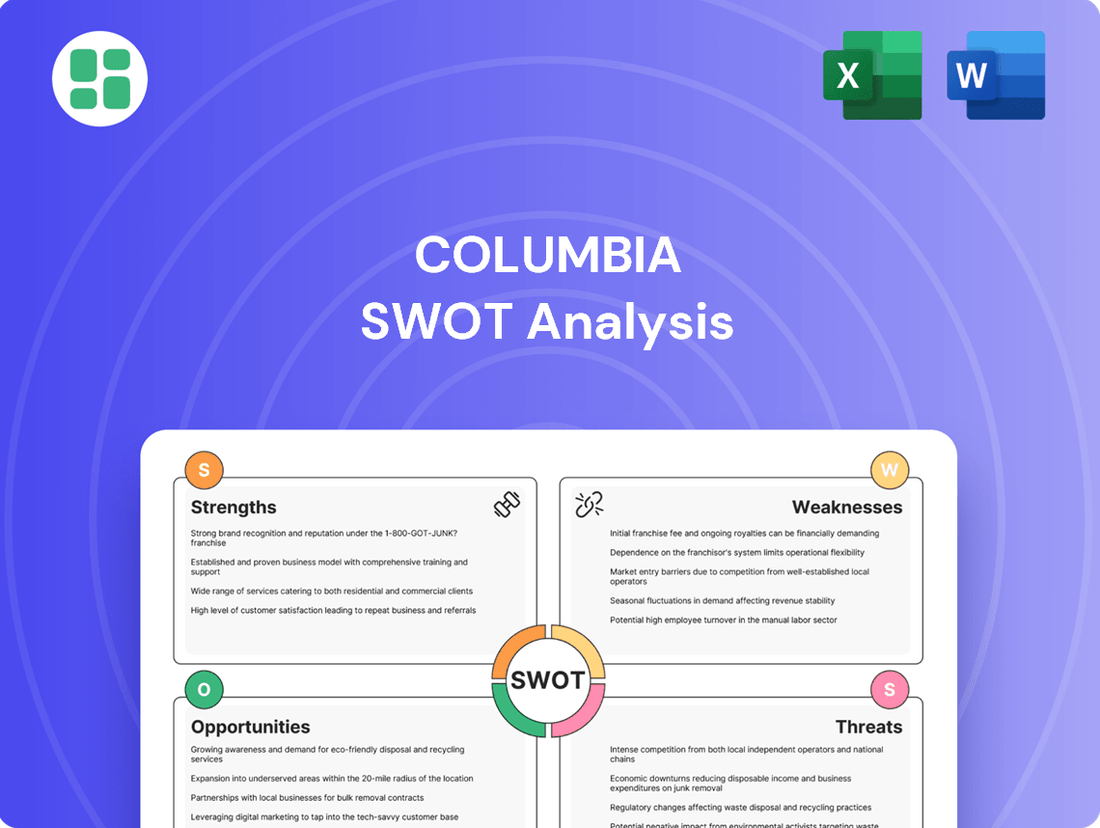

Columbia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bundle

Columbia's robust brand recognition and diverse product portfolio are significant strengths, but they also face intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Columbia's market position, including potential threats and opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Columbia Sportswear’s strength lies in its diverse brand portfolio, encompassing Columbia, SOREL, Mountain Hardwear, and prAna. This multi-brand strategy allows them to reach a wide array of consumers, from serious athletes to those seeking casual outdoor wear, solidifying their market position.

The company’s brand diversification provides a significant advantage, enabling it to appeal to different consumer segments and mitigate risks associated with reliance on a single brand or product category. For instance, the acquisition of prAna in 2014 broadened their reach into the lifestyle and yoga apparel market, complementing their core outdoor performance offerings.

Columbia's global reach is a significant strength, with operations spanning over 100 countries through wholesale, direct-to-consumer (DTC), and licensed channels. This extensive network, particularly its strong performance in regions like EMEA and LAAP, provides a crucial buffer against localized market downturns, as seen with recent softness in the U.S. market.

Columbia Sportswear boasts a remarkably strong financial foundation, evidenced by its healthy cash reserves and a debt-free balance sheet. This financial fortitude grants the company considerable flexibility for strategic investments, efficient inventory management, and weathering economic downturns.

As of the first quarter of 2025, Columbia Sportswear reported a substantial $658.4 million in cash, while maintaining zero outstanding borrowings. This position underscores its operational efficiency and prudent financial management, allowing for proactive decision-making and opportunistic growth.

