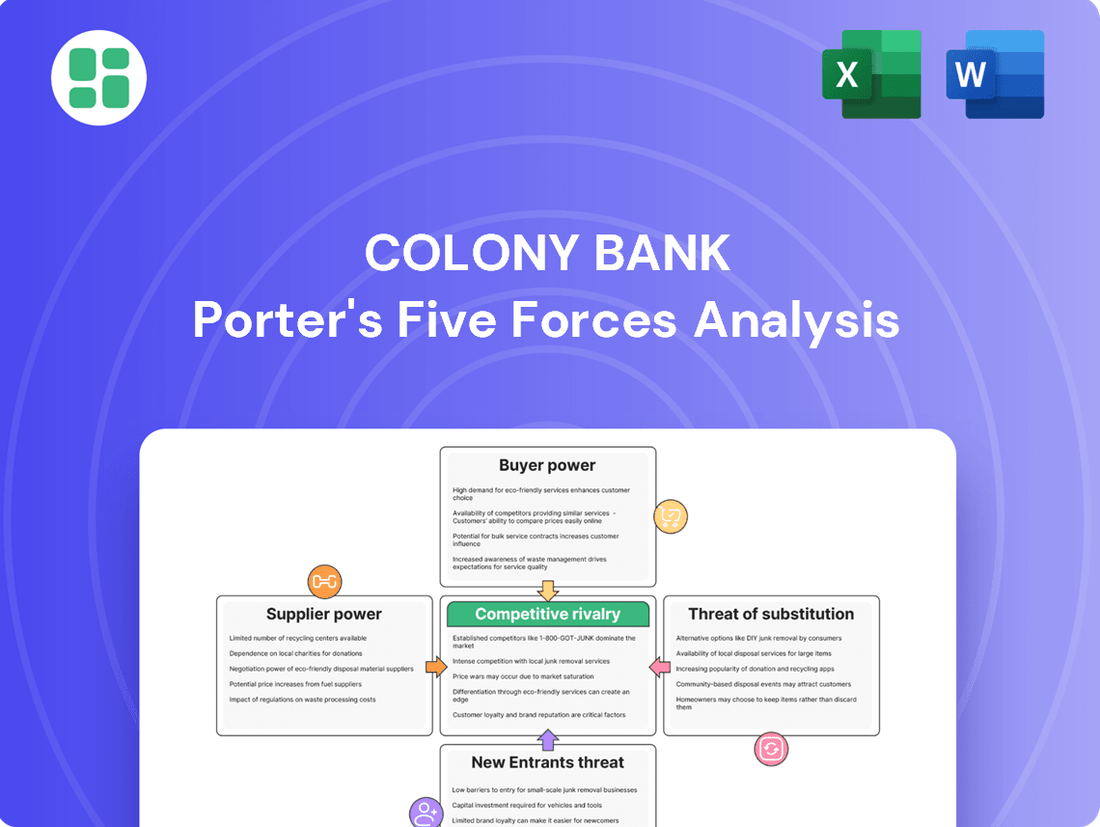

Colony Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colony Bank Bundle

Colony Bank operates within a dynamic financial landscape, facing pressures from existing competitors and the constant threat of new entrants. Understanding the bargaining power of both its customers and its suppliers is crucial for strategic planning.

The complete report reveals the real forces shaping Colony Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Community banks, such as Colony Bank, often find themselves reliant on core banking technology providers, giving these suppliers considerable bargaining power. This dependence is substantial, with around 80% of community banks in the U.S. utilizing fintech firms for their essential core systems, highlighting a significant reliance on these specialized vendors.

The intricate nature and deep integration of these core banking systems mean that switching providers is a complex and costly undertaking for banks. This high switching cost further solidifies the power of the suppliers, as it creates a significant barrier for banks looking to change their technology infrastructure.

The bargaining power of specialized financial technology (Fintech) providers is significantly amplified by the banking sector's increasing reliance on advanced technologies like AI and machine learning. Banks are pouring substantial resources into these areas, with global fintech investment reaching approximately $120 billion in 2024. This heavy investment makes these cutting-edge technology suppliers crucial for enhancing operational efficiency, bolstering fraud detection capabilities, and elevating customer experiences, thereby increasing their negotiation leverage.

The banking sector, including community banks like Colony Bank, grapples with a significant shortage of skilled professionals, especially in critical areas such as information technology, regulatory compliance, and client relationship management. This scarcity of specialized human capital directly translates to increased bargaining power for individual employees and talent recruitment agencies.

