Coloplast Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coloplast Bundle

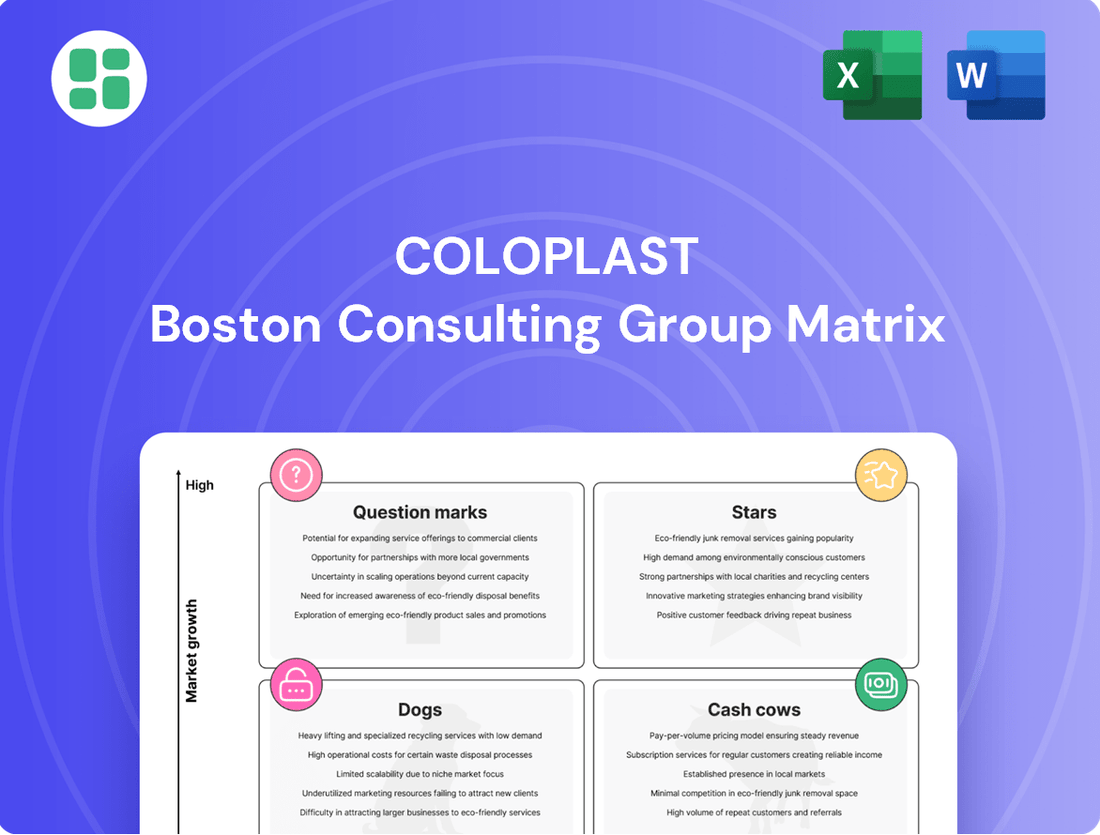

Unlock the strategic power of the Coloplast BCG Matrix and understand precisely where its products fit: Stars, Cash Cows, Dogs, or Question Marks. This initial glimpse sets the stage for informed decision-making.

Purchase the full BCG Matrix report to gain a comprehensive understanding of Coloplast's product portfolio, complete with data-driven insights and actionable strategies to optimize your investments and product development.

Stars

Kerecis, a key player in advanced wound care, is demonstrating impressive growth as Coloplast's biologics subsidiary. In the first quarter of fiscal year 2024/25, it achieved a remarkable 32% organic growth, with the first half of the year showing a strong 30-31% increase. This robust performance underscores Kerecis's success in capturing market share within the dynamic advanced wound care sector.

The company is projected to maintain this upward trajectory, with an anticipated 3-year revenue Compound Annual Growth Rate (CAGR) of around 30% for Kerecis through fiscal year 2025/26. This high growth potential positions Kerecis as a vital component of Coloplast's Strive25 strategy, which aims for sustained leadership in growth markets.

