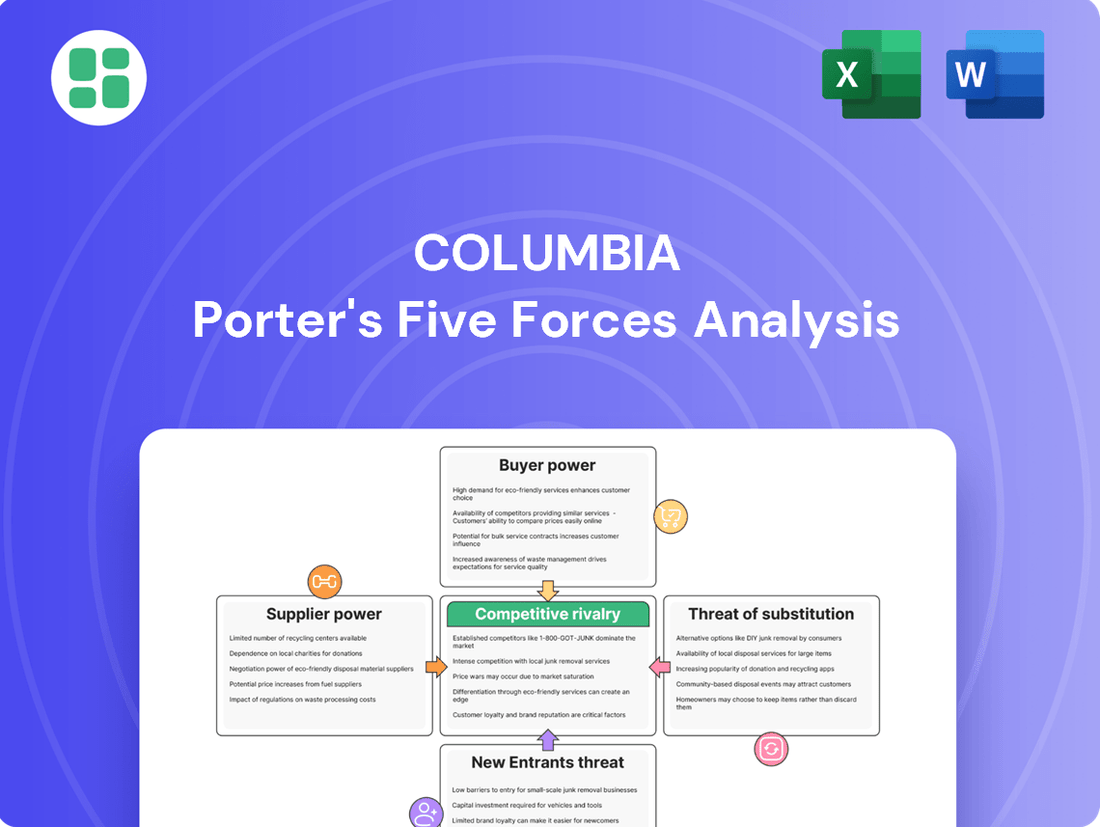

Columbia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bundle

Columbia's competitive landscape is shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Columbia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Columbia Sportswear's reliance on a global supply chain means that a concentration of suppliers, particularly for specialized components like advanced waterproofing fabrics, can significantly amplify their bargaining power. When only a few manufacturers possess the unique technology or scale for these critical materials, they can dictate terms more effectively, potentially impacting Columbia's cost of goods sold. For instance, the development and sourcing of proprietary insulation technologies, such as Omni-Heat™ Infinity, often involve a limited number of specialized producers, granting them leverage.

Switching suppliers for Columbia can involve significant expenses. These include the costs of redesigning products to fit new materials, retooling manufacturing equipment to accommodate different components, and the rigorous process of qualifying new vendors to ensure quality and reliability. For instance, in 2024, many apparel manufacturers faced increased costs related to supply chain disruptions, with some estimating redesign and retooling efforts to cost upwards of 5-10% of their annual operating budget.

These substantial switching costs directly bolster the bargaining power of Columbia's current suppliers. When it becomes economically unfeasible for Columbia to change suppliers, even if prices increase, existing suppliers can leverage this situation. This is especially relevant in complex, integrated supply chains where machinery and production processes are specifically engineered to work with particular materials or components provided by a single supplier.