Consequently, banks often face upward pressure on wage demands and elevated recruitment costs as they compete for limited talent. For instance, in 2024, the demand for cybersecurity professionals in finance outstripped supply, with some roles seeing salary increases of over 15% year-over-year according to industry reports.

To counter this, banks must prioritize strategic investments in talent acquisition and retention programs. This proactive approach is crucial for maintaining operational efficiency and ensuring long-term competitiveness in a rapidly evolving financial landscape.

Wholesale Funding Sources

Colony Bank, like other financial institutions, taps into wholesale funding markets and interbank lending for crucial liquidity and capital. These markets, populated by institutional investors and other banks, act as suppliers of funds, and their willingness to lend directly impacts Colony Bank's operational capacity. The terms and availability of this wholesale funding are not static; they fluctuate based on broader economic conditions and the specific perceived risk profile of Colony Bank itself.

The bargaining power of these wholesale funding suppliers stems from their ability to dictate terms. For instance, in periods of economic uncertainty or heightened financial market stress, these suppliers may demand higher interest rates or impose stricter collateral requirements. This can increase Colony Bank's cost of funds, directly impacting its profitability and lending margins. As of early 2024, the Federal Reserve's monetary policy, including interest rate adjustments, significantly influences the cost of wholesale funding, making it a dynamic factor for banks like Colony.

- Interbank Lending Rates: The Federal Funds Rate, a key benchmark, influences the cost of borrowing between banks.

- Market Liquidity: The overall availability of funds in wholesale markets dictates the ease with which banks can secure necessary capital.

- Credit Risk Perception: A bank's financial health and credit rating directly affect the rates and terms offered by wholesale funding providers.

- Regulatory Environment: Changes in banking regulations can impact a bank's reliance on and access to wholesale funding.

Regulatory and Compliance Service Providers

The increasing complexity of banking regulations, such as those stemming from the Dodd-Frank Act and Basel III, significantly enhances the bargaining power of specialized regulatory and compliance service providers. These firms, including external audit firms and RegTech companies, possess critical expertise that banks cannot easily replicate in-house. This necessity is underscored by the substantial fines levied for non-compliance; for instance, in 2023, financial institutions globally paid billions in regulatory fines, highlighting the cost of failure.

Banks are compelled to engage these expert providers to navigate intricate compliance requirements, ensuring they avoid severe penalties and maintain their operational licenses. The specialized knowledge and established methodologies of these service providers create high switching costs for banks, further solidifying their leverage. In 2024, the demand for these services is projected to grow, driven by new data privacy laws and evolving cybersecurity mandates.

- Specialized Expertise: Firms offering regulatory and compliance services possess niche knowledge essential for banks to operate legally.

- High Switching Costs: Banks face significant disruption and expense when changing compliance service providers.

- Regulatory Penalties: The substantial financial and reputational risks associated with non-compliance empower these service providers.

- Market Growth: The RegTech market, for example, is experiencing robust growth, indicating increasing reliance on external solutions.

Colony Bank, like many financial institutions, faces significant bargaining power from its core technology providers. These vendors offer essential systems that are complex and costly to replace, creating high switching costs for banks. The increasing reliance on advanced fintech solutions, with global fintech investment around $120 billion in 2024, further amplifies these suppliers' leverage.

The bank's need for specialized talent, particularly in IT and compliance, also empowers suppliers in the labor market. For example, demand for cybersecurity professionals in finance saw salary increases exceeding 15% year-over-year in 2024, reflecting a talent shortage that gives skilled individuals and recruitment agencies considerable sway.

Wholesale funding markets and interbank lending also represent suppliers with bargaining power. Their willingness to lend, influenced by economic conditions and Colony Bank's perceived risk, dictates the cost and availability of capital. The Federal Reserve's monetary policy, including interest rate adjustments, directly impacts these borrowing costs as of early 2024.

