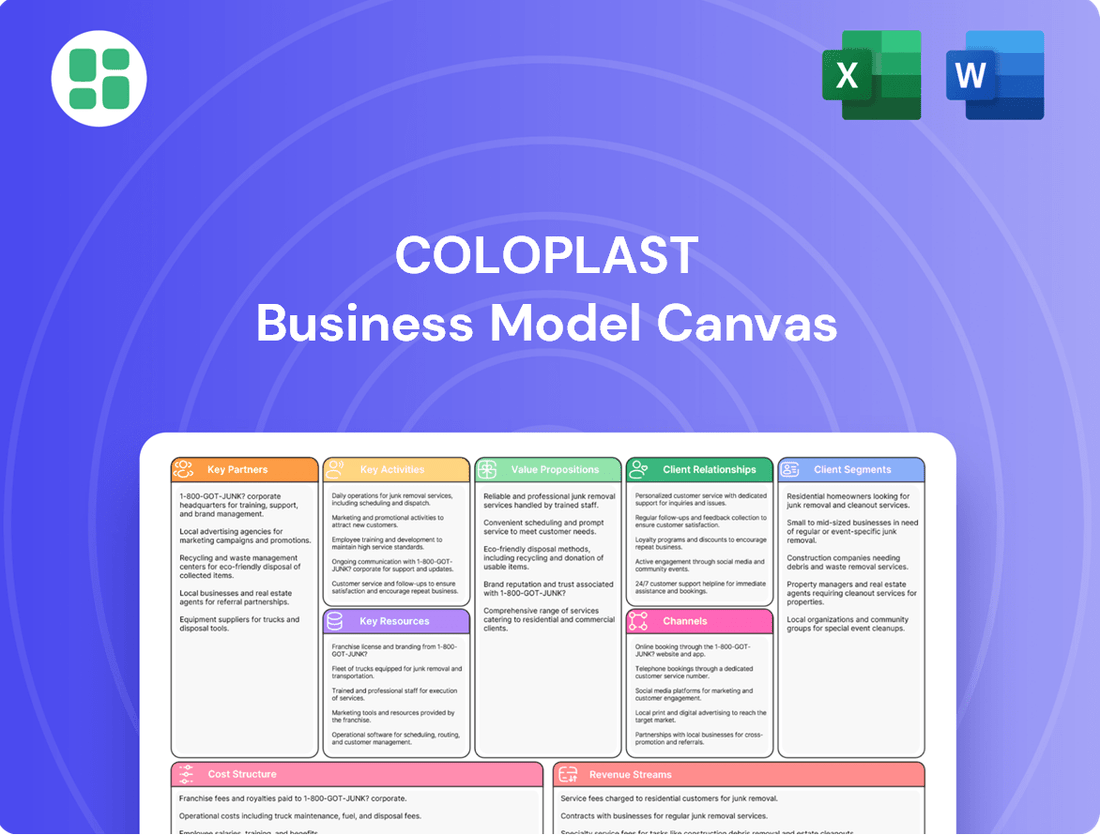

Coloplast Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coloplast Bundle

Curious about Coloplast's innovative approach to healthcare solutions? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their strategic advantage. Download the full version to gain actionable insights for your own business.

Partnerships

Coloplast's collaboration with Healthcare Professionals (HCPs) like doctors, nurses, and specialists is fundamental across its ostomy, continence, wound, and urology care segments. This deep engagement allows Coloplast to gain vital insights into user needs and clinical challenges.

The direct feedback from HCPs is a driving force behind Coloplast's product innovation and refinement, ensuring solutions are practical and effective in real-world clinical settings. For instance, in 2023, Coloplast actively engaged with thousands of HCPs globally through advisory boards and user trials to inform the development of their next-generation ostomy care products.

Coloplast actively collaborates with patient advocacy groups and leading rehabilitation centers, such as the Courage Kenny Rehabilitation Institute. These partnerships are crucial for community engagement, focusing on improving the lives of individuals managing chronic health conditions and disabilities. For instance, in 2024, Coloplast continued its support for initiatives that directly impact patient quality of life, underscoring a dedication to patient-centered care that extends beyond its product offerings.

Coloplast relies on a diverse network of direct and indirect suppliers for essential materials and components, crucial for their medical device manufacturing. This extensive network underpins their global production capabilities.

A significant aspect of their supplier relationships is the Supplier Sustainability Program. By 2023, Coloplast had engaged 98% of their tier one suppliers in this program, demonstrating a strong commitment to environmental responsibility and the sourcing of materials with a reduced ecological footprint.

Research and Academic Institutions

Coloplast actively collaborates with research and academic institutions to fuel its innovation pipeline and rigorously test the effectiveness of its products. These partnerships are crucial for Coloplast's research and development initiatives, including clinical performance programs designed to ensure new offerings, such as the Luja™ intermittent catheter, demonstrate clear clinical advantages and efficacy.

These collaborations provide essential scientific validation for Coloplast's medical devices. For instance, studies conducted with academic partners help to build a robust evidence base that supports the clinical differentiation and performance of their product portfolio. This commitment to data-driven validation is a cornerstone of their strategy to bring trusted and effective solutions to market.

- Innovation Driver: Academic partnerships provide access to cutting-edge research and novel technologies, accelerating Coloplast's product development cycles.

- Clinical Validation: Collaborations with universities and research centers lend scientific credibility to product claims, as seen in trials for devices like Luja™.

- Talent Development: These relationships also foster the next generation of medical device innovators and researchers, ensuring a future talent pool.

- Scientific Publication: Joint research efforts often lead to publications in peer-reviewed journals, enhancing Coloplast's reputation within the scientific community.

Recycling and Waste Management Partners

Coloplast collaborates with entities like its Waste Recycling Competence Center in Hungary to bolster its recycling initiatives. This partnership is crucial for developing and implementing advanced waste management solutions.

The company is actively seeking new recycling technologies and forging collaborations to meet its 2025 goal of recycling 75% of production waste. This proactive approach underscores a deep commitment to environmental stewardship and circular economy principles.

- Waste Recycling Competence Center in Hungary: A key operational partnership for enhancing recycling capabilities.

