Columbus McKinnon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbus McKinnon Bundle

Columbus McKinnon's strengths lie in its established brand and diverse product portfolio, but its reliance on key industries presents a significant vulnerability. Understanding these internal capabilities and external challenges is crucial for navigating the competitive landscape.

Want the full story behind Columbus McKinnon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Columbus McKinnon stands as a global leader in intelligent motion solutions for material handling. Their extensive product range, encompassing hoists, cranes, actuators, and precision conveyor systems, underscores their market dominance and ability to serve a wide array of industrial and commercial sectors worldwide. This broad market penetration, supported by a strong brand reputation, allows them to effectively meet diverse customer demands.

Columbus McKinnon showcased impressive financial strength, achieving record net sales of $1.0 billion in fiscal year 2024. This growth was broad-based, with positive contributions from all operating regions.

The company's robust performance extended into fiscal year 2025, marked by record order intake. This resulted in a substantial backlog of $322.5 million.

A significant portion of this backlog is slated for shipment beyond the three-month horizon. This provides Columbus McKinnon with exceptional revenue visibility and signals enduring market demand for its product and service offerings.

Columbus McKinnon's commitment to innovation is a significant strength, focusing on intelligent motion solutions designed to boost customer productivity and safety. This dedication is clearly demonstrated by their BatteryStar™ Battery-Powered Chain Hoist, recognized as a 2024 Product of the Year by Material Handling Product News. This award underscores their capability in integrating cutting-edge technologies, such as lithium-ion batteries and brushless motors, into their product lines, positioning them for substantial future growth.

Strategic Acquisitions for Enhanced Scale

Columbus McKinnon's strategic acquisitions are a significant strength, notably the pending acquisition of Kito Crosby, which is poised to dramatically expand the company's scale. This move is designed to broaden their global footprint and strengthen their motion control offerings, thereby accelerating their Intelligent Motion strategy.

The Kito Crosby deal is anticipated to yield considerable annual net cost synergies, estimated to be around $35 million, and enhance Adjusted EBITDA margins by approximately 150 basis points. This integration is expected to solidify Columbus McKinnon's position as a global leader in the lifting and rigging industry.

- Significant Scale Expansion: The Kito Crosby acquisition is projected to more than double Columbus McKinnon's revenue in the lifting and rigging segment.

- Geographic Reach: The deal enhances presence in key markets, particularly in Asia-Pacific.

- Synergy Realization: Expected annual net cost synergies of $35 million are a key financial benefit.

- Margin Improvement: A projected 150 basis point increase in Adjusted EBITDA margins is a testament to operational efficiencies.

Strong ESG and Sustainability Initiatives

Columbus McKinnon's commitment to ESG is evident in their published Corporate Sustainability Reports for fiscal years 2024 and 2025. These reports highlight tangible advancements in key areas, reinforcing their dedication to responsible business practices. This proactive stance not only resonates with environmentally and socially conscious stakeholders but also bolsters the company's long-term viability and market appeal.

The company has made significant strides in reducing its environmental footprint. For fiscal year 2024, they reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline. Furthermore, their waste diversion rate increased to 70% in fiscal year 2025, up from 62% the previous year. These metrics underscore a genuine effort to integrate sustainability into their core operations.

- Environmental Progress: Achieved a 15% reduction in Scope 1 and 2 emissions (FY24) and a 70% waste diversion rate (FY25).

- Social Responsibility: Fostering an inclusive corporate culture with employee engagement scores rising by 8% in FY25.

- Governance Strength: Maintaining strong ethical standards and transparent reporting through annual sustainability reports.

- Brand Enhancement: Improved brand reputation and resilience driven by a clear focus on sustainability.

Columbus McKinnon's robust market position is bolstered by its diverse product portfolio and strong brand recognition, enabling it to cater to a wide range of industries globally. Financial performance in FY24 saw record net sales of $1.0 billion, a trend continuing into FY25 with record order intake and a substantial $322.5 million backlog, ensuring significant revenue visibility.

