Comcast Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comcast Bundle

Comcast operates in a highly competitive landscape, facing significant pressure from rivals and the constant threat of new entrants. Understanding the interplay of these forces is crucial for navigating its market position.

The complete report reveals the real forces shaping Comcast’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Comcast faces a significant challenge due to the concentrated market of key technology suppliers for its network infrastructure. In 2024, the top three vendors held over 80% of the market share for essential network equipment, significantly limiting Comcast's choices.

This concentration of power among a few suppliers directly impacts Comcast's bargaining power. It means fewer alternatives are available, potentially driving up the cost of procuring critical infrastructure components needed to maintain and expand its services.

The dominance of these few suppliers also makes it difficult for Comcast to negotiate favorable terms. Furthermore, the high transition costs, estimated to be around $500 million for major infrastructure overhauls, create substantial barriers to switching suppliers, further reducing Comcast's leverage.

Comcast's significant reliance on technology and network equipment manufacturers, such as Cisco Systems, Intel, and Arris, forms a key aspect of its supplier bargaining power. This dependence grants these specialized providers considerable influence over pricing and the introduction of new technologies, directly impacting Comcast's operational costs and competitive edge.

The ongoing necessity for Comcast to maintain and upgrade its extensive infrastructure, which includes broadband networks and cable systems, solidifies its dependence on these critical suppliers. For instance, in 2023, Comcast invested billions in network upgrades, underscoring its continuous need for advanced equipment from these specialized companies.

Content providers, such as major television networks and film studios, possess significant bargaining power because they supply the crucial programming that fuels Comcast's video distribution and burgeoning streaming services. This reliance means these content creators can influence the terms of licensing agreements.

Comcast's immense scale and dominant market presence, however, provide a strong counterweight, enabling it to negotiate more favorable licensing terms. For instance, in 2023, Comcast reported approximately $121.4 billion in revenue, showcasing its financial muscle in these negotiations.

The strategic spin-off of some cable networks into Versant Media Group in 2024 is likely to reshape NBCUniversal's content strategy, with a sharpened focus on broadcast and streaming. This move could alter the supplier dynamics, potentially concentrating Comcast's content acquisition efforts and influencing future negotiations with remaining or new content partners.

Significant Capital Investments Required for Infrastructure

Comcast's substantial capital expenditures, including $7.3 billion for network infrastructure and $2.1 billion for technology upgrades in 2023, demonstrate a significant reliance on equipment suppliers. This ongoing need for advanced networking solutions means suppliers of these critical components hold considerable sway.

The high cost of deploying new technologies, such as fiber optic cable which can range from $15,000 to $25,000 per mile, further solidifies the bargaining power of suppliers in this sector. These substantial upfront investments make switching suppliers a costly and complex endeavor for Comcast.

- High Infrastructure Investment: Comcast's 2023 spending highlights its dependence on suppliers for network build-outs.

- Supplier Dependence: The significant capital required for technology upgrades reinforces supplier leverage.

- Costly Transition: The high per-mile cost of fiber optic deployment makes supplier relationships crucial and difficult to change.

Limited Alternative Suppliers for Specialized Infrastructure

For highly specialized telecommunications infrastructure, Comcast faces a limited pool of viable alternative suppliers. This scarcity of options significantly strengthens the bargaining power of these key technology providers, as they experience less competitive pressure from each other. For instance, the development and deployment of advanced fiber optic networks or proprietary network management software often relies on a handful of established, highly technical firms.

Comcast's deep integration with specific technologies and equipment also creates substantial switching costs. This means that changing suppliers for critical components or systems would be a complex and expensive undertaking, further solidifying existing relationships and empowering current suppliers.

- Limited Supplier Options: The specialized nature of telecommunications infrastructure means few companies can provide essential components or services.

- High Switching Costs: Integrating new technologies or changing providers for critical infrastructure is costly and time-consuming for Comcast.