While less common in apparel, a supplier with highly proprietary technology or a strong brand could consider forward integration into manufacturing or direct sales. This theoretical threat, though remote, can enhance supplier power by highlighting their strategic value beyond mere material supply. For instance, a specialized fabric innovator might explore creating their own branded athleisure line.

Importance of Columbia to Suppliers

Columbia Sportswear's substantial order volumes and extensive global reach position it as a highly valuable client for numerous suppliers. This scale means that for many smaller and medium-sized businesses, a contract with Columbia is not just beneficial but often vital for their sustained operation and growth, inherently limiting their individual leverage in negotiations.

This dynamic creates a scenario of mutual reliance. Suppliers depend on Columbia for consistent business, while Columbia relies on its supplier network for product quality and timely delivery. This interdependence fosters a more balanced negotiation environment, often culminating in enduring, mutually beneficial partnerships rather than adversarial relationships.

- Significant Customer Value: Columbia's consistent demand, driven by its market presence, offers stability to its supplier base.

- Supplier Dependence: For many smaller suppliers, Columbia represents a substantial portion of their revenue, reducing their bargaining power.

- Balanced Negotiations: The mutual need for a stable relationship leads to more collaborative discussions and less confrontational bargaining.

Availability of Substitute Inputs

The availability of substitute inputs significantly curbs the bargaining power of suppliers for companies like Columbia. Even if direct substitutes aren't identical, the continuous innovation within the technical fabric industry means Columbia can often source comparable materials from alternative suppliers or even develop its own proprietary technologies. This dynamic competitive environment among material innovators acts as a crucial check on any single supplier's ability to dictate terms.

For instance, while specific high-performance waterproof-breathable membranes might be patented by a few key players, the broader market for durable and weather-resistant textiles is far more diverse. Columbia's ability to explore and integrate materials from various manufacturers, or to invest in its own R&D for unique fabric solutions, directly diminishes the leverage held by individual fabric mills. This strategic flexibility ensures that Columbia is not overly reliant on any single supplier, thereby maintaining a more balanced negotiation position.

- Material Substitution: Columbia's access to a range of technical fabrics, from proprietary Gore-Tex alternatives to other advanced membranes, provides significant leverage against individual suppliers.

- Innovation in Textiles: The ongoing development of new materials by multiple companies in the apparel industry means Columbia can often find comparable performance characteristics from different sources.

- Proprietary Technology Development: Columbia's investment in its own fabric technologies, such as its Omni-Tech or OutDry systems, reduces its dependence on external suppliers and strengthens its negotiating position.

Columbia Sportswear's bargaining power with its suppliers is influenced by the concentration of suppliers for critical components. When only a few manufacturers can produce specialized materials, like advanced waterproofing fabrics, their leverage increases, impacting Columbia's costs. For example, sourcing proprietary insulation technologies often involves a limited number of specialized producers, granting them considerable influence.

High switching costs for Columbia, encompassing redesign, retooling, and vendor qualification, significantly strengthen existing suppliers' positions. If changing suppliers becomes prohibitively expensive, suppliers can exploit this to their advantage, especially in integrated supply chains where equipment is tailored to specific materials. In 2024, many apparel firms reported redesign and retooling costs ranging from 5-10% of annual operating budgets due to supply chain shifts.

The availability of substitute inputs significantly weakens supplier bargaining power. Continuous innovation in technical fabrics allows Columbia to source comparable materials from various suppliers or develop its own technologies, reducing reliance on any single entity. This competitive landscape among material innovators acts as a crucial check on individual supplier leverage.

| Factor | Impact on Supplier Bargaining Power | Columbia's Mitigation Strategy |

|---|---|---|

| Supplier Concentration | High for specialized components | Diversify sourcing, invest in proprietary tech |

| Switching Costs | High for Columbia | Long-term supplier relationships, strategic partnerships |

| Availability of Substitutes | Low for specialized components, High for general fabrics | Continuous R&D, explore alternative materials |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Columbia's position in the apparel industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force.

Customers Bargaining Power

Customers in the outdoor apparel market, particularly in casual segments, often exhibit price sensitivity, prioritizing value. However, for high-performance gear, quality and functionality tend to outweigh price considerations. In 2023, Columbia's net sales reached $3.4 billion, showing a resilient demand even with varying price points across its product lines.

