Compass Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compass Group Bundle

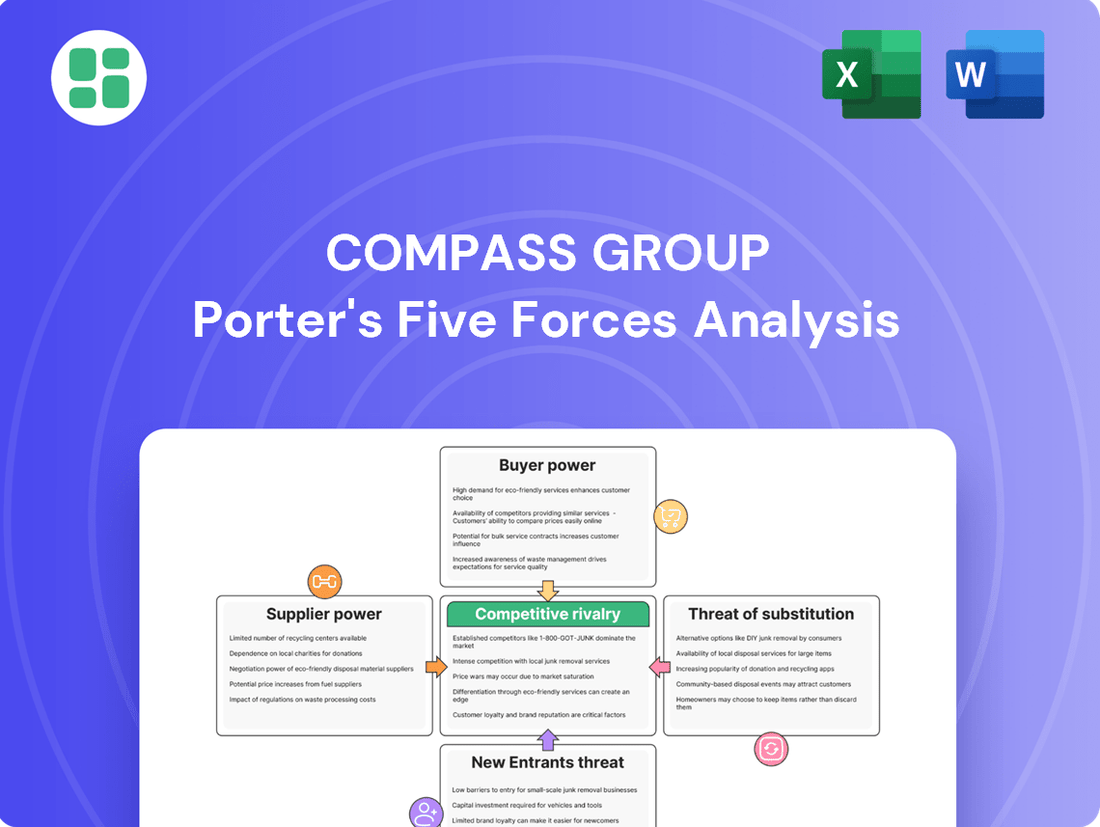

Compass Group operates in a dynamic global market, facing pressures from intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating its competitive landscape effectively.

The complete report reveals the real forces shaping Compass Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Compass Group's immense global supplier network, exceeding 10,000 entities, inherently limits the bargaining power of individual suppliers. This broad sourcing base means no single supplier can dictate terms due to the company's ability to readily shift procurement. For instance, in 2023, Compass Group's procurement spend across its diverse operations provided significant leverage in negotiations, ensuring competitive pricing and stable supply chains.

Compass Group's need for high-quality and fresh ingredients gives some power to suppliers who can provide premium or unique items. This is because about 60% of their spending in fiscal year 2022 went towards these types of ingredients, which are crucial for maintaining their service quality and brand reputation.

Consolidation within the food supply industry presents a significant challenge for Compass Group. As key suppliers merge and grow, their collective bargaining power increases, potentially leading to higher input costs for Compass Group. For instance, in 2023, the top five food suppliers in Europe collectively held around 45% of the market share, a figure that is likely to continue increasing.

This trend of consolidation directly impacts Compass Group's ability to negotiate favorable pricing. When fewer, larger suppliers dominate the market, they have less incentive to offer competitive discounts. Consequently, Compass Group might face reduced margins if they cannot pass these increased costs onto their clients, a crucial factor in their competitive landscape.

