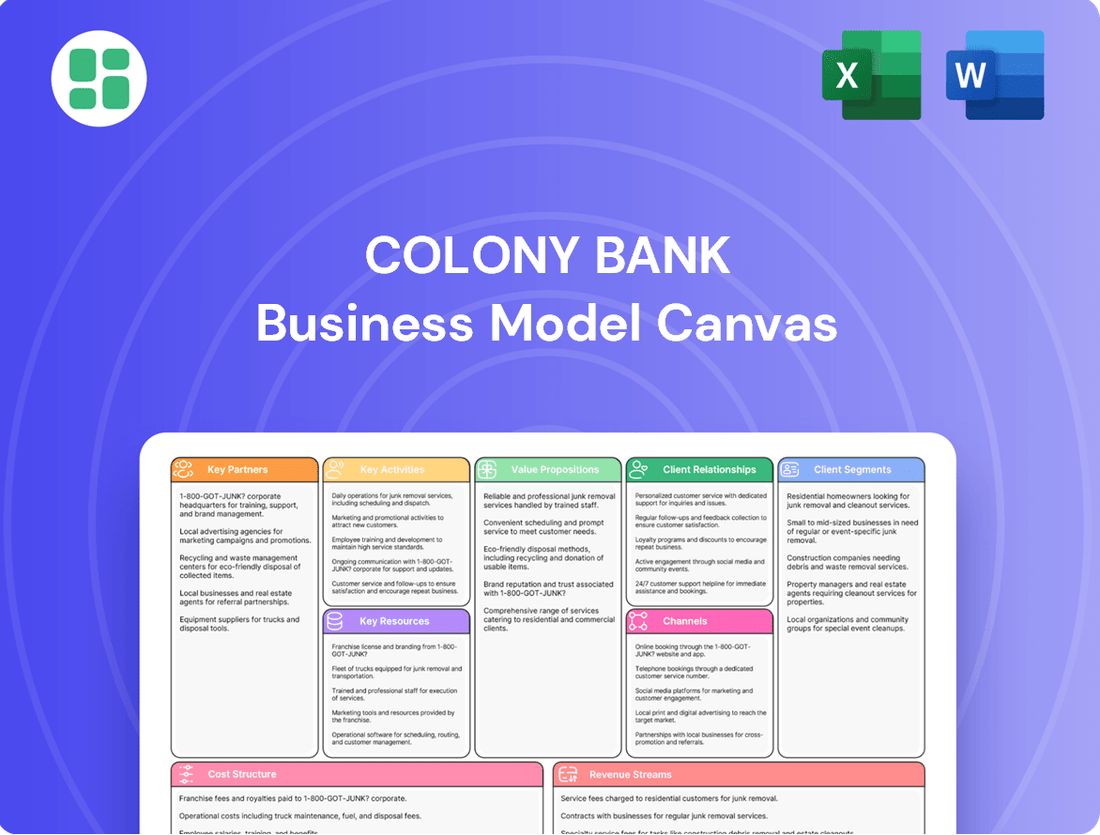

Colony Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colony Bank Bundle

See how Colony Bank strategically leverages its customer segments and value propositions to build a thriving financial institution. This detailed Business Model Canvas breaks down their key resources, activities, and partnerships, offering a clear roadmap to their success.

Unlock the complete strategic blueprint behind Colony Bank's operations with our comprehensive Business Model Canvas. Discover their revenue streams, cost structure, and customer relationships, providing invaluable insights for your own business ventures.

Want to understand the engine driving Colony Bank's growth? Our full Business Model Canvas lays out every critical component, from their unique value proposition to their competitive advantages. Download it now to gain a competitive edge.

Partnerships

Colony Bank strategically partners with fintech innovators like PortX to bolster its digital banking infrastructure. These collaborations are crucial for enhancing customer experience and operational efficiency, allowing for quicker deployment of new digital products and services.

By integrating with specialized technology providers, Colony Bank can bypass the complexities of traditional core banking system integrations. This approach not only improves data accuracy but also significantly speeds up the launch of new offerings, a vital advantage in the fast-paced financial sector.