The Luja™ intermittent catheter line is a cornerstone of Coloplast's Continence Care segment, driving significant growth. In the first quarter of fiscal year 2024/25, Luja™ contributed 7% to organic growth, followed by an 8% increase in the first half of the same fiscal year, demonstrating robust market penetration.

Luja™ represents an innovative approach to continence care, specifically engineered to mitigate the risks associated with urinary tract infections, thereby improving patient outcomes and quality of life. This focus on user well-being is a key differentiator.

Coloplast's strategic emphasis on the high-margin Continence Care division is further bolstered by Luja™'s strong performance. The product commands an impressive global market share of approximately 30%, underscoring its leadership position and the company's successful strategy in this market.

Coloplast's Voice and Respiratory Care segment, bolstered by the Atos Medical acquisition, has shown impressive financial health. In the first quarter of fiscal year 2024/25, this segment achieved a solid 11% organic growth.

The momentum continued into the first half of fiscal year 2024/25, with the segment reporting 7-9% organic growth. This sustained performance highlights the strength of both its Laryngectomy and Tracheostomy product lines, positioning it as a key growth driver for Coloplast.

The company anticipates this segment will continue to deliver long-term growth of 8-10%, significantly contributing to overall profitability. Its strategic importance is further emphasized by its inclusion in discussions at the Executive Leadership Team level.

Overall Advanced Wound Care Segment Growth

The Advanced Wound Care segment, excluding Kerecis, demonstrated robust organic growth, reaching 12% in the first quarter of fiscal year 2024/25 and maintaining a strong 10-11% growth throughout the first half of the fiscal year. This positive trajectory is fueled by the rising incidence of chronic wounds and a growing elderly demographic, establishing a favorable market dynamic for expansion. Coloplast is committed to enhancing its commercial efforts and boosting profitability within this sector.

Coloplast's strategic initiatives and recent product introductions, including the Biatain® Superabsorber, are designed to solidify its competitive standing. The company's focus on innovation and market penetration within advanced wound care is a key driver for its sustained performance.

- Strong Organic Growth: The Advanced Wound Care segment, excluding Kerecis, achieved 12% organic growth in Q1 FY24/25 and 10-11% in H1 FY24/25.

- Market Drivers: Growth is propelled by the increasing prevalence of chronic ulcers and an aging global population.

- Strategic Focus: Coloplast aims to intensify its commercial focus and enhance profitability in this segment.

- Competitive Edge: Investments in strategy and new products like Biatain® Superabsorber bolster market position.

Strategic Innovation and New Product Launches

Coloplast's Strive25 strategy is heavily focused on accelerating new product launches and fostering innovation across all its business segments. This proactive approach is designed to enhance user care and drive future market growth.

The company has demonstrated this commitment through recent product introductions, such as the expansion of the SenSura® Mio portfolio in Ostomy Care. This expansion, which saw new product variants introduced in 2024, directly addresses user needs and reinforces Coloplast's position in a key growth area.

Coloplast's dedicated innovation unit is instrumental in achieving the goal of elevating the standard of care for individuals. Their ongoing efforts in developing groundbreaking solutions are vital for maintaining a competitive edge and ensuring sustained organic growth in the long term.

- SenSura® Mio Portfolio Expansion: New variants launched in 2024 for Ostomy Care.

- Strive25 Strategy: Emphasis on increased pace of new product introductions and innovation.

- Innovation Unit's Role: Actively working to raise the standard of care for users.

- Growth Driver: Continuous innovation in high-potential areas secures future market leadership.

Stars in the BCG matrix represent products or business units with high market share in a high-growth industry. These are typically market leaders that require significant investment to maintain their growth and competitive position. Coloplast's Kerecis, with its projected 30% CAGR through FY25/26 in advanced wound care, exemplifies a Star. Its strong performance and strategic importance within Coloplast's Strive25 plan highlight its role as a key growth driver.