Inflationary Pressures on Input Costs

The foodservice sector, including major players like Compass Group, is keenly aware of how volatile raw material prices and general inflation can affect their bottom line. When the cost of essential inputs like food and labor rises, it directly impacts the cost of goods sold, potentially squeezing profit margins.

For instance, in 2024, the global food price index, tracked by the FAO, experienced significant fluctuations, with certain categories seeing year-on-year increases. This directly translates to higher procurement costs for companies like Compass Group.

- Rising Food Costs: Global commodity prices for staples like grains and dairy saw upward trends in early 2024, impacting catering budgets.

- Labor Inflation: Minimum wage adjustments and general wage pressures in 2024 continued to increase labor expenses for foodservice operations.

- Procurement Strategies: Compass Group leverages its considerable purchasing power to negotiate better rates, a critical strategy given these inflationary headwinds.

- Menu Optimization: Careful menu planning and product rationalization are key to mitigating the impact of fluctuating input costs on profitability.

Technological Advancements in Supply Chain

The ongoing digital transformation in the food sector, driven by consumer demand for traceability, is significantly influencing supplier power. Suppliers embracing advanced technologies for seamless data sharing, efficient inventory control, and real-time updates are becoming more critical partners. This technological evolution can bolster the bargaining power of those suppliers capable of delivering enhanced transparency and operational efficiency throughout the supply chain.

For instance, in 2024, the global food traceability market was valued at approximately USD 12.5 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030. This growth underscores the increasing importance of technology adoption among suppliers. Companies that invest in solutions like blockchain for provenance tracking or AI for demand forecasting can command better terms.

- Technological Adoption: Suppliers integrating IoT sensors for real-time temperature monitoring during transit can reduce spoilage and increase their value proposition.

- Data Transparency: Suppliers offering robust digital platforms for order tracking and quality control provide greater visibility, strengthening their negotiating position.

- Efficiency Gains: Early adopters of automated warehousing and predictive analytics can offer cost savings and reliability, enhancing their bargaining leverage.

The bargaining power of Compass Group's suppliers is influenced by industry consolidation, with fewer, larger entities gaining leverage. For example, in 2023, the top five food suppliers in Europe controlled approximately 45% of the market share, a trend that continues to empower these key players. This concentration means suppliers can command higher prices, potentially impacting Compass Group's profit margins if cost increases cannot be passed on to clients.

Rising raw material costs, such as grains and dairy, in early 2024, coupled with labor inflation due to wage adjustments, directly increase Compass Group's procurement expenses. The company's substantial purchasing volume, however, provides a counter-balance, enabling negotiation for better rates amidst these inflationary pressures.

Suppliers who adopt advanced technologies for traceability and data sharing are increasingly valuable. The global food traceability market, valued at roughly USD 12.5 billion in 2024 and projected for significant growth, highlights the advantage of tech-savvy suppliers. These partners can offer enhanced transparency and efficiency, strengthening their negotiating position.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (2023-2024) |

|---|---|---|

| Industry Consolidation | Increases power for dominant suppliers | Top 5 European food suppliers held ~45% market share in 2023 |

| Input Cost Volatility | Empowers suppliers of essential goods | Rising grain and dairy prices in early 2024 |

| Technological Adoption | Strengthens suppliers with data/traceability capabilities | Food traceability market ~$12.5 billion in 2024 |

What is included in the product

This analysis dissects the competitive forces impacting Compass Group, revealing how supplier and buyer power, new entrant threats, substitute services, and industry rivalry shape its market position and profitability.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Compass Group's customer base is heavily weighted towards large institutional clients in sectors such as business, education, and healthcare. These significant clients wield considerable bargaining power, largely due to the substantial contract values involved. Their ability to influence pricing and contract terms is a key factor in Compass Group's operational landscape.

The sheer scale of these institutional clients allows them to negotiate for tailored solutions and competitive pricing. For instance, the growing demand for customized meal solutions reflects their power to shape service offerings. This leverage means Compass Group must continually demonstrate value and flexibility to retain these crucial relationships.

The bargaining power of customers in the contract catering sector is significantly influenced by low switching costs. For clients, moving from one provider like Compass Group to another, or even bringing catering in-house, typically involves manageable logistical hurdles rather than substantial financial penalties. This ease of transition means customers can readily explore alternatives if they are unhappy with service or pricing, directly impacting Compass Group's ability to command premium pricing or maintain client loyalty without continuous effort.

