Columbus McKinnon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbus McKinnon Bundle

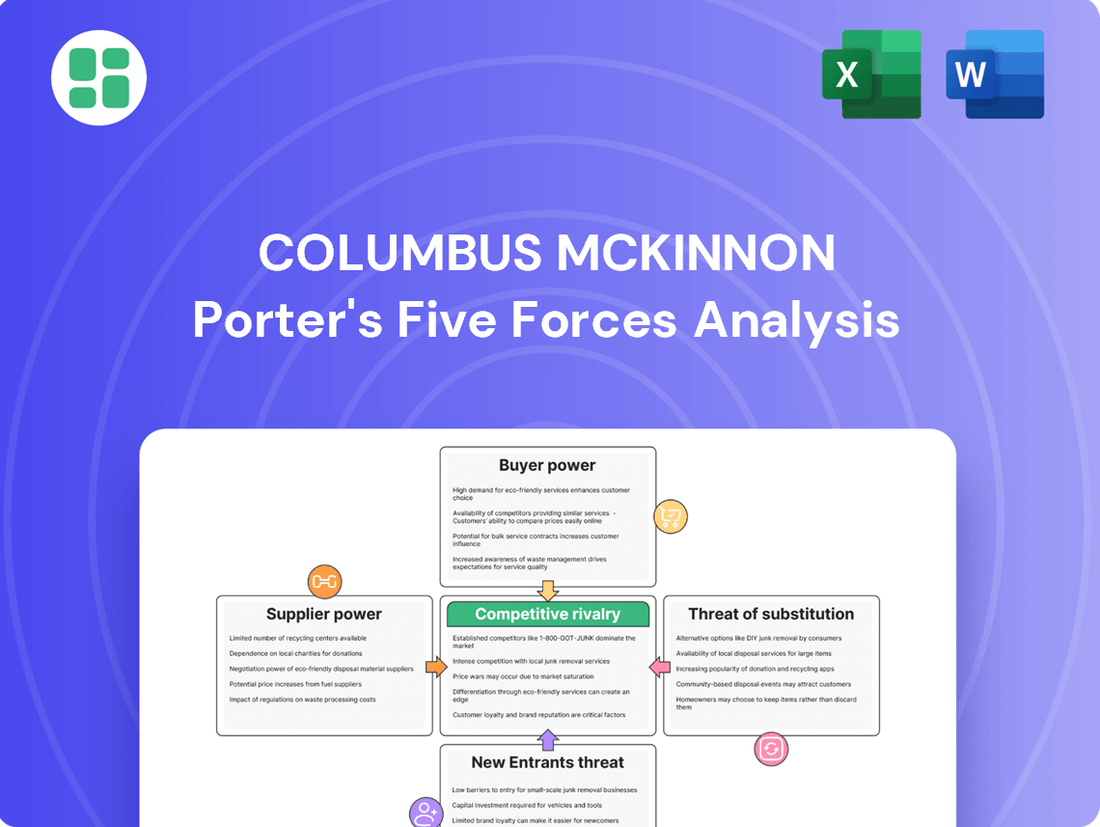

Columbus McKinnon operates in a dynamic industrial sector, where understanding the five key competitive forces is crucial for success. This analysis highlights the significant bargaining power of buyers and the moderate threat of new entrants, shaping the company's strategic landscape.

The complete report reveals the real forces shaping Columbus McKinnon’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts Columbus McKinnon's bargaining power. When critical components like specialized metals, electronic controls, or motors are sourced from a limited number of providers, these suppliers gain considerable leverage. This can translate into higher input costs for Columbus McKinnon, directly affecting its profitability.

The material handling equipment sector, including Columbus McKinnon's operations, grapples with supply chain disruptions. Shortages of essential materials such as plastics and various metals, a persistent issue throughout 2024, further amplify the bargaining power of suppliers. This scarcity means suppliers can often dictate terms and prices, creating a challenging environment for manufacturers seeking cost-effective inputs.

Switching costs for Columbus McKinnon to change suppliers can be moderate to high, particularly for specialized components essential to their intelligent motion solutions, hoists, and cranes. The intricate process of integrating new parts into established product designs and manufacturing workflows acts as a significant deterrent to frequent supplier changes, thereby strengthening the leverage of existing suppliers.