Kerecis is a prime example of a Star within Coloplast's portfolio. Its substantial organic growth, reaching 32% in Q1 FY24/25 and an anticipated 30% CAGR through FY25/26, firmly places it in the high-growth, high-market-share category. This performance is critical to Coloplast's overall growth strategy.

The Luja™ intermittent catheter line also exhibits characteristics of a Star. It is a significant contributor to Coloplast's Continence Care segment, driving 7% organic growth in Q1 FY24/25 and holding a substantial 30% global market share. This product line is a key element in a high-growth market.

| Product/Segment | Market Growth | Market Share | FY24/25 Q1 Organic Growth | Projected 3-Year CAGR |

| Kerecis (Advanced Wound Care) | High | High | 32% | ~30% (through FY25/26) |

| Luja™ (Continence Care) | High | High (~30%) | 7% | N/A (strong contributor) |

What is included in the product

The Coloplast BCG Matrix categorizes products by market share and growth, guiding investment decisions.

This BCG Matrix overview simplifies complex portfolio analysis, relieving the pain of strategic decision-making.

Cash Cows

Coloplast's established ostomy care portfolio represents a significant cash cow, dominating the global market. In 2024, this sector was valued at a substantial USD 3.67 billion, with projections indicating growth to USD 5.59 billion by 2034, at a compound annual growth rate of 4.3%.

While experiencing a slight moderation to 4% organic growth in Q2 2024/25, this segment remains Coloplast's bedrock, consistently delivering strong revenue. The enduring success of product lines like SenSura® Mio and Assura/Alterna® underpins this stability.

This mature yet robust business generates considerable cash flow, requiring comparatively modest reinvestment. Such a profile allows Coloplast to allocate capital efficiently, funding innovation in other areas while maintaining its leadership in ostomy care.

Coloplast's Core Continence Care Products are established cash cows, holding a dominant market share and a strong legacy in the continence care sector. This segment consistently delivers reliable revenue, achieving 7% organic growth in Q1 2024/25 and an impressive 7-8% for the first half of the fiscal year 2024/25.

While newer innovations like Luja™ drive growth, the bedrock of this segment comprises mature, dependable products such as SpeediCath and Conveen. These offerings benefit from a loyal, established user base and predictable demand, meaning they require less intensive marketing investment to maintain their strong market position and generate consistent cash flow.

Coloplast's substantial footprint in the mature European and US chronic care markets serves as a significant driver of its cash flow. These established markets, characterized by robust reimbursement frameworks and strong patient loyalty, offer a predictable revenue stream.

The company's leadership in these geographies translates into consistently high profitability, a testament to its operational efficiency and market penetration. For instance, Coloplast's ostomy care business, a key component of its chronic care offering, has historically shown strong and stable growth. In fiscal year 2023, Coloplast reported organic growth of 8% in its Chronic Care segment, with Europe and North America being the primary contributors.

This unwavering performance in critical developed markets bolsters Coloplast's overall financial stability, providing a solid foundation for investment in growth areas and innovation.

Robust Global Distribution Network

Coloplast's robust global distribution network is a key strength, acting as a significant cash cow. This expansive network reaches hospitals, institutions, wholesalers, and retailers worldwide through both subsidiaries and independent distributors. This established infrastructure ensures efficient market penetration and consistent product delivery, vital for maintaining strong sales of their established products.

The maturity of this distribution system means Coloplast can generate high profit margins with minimal need for further investment in expanding these channels. This allows the company to effectively leverage its market-leading products, translating into a steady and reliable cash flow. For instance, in fiscal year 2023, Coloplast reported a solid revenue growth, with their established product segments continuing to be major contributors to profitability.

- Global Reach: Serves diverse markets via subsidiaries and distributors.

- Efficient Penetration: Facilitates steady product delivery and market access.

- Reduced Investment Needs: Mature network lowers capital expenditure for distribution.

- Strong Cash Generation: Supports high profit margins on established product sales.

Industry-Leading Profitability and Stable EBIT Margin

Coloplast demonstrates industry-leading profitability, with an impressive EBIT margin of 27% reported for both Q1 and H1 of the 2024/25 fiscal year. This robust margin, achieved even amidst some market challenges, highlights the company's exceptional operational efficiency and disciplined cost management within its established product lines.