Customers are increasingly prioritizing health-conscious, nutritious, and sustainable food options in their catering contracts. This evolving consumer preference gives power to clients who demand specific dietary requirements, plant-based menus, and allergen-free options. Compass Group must adapt its offerings to meet these demands, which can influence menu development and sourcing strategies.

Focus on Employee Well-being and Productivity

Corporate clients are increasingly prioritizing employee well-being, viewing contract catering as a strategic tool to boost morale and productivity. This trend means they're actively seeking catering partners who can deliver nutritious meals and flexible service options that contribute to a positive overall employee experience.

This heightened focus on health and wellness within client organizations translates directly to increased bargaining power for customers. They can now demand catering solutions that align with their broader corporate health objectives, pushing providers to innovate and offer more value-added services.

For instance, in 2024, many large corporations began incorporating detailed wellness metrics into their vendor selection criteria for catering services. This includes demands for:

- Demonstrable nutritional quality and variety in menus.

- Flexible dining options catering to diverse dietary needs and schedules.

- On-site health and wellness initiatives supported by catering.

- Partnerships that contribute to a positive company culture and employee retention.

Digital Integration and Flexible Service Models

The growing use of digital ordering platforms and the demand for adaptable service arrangements, such as off-site and mobile catering, give customers a wider array of choices and greater convenience. Clients are increasingly favoring suppliers that provide technology-enhanced services and tailored meal delivery options.

This shift in preference empowers customers, allowing them to utilize technology for effortless ordering and personalized experiences. For instance, in 2024, the global online food delivery market reached an estimated USD 155.6 billion, highlighting the significant impact of digital integration on consumer expectations and purchasing behavior.

- Digital Ordering Dominance: Platforms allowing easy customization and reordering increase customer loyalty and reduce switching costs.

- Flexible Service Demand: A preference for on-demand and remote catering options gives clients leverage to negotiate terms.

- Tech-Savvy Clients: Businesses and individuals expect seamless integration of technology into service delivery, pushing providers to innovate.

The bargaining power of Compass Group's customers is substantial, particularly with large institutional clients who represent significant contract values. These clients can negotiate favorable pricing and service terms due to the scale of their business and the relatively low costs associated with switching providers. In 2024, the increasing emphasis on employee wellness and digital convenience further amplified customer leverage, as clients demanded more customized, health-conscious menus and seamless technology integration in their catering services.

| Factor | Impact on Compass Group | Customer Leverage Example (2024) |

|---|---|---|

| Scale of Clients | High negotiation power on pricing and terms | Large corporations securing multi-year contracts with preferred rates. |

| Switching Costs | Low, enabling easy provider changes | Clients readily exploring alternative caterers for minor service disruptions. |

| Demand for Wellness | Pressure to innovate menu offerings | Clients specifying plant-based options and detailed nutritional information. |

| Digital Integration | Need for tech-enhanced service delivery | Clients preferring platforms for easy ordering and customization. |

Same Document Delivered

Compass Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Compass Group, detailing the competitive landscape and strategic positioning of this global food and support services giant. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, providing actionable insights into industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Rest assured, what you're previewing is precisely what you'll be able to download and utilize without any alterations or omissions.

Rivalry Among Competitors

The contract foodservice sector is a battleground, with global giants like Sodexo and Aramark, alongside numerous local operators, fiercely competing for contracts. This crowded market means Compass Group constantly faces pressure to differentiate its offerings and maintain competitive pricing to secure and keep clients.

The global contract catering market, while expanding, exhibits maturity in developed regions, leading to more subdued organic growth. This maturity naturally fuels heightened competitive rivalry as established players vie for existing market share rather than solely capitalizing on broad market expansion.

In this environment, companies like Compass Group actively pursue new business contracts and strategic acquisitions to bolster their growth trajectory. For instance, Compass Group reported a 13.6% revenue growth in fiscal year 2023, demonstrating their effectiveness in securing new wins and expanding their presence even within mature markets.

The contract catering sector, including giants like Compass Group, is characterized by substantial fixed costs. These stem from the necessity of maintaining extensive kitchen infrastructure, specialized equipment, and a consistent workforce, all of which represent significant upfront and ongoing investments.