- Supplier Leverage: The combination of limited alternatives and high switching costs gives specialized infrastructure suppliers significant bargaining power.

Comcast's bargaining power with suppliers is notably constrained by the concentrated nature of the technology market for its network infrastructure. In 2024, a few key vendors dominated, holding over 80% of the market for essential equipment, which inherently limits Comcast's negotiation leverage and choice.

This reliance on a small group of specialized providers, such as those supplying advanced fiber optics or proprietary network software, grants these suppliers significant influence over pricing and terms. The substantial investment required for infrastructure upgrades, like the $7.3 billion Comcast spent on network infrastructure in 2023, further entrenches these supplier relationships, making switching costly and complex.

| Supplier Type | Market Concentration (2024) | Comcast 2023 Infrastructure Spend | Key Impact on Bargaining Power |

|---|---|---|---|

| Network Equipment | Top 3 Vendors > 80% Market Share | $7.3 Billion | Limited alternatives, high switching costs |

| Fiber Optic Deployment | Few specialized providers | Estimated $15k-$25k per mile | High upfront investment, supplier pricing power |

| Network Management Software | Highly technical, few established firms | Included in technology upgrades | Deep integration, complex transitions |

What is included in the product

Comcast's Porter's Five Forces analysis reveals the intense competition from cable, telco, and streaming rivals, the significant bargaining power of content providers, and the high barriers to entry due to infrastructure costs.

Quickly identify and mitigate competitive threats with a visual breakdown of Comcast's market position, making strategic planning more effective.

Customers Bargaining Power

Consumers in the media and telecommunications industry generally face low switching costs, typically ranging from $60 to $200. This financial ease of moving between providers fuels customer churn, a factor impacting companies like Comcast. In the fourth quarter of 2023, Comcast reported a 4.3% churn rate within its cable communications segment, illustrating the impact of this low barrier to entry for customers.

Comcast's bargaining power of customers is significantly impacted by increasing competition from alternative providers. Fiber-to-the-home services and fixed wireless access (FWA) from major wireless carriers like AT&T, Verizon, and T-Mobile are offering consumers more choices.

This intensified rivalry directly translates to weakened market power for Comcast, evidenced by substantial broadband subscriber losses. For instance, Comcast reported a decline of 199,000 broadband subscribers in the first quarter of 2025 alone, highlighting the direct impact of these competitive pressures on customer retention and Comcast's ability to dictate terms.

Many consumers are highly sensitive to the cost of cable TV and internet services. This means they have significant leverage when it comes to negotiating service packages and prices. For instance, Comcast has responded by rolling out new pricing structures and offering five-year price guarantees to keep customers from switching.

The drive for more affordable alternatives is clear, with the increasing adoption of 5G home internet highlighting this trend. This puts pressure on traditional providers to remain competitive and offer value that meets customer budget expectations.

Bundling and Wireless Service Expansion

Comcast’s bundling strategy, especially with its Xfinity Mobile service, acts as a significant countermeasure against customer bargaining power. By offering a package of services, the company increases the cost and inconvenience for customers to switch providers, thereby solidifying customer loyalty.

This approach is particularly effective as customers with multiple Xfinity Mobile lines exhibit higher retention rates for their broadband services. This indicates that the integration of wireless and broadband creates a stronger value proposition, making it harder for customers to negotiate lower prices or switch to competitors for individual services.

In 2023, Comcast reported that its Xfinity Mobile service had surpassed 6 million customer lines, highlighting the growing adoption of its converged offerings. This expansion directly translates to a reduced ability for individual customers to exert significant bargaining power, as the perceived value of the bundle increases.

- Bundling Services: Comcast's strategy of packaging broadband, TV, and mobile services reduces individual service price sensitivity.

- Increased Customer Stickiness: Xfinity Mobile lines boost broadband retention, as customers are less likely to leave if they have multiple services with one provider.