This sustained high profitability is a direct result of Coloplast's ongoing focus on prudent cost controls, which underpins its ability to generate substantial cash flow.

- Industry-Leading EBIT Margin: 27% in Q1 and H1 2024/25.

- Operational Efficiency: Strong cost management in mature business areas.

- Cash Flow Generation: Supported by prudent cost controls.

- Strategic Funding: Enables R&D and investments in growth areas.

Coloplast's established ostomy care and continence care portfolios are prime examples of cash cows. These mature segments benefit from dominant market positions and loyal customer bases, ensuring consistent revenue generation with minimal need for extensive reinvestment. The robust profitability, evidenced by a 27% EBIT margin in Q1 and H1 2024/25, underscores their role in funding innovation and strategic growth initiatives.

| Segment | 2024 Market Value (USD Billion) | Projected 2034 Market Value (USD Billion) | CAGR (2024-2034) | H1 2024/25 Organic Growth |

|---|---|---|---|---|

| Ostomy Care | 3.67 | 5.59 | 4.3% | 4% (Q2 2024/25) |

| Continence Care | N/A | N/A | N/A | 7% (Q1 2024/25), 7-8% (H1) |

What You See Is What You Get

Coloplast BCG Matrix

The preview you are seeing is the exact Coloplast BCG Matrix document you will receive upon purchase. This comprehensive report is fully formatted and ready for immediate use, offering a clear and actionable strategic overview of Coloplast's product portfolio. You can confidently proceed with your purchase, knowing that the downloaded file will be identical to this preview, containing no watermarks or demo content.

Dogs

Coloplast strategically divested its Skin Care business in December 2024. This decision aimed to streamline operations and boost profitability, particularly within its Advanced Wound Care segment.

The divestment had a tangible effect on reported revenue, reducing it by approximately 1.5 percentage points for the fiscal year 2024/25. This action clearly demonstrates a move to shed an underperforming asset that was likely not contributing significantly to overall returns.

Coloplast's legacy Advanced Wound Dressings, excluding the Kerecis business, showed a modest 3% organic growth in the second quarter of fiscal year 2024/25. This performance was impacted by a decelerating market in China and strong prior-year comparisons, indicating a mature market phase.

The company's strategic focus for this segment is on enhancing profitability rather than pursuing rapid expansion. This approach aligns with a business that exhibits low growth potential and potentially a less dominant market position relative to key rivals, characteristic of a 'Dog' in the BCG matrix.

While Coloplast's Ostomy Care division generally performs as a Cash Cow, certain older product lines within this segment might be showing signs of weakness. These specific offerings could be experiencing low growth or even declining market share in particular geographic areas, indicating a potential shift in market dynamics or customer preferences.

Coloplast itself has acknowledged a slowdown in Ostomy Care growth, partly attributed to the phasing of tenders in emerging markets and a general economic slowdown observed in China. This broader trend likely impacts older product lines more significantly as newer, more innovative solutions gain traction.

These underperforming older lines may demand considerable resources to sustain their current market position, or they might be deliberately de-emphasized by Coloplast to focus on newer, more promising innovations. If these products are no longer strategically aligned with the company's future direction or are proving to be less profitable, they could be classified as Dogs within the BCG matrix, despite being part of a generally strong business unit.

Products Impacted by Specific Regional Tender Delays

Coloplast's Ostomy Care division experienced a slowdown in Q2 2024/25, directly linked to extended tender processes in key emerging markets. This suggests that specific products within this segment, especially those dependent on public sector contracts, are encountering market challenges. These might be products with limited penetration in these particular emerging markets, thus failing to drive the expected growth.

These tender delays can lead to a situation where capital is tied up in products that are not generating adequate returns, a classic indicator of a 'Dog' in the BCG matrix. For instance, if a particular ostomy pouch system, which has a low market share in, say, Southeast Asia due to these tender issues, it would fit this category. The company's overall revenue growth might be hampered by these specific product lines in these geographies.

