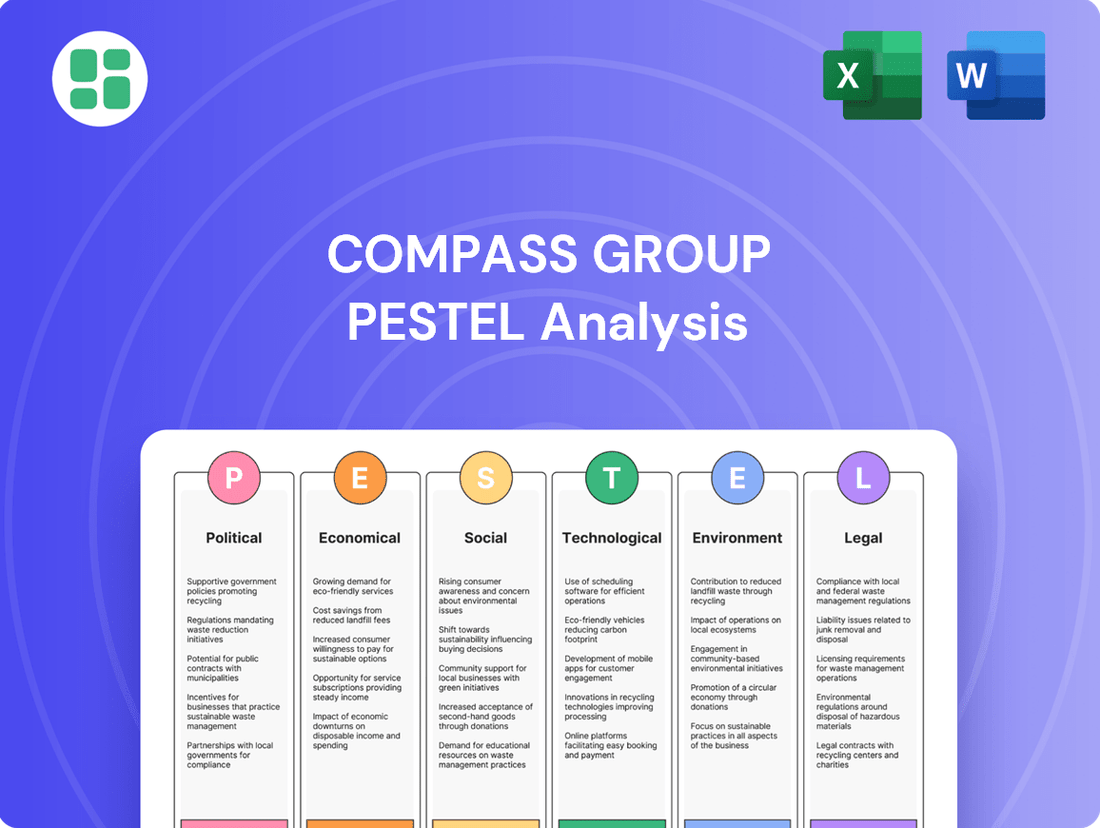

Compass Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compass Group Bundle

Navigate the complex global landscape impacting Compass Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

Government policies heavily shape the demand for Compass Group's services, especially in public sectors like healthcare and education. When governments opt for outsourcing, it opens up substantial growth avenues for companies like Compass. For instance, the UK government's continued focus on efficiency in public services suggests ongoing opportunities for contract catering and support services.

Conversely, a move towards in-house service provision or austerity measures within the public sector can stifle Compass Group's expansion. The company's strategy, as outlined in its 2024 report, involves targeting markets with significant first-time outsourcing potential, particularly in Europe, indicating a proactive response to these policy dynamics.

Compass Group's global footprint, spanning over 40 countries, makes it highly sensitive to shifts in international trade regulations and geopolitical stability. For instance, the ongoing trade discussions between major economic blocs in 2024 could introduce new tariffs or alter existing agreements, directly impacting Compass's ability to source ingredients cost-effectively and manage its diverse supply chains.

Protectionist policies enacted by various nations in 2024 have already presented challenges, potentially increasing the cost of key food items and affecting Compass's pricing strategies. Conversely, a resolution of trade disputes and the establishment of more open international relations would significantly benefit Compass by streamlining cross-border logistics and potentially opening avenues for expansion into previously restricted markets during 2025.

Government regulations on labor, including minimum wage, working hours, and unionization, significantly impact Compass Group's operational expenses due to its extensive global workforce. For instance, the UK's National Living Wage saw an increase to £11.44 per hour for those aged 21 and over starting April 2024, directly affecting Compass Group's UK labor costs.

Stricter labor laws or substantial wage increases can reduce profit margins if not offset by operational efficiencies or price adjustments. The foodservice industry, a core segment for Compass Group, is particularly vulnerable to these shifts, as labor constitutes a substantial portion of its cost base.

