Comcast SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comcast Bundle

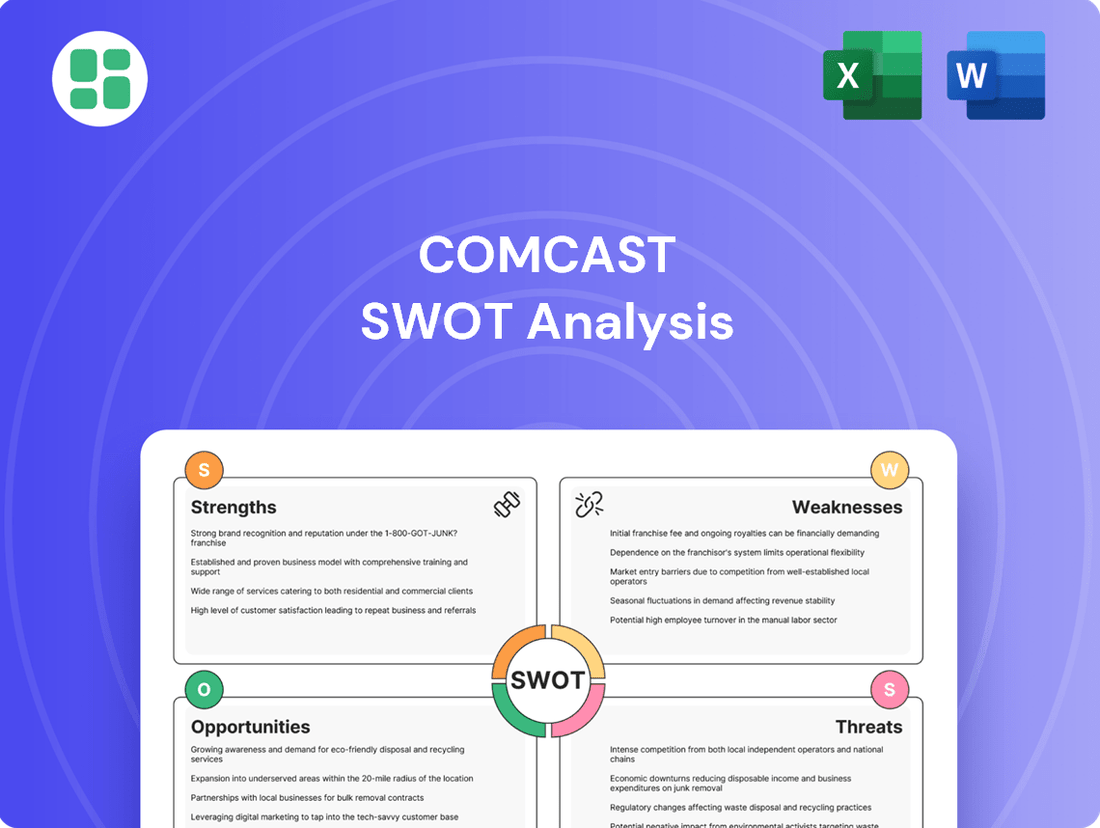

Comcast, a titan in broadband and media, boasts immense strengths in its vast customer base and integrated services, yet faces significant threats from evolving technology and intense competition.

Our comprehensive SWOT analysis dives deep into these dynamics, revealing Comcast's strategic opportunities for expansion and the crucial weaknesses that require attention.

Want the full story behind Comcast's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Comcast Business boasts an extensive and ever-growing network infrastructure, a significant strength. This includes a robust mix of fiber and hybrid fiber-coax (HFC) technologies, continually upgraded with advancements like DOCSIS 4.0 and mid-split enhancements. These upgrades are crucial for delivering the high-speed and reliable connectivity that businesses increasingly demand.

The company's commitment to expanding this network is evident in its substantial investments. For instance, Comcast invested over $265 million in Texas alone during 2024 to broaden its fiber footprint. This strategic expansion aims to bring multi-gigabit speeds and enhanced reliability to a wider array of businesses and residential areas, directly supporting its service offerings.

Comcast Business is a powerhouse in the B2B sector, projected to reach nearly $10 billion in annual revenue by the end of 2024. This impressive growth rate significantly outpaces many competitors in the telecommunications industry.

The company enjoys a dominant market share, especially among small businesses operating within its extensive network coverage. This strong position translates into substantial financial stability.

This robust financial performance and entrenched market position create a solid base for Comcast to continue investing in new technologies and expanding its service offerings.

