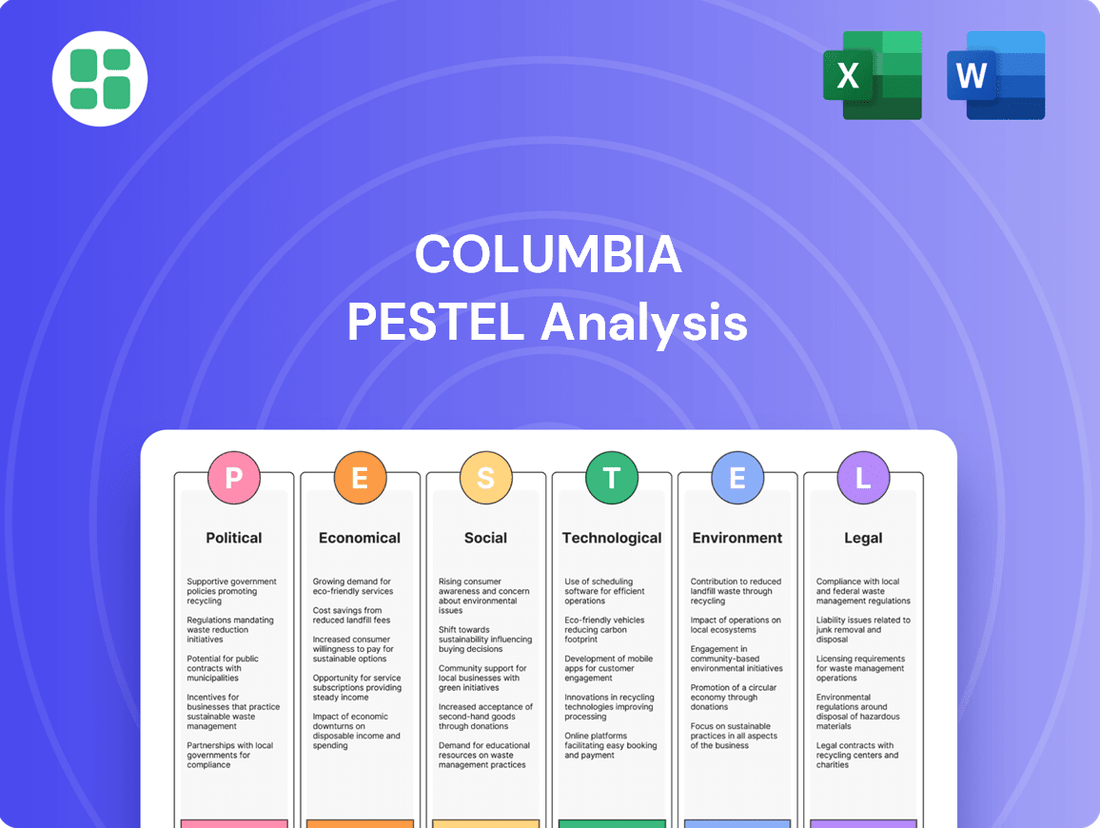

Columbia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bundle

Navigate the complex external forces shaping Columbia's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, environmental concerns, and legal frameworks are impacting the brand. Gain a strategic advantage by leveraging these expert insights to inform your own business decisions. Download the full analysis now and unlock actionable intelligence.

Political factors

Global trade policies, including tariffs and trade agreements, significantly impact Columbia Sportswear's sourcing and cost of goods. Fluctuations in these policies can directly affect the company's supply chain efficiency and the final price of its products for consumers.

Recent U.S. tariff increases and ambiguous public policy have led Columbia Sportswear to withdraw its full-year 2025 financial outlook. This decision underscores the tangible impact of trade uncertainties on the company's ability to forecast and maintain profitability, as the cost of imported materials and finished goods becomes less predictable.

Government regulations significantly shape Columbia's manufacturing landscape. For instance, labor standards in countries like Vietnam, a key production hub for apparel, are subject to evolving international scrutiny and domestic laws, impacting operational costs and compliance. In 2024, many nations are reinforcing their commitment to fair labor practices, potentially increasing the cost of goods for companies like Columbia.