- Reduced Churn: The convenience and potential cost savings of bundled services discourage customers from seeking alternative providers.

- Market Penetration: Xfinity Mobile's growth to over 6 million lines in 2023 demonstrates the effectiveness of this strategy in capturing market share and mitigating customer power.

Cord-Cutting Trend

The widespread adoption of streaming services has significantly increased the bargaining power of customers by offering viable substitutes for traditional cable television. This accelerating cord-cutting trend means consumers have more choices than ever before, diminishing their reliance on bundled pay-TV packages.

In 2024, the shift was stark, with an estimated 74 million U.S. households having cut the cord. Streaming subscriptions have now surpassed cable subscriptions, providing consumers with ample alternatives and reducing the perceived necessity of traditional cable offerings.

- Cord-Cutting Acceleration: Streaming services like Netflix, Disney+, and Max offer a direct substitute for cable TV.

- Consumer Choice: 74 million U.S. households opted out of traditional cable in 2024, highlighting increased consumer power.

- Subscription Shift: Streaming subscriptions now exceed cable subscriptions, giving consumers leverage in negotiating or switching providers.

Customers possess significant bargaining power due to low switching costs, often between $60 and $200, which facilitates churn. In Q4 2023, Comcast's cable segment experienced a 4.3% churn rate.

The rise of competitors like AT&T, Verizon, and T-Mobile offering fiber-to-the-home and fixed wireless access intensifies rivalry, weakening Comcast's market position. This is evident in Comcast's loss of 199,000 broadband subscribers in Q1 2025.

Price sensitivity among consumers gives them leverage, prompting Comcast to introduce pricing guarantees. The growing adoption of 5G home internet further pressures providers to offer competitive value.

Comcast counters this power through service bundling, particularly with Xfinity Mobile, which had over 6 million lines in 2023. This strategy increases customer stickiness and reduces the likelihood of switching, as customers with multiple services are more loyal.

| Factor | Impact on Comcast | Supporting Data |

|---|---|---|

| Switching Costs | Low, enabling customer mobility | $60-$200 range; 4.3% churn rate (Q4 2023) |

| Competition | Intensified rivalry from fiber and FWA | 199,000 broadband subscriber loss (Q1 2025) |

| Price Sensitivity | High, granting customer leverage | Introduction of price guarantees |

| Bundling Strategy | Mitigates customer power | Over 6 million Xfinity Mobile lines (2023) |