Comcast Business cemented its position as the leading U.S. provider of Managed SD-WAN services in 2024, outperforming major players like AT&T. This top ranking is a testament to their sustained investment and innovation in secure, intelligent networking solutions.

This leadership in a rapidly expanding market, critical for enterprises adopting AI and prioritizing security, underscores Comcast's strong offering in evolving network infrastructure.

Diversified and Advanced Solution Portfolio

Comcast Business boasts a robust and evolving suite of solutions that extend well beyond basic internet connectivity. This advanced portfolio includes critical offerings such as cybersecurity, unified communications, and managed IT services, catering to a wide array of business needs. The company also offers Comcast Business Mobile, further diversifying its revenue streams beyond traditional broadband.

This strategic diversification is key to meeting the complex demands of both small businesses and large enterprises. By offering these integrated services, Comcast Business can effectively augment revenue generated from its core broadband services. This comprehensive approach positions the company as a one-stop shop for essential business technology needs.

The company's commitment to expanding this portfolio is evident in strategic acquisitions. For instance, the integration of Masergy and Nitel significantly bolstered its capabilities, particularly in the realm of global secure networking. These moves underscore Comcast's ambition to provide sophisticated, enterprise-grade solutions.

- Diversified Offerings: Cybersecurity, unified communications, managed IT, and mobile services complement core broadband.

- Revenue Augmentation: The expanded portfolio strengthens revenue beyond traditional internet services.

- Strategic Acquisitions: Masergy and Nitel enhance global secure networking capabilities.

- Broad Market Appeal: Solutions cater to businesses of all sizes, from SMBs to large enterprises.

Strategic Use of AI and Innovation

Comcast Business is making significant strides by embedding AI and machine learning throughout its operations. This integration aims to boost network performance, strengthen cybersecurity defenses, and elevate customer support experiences. For instance, AI-powered network self-healing and advanced firewalls are key components in their strategy for enhanced efficiency and network resilience.

This commitment to innovation is crucial for Comcast Business as it navigates the rapidly changing technological landscape. By leveraging AI, the company is well-positioned to meet future technological demands and secure a competitive advantage in the market. For example, in 2024, Comcast invested billions in network upgrades and technology, with AI playing a central role in optimizing these advancements.

- AI-driven network optimization: Enhancing efficiency and reliability.

- Advanced cybersecurity solutions: Utilizing AI for threat detection and prevention.

- Improved customer service: Implementing AI for personalized and responsive support.

- Focus on next-generation technologies: Staying ahead of industry trends.

Comcast Business's extensive fiber and HFC network, continually upgraded with technologies like DOCSIS 4.0, ensures high-speed, reliable connectivity essential for businesses.

The company's substantial investments, such as over $265 million in Texas during 2024 for fiber expansion, underscore its commitment to broadening its reach and capabilities.

Comcast Business leads in Managed SD-WAN services, demonstrating its innovation in secure, intelligent networking solutions that are critical for modern enterprises.

The company's diversified portfolio, including cybersecurity, unified communications, and managed IT services, along with strategic acquisitions like Masergy, strengthens its market position and revenue potential.

| Strength Category | Key Aspect | 2024/2025 Data/Implication |

|---|---|---|

| Network Infrastructure | Fiber & HFC Expansion | Over $265M invested in Texas during 2024 for fiber footprint expansion. |

| Market Leadership | Managed SD-WAN | Ranked #1 U.S. provider in 2024, outpacing competitors. |

| Service Portfolio | Diversification | Acquisition of Masergy and Nitel enhanced global secure networking. |

| Financial Performance | Revenue Growth | Projected to reach nearly $10B in annual revenue by end of 2024. |

What is included in the product

Delivers a strategic overview of Comcast’s internal and external business factors, highlighting its strong brand and vast infrastructure while acknowledging competitive pressures and evolving technology.

Offers a clear, actionable framework to address Comcast's customer service and pricing concerns.

Weaknesses

Comcast Business faced a significant setback in 2024, losing 16,000 customer relationships. This marks a notable shift from prior periods where customer additions were the norm, highlighting difficulties in both attracting and keeping clients, especially within the small business sector.

This trend suggests that Comcast Business needs to re-evaluate and enhance its offerings to better resonate with its target market. Strengthening its value proposition is crucial to reverse this customer attrition and foster future growth.