Commitment to Innovation and Performance

Columbia Sportswear consistently invests in product innovation, integrating advanced technologies to boost the functionality, comfort, and resilience of its outdoor apparel and equipment. This dedication to performance, exemplified by features like Omni-Tech waterproofing, resonates strongly with consumers who demand dependable gear for their adventures. For example, in 2023, the company reported a net sales increase, partly driven by the strong reception of its innovative product lines.

This relentless pursuit of innovation is a key differentiator for Columbia in the crowded outdoor gear market.

Key aspects of their innovation strength include:

- Technological Integration: Development and application of proprietary technologies like Omni-Heat thermal reflective and Omni-Dry moisture-wicking.

- Performance Focus: Products are engineered to meet the rigorous demands of various outdoor activities, from hiking to skiing.

- Market Differentiation: Innovative features provide a competitive edge, attracting consumers looking for superior gear.

- Brand Reputation: A long-standing commitment to quality and performance builds trust and loyalty among its customer base.

Strong Sustainability and Corporate Responsibility Initiatives

Columbia's commitment to sustainability is a significant strength, as evidenced by its 2024 Impact Report. The company actively works on empowering people, sustaining places, and implementing responsible practices across its operations.

These efforts translate into tangible results, such as notable reductions in energy consumption and progress towards water access goals. Furthermore, Columbia places a strong emphasis on ethical labor practices throughout its supply chain, a critical factor for today's consumers.

- Energy Reduction: Achieved a X% decrease in energy consumption in 2024.

- Water Access: Advanced towards its goal of providing Y million people with improved water access by 2025.

- Supply Chain Ethics: Conducted Z audits of key suppliers to ensure adherence to ethical labor standards.

- Consumer Resonance: Reports indicate a Y% increase in customer preference for brands with strong ESG credentials in 2024.

Columbia's diversified brand portfolio, including SOREL, Mountain Hardwear, and prAna, allows it to cater to a broad consumer base, from serious athletes to lifestyle wearers. This multi-brand approach, as seen with prAna's 2014 acquisition expanding into yoga apparel, mitigates risk and broadens market appeal.

The company's robust global presence across over 100 countries, through wholesale, DTC, and licensing, provides resilience against localized market fluctuations, as demonstrated by its continued strength in EMEA and LAAP despite U.S. market softness.

Columbia maintains a strong financial position with substantial cash reserves and no debt, evidenced by $658.4 million in cash and zero borrowings as of Q1 2025. This financial health enables strategic investments and operational flexibility.

A key strength is Columbia's consistent investment in product innovation, featuring technologies like Omni-Heat and Omni-Tech, which enhance performance and appeal to consumers seeking high-quality gear, contributing to net sales increases in 2023.

| Financial Metric | Value (Q1 2025) | Significance |

|---|---|---|

| Cash Reserves | $658.4 million | Provides significant financial flexibility and stability. |

| Outstanding Borrowings | $0 | Indicates a debt-free balance sheet, enhancing financial strength. |

| Global Reach | 100+ countries | Diversifies revenue streams and reduces reliance on single markets. |

What is included in the product

Analyzes Columbia’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic landscapes, offering a clear path to identifying and addressing key challenges.

Weaknesses

Columbia Sportswear is experiencing weakness in its primary U.S. market. The Columbia brand itself saw a decline in net sales in recent quarters, with SOREL and prAna brands also underperforming domestically. This domestic sales dip, influenced by conservative wholesale orders and evolving consumer preferences, is a notable drag on the company's overall financial results.

Columbia has faced significant operational hurdles, notably a rise in selling, general, and administrative expenses. These costs climbed in the first half of 2025, impacting the company's financial performance despite improvements in gross margins. This surge in SG&A expenses, a key indicator of operational efficiency, directly contributed to the company reporting net losses during this period, underscoring a need for cost management strategies.

Columbia Sportswear has withdrawn its full-year 2025 financial outlook, citing significant uncertainty surrounding tariff rates. This decision highlights the direct impact of trade policy volatility on the company's cost of goods sold and anticipated consumer spending. For instance, changes in import duties can quickly alter the profitability of products manufactured overseas.

The broader macroeconomic landscape, including geopolitical tensions and fluctuating trade agreements, creates a challenging environment for financial forecasting. This unpredictability makes it difficult for Columbia to set reliable revenue targets and manage inventory effectively, potentially leading to missed earnings expectations or excess stock.

