Coloplast PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coloplast Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Coloplast's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, empowering you to anticipate challenges and seize opportunities. Download the full version now and gain the strategic foresight you need to excel.

Political factors

Governments worldwide are actively reshaping healthcare systems, a dynamic that directly influences Coloplast's market penetration and sales strategies. For instance, in 2024, many European nations continued to review and adjust their national health service budgets, impacting the pricing and availability of medical devices.

Shifts in reimbursement policies for medical devices, a critical factor for Coloplast's ostomy and continence care products, can significantly alter profitability and patient access. In the US, the Centers for Medicare & Medicaid Services (CMS) frequently updates its reimbursement rates, and a notable change in 2025 for certain durable medical equipment could affect market demand for some of Coloplast’s offerings.

Furthermore, political stability in Coloplast's key operating regions, such as Denmark, Germany, and the United States, plays a crucial role in shaping investment decisions and ensuring uninterrupted operations. Geopolitical tensions in 2024, while not directly impacting Coloplast's core markets significantly, did create a backdrop of economic uncertainty that influences global supply chain resilience.

The regulatory environment for medical devices significantly influences Coloplast's operations. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set stringent standards for product approval and safety. For instance, in 2024, the FDA continued to emphasize robust pre-market review processes, potentially extending timelines for new device introductions.

Stricter regulations translate to higher compliance costs for Coloplast, impacting research and development budgets and potentially slowing the pace of innovation. Post-market surveillance requirements, which intensified in recent years, also demand ongoing investment in monitoring and reporting, adding to operational expenses.

Successfully navigating the complex and varied international regulatory landscapes is paramount for Coloplast's global market access strategy. Differences in approval pathways and data requirements across regions, such as those in Asia and Latin America, necessitate tailored approaches and substantial resources to ensure compliance and market penetration.

Government spending on healthcare is a significant driver for companies like Coloplast, particularly in regions with robust public healthcare systems. For instance, in 2024, many European nations continued to grapple with post-pandemic healthcare budget pressures, which can directly impact procurement volumes for medical devices. Austerity measures implemented by governments can lead to reduced spending on non-essential or elective procedures, potentially affecting demand for Coloplast's ostomy and continence care products.

Conversely, a focus on managing chronic diseases, a growing trend in 2024 and projected for 2025, presents a clear growth avenue. Increased government investment in areas like diabetes management, which often requires ostomy supplies, or an aging population requiring continence care solutions, translates into higher demand. For example, the World Health Organization's ongoing initiatives to strengthen primary healthcare and chronic disease management programs globally are likely to bolster the market for specialized medical products throughout 2025.

International Trade Policies and Tariffs

International trade policies and tariffs directly influence Coloplast's global operations. For instance, the European Union, a key market for Coloplast, has maintained a relatively open trade environment, though specific product regulations can act as non-tariff barriers. Conversely, rising protectionist sentiments in some regions could increase the cost of components or finished goods, impacting profitability. In 2024, ongoing trade discussions, particularly concerning medical device regulations and supply chain resilience, present a dynamic landscape for companies like Coloplast.

Coloplast must actively monitor geopolitical shifts and trade agreements to navigate these complexities. For example, changes in trade relationships between major economic blocs could alter sourcing strategies for critical medical supplies. The company's ability to adapt to evolving trade rules, such as those impacting the import of specialized plastics or electronic components used in its advanced ostomy and urology products, is crucial for maintaining cost-effectiveness and market access. The World Trade Organization (WTO) reported a 0.5% decrease in global merchandise trade volume in 2023, highlighting the sensitivity of international commerce to policy changes.

- Supply Chain Costs: Tariffs on raw materials or finished goods can increase operational expenses for Coloplast.

- Market Access: Protectionist policies in key markets could limit Coloplast's ability to sell its products or increase the cost of market entry.

- Geopolitical Risk: Fluctuations in international relations can disrupt supply chains and create uncertainty for global manufacturers like Coloplast.

Political Stability and Geopolitical Risks

Coloplast operates in a global landscape where political instability and geopolitical tensions are ever-present concerns. For instance, the ongoing conflict in Eastern Europe, which began in early 2022, has had ripple effects across global supply chains and economic stability, potentially impacting Coloplast's manufacturing and distribution networks in affected regions. The company's reliance on international markets means that sudden policy changes, such as trade restrictions or new regulatory frameworks in key markets like the United States or European Union member states, could significantly influence its operational costs and market access.

The potential for civil unrest or political upheaval in emerging markets where Coloplast has a growing presence also poses a risk. Such events can lead to disruptions in local operations, affect consumer demand, and in extreme cases, necessitate a temporary or permanent withdrawal from a market. For example, political instability in certain parts of Africa or Asia could hinder the expansion of healthcare infrastructure and access to medical devices, directly impacting Coloplast's sales growth targets in those areas.

