Comcast Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comcast Bundle

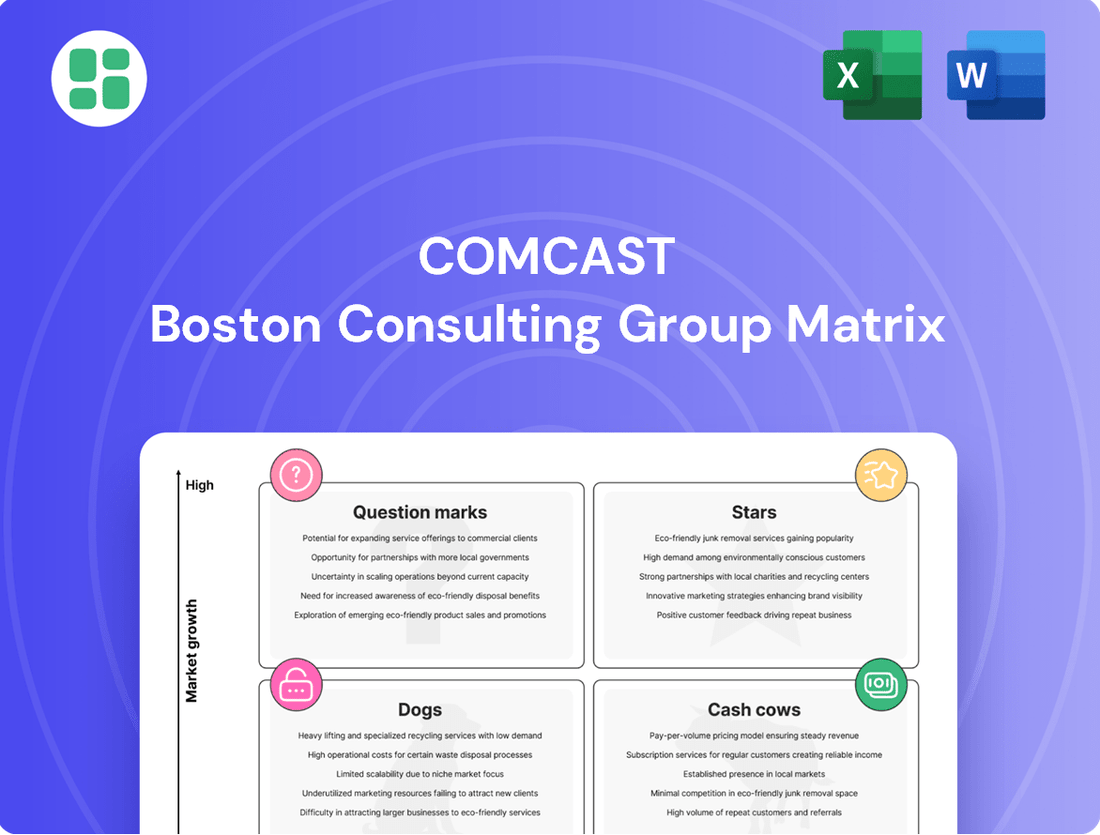

Comcast's diverse portfolio, from high-growth internet services to legacy cable offerings, presents a fascinating case study for the BCG Matrix. Understanding where each of these segments falls—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for strategic resource allocation and future growth.

This preview offers a glimpse into Comcast's market positioning, but the full BCG Matrix report unlocks a comprehensive analysis. Gain detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimize Comcast's product strategy and investment decisions for maximum impact.

Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence.

Stars

Xfinity Mobile is a significant player in Comcast's portfolio, positioned as a Star due to its impressive growth trajectory. The company achieved a record-breaking 378,000 new wireless line additions in Q2 2025, bringing its total to 8.5 million lines. This robust expansion underscores its success within Comcast's broader strategy.

Universal Epic Universe, opening in May 2025, is a prime example of a Star in Comcast's BCG Matrix for its Content & Experiences segment. This ambitious $7 billion project is expected to significantly drive growth and profitability.