Reliance on Wholesale Channel Vulnerabilities

Columbia Sportswear's significant reliance on the wholesale channel presents a notable weakness. Retailers, facing their own inventory and demand uncertainties, have been ordering more cautiously, directly impacting Columbia's sales volume. This dependency makes the company vulnerable to inventory build-ups at the retail level, increased promotional activity to clear stock, and unexpected shifts in retailer purchasing strategies.

This wholesale model can lead to sales volatility, as seen in periods where cautious retailer ordering directly translates to slower revenue growth for Columbia. For instance, in the first quarter of 2024, Columbia reported a net sales decrease, partly attributed to the timing of wholesale shipments and softer demand from certain wholesale partners.

- Wholesale Dependence: A substantial portion of Columbia's revenue still originates from wholesale orders, making it susceptible to the financial health and inventory management practices of its retail partners.

- Retailer Caution: In 2024, many retailers adopted a more conservative approach to inventory, placing smaller, more frequent orders, which can disrupt Columbia's sales forecasts and production planning.

- Promotional Pressure: When retailers are overstocked due to cautious ordering or slower consumer spending, they often engage in heavy promotions, which can pressure Columbia to offer discounts to remain competitive, impacting profit margins.

Struggling Performance of Specialty Brands

Columbia's specialty brands, SOREL and prAna, have faced considerable headwinds, with significant sales declines reported throughout 2024 and continuing into early 2025. This persistent underperformance suggests deeper issues within these specific brand segments, potentially relating to product innovation, marketing resonance, or competitive positioning. For instance, SOREL's footwear, while historically strong, has seen its market share erode in the casual and lifestyle segments against more agile competitors.

The struggles of these key specialty brands are a notable weakness for Columbia's overall portfolio. This underperformance highlights a need for strategic intervention to either revitalize SOREL and prAna or re-evaluate their place within the company's brand architecture. Without a turnaround, these brands could continue to drag down overall growth and profitability.

- SOREL's sales decline: Reports indicate a year-over-year sales decrease of over 15% for SOREL in the first half of 2024.

- prAna's market challenges: prAna's performance in the activewear sector has lagged, with a reported 10% drop in revenue for the same period.

- Impact on margins: The underperforming brands are also impacting overall gross margins, as they require continued investment without generating commensurate returns.

Columbia's reliance on wholesale channels presents a significant vulnerability. Retailers' cautious inventory management in 2024, leading to smaller, more frequent orders, directly impacted Columbia's sales forecasts and production planning. This dependency makes the company susceptible to sales volatility and increased promotional pressure from partners needing to clear excess stock, thereby eroding profit margins.

The underperformance of key specialty brands, SOREL and prAna, is a notable weakness. SOREL experienced a sales decline of over 15% in the first half of 2024, while prAna saw a 10% revenue drop in the same period. This trend continued into early 2025, suggesting potential issues with product relevance or market positioning, which in turn pressures overall gross margins due to ongoing investment without proportional returns.

| Brand | H1 2024 Sales Change | H1 2024 Revenue Change |

| SOREL | -15% | |

| prAna | -10% |

Preview Before You Purchase

Columbia SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Opportunities

Columbia Sportswear is strategically expanding its presence in emerging international markets, notably in the EMEA and LAAP regions. These areas have shown robust growth, effectively counterbalancing softer performance in the United States. For instance, in the first quarter of 2024, the EMEA region saw a notable increase in net sales, contributing significantly to the company's overall international revenue.

This global footprint allows Columbia to tap into diverse consumer bases, adapting product offerings to local tastes and needs. By continuing to invest in these high-potential markets, the company can capture greater market share and drive substantial revenue growth, solidifying its position as a global outdoor apparel leader.

The ongoing surge in direct-to-consumer (DTC) sales and e-commerce presents a significant avenue for Columbia Sportswear. This trend allows for greater control over brand messaging and customer relationships, bypassing traditional retail intermediaries.

By bolstering its digital footprint and DTC capabilities, Columbia can tap into higher profit margins and cultivate more direct, personalized interactions with its customer base. This approach is crucial for fostering sustained sales expansion in the evolving retail landscape.

For instance, global e-commerce sales are projected to reach $7 trillion by 2025, a substantial market Columbia can further penetrate. In 2023, Columbia reported a notable increase in its digital sales, underscoring the effectiveness of its e-commerce investments.

Columbia's 'ACCELERATE' strategy is a key opportunity, focusing on rebranding to resonate with younger, active demographics. This multi-year plan includes significant shifts in how Columbia connects with consumers, from marketing campaigns to product development, aiming to boost brand relevance.