Columbia's ACCELERATE strategy is designed to enhance brand perception and product innovation, targeting younger, active consumers. This focus on differentiation and superior product offerings aims to lessen customer price sensitivity by emphasizing the unique benefits and quality Columbia provides.

For individual consumers, switching costs between outdoor apparel brands are generally low, given the wide array of available alternatives. This means customers can easily move to a competitor if they find a better price or product.

However, Columbia has cultivated significant brand loyalty, often built on perceptions of quality and consistent performance. This established reputation can act as a psychological switching cost, making some consumers hesitant to try new brands, even if they are cheaper.

Columbia's strategy to create iconic and differentiated products, such as their proprietary Omni-Heat™ thermal-reflective technology, further aims to solidify this customer loyalty and increase the perceived cost of switching for their core customer base.

The internet and social media have dramatically shifted the landscape, arming customers with unprecedented access to information. This allows them to easily compare products, prices, and reviews across countless brands, significantly boosting their bargaining power. For instance, a 2024 report indicated that over 85% of consumers research products online before making a purchase, often comparing multiple options simultaneously.

This heightened transparency empowers consumers to make more informed decisions, demanding better value and service. Columbia actively addresses this by investing heavily in its digital presence, ensuring its product information is readily available and easily comparable. They also focus on enhancing the consumer experience through detailed product descriptions and customer testimonials to build trust and differentiate their offerings.

Concentration of Wholesale Buyers

Columbia's reliance on wholesale channels means large retailers, like Dick's Sporting Goods or REI, can wield considerable bargaining power. Their substantial order volumes and influence over shelf space and consumer visibility allow them to negotiate favorable pricing and terms. For instance, in 2023, wholesale revenue still represented a significant portion of Columbia's overall sales, though the company actively sought to grow its direct-to-consumer (DTC) segment to mitigate this dependency.

- Wholesale Dominance: Large retail partners can leverage their buying volume to secure better margins and promotional assistance from Columbia.

- Negotiating Leverage: Key accounts can demand concessions on pricing, payment schedules, and marketing support, impacting Columbia's profitability.

- DTC Counterbalance: Columbia's expanding direct-to-consumer sales, which saw notable growth in 2023, provide an alternative revenue stream and reduce reliance on powerful wholesale buyers.

Growth of Direct-to-Consumer (DTC) Sales

The growing trend of direct-to-consumer (DTC) sales significantly curtails the bargaining power of traditional wholesale customers for Columbia. By selling directly through its own website and retail stores, Columbia gains greater command over pricing strategies and cultivates more direct relationships with its end buyers.

This strategic shift is crucial, as evidenced by Columbia's performance. For the fiscal year ending December 31, 2023, Columbia Sportswear reported net sales of $3.44 billion, with its DTC channel playing an increasingly vital role in this revenue stream.

- DTC Channel Strength: Columbia's DTC segment, encompassing both e-commerce and physical retail, provides a buffer against the price pressures often exerted by wholesale partners.

- Customer Relationship Control: Direct engagement allows Columbia to better understand customer preferences and manage brand perception, reducing reliance on intermediaries.

- Resilience in Sales: Even in markets experiencing broader sales headwinds, the DTC channel has demonstrated resilience, underscoring its strategic importance for Columbia's overall market position.

Customers' bargaining power is influenced by their price sensitivity and the availability of substitutes. While Columbia's high-performance gear commands loyalty, the casual segment sees more price-driven choices. The internet empowers consumers to easily compare prices and reviews, increasing their leverage, with over 85% of consumers researching online in 2024.

Columbia mitigates this by building brand loyalty through quality and innovation, like its Omni-Heat™ technology, and investing in its digital presence to provide transparent product information. This direct engagement helps manage brand perception and customer relationships, thereby reducing reliance on intermediaries.