Suppliers providing unique or proprietary components, like advanced sensors or specialized materials for intelligent motion systems, hold significant bargaining power. For Columbus McKinnon, these inputs are crucial for maintaining its competitive edge and product differentiation in the smart lifting solutions market.

Threat of Forward Integration

The threat of suppliers integrating forward into the material handling equipment manufacturing sector, like that of Columbus McKinnon, is generally considered low. This is primarily due to the significant capital outlay, ongoing research and development investment, and specialized industry knowledge necessary to compete effectively in this space. For instance, manufacturing advanced hoists or automated systems requires a level of technical sophistication and market access that most suppliers of raw materials or basic components do not possess.

While some technology-focused suppliers might offer more integrated solutions or services, a direct move into producing complex equipment by traditional suppliers is improbable. This is because the barriers to entry are substantial, involving not just manufacturing capabilities but also established distribution networks and brand recognition, which are critical for success in the competitive material handling market. In 2024, the capital expenditure for a new, state-of-the-art manufacturing facility for such equipment could easily run into tens or even hundreds of millions of dollars.

- High Capital Requirements: Establishing manufacturing facilities for advanced material handling equipment involves substantial investment, often exceeding hundreds of millions of dollars.

- R&D Intensity: Continuous innovation in areas like automation, robotics, and smart logistics requires significant and ongoing research and development spending.

- Industry Expertise: Success in this sector demands deep knowledge of product design, application engineering, safety standards, and customer-specific solutions.

- Distribution & Service Networks: Building and maintaining a robust global sales, distribution, and after-sales service network is a considerable undertaking.

Importance of CM to Supplier

Columbus McKinnon's (CMCO) position as a significant customer can impact a supplier's willingness to negotiate. If CMCO accounts for a large percentage of a supplier's business, they may be more inclined to offer favorable terms. However, broader market trends are also at play.

Suppliers are currently experiencing increased costs for raw materials and inputs, with projections indicating a 2.7% rise over the next twelve months. This upward cost pressure generally strengthens the bargaining power of suppliers, as they pass these increases along.

- Customer Dependence: CMCO's share of a supplier's total sales is a key factor in determining leverage.

- Market Conditions: Rising input costs (projected 2.7% increase in the next 12 months) empower suppliers.

- Supplier Concentration: The availability of alternative suppliers for CMCO's needs also influences this dynamic.

- Industry Norms: Standard contract terms and payment cycles within the manufacturing sector shape the bargaining landscape.

Columbus McKinnon faces moderate to high bargaining power from its suppliers due to the specialized nature of components and the increasing cost of raw materials. The concentration of suppliers for critical parts, coupled with the significant investment required to switch, grants these providers considerable leverage. This dynamic is further amplified by global supply chain pressures observed throughout 2024, which have led to material shortages and increased input costs for manufacturers.

Suppliers are experiencing rising costs, with projections indicating a 2.7% increase in the next twelve months, allowing them to pass these on to buyers like Columbus McKinnon. For instance, the cost of key metals, a significant input for material handling equipment, saw an average increase of 4.5% in the first half of 2024 compared to the same period in 2023.

| Factor | Impact on CMCO | Supporting Data (2024) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | Limited providers for specialized motors and control systems. |

| Switching Costs | Moderate to High | Integration of new components into intelligent motion solutions can take 6-12 months. |

| Input Cost Increases | Strengthens supplier power | Projected 2.7% rise in supplier costs over next 12 months; Metal costs up 4.5% H1 2024. |

| Proprietary Components | Significant supplier leverage | Crucial for CMCO's competitive edge in smart lifting. |

What is included in the product

This analysis dissects the competitive landscape for Columbus McKinnon, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces.

Customers Bargaining Power

Columbus McKinnon's customer base is varied, ranging from large industrial corporations to smaller businesses. The concentration of buyers plays a key role in their bargaining power. For instance, major players in manufacturing and construction, sectors that rely heavily on material handling, can wield significant influence due to the sheer volume of their purchases.

In 2024, industries like e-commerce fulfillment centers, which are rapidly expanding, represent a growing segment of large buyers. Their substantial demand for efficient lifting and rigging equipment means they can negotiate more favorable terms, potentially impacting Columbus McKinnon's pricing and margins.