Comcast has historically struggled with customer service perceptions, often reflected in lower customer satisfaction ratings. For instance, in J.D. Power's 2023 U.S. Residential Internet Service Provider Satisfaction Study, Comcast (Xfinity) ranked below the industry average for overall satisfaction.

Despite ongoing initiatives to enhance service quality, the lingering perception of poor customer support, coupled with high pricing, continues to be a significant challenge for customer loyalty and retention. This persistent issue directly affects the company's brand image and its ability to minimize customer churn.

As a significant player in the technology and telecommunications sectors, Comcast faces considerable vulnerability to cybersecurity incidents. Its own 2024 Cybersecurity Threat Report highlighted increasing sophistication in cyberattacks, a trend that directly impacts its extensive infrastructure and the sensitive data it manages.

The company's exposure was underscored by a recent breach involving a third-party contractor, which compromised customer information. Despite offering robust cybersecurity solutions to its clients, Comcast's internal systems and the data of millions of users remain prime targets for cybercriminals, potentially damaging its hard-earned reputation and customer trust.

Intense Competition in SMB Segment

Comcast Business faces significant headwinds in the small and medium-sized business (SMB) sector, a crucial revenue driver. The market is saturated with providers, intensifying the battle for market share. This intense competition pressures pricing and requires continuous innovation to stand out. For example, in Q1 2024, Comcast reported that while Business Services revenue grew 3.2% year-over-year to $2.7 billion, the SMB segment specifically experienced intensified competition impacting growth trajectory.

The rise of Fixed Wireless Access (FWA) and Fiber-to-the-Premises (FTTP) alternatives presents a direct challenge to Comcast's traditional offerings. These technologies often promise faster deployment and competitive pricing, forcing Comcast to re-evaluate its value proposition. Furthermore, broader macroeconomic pressures in 2024 and 2025 are causing many SMBs to scrutinize their spending, leading to potential customer churn and reduced upgrade cycles.

- Increased FWA/FTTP adoption: Competitors are aggressively expanding their fiber networks and leveraging FWA as a cost-effective alternative, directly impacting Comcast's SMB customer acquisition and retention.

- Macroeconomic headwinds: Inflationary pressures and concerns about economic slowdown in 2024-2025 are leading SMBs to delay or reduce IT and connectivity investments.

- Value proposition pressure: Comcast must clearly articulate and deliver superior value, including enhanced service reliability and integrated solutions, to counter aggressive pricing from rivals.

Reliance on Legacy Services

Comcast Business faces a significant challenge as businesses increasingly move away from traditional services like pay-TV and legacy VoIP. This ongoing migration, often termed business 'cord-cutting,' directly impacts revenue streams, particularly if growth in newer, more advanced offerings doesn't compensate. For instance, while broadband remains strong, the decline in traditional voice services presents a headwind. The company needs to expedite its shift towards higher-margin, future-proof solutions to counter this erosion.

Comcast's reliance on legacy services like traditional voice and pay-TV presents a significant weakness as businesses increasingly adopt newer, more cost-effective solutions. This ongoing migration, often referred to as business cord-cutting, directly erodes revenue streams. For example, while broadband revenue remains robust, the decline in voice services poses a notable challenge that requires a faster pivot to higher-margin, future-oriented offerings to offset the impact.

Preview Before You Purchase

Comcast SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Comcast Business is well-positioned to capture a larger share of the mid-market and enterprise sectors, a move that could significantly boost its revenue streams. This expansion leverages the company's growing capabilities, particularly after strategic acquisitions.

The integration of Masergy and Nitel, for instance, enhances Comcast Business's ability to deliver sophisticated, globally managed network solutions. These capabilities are crucial for attracting and serving larger organizations with complex connectivity needs, moving beyond its established small business footprint.

This strategic pivot targets a substantial addressable market, offering a clear path for continued revenue growth. By effectively serving these larger clients, Comcast Business can diversify its revenue base and solidify its position as a comprehensive business solutions provider.

The business mobile services market presents a significant avenue for expansion for Comcast Business. Leveraging its vast Wi-Fi infrastructure and a recent Mobile Virtual Network Operator (MVNO) agreement with T-Mobile, Comcast is well-positioned to increase its footprint in the wireless sector.

Comcast Business Mobile enhances its existing portfolio by offering integrated connectivity solutions. This strategic move allows Comcast to provide a more comprehensive and competitive offering to its business clients, solidifying its position in the converged services landscape.