Specialized regulatory and compliance service providers also wield considerable power due to the complexity of banking regulations. Banks rely on their expertise to avoid substantial penalties, such as the billions paid globally in regulatory fines in 2023. The growing demand for these services, driven by new data privacy and cybersecurity mandates in 2024, solidifies their negotiating position.

| Supplier Type | Source of Power | Impact on Colony Bank | Relevant 2024 Data/Trend |

|---|---|---|---|

| Core Technology Providers | High switching costs, specialized systems | Increased cost of technology infrastructure | Global fintech investment ~ $120 billion |

| Skilled Labor / Recruiters | Scarcity of specialized talent | Higher wage demands, increased recruitment costs | Cybersecurity roles saw >15% YoY salary increase |

| Wholesale Funding Providers | Control over capital availability and terms | Fluctuating cost of funds, impact on margins | Federal Reserve monetary policy influences rates |

| Regulatory & Compliance Services | Niche expertise, high penalties for non-compliance | Necessity of external services, risk mitigation costs | Growing demand due to new data privacy/cybersecurity laws |

What is included in the product

This analysis examines the competitive forces impacting Colony Bank, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Colony Bank's Porter's Five Forces.

Customers Bargaining Power

For many basic banking products, such as checking accounts, customers face minimal costs and effort when switching financial institutions. Digital-first banks and neobanks have made this even easier with streamlined onboarding and appealing sign-up bonuses, encouraging customers to explore alternatives.

In 2023, the average customer retention rate in the US banking sector hovered around 90%, indicating that while switching is possible, a significant portion of customers remain loyal. However, the increasing prevalence of digital account opening processes, which can take as little as five minutes, continues to chip away at traditional switching barriers.

Customers today expect seamless digital banking, from mobile apps to instant loan decisions. In 2024, a significant portion of banking transactions are already conducted digitally, with many consumers prioritizing convenience and speed. Banks that don't offer robust digital platforms risk alienating customers who are increasingly turning to fintechs and digitally-focused competitors.

Customers today are keenly aware of interest rate fluctuations, making them quite sensitive to the rates offered on both their deposits and the loans they take out. This sensitivity is a significant factor in their bargaining power.

Even with a general trend of falling interest rates, many customers are reluctant to accept lower returns on their savings. This resistance puts pressure on banks like Colony Bank, potentially squeezing their net interest margins.

This price sensitivity empowers customers to actively shop around for the best available rates. By comparing offers from different financial institutions, they can leverage this information to negotiate more favorable terms, thereby increasing their overall bargaining power.

Access to Diverse Financial Alternatives

Customers today have an unprecedented number of financial choices, moving far beyond traditional banking. The rise of credit unions, peer-to-peer lending platforms, and innovative fintech companies offering everything from digital wallets to robo-advisors means consumers can easily find alternatives for payments, loans, and investments.

This increased accessibility to diverse financial products significantly strengthens the bargaining power of customers. They can readily compare rates, fees, and service offerings across multiple providers, forcing institutions like Colony Bank to remain competitive to retain their business. For instance, in 2024, the fintech sector continued its rapid expansion, with global fintech revenue projected to reach over $3.5 trillion by 2027, indicating a substantial portion of financial services are now available outside traditional channels.

- Wider Choice of Providers: Customers can select from traditional banks, credit unions, online banks, and numerous fintech solutions.

- Comparison Shopping: Easy access to information allows customers to compare interest rates, fees, and service features across different institutions.

- Specialized Services: Fintech firms often cater to niche markets or offer specialized services that traditional banks may not, attracting customers seeking tailored solutions.

- Lower Switching Costs: Digital platforms often make it simpler and faster for customers to move their accounts or financial activities to a new provider.

Information Transparency and Comparison Tools

The increasing availability of financial comparison tools and the push towards open banking significantly enhance customer bargaining power. These platforms allow consumers to easily scrutinize fees, interest rates, and service features from various banks. For instance, in 2024, the number of users actively comparing financial products online continued its upward trend, with many reporting that transparency in pricing was a key factor in their decision-making process.

This heightened information transparency empowers customers to switch providers if they find better terms elsewhere. Banks are therefore compelled to offer more competitive pricing and clearer communication to retain their customer base. Data from early 2024 indicated that a significant percentage of consumers would consider switching their primary bank based on a perceived advantage in fees or rates offered by a competitor.

- Increased Information Access: Open banking initiatives and comparison websites provide customers with unprecedented visibility into bank offerings.

- Informed Decision-Making: Customers can readily compare fees, rates, and services, leading to more strategic choices.

- Competitive Pressure: Banks face pressure to offer attractive terms and transparent pricing to avoid customer attrition.

- Customer Empowerment: The ease of comparison directly translates to stronger customer bargaining power in the financial sector.