- Delayed Procurements: Emerging markets' tender phasing in Q2 2024/25 impacted Coloplast's Ostomy Care.

- Market Stagnation/Decline: Products reliant on government tenders in these regions face potential stagnation.

- Low Market Share: Certain products may have a low share in these specific sub-markets, hindering growth.

- Capital Trap: Products in this category can tie up capital without sufficient returns, characteristic of a 'Dog.'

Inefficient Segments Identified for Simplification

Coloplast's strategic review has pinpointed segments requiring simplification, contributing to DKK 450 million in special charges for the 2024/25 fiscal year. This indicates a focus on enhancing overall profitability by addressing areas that are not performing optimally.

These identified inefficiencies likely represent operational bottlenecks or niche product areas where investment returns are suboptimal. Such segments, often referred to as 'cash traps,' consume resources without generating proportional value, necessitating a streamlining effort.

- Inefficiency Identification: Coloplast's DKK 450 million in special charges for 2024/25 signals a proactive approach to optimizing its portfolio.

- Profitability Focus: The company is actively seeking to improve its financial performance by simplifying underperforming or inefficient business areas.

- Resource Reallocation: Streamlining these segments allows Coloplast to redirect capital and management attention towards more promising growth opportunities.

Coloplast's Skin Care business, divested in December 2024, likely represented a 'Dog' due to its limited contribution to overall returns. This move, reducing reported revenue by approximately 1.5 percentage points in fiscal year 2024/25, signals a strategic shedding of underperforming assets. Similarly, older product lines within the generally strong Ostomy Care division may be classified as Dogs if they exhibit low growth or declining market share in specific regions, especially those impacted by delayed tenders in emerging markets.

These underperforming segments, potentially tying up capital without sufficient returns, are targeted by Coloplast's ongoing portfolio simplification efforts. The DKK 450 million in special charges for fiscal year 2024/25 directly reflects this initiative to address inefficiencies and optimize profitability by de-emphasizing or divesting such 'cash trap' areas.

Question Marks

The Interventional Urology segment is a classic Question Mark, exhibiting a volatile performance trajectory. In the first quarter of fiscal year 2024/25, it managed 1% organic growth, but this was followed by a 1% decline in the second quarter.

This downturn was largely attributed to a voluntary product recall impacting the Bladder Health and Surgery sub-segments. The subsequent sales recovery has been slower than initially projected, leading to a revised full-year growth forecast of approximately 0%, highlighting significant market uncertainty.

Despite Coloplast's established position, the competitive landscape in interventional urology presents substantial opportunity for market share gains. The segment's current performance underscores the challenges and potential rewards of navigating this dynamic market.

Coloplast's Bladder Health and Surgery products, a part of Interventional Urology, faced a voluntary recall. This recall significantly impacted the company, resulting in a DKK 25 million negative effect in Q1 of the 2024/25 fiscal year and an additional DKK 35 million in Q2.

The subsequent slow recovery in sales for these products underscores their current low market share and considerable uncertainty. This sub-segment is currently a cash consumer due to the recall's financial strain and the sluggish sales rebound.

While the broader interventional urology market shows growth potential, the future trajectory of these specific Bladder Health and Surgery products hinges on strategic investment decisions. These choices will ultimately determine whether they can ascend to become Stars or potentially devolve into Dogs within the BCG matrix.

Coloplast's Strive25 strategy focuses on building new growth platforms, meaning new market entries will naturally begin with a low market share. These are typically high-potential but unproven areas where the company is establishing its foothold.

Significant upfront investment in marketing and sales is crucial for these new ventures to gain traction and build market share. For instance, in 2024, Coloplast continued to invest in expanding its presence in emerging markets, which often require substantial initial outlays before achieving significant market penetration.

The success of these low initial share entries hinges on their ability to achieve effective market adoption and establish clear competitive differentiation. Without this, they risk remaining niche players or failing to capture the anticipated growth in these potentially lucrative segments.