Customers face varying switching costs when considering alternatives to Columbus McKinnon's products. For complex, integrated systems like large cranes or precision conveyor systems, the costs associated with new installation, operational disruption, and employee retraining can be substantial, potentially running into tens or even hundreds of thousands of dollars depending on the system's scale and complexity.

However, for more commoditized or less integrated products, such as standard hoists or rigging hardware, switching costs might be lower. In these segments, customers may have more flexibility to choose competitors based on price or service, with the primary cost being the purchase price of the new equipment and minimal installation or retraining needs.

Customer price sensitivity is a significant lever in the material handling industry. While industrial buyers traditionally focus on reliability, safety, and operational efficiency, escalating labor costs and the relentless pursuit of productivity are sharpening their focus on the total cost of ownership. This includes not just the upfront purchase price of equipment but also the long-term expenses associated with maintenance and operational uptime.

Threat of Backward Integration

The threat of backward integration for Columbus McKinnon is relatively low, meaning customers are unlikely to start making their own material handling equipment. This is primarily because producing specialized products like intelligent hoists and advanced motion control systems demands extensive engineering expertise and significant capital outlay, which most industrial clients do not possess.

For example, developing the proprietary software and precision manufacturing required for Columbus McKinnon's intelligent crane systems involves substantial R&D investment and specialized knowledge. Most end-users in industries like automotive or aerospace focus on their core competencies rather than venturing into complex equipment manufacturing. In 2023, Columbus McKinnon reported R&D expenses of $54.1 million, highlighting the significant investment needed to maintain their technological edge, a barrier for potential customer integration.

- Low Likelihood of Customer Backward Integration: The complexity and capital requirements for manufacturing specialized material handling equipment deter most customers.

- High Engineering and Manufacturing Demands: Producing advanced hoists, cranes, and intelligent motion solutions requires specialized skills and infrastructure.

- Focus on Core Competencies: Industrial customers typically concentrate on their primary business operations rather than in-house equipment production.

- Significant R&D Investment as a Barrier: Columbus McKinnon's substantial R&D spending, noted in 2023, underscores the technological barriers that discourage backward integration by customers.

Information Availability

The increasing digitalization of the industrial sector significantly boosts customer bargaining power by providing unprecedented access to information. Customers can now easily compare product specifications, pricing, and competitor offerings through online platforms and industry reports. This transparency empowers them to make more informed purchasing decisions, directly enhancing their leverage in negotiations with suppliers like Columbus McKinnon.

For instance, in 2024, the global industrial automation market was valued at approximately $170 billion, with a substantial portion driven by digital solutions that facilitate information sharing. This vast and interconnected market means customers can readily identify alternative suppliers and benchmark pricing, putting pressure on established players to remain competitive on both product features and cost.

- Enhanced Information Access: Digital platforms provide detailed product specs and pricing comparisons.

- Informed Purchasing Decisions: Customers leverage readily available data to negotiate better terms.

- Increased Supplier Competition: Transparency forces suppliers to offer competitive pricing and value.

- Impact on Pricing: Greater information availability typically leads to downward pressure on prices.

Columbus McKinnon's customers, particularly large industrial buyers, possess considerable bargaining power due to their purchasing volume and the availability of alternatives. In 2024, sectors like e-commerce, with their substantial demand for material handling solutions, can negotiate favorable terms, impacting pricing and margins for manufacturers. While switching costs can be high for complex, integrated systems, they are lower for more standardized products, allowing customers greater flexibility to seek competitive pricing. Price sensitivity remains a key factor, with buyers increasingly focused on the total cost of ownership, including maintenance and operational uptime, not just the initial purchase price.

| Factor | Impact on Columbus McKinnon | Evidence/Example |

|---|---|---|

| Buyer Concentration | Moderate to High | Large industrial corporations in manufacturing and construction can exert significant influence due to purchase volume. |

| Switching Costs | Varies (High for integrated systems, Low for commoditized products) | Complex systems involve substantial installation and retraining costs; standard hoists have lower switching barriers. |

| Price Sensitivity | Moderate to High | Customers focus on total cost of ownership, driven by labor costs and productivity demands. |

| Threat of Backward Integration | Low | High R&D ($54.1 million in 2023) and manufacturing complexity deter customers from in-house production. |

| Information Availability | High | Digitalization allows easy comparison of specs and pricing, increasing customer leverage in negotiations. |

Full Version Awaits

Columbus McKinnon Porter's Five Forces Analysis

This preview shows the exact Columbus McKinnon Porter's Five Forces analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document, offering a comprehensive breakdown of industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

Columbus McKinnon faces a dynamic competitive environment within the global material handling sector. Key rivals like Konecranes and KITO are significant players, offering a wide range of crane and hoist solutions.