Customers today possess significant bargaining power due to the ease of switching, the availability of comparison tools, and the growing array of financial alternatives beyond traditional banks. Their ability to readily compare rates, fees, and services across numerous providers, including fintechs, compels institutions like Colony Bank to offer competitive pricing and transparent terms to retain business.

In 2024, the digital landscape continued to empower consumers, with many financial transactions occurring online, and switching barriers further reduced by streamlined digital onboarding processes. This environment means banks must prioritize customer convenience and competitive offerings to maintain loyalty, as customers are increasingly willing to move for better value.

| Factor | Impact on Customer Bargaining Power | 2024 Trend/Data Point |

|---|---|---|

| Switching Costs | Low, especially with digital banking | Digital account opening can take as little as 5 minutes. |

| Availability of Alternatives | High, with fintechs and credit unions | Fintech sector projected to reach over $3.5 trillion globally by 2027. |

| Information Transparency | High, due to comparison sites and open banking | Increasing number of users comparing financial products online. |

| Price Sensitivity | High, particularly for deposit and loan rates | Customers actively shop for best available rates. |

Same Document Delivered

Colony Bank Porter's Five Forces Analysis

This preview showcases the complete Colony Bank Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the banking industry. You're looking at the actual document, so what you see is precisely what you'll receive instantly after purchase, ensuring no surprises and immediate usability for your strategic planning.

Rivalry Among Competitors

The banking sector in Georgia, Colony Bank's main operating ground, presents a dual nature: highly fragmented with 136 out of 139 Georgia-based banks being community banks, yet simultaneously concentrated. This means while there are many small players, a few large institutions capture a disproportionate share of the market's profitability, creating a fiercely competitive environment for regional banks like Colony Bank.

Colony Bank operates in a highly competitive landscape, facing pressure not just from fellow community banks but also from larger regional and national institutions with significantly more capital and wider operational footprints. This intense rivalry is further amplified by the growing presence of digital-only banks and credit unions, which often attract customers with competitive pricing and user-friendly online platforms.

The banking sector is in the throes of a significant digital overhaul, pushing institutions like Colony Bank to constantly enhance their service offerings and customer interactions. Competitors are rapidly integrating advanced technologies such as artificial intelligence, instant payment systems, and embedded finance, making it crucial for Colony Bank to invest in its own digital infrastructure and personalized customer experiences to stand out and keep its client base.

Consolidation Trends and Mergers

The banking industry, including community banks, is seeing a significant uptick in consolidation. This trend is driven by the need for scale and efficiency in an increasingly competitive landscape. For instance, Colony Bank's own merger with TC Bancshares in 2023, creating a combined entity with approximately $3.5 billion in assets, exemplifies this movement. Such mergers result in larger, more powerful competitors that can leverage greater resources and market reach, intensifying the pressure on smaller, independent banks.

These consolidations lead to fewer, but larger, players in the market. This can mean increased competition for deposits and loans, as these larger institutions often have more sophisticated marketing and product offerings. For example, the FDIC reported that the number of U.S. commercial banks declined from 4,850 in 2019 to 4,396 by the end of 2023, a clear indicator of ongoing consolidation.

- Increased Scale: Merged entities often boast significantly larger asset bases and expanded geographic footprints.

- Enhanced Capabilities: Consolidation allows for greater investment in technology, compliance, and talent, creating more formidable competitors.

- Market Share Growth: Larger banks can capture a greater share of deposits and loans, squeezing smaller institutions.

- Synergies and Efficiencies: Mergers aim to achieve cost savings and operational efficiencies, which can be passed on as competitive pricing.

Economic and Regulatory Pressures

Colony Bank, like all financial institutions, faces significant pressure from the broader economic climate. Interest rate fluctuations directly impact a bank's net interest margin, its primary profit driver. As interest rates have moved from historically low levels, the environment for credit quality is also normalizing, which can lead to increased provisioning for potential loan losses.

The regulatory landscape presents another layer of challenge. Evolving compliance requirements, particularly in areas like capital adequacy, anti-money laundering, and consumer protection, necessitate ongoing investment in technology and personnel. This adds to operational costs and can divert resources from growth initiatives.

- Economic Environment: Rising interest rates, while potentially boosting net interest margins, also increase funding costs and can dampen loan demand. For instance, the Federal Reserve's series of rate hikes throughout 2022 and 2023 has reshaped the lending and deposit landscape.

- Credit Quality Normalization: Following a period of exceptionally low default rates, credit quality is expected to normalize. This means banks must be prepared for a potential uptick in non-performing loans, impacting profitability through higher loan loss provisions.

