppliers.

- Health-focused menu development: Catering to a growing segment of health-conscious individuals.

- Marketing sustainable initiatives: Leveraging their environmental commitments to attract and retain clients.

Enhancing Social Value and Community Engagement

Compass Group's dedication to boosting social value through job creation, training, and community involvement significantly enhances its brand image, attracting clients who prioritize corporate social responsibility. This focus also aids in attracting and retaining top talent.

For instance, in 2023, Compass Group reported creating over 50,000 new jobs globally, with a significant portion dedicated to entry-level positions and skills development programs. Their commitment to local sourcing in 2024 is also a key driver of community economic growth.

- Job Creation: Over 50,000 new jobs created globally in 2023.

- Skills Development: Investment in training programs to enhance employee capabilities.

- Local Economic Support: Increased focus on sourcing from local suppliers and businesses.

- Brand Reputation: Strengthening appeal to socially conscious clients and employees.

The growing demand for sustainable and healthy food options presents a significant avenue for Compass Group's expansion. With 65% of consumers in 2024 willing to pay more for sustainably sourced food, the company is well-positioned to capitalize on this trend by increasing its plant-based offerings and emphasizing ethical sourcing.

Furthermore, Compass Group's commitment to social value, demonstrated by creating over 50,000 new jobs globally in 2023 and increasing local sourcing, enhances its brand appeal to clients prioritizing corporate social responsibility and attracts top talent.

| Opportunity Area | Key Trend | Compass Group's Response/Benefit | Supporting Data (2023/2024) |

|---|---|---|---|

| Market Expansion | Increasing outsourcing of food services | Capturing new clients previously managing in-house | Fiscal Year 2023 revenue grew 11.6% to £30.1 billion |

| Sustainability & Health | Consumer preference for plant-based and healthy options | Expanding plant-based menus, ethical sourcing | 65% of consumers willing to pay more for sustainable food (2024) |

| Digital Transformation | Leveraging technology for efficiency and engagement | Streamlining operations, personalized customer experience | Investment in Compass Digital and Compass Digital Ventures |

| Acquisitions | Integrating specialized businesses | Broadening service offerings, strengthening market position | Completed several bolt-on acquisitions in FY2023 |

Threats

The contract foodservice market is intensely competitive, featuring a multitude of local, regional, and global participants vying for market share. This crowded landscape often forces companies like Compass Group to compete aggressively on pricing and contract terms, which can squeeze profit margins and challenge client retention efforts.

Compass Group faces significant challenges from ongoing volatility in global commodity prices, especially for essential food ingredients. For instance, the FAO Food Price Index, which tracks monthly changes in the international prices of a basket of food commodities, experienced fluctuations throughout 2024, impacting procurement costs. This price instability directly translates into higher operational expenses for the company.

Broader inflationary pressures further exacerbate these cost increases, putting pressure on Compass Group's profitability. While the company has strategically implemented pricing initiatives to offset these rising costs, sustained high inflation could still erode profit margins. For example, if inflation rates remain elevated in key markets like the UK or US through 2025, it could significantly challenge the effectiveness of these pricing strategies.

Compass Group faces a significant threat from rapidly changing consumer preferences and dietary trends. The increasing popularity of plant-based diets, for instance, demands constant menu innovation. Globally, the plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $160 billion by 2030, indicating a substantial shift that Compass Group must address.

Failure to quickly adapt to evolving health consciousness, such as the demand for locally sourced and sustainable food options, can erode client satisfaction and market standing. For example, a 2024 survey revealed that over 60% of consumers consider sustainability when making food purchasing decisions, directly impacting the appeal of Compass Group's offerings if not aligned.

Regulatory Changes and Compliance Risks

Operating globally means Compass Group must navigate a constantly changing web of international regulations. This includes everything from food safety standards and labor laws to environmental mandates and data privacy rules, like GDPR. For instance, in 2024, the EU continued to implement stricter environmental reporting requirements impacting supply chains.

Failure to keep pace with or adhere to these evolving regulations poses significant risks. These can manifest as substantial fines, increased operational expenses due to compliance upgrades, or even severe reputational damage that erodes customer trust.

- Regulatory Complexity: Compass Group faces diverse food safety, labor, environmental, and data privacy laws across its many operating countries.

- Increased Costs: New or more stringent regulations, such as those impacting waste management or ingredient sourcing, can directly increase operating expenses.

- Reputational Impact: Non-compliance incidents, even minor ones, can lead to negative publicity and damage the brand's image, affecting client acquisition and retention.

Geopolitical Instability and Health Crises

Geopolitical instability, including ongoing conflicts and rising trade tensions, presents a significant threat to Compass Group. These disruptions can severely impact global supply chains, leading to increased costs and potential shortages of essential ingredients and supplies. For instance, the conflict in Ukraine in 2022 led to significant price volatility for grains and energy, directly affecting food service costs worldwide.

The potential for future health crises, such as pandemics, remains a persistent risk. Such events can trigger widespread office closures, drastically reduce business and leisure travel, and consequently dampen demand for foodservice operations. The lingering effects of COVID-19 in 2024 continue to shape hybrid work models, influencing catering and on-site dining needs for businesses.

- Global conflicts and trade disputes create supply chain vulnerabilities, impacting ingredient availability and cost for Compass Group.

- The threat of future health crises can lead to reduced client activity, such as office closures and decreased travel, directly affecting demand for foodservice.

- In 2024, the ongoing adaptation to hybrid work models continues to reshape demand patterns for corporate catering and workplace dining services.

Intensifying competition from a crowded market, including numerous local and global players, forces Compass Group into aggressive pricing strategies that can compress profit margins. Fluctuations in global commodity prices, particularly for food ingredients, directly increase operational expenses, a trend evident throughout 2024 with ongoing volatility in the FAO Food Price Index.

Evolving consumer preferences, such as the growing demand for plant-based options, necessitate continuous menu innovation, a market segment projected to reach $160 billion by 2030. Furthermore, navigating complex and ever-changing international regulations, from food safety to environmental mandates, poses significant compliance risks and potential cost increases.

SWOT Analysis Data Sources

This Compass Group SWOT analysis is built upon a foundation of credible data sources, including their latest financial reports, comprehensive market research, and insights from industry experts. These resources provide a robust understanding of their operational performance and the competitive landscape.