Columbia's increasing focus on its direct-to-consumer (DTC) channels, which contributed significantly to its $3.44 billion in net sales for 2023, also serves to lessen the bargaining power of large wholesale partners. This strategic shift allows for greater control over pricing and direct customer interaction.

| Factor | Impact on Columbia | Mitigation Strategy |

|---|---|---|

| Price Sensitivity (Casual) | High | Focus on value and differentiation in product lines. |

| Switching Costs (Individual) | Low | Build brand loyalty through quality, performance, and iconic products. |

| Information Access (Online) | High | Invest in digital presence, transparent product information, and customer experience. |

| Wholesale Partner Power | Significant | Grow DTC sales to reduce reliance on large retailers. |

Same Document Delivered

Columbia Porter's Five Forces Analysis

This preview displays the complete, professionally crafted Porter's Five Forces analysis for Columbia. You are seeing the exact document you will receive, fully formatted and ready for immediate use upon purchase, ensuring no discrepancies or hidden elements.

Rivalry Among Competitors

The outdoor apparel and footwear market is intensely competitive, populated by a multitude of well-established global brands. Companies like Nike and Adidas, with their extensive reach and marketing power, compete directly with specialized outdoor brands such as The North Face, owned by VF Corp, Patagonia, and Arc'teryx.

This crowded marketplace means that brands are constantly vying for consumer attention and market share. For instance, in 2023, the global sportswear market was valued at over $200 billion, with a significant portion attributed to outdoor-specific segments, highlighting the sheer scale of competition.

The presence of numerous niche players further intensifies this rivalry, as they often cater to specific outdoor activities or demographics, creating specialized demand and fragmenting the market further.

Competitive rivalry in the apparel industry, particularly for outdoor and athletic wear, is intense and often hinges on product differentiation. Brands are locked in a continuous race to innovate, introducing new materials, advanced technologies like Columbia's Omni-Heat and Omni-Tech, and cutting-edge designs. This relentless pursuit of enhanced performance, comfort, and increasingly, sustainability, allows companies to carve out unique market positions and command premium pricing.

In 2024, the market saw continued investment in R&D by major players. For instance, Columbia Sportswear reported significant expenditures on product development, aiming to expand its technological advantages. This focus on innovation is crucial for standing out in a crowded marketplace where consumers actively seek superior features and value, directly impacting market share and brand loyalty.

The outdoor apparel market is experiencing robust growth, with forecasts suggesting a compound annual growth rate (CAGR) between 6.4% and 6.9% from 2024 to 2029. This expansion is fueled by ongoing product innovation and a rising interest in outdoor recreational activities.

However, this growth doesn't negate the fierce competition within the industry. The U.S. market, in particular, has seen some softening in sales, intensifying rivalry among established players, especially in more mature product categories.

Marketing and Brand Investments

Competitors in the athletic apparel and footwear industry are locked in a fierce battle for consumer attention, pouring significant resources into marketing, brand building, and high-profile endorsements. This intense rivalry means that capturing and retaining mindshare, alongside fostering deep brand loyalty, requires continuous and substantial investment. For instance, Nike, a dominant player, consistently allocates billions to marketing, with their 2023 fiscal year marketing spend reported to be around $3.9 billion, demonstrating the scale of investment required to maintain market leadership.

Columbia Sportswear, recognizing this competitive landscape, is actively pursuing its 'ACCELERATE' strategy, which places a strong emphasis on elevating its brand presence and resonating with younger demographics. This includes innovative marketing campaigns and collaborations designed to attract a new generation of consumers. In 2023, Columbia reported a 4% increase in its selling, general, and administrative expenses, a significant portion of which is directed towards marketing and brand initiatives, underscoring their commitment to this area.

- Intensified Marketing Spend: Competitors are heavily investing in marketing and brand building to secure consumer mindshare and cultivate loyalty.

- Endorsement Wars: High-profile athlete endorsements remain a critical component of competitive marketing strategies, driving brand visibility and aspirational appeal.

- Columbia's Strategic Focus: Columbia's 'ACCELERATE' strategy prioritizes brand elevation and attracting younger consumers through targeted marketing efforts.

- Increased SG&A Investment: Columbia's 2023 selling, general, and administrative expenses saw a 4% rise, reflecting increased investment in marketing and brand initiatives.

Global and Omni-channel Distribution

Competitive rivalry in the global market is intensely focused on distribution, encompassing wholesale, direct-to-consumer (DTC), and e-commerce platforms. Companies are vying for market share not just through product innovation but also by mastering these diverse sales avenues. For instance, in 2024, the global e-commerce market reached an estimated $6.3 trillion, highlighting the critical importance of a robust online presence.