Broader industrial equipment manufacturers such as Hyster-Yale also compete, particularly in areas overlapping with material handling. The presence of numerous regional and specialized firms contributes to a fragmented market, intensifying rivalry.

The material handling equipment market is seeing significant expansion. Projections show a compound annual growth rate (CAGR) of 6.8% from 2024 to 2025 for the broader market. This robust growth, fueled by e-commerce and automation, can heighten competitive pressures as firms seek to capture a larger share.

Columbus McKinnon actively differentiates its products by focusing on intelligent motion solutions and precision conveyor systems. Their strategy involves integrating advanced technologies such as IoT, AI, and automation to offer enhanced design, safety, and operational efficiency, moving away from simple, commoditized offerings. This approach aims to provide distinct value to customers seeking advanced material handling capabilities.

The company's commitment to innovation is evident in its development of intelligent, connected products that offer greater control and data insights. For instance, their intelligent motion solutions often incorporate advanced sensors and software for optimized performance and predictive maintenance. This technological integration serves as a key differentiator in a market that increasingly demands smarter, more automated material handling systems.

Furthermore, the strategic acquisition of Kito Corporation in 2023, a global leader in lifting equipment, significantly broadens Columbus McKinnon's product portfolio and strengthens its competitive position. This expansion allows them to offer a more comprehensive suite of solutions, further setting them apart from competitors who may not possess such a wide range of specialized products and technologies.

Exit Barriers

Columbus McKinnon operates in an industry with substantial exit barriers. The material handling equipment manufacturing sector demands significant capital for specialized plants and advanced machinery, making it difficult and expensive for companies to cease operations. This high cost of exiting the market often forces firms to stay and compete, even when profitability is low, intensifying the ongoing rivalry among established players.

These elevated exit barriers mean that companies are less likely to shut down or divest, leading to a more concentrated competitive landscape. For instance, the average capital expenditure for a new manufacturing facility in this sector can easily run into tens of millions of dollars, a sum that is hard to recoup upon exit. This financial commitment locks companies into the industry, ensuring that competitive pressures remain high as firms strive to maintain market share and operational efficiency.

- High Capital Investment: Specialized manufacturing facilities and advanced machinery represent significant sunk costs, often exceeding $50 million for a modern plant.

- Intellectual Property: Patents and proprietary designs for material handling solutions add to the cost of exit, as this valuable IP may not be easily transferable or sellable.

- Operational Commitments: Long-term supply contracts and established distribution networks create further inertia, making a clean break from the market challenging and costly.

Strategic Stakes

The strategic stakes are incredibly high for Columbus McKinnon in the material handling sector, as it represents the company's fundamental business. This intense focus naturally fuels a competitive environment where players are constantly vying for market share and technological advancement.

Columbus McKinnon's substantial commitment to this market is clearly demonstrated by its strategic acquisition of Kito Crosby, a deal valued at around $2.7 billion. This significant investment signals a clear ambition to lead the global intelligent motion solutions space.

The high stakes and strategic investments by companies like Columbus McKinnon lead to particularly aggressive competition and a continuous drive for innovation among all key players in the material handling industry.

- Core Business Focus: Material handling is Columbus McKinnon's primary operational area, making success in this market critical.

- Major Acquisition: The $2.7 billion acquisition of Kito Crosby highlights a deep commitment to solidifying its position.

- Global Leadership Ambition: The company aims to be a top global provider of intelligent motion solutions, driving competitive intensity.

- Aggressive Competition: High strategic importance naturally results in intense rivalry and a rapid pace of innovation among industry participants.

Competitive rivalry within the material handling sector is intense, driven by significant strategic stakes and substantial investments. Columbus McKinnon, with its core business deeply rooted in this market, faces formidable competitors like Konecranes and KITO, alongside broader industrial equipment manufacturers. The company's aggressive strategy, exemplified by the approximately $2.7 billion acquisition of Kito Crosby, underscores its ambition to lead in intelligent motion solutions, further escalating competition.