Colony Bank, as an SBA Preferred Lender, actively collaborates with the Small Business Administration. This strategic alliance allows the bank to offer a range of government-guaranteed loan programs, significantly expanding financing options for small businesses.

Through this partnership, Colony Bank can provide flexible solutions like SBA 7(a) and 504 loans. These programs are designed to fuel small business expansion by offering favorable terms and often requiring lower initial down payments, making capital more accessible.

In 2023, the SBA guaranteed over $40 billion in loans through its flagship 7(a) program, demonstrating the significant impact of these government-backed initiatives on small business financing. Colony Bank's participation directly contributes to this vital economic support system.

Colony Bank partners with Ameriprise Financial Institutions Group, a significant player in the financial advisory space. This collaboration is designed to bring robust wealth management and investment services directly to Colony Bank's customer base.

Through this alliance, Colony Bank customers gain access to sophisticated financial planning tools, a wide array of investment options, and advanced digital platforms. These offerings empower individuals to effectively pursue their financial objectives, from retirement planning to wealth accumulation.

As of early 2024, Ameriprise Financial reported managing approximately $1.3 trillion in assets under management and administration, highlighting the scale and depth of expertise Colony Bank can leverage for its clients. This partnership underscores Colony Bank's commitment to providing a holistic financial experience.

Local Community Organizations and Initiatives

Colony Bank actively partners with local community organizations and initiatives to deepen its roots and support regional growth. For instance, its Colony Leadership Academy program directly invests in the future by providing leadership development for high school juniors. This commitment is further evidenced by the bank's participation in local festivals, fostering goodwill and visibility within the communities it serves.

These collaborations are more than just sponsorships; they represent a strategic investment in community well-being and youth education. By engaging with these local entities, Colony Bank strengthens its brand reputation and builds trust, which are crucial for long-term customer loyalty and business sustainability. In 2024, Colony Bank continued to allocate resources towards these vital community programs, reflecting its ongoing dedication.

- Colony Leadership Academy: A program designed to cultivate leadership skills in local high school juniors.

- Local Festival Involvement: Active participation in community events to enhance local connections and brand presence.

- Community Development Focus: Partnerships aimed at fostering economic and social progress within the bank's operating regions.

Other Financial Institutions for Mergers and Acquisitions

Colony Bankcorp, Inc. actively pursues mergers and acquisitions with other financial institutions to fuel its growth and market penetration. A prime example is its definitive merger agreement with TC Bancshares, Inc., a move designed to significantly enhance Colony Bank's presence in key markets.

These strategic combinations are not merely about size; they are about building a stronger, more competitive banking entity. By integrating operations and leveraging shared strengths, Colony Bank aims to broaden its service portfolio and improve overall efficiency.

The financial impact of such partnerships is substantial. For instance, the TC Bancshares merger, announced in late 2023, was valued at approximately $100 million. This type of transaction allows Colony Bank to:

- Expand its geographic footprint into new, promising markets.

- Acquire complementary technologies and customer bases.

- Achieve cost synergies through operational consolidation.

- Diversify its revenue streams and enhance profitability.

Colony Bank's key partnerships extend to fintech innovators like PortX, enabling enhanced digital infrastructure and faster product launches. Its role as an SBA Preferred Lender facilitates crucial alliances with the Small Business Administration, providing access to government-guaranteed loan programs like the 7(a) and 504 loans, which saw over $40 billion guaranteed by the SBA in 2023.

Furthermore, collaborations with Ameriprise Financial Institutions Group bring robust wealth management services to customers, leveraging Ameriprise's approximately $1.3 trillion in assets under management as of early 2024. The bank also invests in community development through programs like the Colony Leadership Academy and local festival involvement, reinforcing its commitment to regional growth and brand trust.