Innovation is a key strength, highlighted by their BatteryStar™ Battery-Powered Chain Hoist winning a 2024 Product of the Year award, showcasing their integration of advanced technologies like lithium-ion batteries.

The strategic acquisition of Kito Crosby is set to significantly expand the company's scale and global reach, projected to deliver $35 million in annual net cost synergies and improve Adjusted EBITDA margins by approximately 150 basis points.

Columbus McKinnon's commitment to ESG is demonstrated through tangible progress, including a 15% reduction in Scope 1 and 2 emissions by FY24 and a 70% waste diversion rate by FY25, enhancing its brand reputation and long-term viability.

| Metric | FY24 | FY25 (Projected/Actual) | Significance |

|---|---|---|---|

| Net Sales | $1.0 Billion | Continued Growth | Record performance, broad-based expansion |

| Backlog | N/A | $322.5 Million | High revenue visibility, strong demand |

| Scope 1 & 2 Emissions Reduction | 15% (vs. 2020 baseline) | Ongoing | Environmental responsibility, operational efficiency |

| Waste Diversion Rate | N/A | 70% | Sustainability commitment, reduced environmental impact |

| Kito Crosby Synergies | N/A | $35 Million (Annual Net Cost) | Financial benefit, operational integration |

What is included in the product

Delivers a strategic overview of Columbus McKinnon’s internal and external business factors, highlighting its strengths in product innovation and market reach, while also identifying weaknesses in supply chain management and opportunities in emerging markets and threats from global competition.

Offers a clear, actionable framework to identify and leverage Columbus McKinnon's competitive advantages and mitigate potential risks.

Weaknesses

While Columbus McKinnon demonstrated strong overall fiscal year results, the company has encountered some quarterly fluctuations. For instance, they missed consensus estimates for both earnings and revenue in Q4 FY2024, and similarly for Q4 FY2025 revenue. This pattern of inconsistency in short-term financial performance can introduce uncertainty for investors.

More recently, the first quarter of fiscal year 2026 saw Columbus McKinnon fall short of analyst expectations for both revenue and adjusted earnings per share. Such deviations from projected financial outcomes can impact investor confidence and create a perception of volatility in the company's operational execution.

Columbus McKinnon faces considerable risks due to tariffs and shifting trade policies, with an anticipated $40 million hit to EBITDA in fiscal year 2026. While the company is actively implementing countermeasures, the delayed implementation of price hikes and surcharges has temporarily squeezed its profit margins.

Columbus McKinnon's reliance on industrial markets makes it vulnerable to economic downturns. For instance, the company's third quarter of fiscal year 2025 saw a 4% decrease in net sales, partly attributed to softening demand in key sectors.

This sensitivity is exacerbated by current global economic conditions. Projections for late 2024 and early 2025 highlight a slowdown in industrial activity, especially in Europe, driven by policy shifts and economic headwinds. This trend could translate into reduced capital spending by Columbus McKinnon's customer base.

A significant economic contraction or recession would likely dampen customer investment in new equipment and upgrades, directly impacting Columbus McKinnon's order volumes and overall revenue generation.

Volatility in Short-Cycle Orders

Columbus McKinnon's short-cycle order segment faced a notable dip in Q3 FY2025, though a rebound was observed in Q4 FY2025. This business area is highly sensitive to immediate policy shifts and broader economic uncertainties, making consistent revenue generation a challenge.

The inherent volatility in short-cycle orders, influenced by rapid changes in economic sentiment and policy, presents a significant weakness. For instance, while Q3 FY2025 saw a decline, Q4 FY2025 indicated a recovery, highlighting the unpredictable nature of this revenue stream. This fluctuation impacts the company's ability to forecast and manage production and inventory effectively, potentially leading to missed revenue targets or excess stock.

- Q3 FY2025 Short-Cycle Order Decline: The company reported a decrease in this segment during the third quarter of fiscal year 2025.

- Q4 FY2025 Improvement: A positive trend emerged in the fourth quarter of fiscal year 2025, showing a recovery in short-cycle orders.

- Sensitivity to Macroeconomic Factors: Short-cycle orders are particularly vulnerable to immediate policy changes and broader economic conditions.