Food Safety and Health Regulations

Governments worldwide, including those where Compass Group operates, maintain rigorous food safety and health regulations to safeguard public well-being. These standards, enforced by bodies like the U.S. Food and Drug Administration (FDA), necessitate constant vigilance and adaptation from Compass Group to ensure compliance across its diverse service offerings.

Changes in these regulations, such as evolving allergen labeling requirements or new hygiene protocols, demand ongoing investment in operational adjustments, staff training, and supply chain management. For instance, the FDA's proposed modernization of its Human Foods Program for 2025 highlights a heightened focus on microbiological safety, chemical contaminants, and nutritional integrity, directly influencing food preparation and sourcing practices within the catering industry.

- Regulatory Compliance: Compass Group must navigate a complex web of food safety laws, impacting everything from ingredient sourcing to waste disposal.

- Adaptation Costs: Updates to regulations, like enhanced traceability mandates, require capital expenditure for new technologies and process re-engineering.

- Public Health Focus: The FDA's 2025 emphasis on microbiological, chemical, and nutritional safety underscores the critical importance of robust internal quality control systems.

Sustainability and Environmental Governance

Governments worldwide are intensifying their focus on environmental sustainability, impacting foodservice companies like Compass Group. This includes stricter regulations on food waste reduction, carbon emissions, and ethical sourcing, setting new operational targets.

Legislation such as California's SB 1383, which mandates organic waste diversion, and the UK's upcoming requirement for mandatory food waste separation from 2025, are forcing significant shifts in waste management and supply chain strategies. Compass Group's proactive adaptation to these evolving legal landscapes is vital for maintaining compliance and safeguarding its corporate reputation.

- Regulatory Landscape: Expect increased legislation around food waste (e.g., diversion targets, reporting) and carbon footprint reduction in operations and supply chains.

- Supply Chain Scrutiny: Growing pressure for ethical sourcing and transparency in food production, demanding robust supplier audits and sustainable procurement practices.

- Consumer Demand: A significant portion of consumers, particularly younger demographics, are prioritizing businesses with strong environmental credentials, influencing purchasing decisions. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability efforts when choosing where to eat.

- Operational Impact: Companies will need to invest in new technologies and processes for waste management, energy efficiency, and potentially alternative sourcing to meet these environmental governance standards.

Government policies directly influence Compass Group's market access and operational costs through trade agreements and protectionist measures. For example, ongoing trade discussions in 2024 could impact tariffs, affecting ingredient sourcing and supply chain management. Protectionist policies in 2024 have already increased the cost of key food items, influencing Compass's pricing strategies.

Labor regulations, such as minimum wage increases, significantly impact Compass Group's operating expenses. The UK's National Living Wage rose to £11.44 per hour in April 2024, directly affecting labor costs for the company. Stricter labor laws can reduce profit margins if not offset by efficiencies or price adjustments.

Food safety and health regulations are critical for Compass Group, requiring constant adaptation. The FDA's 2025 focus on microbiological, chemical, and nutritional safety necessitates robust internal quality control systems and ongoing investment in operational adjustments and training.

Environmental sustainability regulations are increasingly shaping Compass Group's operations. Legislation like California's SB 1383 mandates organic waste diversion, and the UK will require mandatory food waste separation from 2025, impacting waste management and supply chain strategies. A 2024 survey showed over 60% of consumers consider sustainability when choosing a business.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Compass Group, covering Political, Economic, Social, Technological, Environmental, and Legal influences. It provides a strategic overview for identifying opportunities and navigating challenges within the global food and support services sector.

Provides a concise overview of external factors impacting Compass Group, offering clarity and strategic direction to alleviate the pain of navigating complex market dynamics.

Economic factors

The foodservice sector, including giants like Compass Group, is still contending with rising costs for food, energy, and staff. While the pace of price increases has slowed, there's a possibility of them picking up again in 2025, perhaps due to new laws impacting wages or shifts in commodity markets.

Compass Group's success hinges on its skill in managing these expenses. Leveraging its buying power and adjusting prices strategically are key to keeping profits healthy amidst these economic headwinds.

Global economic growth significantly influences Compass Group's performance, particularly in its education, sports, and leisure segments. As economies expand, businesses and institutions tend to increase spending on catering and hospitality services. For instance, in 2024, the IMF projected global GDP growth of 3.2%, a steady rate that supports increased demand for Compass Group's offerings.

Higher disposable income directly translates to greater consumer spending on dining out and premium catering. When individuals have more money after essential expenses, they are more likely to engage with services like those provided by Compass Group. This trend was evident in many developed economies throughout 2023 and into early 2024, where post-pandemic recovery saw a rebound in consumer confidence and spending.

Conversely, economic downturns or a squeeze on disposable income can negatively impact Compass Group. Clients might reduce their catering budgets, and consumers may shift towards cheaper food options. For example, periods of high inflation, like that experienced in 2022 and parts of 2023, often lead to reduced discretionary spending, posing a challenge for businesses reliant on non-essential services.