What You See Is What You Get

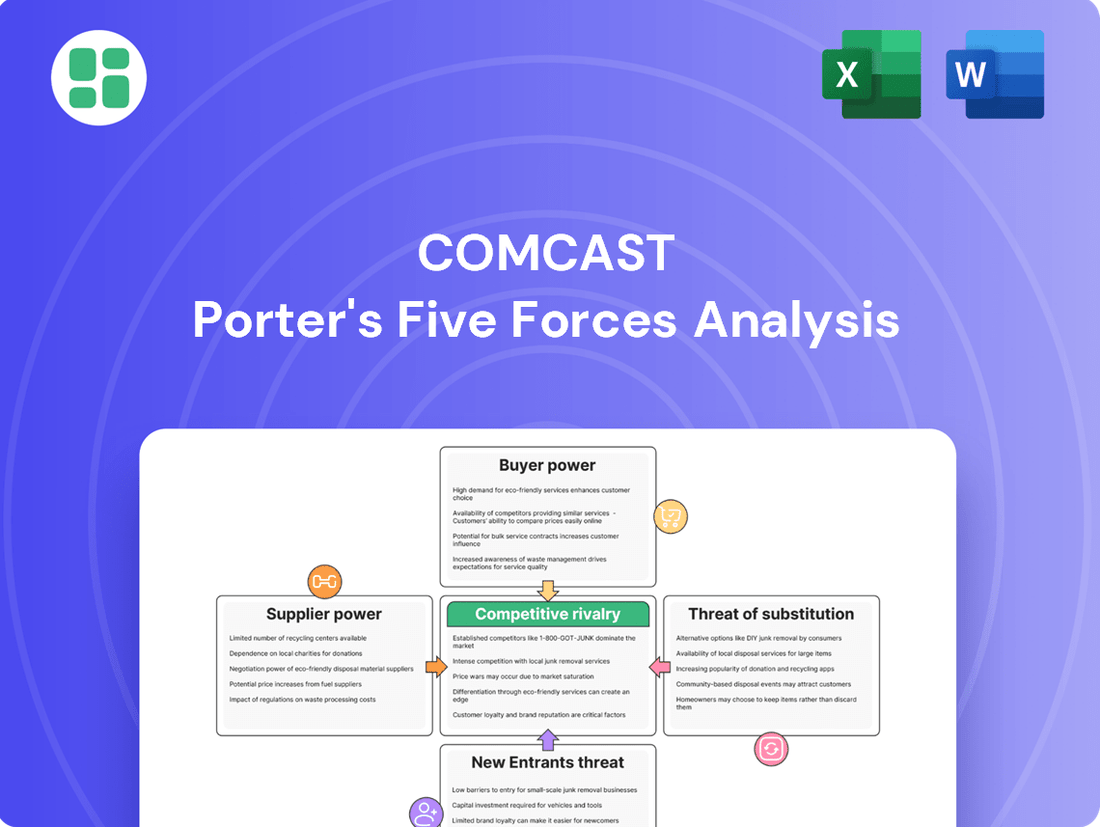

Comcast Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Comcast, detailing the competitive landscape, buyer and supplier power, threat of new entrants, and substitute products. The document you see here is precisely what you’ll be able to download and utilize immediately after completing your purchase, offering a complete and ready-to-use strategic overview.

Rivalry Among Competitors

Comcast navigates a highly competitive broadband landscape. The company faces direct challenges from rivals like AT&T and Verizon, who are actively expanding their fiber optic networks. Furthermore, the rise of fixed wireless access (FWA) from providers such as T-Mobile presents an increasingly potent alternative for consumers.

This intensified competition has directly impacted Comcast's subscriber base. In the first quarter of 2025, the company reported a loss of 199,000 broadband subscribers, underscoring the pressure from these competing technologies and providers. The battle for market share is particularly fierce, especially among customers who prioritize cost-effectiveness.

Comcast's NBCUniversal, through its Peacock platform, faces intense competition from established streaming giants like Netflix, Disney+, and Amazon Prime Video. These players have substantial global reach and vast content libraries, significantly influencing consumer viewing habits away from traditional television.

The streaming market is highly saturated, making it challenging for newer entrants like Peacock to gain substantial market share. For instance, as of Q1 2024, Netflix reported over 270 million global paid subscribers, highlighting the scale of competition.

While Peacock has shown growth, its subscriber numbers, around 31 million paid subscribers in early 2024, are still considerably smaller than its primary rivals, underscoring the fierce rivalry and the need for continuous content investment and strategic differentiation.

Many markets for cable TV and internet services are saturated, leading to intense competition that often manifests as price wars and aggressive bundled offerings. For instance, in 2024, the US broadband market continued to see significant competition, with providers frequently offering promotional pricing to acquire new subscribers.

Companies like Comcast must continually innovate and adjust pricing strategies to attract and retain customers in this mature market. This includes tactics such as offering multi-year price guarantees, like five-year price locks, to provide customers with predictable costs and reduce churn amid aggressive competitor promotions.

Diversified Competitors

Comcast faces a dynamic and diverse competitive landscape. Traditional rivals like Charter Communications vie for cable and broadband customers, while satellite providers continue to hold a segment of the pay-TV market. The rise of streaming services, such as Netflix and Disney+, presents a significant challenge to Comcast's traditional video offerings, forcing it to innovate and bundle services effectively.