The impact of Epic Universe is already being felt, with early projections indicating a nearly 19% surge in theme park revenue for Q2 2025. This boost is attributed to increased attendance and higher per capita spending across the Universal Orlando Resort, underscoring its star potential.

As a major new attraction, Epic Universe is positioned to be a key growth driver for Comcast's broader entertainment division. Its success will likely contribute to enhanced market share and solidify its position as a leader in the theme park industry.

Peacock is demonstrating impressive momentum within Comcast's portfolio. In the second quarter of 2025, the streaming service achieved a significant revenue increase of 18%, reaching $1.2 billion. This growth, coupled with a substantial improvement in Adjusted EBITDA losses by $247 million year-over-year, highlights its transition towards profitability.

The platform's strategic focus on exclusive premium content and live sports, such as its forthcoming NBA broadcasts, is a key driver for its expanding subscriber base and enhanced monetization capabilities. This combination of strong financial gains and a clear content strategy positions Peacock as a notable rising star for Comcast.

Comcast Business Services (Enterprise Solutions)

Comcast Business Services, especially its enterprise solutions and managed services like SD-WAN, is a clear star in the BCG matrix. This segment is experiencing robust growth and capturing a larger piece of the business market.

In 2024, Comcast Business achieved nearly $10 billion in annual revenue, a significant figure that highlights its strong performance and ability to outgrow established competitors. This growth is fueled by strategic initiatives, such as expanding Dedicated Internet Access (DIA) availability to an additional one million business locations, further solidifying its market position.

- High Growth: Demonstrates strong revenue increases year-over-year in the B2B sector.

- Increasing Market Share: Consistently gains ground against competitors in enterprise solutions.

- Revenue Milestone: Achieved nearly $10 billion in annual revenue in 2024.

- Strategic Expansion: Expanded DIA to 1 million new business locations, enhancing its network reach.

International Connectivity (Sky)

Comcast's International Connectivity, largely represented by Sky in Europe, is a key growth driver. Despite domestic subscription pressures, Sky's customer relationships have expanded, bolstering the Connectivity & Platforms segment. This international reach, with a significant presence in markets like the UK, Germany, and Italy, highlights a strategic expansion into new territories.

Sky's performance in 2024 demonstrates this upward trend. For instance, Sky's total group revenue reached approximately $20.8 billion in 2023, with a notable portion attributed to its broadband and connectivity services across its European footprint. This financial performance underscores the segment's importance in Comcast's diversified portfolio.

The focus on international operations is paying off, with Comcast reporting continued growth in its international customer base. This expansion into new markets and the ongoing investment in international infrastructure are critical for future revenue streams and market share gains.

- International Revenue Growth: Sky's contribution to Comcast's overall revenue continues to be a significant factor, demonstrating the value of international expansion.

- Customer Relationship Expansion: An increase in international customer relationships, particularly in broadband, signals strong market penetration and customer loyalty in key European countries.

- Strategic Market Presence: Comcast's sustained investment in Sky's operations in the UK, Germany, and Italy positions it well for future growth in these competitive markets.

- Connectivity as a Core Offering: The emphasis on international connectivity reflects a strategic understanding of global demand for reliable broadband and related services.

Xfinity Mobile, Universal Epic Universe, Peacock, Comcast Business Services, and Sky are all prime examples of Stars within Comcast's BCG Matrix. These entities are characterized by their high growth rates and strong market positions, contributing significantly to Comcast's overall performance.