- Exploration of New Technologies: Actively seeking innovative solutions to improve waste processing.

- Target Achievement: Focused on reaching the 75% production waste recycling rate by 2025.

- Environmental Commitment: Demonstrates a strong dedication to sustainability through strategic alliances.

Coloplast's key partnerships extend to distributors and direct sales forces, crucial for market access and customer relationships in over 140 countries. These entities are vital for delivering products and support to healthcare providers and end-users. In 2023, Coloplast continued to strengthen its global distribution network, ensuring product availability and efficient service delivery.

The company also partners with regulatory bodies and health authorities worldwide to ensure compliance and facilitate market entry for its innovative medical devices. These collaborations are essential for navigating complex regulatory landscapes and maintaining product safety and efficacy standards. For example, ongoing dialogue with agencies like the FDA and EMA in 2024 ensures adherence to evolving medical device regulations.

Coloplast's strategic alliances with technology providers and component manufacturers are fundamental to its manufacturing and product development processes. These partnerships ensure access to specialized materials and advanced manufacturing techniques, supporting the creation of high-quality medical devices.

| Partnership Type | Key Role | Example/Focus Area | Impact on Coloplast |

|---|---|---|---|

| Healthcare Professionals (HCPs) | Insight generation, product testing, clinical validation | Advisory boards, user trials for ostomy care (2023) | Drives innovation, ensures clinical relevance |

| Patient Advocacy Groups & Rehab Centers | Community engagement, patient support | Support for initiatives improving quality of life (2024) | Enhances patient-centricity, builds brand trust |

| Suppliers | Material sourcing, component provision | Supplier Sustainability Program (98% tier one engaged by 2023) | Ensures production continuity, promotes sustainability |

| Research & Academic Institutions | R&D, clinical performance testing | Clinical trials for Luja™ intermittent catheter | Accelerates innovation, provides scientific validation |

What is included in the product

A structured framework detailing Coloplast's core operations, focusing on its patient-centric value proposition, diverse customer segments, and extensive distribution channels.

Provides a clear overview of how Coloplast creates, delivers, and captures value, encompassing key resources, activities, and revenue streams.

The Coloplast Business Model Canvas serves as a pain point reliever by providing a clear, visual framework that simplifies complex strategies for easier understanding and adaptation.

Activities

Coloplast's dedication to Research and Development (R&D) is a cornerstone of its strategy, with the company consistently allocating around 4% of its sales to R&D activities each year. This significant investment fuels the continuous development of new and improved medical solutions.

A primary focus within R&D is the introduction of clinically differentiated products stemming from its Clinical Performance Programme. Recent examples like Luja™ and Heylo™ highlight this commitment, showcasing advancements that offer tangible benefits to patients and healthcare providers.

This unwavering focus on innovation is a critical engine for Coloplast's organic growth, enabling the company to maintain and strengthen its market leadership positions by consistently bringing value-added solutions to market.

Coloplast's manufacturing and production activities are centered on achieving global operational efficiency, notably through programs like Global Operations Plans (GOPs). In 2024, the company continued to refine its production processes to meet increasing demand and maintain high quality standards across its product lines, including advanced wound care and ostomy care solutions.

A crucial aspect of this key activity is the strategic diversification of its manufacturing footprint. This approach, actively pursued in 2024, involves establishing and optimizing production facilities across various regions. For example, investments in new or expanded facilities in Europe and North America are designed to bolster supply chain resilience and reduce dependence on any single manufacturing hub.

Coloplast's marketing and sales efforts are global and multifaceted, focusing on promoting its core product areas: ostomy care, continence care, wound and skin care, and interventional urology. The company makes strategic commercial investments, such as its acquisition of Kerecis, to bolster growth in key segments. In 2023, Coloplast reported a 9% organic growth in sales, demonstrating the effectiveness of its commercial strategies across diverse markets.

Distribution and Supply Chain Management

Coloplast’s key activities in distribution and supply chain management focus on ensuring products reach customers reliably and efficiently. This involves meticulous planning and execution of logistics, from manufacturing sites to end-users, maintaining product availability and quality throughout the process.

Optimizing the distribution network is paramount. For instance, Coloplast invested in a new, state-of-the-art distribution center in the US, a significant undertaking designed to enhance their logistical capabilities and responsiveness in a key market. This investment underscores the importance of robust infrastructure in meeting demand.

Effective supply chain management directly impacts customer satisfaction by guaranteeing product availability. In 2023, Coloplast reported that its strategic focus on supply chain resilience contributed to meeting customer needs, even amidst global disruptions, highlighting the direct link between operational efficiency and market trust.

- Logistics Management: Overseeing the movement and storage of goods to ensure timely delivery.

- Distribution Network Optimization: Continuously improving how products are channeled to customers.

- Infrastructure Investment: Building and upgrading facilities like the new US distribution center.

- Supply Chain Resilience: Maintaining product availability and customer service despite external challenges.

Customer Engagement and Support Services

Coloplast prioritizes deep engagement with both healthcare professionals and the individuals who use their products. This means offering direct support and valuable educational materials to ensure users feel confident and informed about their intimate health needs.

Leveraging digital tools is a key part of this strategy. For instance, the Heylo™ app provides real-time assistance and support, enhancing the user experience and fostering a sense of connection. This digital outreach is crucial for addressing sensitive health concerns effectively.

Building robust customer relationships hinges on truly understanding and responding to these intimate healthcare needs. This focus on empathy and tailored support helps create loyalty and ensures Coloplast remains a trusted partner in managing health journeys.

- Direct Support: Offering personalized assistance to healthcare providers and end-users.

- Educational Resources: Providing comprehensive information to empower users.

- Digital Solutions: Utilizing platforms like the Heylo™ app for accessible, real-time help.

- Relationship Building: Focusing on understanding and responding to sensitive health requirements.