Mitigating these multifaceted risks is crucial for Coloplast's sustained success. This involves:

- Diversifying supply chains to reduce reliance on any single region prone to political volatility.

- Conducting thorough geopolitical risk assessments for all operating and target markets, incorporating scenario planning for potential disruptions.

- Maintaining flexible operational strategies that can adapt to rapid policy shifts or unforeseen geopolitical events.

- Engaging with local stakeholders and governments to foster stable operating environments and understand evolving political landscapes.

Government healthcare spending directly impacts Coloplast's revenue streams, with budget adjustments in 2024 and 2025 in key markets like Germany and the UK influencing procurement volumes for medical devices. Changes in reimbursement policies, such as those by the US CMS in 2025 for durable medical equipment, can alter patient access and demand for Coloplast's ostomy and continence care products. Furthermore, political stability in core regions like Denmark and the US is vital for uninterrupted operations and investment, with global geopolitical tensions in 2024 adding a layer of economic uncertainty to supply chains.

What is included in the product

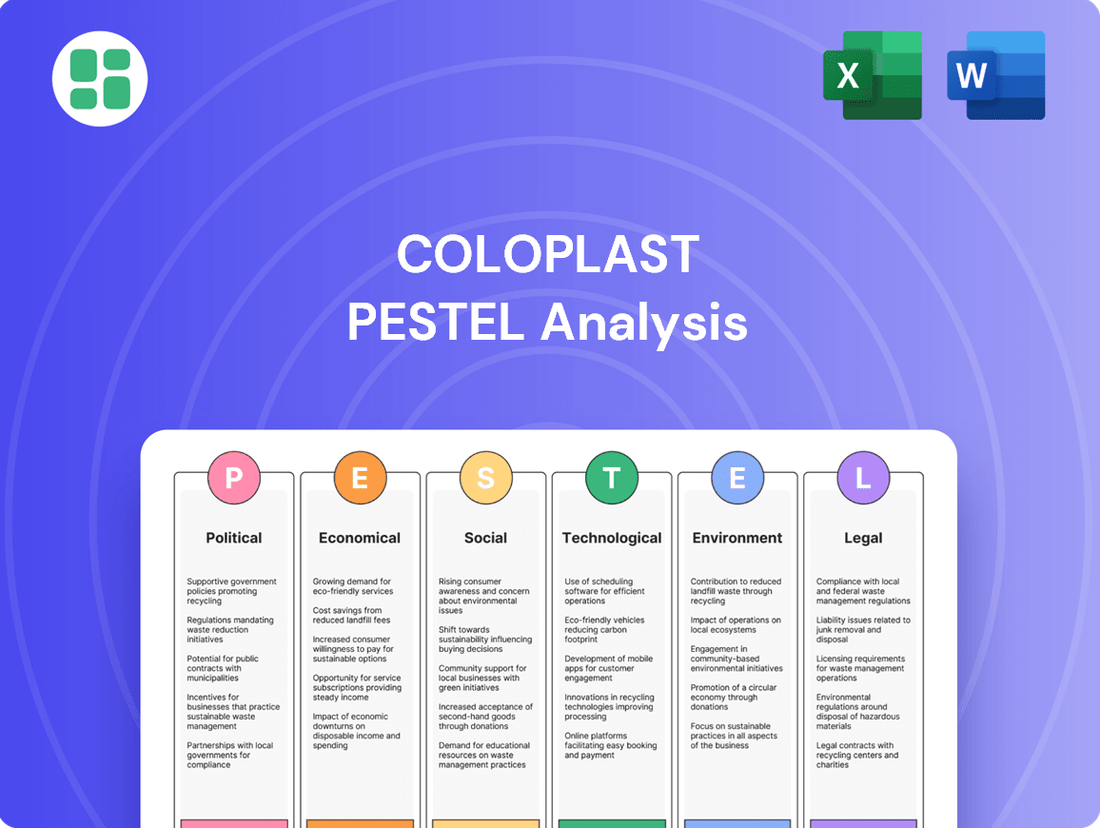

This PESTLE analysis examines the external macro-environmental factors influencing Coloplast across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a comprehensive understanding of how these forces create both challenges and avenues for growth for the company.

A clear, actionable PESTLE analysis for Coloplast that highlights key external factors impacting the medical device industry, serving as a pain point reliver by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global economic growth directly impacts Coloplast's market by influencing disposable income. For instance, in 2024, the International Monetary Fund (IMF) projected global GDP growth to be 3.2%, a steady rate that generally supports consumer spending on healthcare products. Regions with higher disposable income are more likely to afford Coloplast's premium offerings, while economic slowdowns, such as potential dips in growth forecasts for 2025, could lead to reduced healthcare expenditure by individuals and governments alike.