Xfinity Mobile added a record 378,000 new wireless lines in Q2 2025, reaching 8.5 million total lines. Universal Epic Universe, a $7 billion project, is projected to boost theme park revenue by nearly 19% in Q2 2025. Peacock's revenue grew 18% to $1.2 billion in Q2 2025, with improved EBITDA losses. Comcast Business Services achieved nearly $10 billion in annual revenue in 2024, expanding DIA to 1 million new business locations. Sky's total group revenue was approximately $20.8 billion in 2023, showing strong international connectivity growth.

| Segment | Key Star Example | 2025 Growth Metric | 2024/2023 Financial Data | Strategic Importance |

| Connectivity | Xfinity Mobile | +378k lines (Q2 2025) | 8.5M total lines | Wireless growth driver |

| Content & Experiences | Universal Epic Universe | +19% theme park revenue (Q2 2025 projection) | $7B project investment | Major entertainment draw |

| Content & Experiences | Peacock | +18% revenue (Q2 2025) | $1.2B revenue (Q2 2025) | Streaming platform growth |

| Business Services | Comcast Business Services | Expanded DIA to 1M locations | ~$10B annual revenue (2024) | Enterprise market expansion |

| Connectivity & Platforms (International) | Sky | Continued customer growth | ~$20.8B group revenue (2023) | European market penetration |

What is included in the product

This BCG Matrix analysis categorizes Comcast's offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

Comcast's BCG Matrix offers a clear, one-page overview, quickly identifying Stars, Cash Cows, Question Marks, and Dogs to inform strategic decisions and alleviate the pain of resource allocation uncertainty.

Cash Cows

Comcast's domestic broadband internet, under the Xfinity brand, continues to be a robust cash cow for the company. Despite a slight dip in subscriber numbers, the service is still a revenue powerhouse. In the second quarter of 2025, domestic broadband revenue saw a 1.6% increase, largely driven by higher average rates per customer.

The company is actively working to sustain this strong performance by refining its market approach. This includes introducing new service plans and offering price guarantees, all aimed at solidifying its dominant market share and ensuring continued strong cash flow generation from this essential service.

NBCUniversal's linear television networks, including NBC and USA Network, remain significant contributors to Comcast's revenue. In 2024, these networks continue to benefit from substantial advertising sales and carriage fees from cable providers. Their established brands and valuable content libraries, especially live sports and news, ensure a consistent, albeit mature, revenue stream.

Universal Studios Florida and Islands of Adventure are mature, cash-generating powerhouses for Comcast. These established resorts consistently deliver robust profits, acting as reliable income streams within the Content & Experiences segment.

In 2023, Universal Parks & Resorts, a significant contributor to Comcast's overall revenue, reported a substantial increase in operating income, reaching $2.3 billion. This growth was largely driven by the strong performance of these existing parks, which benefit from consistent visitor numbers and increased guest spending.

Content Licensing and Distribution

Comcast's Studios segment, encompassing NBCUniversal, boasts a vast library of film and television content. This intellectual property is a significant driver of revenue through licensing and distribution agreements, positioning it as a classic cash cow.

This segment operates as a high-margin business by monetizing existing assets. The predictable and steady cash flow generated from these deals requires relatively minimal new investment compared to the costs associated with producing fresh content.

In 2023, NBCUniversal's Content Licensing & Distribution segment reported significant revenue. For instance, the Media segment, which heavily relies on content distribution, saw substantial contributions from these activities, underscoring its cash cow status.

- Revenue Generation: Monetizes a deep catalog of films and TV shows.

- High Margins: Leverages existing intellectual property with lower incremental costs.

- Predictable Cash Flow: Provides a stable income stream with limited reinvestment needs.

- Strategic Importance: Supports other Comcast business segments through content provision.

Sky's Established Pay TV Operations in Europe

Sky's established pay TV operations in the UK and Italy are classic cash cows for Comcast. These businesses, while operating in a mature market with modest growth prospects, boast significant market share and a loyal subscriber base. This allows them to generate substantial and consistent cash flow, which Comcast can then strategically reinvest in other areas of its portfolio.

The stability of Sky's revenue streams, underpinned by its extensive content library and established infrastructure, makes these operations a reliable source of funding. For instance, in 2023, Sky's total revenue was approximately $19.1 billion, demonstrating the scale of these established businesses. This dependable income stream is crucial for Comcast's ability to pursue new growth opportunities and innovation across its diverse media and technology segments.