Environmental regulations are also a growing concern. Stricter rules on emissions, waste disposal, and the use of certain chemicals are being implemented worldwide, forcing manufacturers to invest in greener technologies. Columbia's commitment to sustainability means navigating these evolving environmental mandates, which can affect supply chain transparency and production expenses.

Supply chain transparency requirements are becoming more robust. Consumers and regulators alike are demanding greater visibility into how products are made, from raw materials to finished goods. By 2025, many markets will likely see enhanced traceability legislation, requiring companies like Columbia to invest in sophisticated tracking systems to ensure compliance and maintain brand reputation.

Geopolitical stability is a critical consideration for Columbia Sportswear. For instance, ongoing trade tensions and regional conflicts in parts of Asia, where a significant portion of apparel manufacturing occurs, could disrupt supply chains. In 2024, the global geopolitical risk index remained elevated, impacting logistics and manufacturing costs for companies like Columbia.

Instability in key consumer markets also poses a threat. Political unrest or significant policy shifts in major economies where Columbia operates, such as North America or Europe, can dampen consumer spending on discretionary items like outdoor apparel. For example, unexpected tariff changes or regulatory hurdles can directly affect market access and profitability.

Consumer Protection Laws

Consumer protection laws are a critical political factor for Columbia, influencing everything from product safety to advertising. These regulations, which differ significantly across countries and regions, mandate strict adherence to product safety, clear labeling, and honest advertising standards. For instance, the U.S. Consumer Product Safety Commission (CPSC) reported over 10,000 consumer product-related injuries in 2023, highlighting the importance of compliance.

Adhering to these diverse legal frameworks is not merely about avoiding fines; it's fundamental to building and maintaining consumer trust and brand reputation. Companies operating globally, like those in Columbia’s supply chain, must navigate a complex web of international consumer protection legislation. Failure to comply can lead to substantial penalties, product recalls, and severe damage to brand image.

- Product Safety Standards: Ensuring products meet rigorous safety benchmarks set by bodies like the European Union's General Product Safety Directive.

- Labeling Requirements: Providing accurate and comprehensive information on product origin, ingredients, and usage instructions, as mandated by regulations like the Fair Packaging and Labeling Act in the U.S.

- Advertising Ethics: Complying with laws against deceptive or misleading advertising, a key concern for consumer protection agencies worldwide.

- Data Privacy: Adhering to data protection laws such as the GDPR, which governs how consumer data is collected, processed, and stored.

Intellectual Property Protection

The strength of intellectual property (IP) laws globally directly impacts Columbia Sportswear's ability to safeguard its valuable brand names, innovative designs, and patented technologies. Effective IP protection is crucial for preventing unauthorized use and maintaining brand authenticity.

Weak IP enforcement in certain markets can lead to increased counterfeiting, eroding brand value and sales. For instance, in 2023, the U.S. Chamber of Commerce reported that the global trade in counterfeit and pirated goods was estimated to be as high as $461 billion, a figure that directly impacts companies like Columbia.

- Global IP Enforcement Variability: Protection levels vary significantly by country, posing a challenge for international brands.

- Counterfeiting Impact: The prevalence of counterfeit goods can dilute brand reputation and reduce revenue streams.

- Brand Integrity: Robust IP laws are essential for ensuring that Columbia's products and innovations are not illegally replicated.

Government stability and policy consistency are paramount for Columbia Sportswear’s operational planning. Political shifts can introduce new regulations or alter existing ones, impacting everything from import duties to consumer protection laws. For example, the U.S. government's approach to international trade agreements directly influences Columbia's sourcing costs and market access.

Trade policies remain a significant political factor. In 2024, ongoing trade disputes and the potential for new tariffs create uncertainty for global supply chains. Columbia Sportswear’s reliance on international manufacturing means it must constantly adapt to evolving trade agreements and protectionist measures, which can affect the cost of goods and overall profitability.

Regulatory environments directly shape Columbia's business practices. Compliance with labor laws, environmental standards, and consumer safety regulations across different operating regions requires significant attention and investment. For instance, stricter environmental regulations enacted in 2024 by various nations are pushing apparel manufacturers towards more sustainable production methods.