Labor shortages and rising wage costs are critical economic considerations for Compass Group, given its labor-intensive operational model. The company faces intense competition for skilled culinary and service professionals. For instance, in the UK, the Office for National Statistics reported average weekly earnings in hospitality increasing by 8.7% in the year to March 2024, highlighting this pressure.

These escalating labor expenses, potentially amplified by legislative changes like minimum wage hikes, directly affect operating margins. Compass Group will need to strategically implement efficiency improvements, explore automation opportunities, or adjust pricing to maintain profitability amidst these economic headwinds.

Currency Fluctuations and Global Operations

Currency fluctuations significantly impact Compass Group's global operations, as the company operates in over 40 countries. A stronger Euro, for instance, compared to the British Pound where Compass Group is headquartered, could positively inflate reported revenues and profits from its European operations when translated back. Conversely, a weakening of key currencies in markets like the United States or Brazil could reduce the sterling value of earnings generated there.

For example, in the fiscal year ending September 2023, Compass Group reported that a 1% adverse movement in exchange rates would have impacted operating profit by approximately £5 million. This highlights the tangible financial exposure. The company actively manages this through a combination of diversified geographical revenue streams and strategic currency hedging instruments to stabilize its financial results.

- Revenue Exposure: Operating in numerous countries means Compass Group's reported financial results are sensitive to the exchange rates between local currencies and the British Pound.

- Profit Impact: Favorable currency movements can boost reported profits, while unfavorable movements can diminish them, as seen with the £5 million impact for a 1% adverse rate change in FY23.

- Mitigation Strategies: Diversification across many markets and the use of currency hedging are key tools Compass Group employs to reduce the volatility caused by exchange rate shifts.

Outsourcing Trends and Market Penetration

The ongoing shift towards outsourcing non-core functions, including catering and facilities management, creates a fertile ground for Compass Group's expansion. Businesses are increasingly looking to external providers to manage these services, aiming to boost operational efficiency and cut expenses. This trend directly translates into a larger addressable market for Compass Group's comprehensive service offerings.

Compass Group itself recognizes this vast potential, estimating that approximately 50% of its addressable market currently outsources food preparation services. This leaves a significant untapped segment, suggesting substantial opportunities for acquiring new clients and increasing market penetration in the coming years. This growth potential is a key economic driver for the company.

- Market Penetration: Only about half of Compass Group's target market currently outsources food preparation.

- Economic Opportunity: Organizations outsourcing non-core services like foodservice seek cost efficiencies and streamlined operations.

- Growth Potential: The substantial remaining untaped market offers significant room for new business acquisition and revenue growth.

Economic factors continue to shape Compass Group's operational landscape. While inflation's intensity has lessened, the potential for renewed price hikes in 2025 remains, driven by labor costs and commodity market volatility. Compass Group's ability to manage these rising expenses through its significant purchasing power and strategic pricing adjustments is paramount for maintaining profitability.

Global economic growth directly fuels demand, particularly in segments like education and sports. The IMF projected a steady 3.2% global GDP growth for 2024, supporting increased client spending on catering services. Conversely, economic downturns or reduced disposable income can lead clients to trim catering budgets, impacting revenue streams.

Labor shortages and escalating wages present a persistent challenge, with average weekly earnings in the UK hospitality sector rising by 8.7% by March 2024. This necessitates efficiency improvements and potential price adjustments to safeguard operating margins.

Currency fluctuations also play a significant role, as evidenced by Compass Group's exposure to over 40 currencies. A 1% adverse currency movement could impact operating profit by approximately £5 million, as reported for FY23, underscoring the importance of diversification and hedging strategies.

| Economic Factor | Impact on Compass Group | Supporting Data/Trend |

|---|---|---|

| Inflation & Costs | Increased operating expenses (food, energy, labor) | Slowing but potential for renewed price hikes in 2025; UK hospitality wage growth of 8.7% (Mar 2024) |

| Global Economic Growth | Drives demand in key segments (education, sports, leisure) | IMF projected 3.2% global GDP growth for 2024 |

| Disposable Income | Influences client spending and consumer choices | Higher income supports discretionary spending; downturns reduce it |

| Labor Market | Wage pressure and competition for staff | Intense competition for skilled professionals; rising wage costs |

| Currency Exchange Rates | Impacts reported revenue and profit | 1% adverse movement could impact operating profit by ~£5 million (FY23); diversification and hedging are key |

Preview Before You Purchase

Compass Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Compass Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving demand for plant-based, high-protein, and gut-friendly foods. This shift is evident globally, with plant-based food sales projected to reach $162 billion by 2030, according to Bloomberg Intelligence. Compass Group must adapt by offering diverse, nutritious, and sustainably sourced options, including those with reduced sugar and functional ingredients.