- UK and Italy Pay TV Market Share: Sky holds a dominant position in the UK pay TV market, with approximately 12.5 million subscribers as of early 2024. In Italy, while facing more competition, Sky Italia remains a significant player.

- Revenue Generation: Sky's pay TV services are a primary revenue driver for Comcast, contributing billions annually. In Q1 2024, Sky's revenue saw a slight increase, highlighting its resilience.

- Cash Flow Contribution: The mature nature of these operations allows for efficient cost management and strong cash flow generation, enabling Comcast to fund investments in areas like broadband and streaming services.

- Strategic Importance: These cash cows provide the financial backbone for Comcast to invest in new technologies and content, ensuring long-term competitiveness in the evolving media landscape.

Comcast's domestic broadband internet, under the Xfinity brand, continues to be a robust cash cow. Despite a slight dip in subscriber numbers, the service is still a revenue powerhouse, with domestic broadband revenue seeing a 1.6% increase in Q2 2025, driven by higher average rates per customer.

NBCUniversal's linear television networks, including NBC and USA Network, remain significant revenue contributors. In 2024, these networks benefit from substantial advertising sales and carriage fees, ensuring a consistent, albeit mature, revenue stream due to their established brands and valuable content libraries.

Universal Studios Florida and Islands of Adventure are mature, cash-generating powerhouses for Comcast, consistently delivering robust profits. In 2023, Universal Parks & Resorts reported a substantial increase in operating income, reaching $2.3 billion, largely driven by the strong performance of these existing parks.

Sky's established pay TV operations in the UK and Italy are classic cash cows, boasting significant market share and a loyal subscriber base. In 2023, Sky's total revenue was approximately $19.1 billion, demonstrating the scale of these businesses and their contribution to Comcast's financial stability.

| Business Unit | Status | Key Driver | 2023/2024 Data Point |

|---|---|---|---|

| Xfinity Broadband | Cash Cow | High average rates, dominant market share | Q2 2025 revenue up 1.6% |

| NBCUniversal Linear TV | Cash Cow | Advertising sales, carriage fees, content library | Significant revenue contribution in 2024 |

| Universal Parks (Florida) | Cash Cow | Consistent visitor numbers, increased guest spending | Universal Parks & Resorts operating income $2.3 billion in 2023 |

| Sky (UK & Italy Pay TV) | Cash Cow | Market share, loyal subscriber base, established infrastructure | Sky total revenue approx. $19.1 billion in 2023 |

What You See Is What You Get

Comcast BCG Matrix

The Comcast BCG Matrix preview you are currently viewing is the identical, fully unlocked document you will receive immediately after your purchase. This means you're seeing the exact strategic analysis, complete with all data and formatting, ready for your immediate use. There are no hidden watermarks, demo sections, or missing components; what you see is precisely what you get to implement in your business planning.

Dogs

Comcast's traditional domestic cable TV service is firmly positioned as a 'dog' in the BCG matrix. This segment is grappling with substantial and accelerating subscriber attrition, a trend that directly impacts its growth prospects.

In the second quarter of 2025, Comcast reported a loss of 325,000 video subscribers. This significant decline underscores the ongoing shift in consumer behavior, with many opting for streaming services over traditional cable packages.

The persistent cord-cutting phenomenon, driven by evolving entertainment preferences and the rise of over-the-top content, solidifies the cable TV service's status as a low-growth, low-market-share product within Comcast's portfolio.

Comcast's residential wireline voice service, a classic example of a "dog" in the BCG matrix, is experiencing a significant decline. With the widespread adoption of mobile phones and over-the-top communication apps, traditional landlines are becoming obsolete for many households. This trend is reflected in the shrinking subscriber base for this service.

The market share for wireline voice services continues to erode, as consumers opt for more flexible and integrated communication solutions. This diminishing relevance translates into low growth prospects for this segment of Comcast's business.