- Regulatory Burden: Compliance with regulations such as Basel III endgame requirements, which are set to be implemented in the coming years, will demand significant capital and operational adjustments from banks. These rules aim to enhance financial stability but increase the cost of doing business.

Colony Bank faces intense competition from a wide array of players, including numerous community banks, larger regional and national institutions, and increasingly, digital-only banks and credit unions. This fragmented yet concentrated market means that while many small banks exist, larger entities often dominate profitability, forcing Colony Bank to constantly innovate. The digital transformation across the industry, with competitors adopting AI and instant payment systems, further intensifies rivalry, requiring continuous investment in technology and customer experience to remain competitive.

Consolidation within the banking sector is a significant driver of competitive rivalry. Mergers create larger entities with greater scale, enhanced capabilities, and expanded market share, intensifying pressure on smaller banks like Colony Bank. For example, Colony Bank's own merger in 2023 with TC Bancshares, resulting in approximately $3.5 billion in assets, reflects this trend. The overall decline in the number of U.S. commercial banks, from 4,850 in 2019 to 4,396 by the end of 2023, underscores this consolidation movement.

| Competitor Type | Key Characteristics | Impact on Colony Bank |

|---|---|---|

| Community Banks | Numerous, localized focus, relationship-driven | Direct competition for local deposits and loans |

| Regional/National Banks | Larger scale, broader product offerings, significant capital | Competition for market share, talent, and sophisticated customers |

| Digital-Only Banks | Technology-driven, competitive pricing, convenient online platforms | Pressure to enhance digital offerings and customer experience |

| Credit Unions | Member-focused, often competitive rates | Competition for specific customer segments, particularly those valuing mutual ownership |

SSubstitutes Threaten

Fintech companies are increasingly offering direct substitutes for traditional banking services, including digital payments, online lending, and mobile investment platforms. For instance, by the end of 2023, the global fintech market was valued at approximately $2.5 trillion, showcasing significant customer adoption of these alternatives.

These non-bank alternatives frequently offer enhanced convenience, quicker transaction speeds, and reduced fees, drawing customers away from established financial institutions. In 2024, digital payment transaction volumes are projected to exceed $10 trillion globally, highlighting the growing preference for these streamlined services.

Embedded finance, where non-financial companies weave banking services into their offerings, poses a significant substitution threat. For instance, e-commerce platforms now offer buy-now-pay-later options directly at checkout, bypassing traditional credit applications and the need to visit a bank. This trend is rapidly growing, with the global embedded finance market projected to reach $7.2 trillion by 2030, according to Statista.

Banking-as-a-Service (BaaS) further amplifies this threat by enabling fintechs and other businesses to leverage a bank's license and infrastructure to offer their own branded financial products. This allows customers to access services like payments, lending, or even deposit accounts through familiar, non-bank interfaces, directly competing with Colony Bank's core services and potentially eroding its customer base.

Credit unions present a significant threat as substitutes, particularly for consumer banking needs. Their member-centric approach often translates to more favorable rates on loans and deposits, directly competing with community banks. In 2023, credit unions saw substantial growth, with assets climbing to over $2.2 trillion, indicating their increasing market penetration and appeal.

The rise of non-bank lenders, including fintech companies and online platforms, further intensifies this threat. These entities offer specialized and often faster lending solutions, especially for small businesses and niche consumer markets, directly challenging traditional bank loan portfolios. For instance, online small business lending volume has been steadily increasing, with some reports showing double-digit annual growth in recent years, highlighting the competitive pressure on established institutions.

Alternative Investment Platforms

Customers seeking investment and wealth management services face a growing array of alternative platforms. These include sophisticated robo-advisors, accessible online brokerages, and direct investment avenues in areas like private debt and real estate. These options present diverse investment opportunities and often feature competitive fee structures.

For instance, the global robo-advisory market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly, indicating a strong preference for digital wealth management solutions. Similarly, online brokerages have seen substantial user growth, with platforms like Robinhood reporting over 23 million funded accounts by the end of 2023. These alternatives directly challenge traditional bank offerings by providing specialized, often lower-cost, and more technologically advanced ways to manage wealth.

- Robo-Advisors: Offer automated, algorithm-driven investment management, often with lower fees than traditional advisors.

- Online Brokerages: Provide direct access to stock, bond, and ETF markets, empowering self-directed investors.