The surge in hybrid and remote work models has fundamentally altered corporate catering needs, pushing Compass Group to adapt. For instance, a 2024 survey indicated that 60% of employees now work in a hybrid capacity, a significant increase from pre-pandemic levels. This necessitates a pivot towards more localized, flexible solutions, such as individual meal kits and subscription services, designed to cater to a fragmented workforce and encourage in-office engagement.

The global health and wellness market is booming, projected to reach $7.5 trillion by 2025, according to Grand View Research. This surge, amplified by the pandemic, has consumers actively seeking foods that contribute to their overall well-being, boost cognitive function, and support healthy aging. Compass Group can tap into this by highlighting their commitment to nutritious options and transparent ingredient sourcing.

This societal shift directly impacts food preferences, driving demand for fresh, nutrient-dense ingredients and clear, informative labeling. For instance, a 2024 survey by NielsenIQ revealed that 60% of consumers are more likely to purchase products with health-focused claims. Compass Group's strategy can involve developing and promoting healthy eating programs and crafting meals that specifically address diverse health goals, from energy enhancement to immune support.

Sustainability and Ethical Consumption

Growing consumer consciousness around sustainability is reshaping food choices, with a notable preference for locally sourced ingredients and a strong emphasis on reducing food waste. This trend directly influences purchasing decisions, pushing companies like Compass Group to adapt their supply chains and operational practices to meet these evolving demands. For instance, a significant portion of consumers now actively seek out brands demonstrating a commitment to environmental responsibility.

Compass Group's proactive stance on ESG principles and its transparent reporting on sustainability initiatives are increasingly becoming a differentiator in the competitive landscape. By highlighting its efforts in areas such as reducing carbon emissions and improving ethical sourcing, the company can attract and retain environmentally and socially conscious clients and consumers. This focus on responsible business practices is not just a trend but a fundamental expectation for many stakeholders.

- Consumer Demand: Reports indicate that over 70% of consumers consider sustainability when making food purchases.

- Food Waste Reduction: Compass Group has set targets to halve food waste across its operations by 2030, aligning with global sustainability goals.

- Ethical Sourcing: The company aims to ensure 100% of its key commodities are sustainably sourced by 2025.

- ESG Investment: Investment in companies with strong ESG performance saw substantial growth in 2024, reflecting market confidence in sustainable business models.

Demographic Shifts and Lifestyle Changes

Demographic shifts, such as the increasing proportion of older adults in many developed nations, directly impact the demand for specialized catering services within healthcare facilities and retirement communities. For instance, in 2024, the global population aged 65 and over was projected to reach over 770 million, a figure expected to continue growing. This trend necessitates adaptable food service models that can cater to specific dietary needs and preferences of an aging demographic.

Furthermore, evolving lifestyle patterns, particularly the rise of dual-income households and a greater emphasis on convenience, are fueling demand for readily available, high-quality meal solutions. Busy schedules mean consumers are increasingly seeking out services that offer nutritious and appealing food options without the burden of preparation. This is evident in the growing market for ready-to-eat meals and food delivery services, a sector Compass Group actively participates in.

- Aging Population: By 2050, one in six people globally will be over 65, presenting opportunities in healthcare and senior living catering.

- Busy Lifestyles: Increased demand for convenient, healthy food options as more individuals work longer hours and have less time for meal preparation.

- Household Structures: Changes in family sizes and living arrangements influence the types of catering packages and portion sizes required.

- Health Consciousness: Growing awareness of nutrition and wellness drives demand for catering services offering healthier, allergen-free, and plant-based options.

Societal attitudes towards health and wellness are profoundly shaping food choices, with a significant portion of consumers, over 60% as of 2024 surveys, actively seeking out nutritious and functional ingredients. This trend is driving demand for plant-based options and foods that support cognitive function and healthy aging, a market projected to reach $7.5 trillion by 2025. Compass Group's adaptation involves highlighting transparent ingredient sourcing and developing meals that cater to diverse health goals, reflecting a broader societal push for well-being.

The evolving nature of work, with hybrid models becoming standard for many businesses, necessitates flexible catering solutions. A 2024 survey indicated that 60% of employees now work in a hybrid capacity, impacting corporate dining needs. Compass Group must therefore offer localized, adaptable options like individual meal kits to serve a more dispersed workforce and encourage office attendance.

Consumer consciousness around sustainability is a major sociological driver, with over 70% of consumers considering environmental impact in their food purchases. Compass Group's commitment to halving food waste by 2030 and sourcing 100% of key commodities sustainably by 2025 aligns with these expectations, enhancing its appeal to ethically-minded clients and consumers. This focus on ESG principles is increasingly a competitive advantage.