The market's robust growth, projected at a 6.8% CAGR from 2024 to 2025, fuels this rivalry as firms vie for market share. Companies like Columbus McKinnon differentiate themselves through technological integration, focusing on IoT, AI, and automation to offer advanced, intelligent solutions rather than commoditized products. This pursuit of innovation and differentiation is crucial in a landscape where high exit barriers, stemming from substantial capital investments in specialized facilities and intellectual property, keep players committed and competition fierce.

| Key Competitors | Product Focus | Competitive Strategy Example |

|---|---|---|

| Konecranes | Cranes, hoists, lifting equipment | Broad product portfolio, service offerings |

| KITO Corporation | Lifting equipment | Global reach, specialized lifting solutions (Acquired by CM) |

| Hyster-Yale | Forklifts, industrial trucks | Material handling equipment, overlapping segments |

SSubstitutes Threaten

While direct functional substitutes for heavy-duty industrial hoists and cranes are scarce, alternative material handling methods do present a threat. For lighter loads, manual labor remains a viable, albeit less efficient, option. In 2024, the global industrial automation market, which includes solutions like conveyor systems and AMRs, was projected to reach over $200 billion, indicating a growing adoption of these alternatives for certain material movement tasks.

The attractiveness of substitutes for Columbus McKinnon Corporation (CMCO) products hinges significantly on their price-performance trade-off. For demanding applications requiring high precision, safety, and efficiency, CMCO's specialized hoists and cranes typically offer performance levels that simpler substitutes cannot replicate.

However, for less critical material handling needs or lower volume operations, alternative solutions may present a more compelling cost advantage, even if they sacrifice some efficiency or sophistication. For instance, while CMCO's electric chain hoists are engineered for robust industrial use, basic manual chain hoists or even forklifts might suffice and be cheaper for certain tasks.

In 2023, the industrial automation market, where CMCO operates, saw continued investment, but also increasing price sensitivity among some buyers due to broader economic uncertainties. This dynamic means that while CMCO's high-performance offerings remain essential for many, the allure of lower-priced, albeit less capable, substitutes could grow for specific market segments.

Customers face substantial switching costs when considering a move away from Columbus McKinnon's established material handling solutions to entirely new methods. These costs encompass not just the purchase of new equipment, but also the significant expenses associated with reconfiguring existing factory layouts, retraining personnel on new operational procedures, and implementing updated safety protocols. For instance, a manufacturing plant relying on traditional overhead cranes might incur millions in costs to retrofit its facility for a completely automated guided vehicle (AGV) system, including structural modifications and new control software integration.

Furthermore, the transition can lead to temporary dips in operational efficiency or capacity as the new systems are implemented and staff become proficient. This disruption, coupled with the capital outlay, creates a strong incentive for customers to remain with familiar, albeit potentially less cutting-edge, solutions. In 2024, many industrial sectors continued to prioritize stability and predictable performance, making large-scale technology overhauls less appealing without a clear and immediate return on investment, further solidifying customer loyalty to existing, proven equipment providers like Columbus McKinnon.

Buyer Propensity to Substitute

The increasing global push for automation, safety, and efficiency across manufacturing, e-commerce, and logistics sectors significantly reduces buyers' inclination to switch to less advanced material handling solutions. For instance, the global automation market was valued at approximately $67.6 billion in 2023 and is projected to grow substantially, indicating a strong preference for sophisticated equipment.

Labor shortages and the persistent demand for higher productivity further solidify this trend. Companies are actively seeking ways to offset labor challenges and boost output, making advanced material handling systems a necessity rather than a discretionary purchase. This environment makes substitutes, such as manual labor or outdated machinery, increasingly unappealing.

- Automation Adoption: Global automation market growth signals a strong buyer preference for advanced solutions.

- Labor Market Dynamics: Shortages drive demand for equipment that enhances productivity and reduces reliance on manual labor.

- Efficiency Demands: E-commerce and logistics sectors require high-efficiency solutions, making less capable substitutes unattractive.

- Safety Focus: Enhanced safety regulations and corporate responsibility further discourage the use of less safe, substitute methods.