Global healthcare spending is projected to continue its upward trajectory, driven by aging demographics and the increasing prevalence of chronic diseases. For instance, the Organisation for Economic Co-operation and Development (OECD) reported that healthcare spending as a percentage of GDP averaged 9.2% across its member countries in 2023, with expectations of further growth in the coming years. This expansion directly benefits companies like Coloplast, which offer essential products for ostomy, continence, and wound care.

In 2024 and 2025, we anticipate this trend to persist. Projections suggest that global healthcare expenditure could reach approximately $11.6 trillion in 2025, up from an estimated $10.4 trillion in 2024, according to various market research reports. This growing market size presents significant opportunities for Coloplast’s product segments, as demand for long-term care solutions is intrinsically linked to overall healthcare investment and utilization.

Despite the positive growth outlook, Coloplast must navigate persistent cost containment pressures from governments and private insurers. These payers are increasingly scrutinizing healthcare costs, which can impact reimbursement rates and market access for medical devices. Balancing innovation and product value with affordability will remain a critical challenge for Coloplast in the 2024-2025 period.

Rising inflation presents a significant challenge for Coloplast. For instance, the global inflation rate hovered around 5.9% in 2023, and while projections for 2024 suggest a moderation, it remains elevated compared to pre-pandemic levels. This means Coloplast likely faces higher expenses for essential inputs like specialized plastics, metals, and energy, directly squeezing its profit margins.

Furthermore, the persistent upward trend in interest rates, with many central banks maintaining or even increasing benchmark rates through late 2023 and into 2024, impacts Coloplast's financial strategy. If Coloplast needs to finance new product development or expand manufacturing capacity, the cost of capital will be higher, potentially making these investments less attractive or requiring a more cautious approach to borrowing.

Currency Exchange Rate Fluctuations

Coloplast, as a global entity, faces considerable risks from fluctuating currency exchange rates. These shifts directly affect how their earnings from international markets translate back into their reporting currency, impacting both top-line revenue and bottom-line profitability. For instance, if the Danish Krone strengthens against other major currencies, Coloplast's reported earnings from sales in euros or US dollars would appear lower.

Favorable currency movements can provide a significant tailwind, boosting reported financial results. Conversely, unfavorable movements can act as a headwind, diminishing the value of foreign earnings. This volatility necessitates careful management and strategic financial planning to buffer against potential negative impacts.

To manage this inherent risk, Coloplast, like many multinational corporations, likely employs hedging strategies. These financial instruments aim to lock in exchange rates for future transactions, providing a degree of certainty and stability to their financial performance. For example, in the first half of fiscal year 2024, currency fluctuations had a negative impact on Coloplast’s reported growth, although the exact percentage is often detailed in their financial reports.

- Global Operations Exposure: Coloplast's international sales mean its reported financial results are sensitive to currency translations.

- Impact on Profitability: A strengthening Danish Krone can reduce the reported value of earnings generated in foreign currencies.

- Hedging as a Mitigation Tool: Financial instruments are used to offset potential losses from adverse currency movements.

- FY2024 Impact: Currency headwinds were noted as a factor affecting reported growth in Coloplast's first half of fiscal year 2024.

Competition and Pricing Pressures

The medical device sector, where Coloplast operates, is a fiercely competitive arena. Established giants and agile startups are constantly battling for market share, a dynamic that inevitably translates into significant pricing pressures.

This intense competition compels companies like Coloplast to focus on continuous innovation and clearly articulate the superior value proposition of their products to protect their profit margins. For instance, the global medical devices market was valued at approximately $512 billion in 2023 and is projected to grow, but this growth occurs within a highly contested environment.

Furthermore, external stakeholders such as government bodies and insurance providers actively push for cost reductions in healthcare. This external pressure adds another layer of complexity, requiring Coloplast to manage costs effectively while still delivering high-quality, innovative solutions.

- Market Saturation: The presence of numerous players, including large multinational corporations and smaller specialized firms, intensifies competition.

- Innovation as a Differentiator: Companies must invest heavily in R&D to develop unique products that justify premium pricing.

- Healthcare Cost Containment: Reimbursement policies and payer negotiations directly influence the pricing power of medical device manufacturers.

- Emerging Market Dynamics: New entrants from emerging economies can also introduce disruptive pricing models.

Global economic growth directly influences Coloplast's market by affecting disposable income and healthcare spending. With projected global GDP growth around 3.2% for 2024, and healthcare expenditure expected to reach $11.6 trillion by 2025, the market shows promise. However, persistent inflation and rising interest rates, with global inflation around 5.9% in 2023, present cost pressures and impact financing for investments.