The escalating threat landscape, marked by increasingly sophisticated cyber-attacks, fuels a robust demand for advanced secure networking and cybersecurity solutions. Comcast Business is strategically positioned to address this by offering a suite of services including Managed SD-WAN, Secure Access Service Edge (SASE), DDoS mitigation, and Managed Detection and Response (MDR).

This burgeoning market presents a significant growth opportunity, allowing Comcast to deepen customer loyalty through essential security provisions. For instance, the global cybersecurity market was projected to reach over $230 billion in 2024, with significant growth expected in managed security services.

Strategic Fiber Network Expansion

Comcast Business is actively expanding its fiber network into areas that previously lacked high-speed internet access, often leveraging government funding. For instance, significant investments are being made in regions like Texas and Georgia, bringing multi-gigabit symmetrical speeds to new customer bases.

These strategic buildouts are crucial for extending Comcast's market reach and positioning the company for long-term growth in these developing communities.

- Fiber Network Expansion: Comcast Business is investing in new fiber infrastructure to reach unserved and underserved markets.

- Government Support: Federal and state grants are playing a role in funding these multi-million dollar expansion projects.

- Enhanced Service Offering: The expansion allows for the delivery of multi-gigabit symmetrical speeds, a significant upgrade for new areas.

- Market Penetration: This strategy directly increases Comcast's addressable market and secures future revenue streams.

Leveraging AI for Operational Efficiency and New Services

Comcast can significantly boost its operational efficiency by further integrating AI and machine learning. This allows for the automation of routine tasks, freeing up resources and reducing human error. For instance, AI-powered network self-healing capabilities can proactively identify and resolve issues, minimizing downtime and improving service reliability, a critical factor for customer satisfaction.

The application of AI extends to optimizing customer interactions and sales processes. By analyzing customer data, AI can personalize offers, improve support response times, and predict customer needs, leading to enhanced customer experiences. In 2024, companies leveraging AI in customer service reported an average reduction in resolution times by up to 20%.

Furthermore, AI presents a substantial opportunity for developing innovative new services and strengthening cybersecurity. Advanced AI algorithms can detect and neutralize sophisticated cyber threats in real-time, protecting both Comcast's infrastructure and customer data. This technological advancement is projected to contribute to increased profitability through improved service delivery and new revenue streams.

- Enhanced Network Performance: AI-driven network self-healing can reduce outages and improve overall service stability.

- Optimized Customer Engagement: AI in sales and support can lead to higher customer satisfaction and retention rates.

- Strengthened Security: Advanced AI capabilities bolster defenses against evolving cyber threats.

- New Service Development: AI facilitates the creation of innovative offerings, potentially opening new market segments.

Comcast Business is strategically expanding its reach into the mid-market and enterprise sectors, a move supported by acquisitions like Masergy and Nitel. These integrations bolster its capacity to offer complex, global network solutions, which is vital for attracting larger clients and diversifying revenue beyond its small business base.

The company is also capitalizing on the growing business mobile market, leveraging its extensive Wi-Fi network and a key MVNO agreement with T-Mobile. This allows for integrated connectivity solutions, enhancing its competitive edge in the converged services landscape.

The increasing demand for cybersecurity solutions presents a significant opportunity, with Comcast Business offering services like Managed SD-WAN and MDR. The global cybersecurity market, projected to exceed $230 billion in 2024, highlights the substantial growth potential in managed security services.

Furthermore, Comcast is actively extending its fiber network into unserved and underserved areas, often with government funding, bringing multi-gigabit speeds to new markets. AI integration is also a key focus, promising to enhance operational efficiency, customer engagement, and cybersecurity, with AI in customer service already showing up to a 20% reduction in resolution times in 2024.

| Opportunity Area | Key Action/Benefit | Market Data/Impact |

|---|---|---|

| Mid-Market & Enterprise Expansion | Leveraging acquisitions (Masergy, Nitel) for advanced network solutions | Targets substantial addressable market for revenue growth |

| Business Mobile Services | Utilizing Wi-Fi infrastructure and T-Mobile MVNO agreement | Enhances integrated connectivity offerings |

| Cybersecurity Solutions | Offering Managed SD-WAN, SASE, MDR | Global cybersecurity market projected over $230B in 2024 |

| Fiber Network Expansion | Investing in new fiber to unserved/underserved areas | Bringing multi-gigabit speeds to new customer bases |

| AI & Machine Learning Integration | Automating tasks, optimizing customer interactions, enhancing security | AI in customer service reduced resolution times by up to 20% in 2024 |

Threats

Comcast Business is experiencing heightened competition from both wireless and fiber providers. Companies like Verizon and T-Mobile are expanding their Fixed Wireless Access (FWA) offerings, presenting a viable alternative for high-speed internet.