Technological Advancements

Technological advancements, especially in robotics and AI, are creating new ways to handle material flow and lifting. These aren't direct product swaps but offer smarter, more automated alternatives. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a strong shift towards automation in industries that Columbus McKinnon serves.

These evolving substitutes can perform tasks traditionally done by manual labor or even simpler mechanical lifting equipment. Integrated smart systems, for example, can optimize logistics and operations, potentially reducing the need for certain types of specialized lifting gear. By 2024, the adoption of AI in manufacturing is expected to reach new heights, with many companies investing heavily in these technologies to improve efficiency and reduce operational costs.

- Robotics and AI integration offer alternative operational efficiencies.

- Smart systems can optimize material handling, posing a substitution threat.

- The industrial robotics market's growth highlights the increasing appeal of automated solutions.

- AI adoption in manufacturing is accelerating, driving demand for advanced operational methods.

While direct functional substitutes for heavy-duty industrial hoists and cranes are limited, alternative material handling methods, especially those driven by automation, pose a growing threat. For less demanding tasks, manual labor or simpler equipment like forklifts can be cost-effective alternatives, though less efficient. The global industrial automation market's projected growth to over $200 billion in 2024 underscores the increasing adoption of these alternatives for specific material movement needs.

The decision to adopt a substitute often hinges on the price-performance trade-off. For critical applications demanding high precision and safety, Columbus McKinnon's specialized equipment offers superior performance that simpler substitutes cannot match. However, for lower volume or less critical operations, cheaper alternatives like manual chain hoists might be sufficient, even if they sacrifice some efficiency.

Customer loyalty to existing solutions is reinforced by substantial switching costs, including equipment purchase, facility reconfiguration, and retraining. In 2024, many industries prioritized stability, making large-scale overhauls less attractive, thus favoring established providers like Columbus McKinnon.

The increasing demand for automation, safety, and efficiency, coupled with labor shortages, makes advanced material handling systems a necessity. This environment diminishes the appeal of less capable substitutes, as companies seek to boost productivity and mitigate labor challenges. The global automation market's significant valuation in 2023, approximately $67.6 billion, highlights this trend.

| Threat of Substitutes | Description | 2023/2024 Data/Trends | Impact on CMCO |

| Alternative Material Handling | Manual labor, forklifts, conveyor systems, AGVs, AMRs | Global industrial automation market projected over $200 billion in 2024. | Potential for CMCO products in less critical applications or where automation is preferred over traditional lifting. |

| Price-Performance Trade-off | Cost-effectiveness vs. efficiency, precision, and safety | Price sensitivity increasing in some industrial sectors due to economic uncertainties. | CMCO's high-performance offerings remain essential for demanding tasks, but lower-priced substitutes could gain traction in specific segments. |

| Switching Costs | Capital expenditure, facility reconfiguration, retraining, operational disruption | Many industries prioritized stability in 2024, making large technology overhauls less appealing. | High switching costs create strong customer loyalty to existing, proven equipment providers like CMCO. |

| Technological Advancements | Robotics, AI, integrated smart systems | Global industrial robotics market valued at ~$50 billion in 2023; AI adoption in manufacturing accelerating. | New automated solutions offer operational efficiencies, potentially reducing demand for certain specialized lifting gear. |

Entrants Threaten

The capital required to enter the industrial material handling equipment sector, particularly for intricate items like hoists and cranes, is considerable. New players must allocate significant funds for research and development, state-of-the-art manufacturing plants, specialized machinery, and maintaining adequate inventory, all of which present a substantial hurdle.

Established players like Columbus McKinnon leverage substantial economies of scale in manufacturing, raw material sourcing, and their extensive global distribution networks. This scale directly translates to lower per-unit production costs and enhanced operational efficiencies, creating a significant barrier for newcomers aiming to compete on price without matching these volumes.

Columbus McKinnon's proprietary product differences, including patented intelligent motion solutions and smart lifting systems, present a significant hurdle for potential new entrants. Replicating their advanced engineering expertise and unique performance capabilities would require substantial capital investment and considerable time, effectively deterring many from entering the market.