Demographic shifts, particularly the growing aging population, are creating new demands in specialized catering. With the global population aged 65 and over projected to exceed 770 million in 2024, there's a clear need for adaptable food services in healthcare and senior living. Furthermore, busy lifestyles, driven by dual-income households and time constraints, fuel demand for convenient, high-quality meal solutions, a market segment Compass Group is well-positioned to serve.

| Sociological Factor | Impact on Compass Group | Supporting Data/Trend |

|---|---|---|

| Health & Wellness Consciousness | Increased demand for nutritious, plant-based, and functional foods. | Global health and wellness market projected to reach $7.5 trillion by 2025. Over 60% of consumers seek healthier options (2024 surveys). |

| Work Model Evolution (Hybrid/Remote) | Need for flexible, localized catering solutions. | 60% of employees work hybrid (2024 survey), altering corporate dining needs. |

| Sustainability Awareness | Preference for eco-friendly practices and ethical sourcing. | Over 70% of consumers consider sustainability in food purchases. Compass Group aims to halve food waste by 2030. |

| Demographic Shifts (Aging Population) | Growth opportunities in specialized healthcare and senior living catering. | Global population aged 65+ projected to exceed 770 million in 2024. |

| Lifestyle Changes (Busy Schedules) | Increased demand for convenient, ready-to-eat, and high-quality meal solutions. | Rise in dual-income households and time-poor consumers seeking convenient food options. |

Technological factors

The foodservice sector's reliance on digital ordering and contactless payments is no longer optional. Compass Group must prioritize investments in user-friendly online platforms, intuitive mobile apps, and integrated payment solutions to cater to consumer demands for efficiency and personalized experiences. For instance, the global digital payment market was projected to reach over $1.5 trillion by the end of 2024, highlighting the significant shift towards cashless transactions.

These technological advancements offer more than just convenience; they are crucial data-gathering tools. By analyzing customer behavior through these digital channels, Compass Group can gain deeper insights into preferences, enabling more targeted marketing and service offerings. In 2023, companies leveraging data analytics saw an average revenue increase of 5-10%, underscoring the financial benefits of understanding customer data.

Automation and robotics are significantly reshaping foodservice kitchens, impacting everything from how food is prepped and cooked to how inventory is managed and delivered. For instance, by 2024, the global market for food service robots was projected to reach $2.5 billion, highlighting a substantial investment in this area.

Leveraging AI-powered automation offers Compass Group a clear path to boost speed, ensure consistent quality, and achieve greater precision in food production. This technology also presents an opportunity to potentially lower labor expenses and minimize errors that can occur with manual processes.

By strategically adopting these advanced technologies, Compass Group can expect to see tangible improvements in its overall operational efficiency and a notable uplift in the quality of services delivered to its clients.

Artificial Intelligence is set to transform catering operations by refining demand forecasting, inventory control, and staff scheduling. For instance, AI can analyze vast datasets to anticipate customer needs, thereby reducing food waste and optimizing resource allocation, a critical factor in the food service industry. Compass Group, a global leader, is likely leveraging AI to enhance efficiency and personalize customer experiences, aiming to improve margins and client retention.

AI's ability to personalize meal recommendations based on individual preferences and dietary needs represents a significant advancement. By processing customer data, AI can suggest tailored menu options, boosting satisfaction and potentially increasing sales. This focus on personalization is crucial for differentiating services in a competitive market, with early adopters reporting noticeable improvements in customer engagement and loyalty.

Supply Chain Technology and Traceability

Technology is a game-changer for the food supply chain, making it more efficient and traceable. For Compass Group, this means better inventory management and less food waste. For instance, advanced systems can track produce from the farm to the customer's plate in real-time.

Predictive analytics, a key technological advancement, helps Compass Group anticipate demand more accurately. This reduces the likelihood of overstocking and subsequent spoilage. In 2024, companies leveraging AI for demand forecasting reported an average of 10-15% reduction in food waste.

Blockchain technology offers unparalleled traceability, ensuring food safety and authenticity. This is crucial for compliance with evolving regulations. By 2025, the global blockchain in supply chain market is projected to reach $12.5 billion, highlighting its growing importance.

- Real-time tracking systems provide immediate visibility into inventory levels and product location.

- Predictive analytics leverage data to forecast demand, minimizing overstocking and spoilage.

- Blockchain enhances food safety and traceability, building consumer trust.

- Investing in these technologies can lead to significant cost savings and improved operational efficiency for Compass Group.

Data Analytics for Business Insights

Leveraging big data analytics allows Compass Group to gain deeper insights into consumer behavior, operational efficiency, and market trends. For instance, in 2024, the company continued to invest in platforms that process vast amounts of data from digital ordering systems and customer feedback, aiming to refine their service delivery.

Data from these digital touchpoints, alongside supply chain metrics, directly informs strategic decisions. This enables Compass Group to optimize menu offerings based on real-time demand and enhance personalized services, a key differentiator in the competitive food service landscape.