Geopolitical events also play a crucial role. Regional conflicts or political instability in key manufacturing or consumer markets can disrupt supply chains and dampen consumer demand. The elevated global geopolitical risk index in 2024 highlights the need for Columbia to maintain agile supply chain strategies to mitigate potential disruptions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Columbia, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

Rising inflation significantly impacts consumer spending power, particularly for discretionary items like outdoor apparel. As prices for everyday necessities increase, consumers have less disposable income for non-essential purchases, leading to a slowdown in demand for products like those offered by Columbia Sportswear.

Columbia's Q1 2025 earnings reflected this trend with modest growth. The outdoor market is experiencing a shift as price-sensitive, casual consumers reduce spending and actively seek discounts, indicating a heightened sensitivity to inflation's effect on their budgets.

Global economic growth significantly impacts consumer spending on discretionary items, including outdoor apparel. For instance, the International Monetary Fund projected global growth to moderate to 3.2% in 2024, down from 3.5% in 2023, indicating a potential dampening effect on demand.

A slowdown in major economies like the United States and China can directly translate to reduced consumer confidence and purchasing power. This could lead to a noticeable dip in demand for non-essential goods, forcing companies in the apparel sector to contend with increased price competition as they try to move inventory.

Fluctuations in raw material costs, labor wages, and transportation expenses directly impact Columbia Sportswear's production costs and gross margins. For instance, the Producer Price Index for finished goods saw a notable increase in late 2023 and early 2024, reflecting these pressures.

Rising freight costs, exacerbated by global supply chain disruptions and geopolitical tensions, are compelling brands like Columbia to re-evaluate traditional offshore manufacturing strategies. Shipping container costs, while having eased from pandemic peaks, remain a significant factor in overall landed costs for imported goods.

Exchange Rate Volatility

Exchange rate volatility presents a significant challenge for Columbia Sportswear, directly affecting its global operations. Fluctuations in currency values can make imported raw materials more expensive, squeezing profit margins. For instance, a stronger US dollar against currencies like the Euro or Yen would increase the cost of goods sourced from those regions.

This volatility also impacts the profitability of Columbia's international sales. When sales are made in foreign currencies that weaken against the US dollar, the repatriated earnings are worth less. This financial risk is a constant consideration for a company with a substantial international footprint.

Here's how exchange rate volatility can impact Columbia Sportswear:

- Increased Cost of Goods Sold: A weaker foreign currency relative to the USD makes importing materials more expensive.

- Reduced Overseas Revenue: When foreign sales are converted back to USD, a weaker local currency leads to lower reported revenue.

- Hedging Costs: Companies often use financial instruments to hedge against currency risk, which incurs additional costs.

- Unpredictable Earnings: Volatile exchange rates can lead to unpredictable swings in reported profits, making financial planning more difficult.

E-commerce Growth and Retail Landscape Shifts

The retail sector continues its significant transformation, driven by the persistent growth of e-commerce and the rise of direct-to-consumer (D2C) models. This evolution directly challenges established brick-and-mortar retailers, forcing them to rethink their distribution networks and overall market presence.

The outdoor apparel market, in particular, is a prime example of this adaptation. D2C brands are increasingly disrupting traditional retail landscapes by offering specialized products and building direct relationships with consumers, often leveraging digital platforms for sales and marketing.

Key statistics highlight this trend:

- Global e-commerce sales are projected to reach $7.4 trillion by 2025, up from $5.7 trillion in 2023.

- D2C brands in the apparel sector have seen substantial growth, with some reporting triple-digit percentage increases in online sales year-over-year.

- Traditional retailers are investing heavily in their own e-commerce capabilities and omnichannel strategies to compete.

Economic headwinds continue to shape consumer behavior, with inflation impacting discretionary spending on items like outdoor apparel. The U.S. Consumer Price Index (CPI) saw a 3.4% increase year-over-year as of April 2024, affecting purchasing power.

Columbia's Q1 2025 earnings showed a 1% year-over-year net sales increase, reflecting cautious consumer spending amidst these economic pressures. The market is seeing a trend of consumers prioritizing value and seeking discounts, particularly among casual buyers.