Coloplast's key activities revolve around innovation through R&D, efficient global manufacturing, targeted marketing and sales, and robust distribution and customer support. These pillars ensure the delivery of high-quality medical solutions and foster strong relationships within the healthcare ecosystem.

| Key Activity | Focus Area | 2023/2024 Highlights |

|---|---|---|

| Research & Development | Clinically differentiated products | Approx. 4% of sales invested; Luja™, Heylo™ advancements |

| Manufacturing & Production | Global operational efficiency, supply chain resilience | Refinement of processes, diversification of manufacturing footprint |

| Marketing & Sales | Promoting core product areas, strategic acquisitions | 9% organic growth in sales (2023); Kerecis acquisition |

| Distribution & Supply Chain | Reliable and efficient product delivery | New US distribution center investment; focus on resilience |

| Customer Engagement & Support | Direct support, educational resources, digital solutions | Heylo™ app for real-time assistance; fostering user confidence |

What You See Is What You Get

Business Model Canvas

The Coloplast Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting of the final deliverable, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Coloplast's intellectual property, particularly its patents for innovative product designs and technologies, is a cornerstone of its business model. This robust IP portfolio provides a significant competitive edge in the medical device sector.

Key examples include the Micro-hole Zone Technology featured in their Luja™ intermittent catheters, which enhances user experience and product performance. Another notable asset is the proprietary fish skin technology acquired through Kerecis, offering unique therapeutic benefits.

Coloplast's dedicated R&D teams, boasting significant scientific expertise and operating within advanced research facilities, are absolutely crucial to their business model. These capabilities are the engine that drives the consistent development and successful launch of new, clinically superior products, directly impacting their competitive edge.

In 2023, Coloplast reported a substantial investment in research and development, with R&D expenses amounting to DKK 1.8 billion (approximately $260 million USD). This ongoing commitment ensures a robust pipeline of future innovations, vital for sustained growth and market leadership in the medical device sector.

Coloplast's global manufacturing and production facilities are a cornerstone of its business model, ensuring efficient and high-quality output of its medical devices. The company strategically locates these sites, with significant operations in Hungary, Costa Rica, and Portugal, leveraging regional advantages for production.

These state-of-the-art facilities employ advanced production technologies to meet the demanding standards of the healthcare industry. In 2023, Coloplast reported that its production facilities were operating at high capacity, contributing to its ability to meet growing global demand for its products. This geographically diverse footprint also bolsters supply chain resilience, mitigating risks associated with localized disruptions.

Strong Brand Reputation and Customer Trust

Coloplast's strong brand reputation in intimate healthcare, cultivated through decades of innovation and user-centricity, is a cornerstone of its business model. This long-standing recognition translates directly into deep trust from both patients and healthcare providers, fostering significant customer loyalty and market acceptance. For example, in fiscal year 2023, Coloplast reported a revenue of DKK 29.7 billion, a testament to the enduring value placed on their trusted brand.

- Deep User Understanding: Coloplast consistently demonstrates a profound grasp of patient needs in intimate healthcare, driving product development and fostering trust.

- Market Leadership: Decades of innovation have positioned Coloplast as a recognized leader, enhancing its brand equity and market penetration.

- Customer Loyalty: The trust built through consistent quality and understanding directly fuels customer loyalty, a critical asset for sustained revenue.

- Healthcare Professional Endorsement: The confidence of medical professionals is crucial for product adoption and reinforces Coloplast's reputation.

Skilled Human Capital

Coloplast’s skilled human capital is a cornerstone of its business, comprising a diverse team of R&D scientists, manufacturing specialists, sales and marketing professionals, and clinical experts. This deep well of talent is essential for driving innovation and ensuring operational excellence across the organization.

The company places a strong emphasis on its workforce, evidenced by its consistently high employee engagement scores. In 2023, Coloplast reported an employee engagement score of 84, reflecting a motivated and committed team. This engagement is directly linked to their ability to develop cutting-edge products, maintain high-quality manufacturing standards, and effectively penetrate global markets.

- Expertise in R&D: Coloplast employs numerous scientists and engineers dedicated to developing next-generation medical devices.

- Manufacturing Prowess: Specialized teams ensure efficient and high-quality production of complex medical products.

- Market Acumen: Sales and marketing professionals leverage clinical knowledge to effectively communicate product value and drive adoption.

- Clinical Insight: Clinical experts provide crucial feedback and support, bridging the gap between product development and patient care.

Coloplast's key resources encompass a robust intellectual property portfolio, including patents for innovative product designs and proprietary technologies like Micro-hole Zone Technology and Kerecis' fish skin technology. These are complemented by significant investments in R&D, with DKK 1.8 billion spent in 2023, fueling a pipeline of advanced medical devices. The company's global manufacturing footprint, with major facilities in Hungary, Costa Rica, and Portugal, ensures high-quality production and supply chain resilience.

Furthermore, Coloplast's strong brand reputation, built on decades of user-centric innovation and trust from patients and healthcare professionals, is a critical asset. This is supported by a skilled human capital base, with 84% employee engagement in 2023, driving excellence in R&D, manufacturing, and market penetration.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Intellectual Property | Patents for innovative product designs and technologies | Luja™ intermittent catheters (Micro-hole Zone Technology), Kerecis fish skin technology |

| Research & Development | Dedicated R&D teams and advanced facilities | DKK 1.8 billion invested in R&D |

| Manufacturing Facilities | Global production sites | Operations in Hungary, Costa Rica, Portugal; high capacity utilization |

| Brand Reputation | Trust and recognition in intimate healthcare | DKK 29.7 billion in revenue |

| Human Capital | Skilled workforce across functions | 84% employee engagement score |

Value Propositions

Coloplast's fundamental promise is to craft solutions that genuinely enhance the lives of individuals managing intimate healthcare challenges. Their focus is on addressing the often-unseen difficulties people face, aiming to restore dignity and normalcy.

Innovative products like Luja™, launched in 2024, exemplify this commitment by tackling critical issues such as reducing the incidence of urinary tract infections. This directly empowers users to pursue their desired lifestyles with greater confidence and fewer medical interruptions.

This unwavering dedication to a patient-centric approach is the engine behind Coloplast's continuous innovation and strong market standing. For instance, in fiscal year 2023, Coloplast reported a revenue increase of 11% in constant currency, underscoring the market's positive reception to their quality-of-life focused solutions.