This data-driven approach is crucial for competitive decision-making and identifying growth opportunities. By understanding granular customer preferences and operational bottlenecks, Compass Group can proactively adapt to evolving market demands and capitalize on emerging trends.

- Enhanced Customer Understanding: Data analytics provides granular insights into customer preferences and ordering habits, enabling tailored offerings.

- Operational Optimization: Real-time data on food costs, waste, and labor efficiency allows for continuous improvement in operational performance.

- Market Trend Identification: Analyzing sales data and external market signals helps Compass Group anticipate and respond to evolving consumer tastes and dietary trends.

The increasing adoption of AI in the foodservice sector is revolutionizing operations. Compass Group can leverage AI for sophisticated demand forecasting, leading to a projected 10-15% reduction in food waste by 2024. This technology also optimizes inventory and staffing, enhancing efficiency and potentially lowering labor costs.

Digital transformation remains a key technological driver. The global digital payment market was expected to exceed $1.5 trillion by the end of 2024, underscoring the importance of seamless online ordering and contactless payment solutions for Compass Group. These platforms also serve as valuable data sources, with companies using data analytics reporting an average 5-10% revenue increase in 2023.

Automation, including robotics, is reshaping kitchen operations, with the foodservice robot market projected to reach $2.5 billion by 2024. Compass Group can utilize AI-powered automation to improve food preparation consistency, speed, and accuracy, while also managing inventory and delivery more effectively.

Blockchain technology is enhancing supply chain traceability and food safety, a critical factor as regulations evolve. The global blockchain in supply chain market is anticipated to reach $12.5 billion by 2025, indicating its growing significance for businesses like Compass Group seeking to build consumer trust and ensure product integrity.

| Technology Area | Key Impact | 2024/2025 Projection/Data |

| AI & Machine Learning | Demand Forecasting, Personalization, Operational Efficiency | 10-15% food waste reduction (AI forecasting); 5-10% revenue increase (data analytics) |

| Digital Payments & Ordering | Customer Convenience, Data Collection | Global digital payment market >$1.5 trillion (end of 2024) |

| Automation & Robotics | Kitchen Efficiency, Consistency, Cost Reduction | Global foodservice robot market $2.5 billion (2024) |

| Blockchain | Supply Chain Traceability, Food Safety | Global blockchain in supply chain market $12.5 billion (2025) |

Legal factors

Compass Group navigates a complex web of global food safety regulations, including the US Food Safety Modernization Act (FSMA), which mandates stricter controls on food production and imports. Recent updates in 2024 and anticipated changes for 2025 continue to emphasize enhanced traceability and potential restrictions on specific ingredients, requiring constant vigilance and adaptation in their supply chain management. Failure to comply can result in significant fines, with FSMA violations potentially leading to millions in penalties, alongside severe damage to brand reputation and the risk of losing lucrative contracts with major clients.

Compass Group navigates a complex web of global labor laws, from minimum wage and working condition mandates to anti-discrimination statutes. For instance, in the UK, the National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, directly affecting Compass's operational costs.

Shifting employment regulations, such as new mandates on flexible working or stricter data privacy for employee information, can necessitate significant adjustments in HR practices and increase compliance expenses. Failure to adapt can lead to substantial fines and reputational damage, impacting the company's ability to attract and retain talent.

Maintaining robust compliance with labor laws, including fair pay and equitable treatment, is paramount. In 2023, the UK's Equality and Human Rights Commission reported that discrimination claims in employment tribunals cost businesses an average of £15,000 per case, highlighting the financial and operational risks of non-compliance.

Compass Group's operational success hinges on robust contract law and meticulously crafted Service Level Agreements (SLAs). These agreements define the terms of service, liability, and termination, forming the bedrock of their client relationships across diverse industries.

The company's reliance on these legal instruments means that any shifts in contract legislation, particularly concerning public sector procurement or data privacy within contracts, could significantly impact their business stability and expansion plans. For instance, increased regulatory oversight on outsourcing contracts, a key area for Compass, could necessitate adjustments to their standard agreement frameworks.

Data Privacy and Protection Laws

Compass Group's increasing reliance on digital platforms for ordering, payments, and customer interaction means it manages vast quantities of personal data. Staying compliant with global data privacy laws, such as the General Data Protection Regulation (GDPR) and similar regional statutes, is paramount. Failure to comply can result in significant financial penalties and damage to its reputation. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Therefore, robust data security protocols and clear data handling practices are non-negotiable for maintaining customer trust and operational integrity.

Key considerations for Compass Group regarding data privacy include:

- GDPR and regional compliance: Ensuring adherence to evolving data protection regulations worldwide.

- Data security investment: Allocating resources for advanced cybersecurity measures to protect sensitive customer information.

- Transparency in data usage: Clearly communicating to customers how their data is collected, stored, and utilized.