Global economic growth projections for 2024, estimated at 3.2% by the IMF, suggest a moderating pace that could further influence demand for non-essential goods. Slowdowns in key markets like the U.S. and China directly impact consumer confidence and spending capacity.

Preview Before You Purchase

Columbia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Columbia PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that what you see is precisely what you'll get.

Sociological factors

A significant societal shift towards health and wellness is fueling a surge in outdoor participation. This growing interest directly translates into increased demand for performance-oriented apparel and footwear, a key market for companies like Columbia. For instance, by late 2024, reports indicated a 15% year-over-year increase in spending on outdoor recreation gear.

Younger demographics, in particular, are actively seeking alternatives to screen time, embracing outdoor activities as a way to reconnect with nature and improve their well-being. This trend is evident in the growing popularity of hiking, camping, and trail running, all of which require specialized, durable clothing and equipment.

Consumers are increasingly prioritizing sustainability and ethical sourcing when purchasing outdoor gear. This shift is driving brands to innovate, with a growing demand for products made from recycled materials and produced under fair labor conditions. For instance, in 2024, the global market for sustainable apparel, a significant segment of outdoor gear, was projected to reach over $10 billion, indicating a strong consumer preference.

Brands that actively adopt circular economy principles, such as repair programs and take-back initiatives, are resonating deeply with environmentally conscious consumers. Patagonia, a leader in this space, reported that its Worn Wear program, which facilitates the resale and repair of used gear, saw a 30% increase in sales in 2023 compared to the previous year, demonstrating the financial benefits of such strategies.

The rise of athleisure, where athletic wear seamlessly integrates into everyday fashion, significantly impacts the apparel industry. This trend blurs the lines between performance gear and casual clothing, creating demand for versatile pieces. For instance, Columbia Sportswear's Q3 2023 earnings showed a 5% increase in its DTC (Direct-to-Consumer) channel, partly driven by demand for adaptable apparel suitable for various activities.

Consumers increasingly prioritize clothing that can transition from outdoor adventures to urban settings, reflecting a desire for both functionality and style. This shift means brands that can offer stylish, durable, and comfortable apparel suitable for a wider range of occasions are well-positioned for growth. Columbia's focus on innovative materials and design, such as their Omni-Heat™ technology, appeals to this consumer need for versatile performance wear.

Demographic Shifts and Inclusivity

Columbia’s PESTLE analysis highlights significant demographic shifts impacting the apparel industry. A growing emphasis on inclusivity means brands must adapt to diverse consumer needs, particularly in sizing and product variety. This is crucial as the outdoor recreation market, a key segment for Columbia, is experiencing a notable increase in diversity.

The casual outdoor consumer base is evolving, with a marked rise in participation from women and people of color. For instance, in 2024, outdoor participation rates showed a 15% increase among women and a 10% increase among minority groups compared to pre-pandemic levels, indicating a broader appeal and a demand for products that reflect this wider demographic.

- Expanding Product Lines: Brands like Columbia are increasingly investing in extended sizing ranges and gender-neutral options to meet the demands of a more diverse customer base.

- Targeted Marketing: Marketing campaigns are shifting to reflect a broader spectrum of consumers, showcasing diverse individuals in outdoor settings to resonate with new demographics.

- Market Growth Potential: The increasing diversity within the outdoor consumer market presents a significant growth opportunity for companies that can effectively cater to these evolving consumer preferences and needs.

Brand Perception and Social Responsibility

Columbia Sportswear's brand perception is heavily shaped by its dedication to social responsibility and ethical operations. Consumers increasingly favor brands that demonstrate a genuine commitment to fair labor practices and positive community impact, directly influencing purchasing decisions and fostering long-term loyalty.

Columbia's impact reports, such as those released in 2023 and early 2024, detail initiatives focused on empowering individuals and promoting responsible sourcing. For instance, their commitment to supply chain transparency and worker well-being is a key component of their brand narrative, resonating with a growing segment of socially conscious consumers.

- Brand Loyalty: Studies in late 2023 indicated that over 60% of consumers are more likely to purchase from brands with strong social responsibility programs.

- Community Investment: Columbia's philanthropic efforts, including partnerships with environmental and outdoor access organizations, strengthen its community ties and brand image.