Achieving profitability hinges on maximizing operational efficiency and leveraging economies of scale. For instance, in 2023, Compass Group reported revenues of £32.1 billion, demonstrating the scale required to absorb these fixed costs and achieve competitive pricing. This drive for efficiency often intensifies price competition among players.

To navigate this, companies are increasingly adopting technology, such as AI-powered solutions, to streamline supply chains, optimize inventory management, and enhance labor scheduling. These advancements are critical for controlling costs and improving profit margins in a competitive landscape.

Differentiated Service Offerings and Innovation

Competitors in the contract catering sector, including Compass Group, actively differentiate their services through highly customized food programs, comprehensive facility management, and unique culinary experiences. This focus on tailored solutions, rather than just basic catering, is crucial for winning and retaining clients.

The drive for differentiation is fueled by significant investment in technology. For instance, in 2024, many leading contract caterers are enhancing their digital platforms for streamlined menu planning, real-time client feedback, and improved operational efficiency. This technological adoption is becoming a standard expectation.

Sustainability and health-conscious options are also paramount differentiators. Companies are increasingly highlighting:

- Plant-based and locally sourced menu options

- Reduced food waste initiatives

- Nutritional transparency and allergen management

- Innovative healthy eating campaigns

This continuous pursuit of innovation and service diversification represents a core competitive arena, directly impacting market share and profitability for players like Compass Group.

Strategic Acquisitions and Organic Expansion

Leading players in the contract catering industry, including Compass Group, Sodexo, and Aramark, are aggressively pursuing both strategic acquisitions and organic expansion. This dual approach aims to broaden their service portfolios and extend their global footprint, directly intensifying competitive rivalry.

These consolidation and growth strategies allow major players to gain market power and efficiently enter new service segments or bolster their presence in existing ones. For instance, Compass Group's acquisition of CH&Co in 2024 is a clear demonstration of this strategic imperative, signaling a proactive stance in a dynamic market.

- Market Consolidation: Acquisitions by major players like Compass Group lead to fewer, larger competitors.

- Geographic Expansion: Companies are buying or building operations in new regions to capture wider market share.

- Service Diversification: Acquiring companies with specialized services allows for cross-selling opportunities and a more comprehensive offering.

- Increased Capital Investment: The pursuit of growth necessitates significant capital outlay, raising barriers for smaller competitors.

The competitive rivalry within the contract foodservice sector is intense, driven by a crowded market and the need for differentiation. Compass Group, alongside global peers like Sodexo and Aramark, faces constant pressure to offer customized solutions, embrace sustainability, and leverage technology to win and retain clients. This dynamic environment necessitates significant investment in innovation and strategic growth.

The pursuit of new contracts and market share is a primary driver of competition, with companies like Compass Group reporting strong revenue growth, such as 13.6% in fiscal year 2023. This growth is often fueled by strategic acquisitions, like Compass Group's acquisition of CH&Co in 2024, which consolidates market power and expands service offerings.

Companies differentiate through tailored food programs, facility management, and a focus on sustainability, including plant-based options and waste reduction. Technological adoption, such as AI for supply chain optimization, is also becoming a standard expectation for controlling costs and improving margins in this highly competitive industry.

SSubstitutes Threaten

Clients managing their catering in-house presents a significant threat of substitutes for contract foodservice providers like Compass Group. This move offers clients direct control over menu customization, quality standards, and cost management, which can be particularly appealing if they feel external providers lack flexibility or sufficient value. For instance, a large university might decide to bring its dining services in-house if it believes it can achieve better student satisfaction and cost efficiencies, especially after reviewing the pricing structures of major contract caterers.

Employees increasingly have the flexibility to bring their own meals from home or access a wide array of local dining options, including restaurants, cafes, and even convenient vending machines. This growing trend directly challenges the demand for on-site contract catering services, especially within sectors like business and industry. For instance, the rise of hybrid work models means fewer employees are on-site daily, further diminishing reliance on traditional catering.

The growing popularity of meal kit services and food delivery apps presents a significant threat of substitutes for Compass Group. These services offer consumers convenient alternatives to traditional prepared meals, even impacting choices within institutional settings. For instance, the global meal kit delivery service market was valued at approximately $15 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards these alternatives.