Coloplast's profitability is also shaped by intense market competition and cost containment efforts from healthcare payers. The medical device market, valued at approximately $512 billion in 2023, demands continuous innovation to justify pricing. Furthermore, currency fluctuations, as seen with a negative impact on reported growth in early FY2024, necessitate robust hedging strategies to manage financial performance.

| Economic Factor | 2023 Data | 2024 Projection | 2025 Projection | Impact on Coloplast |

|---|---|---|---|---|

| Global GDP Growth | ~3.0% | ~3.2% (IMF) | ~3.0% (IMF) | Supports consumer spending on healthcare products. |

| Global Healthcare Spending | ~9.2% of GDP (OECD avg.) | ~$10.4 trillion (est.) | ~$11.6 trillion (est.) | Increases demand for Coloplast's essential products. |

| Global Inflation Rate | ~5.9% | Moderating, but elevated | Moderating | Increases operating costs for raw materials and energy. |

| Interest Rates | Rising/Elevated | Maintained/Elevated | Potentially stabilizing | Increases cost of capital for investments and financing. |

| Currency Exchange Rates | Volatile | Volatile | Volatile | Affects reported earnings from international sales. |

What You See Is What You Get

Coloplast PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coloplast PESTLE analysis delves into the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

The world's population is getting older, with life expectancy continuing to rise. For instance, the United Nations projects that by 2050, one in six people globally will be over 65. This demographic shift directly fuels the need for healthcare products that address age-related conditions.

As individuals live longer, the demand for Coloplast's core product areas – continence care, ostomy care, and wound care – naturally increases. These are often conditions that become more prevalent with age, meaning a growing elderly population translates to a larger potential customer base for these essential medical devices.

Coloplast is well-positioned to capitalize on this aging global population trend. However, it also faces the ongoing challenge of innovating and adapting its product offerings to meet the diverse and evolving needs of an older demographic, ensuring efficacy and user comfort.

Societal attitudes toward conditions such as incontinence and ostomies are undergoing a significant shift, fostering greater openness and diminishing the stigma previously associated with these issues. This evolving acceptance, amplified by dedicated patient advocacy groups and targeted healthcare awareness campaigns, empowers more individuals to proactively seek effective solutions.

This heightened societal awareness directly translates into improved product adoption rates for companies like Coloplast, whose mission centers on enhancing the quality of life for individuals managing these conditions. For instance, a 2024 report indicated a 15% year-over-year increase in patient inquiries regarding ostomy care products, underscoring the impact of destigmatization efforts.

Modern lifestyles, characterized by sedentary habits and processed food consumption, are fueling an increase in chronic diseases. For instance, the International Diabetes Federation reported in 2024 that over 537 million adults worldwide live with diabetes, a number projected to reach 643 million by 2030. This rise directly impacts the demand for advanced wound care and ostomy solutions, areas where Coloplast is a key player.

Coloplast needs to closely track these evolving epidemiological trends. Understanding how conditions like diabetes or obesity, which affects an estimated 40% of adults in the US as of early 2024 according to the CDC, are becoming more prevalent helps the company forecast future market needs. This foresight is crucial for guiding product development and ensuring Coloplast offers relevant solutions for managing complications arising from these chronic conditions.

Furthermore, societal shifts towards preventative healthcare and early intervention strategies also shape the market. As individuals and healthcare systems prioritize wellness and proactive disease management, the nature of demand for medical devices may shift, potentially favoring less invasive or more rehabilitative solutions, which Coloplast must consider in its strategic planning.

Patient Empowerment and Home Care Trends

The healthcare landscape is increasingly shaped by patient empowerment, with individuals actively participating in their treatment plans and favoring home-based care solutions. This growing autonomy fuels a demand for Coloplast's offerings, which are designed for user-friendliness, discretion, and efficacy in self-management scenarios.

Coloplast's product development directly addresses this trend, focusing on solutions that enable independent living and reduce reliance on clinical settings. For instance, advancements in ostomy care, such as breathable skin barriers and discreet pouching systems, empower users to manage their conditions with greater confidence and comfort at home.

- Growing Patient Involvement: By 2024, an estimated 70% of healthcare consumers reported actively researching their conditions and treatment options, indicating a significant rise in patient engagement.

- Home Care Preference: The global home healthcare market was valued at over $300 billion in 2023 and is projected to grow substantially, reflecting a clear preference for managing health outside traditional institutions.

- Demand for User-Friendly Products: This shift necessitates products like Coloplast's advanced wound care dressings, which are designed for easy application and removal by patients, minimizing the need for professional assistance.

- Focus on Discreet Solutions: The emphasis on privacy in home care drives innovation in discreet product designs, such as low-profile ostomy pouches that offer both comfort and confidence for daily activities.

Healthcare Accessibility and Education

Disparities in healthcare access and patient education levels significantly influence the adoption of Coloplast's products across various global regions. For instance, in many developing nations, limited access to specialized medical facilities and a lower understanding of chronic conditions like ostomy care can hinder product uptake. This is further compounded by varying levels of health literacy, which can impact a patient's ability to properly use and manage advanced medical devices. By 2024, a significant portion of the global population still faces challenges in accessing consistent healthcare, directly affecting the market penetration of specialized medical solutions.