- Incident response planning: Developing and regularly testing plans to address potential data breaches effectively.

Environmental Regulations and Waste Management

Governments worldwide are tightening environmental legislation, directly impacting Compass Group's operations, especially concerning food waste and carbon emissions. For instance, the UK's Environment Act 2021 mandates stricter waste reporting and reduction targets for businesses, pushing companies like Compass Group to invest in advanced waste management technologies and processes to ensure compliance.

New regulations often necessitate significant operational adjustments and capital expenditure. Mandatory food waste separation, as seen in various European Union member states, requires foodservice providers to implement new sorting systems and potentially upgrade kitchen infrastructure. This legal imperative for compliance is a growing operational cost and a key factor in strategic planning.

Compliance with these evolving environmental laws is no longer optional but a critical legal duty for Compass Group. Failure to adhere can result in substantial fines and reputational damage. For example, in 2023, several large food retailers faced penalties for non-compliance with organic waste diversion laws in specific regions, highlighting the financial risks involved.

- UK's Environment Act 2021: Sets legally binding targets for waste reduction and resource efficiency.

- EU Food Waste Regulations: Mandate specific measures for food waste prevention and management across member states.

- Carbon Emission Targets: Increasing pressure from governments to reduce Scope 1, 2, and 3 emissions, impacting supply chain and operational logistics.

Compass Group must adhere to a complex framework of international and national laws governing its operations. This includes stringent food safety regulations like the US Food Safety Modernization Act, with ongoing updates in 2024 and 2025 focusing on traceability and ingredient restrictions, carrying potential fines in the millions for violations.

Labor laws are also critical, with minimum wage increases, such as the UK's National Living Wage rising to £11.44 per hour for those 21+ in April 2024, directly impacting payroll costs. Furthermore, evolving employment regulations around flexible working and data privacy necessitate continuous adaptation and can lead to significant compliance expenses and reputational risks.

Contract law and Service Level Agreements (SLAs) are fundamental to Compass Group's client relationships, and shifts in legislation, particularly concerning public sector procurement or data privacy within contracts, can affect business stability and expansion. The company's extensive use of digital platforms also mandates strict compliance with data privacy laws like GDPR, where penalties can reach up to 4% of global annual revenue.

Environmental legislation, such as the UK's Environment Act 2021, imposes stricter waste reporting and reduction targets, compelling investment in new technologies and processes. Non-compliance with these environmental laws can result in substantial fines, as evidenced by penalties faced by food retailers in 2023 for organic waste diversion violations.

| Legal Factor | Key Legislation/Regulation | Impact on Compass Group | Potential Financial Consequence (Example) |

| Food Safety | US Food Safety Modernization Act (FSMA) | Stricter controls on production, imports, traceability | Millions in fines for violations |

| Labor Laws | UK National Living Wage (April 2024: £11.44/hr for 21+) | Increased payroll costs, potential HR practice adjustments | Increased operational expenses |

| Data Privacy | GDPR | Mandatory data security, transparency, incident response | Up to 4% of global annual revenue or €20 million in fines |

| Environmental | UK Environment Act 2021 | Stricter waste reporting and reduction targets | Investment in waste management tech; fines for non-compliance |

Environmental factors

The global imperative to slash food waste is intensifying, with many nations enacting stricter laws mandating sustainable organic waste management for businesses. Compass Group must bolster its programs for preventing, recovering, and recycling food waste to adhere to these regulations and satisfy public demand for eco-conscious operations.

This includes expanding initiatives like donating surplus edible food, a practice that saw significant growth in 2024 as companies sought to divert waste from landfills. Furthermore, investments in advanced technologies for processing unavoidable organic waste, such as anaerobic digestion, are becoming crucial for compliance and resource recovery.

Compass Group faces increasing pressure to prioritize sustainably sourced ingredients, with consumers and clients actively seeking local, seasonal, and ethically produced options. This trend is driven by heightened environmental awareness, influencing purchasing decisions across the food service sector.

Ensuring supply chain adherence to robust environmental standards is critical for Compass Group. This includes actively working to reduce the carbon footprint of transportation, a significant contributor to emissions in the food industry, and fostering partnerships that support regenerative agricultural practices aimed at soil health and biodiversity.

Transparency in sourcing practices is paramount. Compass Group must provide clear and verifiable information to consumers and clients regarding the origin and sustainability credentials of its ingredients, building trust and meeting evolving expectations for corporate responsibility. For instance, many major food service providers are setting targets to increase the proportion of sustainably sourced ingredients in their offerings, with some aiming for over 80% by 2025.

The foodservice industry, including Compass Group, faces scrutiny for its significant contribution to greenhouse gas emissions, stemming from energy use in kitchens, food transportation, and agricultural practices. By 2023, the global food system was estimated to be responsible for over a third of all human-caused greenhouse gas emissions.