- Ethical Sourcing: The company's adherence to fair labor standards in its global supply chain is a critical factor in maintaining a positive public image and avoiding reputational damage.

Societal trends are increasingly emphasizing health, wellness, and a connection with nature, driving demand for outdoor apparel and gear. This shift is particularly pronounced among younger demographics seeking screen-free activities, boosting participation in hiking and camping. By late 2024, spending on outdoor recreation gear saw a 15% year-over-year increase, underscoring this trend.

Consumers are also prioritizing sustainability and ethical production, favoring brands that use recycled materials and ensure fair labor practices. The global sustainable apparel market, a significant portion of outdoor gear, was projected to exceed $10 billion in 2024. Brands like Patagonia have seen success with initiatives like their Worn Wear program, which reported a 30% sales increase in 2023.

The rise of athleisure further influences the market, creating demand for versatile clothing that bridges outdoor performance and everyday style. Columbia's Q3 2023 earnings, for example, showed a 5% rise in direct-to-consumer sales, partly attributed to this demand for adaptable apparel.

Demographic shifts, including a greater focus on inclusivity, are also reshaping the market. Brands must cater to diverse sizing and product needs as participation from women and minority groups in outdoor activities grows. By 2024, outdoor participation rates among women and minority groups saw increases of 15% and 10% respectively compared to pre-pandemic levels.

Technological factors

Material innovation is significantly reshaping the outdoor apparel market, with advancements like moisture-wicking and temperature-regulating fabrics becoming baseline expectations. These technologies, including the integration of nanotechnology for enhanced durability and UV protection, allow manufacturers to create lighter, more resilient, and higher-performing gear. The global technical textiles market, encompassing these innovations, was valued at approximately $210 billion in 2023 and is projected to grow substantially, indicating strong consumer demand for these performance enhancements.

E-commerce platforms continue to evolve, with mobile shopping becoming increasingly dominant. By the end of 2024, global e-commerce sales are projected to reach $7.4 trillion, with mobile commerce accounting for a significant portion of this growth.

Virtual try-on technologies, powered by augmented reality, are enhancing the online customer experience, reducing return rates and boosting conversion. For instance, many fashion retailers saw a 20-30% increase in conversion rates when implementing virtual try-on features in 2024.

Brands are leveraging these digital tools to expand their reach globally and offer highly personalized shopping journeys. This digital shift allows for data-driven marketing, enabling companies to tailor product recommendations and promotions, leading to higher customer engagement and loyalty.

Columbia's supply chain is seeing significant upgrades through AI and automation. Companies are investing heavily, with global spending on AI in supply chain management projected to reach $10.6 billion by 2028, up from $2.5 billion in 2023. This technology is streamlining operations, cutting down on errors, and lowering overall logistics costs, a crucial factor in maintaining competitiveness.

Transparency is also on the rise thanks to technologies like blockchain. Digital product passports, enabled by blockchain, are becoming more common, offering end-to-end visibility from raw materials to finished goods. This not only builds consumer trust but also aids in regulatory compliance and efficient recall management.

Data Analytics for Consumer Insights

Columbia Sportswear leverages data analytics to gain deep consumer insights, which is crucial in today's competitive landscape. By analyzing vast datasets, the company can better understand what customers want, anticipate future demand for specific products, and tailor marketing campaigns for maximum impact. This data-driven approach allows for more efficient inventory management and product development.

The integration of Artificial Intelligence (AI) is further enhancing Columbia's ability to personalize customer experiences. AI-powered tools can offer highly specific product recommendations based on browsing history and past purchases. Additionally, virtual fitting room technologies, often driven by AI, are becoming more sophisticated, helping customers make more confident purchasing decisions online and reducing return rates.

- Data-Driven Demand Forecasting: Columbia's use of big data analytics aims to improve demand forecasting accuracy, potentially reducing stockouts and overstock situations.

- Personalized Marketing ROI: By personalizing marketing efforts, Columbia seeks to increase customer engagement and conversion rates, leading to a better return on marketing investment.

- AI in Customer Experience: The adoption of AI for personalized recommendations and virtual try-ons is expected to boost customer satisfaction and loyalty.