Mobile carriers have also entered the fray, offering bundled internet and mobile plans, further intensifying competition. For instance, in 2024, the U.S. broadband market saw continued growth, with major players like Comcast and Charter reporting subscriber gains, but the overall market penetration is high, indicating a mature and competitive environment.

- Charter Communications: A primary competitor in broadband and cable TV, particularly in overlapping service areas.

- Streaming Services: Platforms like Netflix, Hulu, and Max directly compete for entertainment spending, impacting traditional pay-TV subscriptions.

- Satellite TV Providers: Companies such as DirecTV and Dish Network remain competitors, especially in regions where cable penetration is lower.

- Other Telecommunications Companies: AT&T and Verizon, among others, offer competing broadband and increasingly, wireless services that can be bundled.

High Capital Expenditures for Network Upgrades

Comcast faces intense rivalry from competitors also heavily investing in infrastructure. To stay ahead and meet escalating customer demands for faster and more reliable internet, the company consistently pours billions into upgrading its network. This includes the rollout of fiber optic cables and the implementation of advanced DOCSIS 4.0 technology.

These significant capital expenditures, projected to surpass $10 billion in 2024 alone, are crucial for delivering the multi-gigabit symmetrical speeds that customers now expect. This ongoing investment highlights a fierce competition within the telecommunications sector, where providing superior connectivity is paramount to maintaining a competitive edge.

- Massive Infrastructure Investment: Comcast's commitment to network upgrades, including fiber and DOCSIS 4.0, requires substantial capital outlay.

- 2024 Capital Expenditure: The company is expected to invest over $10 billion in 2024 for these essential network enhancements.

- Industry Arms Race: These expenditures reflect an industry-wide effort to offer the fastest and most dependable internet services.

- Meeting Demand: The upgrades are vital for meeting the growing consumer and business demand for high-speed, symmetrical bandwidth.

Comcast operates in a fiercely competitive environment, particularly in the broadband sector where rivals like Charter Communications, AT&T, and Verizon are aggressively expanding their fiber networks. The increasing adoption of fixed wireless access (FWA) by companies such as T-Mobile also presents a growing alternative for consumers, intensifying market pressures.

This intense rivalry is evident in Comcast's subscriber trends. The company experienced a net loss of 199,000 broadband subscribers in Q1 2025, a clear indicator of the competitive headwinds. In the streaming arena, Comcast's Peacock faces formidable competition from established players like Netflix, which boasted over 270 million global subscribers by Q1 2024, highlighting the significant challenge Peacock, with its approximately 31 million paid subscribers in early 2024, faces in capturing market share.

| Competitor | Primary Service Area | Key Competitive Strategy |

| Charter Communications | Broadband, Cable TV | Bundled services, competitive pricing |

| AT&T | Broadband, Mobile | Fiber expansion, bundled mobile/internet |

| Verizon | Broadband, Mobile | Fiber expansion, 5G integration |

| T-Mobile | Mobile, Fixed Wireless Access (FWA) | FWA as an alternative to traditional broadband |

| Netflix | Streaming Video | Vast content library, global reach |

SSubstitutes Threaten

The proliferation of streaming services like Netflix, Disney+, and Amazon Prime Video represents a substantial threat of substitution for Comcast's legacy cable TV business. These platforms offer extensive on-demand content libraries, often at attractive price points, fueling the ongoing cord-cutting phenomenon. For instance, by the end of 2023, Netflix reported over 270 million paid subscribers globally, demonstrating the significant consumer shift towards streaming.

This trend is further exacerbated by the migration of live sports, a traditional stronghold of cable, to streaming platforms. Many major sports leagues and events are increasingly making their content available exclusively through streaming subscriptions, directly challenging cable's value proposition. This shift is critical as live sports viewership has historically been a key driver of cable subscriptions.