Brands that excel at integrating these channels into a seamless, omni-channel experience are carving out significant advantages. This integrated approach allows for consistent customer engagement and data collection across touchpoints. In 2023, a significant portion of retail sales, estimated to be around 20-25% in developed markets, were already attributed to omni-channel strategies.

- Global E-commerce Growth: The worldwide e-commerce market is projected to continue its expansion, with sales expected to reach $8.1 trillion by 2026, underscoring the strategic imperative of digital distribution.

- Omni-channel Adoption: Consumer surveys in early 2024 indicated that over 70% of shoppers now utilize multiple channels during their purchasing journey, favoring retailers that offer a connected experience.

- DTC Channel Significance: Many brands have seen substantial revenue increases through their DTC channels, with some reporting that DTC sales now account for over 30% of their total revenue, demonstrating a shift in consumer preference and a competitive battleground.

- Logistics and Fulfillment: Effective management of global logistics and fulfillment is a key differentiator, as delays or inefficiencies in delivery can severely damage brand reputation and customer loyalty in a highly competitive landscape.

The competitive rivalry in the outdoor apparel and footwear market is characterized by intense innovation and significant marketing expenditures. Brands are continuously developing new technologies and materials to differentiate themselves, as seen with Columbia's Omni-Heat and Omni-Tech. This innovation race is crucial for capturing market share in a sector experiencing robust growth, projected at a CAGR of 6.4% to 6.9% from 2024 to 2029.

Companies are also heavily investing in marketing and endorsements to build brand loyalty and capture consumer mindshare. For instance, Nike's marketing spend in fiscal year 2023 was approximately $3.9 billion, illustrating the scale of investment. Columbia Sportswear, in line with this trend, increased its selling, general, and administrative expenses by 4% in 2023, largely directed towards its 'ACCELERATE' strategy focused on brand elevation and attracting younger demographics.

Distribution channels, including wholesale, direct-to-consumer (DTC), and e-commerce, are also key battlegrounds. The global e-commerce market's continued expansion, reaching an estimated $6.3 trillion in 2024, emphasizes the need for strong online presences. Brands successfully integrating these channels into an omni-channel experience gain a significant competitive edge, as over 70% of shoppers in early 2024 utilized multiple channels.

| Company | Key Competitive Strategy | 2023 Marketing/SG&A Investment (Approx.) | Market Share Focus |

|---|---|---|---|

| Nike | Product Innovation, High-Profile Endorsements, Global Marketing | $3.9 Billion (Marketing) | Global Market Leadership |

| Columbia Sportswear | Technological Innovation (Omni-Heat), Brand Elevation ('ACCELERATE' Strategy) | 4% Increase in SG&A (incl. Marketing) | Attracting Younger Demographics, Brand Resonance |

| The North Face (VF Corp) | Specialized Outdoor Performance, Brand Heritage | N/A (VF Corp reporting) | Outdoor Enthusiast Segment |

| Patagonia | Sustainability Focus, Brand Activism, Product Durability | N/A (Private Company) | Environmentally Conscious Consumers |

SSubstitutes Threaten

The threat of substitutes for Columbia's specialized outdoor apparel is significant, particularly from general sportswear and athleisure brands. Consumers increasingly choose less technical, more fashion-forward athleisure for casual outdoor activities, especially when budget is a key consideration. For instance, the global athleisure market was valued at approximately $321 billion in 2023 and is projected to reach over $570 billion by 2030, indicating a substantial shift in consumer preferences towards versatile, everyday wear.

The rise of rental services for premium outdoor equipment, like skis or camping gear, presents a significant threat. For instance, platforms facilitating gear rental saw a substantial increase in user engagement throughout 2024, with many consumers opting for short-term use over outright purchase, especially for items used seasonally.

Similarly, the secondhand market for durable goods is booming. In 2024, the resale market for outdoor apparel and equipment experienced robust growth, with platforms reporting double-digit percentage increases in transaction volumes. This trend directly substitutes the need for new product sales by offering more affordable alternatives.

Lower-cost generic or private-label outdoor apparel and footwear present a significant threat. These alternatives, readily available at mass merchandisers, appeal to budget-conscious consumers who may not require the specialized features of premium brands.