Simultaneously, AT&T and other carriers are aggressively building out Fiber-to-the-Premises (FTTP) networks. This dual threat from wireless and fiber expansion puts pressure on Comcast's market share, particularly in segments where customers are more sensitive to pricing.

Widespread economic uncertainty and significant layoffs across various industries are forcing businesses to re-evaluate their expenditures, potentially leading to reduced spending on essential services like connectivity. This trend directly impacts Comcast Business, as companies may seek to optimize or cut back on their telecom and internet services.

The current economic climate presents a tangible threat to Comcast Business's growth trajectory. As businesses tighten their belts, the demand for new services or upgrades may slow, and existing customers might become more price-sensitive, potentially leading to slower revenue growth or even a contraction in this key segment.

For instance, while specific Comcast Business revenue figures for late 2024 or early 2025 are not yet public, broader industry trends suggest a challenging environment. The U.S. Bureau of Labor Statistics reported continued job cuts in sectors like technology and finance through early 2025, directly impacting the B2B customer base for connectivity providers.

Comcast faces persistent customer churn, especially in competitive broadband and small business markets. High perceived costs, service reliability concerns, and aggressive competitor promotions are key drivers pushing customers away. For instance, Comcast reported a net loss of approximately 178,000 broadband customers in the first quarter of 2024, highlighting the ongoing struggle to retain its subscriber base.

Evolution of Cybersecurity

The cybersecurity landscape is a moving target, with cybercriminals increasingly using artificial intelligence to launch more sophisticated attacks. This includes advanced phishing schemes and the creation of convincing deepfakes, making it harder for even security-aware individuals and businesses to discern genuine communications from malicious ones. For instance, phishing attacks continue to be a significant vector, with reports in early 2024 indicating a steady rise in their prevalence across various industries.

While Comcast Business provides security solutions, the escalating complexity and sheer volume of these evolving threats represent a persistent risk. This necessitates continuous, substantial investment in research, development, and adaptation of their own security infrastructure to protect both their internal operations and the sensitive data of their vast customer base. The financial commitment to staying ahead of these threats is ongoing, with cybersecurity spending by businesses globally projected to exceed $200 billion in 2024.

- AI-powered cyberattacks: Increasing sophistication of threats like deepfakes and advanced phishing.

- Constant investment required: Need for ongoing capital allocation to adapt security measures.

- Customer data protection: Protecting customer information from increasingly potent cyber threats is paramount.

Disruption from Emerging Technologies

Emerging technologies like private 5G networks and advanced edge computing present a significant threat to Comcast's traditional connectivity business. These nascent solutions could offer businesses more tailored and potentially lower-cost alternatives to current broadband and network services. For instance, the private wireless market, projected to reach $10 billion by 2028 according to some industry forecasts, could siphon off enterprise clients seeking dedicated, high-performance networks.

Comcast Business is actively exploring these disruptive areas, but a cautious or delayed entry could prove detrimental. If competitors or new entrants are quicker to develop and deploy robust private 5G or edge computing solutions, they could capture market share before Comcast fully establishes its offerings. This could especially impact the enterprise segment, where businesses are increasingly seeking specialized network capabilities.

The threat is amplified by the agility of smaller, more focused technology firms that can adapt rapidly to market demands. Comcast's ability to effectively integrate and scale these new technologies will be crucial. A failure to innovate at a comparable pace could see its market position eroded, particularly as businesses prioritize flexibility and cutting-edge solutions.

Comcast faces intense competition from wireless providers offering Fixed Wireless Access (FWA) and from fiber network build-outs by rivals like AT&T. Economic uncertainty and widespread layoffs are also pressuring businesses to cut spending on essential services, directly impacting Comcast Business's revenue growth and customer retention. The company experienced a net loss of approximately 178,000 broadband customers in Q1 2024, underscoring the challenge of maintaining its subscriber base amidst these pressures.

SWOT Analysis Data Sources

This Comcast SWOT analysis is built upon a foundation of robust data, including publicly available financial filings, comprehensive market research reports, and insights from industry experts. We also incorporate information from reputable news outlets and official company disclosures to ensure a well-rounded and accurate assessment.