Vending Machines and Automated Food Solutions

Advancements in vending machine technology and the rise of fully automated food operations, like self-serve ramen shops, are increasingly posing a threat of substitutes for Compass Group. These automated solutions offer significant convenience and can lead to reduced labor costs, making them attractive to clients looking for more efficient and budget-friendly food service options. For instance, the global vending machine market was valued at approximately $25.3 billion in 2023 and is projected to grow, indicating a substantial and expanding alternative.

The appeal of these substitutes lies in their ability to provide quick service and potentially lower operational expenses compared to traditional catering models. This directly challenges Compass Group's traditional service offerings, particularly in environments where cost-efficiency and speed are paramount. Companies within the broader food service industry are recognizing this shift, with examples like Sodexo acquiring vending machine suppliers to broaden their service portfolio and compete more effectively in this evolving landscape.

- Growing Market Value: The global vending machine market reached an estimated $25.3 billion in 2023, highlighting the scale of this substitute threat.

- Cost and Convenience Appeal: Automated food solutions offer clients reduced labor costs and enhanced convenience, directly competing with traditional catering services.

- Industry Adaptation: Companies like Sodexo are actively acquiring vending machine suppliers, demonstrating a strategic response to the increasing viability of these substitutes.

- Technological Advancements: Innovations in vending technology are continuously improving the variety and quality of offerings, further strengthening their competitive position.

Changing Work Models and Office Footprints

The increasing prevalence of hybrid and remote work models significantly impacts the demand for traditional on-site contract catering, especially within the business and industry sector. As fewer employees are physically present in offices, the volume of meals required for contract catering decreases, potentially making established service models less economically viable for clients.

This shift directly affects catering providers like Compass Group by reducing the need for large-scale, daily meal provisions. For instance, a company that previously catered for 500 employees daily might now only need services for 200 on-site staff, fundamentally altering the economics of their contract. This necessitates a strategic pivot towards more adaptable and modular service offerings to meet evolving client needs.

- Reduced Office Attendance: Reports indicate a significant portion of the workforce continues to operate under hybrid models, with many businesses maintaining flexible work policies post-2020.

- Impact on Volume: Lower daily office occupancy directly translates to fewer meals served, impacting the revenue streams for contract caterers.

- Need for Flexibility: Catering companies must innovate to offer solutions like on-demand ordering, smaller-scale event catering, and grab-and-go options to remain competitive.

The threat of substitutes for Compass Group is multifaceted, encompassing shifts in consumer behavior and technological advancements. Clients bringing catering in-house, employees opting for home-prepared meals or local dining, and the rise of meal kits and delivery apps all represent significant alternatives. Furthermore, advancements in automated food solutions, such as sophisticated vending machines, are increasingly offering convenient and cost-effective options that directly compete with traditional contract catering services.

| Substitute Category | Key Characteristics | Impact on Compass Group | 2023/2024 Data/Trends |

|---|---|---|---|

| In-house Catering | Direct control, customization, potential cost savings | Reduced demand for outsourced services | Universities and large corporations may re-evaluate outsourcing costs vs. in-house management. |

| Employee Meal Choices | Home-prepared meals, local restaurants, cafes | Lower on-site catering utilization | Hybrid work models continue to reduce daily office populations, impacting meal volumes. |

| Meal Kits & Delivery Apps | Convenience, variety, direct-to-consumer | Erosion of prepared meal market share | Global meal kit market projected for substantial growth beyond its 2023 valuation of ~$15 billion. |

| Automated Food Solutions | 24/7 availability, reduced labor costs, speed | Competition on convenience and efficiency | Vending machine market valued at ~$25.3 billion in 2023, with ongoing technological enhancements. |

Entrants Threaten

The contract catering sector demands significant upfront capital for state-of-the-art kitchens, specialized equipment, and robust supply chain networks. For instance, setting up a modern catering facility can easily run into millions of dollars.

Established giants like Compass Group leverage substantial economies of scale. This allows them to negotiate better prices for ingredients and optimize operational efficiencies, creating a cost advantage that new entrants struggle to match.

This high capital intensity and the entrenched cost benefits of scale present a formidable barrier, deterring many potential new competitors from entering the market.

Building a strong reputation and client trust is paramount in the contract foodservice industry, particularly when vying for substantial, long-term agreements in sectors such as healthcare and education. Newcomers often struggle to match the established brand recognition and the proven history of reliability that global players like Compass Group have cultivated. For instance, in 2024, securing new large-scale contracts often hinges on demonstrating a consistent track record of service excellence, a factor that takes years to build.