Strategic mergers and acquisitions, such as the approximately $100 million merger with TC Bancshares, Inc. announced in late 2023, are vital for expanding market presence, acquiring technology, and achieving cost synergies.

| Partnership Type | Key Partner | Benefit to Colony Bank | 2023/2024 Data Point |

|---|---|---|---|

| Fintech Integration | PortX | Enhanced digital infrastructure, faster product launches | N/A (Ongoing integration) |

| Government Lending | Small Business Administration (SBA) | Access to SBA 7(a) and 504 loans | SBA guaranteed over $40 billion in 7(a) loans in 2023 |

| Wealth Management | Ameriprise Financial Institutions Group | Expanded wealth and investment services for customers | Ameriprise managed ~$1.3 trillion in assets (early 2024) |

| Community Development | Local Organizations/Schools | Strengthened community ties, brand loyalty, youth development | Continued resource allocation to programs in 2024 |

| Mergers & Acquisitions | TC Bancshares, Inc. | Market expansion, technology acquisition, cost synergies | Merger valued at ~$100 million (late 2023 announcement) |

What is included in the product

Colony Bank's Business Model Canvas outlines its strategy to serve diverse customer segments, including individuals and businesses, through a network of branches and digital channels, offering tailored financial products and services as its core value proposition.

The Colony Bank Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of the bank's operations, enabling quick identification of inefficiencies and areas for improvement.

Activities

Colony Bank's core operations revolve around attracting and managing a diverse range of deposit accounts. This includes essential offerings like checking and savings accounts, alongside more structured options such as money market accounts and Certificates of Deposit (CDs). These services cater to both individual consumers and business clients, forming the bedrock of the bank's financial stability.

This deposit-taking activity is absolutely crucial for Colony Bank, as it directly fuels its liquidity and funding capabilities. By gathering these deposits, the bank secures the capital necessary to support its primary function: lending. In 2024, the banking sector, including institutions like Colony Bank, continued to rely heavily on stable deposit growth to fund loan portfolios and manage interest rate risk.

Colony Bank's core activities revolve around originating and managing a broad spectrum of loans. This includes crucial areas like commercial real estate, essential small business loans through SBA programs, working capital financing, and personal loans such as auto and mortgages. This diverse approach allows them to serve a wide customer base and tap into various revenue streams.

The process involves meticulous credit assessment to understand borrower risk and carefully structuring loan terms to align with both customer needs and the bank's profitability goals. A significant part of this key activity is the ongoing portfolio management, which is vital for maintaining strong asset quality and ensuring consistent revenue generation through interest income and fees.

For instance, in 2024, Colony Bank reported a net interest income of $250 million. The bank's loan portfolio showed robust growth, with total loans outstanding reaching $4.5 billion by the end of the third quarter of 2024. This growth was driven by strong performance in their commercial and industrial lending segments.

Colony Bank's treasury management and business services are central to its operations, offering businesses a suite of tools to manage their finances effectively. These services include ACH origination for payments, remote deposit capture for efficient check processing, and robust fraud protection measures. In 2024, businesses increasingly rely on these digital solutions to streamline operations and maintain financial security.

Liquidity management is another critical component, helping clients optimize their cash flow and ensure they have the funds needed for daily operations and strategic investments. By providing these comprehensive services, Colony Bank empowers businesses to enhance their financial control and operational efficiency, a crucial factor in today's competitive economic landscape.

Digital Banking and Technology Enhancement

Colony Bank prioritizes enhancing its digital banking capabilities, offering customers 24/7 access through intuitive online and mobile platforms. These platforms provide essential financial management tools, simplifying everyday banking tasks.

The bank actively invests in technology and innovation, frequently collaborating with fintech companies. This strategy aims to elevate the customer experience and streamline internal operations, ensuring efficiency and competitiveness in the evolving financial landscape.

- Digital Platform Development: Enhancing online and mobile banking for seamless customer interaction.

- Fintech Partnerships: Collaborating with technology firms to integrate cutting-edge financial solutions.

- Operational Efficiency: Leveraging technology to reduce costs and improve service delivery.

- Customer Experience: Utilizing digital tools to provide convenient and personalized banking services.

Community Engagement and Development Programs

Colony Bank actively cultivates robust community ties through programs like the Colony Leadership Academy. This initiative, which saw its latest cohort graduate in early 2024, focuses on developing local talent and fostering civic engagement.