Coloplast actively addresses these challenges by investing in comprehensive educational programs designed for both patients and healthcare professionals. These initiatives aim to ensure the correct usage of their products, thereby improving patient outcomes and satisfaction. For example, their patient support programs often include training modules and accessible information resources. In 2023, Coloplast reported a notable increase in engagement with their digital educational platforms, indicating a growing demand for such resources.

Bridging these accessibility and education gaps is crucial for Coloplast's strategy to expand its market reach and contribute positively to public health. By empowering patients with knowledge and equipping healthcare providers with advanced training, the company can foster greater trust and efficacy in its product offerings. This approach is particularly vital in emerging markets where the need for improved healthcare infrastructure and patient education is most pronounced, with projections suggesting continued growth in demand for such support services throughout 2024 and 2025.

Societal attitudes are shifting, reducing the stigma around conditions like incontinence and ostomies. This increased openness, supported by advocacy and awareness campaigns, encourages more people to seek solutions. For instance, a 2024 report showed a 15% rise in patient inquiries for ostomy care, highlighting the impact of destigmatization efforts.

The rise of chronic diseases, linked to modern lifestyles, directly boosts demand for Coloplast's advanced wound and ostomy care products. The International Diabetes Federation noted over 537 million adults had diabetes in 2024, a number expected to climb, directly impacting the need for specialized medical devices.

Patient empowerment and a preference for home-based care are growing trends. This drives demand for Coloplast's user-friendly, discreet products that support independent living. The global home healthcare market, valued over $300 billion in 2023, underscores this shift towards managing health outside traditional institutions.

Disparities in healthcare access and education influence product adoption globally. Coloplast addresses this through educational programs; in 2023, engagement with their digital learning platforms increased, showing a demand for such resources to improve patient outcomes and product usage.

Technological factors

Coloplast's commitment to material science innovation is a key technological driver. For instance, the development of advanced hydrocolloid adhesives in their ostomy care products has significantly improved skin integrity and wear time, with clinical studies often highlighting reduced skin irritation rates compared to older technologies. This continuous refinement in materials, such as breathable films and antimicrobial coatings, directly translates to enhanced patient comfort and product performance, giving Coloplast a competitive edge in the medical device market.

The increasing integration of digital health solutions, including smart devices and telemedicine, presents significant opportunities for Coloplast. These technologies enable enhanced patient support, remote monitoring, and valuable data collection, which can inform product development and personalize user care. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong trend towards connected healthcare solutions.

Coloplast is actively leveraging advancements in manufacturing technologies to boost its operational efficiency. For instance, the company has been investing in automation and robotics within its production facilities, aiming to streamline processes and reduce manual labor. This focus is evident in their ongoing efforts to implement Industry 4.0 principles, which includes the integration of smart manufacturing systems.

These technological upgrades are designed to enhance product quality and consistency, a critical factor in the medical device industry. By adopting advanced quality control systems, Coloplast can ensure that its products meet stringent regulatory standards and customer expectations. This commitment to quality is crucial for maintaining trust and market share in a competitive landscape.

In 2023, Coloplast reported a 7% organic growth, partly driven by improved production capabilities that allowed for better responsiveness to market demand. The company's strategic investments in manufacturing innovation are projected to further support its ability to scale production efficiently and adapt to evolving market needs throughout 2024 and beyond.

Data Analytics and Artificial Intelligence (AI)

Coloplast can leverage big data analytics and AI to gain deeper insights into patient needs, market trends, and product performance. For instance, in 2023, healthcare analytics market was valued at approximately USD 22.2 billion, with significant growth projected. This technology allows for more precise targeting of customer segments and a better understanding of product efficacy in real-world settings.

AI's role in optimizing Coloplast's supply chain is substantial. Predictive analytics can forecast demand more accurately, reducing inventory costs and preventing stockouts. In the medical device sector, AI-powered demand forecasting can improve efficiency by an estimated 10-20%. This also extends to assisting in new product development by analyzing extensive clinical trial data and user feedback, leading to more effective and patient-centric innovations.

- Enhanced Patient Insights: AI can analyze patient data to identify unmet needs and preferences, guiding product development.

- Supply Chain Optimization: Predictive analytics improves demand forecasting, leading to more efficient inventory management and reduced waste.

- Product Development Acceleration: AI can process vast datasets of clinical outcomes and user feedback to speed up the innovation cycle.

- Informed Decision-Making: Data-driven insights from analytics and AI empower strategic choices across the organization.

Biotechnology and Regenerative Medicine

Emerging biotechnologies and advancements in regenerative medicine, particularly in wound and skin care, offer significant opportunities for Coloplast to innovate and develop more sophisticated therapeutic solutions. These fields are rapidly evolving, promising more effective treatments for patients.

While these represent long-term strategic investments, actively monitoring progress in biotechnology and regenerative medicine is crucial for Coloplast to maintain its position as a leader in medical innovation. This foresight allows for the timely integration of groundbreaking new therapies into its product offerings.