Consequently, this service likely generates minimal cash flow, and could even represent a cash trap, requiring ongoing investment without commensurate returns. For instance, the number of U.S. households with landline-only service has been steadily decreasing, with many households now relying solely on mobile phones.

Within NBCUniversal's vast media holdings, some older linear cable channels, particularly those without a strong emphasis on live news or sports, are experiencing a downturn. These channels are navigating a low-growth market and often struggle with a diminished market share in today's highly fragmented media environment.

These less popular channels, often characterized by declining viewership and advertising revenue, can become cash traps. For instance, in 2024, the overall linear TV advertising market continued to shrink, with many niche cable channels seeing steeper declines than major networks.

Such assets may require strategic divestiture or a significant overhaul to become viable again. The challenge lies in their inability to attract substantial audiences or advertisers, making them a drain on resources rather than contributors to growth.

Legacy Advertising Revenue from Traditional TV

Legacy advertising revenue from traditional TV represents a declining segment for Comcast. Advertisers are increasingly reallocating their budgets towards digital and streaming platforms, impacting the traditional linear TV model.

While this segment remains a part of Comcast's media business, its growth prospects are limited. This is primarily due to the ongoing decline in linear TV viewership and the intensifying competition from the rapidly expanding digital advertising markets.

- Declining Revenue: Traditional TV ad revenue is shrinking as viewer habits shift.

- Digital Shift: Advertisers are moving budgets to digital and streaming channels.

- Low Growth Prospects: Shrinking viewership and digital competition limit growth.

Outdated Customer Premise Equipment (CPE)

Outdated Customer Premise Equipment (CPE) represents a challenging segment within Comcast's portfolio, fitting the description of a 'dog' in the BCG Matrix. These older devices, often requiring frequent maintenance and consuming more energy, are a legacy burden. While they still serve existing customers, the return on investment for further upgrades or support is minimal, especially as the customer base for these older technologies shrinks.

Comcast's focus has shifted towards more advanced, energy-efficient equipment, leaving these legacy devices in a position of low growth and low market share. The resources dedicated to maintaining and supporting this outdated CPE could be more effectively deployed in areas with higher growth potential, such as next-generation broadband or advanced entertainment services.

- Low Market Share: A declining number of subscribers rely on older CPE models.

- Low Growth Rate: The market for these legacy devices is contracting.

- High Maintenance Costs: Older equipment necessitates significant ongoing support and repair expenses.

- Resource Drain: Investment in outdated CPE diverts capital from more innovative and profitable ventures.

Comcast's traditional cable TV service, facing significant subscriber losses, is a clear 'dog' in the BCG matrix. This segment is characterized by declining revenue and market share, as consumers increasingly opt for streaming alternatives. For example, in Q2 2025, Comcast lost 325,000 video subscribers, highlighting the ongoing cord-cutting trend.

Legacy wireline voice services also fall into the 'dog' category, with a shrinking subscriber base due to the dominance of mobile communication. This segment offers minimal growth and can be a cash drain, as evidenced by the steady decrease in households relying on landline-only service.

Certain older, less popular linear cable channels within NBCUniversal are also considered 'dogs.' These channels contend with low viewership and advertising revenue, especially as the linear TV advertising market contracted in 2024, with niche channels experiencing steeper declines.

Outdated Customer Premise Equipment (CPE) represents another 'dog' segment. These legacy devices have a low market share and growth rate, while incurring high maintenance costs and diverting resources from more innovative ventures.

| Comcast Segment | BCG Category | Key Challenges | Recent Data/Trends |

|---|---|---|---|

| Traditional Domestic Cable TV | Dog | Subscriber attrition, cord-cutting | Lost 325,000 video subscribers in Q2 2025 |

| Residential Wireline Voice | Dog | Obsolescence due to mobile, declining relevance | Shrinking subscriber base, erosion of market share |

| Older Linear Cable Channels (NBCUniversal) | Dog | Low viewership, declining ad revenue, fragmented market | Linear TV ad market contracted in 2024; niche channels saw steeper declines |

| Outdated Customer Premise Equipment (CPE) | Dog | Low market share, high maintenance costs, resource drain | Declining reliance on older models, contracting market for legacy devices |