- Alternative Asset Platforms: Facilitate investment in less traditional assets like real estate crowdfunding or private equity, appealing to investors seeking diversification beyond public markets.

Peer-to-Peer (P2P) Lending and Crowdfunding

Peer-to-peer (P2P) lending platforms and crowdfunding initiatives offer alternative avenues for borrowing and investing, directly connecting individuals and businesses and bypassing traditional banks. These services are increasingly recognized as viable substitutes for conventional loan products, particularly for entities seeking diverse funding options or investors looking for non-traditional returns.

The growth of P2P lending and crowdfunding presents a notable threat to traditional banking models. For instance, the P2P lending market globally was projected to reach over $300 billion by 2025, demonstrating a substantial shift in how capital is accessed and deployed. In 2024, platforms like LendingClub and Prosper continued to facilitate significant transaction volumes, offering competitive rates that can challenge bank offerings, especially for certain borrower segments.

- Market Growth: The global P2P lending market is experiencing robust expansion, with significant year-over-year growth reported in 2023 and continuing into 2024.

- Investor Attraction: These platforms attract investors seeking higher yields than traditional savings accounts, directly impacting deposit bases for banks.

- Borrower Diversification: Businesses and individuals are increasingly utilizing crowdfunding for capital, especially for early-stage funding and niche projects, offering an alternative to bank loans.

- Regulatory Evolution: While still evolving, regulatory frameworks for P2P and crowdfunding are becoming more established, increasing their legitimacy and accessibility as substitutes.

The threat of substitutes for Colony Bank is substantial, driven by a rapidly evolving financial landscape. Fintech innovations offer direct alternatives for payments, lending, and investments, often with greater convenience and lower costs. For example, global digital payment transaction volumes are expected to surpass $10 trillion in 2024, indicating a strong customer shift towards these streamlined services.

Embedded finance, where non-financial companies integrate banking services, presents another significant challenge. E-commerce platforms offering buy-now-pay-later at checkout directly bypass traditional banking processes. The embedded finance market is projected to reach $7.2 trillion by 2030, underscoring its growing impact.

Moreover, credit unions and non-bank lenders provide competitive alternatives, particularly for consumer and small business lending. Credit union assets exceeded $2.2 trillion in 2023, demonstrating their increasing market share. These substitutes challenge traditional banking by offering potentially better rates and specialized services.

Investment and wealth management also face substitution threats from robo-advisors and online brokerages. The global robo-advisory market, valued at approximately $3.5 billion in 2023, and platforms like Robinhood, with over 23 million funded accounts by the end of 2023, highlight the growing preference for digital, lower-cost investment solutions.

| Substitute Category | Key Offerings | Market Indicator (2023/2024 Data) | Impact on Traditional Banks |

|---|---|---|---|

| Fintech Platforms | Digital Payments, Online Lending, Mobile Investments | Global digital payment volume projected >$10T in 2024 | Erodes transaction fees, loan origination revenue |

| Embedded Finance | BNPL, Integrated Payment Solutions | Global embedded finance market projected $7.2T by 2030 | Disintermediates customer relationships, reduces direct bank interaction |

| Credit Unions | Consumer Loans, Deposits | Credit union assets >$2.2T in 2023 | Captures deposit base, offers competitive lending rates |

| Non-Bank Lenders | Specialized Business Loans, Consumer Credit | Double-digit annual growth in online SMB lending | Challenges loan portfolio, particularly in niche markets |

| Robo-Advisors & Online Brokerages | Automated Investment Management, Direct Market Access | Robo-advisor market ~$3.5B in 2023; Robinhood >23M funded accounts (2023) | Reduces demand for traditional wealth management services |

Entrants Threaten

The banking sector faces substantial regulatory and compliance barriers. New entrants must contend with intricate licensing processes, significant capital requirements, and strict adherence to laws like the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations, alongside consumer protection and data privacy mandates. These extensive requirements make market entry for new traditional banks a costly and challenging endeavor.

Establishing a new bank demands significant capital, often in the hundreds of millions of dollars, to cover initial setup, technology, regulatory compliance, and operating expenses. For instance, in 2024, the average minimum capital requirement for a de novo bank charter in the US can easily exceed $10 million, with many requiring substantially more to ensure stability and absorb potential early-stage losses. This substantial financial barrier significantly deters many potential new entrants, particularly those without access to deep pockets or established financial backing, making the community banking sector less accessible.