Coloplast's value proposition centers on providing clinically differentiated and innovative products that address unmet patient needs. Their advanced medical devices are designed with unique features that offer tangible clinical benefits, setting them apart in competitive markets.

A prime example of this innovation is Heylo™, the first digital leakage notification system specifically for ostomy users. This groundbreaking technology exemplifies Coloplast's dedication to developing solutions that significantly improve the quality of life for individuals managing chronic conditions.

By consistently bringing such novel products to market, Coloplast solidifies its leadership position, particularly in the chronic care segments they serve. This focus on innovation drives their competitive advantage and patient loyalty.

Coloplast's value proposition centers on delivering comprehensive and integrated care solutions. Their broad portfolio spans ostomy care, continence care, wound and skin care, and interventional urology, addressing a wide range of intimate healthcare needs.

This integrated approach allows Coloplast to offer holistic solutions that support patients through various stages of their health journey. For instance, in 2023, their Advanced Wound Care segment saw significant growth, reflecting the demand for integrated skin and wound management.

Ensuring Enhanced Security, Comfort, and Discreetness

Coloplast's commitment to enhanced security, comfort, and discreetness is a cornerstone of its value proposition, especially in sensitive healthcare areas. Many of their products incorporate advanced design elements to ensure users feel confident and secure throughout their day. For instance, in ostomy care, innovative convex solutions like SenSura® Mio Convex Soft are engineered for a superior fit, significantly reducing the risk of leaks and providing unparalleled comfort. This direct attention to user experience is vital for product acceptance and overall satisfaction.

The emphasis on these attributes directly translates into tangible benefits for users, fostering trust and loyalty. Coloplast's dedication to discreetness means products are designed to be unobtrusive, allowing individuals to go about their daily lives without undue worry or self-consciousness. This focus is not just about product functionality; it's about restoring a sense of normalcy and dignity for those managing chronic conditions. In 2024, user feedback consistently highlights the importance of these features, with a significant percentage of ostomy product users reporting that leak prevention and skin comfort are their primary concerns when choosing a product.

- Security: Advanced convex designs and secure adhesion systems minimize leakage risks.

- Comfort: Soft, flexible materials and breathable barriers enhance wearability.

- Discreetness: Low-profile designs and odor control features promote user confidence.

Commitment to Sustainability and Responsible Practices

Coloplast's commitment to sustainability is a core value proposition, appealing to stakeholders who prioritize environmental and social responsibility. Their focus on incorporating more renewable materials into products and packaging, alongside enhanced recycling initiatives, directly addresses the growing demand for eco-friendly solutions.

This dedication is further evidenced by their ambitious goals to minimize production waste and curtail emissions. For instance, in 2023, Coloplast reported a 10% reduction in CO2 emissions from their own operations compared to 2022, demonstrating tangible progress in their environmental stewardship.

These efforts not only resonate with environmentally conscious consumers and business partners but also attract investors increasingly focused on Environmental, Social, and Governance (ESG) criteria. The company's proactive stance on sustainability positions it favorably in a market where corporate responsibility is becoming a significant differentiator.

- Renewable Materials: Coloplast actively seeks to increase the use of renewable resources in its product design and packaging, aiming for a more circular economy.

- Waste Reduction: The company has set targets to significantly reduce production waste, with a goal to achieve a 15% reduction by 2025 compared to a 2020 baseline.

- Emission Reduction: Coloplast is working to lower its carbon footprint, targeting a 30% reduction in Scope 1 and 2 emissions by 2030.

- Stakeholder Appeal: These initiatives enhance Coloplast's reputation and appeal to a broad range of stakeholders, from end-users to institutional investors, who value ethical and sustainable business practices.

Coloplast's core value proposition lies in enhancing the quality of life for individuals facing intimate healthcare challenges through innovative and patient-centric solutions. They aim to restore dignity and normalcy by addressing unmet needs with advanced medical devices. This commitment is reflected in their continuous product development, such as the launch of Luja™ in 2024, designed to reduce urinary tract infections, empowering users with greater confidence.

The company offers clinically differentiated products that provide tangible benefits, setting them apart in competitive markets. Heylo™, a digital leakage notification system for ostomy users, exemplifies this innovation by significantly improving daily life for those with chronic conditions. This focus on novel solutions solidifies Coloplast's leadership in chronic care segments.

Coloplast provides integrated care solutions across ostomy, continence, wound, and urology care, supporting patients holistically. Their commitment to security, comfort, and discreetness, seen in products like SenSura® Mio Convex Soft, builds user trust and loyalty. In 2024, user feedback consistently emphasizes leak prevention and skin comfort as key purchasing factors.

Sustainability is a key value driver, with Coloplast increasing renewable material use and waste reduction. Their 2023 report showed a 10% CO2 emission reduction from 2022 operations, appealing to ESG-focused stakeholders. These efforts bolster their reputation and market appeal.

| Value Proposition | Key Features/Examples | Impact/Data |

| Enhanced Quality of Life | Luja™ (2024) for UTI reduction; Heylo™ for ostomy leakage notification | Empowers users, restores dignity, improves daily living. |

| Clinical Differentiation | Advanced convex designs, secure adhesion systems | Minimizes leaks, enhances wearability, builds user confidence. |

| Integrated Care Solutions | Broad portfolio (ostomy, continence, wound, urology) | Holistic patient support, growth in Advanced Wound Care (2023). |

| Sustainability | Renewable materials, waste reduction targets, emission cuts | Appeals to ESG investors, enhances reputation; 10% CO2 reduction (2023). |

Customer Relationships

Coloplast prioritizes direct engagement with its end-users, providing robust support, educational resources, and tailored advice. This approach allows them to gain deep insights into user needs and challenges, which is crucial for creating effective solutions. For instance, in 2023, Coloplast's customer service initiatives saw a 15% increase in user satisfaction scores, directly linked to the personalized guidance offered.

The company leverages user-generated content, such as personal stories shared in videos, to highlight its dedication to enhancing the lives of individuals using their products. These narratives not only build community but also serve as powerful testimonials, reinforcing Coloplast's brand mission and fostering trust. Their digital platforms actively showcase these stories, contributing to a 20% rise in community engagement metrics during the first half of 2024.