Question Marks

Comcast's significant investments in expanding its fiber-to-the-home (FTTH) network place it squarely in the question mark category of the BCG matrix. The company is actively upgrading its infrastructure to offer faster and more reliable internet services, a necessary move in a rapidly evolving market. For instance, Comcast announced plans in 2024 to further accelerate its fiber buildout, aiming to pass millions more homes with its high-speed network.

This strategic push into next-generation broadband, while crucial for long-term growth and competitiveness, carries inherent uncertainties. The broadband market is experiencing robust growth, but Comcast faces stiff competition from a variety of sources, including dedicated fiber providers and emerging fixed wireless access (FWA) technologies. These competitors are also investing heavily, making the return on Comcast's substantial capital expenditures in FTTH not immediately guaranteed.

Comcast's proposed UK theme park, slated for a 2031 debut, represents a significant question mark within its portfolio. This ambitious international expansion taps into the strong growth potential of the theme park sector, a market that saw global revenues reach approximately $48 billion in 2023.

However, the venture demands substantial capital investment, estimated to be in the billions, and carries inherent risks. These include navigating diverse market preferences, complex regulatory environments, and potential construction delays, all of which could impact the timeline for profitability.

Sky Stream and Sky Glass, Comcast's innovative European streaming hardware, are currently positioned as question marks within the BCG matrix. These devices are designed to attract cord-cutters and a new generation of streaming-centric users in international territories.

The strategy behind Sky Stream and Sky Glass is to capture a significant portion of the evolving media consumption landscape, particularly in Europe. They aim to offer a streamlined, integrated streaming experience that appeals to consumers moving away from traditional pay-TV packages.

However, their success hinges on their ability to carve out substantial market share against deeply entrenched global streaming giants and established European broadcasters. This requires significant ongoing investment in marketing and product development to differentiate and gain traction.

Advanced Business Services (AI Implementation, IoT Solutions)

Comcast Business is actively exploring and implementing advanced services like AI and IoT solutions for its business clients. These areas represent high-growth technology markets, but their adoption and revenue generation for Comcast are still in early stages.

Significant investment in research, development, and market cultivation is crucial for these offerings to mature into future revenue drivers. For instance, the global AI market was projected to reach $1.8 trillion by 2030, indicating substantial growth potential, while the IoT market is also experiencing rapid expansion.

- AI Implementation: Focuses on leveraging artificial intelligence for enhanced business operations, data analytics, and customer engagement.

- IoT Solutions: Involves connecting devices and systems to collect and analyze data, driving efficiency and new service models.

- Market Potential: Both AI and IoT are in rapidly expanding technology sectors with significant long-term growth prospects.

- Investment Needs: These services require substantial R&D and market development to achieve widespread adoption and profitability.

New Bundled Service Offerings (e.g., Internet + Mobile + Streaming packages)

Comcast's aggressive push into bundled services, like pairing high-speed internet with a complimentary Xfinity Unlimited Mobile line and Peacock, positions these offerings as question marks within the BCG Matrix. This strategy is a direct response to intense competition and ongoing subscriber attrition in the broadband market.

These bundled packages are designed to both retain existing customers and attract new ones by offering perceived value and convenience. The success of these initiatives in shoring up Comcast's broadband subscriber base and ultimately boosting profitability remains a key area of evaluation.

- Customer Retention Efforts: Bundles aim to increase customer stickiness, making it harder for subscribers to switch to competitors.

- Market Share Defense: These offerings are a strategic move to counter aggressive pricing and package deals from rival telecommunications and media companies.