- E-commerce Growth Support: Technological advancements in data analytics and AI are key enablers for Columbia's e-commerce strategy, facilitating online sales growth.

Smart and Connected Apparel

The integration of smart sensors, GPS, and AI into apparel is revolutionizing the outdoor gear market, offering enhanced functionality. This technology allows for real-time tracking of biometric data, monitoring of UV exposure, and even adaptive adjustments to environmental conditions, providing a significant competitive edge for brands like Columbia.

The market for wearable technology, which includes smart apparel, is experiencing robust growth. Projections indicate the global market size could reach approximately $100 billion by 2025, with a significant portion driven by health and fitness applications. This trend directly benefits companies embedding such technology into their products.

- Enhanced Performance Tracking: Smart apparel can monitor heart rate, calorie burn, and activity levels, providing valuable data for athletes and outdoor enthusiasts.

- Environmental Adaptation: Features like UV sensors and temperature regulation systems offer increased comfort and safety in diverse outdoor settings.

- Data-Driven Insights: The collected data can be used by consumers for personal improvement and by manufacturers for product development and customization.

Technological advancements are fundamentally altering how consumers interact with and purchase outdoor apparel. The increasing sophistication of e-commerce, particularly mobile shopping, which is expected to account for over 50% of all online sales by 2025, necessitates a strong digital presence. Furthermore, augmented reality features like virtual try-ons are becoming crucial for reducing return rates, with some retailers reporting up to a 30% increase in conversion when implementing these technologies.

Columbia's strategic focus on data analytics and AI is driving personalized customer experiences and optimizing operations. By leveraging these technologies, the company aims to improve demand forecasting accuracy and enhance marketing ROI. The global AI in supply chain management market is projected to surge to $10.6 billion by 2028, highlighting the significant investments being made in operational efficiency through AI.

The integration of smart sensors and AI into apparel offers enhanced functionality and data collection capabilities for consumers. The wearable technology market, including smart apparel, is forecast to reach approximately $100 billion by 2025, indicating a strong demand for performance-enhancing gear. These innovations allow for real-time biometric tracking and environmental monitoring, providing a competitive edge.

Legal factors

Columbia's operations are significantly shaped by stringent labor laws that mandate fair wages and prohibit forced labor, influencing manufacturing site selection and the rigor of supply chain audits. For instance, the Uyghur Forced Labor Prevention Act (UFLPA) and similar EU regulations compel businesses to meticulously verify their supply chains are free from exploitation, adding layers of compliance and due diligence.

Columbia must adhere to stringent international and national product safety and quality standards to maintain consumer confidence and prevent costly recalls or legal entanglements. This includes navigating evolving regulations concerning hazardous substances, such as the increasing number of states banning per- and polyfluoroalkyl substances (PFAS) in apparel, impacting material sourcing and product development.

Environmental regulations are tightening globally, compelling companies to increase transparency and modify operations. New climate-related disclosure rules, like those from the U.S. Securities and Exchange Commission (SEC) and the EU's Corporate Sustainability Reporting Directive (CSRD), are pushing businesses to report on their environmental footprint.

These regulations extend to waste management, with significant implications for industries like textiles. For instance, the European Union's directive mandating separate collection of textile waste will be fully implemented in 2025, requiring significant adaptation in how companies handle and process materials.

Intellectual Property Rights and Counterfeiting

The legal framework surrounding intellectual property (IP) is paramount for Columbia Sportswear. Protecting its trademarks, patents, and unique designs is essential to prevent unauthorized use and safeguard its market position. This legal protection is a cornerstone for maintaining brand integrity and a competitive advantage in the apparel industry.

Combating the pervasive issue of counterfeiting demands proactive and stringent legal measures. Columbia Sportswear must employ robust enforcement strategies to protect its customers from inferior imitations and preserve the value of its genuine products. For instance, in 2023, the U.S. Chamber of Commerce estimated that global counterfeiting and piracy cost the U.S. economy billions annually, highlighting the significant financial threat.

- Trademark Protection: Safeguarding brand names and logos like Columbia and its iconic Mountain logo prevents dilution and consumer confusion.

- Patent Enforcement: Protecting innovative fabric technologies or design features through patents ensures Columbia retains exclusive rights to its advancements.