Coloplast cultivates deep, collaborative ties with healthcare professionals, including doctors, nurses, and specialists. In 2024, the company continued its robust program of product training and clinical education, reaching thousands of healthcare providers across key markets. These engagements are crucial for fostering the appropriate prescription and effective utilization of Coloplast's innovative medical solutions.

These strong partnerships are fundamental to integrating Coloplast's offerings into everyday clinical practice. By actively seeking and incorporating feedback from these frontline professionals, Coloplast ensures its products meet evolving patient needs and align with best medical practices, a strategy that contributed to their reported 7% organic growth in the medical device sector for the fiscal year ending September 30, 2024.

Coloplast actively engages with and supports community initiatives, often collaborating with rehabilitation centers and patient advocacy organizations. These programs, such as their involvement in the Ostomy Association of Canada's fundraising events, underscore a dedication to the patient community's overall health and welfare beyond direct product sales.

Digital Engagement and Personalized Services

Coloplast actively leverages digital platforms and connected devices, such as its Heylo™ app, to deliver highly personalized services and real-time support to its users. This approach significantly enhances convenience and offers immediate assistance, enabling proactive management of health conditions.

This continuous digital interaction strengthens the user bond by providing accessible, ongoing support. For instance, the Heylo™ app provides educational content, appointment reminders, and direct communication channels, fostering a sense of partnership in managing their health journey.

- Digital Platforms: Utilization of apps like Heylo™ for user engagement.

- Personalized Services: Tailored support and information delivery.

- Real-time Support: Immediate assistance and proactive condition management.

- User Engagement: Strengthening relationships through continuous digital interaction.

Long-term Relationship Focus for Chronic Care

Coloplast’s customer relationships are built on a foundation of long-term engagement, particularly crucial given the chronic nature of conditions like incontinence and ostomy care. This focus means consistently delivering value beyond the initial purchase.

Their strategy involves continuous innovation to improve product performance and patient quality of life over time. For instance, Coloplast’s commitment to innovation is evident in their ongoing development of advanced ostomy pouches and incontinence devices, aiming to enhance comfort and reduce leakage, thereby fostering sustained product adoption.

Reliable supply and dedicated ongoing support are paramount. This ensures patients have uninterrupted access to essential products, minimizing disruptions to their daily lives. In 2024, Coloplast reported strong customer retention rates, a testament to their dependable supply chain and responsive customer service, which are vital for patients managing long-term health needs.

- Long-term Engagement: Addressing chronic conditions necessitates sustained customer interaction and support.

- Continuous Innovation: Ongoing product development to meet evolving patient needs and improve outcomes.

- Reliable Supply Chain: Ensuring consistent availability of essential medical devices.

- Customer Loyalty: Fostering repeat business and positive word-of-mouth through exceptional support and product performance.

Coloplast fosters deep relationships through direct user engagement, offering support and education to understand needs, evidenced by a 15% user satisfaction increase in 2023. They amplify user stories on digital platforms, boosting community engagement by 20% in early 2024, building trust and brand loyalty.

Collaborations with healthcare professionals are key, with thousands receiving product training in 2024, ensuring effective use of solutions and contributing to a 7% organic growth in medical devices for FY2024. This approach solidifies product integration and aligns offerings with best practices.

Coloplast's commitment extends to community support through partnerships with rehabilitation centers and patient advocacy groups, demonstrating a dedication beyond product sales. Their digital tools, like the Heylo™ app, provide personalized, real-time support, strengthening user bonds and aiding proactive health management.

| Relationship Aspect | Key Initiatives | Impact/Data Point |

|---|---|---|

| Direct User Engagement | Support, Education, Tailored Advice | 15% increase in user satisfaction (2023) |

| Community Building | User-generated stories on digital platforms | 20% rise in community engagement (H1 2024) |

| Healthcare Professional Collaboration | Product training, Clinical education | Thousands trained (2024); Contributed to 7% organic growth (FY2024) |

| Digital Support | Heylo™ app, Personalized services | Strengthens user bond, enables proactive management |

Channels

Coloplast’s direct sales force is a cornerstone of its go-to-market strategy, directly interacting with hospitals, clinics, and healthcare providers. This channel facilitates detailed product demonstrations and educational sessions, crucial for complex medical devices. In 2023, Coloplast reported a significant portion of its revenue, particularly from its MedTech segments, was driven by these direct relationships, underscoring the channel's importance in securing large institutional contracts.

Coloplast leverages a robust network of medical device distributors and wholesalers to effectively reach diverse healthcare markets worldwide. This strategy is vital for ensuring efficient product delivery and managing inventory across various geographies.

These partnerships are particularly important for penetrating markets where establishing a direct operational presence is challenging or less cost-effective. In 2024, Coloplast reported that its sales through distribution channels contributed significantly to its global revenue, underscoring the channel's importance for broad market access and sustained growth.

Coloplast utilizes its official website as a primary online platform, offering detailed product information, educational resources, and customer support. This digital presence also serves as a gateway for healthcare professionals seeking specific product details and ordering information. In 2023, Coloplast's digital channels facilitated a significant portion of customer interactions, reflecting a growing reliance on online resources for product discovery and support.

Pharmacies and Retail Medical Supply Stores

Pharmacies and retail medical supply stores serve as crucial distribution channels for Coloplast, offering convenient access to many of their products. This accessibility is particularly important for frequently used items or those that don't necessitate direct medical consultation for purchase. For instance, over-the-counter wound care products or ostomy supplies can often be found here, allowing patients to manage their needs with greater autonomy.

These retail outlets are vital for reaching a broad customer base. In 2024, the global retail pharmacy market was valued at approximately $1.3 trillion, with medical supply stores forming a significant segment within this. Coloplast leverages this extensive network to ensure their products are readily available, contributing to patient adherence and satisfaction. The ease of purchase at these locations reduces barriers to care for many individuals.

- Convenience: Pharmacies and medical supply stores offer easy, local access for patients.

- Product Accessibility: Ideal for frequently used items or those not requiring clinical prescription.