The food service industry, including sectors Compass Group operates in, faces significant hurdles due to complex and varied regulatory landscapes and stringent food safety mandates globally. New entrants must invest heavily in understanding and adhering to these rules, which often differ by region and service type, demanding specialized knowledge and robust compliance systems.

For instance, in the UK, the Food Safety Act 1990 and its associated regulations set a high bar for hygiene and product safety. Similarly, in the US, the Food and Drug Administration (FDA) and the Department of Agriculture (USDA) impose rigorous standards. These compliance costs, coupled with the potential for severe penalties for breaches, act as a substantial deterrent for potential new competitors.

Access to Distribution Channels and Supply Networks

Newcomers face significant hurdles in establishing the robust global supply chains necessary for fresh ingredients and consumables, a core competency for established players like Compass Group. These existing networks offer economies of scale and preferential terms, making it difficult for new entrants to secure competitive pricing and consistent supply.

Gaining access to established distribution channels and supplier relationships is a major barrier. Compass Group, for instance, leverages its vast operational scale to negotiate favorable terms and ensure reliability, a feat challenging for smaller, emerging competitors.

- Supply Chain Complexity: Global food service operations require intricate logistics for perishable goods, a significant investment for new entrants.

- Supplier Relationships: Long-standing partnerships provide incumbents with preferential pricing and guaranteed availability.

- Economies of Scale: Established firms benefit from bulk purchasing power, lowering their per-unit costs for supplies.

Talent Acquisition and Retention in Labor-Intensive Industry

The contract catering sector is inherently labor-intensive, demanding a diverse and skilled workforce. This includes everything from talented chefs and kitchen staff to front-of-house service personnel and experienced management. New companies entering this market face significant hurdles in securing and keeping the right people.

Attracting and retaining qualified staff is a major challenge, particularly with persistent labor shortages impacting the broader foodservice industry. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the leisure and hospitality sector, which includes food services, continued to grapple with vacancies, although employment levels were approaching pre-pandemic figures.

Established players like Compass Group often possess established recruitment pipelines and comprehensive training programs. These existing structures give them an advantage in sourcing and developing talent, making it harder for newcomers to compete for skilled employees. This can translate into higher initial operating costs for new entrants needing to invest heavily in training and recruitment incentives.

- Labor-Intensive Nature: Contract catering relies heavily on human capital, from culinary expertise to operational management.

- Talent Shortages: The foodservice industry, including contract catering, experienced ongoing staffing challenges in 2024, impacting recruitment efforts.

- Established Recruitment: Incumbent firms benefit from existing recruitment infrastructure and training programs, creating a barrier for new entrants.

- Competitive Labor Market: New entrants must contend with established companies offering competitive compensation and benefits to attract scarce talent.

The threat of new entrants for Compass Group is generally low, primarily due to the substantial capital investment required to establish operations. Setting up state-of-the-art kitchens and robust supply chains can easily cost millions, a significant hurdle for newcomers.

Furthermore, established players like Compass Group benefit from strong brand recognition and proven track records, which are crucial for securing large, long-term contracts. Navigating complex global regulations and stringent food safety standards also demands considerable expertise and investment, acting as another deterrent.

Economies of scale enjoyed by incumbents allow for better pricing on supplies and optimized operations, creating a cost advantage that new entrants find difficult to overcome. Access to established distribution channels and supplier relationships further solidifies the barriers to entry.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront costs for kitchens, equipment, and supply chains. | Significant financial barrier, limiting the number of potential entrants. |

| Brand Reputation & Trust | Established players have long histories of reliable service. | Newcomers struggle to gain credibility for large contracts. |

| Regulatory Compliance | Complex and varied global food safety and operational regulations. | Requires specialized knowledge and investment, increasing initial costs. |

| Economies of Scale | Incumbents leverage bulk purchasing and operational efficiencies. | Creates a cost disadvantage for smaller, new competitors. |

| Supply Chain Access | Established networks provide preferential terms and consistent supply. | Difficult for new entrants to secure competitive pricing and reliable sourcing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Compass Group is built upon a foundation of comprehensive data, including Compass Group's annual reports, investor presentations, and filings with regulatory bodies like the SEC. We also incorporate industry-specific data from reputable market research firms such as IBISWorld and Statista, alongside insights from financial news outlets and competitor announcements.