- Forecasting Challenges: The unpredictable nature of this demand makes consistent revenue generation and operational planning more difficult.

Increased Debt from Strategic Acquisitions

Columbus McKinnon's strategic acquisition of Kito Crosby, valued at $2.7 billion, was primarily financed through $2.6 billion in debt. This substantial increase in leverage places a significant emphasis on debt repayment, potentially limiting financial maneuverability.

The heightened debt burden directly impacts the company's financial flexibility. Higher interest expenses will likely be incurred, and the capacity for future investments or strategic initiatives could be constrained as cash flow is directed towards servicing this debt.

- Acquisition Funding: $2.6 billion of the $2.7 billion Kito Crosby acquisition was debt-financed.

- Leverage Impact: This significantly increases Columbus McKinnon's debt-to-equity ratio.

- Financial Constraint: Prioritizing debt repayment may reduce funds available for organic growth or other strategic opportunities.

- Interest Expense: Increased debt naturally leads to higher interest payments, impacting profitability.

Columbus McKinnon's financial performance has shown inconsistency, missing consensus estimates for earnings and revenue in Q4 FY2024 and Q4 FY2025 revenue, and again in Q1 FY2026 for both revenue and EPS. This volatility can make it harder for investors to rely on predictable short-term results, creating a perception of instability in their operational execution.

The company's reliance on industrial markets makes it susceptible to economic downturns, as seen in the 4% net sales decrease in Q3 FY2025 due to softening demand. Projections for late 2024 and early 2025 indicated a slowdown in industrial activity, particularly in Europe, which could reduce customer capital spending on new equipment and upgrades.

The significant debt taken on for the $2.7 billion Kito Crosby acquisition, with $2.6 billion financed by debt, increases financial risk. This substantial leverage means a greater portion of cash flow will be directed towards debt repayment, potentially limiting future investment and strategic flexibility due to higher interest expenses.

Columbus McKinnon's short-cycle order segment is highly sensitive to immediate policy shifts and broader economic uncertainties, leading to forecasting challenges. While this segment saw a dip in Q3 FY2025, a rebound occurred in Q4 FY2025, highlighting the unpredictable nature of this revenue stream and impacting operational planning.