Fixed Wireless Access (FWA) from mobile carriers like T-Mobile and Verizon is increasingly posing a threat to Comcast's traditional wired broadband services. FWA utilizes radio signals to deliver internet, often at competitive prices and with easier setup, appealing to a segment of the market looking for alternatives.

This growing availability of FWA is directly impacting Comcast's subscriber base, particularly among price-conscious consumers and in areas where wired infrastructure might be less developed. For instance, T-Mobile reported over 3.7 million FWA customers by the end of 2023, showcasing the significant inroads this substitute technology is making.

The threat of substitutes for Comcast's traditional voice services is significant, primarily from Over-the-Top (OTT) voice and communication applications. Services like WhatsApp, Zoom, and other Voice over Internet Protocol (VoIP) providers offer compelling alternatives that directly compete with landline offerings.

These OTT platforms often provide free or very low-cost calling and messaging capabilities, directly eroding the perceived value of bundled voice plans. For instance, in 2024, global mobile data traffic was projected to reach hundreds of exabytes, a substantial portion of which is driven by these communication apps, indicating a strong consumer preference for digital communication channels over traditional telephony.

Mobile-First Internet Usage

The increasing reliance on mobile data and the widespread adoption of smartphones, especially with the ongoing 5G network expansion, pose a substitution threat to traditional fixed-line home broadband services for specific customer groups. This trend is particularly noticeable among younger demographics who increasingly view mobile as their primary internet source, potentially diminishing the perceived need for a dedicated home broadband subscription. For instance, in 2024, it's estimated that over 70% of internet access globally occurs via mobile devices, a figure projected to climb further.

While Comcast offers its own mobile service, Xfinity Mobile, the broader societal shift towards mobile-first internet usage can still impact the core broadband business. This means that even with integrated mobile offerings, the fundamental demand for high-speed, reliable home internet could be challenged if mobile data plans become sufficiently robust and cost-effective for all online activities. The convenience and ubiquity of mobile internet are powerful substitutes for many users.

- Mobile internet usage is growing rapidly: Global mobile data traffic is expected to increase significantly by 2025, driven by video streaming and social media.

- 5G rollout enhances mobile capabilities: The expansion of 5G networks offers faster speeds and lower latency, making mobile internet a more viable substitute for home broadband.

- Younger demographics lead the mobile-first trend: Studies in 2024 indicate a higher preference for mobile internet among Gen Z and Millennials for daily online tasks.

- Data caps and throttling can be a limiting factor: While mobile is a substitute, limitations on data usage for heavy internet users can still favor traditional broadband.

DIY Smart Home and Security Solutions

The threat of substitutes for Comcast's Xfinity Home services is significant, primarily driven by the burgeoning DIY smart home and security market. Consumers increasingly opt for modular, third-party solutions that allow them to build custom home ecosystems, bypassing the need for integrated, bundled offerings like those from Comcast. This shift reflects a growing preference for flexibility and cost-effectiveness.

For instance, in 2024, the global smart home market was projected to reach over $150 billion, with a substantial portion attributed to DIY installations. Products from companies like Google Nest, Amazon Ring, and Apple HomeKit offer consumers the ability to control lighting, thermostats, and security cameras independently. These systems are often more affordable upfront and allow for gradual expansion as needs and budgets allow.

- DIY solutions offer lower entry costs compared to professionally installed systems.

- Consumers can choose specific devices that meet their unique needs, fostering customization.

- The widespread availability of user-friendly smart home devices reduces the technical barrier for adoption.

- Many DIY systems are compatible with a wide range of third-party smart devices, creating flexible ecosystems.

The rise of streaming services like Netflix and Disney+ presents a significant substitution threat to Comcast's traditional cable TV offerings, as consumers increasingly cut the cord for more flexible, on-demand content. This trend is amplified by live sports migrating to streaming platforms, a key driver of cable subscriptions historically. By the end of 2023, Netflix alone boasted over 270 million global subscribers, underscoring the substantial consumer shift.