The financial services industry, including banking, places a premium on trust and brand recognition, making it a significant barrier for new entrants. Building this trust is a marathon, not a sprint, often requiring decades of consistent service and community involvement. For instance, established banks like Colony Bank have cultivated deep roots within their communities, fostering loyalty that is difficult for newcomers to replicate. In 2024, the banking sector continued to see the impact of this legacy, with customer acquisition costs for new digital banks remaining high due to the need to overcome established brand perceptions.

Economies of Scale and Cost Advantages of Incumbents

Colony Bank, like other established financial institutions, benefits significantly from economies of scale. These scale advantages allow for more efficient operations, lower per-unit costs in technology adoption and maintenance, and more cost-effective customer acquisition strategies. For instance, a larger bank can spread the fixed costs of its IT infrastructure over a much broader customer base, making its technology investments more economical than a smaller, newer entrant. This cost advantage is a substantial barrier for potential new competitors.

New entrants often struggle to match the cost efficiencies of incumbents. They typically lack the established infrastructure, brand recognition, and large customer base that allow existing banks to operate at a lower cost per transaction. This disparity makes it difficult for new players to compete on price, whether through lower fees, higher deposit rates, or more attractive loan terms, thereby deterring new entrants.

In 2024, the banking sector continued to see consolidation, further amplifying the scale advantages of larger players. For example, the average asset size of US commercial banks remained substantial, with the top 10 banks holding a significant portion of the industry's total assets. This concentration means that any new entrant would face an uphill battle to achieve comparable operational efficiencies and pricing power.

- Economies of Scale: Established banks leverage large operational volumes to reduce per-unit costs in areas like technology and customer service.

- Cost Advantages: Incumbents benefit from lower customer acquisition costs and the ability to absorb fixed technology expenses across a wider customer base.

- Barrier to Entry: New entrants lack the scale to compete on price effectively, making market penetration challenging.

- 2024 Context: Industry consolidation in 2024 has further entrenched the scale advantages of larger, established banking institutions.

Fintech Partnerships as a Preferred Entry Model

Fintech partnerships are becoming a favored route for new players entering the financial services landscape. Instead of building their own infrastructure from scratch, many fintechs collaborate with established banks, utilizing a 'bank-as-a-service' approach. This strategy significantly lowers the capital requirements and regulatory hurdles for the fintechs, effectively shifting the competitive threat.

This model transforms the threat of new entrants. Rather than facing direct competition from new, fully licensed banks, Colony Bank might see increased competition from fintechs leveraging partner banks. For example, in 2024, the fintech sector continued its robust growth, with many companies focusing on embedded finance solutions, often through partnerships. This trend suggests that the threat is less about a new bank opening its doors and more about innovative digital services being offered through existing banking frameworks.

- Reduced Capital Outlay: Fintechs bypass the substantial costs associated with obtaining banking charters and building physical or extensive digital infrastructure.

- Accelerated Market Entry: Partnering allows fintechs to offer services much faster than if they were to build out their own regulatory and operational capabilities.

- Focus on Innovation: By outsourcing core banking functions, fintechs can concentrate their resources on developing unique customer experiences and specialized financial products.

- Evolving Competitive Landscape: The threat shifts from direct banking competitors to technology-driven service providers integrated into existing financial ecosystems.

The threat of new entrants for banks like Colony Bank is considerably low due to substantial barriers. These include stringent regulatory requirements, significant capital demands, and the necessity of building trust and brand recognition, which takes considerable time and investment. Furthermore, established institutions benefit from economies of scale, making it difficult for newcomers to compete on cost. In 2024, the banking sector's ongoing consolidation further solidified the advantages of larger, existing players.

| Barrier Type | Description | Impact on New Entrants | 2024 Relevance |

| Regulatory & Compliance | Licensing, capital, BSA/AML adherence | High cost and complexity | Continued strict enforcement |

| Capital Requirements | Minimum capital for charter | Millions of dollars needed | Average US de novo charter > $10M |

| Brand & Trust | Customer loyalty and reputation | Difficult to replicate | High customer acquisition costs for new digital banks |

| Economies of Scale | Operational efficiency from size | Cost advantages for incumbents | Industry consolidation amplifies scale |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Colony Bank is built upon a robust foundation of data, including the bank's annual reports, SEC filings, and investor presentations. We also incorporate insights from industry-specific market research reports and financial data providers to ensure a comprehensive understanding of the competitive landscape.