Preview Before You Purchase

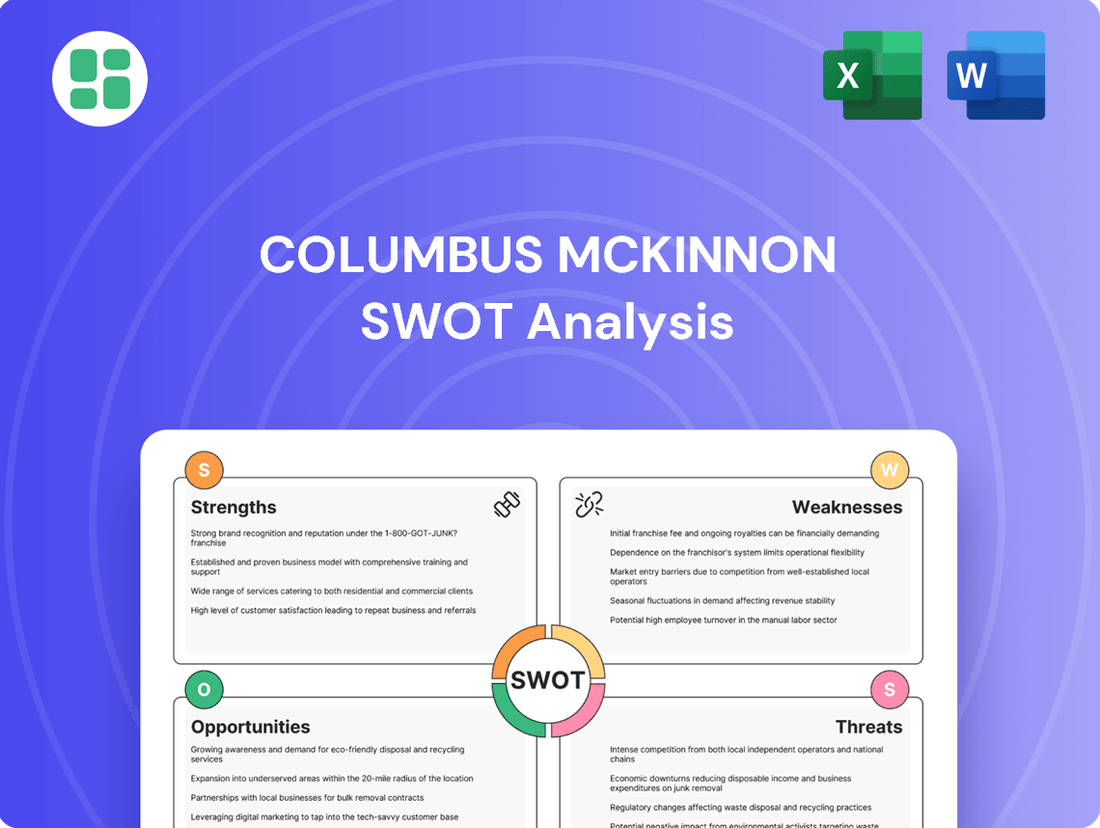

Columbus McKinnon SWOT Analysis

This is the actual Columbus McKinnon SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing the company's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete Columbus McKinnon SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The global material handling market is projected to reach $225.2 billion by 2026, with automation and robotics being key growth drivers. Columbus McKinnon's strategic emphasis on intelligent motion solutions, including their robust portfolio of hoists, cranes, and automated guided vehicles (AGVs), directly addresses this expanding demand.

The ongoing Industry 4.0 transformation, characterized by the integration of digital technologies and smart manufacturing, is significantly accelerating the need for automated systems. This trend creates a substantial market opportunity for Columbus McKinnon to offer advanced products and integrated systems that enhance efficiency and productivity in industrial settings.

The booming e-commerce sector presents a substantial opportunity for Columbus McKinnon. As online sales continue their upward trajectory, projected to reach $7.1 trillion globally by 2024, the demand for efficient material handling solutions in warehouses and distribution centers intensifies. Columbus McKinnon is well-positioned to capitalize on this by offering advanced automation and precision conveyance systems that are vital for rapid order fulfillment and inventory management.

The acquisition of Kito Crosby presents a significant avenue for Columbus McKinnon to expand its market reach, especially into Europe, and to enrich its existing product portfolio with complementary solutions. This strategic move is poised to unlock substantial operational efficiencies and revenue growth opportunities.

Columbus McKinnon anticipates realizing approximately $70 million in annual net cost synergies following the Kito Crosby integration, a figure that directly bolsters expected Adjusted EBITDA margins. This financial uplift is a key driver for the anticipated value creation from the transaction.

Leveraging Global Infrastructure Investment Trends

Megatrends like reshoring, substantial global infrastructure investments, and the critical modernization of older industrial facilities are creating a fertile ground for growth. Columbus McKinnon's business, particularly its project-related work and precision conveyance solutions, is well-positioned to capitalize on these powerful shifts. For instance, the U.S. alone is projected to spend over $1.7 trillion on infrastructure through 2029 according to some analyses, directly benefiting companies supplying essential components and systems.

Increased government and private sector spending in these key areas is expected to drive sustained demand for Columbus McKinnon's high-margin products. This translates into a robust pipeline of opportunities.

- Reshoring initiatives are bringing manufacturing back to developed nations, requiring new and upgraded industrial facilities.

- Global infrastructure spending, including transportation networks and energy grids, necessitates advanced material handling solutions.

- Modernization of aging industrial plants presents a significant upgrade cycle for existing infrastructure.

- Project-driven revenue streams are directly linked to the execution of these large-scale investments.

Growing Focus on Safety and Ergonomics

The material handling industry is increasingly prioritizing operator safety and ergonomic design, a trend Columbus McKinnon is well-positioned to capitalize on. Their commitment to developing solutions that enhance efficient and safe material handling directly addresses this growing market need. This focus can serve as a significant differentiator for their product portfolio, particularly within sectors where safety is paramount.