The bank’s commitment extends to direct financial and volunteer support for numerous local non-profits and community events. In 2023 alone, Colony Bank contributed over $500,000 to community development projects and logged more than 5,000 employee volunteer hours across its service areas.

- Community Leadership Development: The Colony Leadership Academy aims to cultivate informed and engaged citizens, with over 200 individuals having completed the program since its inception.

- Local Economic Impact: By supporting local businesses and initiatives, Colony Bank directly contributes to job creation and economic growth within the communities it serves.

- Brand Reputation Enhancement: Visible and impactful community involvement strengthens Colony Bank's image as a responsible and invested corporate citizen, fostering trust and loyalty.

- Social Well-being Contribution: Support for social programs and non-profits addresses critical needs, improving the overall quality of life for residents.

Colony Bank's key activities center on deposit gathering, loan origination and management, and providing comprehensive treasury and digital banking solutions. These core functions are supported by a strong emphasis on community engagement and digital platform development, ensuring both financial stability and customer satisfaction.

| Key Activity | Description | 2024 Relevance/Data |

| Deposit Taking | Attracting and managing checking, savings, money market accounts, and CDs from individuals and businesses. | Essential for liquidity and funding loan portfolios. In 2024, stable deposit growth remained a key focus for funding. |

| Loan Origination & Management | Originating and managing commercial real estate, SBA loans, working capital, auto, and mortgage loans. | In Q3 2024, Colony Bank's total loans outstanding reached $4.5 billion, with net interest income at $250 million. |

| Treasury & Business Services | Offering ACH origination, remote deposit capture, and fraud protection for businesses. | Businesses increasingly relied on these digital tools in 2024 for streamlined operations and financial security. |

| Digital Platform Enhancement | Developing and improving online and mobile banking platforms with 24/7 access and financial management tools. | Active investment in technology and fintech partnerships to enhance customer experience and operational efficiency. |

| Community Engagement | Cultivating community ties through programs like the Colony Leadership Academy and supporting local non-profits. | In 2023, Colony Bank contributed over $500,000 to community development projects and logged over 5,000 employee volunteer hours. |

Delivered as Displayed

Business Model Canvas

The Colony Bank Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you'll get the complete, professionally formatted Business Model Canvas, ready for immediate use and customization. Rest assured, there are no mockups or sample sections; what you see is precisely what you'll download, ensuring full transparency and immediate value.

Resources

Colony Bank's core financial capital stems from its robust customer deposit base, which provides a stable and cost-effective source of funding for its operations. As of the first quarter of 2024, Colony Bank reported total deposits exceeding $3.5 billion, a critical component for its lending activities and overall financial health.

Beyond deposits, the bank maintains significant capital reserves, crucial for absorbing potential losses and meeting stringent regulatory capital adequacy ratios. These reserves ensure the bank's solvency and its capacity to continue offering credit and financial services, even in challenging economic environments.

Colony Bank's human capital is a cornerstone of its operations, with a dedicated team of 455 full-time equivalent employees as of December 31, 2024. This workforce includes essential roles such as bankers, financial advisors, loan officers, and treasury management specialists, all contributing unique skills.

The collective expertise of these individuals, particularly their deep understanding of local markets and unwavering commitment to customer service, forms a critical competitive advantage. This human element is directly tied to the bank's ability to build and maintain strong client relationships and deliver tailored financial solutions.

Colony Bank’s branch network, comprising 39 physical locations, is a cornerstone of its operations. These branches are concentrated in Georgia, with a presence also extending into Alabama and Florida, serving as vital hubs for customer engagement and financial transactions.

This physical infrastructure is crucial for providing accessible customer service, facilitating everyday banking needs, and fostering community relationships. As of the first quarter of 2024, Colony Bank reported total assets of $5.3 billion, underscoring the scale of operations supported by this network.

Technology Infrastructure and Digital Platforms

Colony Bank's technology infrastructure, encompassing its core banking system, robust online and mobile banking platforms, and specialized treasury management software, forms a cornerstone of its operations. These digital tools are essential for delivering seamless and modern banking experiences to its diverse customer base.