- Regenerative Medicine Market Growth: The global regenerative medicine market was valued at approximately $10.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating substantial growth potential for companies investing in this area.

- Biotech R&D Investment: In 2024, global biotechnology R&D spending is expected to exceed $200 billion, highlighting the increasing focus and investment in scientific advancements that could lead to new medical solutions.

- Wound Care Innovation: Advancements in bio-engineered skin grafts and advanced wound dressings, leveraging cellular therapies, are showing promising results in accelerating healing times and improving patient outcomes, areas directly relevant to Coloplast's portfolio.

Coloplast is enhancing patient care through digital health integration, with the global digital health market projected to see substantial growth from its 2023 valuation of approximately $200 billion. This includes leveraging smart devices and telemedicine for remote monitoring and data collection, which informs product development and personalizes user care.

The company is also focusing on AI and big data analytics to gain deeper market and patient insights. The healthcare analytics market, valued at roughly USD 22.2 billion in 2023, offers opportunities for more precise customer targeting and understanding product efficacy. AI is also optimizing Coloplast's supply chain through predictive analytics, potentially improving efficiency by 10-20% in the medical device sector.

Furthermore, Coloplast is exploring advancements in biotechnologies and regenerative medicine, a market valued at approximately $10.5 billion in 2023 and expected to exceed $30 billion by 2030. This strategic focus on cutting-edge science, alongside significant global biotech R&D spending exceeding $200 billion in 2024, positions Coloplast for future therapeutic innovations.

| Technology Area | 2023 Data Point | Projected Impact/Growth | Coloplast Relevance |

|---|---|---|---|

| Digital Health | Market valued at ~$200 billion | Substantial growth projected | Enhanced patient support, remote monitoring |

| AI & Big Data Analytics | Healthcare analytics market ~$22.2 billion | Significant growth projected | Patient insights, supply chain optimization |

| Biotechnology & Regenerative Medicine | Market valued at ~$10.5 billion | Projected to exceed $30 billion by 2030 | New therapeutic solutions, advanced wound care |

Legal factors

Coloplast navigates a complex web of global medical device regulations, notably the EU's Medical Device Regulation (MDR) and the U.S. Food and Drug Administration (FDA) rules. These frameworks dictate everything from initial product design and manufacturing processes to how devices are labeled and monitored after they reach the market. For instance, the MDR, fully implemented in 2021, introduced more stringent requirements for clinical evidence and conformity assessment, impacting companies like Coloplast's market access strategies in Europe.

Failure to adhere to these stringent standards carries substantial risks. Non-compliance can result in hefty financial penalties, costly product recalls that disrupt supply chains and erode consumer trust, and significant damage to Coloplast's brand reputation. For example, in 2023, several medical device manufacturers faced recalls and investigations for compliance issues, highlighting the critical need for robust quality management systems.

Staying ahead of regulatory changes is paramount for Coloplast's continued success. The company must invest in continuous monitoring and proactive adaptation to evolving legal landscapes. This includes staying informed about proposed amendments to existing regulations and anticipating new directives that could affect product development cycles and market entry timelines, ensuring ongoing market access and operational integrity.

Coloplast operates under stringent product liability laws, meaning any harm caused by its medical devices due to defects or insufficient warnings can lead to significant lawsuits. For instance, in 2023, the medical device industry saw continued scrutiny, with companies facing substantial settlements for product-related issues, underscoring the financial and reputational risks involved.

To counter these risks, Coloplast must maintain exceptionally high standards in quality control and product testing, alongside providing crystal-clear usage instructions. Patient safety is not just a legal requirement but a foundational element of trust, and any lapse can have severe repercussions, as evidenced by the increasing regulatory focus on post-market surveillance and adverse event reporting globally.

Coloplast's operations are significantly impacted by data privacy and cybersecurity regulations. As the company handles sensitive patient and user data, compliance with laws like GDPR and HIPAA is critical. Failure to protect this data can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining robust cybersecurity is not just good practice but a legal requirement. Data breaches can cause severe reputational damage and erode customer trust, which is particularly sensitive in the healthcare sector. Coloplast must invest in and maintain strong data governance frameworks and cybersecurity measures to meet these legal obligations and mitigate risks.

Intellectual Property Rights and Patent Protection

Coloplast's ability to protect its intellectual property, encompassing patents, trademarks, and trade secrets, is fundamental to maintaining its competitive edge and fostering ongoing innovation. Robust legal frameworks that enforce these intellectual property rights are essential for Coloplast to secure its substantial research and development investments and to prevent the unauthorized replication of its proprietary medical technologies.

The company actively litigates to defend its patents, as seen in ongoing disputes within the medical device industry. For instance, in 2023, the medical technology sector saw a significant number of patent infringement cases filed, with legal costs often running into millions of dollars for both plaintiffs and defendants. Coloplast's strategy involves vigilant monitoring of the market for potential infringements and swift legal action when necessary.