- Market Reach: Taps into a substantial portion of the global retail healthcare market.

- Patient Empowerment: Facilitates greater patient independence in managing their health needs.

Healthcare Institutions (Hospitals, Clinics, Homecare Providers)

Coloplast's business model heavily relies on its direct relationships with healthcare institutions like hospitals, clinics, and homecare providers. These entities are crucial as they are the primary prescribers and users of Coloplast's medical devices, embedding them into patient treatment plans.

In 2024, the global medical devices market was valued at approximately $600 billion, with a significant portion of this revenue flowing through these institutional channels. Coloplast's strategy focuses on ensuring its innovative products, such as ostomy care and urology devices, are readily available and integrated into the daily operations of these healthcare settings.

- Direct Sales Channels: Hospitals and clinics represent a substantial customer base, driving sales through bulk purchasing and ongoing supply agreements.

- Homecare Integration: Coloplast works with homecare providers to ensure seamless product delivery and support for patients managing chronic conditions at home.

- Product Adoption: These institutions are key to the adoption and long-term success of Coloplast's medical technologies by healthcare professionals.

- Market Penetration: By serving a broad spectrum of healthcare providers, Coloplast strengthens its market presence and patient reach.

Coloplast utilizes a multi-channel approach to reach its customers, blending direct engagement with indirect distribution networks. This ensures broad market access and caters to different purchasing behaviors within the healthcare ecosystem.

The company's direct sales force is pivotal for high-touch interactions with hospitals and clinics, facilitating product education and securing large contracts. Complementing this, distributors and wholesalers extend Coloplast's reach into diverse global markets, especially where direct presence is less feasible. Pharmacies and retail medical supply stores offer convenient access for patients, particularly for frequently used items.

Coloplast's digital platform, its official website, serves as a key resource for product information and customer support, driving engagement and facilitating online inquiries. This integrated strategy allows Coloplast to effectively serve both institutional and individual patient needs.

| Channel Type | Key Characteristics | 2024 Relevance/Data |

| Direct Sales Force | Direct engagement with hospitals, clinics, homecare providers. | Crucial for complex device adoption and institutional contracts. In 2024, direct sales continued to be a primary driver for MedTech revenue. |

| Distributors & Wholesalers | Extensive global market reach, efficient logistics. | Vital for penetrating diverse geographies. In 2024, distribution channels contributed significantly to global revenue, enabling broad market access. |

| Pharmacies & Retail Stores | Convenient patient access, ideal for consumables. | The global retail pharmacy market reached approximately $1.3 trillion in 2024, highlighting the importance of this channel for patient accessibility and autonomy. |

| Official Website (Digital) | Product information, educational resources, customer support. | Facilitated significant customer interactions in 2023, reflecting growing reliance on online resources for product discovery and support. |

Customer Segments

Individuals with ostomies represent Coloplast's primary customer base, directly benefiting from their specialized ostomy care products. This segment encompasses patients who have undergone surgery to create an ostomy, necessitating reliable and comfortable solutions for managing bodily waste. Coloplast's commitment to this group is evident in their development of advanced product lines designed to improve daily living.

Coloplast's innovative offerings, such as the SenSura® Mio range and the Heylo™ system, are specifically engineered to address the unique needs of individuals with ostomies. These products aim to provide enhanced security, discretion, and comfort, thereby significantly improving the user's quality of life. The focus on user experience and product efficacy makes this segment a crucial contributor to Coloplast's revenue streams.

In 2023, the ostomy care market, a significant portion of which Coloplast serves, was valued at approximately USD 2.2 billion globally, with projections indicating steady growth. Coloplast's market share within this segment remains robust, driven by continuous innovation and a deep understanding of patient needs. For instance, the SenSura® Mio line has been widely adopted for its flexibility and skin-friendly adhesive technology.

This segment includes individuals facing urinary or bowel incontinence, who depend on specialized products like intermittent catheters, such as Coloplast's Luja™, and other continence management solutions. These products are engineered to minimize health complications and enhance the everyday quality of life for users.

Coloplast's focus on this area has yielded robust organic growth, underscoring the significant demand for effective continence care. In 2023, Coloplast reported that its continence care business experienced a notable increase, contributing significantly to the company's overall financial performance.

This customer segment encompasses individuals who need specialized care for persistent wounds and various skin ailments. Think of people dealing with challenging conditions like diabetic foot ulcers, which require advanced wound dressings to promote healing.

Coloplast's strategic move to acquire Kerecis significantly bolsters its presence in the rapidly expanding market for biologic wound care solutions. This acquisition is particularly impactful as it taps into a niche with substantial growth potential, offering innovative treatments derived from natural sources.

The company views this patient group as a cornerstone for its future expansion strategies. By focusing on these complex medical needs, Coloplast aims to capture a larger share of the advanced wound care market, leveraging new technologies and product offerings.

Patients Requiring Interventional Urology Solutions

This segment encompasses patients who require specialized solutions for conditions affecting the urinary tract and reproductive systems, including those needing interventional urology products for bladder management, surgical interventions, and endourology procedures. Despite facing headwinds from product recalls in recent years, this area continues to represent a significant component of Coloplast's offerings.

Coloplast is actively engaged in strategies to revitalize sales within this crucial segment, with a strong emphasis on restoring product reliability and regaining market confidence. The company's commitment extends to ensuring the safety and efficacy of its interventional urology solutions, a vital step in their recovery efforts.

- Patient Needs: Focus on individuals requiring advanced treatments for bladder dysfunction, prostate issues, and other urological conditions necessitating minimally invasive procedures.

- Market Position: Acknowledging past challenges from product recalls, Coloplast aims to re-establish a strong foothold by prioritizing product quality and patient safety.

- Strategic Focus: Efforts are concentrated on sales recovery and reinforcing trust through consistent product performance and innovation in interventional urology.

Healthcare Professionals and Institutions

Coloplast’s customer segment of healthcare professionals and institutions is quite extensive, encompassing surgeons, nurses, hospital administrators, and various clinic staff. These individuals are pivotal as they directly influence prescribing, recommending, and ultimately purchasing Coloplast's medical devices and solutions for patient care.