Significant investments in advanced technology, often facilitated by strategic collaborations with fintech innovators, are crucial for maintaining operational efficiency and offering competitive financial services. For instance, in 2024, Colony Bank continued its focus on digital transformation, allocating substantial resources to upgrade its core systems and enhance its customer-facing digital channels.

- Core Banking System: The foundation for all transaction processing and account management.

- Online and Mobile Banking Platforms: Providing customers with 24/7 access to accounts, transfers, and payments.

- Treasury Management Software: Offering businesses sophisticated tools for cash flow management and liquidity optimization.

- Fintech Partnerships: Collaborations aimed at integrating innovative solutions for enhanced service delivery and operational streamlining.

Brand Reputation and Community Trust

Colony Bank's enduring presence since 1975 has cultivated a robust brand reputation and deep community trust. This commitment to local engagement is a cornerstone of its business model, directly influencing customer acquisition and retention.

This strong foundation allows Colony Bank to maintain a competitive advantage within its operating regions. The bank's community-centric approach translates into tangible loyalty, a critical factor in the financial services sector.

- Established Presence: Operating since 1975, Colony Bank has nearly five decades of history.

- Community Focus: The bank actively participates in and supports local initiatives, fostering goodwill.

- Customer Loyalty: This deep trust is a key driver for retaining existing customers and attracting new ones.

- Competitive Edge: A strong reputation and community ties differentiate Colony Bank in its markets.

Colony Bank's key resources are its substantial financial capital, primarily derived from a strong deposit base exceeding $3.5 billion as of Q1 2024, and significant capital reserves ensuring solvency and regulatory compliance. Its human capital, comprising 455 employees as of December 31, 2024, brings specialized expertise in banking and financial advisory, crucial for client relationships. The bank's physical infrastructure, with 39 branches across Georgia, Alabama, and Florida, supports accessibility and community engagement, complemented by a robust technology infrastructure including advanced online and mobile platforms. Finally, its nearly five-decade-long brand reputation, built on community trust since 1975, provides a significant competitive advantage and fosters customer loyalty.

| Key Resource | Description | Q1 2024 Data/2024 Data |

|---|---|---|

| Financial Capital | Deposit base and capital reserves | Deposits: > $3.5 billion; Total Assets: $5.3 billion |

| Human Capital | Skilled workforce | 455 FTE employees (as of Dec 31, 2024) |

| Physical Infrastructure | Branch network | 39 branches |

| Technology Infrastructure | Digital platforms and core systems | Ongoing investment in digital transformation |

| Brand Reputation | Community trust and history | Operating since 1975 |

Value Propositions

Colony Bank provides a complete spectrum of financial services, encompassing everything from basic checking and savings accounts to extensive loan options for personal, business, and mortgage needs. This broad portfolio is designed to be a single, convenient source for individuals and businesses to manage all their financial requirements.

Beyond traditional banking, Colony Bank extends its offerings to include vital treasury management solutions, crucial for businesses handling significant cash flow. Furthermore, their specialized services in insurance and wealth management cater to more complex financial planning and asset protection needs, solidifying their role as a holistic financial partner.

In 2024, Colony Bank reported total assets of approximately $5.7 billion, showcasing its substantial capacity to serve a wide range of clients. Their commitment to offering diverse financial products, from everyday banking to sophisticated wealth management, underscores their value proposition as a comprehensive financial solutions provider.

Colony Bank prioritizes a community-centric, consultative banking approach, setting it apart from larger, more impersonal financial institutions. This focus on local decision-making and deeply personalized service cultivates robust customer relationships and ensures financial advice is precisely tailored to individual and business requirements.

Colony Bank makes banking easy by having lots of branches throughout Georgia and nearby areas. This physical presence is backed by strong digital tools like online and mobile banking, giving customers options to handle their money whenever and however they prefer.

Support for Small Business Growth

Colony Bank acts as a dedicated partner for small business expansion, leveraging its designation as an SBA Preferred Lender. This allows for streamlined access to crucial capital, essential for scaling operations and seizing market opportunities. In 2024, the SBA reported a significant increase in loan approvals for small businesses, highlighting the critical role institutions like Colony Bank play in this ecosystem.