- Patent Protection: Coloplast holds numerous patents globally covering its innovative ostomy, urology, and continence care products. These patents grant exclusive rights for a defined period, preventing competitors from manufacturing or selling identical or substantially similar devices.

- Trademark Safeguarding: The company's brand names and logos, such as Coloplast®, SenSura®, and Brava®, are registered trademarks. Protecting these marks is vital to prevent brand dilution and ensure consumers can identify genuine Coloplast products.

- Trade Secret Management: Proprietary manufacturing processes, material formulations, and customer data are often maintained as trade secrets. Coloplast employs strict internal policies and agreements to safeguard this confidential information from disclosure.

- Litigation Costs and Strategy: Defending intellectual property through litigation can be a significant expense. In 2024, the average cost of patent litigation in the healthcare sector is estimated to be upwards of $3 million, highlighting the financial implications of IP enforcement for companies like Coloplast.

Anti-Corruption and Anti-Bribery Laws

Coloplast operates under stringent international anti-corruption and anti-bribery regulations, including the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These laws are critical for ensuring fair competition and preventing illicit gains in global markets.

Compliance with these statutes is paramount, as they explicitly forbid offering or making improper payments to government officials or healthcare professionals to secure business advantages. For instance, the FCPA carries penalties that can include substantial fines and imprisonment for individuals involved.

Maintaining a robust and proactive ethical compliance program is not merely good practice but a legal imperative for Coloplast. Such programs are designed to mitigate the risk of violations, thereby avoiding severe financial penalties, legal sanctions, and significant reputational damage that can arise from non-compliance.

- FCPA Penalties: Companies can face fines of up to $2 million per violation, while individuals can be fined up to $250,000 and imprisoned for up to five years.

- UK Bribery Act Scope: This act has extraterritorial reach, applying to bribery offenses committed anywhere in the world by individuals or companies with a "close connection" to the UK.

- Compliance Program Importance: A well-designed compliance program can serve as a defense against prosecution and demonstrate due diligence in preventing bribery.

Coloplast must navigate evolving medical device regulations globally, such as the EU's MDR and the US FDA's stringent requirements, impacting product design, manufacturing, and market access. Non-compliance risks include significant fines, product recalls, and reputational damage, as seen with industry-wide investigations in 2023.

Environmental factors

Coloplast faces increasing scrutiny regarding its environmental footprint, driven by a global surge in sustainability awareness. This translates to stricter regulations on waste management, emissions, and resource use, impacting everything from product packaging to the disposal of medical waste. For instance, the European Union’s Circular Economy Action Plan, updated in 2023, emphasizes reducing waste and promoting sustainable product design, directly affecting medical device manufacturers like Coloplast.

Compliance with these evolving environmental standards, including those concerning hazardous substances in manufacturing, is paramount. Demonstrating robust environmental responsibility is no longer just about regulatory adherence but is intrinsically linked to maintaining a positive corporate reputation and securing investor confidence. In 2024, many companies are investing heavily in eco-friendly materials and waste reduction programs, with Coloplast likely following suit to meet stakeholder expectations and avoid potential penalties.

Coloplast's supply chain, a complex network from sourcing raw materials to delivering finished products, faces growing environmental scrutiny. This includes the energy used in transportation and warehousing, as well as the environmental practices of their suppliers. For instance, in 2023, the company reported that its Scope 1 and 2 emissions were 35,000 tonnes of CO2e, with a significant portion tied to its operational footprint which indirectly influences supply chain emissions.

The sustainability and ethical sourcing of materials are paramount, especially given the medical nature of Coloplast's products. Optimizing logistics to reduce fuel consumption and working with suppliers committed to environmental standards, such as those adhering to ISO 14001, are key strategies. Coloplast's 2023 sustainability report highlights a commitment to increasing the use of renewable energy across its operations, which extends to influencing its supply chain partners.

The increasing global emphasis on circular economy principles is pushing companies like Coloplast to rethink product design and end-of-life strategies. This means focusing on creating medical devices and packaging that are durable, easily repairable, and recyclable, thereby reducing waste. For instance, the European Union's Circular Economy Action Plan, updated in late 2023, sets ambitious targets for waste reduction and resource efficiency, directly impacting industries like healthcare.

Coloplast must proactively address the lifecycle management of its products, from material sourcing to disposal. This includes exploring innovative solutions for recycling single-use medical plastics or developing take-back programs for reusable components. By integrating circularity into its operations, Coloplast can not only minimize its environmental footprint but also potentially unlock new business opportunities and enhance its brand reputation in a market increasingly sensitive to sustainability.

Climate Change and Resource Scarcity

Climate change presents tangible risks to Coloplast's operations. Extreme weather events, like the increased frequency of floods and heatwaves observed globally, could potentially disrupt manufacturing sites or vital supply chain routes, impacting product delivery.