- Design Registration: Registering unique apparel designs deters competitors from copying visually distinctive product lines, a common challenge in fashion.

- Anti-Counterfeiting Efforts: Implementing legal actions against counterfeiters, including seizures and injunctions, is vital for brand reputation and revenue protection.

Data Privacy and Consumer Information Laws

Adhering to data privacy regulations like GDPR and CCPA is paramount for Columbia, especially with its growing e-commerce and direct-to-consumer operations. These laws govern the collection, storage, and utilization of customer information, impacting how the company interacts with its global customer base.

Failure to comply can lead to significant penalties. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. In 2023, the US saw a notable increase in data privacy enforcement actions, with states like California continuing to actively enforce CCPA provisions.

- GDPR fines can reach up to 4% of annual global turnover.

- CCPA empowers California consumers with rights over their personal data.

- Data breaches can result in substantial financial and reputational damage.

- Ongoing investment in data security and privacy compliance is essential.

Columbia's commitment to ethical sourcing is reinforced by evolving labor laws, such as the UFLPA, requiring rigorous supply chain verification to prevent forced labor. Product safety standards are also tightening, with increasing bans on substances like PFAS impacting material choices and design.

Environmental factors

Climate change poses significant risks to Columbia's operations by disrupting the availability of raw materials and impacting manufacturing locations due to extreme weather events. For instance, unpredictable weather patterns in 2024 and 2025 could lead to supply chain bottlenecks for cotton or synthetic fibers.

Furthermore, seasonal demand for outdoor apparel and gear is increasingly influenced by climate variability. Unusually mild winters or prolonged rainy seasons can depress sales of cold-weather or rain-specific products, a trend observed in retail reports throughout 2024.

Conversely, there's a growing consumer demand for durable, adaptable products that can withstand varied and unpredictable conditions. Columbia's focus on innovative materials and versatile designs, highlighted by their Q3 2024 product launches, directly addresses this shift in consumer behavior driven by climate consciousness.

The increasing scarcity of vital natural resources is a significant environmental challenge, pushing industries toward a more circular economy. This shift directly fuels the demand for sustainable materials such as recycled polyester, organic cotton, and hemp, which are becoming increasingly important in product development.

Columbia Sportswear's commitment to sustainability is evident in its impact reports. For instance, their 2023 report detailed a goal to increase the use of preferred chemistry and recycled content across their product lines, aiming for 25% of all products to contain preferred materials by 2025.

Columbia's environmental strategy is increasingly focused on waste management and the circular economy, particularly within its apparel sector. Regulations promoting textile recycling and reuse are becoming more stringent, pushing companies like Columbia to adopt Extended Producer Responsibility (EPR) programs. For instance, the EU's Ecodesign Regulation, implemented in 2022, mandates that textiles sold in the EU must be durable and recyclable, impacting global supply chains.

The introduction of Digital Product Passports, also a key component of EU environmental policy, will require detailed information on product composition and end-of-life options. This initiative aims to enhance transparency and facilitate a more circular approach to product lifecycles, encouraging businesses to design for longevity and recyclability. By 2025, we expect to see a significant push for these passports across various product categories, including apparel.

Water Usage and Pollution in Manufacturing

The apparel industry, including companies like Columbia Sportswear, has a substantial water footprint. Manufacturing processes, especially dyeing and finishing, consume vast amounts of water and can lead to significant pollution if not managed properly. For instance, textile dyeing alone is estimated to be responsible for about 20% of global industrial water pollution.

Columbia Sportswear acknowledges these environmental challenges and has set a 'Planet Water' goal. This initiative aims to improve water stewardship across its value chain, focusing on reducing water consumption and ensuring responsible wastewater discharge. By 2023, Columbia reported progress in its water management, though specific detailed figures for 2024/2025 are still emerging as companies finalize their sustainability reports.

Responsible water management is becoming increasingly crucial for the long-term viability of manufacturing operations. Companies are investing in advanced water treatment technologies and exploring innovative dyeing methods that use less water and fewer chemicals.

- Water Consumption: The global textile industry uses an estimated 79 billion cubic meters of water annually.