Early-Stage Innovative Pipeline Products

Coloplast’s commitment to innovation fuels a robust pipeline of early-stage products. These nascent offerings, characterized by significant R&D investment and high-growth market potential, are currently positioned as Question Marks in the BCG matrix. Their market share is minimal, reflecting their pre-commercialization status, but they represent key opportunities for future growth.

These early-stage products are crucial for Coloplast’s long-term strategy, targeting emerging needs within the healthcare sector. For instance, their investments in areas like advanced wound care or innovative ostomy solutions are designed to capture future market share. These initiatives require substantial capital outlay, typical of Question Mark products, as the company navigates the uncertainties of product development and market acceptance.

- High-Growth Potential: Products in development targeting areas like advanced wound care or bio-integrated ostomy solutions are positioned in high-growth segments of the medical device market.

- Substantial R&D Investment: Coloplast consistently allocates significant resources to its R&D pipeline, with figures often representing a notable percentage of total revenue, underscoring the investment in these early-stage products. For example, in fiscal year 2023, Coloplast reported R&D expenses of DKK 1.8 billion (approximately USD 260 million), a portion of which is dedicated to these nascent innovations.

- Negligible Current Market Share: As these products are in the early stages of development or initial market testing, their current contribution to Coloplast's overall revenue and market share is minimal.

- Potential Future Stars: Successful development and market adoption of these pipeline products could transform them into future Stars, generating substantial revenue and solidifying Coloplast's market leadership in specific therapeutic areas.

Segments Facing Significant Regulatory or Market Uncertainty

Certain segments within Coloplast's portfolio are navigating significant regulatory and market uncertainties. Kerecis, a promising area, is experiencing a delay in the US Local Coverage Determination (LCD) policy implementation, now slated for January 2026. This postponement introduces a degree of market unpredictability that could affect its anticipated growth, even though it's currently classified as a Star.

Beyond specific product lines, broader macroeconomic challenges are also contributing to market unease. Slower-than-expected recoveries in key emerging markets, notably China, are creating headwinds for various product categories. These external economic factors can introduce volatility, potentially impacting segments that otherwise show strong potential.

- Kerecis Regulatory Delay: US LCD policy implementation pushed to January 2026.

- Emerging Market Slowdown: China's recovery is slower than anticipated.

- Macroeconomic Headwinds: General economic uncertainty affects multiple product lines.

- Impact on Growth Trajectory: Delays and slowdowns can temper growth potential for promising segments.

The Interventional Urology segment, particularly Bladder Health and Surgery, embodies a Question Mark due to its volatile performance and the impact of a product recall. This segment experienced a 1% decline in Q2 FY24/25, following 1% growth in Q1, with a revised full-year forecast of approximately 0% growth.

The recall resulted in a DKK 25 million negative impact in Q1 and DKK 35 million in Q2, highlighting significant financial strain and slow sales recovery. While the broader market offers growth, the future of these specific products depends on strategic investments to potentially become Stars or Dogs.

Coloplast's early-stage products, developed under the Strive25 strategy, also represent Question Marks. These innovations, such as in advanced wound care, require substantial R&D investment, with DKK 1.8 billion reported in FY23, and currently have negligible market share but high future growth potential.

The Kerecis segment, despite its Star potential, faces uncertainty due to a delay in US LCD policy implementation until January 2026, alongside broader macroeconomic headwinds affecting emerging markets like China.

| BCG Category | Segment/Product Example | Market Growth | Market Share | Financials/Notes |

|---|---|---|---|---|

| Question Mark | Interventional Urology (Bladder Health & Surgery) | High (overall market) | Low (specific products) | Q2 FY24/25: 1% decline; Recall impact DKK 60M (Q1+Q2 FY24/25); FY24/25 growth forecast ~0% |

| Question Mark | Early-Stage Innovations (e.g., Advanced Wound Care) | High | Negligible | Significant R&D investment (e.g., DKK 1.8B in FY23); High potential, unproven market acceptance |

| Star | Kerecis (potentially) | High | Growing | US LCD policy delay to Jan 2026 creates market unpredictability |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and competitor performance data to provide a comprehensive view of product portfolios.