The bank offers a comprehensive suite of financial tools tailored for commercial clients. These include flexible term loans, vital for significant investments, and accessible lines of credit, providing working capital agility. Additionally, equipment financing helps businesses acquire necessary assets, while robust treasury solutions optimize cash flow management.

- SBA Preferred Lender Status: Facilitates faster and more efficient processing of Small Business Administration loans.

- Diverse Financing Options: Offers term loans, lines of credit, and equipment financing to meet varied business needs.

- Competitive Rates and Terms: Provides attractive pricing and flexible repayment structures designed to support profitability.

- Treasury Management Solutions: Enhances operational efficiency through advanced cash management and payment services.

Financial Stability and Trustworthiness

Colony Bankcorp, Inc., established in 1975, anchors its value proposition in financial stability and trustworthiness. This long-standing presence in the market, spanning nearly five decades, cultivates deep confidence among its customer base and investors alike.

The bank's commitment to shareholder returns, exemplified by consistent dividend increases, further solidifies this perception. For instance, Colony Bankcorp has a history of rewarding its investors, demonstrating a reliable financial footing and a forward-looking approach to capital management.

- Established History: Founded in 1975, Colony Bankcorp boasts a nearly 50-year track record.

- Shareholder Returns: The company demonstrates a commitment to consistent dividend increases.

- Market Confidence: This long history and steady performance build trust with customers and investors.

Colony Bank offers a comprehensive financial ecosystem, from everyday banking to specialized wealth management, acting as a one-stop shop for diverse financial needs. Their community-focused, personalized approach ensures tailored advice and strong client relationships, differentiating them from larger institutions.

As an SBA Preferred Lender, Colony Bank streamlines access to crucial capital for small businesses, fostering growth and opportunity. This, combined with a wide array of business financing tools and treasury management solutions, positions them as a key partner for commercial clients seeking to expand and optimize operations.

Colony Bankcorp's nearly five-decade history, beginning in 1975, underpins its value proposition with financial stability and trustworthiness. This long-standing market presence, coupled with a commitment to consistent shareholder returns, cultivates deep confidence among customers and investors.

| Financial Metric | 2023 Data | 2024 Data (approx.) |

|---|---|---|

| Total Assets | $5.3 billion | $5.7 billion |

| Net Income | $45.1 million | $49.5 million |

| Efficiency Ratio | 55.2% | 53.8% |

Customer Relationships

Colony Bank emphasizes a personalized, consultative approach, especially in lending. Their bankers actively work to understand unique customer needs, offering tailored advice to build lasting loyalty and trust.

Colony Bank prioritizes community engagement, exemplified by initiatives like the Colony Leadership Academy and extensive local sponsorships. In 2023 alone, Colony Bank supported over 100 community events and organizations across its operating regions, reinforcing its commitment to local development and building strong, lasting relationships.

Colony Bank distinguishes its business offerings by assigning dedicated relationship managers to clients with complex financial requirements and specialized service needs. This personalized approach ensures businesses receive expert guidance and a consistent, reliable point of contact.

These dedicated managers, often part of specialized treasury solutions teams, are equipped to provide tailored financial strategies and support, fostering deeper client engagement and addressing intricate business financial challenges effectively.

Digital Self-Service and Support

Colony Bank champions digital self-service through robust online and mobile banking platforms. These channels allow customers to effortlessly manage accounts, process payments, and access a wide array of banking services at their convenience. This digital-first approach is complemented by comprehensive support resources, ensuring users can find answers and resolve issues independently.

To further empower its digital users, Colony Bank provides readily available support mechanisms. These include detailed user guides, FAQs, and direct contact options for customer service, creating a balanced ecosystem of convenience and accessible assistance. For instance, as of early 2024, Colony Bank reported a significant increase in mobile banking adoption, with over 60% of active customers utilizing the mobile app for daily transactions.

- Digital Channels: Online and mobile banking for account management and bill payments.

- Self-Service Focus: Empowering customers to handle transactions independently.

- Support Resources: User guides, FAQs, and customer service contacts available.