Consequently, Compass Group is actively engaged in reducing its carbon footprint. This involves implementing energy-efficient kitchen equipment, streamlining delivery routes to cut down on transportation emissions, and investigating the use of renewable energy sources across its operations. These initiatives are largely driven by evolving climate change policies and the company's own ambitious corporate sustainability targets.

Water Conservation and Management

Water scarcity and quality are growing environmental issues globally. Compass Group, a major player in food service, must prioritize water-saving methods across its kitchens and operations. For instance, by 2024, many regions are seeing tighter regulations on water usage, pushing companies to innovate.

Efficient water management is crucial for Compass Group, impacting everything from how food is prepared to how facilities are cleaned. This focus not only supports environmental responsibility but also bolsters operational resilience against potential water shortages. In 2023, the company reported a commitment to reducing water consumption by 10% across its European operations by 2025.

- Water Scarcity Impact: Increasing droughts in key agricultural regions affect raw material availability and cost.

- Regulatory Pressure: Stricter water usage laws in the UK and EU by 2024-2025 necessitate proactive management.

- Operational Efficiency: Implementing water-efficient dishwashing and cooking technologies can reduce utility costs by up to 15%.

- Brand Reputation: Demonstrating strong water stewardship enhances brand image and attracts environmentally conscious consumers and clients.

Packaging Waste and Circular Economy

The foodservice industry faces increasing scrutiny over single-use packaging waste, a critical environmental challenge. Compass Group, as a major player, is responding by prioritizing more sustainable packaging options. This includes a focus on materials that are compostable, readily recyclable, or designed for reuse, aligning with broader circular economy principles to drastically cut down on waste generation.

Consumer demand for reduced plastic consumption and more effective waste management systems is a powerful driver for innovation in packaging. By 2024, for instance, the UK government's Extended Producer Responsibility (EPR) scheme for packaging is expected to place greater financial responsibility on businesses for the end-of-life management of their packaging. This regulatory shift, coupled with growing public awareness, compels companies like Compass Group to actively seek and implement greener alternatives.

Compass Group's strategic shift towards eco-friendly packaging is not just about environmental stewardship; it's also about future-proofing their operations. Initiatives include:

- Increased use of compostable and biodegradable materials in food packaging to reduce landfill burden.

- Investment in reusable container programs for catering and takeaway services, promoting a closed-loop system.

- Partnerships with waste management providers to enhance the recyclability of their packaging portfolio.

- Setting targets for plastic reduction, aiming for significant decreases in virgin plastic use across their supply chain.

The intensifying global focus on reducing food waste and adopting sustainable organic waste management practices directly impacts Compass Group's operational strategies. With many nations implementing stricter regulations, the company must enhance its waste prevention, recovery, and recycling programs to ensure compliance and meet public expectations for environmentally responsible operations.

Compass Group is also under increasing pressure to prioritize sustainably sourced ingredients, with consumers and clients actively seeking local, seasonal, and ethically produced options. This trend is driven by heightened environmental awareness, influencing purchasing decisions across the food service sector and requiring robust supply chain adherence to environmental standards, including reducing transportation carbon footprints and supporting regenerative agriculture.

The foodservice industry, including Compass Group, faces scrutiny for its significant contribution to greenhouse gas emissions, estimated to be over a third of all human-caused emissions globally by 2023. Consequently, Compass Group is actively engaged in reducing its carbon footprint through energy-efficient equipment, optimized delivery routes, and exploring renewable energy sources, driven by evolving climate policies and corporate sustainability targets.

Water scarcity and quality are growing environmental concerns, necessitating Compass Group's prioritization of water-saving methods across its operations. By 2024, tighter regulations on water usage in many regions are pushing companies to innovate, with Compass Group committing to reducing water consumption by 10% across its European operations by 2025.

| Environmental Factor | Impact on Compass Group | Key Data/Trends (2024-2025) |

| Food Waste Reduction | Need for enhanced waste prevention, recovery, and recycling programs. | Stricter organic waste management laws globally; growing consumer demand for eco-conscious operations. |

| Sustainable Sourcing | Increased demand for local, seasonal, and ethically produced ingredients. | Heightened environmental awareness influencing purchasing decisions; focus on reducing supply chain carbon footprint. |

| Greenhouse Gas Emissions | Pressure to reduce operational carbon footprint. | Food system responsible for over a third of global human-caused emissions (2023); implementation of energy efficiency and renewable energy initiatives. |

| Water Management | Requirement to implement water-saving methods and comply with usage regulations. | Commitment to 10% water consumption reduction in European operations by 2025; increasing regional water scarcity and regulatory pressure. |

PESTLE Analysis Data Sources

Our Compass Group PESTLE analysis is meticulously constructed using data from reputable sources like the World Bank, IMF, and various national statistical offices. We also incorporate insights from leading market research firms and industry-specific reports to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.