Resource scarcity, especially concerning water and specific raw materials essential for medical devices, poses another significant challenge. For instance, in 2024, several regions experienced severe water shortages, driving up operational costs for water-intensive manufacturing processes. This scarcity can also limit the availability of key components, potentially affecting production capacity and increasing material procurement expenses.

Coloplast's proactive adaptation and mitigation strategies are therefore crucial for long-term business resilience. The company's commitment to sustainability, including efforts to reduce its carbon footprint and secure responsible sourcing of materials, directly addresses these environmental pressures.

- Physical Risks: Increased frequency of extreme weather events (floods, droughts, storms) could disrupt manufacturing and logistics.

- Resource Scarcity: Growing demand for water and specific raw materials could lead to higher operational costs and supply chain vulnerabilities.

- Mitigation Imperative: Adapting to climate change and mitigating its impacts is becoming essential for maintaining operational continuity and cost efficiency.

Stakeholder Expectations for Corporate Environmental Responsibility

Stakeholder expectations for environmental responsibility are significantly shaping corporate strategies, including those at Coloplast. Investors are increasingly scrutinizing environmental, social, and governance (ESG) performance, with a growing portion of assets under management being directed towards sustainable investments. For instance, by the end of 2024, it's projected that global sustainable investment assets could reach $50 trillion, a substantial increase that underscores this trend.

Customers, too, are demonstrating a preference for brands that align with their environmental values. A 2024 survey indicated that over 60% of consumers are willing to pay more for products from sustainable brands. This shift directly impacts market perception and purchasing decisions.

Employees are also prioritizing workplaces with a strong commitment to sustainability. Companies with robust environmental initiatives often report higher employee engagement and are more successful in attracting top talent. This is particularly relevant in the healthcare sector, where mission-driven work is highly valued.

Regulatory bodies are also tightening environmental standards, pushing companies to adopt more eco-friendly practices and transparent reporting. Coloplast, like its peers, must navigate these evolving expectations to maintain its social license to operate and enhance its brand reputation.

- Investor Scrutiny: Growing demand for ESG-focused investments, with global sustainable assets projected to exceed $50 trillion by the end of 2024.

- Consumer Preferences: Over 60% of consumers in 2024 expressed willingness to pay a premium for sustainable products.

- Talent Attraction: Companies with strong environmental programs report increased employee engagement and a competitive edge in recruitment.

- Regulatory Landscape: Increasing environmental regulations necessitate proactive adoption of sustainable practices and transparent reporting.

Coloplast's environmental strategy is increasingly shaped by global sustainability trends and regulatory pressures, particularly concerning waste reduction and resource efficiency. The company must adapt to evolving standards, such as those outlined in the European Union’s Circular Economy Action Plan, to maintain its market position and avoid penalties. Proactive investment in eco-friendly materials and waste reduction programs is essential for meeting stakeholder expectations and enhancing corporate reputation in 2024.

Climate change poses physical risks to Coloplast's operations through extreme weather events that could disrupt manufacturing and logistics, alongside resource scarcity impacting water and raw material availability. For example, water shortages in 2024 increased operational costs for water-intensive manufacturing. Adapting to these challenges through carbon footprint reduction and responsible sourcing is vital for business resilience and cost efficiency.

Stakeholder expectations, driven by a surge in ESG investing and consumer preferences for sustainable brands, are significantly influencing Coloplast's strategic direction. With global sustainable investment assets projected to exceed $50 trillion by the end of 2024, and over 60% of consumers willing to pay more for sustainable products, environmental responsibility is a key differentiator. Furthermore, strong environmental programs aid in attracting and retaining top talent.

| Environmental Factor | Impact on Coloplast | Data/Trend (2023-2024) |

| Sustainability Awareness | Increased scrutiny on environmental footprint, driving demand for eco-friendly practices. | Global sustainable investment assets projected to exceed $50 trillion by end of 2024. |

| Regulatory Environment | Stricter regulations on waste, emissions, and resource use, impacting product design and disposal. | EU Circular Economy Action Plan (updated 2023) emphasizes waste reduction and sustainable design. |

| Climate Change | Physical risks from extreme weather events; resource scarcity impacting operations and costs. | Water shortages in 2024 increased operational costs for water-intensive manufacturing. |

| Stakeholder Expectations | Growing demand for ESG performance from investors; consumer preference for sustainable brands. | Over 60% of consumers in 2024 willing to pay more for sustainable products. |

PESTLE Analysis Data Sources

Our Coloplast PESTLE Analysis is meticulously constructed using data from reputable sources such as the World Health Organization, regulatory bodies like the FDA and EMA, and leading market research firms specializing in the medical device industry. We also incorporate insights from economic indicators and reports on social and technological trends relevant to healthcare.