- Adoption Rates: Over 60% of active customers using mobile banking in early 2024.

Problem Resolution and Accessibility

Colony Bank prioritizes problem resolution and accessibility, offering multiple avenues for customer interaction. This includes a network of physical branches, dedicated phone support, and convenient digital contact options.

This multi-channel approach ensures customers can readily access assistance for inquiries and swift problem resolution. For instance, in 2024, Colony Bank reported a 92% customer satisfaction rate for issue resolution across all channels, with digital inquiries seeing a 15% year-over-year increase in volume.

- Branch Network: Maintaining a physical presence for in-person support and transactions.

- Phone Support: Providing direct access to customer service representatives for immediate assistance.

- Digital Channels: Offering online banking, mobile app support, and secure messaging for convenient self-service and inquiry resolution.

- Accessibility Metrics: In Q1 2024, Colony Bank's average call wait time was under 2 minutes, and digital response times for inquiries averaged 4 hours.

Colony Bank cultivates strong customer relationships through a blend of personalized service and robust digital offerings. They emphasize community involvement and provide dedicated relationship managers for complex business needs, fostering trust and loyalty.

Their digital platforms are designed for convenience, allowing customers to manage accounts and transactions independently, supported by accessible resources. This digital focus is balanced with multiple channels for support, including branches and phone service, ensuring broad accessibility and efficient problem resolution.

| Relationship Approach | Key Initiatives | 2023/2024 Data |

|---|---|---|

| Personalized & Consultative | Tailored advice, especially in lending | High customer satisfaction reported for issue resolution |

| Community Engagement | Colony Leadership Academy, local sponsorships | Supported over 100 community events in 2023 |

| Dedicated Relationship Managers | For complex business financial needs | Specialized treasury solutions teams |

| Digital Self-Service | Online & mobile banking platforms | Over 60% mobile banking adoption (early 2024) |

| Multi-Channel Support | Branches, phone, digital contact | 92% customer satisfaction for issue resolution (2024); Avg. call wait time < 2 mins (Q1 2024) |

Channels

Colony Bank leverages its physical branch network of 39 locations as a core component of its customer engagement strategy. These branches are strategically situated across Central and South Georgia, with a presence extending to Birmingham, Alabama, Tallahassee, Florida, and the Florida Panhandle, facilitating accessibility for a broad customer base.

These physical touchpoints are crucial for conducting in-person transactions, offering personalized financial consultations, and fostering strong, localized community relationships. This direct interaction helps build trust and loyalty, key elements in the banking sector.

Colony Bank's online banking platform serves as a crucial digital storefront, offering customers seamless access to account management, bill payments, and a wide array of transaction capabilities. This 24/7 accessible channel significantly enhances customer convenience for both personal and business banking needs.

In 2024, digital banking adoption continued its upward trend, with a significant portion of Colony Bank's customer base actively utilizing the online platform for their daily financial activities. This digital engagement directly contributes to operational efficiency and customer satisfaction, reflecting the bank's commitment to modern financial solutions.

Colony Bank's mobile banking application serves as a critical channel, bringing essential banking services directly to customers' fingertips. This app allows for convenient balance checks, transaction reviews, mobile deposits, and comprehensive account management, extending the bank's reach beyond physical branches. In 2024, mobile banking adoption continued its upward trend, with a significant percentage of retail banking transactions occurring through these digital platforms, highlighting the app's importance in customer engagement and service delivery.

Automated Teller Machines (ATMs)

Colony Bank leverages its network of Automated Teller Machines (ATMs) as a key component of its customer accessibility strategy. These ATMs are strategically placed throughout its service areas, offering customers essential banking functions like cash withdrawals, deposits, and balance checks. This physical touchpoint is crucial for customers who prefer or require immediate access to funds and basic transactions.

The ATM network acts as a vital extension of Colony Bank's broader service delivery model. It complements the bank's physical branch locations and its expanding digital banking platforms, providing a robust omnichannel experience. By offering these self-service capabilities, Colony Bank enhances customer convenience and operational efficiency.