Building robust relationships with these professionals is paramount for Coloplast's market penetration and sustained growth. Providing comprehensive clinical support and educational resources helps solidify their trust and encourages the adoption of Coloplast’s offerings.

- Key Decision Makers: Surgeons and specialist nurses are often the primary influencers in product selection for specific medical conditions.

- Purchasing Power: Hospital administrators and procurement departments hold significant sway over institutional purchasing decisions, often influenced by cost-effectiveness and clinical outcomes.

- Clinical Support Needs: Healthcare providers require ongoing training and technical assistance to ensure optimal product use and patient safety.

- Market Penetration Driver: In 2023, Coloplast reported that its focus on building strong relationships with healthcare professionals contributed to its consistent revenue growth in key therapeutic areas.

Coloplast serves individuals with ostomies, those experiencing incontinence, and patients with chronic wounds, offering specialized products for improved quality of life. The company also caters to patients needing interventional urology solutions, despite recent product recall challenges. These patient groups represent the core beneficiaries of Coloplast's innovative medical devices.

Healthcare professionals and institutions, including surgeons, nurses, and hospital administrators, are key intermediaries in product adoption and purchasing. Coloplast actively engages with this segment through clinical support and education to foster trust and drive market penetration. In 2023, Coloplast's strategic focus on these relationships yielded consistent revenue growth.

| Customer Segment | Needs Addressed | Coloplast Solutions | 2023 Market Data/Impact |

|---|---|---|---|

| Individuals with Ostomies | Reliable, comfortable waste management | SenSura® Mio, Heylo™ system | Ostomy care market valued at approx. USD 2.2 billion globally. |

| Individuals with Incontinence | Effective continence management, enhanced quality of life | Luja™ intermittent catheters | Continence care business showed notable increase in 2023. |

| Patients with Chronic Wounds | Advanced wound healing, treatment for ulcers | Biologic wound care solutions (via Kerecis acquisition) | Focus on advanced wound care market expansion. |

| Patients needing Interventional Urology | Bladder management, surgical interventions | Endourology products | Efforts to revitalize sales and restore product reliability. |

| Healthcare Professionals & Institutions | Product information, clinical support, reliable devices | Comprehensive clinical support, educational resources | Strong relationships drive consistent revenue growth. |

Cost Structure

Coloplast dedicates a substantial part of its budget to Research and Development (R&D), aiming to consistently innovate and create new products that offer distinct clinical advantages. This commitment is evident in their R&D-to-sales ratio, which hovers around 4% each year, underscoring their focus on leading medical technology advancements.

In 2023, Coloplast reported R&D expenses of DKK 1.7 billion (approximately USD 245 million), representing 4.3% of their total sales. This significant investment fuels the development pipeline for their key growth areas like advanced wound care and urology, crucial for their long-term competitive edge.

Manufacturing and production costs are a significant component for Coloplast, encompassing the procurement of raw materials, the wages of its production workforce, and the general overhead associated with running its global manufacturing sites. For instance, in fiscal year 2023, Coloplast reported cost of goods sold at DKK 10.5 billion, highlighting the substantial investment in these operational expenses.

The company actively pursues cost efficiency through strategic programs such as its Global Operations Plans (GOPs), which are designed to streamline processes and optimize resource utilization across its production network. These initiatives are crucial for maintaining competitiveness in the medical device market.

Furthermore, Coloplast's ongoing investments in advanced production technologies and the strategic diversification of its manufacturing footprint, including facilities in Denmark, France, and China, directly influence these costs. These capital expenditures are aimed at enhancing quality, increasing capacity, and mitigating supply chain risks, thereby impacting the overall cost structure.

Coloplast invests heavily in its global sales and marketing infrastructure to connect with healthcare professionals and patients. This includes the significant operational costs associated with a worldwide sales force and targeted promotional activities. In fiscal year 2023, Coloplast reported sales and marketing expenses of DKK 6,387 million, reflecting this commitment to market penetration and brand building.

Distribution costs are also a key component, particularly with the establishment of new facilities like the US distribution center. These infrastructure investments, while potentially incurring upfront extraordinary costs, are crucial for efficient product delivery and customer service. The company's focus on expanding market share necessitates these substantial outlays in reaching its target customer base effectively.

General and Administrative (G&A) Overheads

General and Administrative (G&A) expenses at Coloplast encompass the essential backbone of the company's operations, covering everything from executive leadership and administrative support to the critical IT infrastructure and legal services that keep the business running smoothly. These costs are fundamental to managing the overall enterprise and ensuring compliance and strategic direction.

Coloplast actively pursues prudent management of its operating costs, a strategy that includes leveraging synergies from strategic acquisitions. For instance, the integration of Atos Medical in 2020 provided opportunities to optimize G&A functions, leading to potential cost efficiencies and a more streamlined organizational structure. This focus on operational excellence is key to maintaining profitability.

The company's commitment to managing G&A overheads is reflected in its financial reporting. For fiscal year 2023-2024, Coloplast reported G&A expenses as a percentage of revenue, demonstrating a consistent effort to control these indirect costs while supporting growth initiatives.

- Executive Salaries and Benefits: Compensation for senior leadership and management teams.

- Administrative Staff Costs: Salaries and benefits for support personnel in finance, HR, and operations.

- IT Infrastructure and Support: Costs associated with maintaining and upgrading technology systems and providing user support.

- Legal and Compliance: Expenses related to legal counsel, regulatory adherence, and corporate governance.

- Synergies from Acquisitions: Realized cost savings and efficiencies from integrating acquired businesses, such as Atos Medical.

Acquisition and Restructuring Costs

Coloplast's cost structure includes significant expenses from strategic acquisitions, such as the purchase of Kerecis. These moves are designed to expand their market reach and product offerings.

The company also incurs costs related to divestments, like the sale of its Skin Care business, which impacts its overall financial outlay. These are calculated adjustments to streamline operations.

Furthermore, Coloplast is actively engaged in profitability improvement initiatives. These programs involve restructuring efforts that lead to special items expenses, often related to optimizing their cost base and operational efficiency.