For instance, in 2024, the market share of private-label apparel brands in the US has been steadily growing, with some categories seeing increases of 5-10% year-over-year, directly impacting the perceived value of higher-priced, branded alternatives.

Non-Participation in Outdoor Activities

The most potent substitute for Columbia's specialized outdoor gear is consumers opting out of outdoor activities altogether. This non-participation can stem from various factors, impacting demand for their core product lines.

Economic pressures, such as a potential recession or increased inflation, can lead consumers to cut back on discretionary spending, including outdoor recreation. For instance, if disposable income shrinks, fewer people might invest in hiking boots or waterproof jackets. Additionally, shifts in leisure preferences, perhaps a move towards more indoor entertainment or digital experiences, could also reduce the need for outdoor apparel.

Accessibility to outdoor spaces also plays a role. Restrictions on park access, environmental concerns, or even personal safety considerations can deter participation. If people cannot easily or safely engage in outdoor pursuits, the demand for the gear that facilitates them naturally diminishes.

- Economic Downturns: Consumer spending on non-essential items like outdoor gear can drop significantly during economic slowdowns.

- Shifting Leisure Preferences: A growing trend towards indoor activities or digital entertainment could divert consumer interest away from outdoor pursuits.

- Accessibility Issues: Limited or declining access to natural spaces for recreation directly reduces the need for specialized outdoor equipment.

Innovation in Alternative Solutions

Technological advancements in adjacent or entirely new industries constantly introduce novel solutions that can substitute for existing products or services. For example, the rapidly evolving field of wearable technology and smart fabrics could present compelling alternatives to traditional outdoor apparel, offering integrated features like climate control or real-time biometric monitoring. This innovation poses a significant threat as these new solutions may offer enhanced functionality or a more integrated user experience, potentially diminishing the appeal of conventional offerings.

Consider the burgeoning market for advanced materials. In 2024, the global advanced materials market was valued at approximately $250 billion, with significant growth projected. Innovations in areas like graphene-enhanced textiles or self-healing polymers could lead to outdoor gear that is lighter, stronger, and more durable than current options. Such breakthroughs could disrupt established players by offering superior performance characteristics that consumers find increasingly attractive, thereby raising the threat of substitutes.

- Emergence of Smart Apparel: Companies in the tech sector are increasingly developing smart clothing with integrated sensors and connectivity, offering functionalities like health tracking or communication capabilities that traditional outdoor wear lacks.

- Advanced Material Innovations: Breakthroughs in materials science, such as the development of ultra-lightweight yet highly durable composites or temperature-regulating fabrics, could render existing outdoor gear obsolete.

- Digital Integration: The trend towards digital integration in consumer products means that solutions offering seamless connectivity and data-driven insights (e.g., performance analytics) may become more appealing than standalone physical products.

- Shifting Consumer Preferences: As consumers become more accustomed to technologically advanced products in other areas of their lives, their expectations for performance and convenience in outdoor gear may also shift, favoring innovative substitutes.

The threat of substitutes for Columbia's specialized outdoor apparel is multifaceted, encompassing general sportswear, rental services, the secondhand market, and even opting out of outdoor activities entirely. Consumers are increasingly drawn to versatile athleisure wear, with the global athleisure market projected to exceed $570 billion by 2030, up from approximately $321 billion in 2023. This indicates a significant shift in preferences away from highly specialized gear towards more casual, everyday options.

Furthermore, the growing popularity of rental services for outdoor equipment and the robust expansion of the resale market, which saw double-digit percentage increases in transaction volumes in 2024, offer compelling alternatives. These trends directly challenge new product sales by providing more affordable or flexible access to outdoor gear.

| Substitute Category | Key Characteristics | Impact on Columbia |

|---|---|---|

| General Sportswear/Athleisure | Versatile, fashion-forward, budget-friendly | Reduces demand for specialized, higher-priced items |

| Rental Services | Short-term use, cost-effective for seasonal activities | Decreases outright purchase of infrequently used gear |

| Secondhand Market | Affordable alternatives, increased accessibility | Cannibalizes new sales, impacts perceived value |

| Opting Out of Activities | Economic pressures, shifting leisure preferences | Reduces overall market demand for outdoor apparel |

Entrants Threaten

Entering the competitive outdoor apparel and footwear market demands significant upfront capital. Companies need to invest heavily in product design and development, sophisticated manufacturing processes, substantial inventory to meet demand, extensive marketing campaigns to build brand awareness, and the creation of robust distribution networks. For example, establishing a new, fully integrated manufacturing facility for high-performance outdoor gear can easily cost tens of millions of dollars, making it a formidable hurdle for aspiring entrants.