This emphasis on safety is not just a trend but a fundamental shift. For instance, workplace injuries in manufacturing and logistics, often stemming from poor ergonomics or unsafe lifting practices, can lead to substantial costs for businesses. By offering products that mitigate these risks, Columbus McKinnon can tap into a market segment actively seeking to reduce incident rates and associated expenses. In 2023, the global industrial safety market was valued at over $50 billion and is projected to grow steadily, with ergonomics playing a key role.

- Alignment with Market Demand: Columbus McKinnon's core competency in safe and efficient material handling directly meets the growing industry demand for ergonomic solutions.

- Competitive Advantage: Products designed with enhanced safety and ergonomics can provide a competitive edge, attracting safety-conscious customers.

- Reduced Customer Costs: By offering solutions that minimize workplace injuries, Columbus McKinnon helps its customers reduce costs associated with accidents and downtime.

The global material handling market is expanding, driven by automation and Industry 4.0, creating demand for Columbus McKinnon's intelligent motion solutions. The booming e-commerce sector, projected to reach $7.1 trillion globally by 2024, requires efficient warehouse automation, a key area for the company. Strategic acquisitions, like Kito Crosby, are expected to yield $70 million in annual net cost synergies, enhancing EBITDA margins and expanding market reach, particularly in Europe.

Megatrends such as reshoring and substantial infrastructure investments, with the U.S. alone planning over $1.7 trillion in spending through 2029, are creating significant opportunities for Columbus McKinnon's project-related work and precision conveyance systems. The growing emphasis on operator safety and ergonomics in material handling also aligns perfectly with Columbus McKinnon's product development, offering a competitive advantage in a market valued over $50 billion in 2023 for industrial safety.

| Opportunity Area | Key Driver | Columbus McKinnon Relevance | Market Data/Projection |

| Automation & Industry 4.0 | Digital transformation in manufacturing | Intelligent motion solutions, AGVs | Global material handling market to reach $225.2B by 2026 |

| E-commerce Growth | Increased online retail activity | Warehouse automation, precision conveyance | Global e-commerce to reach $7.1T by 2024 |

| Strategic Acquisitions (Kito Crosby) | Market expansion, portfolio enhancement | $70M annual net cost synergies expected | Enhances EBITDA margins and European presence |

| Reshoring & Infrastructure Spending | Manufacturing repatriation, public investment | Project-driven solutions, precision conveyance | U.S. infrastructure spending > $1.7T through 2029 |

| Safety & Ergonomics | Focus on worker well-being and efficiency | Ergonomic and safe material handling products | Global industrial safety market > $50B in 2023 |

Threats

The manufacturing sector navigates a challenging economic landscape, marked by persistent inflation and elevated interest rates, which could dampen industrial investment. For instance, the Federal Reserve maintained its benchmark interest rate at 5.25%-5.50% through early 2024, a level that increases the cost of capital for customers. This economic uncertainty, coupled with geopolitical tensions, may lead to a contraction in global demand for industrial equipment, directly impacting Columbus McKinnon's revenue streams.

Ongoing global supply chain disruptions continue to present a significant threat, impacting everything from transportation costs to the availability of essential materials. These persistent bottlenecks can directly translate into higher operational expenses and slower production timelines for manufacturers like Columbus McKinnon.

In 2023, for instance, many industrial companies reported continued challenges with supplier lead times and elevated freight expenses, a trend that persisted into early 2024. Columbus McKinnon's own disclosures have acknowledged these pressures, noting their strategic efforts to navigate tariff impacts and diversify their supply base, underscoring the dynamic and persistent nature of these global economic headwinds.

Columbus McKinnon faces significant pressure from industry titans like Konecranes and Terex Corporation, alongside other major competitors such as Toyota Industries and KION. This crowded landscape directly impacts pricing power and market share, demanding constant strategic adaptation.

The intense rivalry necessitates continuous investment in innovation and product differentiation to maintain Columbus McKinnon's competitive standing. For instance, in fiscal year 2024, the company reported a 12% increase in R&D spending, highlighting its commitment to staying ahead in a dynamic market.