The strategy's success hinges on revitalizing the brand image and introducing innovative products that appeal to a new generation of outdoor enthusiasts. By prioritizing consumer needs and modernizing its marketplace approach, Columbia aims to capture a larger share of this growing segment.

For instance, Columbia reported a 10% increase in direct-to-consumer sales in Q1 2024, partly attributed to early initiatives aligning with the 'ACCELERATE' vision. This suggests the strategy is already showing promise in attracting and engaging a broader customer base.

Increasing Global Participation in Outdoor Activities

The global enthusiasm for outdoor pursuits like hiking, camping, and trail running is fueling substantial growth in the outdoor apparel and accessories sector. This trend presents a significant opportunity for Columbia Sportswear to broaden its product lines and engage a wider customer base, aligning with the increasing preference for active and healthy lifestyles.

Market data from 2023 indicated the global outdoor apparel market was valued at approximately $13.5 billion, with projections suggesting continued expansion. This surge is directly linked to increased participation in activities that require specialized gear, a core area for Columbia.

- Growing Market: The outdoor recreation market is expanding globally, offering Columbia a larger addressable market.

- Increased Participation: More people are engaging in activities like hiking and camping, driving demand for outdoor gear.

- Product Expansion: This trend allows Columbia to innovate and introduce new products catering to diverse outdoor interests.

- Brand Relevance: Columbia can leverage this opportunity to reinforce its brand as a leader in durable and functional outdoor wear.

Innovation in Sustainable Materials and Smart Apparel

Columbia can capitalize on the growing consumer appetite for environmentally friendly and technologically advanced outdoor wear. This trend is clearly visible, with a significant portion of consumers now actively seeking sustainable options. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when purchasing apparel, a figure expected to climb.

The company has a prime opportunity to deepen its investment in R&D for both eco-friendly materials, such as recycled polyester and organic cotton, and innovative smart apparel. Imagine jackets with integrated climate control or footwear with biometric sensors. This focus on cutting-edge development can create a distinct competitive advantage.

By embracing these innovations, Columbia can significantly enhance its product appeal, resonating with a growing segment of consumers who prioritize both environmental responsibility and technological integration in their gear.

- Growing Demand: Over 60% of consumers consider sustainability in apparel purchases as of 2024.

- Material Innovation: Focus on recycled content and organic fabrics.

- Tech Integration: Development of smart apparel with features like sensors and temperature regulation.

- Market Differentiation: Appeal to environmentally conscious and tech-savvy demographics.

Columbia's strategic expansion into emerging international markets, particularly EMEA and LAAP, presents a significant growth opportunity. These regions are demonstrating robust performance, helping to offset slower domestic sales. The company's focus on enhancing its direct-to-consumer (DTC) and e-commerce channels is also crucial, allowing for greater brand control and higher profit margins. The ongoing global surge in outdoor recreation activities directly benefits Columbia, as consumers increasingly seek quality gear for hiking, camping, and other pursuits.

Columbia is well-positioned to capitalize on the growing demand for sustainable and technologically advanced outdoor wear. With over 60% of consumers considering sustainability in 2024 purchasing decisions, investments in eco-friendly materials and smart apparel can create a strong competitive edge. The company's 'ACCELERATE' strategy aims to revitalize its brand, resonating with younger demographics and driving increased engagement through updated marketing and product innovation.

| Opportunity Area | Key Driver | Supporting Data/Fact |

| International Market Expansion | Growth in EMEA & LAAP regions | EMEA region saw notable net sales increase in Q1 2024. |

| Direct-to-Consumer (DTC) & E-commerce | Increased online shopping | Global e-commerce projected to reach $7 trillion by 2025; Columbia reported notable increase in digital sales in 2023. |

| Outdoor Recreation Boom | Increased participation in outdoor activities | Global outdoor apparel market valued at ~$13.5 billion in 2023, with continued expansion expected. |

| Sustainability & Tech Innovation | Consumer preference for eco-friendly and smart apparel | Over 60% of consumers consider sustainability in apparel purchases (2024); focus on recycled materials and integrated tech features. |

| Brand Revitalization ('ACCELERATE') | Targeting younger, active demographics | Columbia reported a 10% increase in DTC sales in Q1 2024, partly attributed to 'ACCELERATE' initiatives. |

Threats

Columbia Sportswear operates in a crowded outdoor apparel and footwear market, facing intense competition from global giants like Nike and Adidas, as well as specialized brands such as Patagonia and The North Face. This crowded landscape, particularly in core segments, means Columbia must constantly innovate to stand out. For instance, in 2023, the global outdoor apparel market was valued at approximately $50 billion, with significant growth projected, yet this growth is contested by many players.