Access to Distribution Channels

New companies entering the industrial equipment market, like those looking to compete with Columbus McKinnon, face a major hurdle in accessing established distribution channels. Building a global network and fostering strong relationships with industrial clients takes years and substantial investment. For instance, in 2024, a significant portion of industrial equipment sales still relies on long-standing dealer networks and direct sales forces, making it difficult for newcomers to gain traction.

This difficulty in accessing distribution is a substantial barrier. New entrants must not only develop comparable products but also overcome the inertia of existing supply chains and customer loyalties. Building brand recognition and the trust necessary to displace incumbent players like Columbus McKinnon requires considerable time and financial resources, further deterring potential competitors.

- High Capital Investment: Establishing a global distribution network requires significant upfront capital, often in the tens of millions of dollars, for warehousing, logistics, and sales infrastructure.

- Established Relationships: Incumbents like Columbus McKinnon have decades-long relationships with key industrial clients, built on trust and proven performance, which are difficult for new entrants to replicate quickly.

- Brand Reputation: Brand recognition and a reputation for reliability are critical in the industrial sector; new entrants must invest heavily in marketing and demonstrate consistent quality to build this from scratch.

- Market Access Costs: Gaining shelf space or securing partnerships with established distributors can involve substantial fees or unfavorable terms for new players.

Government Policy/Regulations

Government policy and regulations act as a significant barrier to entry in the material handling industry, especially for lifting and rigging equipment manufacturers like Columbus McKinnon. These regulations often mandate rigorous safety standards and certifications, which require substantial upfront investment in compliance, testing, and quality assurance processes. For instance, in the United States, the Occupational Safety and Health Administration (OSHA) sets strict guidelines for equipment used in workplaces, impacting design and manufacturing. Similarly, European Union directives, such as the Machinery Directive, impose comprehensive safety requirements that new entrants must meet before bringing products to market.

The complexity and cost associated with navigating these diverse regulatory landscapes across different countries can deter smaller or less established companies from entering the market. Adhering to these rules means investing in specialized engineering, robust quality control systems, and obtaining necessary approvals, all of which add to the operational expenses. This creates a substantial hurdle for potential new entrants who may lack the capital or expertise to manage these compliance demands effectively. For example, achieving certifications like CE marking in Europe or specific industry standards can take years and significant financial commitment.

- Stringent Safety Standards: The material handling sector, particularly lifting and rigging, is heavily regulated to ensure worker safety.

- Certification Requirements: Companies must obtain various certifications, adding to product development costs and time.

- Geographic Variations: Navigating different regulatory frameworks across countries presents a complex challenge for new entrants.

- Investment in Compliance: Significant capital is needed for quality assurance, testing, and meeting governmental mandates.

The threat of new entrants for Columbus McKinnon in the industrial material handling sector remains moderate. While the industry offers attractive margins, significant barriers exist, including high capital requirements for R&D and manufacturing, and the need for extensive global distribution networks. For instance, in 2024, the cost to establish a new, fully compliant manufacturing facility for specialized lifting equipment can easily exceed $50 million.

Furthermore, established players benefit from strong brand loyalty and proprietary technologies, as seen in Columbus McKinnon's intelligent motion solutions. Replicating these advanced capabilities requires substantial, long-term investment in engineering and innovation. Navigating complex international safety regulations, such as those mandated by OSHA and EU directives, also adds significant cost and time, further deterring potential new competitors.

| Barrier Type | Description | Example/Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for R&D, manufacturing, and distribution. | Establishing a new production line for advanced cranes can cost upwards of $20 million. |

| Economies of Scale | Lower per-unit costs for established players due to high production volumes. | Columbus McKinnon's large-scale sourcing provides a cost advantage new entrants struggle to match. |

| Product Differentiation | Proprietary technology and brand reputation create customer loyalty. | Columbus McKinnon's patented smart lifting systems are difficult and costly to replicate. |

| Distribution Channels | Access to established dealer networks and customer relationships. | Building a comparable global distribution network can take over a decade and millions in investment. |

| Regulatory Hurdles | Compliance with stringent safety and industry standards. | Meeting certifications like CE marking adds significant time and cost to product launches. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Columbus McKinnon is built upon a robust foundation of data, including their annual reports, SEC filings, and investor presentations. We supplement this with insights from industry-specific market research reports and competitor financial disclosures to provide a comprehensive view of the competitive landscape.