- Revenue Diversification: Integrating mobile and streaming services seeks to create new revenue streams beyond traditional broadband.

- Uncertain Long-Term Viability: The ultimate impact on subscriber numbers and profitability is still being determined as the market adapts to these combined service models.

Comcast's significant investments in expanding its fiber-to-the-home (FTTH) network place it squarely in the question mark category of the BCG matrix. The company is actively upgrading its infrastructure to offer faster and more reliable internet services, a necessary move in a rapidly evolving market. For instance, Comcast announced plans in 2024 to further accelerate its fiber buildout, aiming to pass millions more homes with its high-speed network.

This strategic push into next-generation broadband, while crucial for long-term growth and competitiveness, carries inherent uncertainties. The broadband market is experiencing robust growth, but Comcast faces stiff competition from a variety of sources, including dedicated fiber providers and emerging fixed wireless access (FWA) technologies. These competitors are also investing heavily, making the return on Comcast's substantial capital expenditures in FTTH not immediately guaranteed.

Comcast's proposed UK theme park, slated for a 2031 debut, represents a significant question mark within its portfolio. This ambitious international expansion taps into the strong growth potential of the theme park sector, a market that saw global revenues reach approximately $48 billion in 2023.

However, the venture demands substantial capital investment, estimated to be in the billions, and carries inherent risks. These include navigating diverse market preferences, complex regulatory environments, and potential construction delays, all of which could impact the timeline for profitability.

Sky Stream and Sky Glass, Comcast's innovative European streaming hardware, are currently positioned as question marks within the BCG matrix. These devices are designed to attract cord-cutters and a new generation of streaming-centric users in international territories.

The strategy behind Sky Stream and Sky Glass is to capture a significant portion of the evolving media consumption landscape, particularly in Europe. They aim to offer a streamlined, integrated streaming experience that appeals to consumers moving away from traditional pay-TV packages.

However, their success hinges on their ability to carve out substantial market share against deeply entrenched global streaming giants and established European broadcasters. This requires significant ongoing investment in marketing and product development to differentiate and gain traction.

Comcast Business is actively exploring and implementing advanced services like AI and IoT solutions for its business clients. These areas represent high-growth technology markets, but their adoption and revenue generation for Comcast are still in early stages.

Significant investment in research, development, and market cultivation is crucial for these offerings to mature into future revenue drivers. For instance, the global AI market was projected to reach $1.8 trillion by 2030, indicating substantial growth potential, while the IoT market is also experiencing rapid expansion.

- AI Implementation: Focuses on leveraging artificial intelligence for enhanced business operations, data analytics, and customer engagement.

- IoT Solutions: Involves connecting devices and systems to collect and analyze data, driving efficiency and new service models.

- Market Potential: Both AI and IoT are in rapidly expanding technology sectors with significant long-term growth prospects.

- Investment Needs: These services require substantial R&D and market development to achieve widespread adoption and profitability.

Comcast's aggressive push into bundled services, like pairing high-speed internet with a complimentary Xfinity Unlimited Mobile line and Peacock, positions these offerings as question marks within the BCG Matrix. This strategy is a direct response to intense competition and ongoing subscriber attrition in the broadband market.

These bundled packages are designed to both retain existing customers and attract new ones by offering perceived value and convenience. The success of these initiatives in shoring up Comcast's broadband subscriber base and ultimately boosting profitability remains a key area of evaluation.

- Customer Retention Efforts: Bundles aim to increase customer stickiness, making it harder for subscribers to switch to competitors.

- Market Share Defense: These offerings are a strategic move to counter aggressive pricing and package deals from rival telecommunications and media companies.

- Revenue Diversification: Integrating mobile and streaming services seeks to create new revenue streams beyond traditional broadband.

- Uncertain Long-Term Viability: The ultimate impact on subscriber numbers and profitability is still being determined as the market adapts to these combined service models.

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive dataset, including Comcast's financial reports, subscriber growth figures, and market share data for each business segment.