Geopolitical Tensions and Trade Policy Shifts

Columbus McKinnon faces significant headwinds from escalating geopolitical tensions and evolving trade policies, particularly concerning tariffs. These shifts can directly impact the cost of goods sold and overall profitability, especially given the company's global manufacturing and distribution footprint. For instance, ongoing trade disputes and the potential for new tariffs on imported components or finished goods could disrupt supply chains and necessitate costly adjustments.

The company's exposure to these risks is amplified by the interconnected nature of global commerce. Uncertainty surrounding future trade agreements and potential retaliatory measures between nations requires Columbus McKinnon to maintain strategic flexibility. This might involve diversifying sourcing locations or exploring localized production to mitigate the impact of protectionist policies. For example, a significant portion of industrial product manufacturing relies on international supply chains, making them vulnerable to sudden policy changes.

- Tariff Impact: Potential for increased import duties on raw materials and components, directly affecting manufacturing costs.

- Supply Chain Disruption: Geopolitical instability can lead to delays or interruptions in the flow of goods, impacting delivery times and inventory management.

- Market Access: Shifting trade policies could restrict access to key international markets or increase the cost of doing business in those regions.

- Strategic Adaptation: The need for agile responses, including supply chain diversification and potential reshoring or nearshoring initiatives, to maintain competitiveness.

Labor Shortages and Skills Gap in Manufacturing

Columbus McKinnon, like much of the global manufacturing sector, is susceptible to ongoing labor shortages and a widening skills gap, especially for positions demanding specialized technical abilities. This is a critical threat as an aging workforce continues to retire, and fewer young individuals are entering manufacturing trades, potentially constraining production output and overall operational effectiveness.

The impact of these shortages is already being felt across the industry. For instance, in 2024, a significant percentage of U.S. manufacturers reported difficulty finding qualified workers, with the National Association of Manufacturers (NAM) highlighting this as a top concern. This trend is projected to persist, directly affecting the ability to meet demand and innovate.

Addressing this threat requires proactive strategies. Columbus McKinnon may need to increase investment in robust workforce training programs to upskill existing employees and attract new talent. Furthermore, strategic adoption of automation technologies can help bridge gaps in manual labor and enhance productivity, ensuring continued operational resilience in the face of these labor market challenges.

- Labor Shortages: A 2024 survey indicated that over 70% of U.S. manufacturers faced challenges filling open positions.

- Skills Gap: The demand for workers with advanced manufacturing skills, such as robotics and data analytics, outstrips supply.

- Aging Workforce: The average age of manufacturing workers is increasing, with a significant portion nearing retirement age.

- Mitigation: Investment in apprenticeships and reskilling initiatives is crucial to combat these trends.

Columbus McKinnon operates in a highly competitive environment, facing pressure from established players like Konecranes and Terex, as well as emerging competitors. This intense rivalry can limit pricing flexibility and market share growth, necessitating continuous innovation. For example, the company's fiscal year 2024 saw a 12% increase in R&D spending, underscoring the need to stay ahead.

Geopolitical tensions and evolving trade policies, including tariffs, pose a significant threat by potentially increasing costs and disrupting supply chains. The global nature of manufacturing means that shifts in trade agreements can directly impact profitability. For instance, trade disputes can lead to higher import duties on essential components, forcing costly adjustments.

Labor shortages and a widening skills gap, particularly for specialized technical roles, present another critical challenge. With an aging workforce and fewer young people entering manufacturing trades, production output and operational efficiency could be constrained. A 2024 survey revealed over 70% of U.S. manufacturers struggled to fill open positions, highlighting the severity of this issue.

The company's reliance on global supply chains makes it vulnerable to disruptions caused by geopolitical instability and logistical bottlenecks. These issues can lead to increased transportation costs and delays in material availability, impacting production timelines and inventory management. For example, many industrial companies in 2023 and early 2024 reported sustained challenges with supplier lead times and elevated freight expenses.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Columbus McKinnon's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.