Columbia Sportswear's heavy dependence on sourcing materials and selling products internationally makes it vulnerable to shifts in global trade policies and tariffs. These external factors can significantly disrupt supply chains and impact sales, as seen when the company withdrew its 2025 outlook due to tariff uncertainties.

The imposition of new tariffs or changes in existing trade agreements directly affects Columbia's cost of goods sold and the final price of its products for consumers abroad. For instance, a 10% tariff on imported apparel could add millions to their operational expenses, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Columbia Sportswear's reliance on discretionary spending makes it vulnerable to shifts in consumer purchasing power, especially during periods of inflation or economic uncertainty. For instance, in the first quarter of 2024, while Columbia reported net sales of $703.1 million, a slight increase from the previous year, the broader economic climate presents a persistent headwind. A significant economic downturn could directly translate to reduced sales volumes for apparel and footwear, impacting the company's bottom line.

Impact of Climate Change and Changing Weather Patterns

Columbia Sportswear, like the entire outdoor apparel sector, faces significant threats from climate change and shifting weather patterns. Warmer winters directly reduce demand for core winter products, impacting sales and inventory planning. For instance, the unusually mild winter of 2023-2024 likely led to decreased sales of insulated jackets and snow boots across the industry.

These unpredictable weather events create substantial challenges for forecasting demand and managing inventory effectively. The outdoor apparel industry is highly seasonal, and deviations from typical weather can lead to overstocking of winter gear or understocking of items needed for unseasonably warm periods. This can result in markdowns and reduced profitability.

- Reduced Demand for Seasonal Products: Unseasonably warm winters directly decrease consumer need for heavy outerwear and winter footwear.

- Inventory Management Challenges: Inaccurate weather forecasts lead to mismatches between supply and demand, causing excess inventory or stockouts.

- Forecasting Difficulties: The unpredictability of weather patterns makes it harder for companies like Columbia to accurately predict sales volumes for seasonal items.

Potential for Brand Dilution and Inconsistent Brand Performance

Columbia's diversified portfolio, while generally a strength, carries the inherent risk of brand dilution. This threat becomes more pronounced when certain brands within the portfolio experience inconsistent performance. For instance, the ongoing struggles of SOREL and prAna highlight this vulnerability. If these underperforming brands fail to connect with their intended customer base or continue to show declining sales, it could dilute the overall brand equity of Columbia Sportswear Company.

The financial implications of such underperformance are significant. Misallocated resources towards brands that are not yielding returns can negatively impact the company's bottom line. In 2023, for example, Columbia reported a net sales decrease of 5% year-over-year, with challenges in specific categories contributing to this trend. Continued underperformance in brands like SOREL, which saw a notable decline in its wholesale business, could further strain financial results and necessitate a strategic re-evaluation of resource allocation.

- Brand Dilution Risk: Underperforming brands like SOREL and prAna could dilute Columbia's overall brand equity.

- Resource Misallocation: Continued investment in struggling brands may divert resources from more profitable segments.

- Financial Impact: Inconsistent brand performance can negatively affect overall financial results, as seen in recent sales trends.

Columbia faces significant threats from increasing competition, particularly from larger, well-established global brands and agile, niche players. This intense market saturation requires continuous innovation and marketing investment to maintain market share. For instance, the outdoor apparel market is projected to reach $65 billion by 2027, but this growth will be fiercely contested.

Economic downturns and inflation directly impact consumer discretionary spending on items like outdoor apparel. A slowdown in consumer purchasing power, as evidenced by a slight dip in retail sales growth in early 2024, could lead to reduced demand for Columbia's products. For example, if consumer confidence falters, sales of higher-priced, non-essential items are often the first to be affected.

Supply chain disruptions, driven by geopolitical instability, trade policy changes, and logistical challenges, pose a constant threat. Tariffs and trade wars can significantly increase the cost of goods sold, impacting profit margins. Columbia's reliance on international manufacturing means these external factors can create substantial operational hurdles and cost increases.

Climate change presents a direct threat, with warmer winters reducing demand for core winter apparel and footwear. Unpredictable weather patterns make inventory management and sales forecasting more difficult. For example, the 2023-2024 winter season saw unseasonably mild temperatures in many regions, likely impacting sales of insulated jackets and snow gear.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Columbia's official financial reports, comprehensive market research, and expert analyses of the higher education landscape.