Columbia's robust brand loyalty, cultivated over decades, presents a substantial barrier for newcomers. Established brands benefit from deep customer trust and recognition, making it difficult for new entrants to gain traction. For instance, in 2024, Columbia Sportswear reported a 9% increase in net sales, reflecting continued consumer demand for its established product lines and brand equity.

New companies often struggle to gain access to crucial distribution channels, a significant barrier to entry. For instance, securing prime shelf space in major grocery chains or obtaining favorable placement in electronics retailers can be incredibly difficult and expensive. In 2024, the cost of securing prominent retail placement, including slotting fees and promotional support, continued to be a substantial hurdle for emerging brands across various consumer goods sectors.

Established players benefit immensely from pre-existing relationships with distributors and retailers, along with their developed logistics and supply chain infrastructure. This makes it hard for newcomers to compete on reach and availability. For example, a new beverage company entering the market in 2024 faced significant challenges in matching the distribution networks of established giants like Coca-Cola or PepsiCo, which have decades of investment in their supply chains and retail partnerships.

Economies of Scale in Production and Sourcing

Columbia's established presence allows it to leverage significant economies of scale in production and sourcing. This means they can negotiate better prices for raw materials like polyester and nylon, and their large-scale manufacturing operations reduce per-unit costs. For instance, in 2023, the outdoor apparel market saw continued consolidation, with larger players like Columbia benefiting from their existing supply chain efficiencies.

New entrants face a substantial hurdle in matching these cost advantages. Without the volume to secure similar discounts on materials or spread fixed manufacturing costs across a vast output, newcomers will likely have higher production costs. This cost disparity can make it difficult for new companies to compete on price with established brands like Columbia, especially in a market sensitive to value.

Consider these points regarding economies of scale:

- Lower per-unit production costs due to high-volume manufacturing.

- Enhanced bargaining power with suppliers for raw materials and components.

- More efficient logistics and distribution networks, reducing transportation expenses.

- Ability to invest more heavily in R&D and marketing due to cost savings.

Intellectual Property and Technological Expertise

The threat of new entrants in the outdoor apparel market is significantly influenced by the high barriers associated with intellectual property and technological expertise. Companies like Columbia, with their proprietary technologies such as Omni-Heat and Omni-Tech, have invested heavily in research and development to create performance-enhancing features. These innovations are often protected by patents, making it a costly and time-consuming endeavor for new players to develop comparable offerings.

For instance, Columbia's commitment to R&D is reflected in its consistent product development pipeline, aiming to offer distinct advantages in warmth, breathability, and waterproofing. New companies entering this space would need substantial capital to not only develop their own unique technologies but also to secure the necessary intellectual property rights to compete effectively on product performance and differentiation.

This reliance on specialized knowledge and protected IP creates a formidable barrier. New entrants must overcome the challenge of replicating or surpassing existing technological advantages, which requires considerable investment in research, engineering talent, and patent acquisition. Without this, they risk being perceived as offering inferior products, limiting their market penetration and ability to capture market share from established brands.

Key considerations for new entrants regarding intellectual property and technological expertise include:

- High R&D Investment: The necessity for significant upfront investment in developing proprietary technologies and materials.

- Patent Protection: The challenge of navigating and overcoming existing patent landscapes to avoid infringement.

- Talent Acquisition: The need to attract and retain specialized engineers and scientists to drive innovation.

- Brand Reputation: Building a reputation for technological innovation takes time and consistent product performance.

The threat of new entrants in the outdoor apparel market is moderate, largely due to substantial capital requirements and established brand loyalty. New companies need significant investment for product development, manufacturing, marketing, and distribution. Columbia's strong brand equity, built over years, makes it difficult for newcomers to gain customer trust and market share.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government regulatory filings to provide a comprehensive view of competitive dynamics.