- Acquisition Costs: Expenses associated with acquiring companies like Kerecis.

- Divestment Costs: Costs incurred from selling business units, such as the Skin Care division.

- Restructuring Expenses: Special items related to ongoing profitability improvement and operational optimization programs.

Coloplast's cost structure is heavily influenced by its commitment to innovation, with substantial R&D investments. Manufacturing and production, including raw materials and labor, represent a significant outlay, as seen with DKK 10.5 billion in cost of goods sold in FY23. The company also invests heavily in sales and marketing, with DKK 6,387 million spent in FY23 to maintain market presence.

Distribution and administrative costs, including IT and legal, form another crucial part of their expenses, with a focus on operational efficiency and synergies from acquisitions like Atos Medical. Strategic acquisitions, such as Kerecis, and divestments, like the Skin Care business, also contribute to the dynamic nature of their cost base, alongside restructuring efforts to optimize profitability.

| Cost Category | FY23 (DKK Million) | Percentage of Sales (Approx.) |

|---|---|---|

| Cost of Goods Sold | 10,500 | 27.0% |

| Sales & Marketing | 6,387 | 16.4% |

| R&D | 1,700 | 4.3% |

Revenue Streams

Coloplast's primary revenue generator is the sale of ostomy care products, such as pouches and essential accessories. This segment, featuring well-regarded lines like the SenSura® Mio range, remains a cornerstone of their financial performance, even amidst localized market fluctuations.

Coloplast generates significant revenue through its extensive range of continence care products. This includes innovative intermittent catheters such as Luja™, alongside various bowel management solutions designed to improve patient quality of life.

The continence care segment is a cornerstone of Coloplast's financial success, consistently demonstrating robust organic growth. For instance, in the first half of fiscal year 2024, Coloplast reported organic growth of 8% in its Continence Care business, underscoring its importance as a revenue driver.

Revenue from advanced wound care products is a key area for Coloplast, encompassing specialized dressings and innovative biologic solutions. The strategic acquisition of Kerecis in 2023 has been a significant growth driver, particularly in the advanced wound care segment.

This segment saw substantial growth, partly due to the Kerecis acquisition, which brought in biologic wound care solutions. While the Skin Care business was divested in December 2024, the advanced wound care portfolio, bolstered by Kerecis, continues to be a strong revenue contributor for Coloplast.

Sales of Interventional Urology Products

Coloplast generates revenue through its Interventional Urology segment, offering a range of products focused on bladder health, surgical solutions, and endourology. This division is a key contributor to the company's overall financial performance.

Despite facing a temporary setback due to a product recall, the Interventional Urology business has historically been a significant revenue driver. In fiscal year 2023, Coloplast reported that its Urology Care business, which includes interventional urology products, saw organic growth.

- Sales of interventional urology products: This includes devices for urinary incontinence, bladder outlet obstruction, and kidney stones.

- Bladder health solutions: Revenue from products designed to manage bladder conditions.

- Surgical and endourology products: Income generated from instruments used in urological procedures and for examining the urinary tract.

- Impact of product recall: While a recall affected sales, the segment's underlying strength remains a factor in Coloplast's revenue diversification.

Digital Service-Based Offerings

Coloplast is expanding beyond traditional medical devices by developing digital service-based offerings. A prime example is the Heylo™ digital leakage notification system, which aims to provide enhanced user support and product integration. These digital solutions are a developing revenue stream, designed to increase customer loyalty and explore new avenues for recurring income, potentially through subscription models.

While specific revenue figures for these nascent digital services are not yet separately disclosed by Coloplast, the company's overall strategy emphasizes innovation in patient care. In fiscal year 2023, Coloplast reported total revenue of DKK 25.2 billion (approximately USD 3.6 billion), indicating a strong foundation upon which to build these digital initiatives. The Heylo™ system, for instance, is part of a broader push to leverage technology for improved outcomes and engagement.

- Digital Service Expansion: Coloplast is actively investing in digital solutions to complement its core medical device portfolio.

- Heylo™ Leakage Notification: This system exemplifies the company's move towards integrated digital patient support.

- Nascent Revenue Stream: These digital offerings represent a growing, though currently small, component of Coloplast's revenue.

- Value-Added Services: The digital services aim to enhance product stickiness and create opportunities for recurring revenue.

Coloplast's revenue streams are diversified across several key medical device segments. The company's financial performance is significantly driven by its ostomy care and continence care product sales, which consistently show robust organic growth. For example, in the first half of fiscal year 2024, Coloplast reported 8% organic growth in its Continence Care business.

The advanced wound care segment, significantly bolstered by the 2023 acquisition of Kerecis, represents another crucial revenue contributor. While the Skin Care business was divested in December 2024, the remaining advanced wound care portfolio, especially its biologic solutions, continues to drive growth. The Interventional Urology segment also contributes to revenue, although it experienced a temporary impact from a product recall.

Coloplast is also venturing into digital service-based offerings, such as the Heylo™ digital leakage notification system, to create new revenue avenues and enhance customer loyalty. In fiscal year 2023, Coloplast achieved total revenue of DKK 25.2 billion (approximately USD 3.6 billion), highlighting the overall strength of its diverse revenue streams.

| Segment | Key Products | Fiscal Year 2023 Revenue Contribution (Illustrative) |

| Ostomy Care | Pouches, accessories (e.g., SenSura® Mio) | Significant portion of total revenue |

| Continence Care | Intermittent catheters (e.g., Luja™), bowel management | Strong organic growth, 8% in H1 FY24 |

| Advanced Wound Care | Specialized dressings, biologic solutions (Kerecis) | Growth driver, especially post-Kerecis acquisition |

| Interventional Urology | Bladder health, surgical/endourology devices | Historically significant, impacted by recall |

| Digital Services | Heylo™ leakage notification | Nascent, developing revenue stream |

Business Model Canvas Data Sources

The Coloplast Business Model Canvas is informed by a blend of internal financial reports, extensive market research on healthcare trends, and direct customer feedback from healthcare professionals and patients. These diverse data sources ensure a comprehensive and accurate representation of Coloplast's strategic framework.