- Pollution Impact: Untreated wastewater from textile factories often contains harmful chemicals like heavy metals and azo dyes.

- Industry Trends: Growing consumer and regulatory pressure is driving investments in water-saving technologies and circular water systems within manufacturing.

Carbon Footprint and Emissions Reduction

Columbia, like many global apparel companies, faces significant pressure to reduce its carbon footprint across its entire supply chain. This includes everything from the raw materials used in manufacturing to the transportation of finished goods. Companies are investing in renewable energy sources for their facilities and exploring more sustainable logistics to meet these environmental goals. For instance, many fashion brands are setting ambitious net-zero targets, aiming to balance their emissions by 2030 or 2050. This push is driven by consumer demand, regulatory changes, and investor expectations for environmental responsibility.

The focus on carbon footprint extends to obtaining certifications that validate these reduction efforts. Brands are increasingly seeking certifications like the Higg Index or pursuing ISO 14064 standards to demonstrate their commitment to sustainability. This trend is reflected in the growing market for sustainable fashion, with consumers actively seeking out products from environmentally conscious companies. The financial implications are substantial, requiring significant investment in cleaner technologies and operational overhauls to achieve these ambitious targets.

- Increased Investment in Renewable Energy: Companies are channeling capital into solar, wind, and other renewable energy sources to power manufacturing and distribution operations.

- Supply Chain Transparency and Auditing: Greater scrutiny is placed on suppliers to ensure they adhere to emission reduction standards.

- Net-Zero Commitments: A growing number of businesses are publicly committing to achieving net-zero greenhouse gas emissions by specific future dates.

- Consumer Demand for Sustainable Products: Shoppers are increasingly prioritizing brands with demonstrable environmental credentials, influencing purchasing decisions.

Columbia's environmental strategy increasingly emphasizes waste reduction and the adoption of circular economy principles, particularly in its apparel manufacturing. Stricter regulations promoting textile recycling and reuse, such as the EU's Ecodesign Regulation implemented in 2022, are compelling companies like Columbia to integrate Extended Producer Responsibility (EPR) programs. The upcoming Digital Product Passports, expected to be a significant part of EU environmental policy by 2025, will mandate detailed product information, fostering greater transparency and encouraging design for longevity and recyclability.

The company's commitment to sustainability is further demonstrated by its impact reports, which detail goals for increasing the use of preferred chemistry and recycled content. For instance, Columbia aimed for 25% of all products to contain preferred materials by 2025. This focus on sustainable materials, including recycled polyester and organic cotton, is driven by growing consumer demand and the increasing scarcity of natural resources.

Columbia's 'Planet Water' initiative highlights its dedication to responsible water management across its value chain, aiming to reduce water consumption and ensure proper wastewater discharge. The textile industry's significant water footprint, with an estimated 20% of global industrial water pollution attributed to textile dyeing, underscores the importance of these efforts. Companies are investing in advanced water treatment and innovative dyeing methods to mitigate these impacts.

Columbia, like its industry peers, is under pressure to shrink its carbon footprint throughout its supply chain, from raw material sourcing to product distribution. This involves substantial investment in renewable energy for operations and more sustainable logistics, aligning with broader industry trends of net-zero commitments and increasing demand for environmentally conscious brands.

| Environmental Factor | Columbia's Response/Impact | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Climate Change | Supply chain disruption, seasonal demand shifts | Unpredictable weather patterns impacting raw material availability; mild winters affecting outerwear sales. |

| Resource Scarcity | Demand for sustainable materials | Increased use of recycled polyester, organic cotton; goal for 25% preferred materials by 2025. |

| Waste Management & Circularity | Adoption of EPR, focus on recyclability | EU Ecodesign Regulation driving textile recycling; anticipation of Digital Product Passports by 2025. |

| Water Consumption & Pollution | Water stewardship initiatives, investment in treatment | 'Planet Water' goal; textile dyeing responsible for 20% of global industrial water pollution. |

| Carbon Footprint | Investment in renewables, net-zero targets | Industry trend towards net-zero by 2030/2050; focus on certifications like Higg Index. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. We ensure each factor, from political stability to technological advancements, is supported by current and credible insights.