Entrants Threaten

Entering the broadband and cable television market requires substantial capital for building and maintaining a vast network infrastructure. Comcast's own investment in its network infrastructure reached $30.2 billion in 2024, illustrating the significant financial hurdle new companies face. This considerable upfront cost acts as a strong deterrent for potential competitors looking to enter the industry.

The telecommunications and media sectors, where Comcast operates, are heavily regulated. New companies must contend with intricate licensing processes, franchise agreements, and a web of government policies. For instance, in 2024, obtaining federal and state broadband deployment permits can still take months, if not years, depending on the jurisdiction and scope of operations.

Comcast's significant economies of scale create a formidable barrier to entry. For instance, its massive investment in broadband infrastructure, estimated in the tens of billions of dollars, allows it to spread fixed costs over a vast subscriber base, lowering per-unit costs. Newcomers would need to replicate this extensive network, a capital-intensive undertaking that is incredibly difficult to achieve without comparable scale.

Brand Recognition and Customer Loyalty

Comcast, with its well-established Xfinity and NBCUniversal brands, has built formidable brand recognition and a loyal customer following. This makes it incredibly challenging for new companies to gain traction. New entrants must invest heavily in marketing and customer acquisition to even begin to erode Comcast's established market position.

The threat of new entrants is significantly lowered by Comcast's strong brand equity. For instance, in 2023, Xfinity reported over 32 million customer relationships across its broadband, video, and voice services. This deep-rooted customer base is difficult for newcomers to replicate, requiring substantial capital and time to build comparable trust and loyalty.

- Brand Recognition: Comcast's brands, like Xfinity, are household names, making it easier to attract and retain customers.

- Customer Loyalty: Years of service and bundled offerings foster loyalty, making customers less likely to switch to unknown providers.

- Marketing Investment: New entrants need massive marketing budgets to challenge Comcast's brand awareness, a significant barrier.

- Customer Acquisition Costs: Acquiring customers in a market dominated by an entrenched player like Comcast is expensive.

Proprietary Content and Distribution Agreements

Comcast's significant advantage stems from its extensive proprietary content and exclusive distribution agreements, particularly through NBCUniversal. Access to a vast library of licensed and internally produced content, including high-value sports rights like the NBA, presents a formidable barrier. For instance, in 2024, the continued investment in premium sports broadcasting rights by established players like Comcast ensures that new entrants face substantial hurdles in replicating a comparable content offering.

New companies entering the media landscape must either undertake massive content acquisition and production investments or forge complex, expensive distribution partnerships to compete. This financial and operational commitment required to match Comcast's content portfolio makes the threat of new entrants relatively low.

- Proprietary Content Ownership: Comcast, through NBCUniversal, owns a significant library of intellectual property and production capabilities.

- Exclusive Distribution Deals: Key content, especially live sports, is often secured through exclusive, long-term licensing agreements that are difficult for newcomers to replicate.

- High Investment Threshold: New entrants require substantial capital to acquire or create content that can rival Comcast's established offerings, thereby limiting the ease of entry.

The threat of new entrants into Comcast's core markets is notably low due to immense capital requirements for network infrastructure and content acquisition. These high entry barriers, coupled with stringent regulatory hurdles and significant economies of scale enjoyed by Comcast, make it exceptionally difficult for new players to establish a competitive foothold. Furthermore, Comcast's established brand loyalty and extensive content library, including exclusive sports rights, create formidable challenges for any potential disruptor seeking to gain market share.

Porter's Five Forces Analysis Data Sources

Our Comcast Porter's Five Forces analysis is built upon a foundation of robust data, including Comcast's annual reports and SEC filings, alongside industry-specific research from firms like Statista and IBISWorld.

We also integrate insights from financial analyst reports, competitor disclosures, and macroeconomic data to provide a comprehensive view of the competitive landscape.