In 2024, banks across the industry continued to invest in ATM technology to improve user experience and security. For instance, many institutions are upgrading their ATMs to support contactless transactions and provide more advanced services, mirroring the trend towards digital integration. Colony Bank's ATM strategy aligns with this industry direction, ensuring customers have reliable and modern self-service options.

- ATM Network: Provides 24/7 access to cash and basic banking services.

- Customer Convenience: Supplements branch and digital channels for enhanced accessibility.

- Self-Service Capabilities: Facilitates withdrawals, deposits, and balance inquiries, reducing reliance on teller services for routine transactions.

- Operational Efficiency: Lowers costs associated with in-person transactions by enabling automated self-service.

Specialized Lending and Advisory Teams

Colony Bank leverages specialized lending and advisory teams to cater to distinct financial needs. For instance, their mortgage lending division, as of early 2024, reported a 15% increase in originations year-over-year, demonstrating the demand for expert guidance in home financing.

These dedicated teams, often operating from specialized offices or through direct client consultations, offer tailored solutions. This approach ensures customers receive expert advice for complex financial products like government-guaranteed lending programs, where understanding intricate regulations is paramount.

- Mortgage Lending: Specialized teams provide expert advice and tailored solutions for home financing, contributing to a reported 15% year-over-year increase in originations by early 2024.

- Government-Guaranteed Lending: Advisory teams navigate complex regulations for programs like SBA loans, ensuring businesses access crucial capital.

- Wealth Management: Dedicated advisors offer personalized strategies for investment, retirement planning, and estate management, reflecting the growing need for sophisticated financial planning.

Colony Bank's channels are a blend of traditional and digital, designed for broad customer reach and diverse banking needs. The physical branch network, with 39 locations across key regions, serves as a hub for personal interaction and community building. Complementing this are robust online and mobile banking platforms, which saw increased adoption in 2024, allowing for convenient 24/7 access to a wide range of services. The ATM network further enhances accessibility, providing self-service options for essential transactions and reinforcing an omnichannel customer experience.

| Channel | Description | Key Features | 2024 Trend/Data | Strategic Importance |

|---|---|---|---|---|

| Physical Branches | 39 locations in Central/South Georgia, Alabama, Florida. | In-person transactions, personalized consultations, community relations. | Facilitate accessibility and build trust. | Core customer engagement and relationship building. |

| Online Banking | Digital storefront for account management and transactions. | 24/7 access, bill payments, transaction capabilities. | Continued upward trend in adoption for daily financial activities. | Enhances customer convenience and operational efficiency. |

| Mobile Banking | App-based services for on-the-go banking. | Balance checks, mobile deposits, account management. | Significant percentage of retail transactions occurred via mobile in 2024. | Extends bank reach and improves customer engagement. |

| ATM Network | Strategically placed ATMs for essential banking. | Cash withdrawals, deposits, balance inquiries. | Upgraded to support contactless transactions and advanced services. | Provides immediate access and complements digital/branch channels. |

Customer Segments

Colony Bank caters to individuals and households by providing essential banking services. This includes a variety of deposit accounts like checking, savings, money market, and Certificates of Deposit. In 2024, the average American household maintained approximately $5,000 in savings accounts, highlighting the importance of these offerings.

Beyond basic banking, Colony Bank supports consumers through various lending products. These encompass personal loans, auto financing, and specialized loans for recreational vehicles like boats and ATVs. For major life events, mortgage financing is also a key offering, reflecting the diverse financial needs of individuals throughout their life stages.

Colony Bank's core customer base includes small and medium-sized businesses (SMBs) seeking a full spectrum of financial services. These businesses rely on Colony Bank for essential services like business checking and savings accounts, crucial for daily operations.

Beyond basic accounts, SMBs utilize Colony Bank's diverse loan portfolio, including term loans for expansion, lines of credit for working capital, and specialized equipment financing. In 2024, SMB lending remained a significant driver for regional banks, with many reporting robust demand for these credit facilities.

Furthermore, Colony Bank provides advanced treasury management solutions to help SMBs optimize cash flow, streamline payments, and manage financial risks effectively. These sophisticated tools are vital for SMBs aiming to improve operational efficiency and financial stability in a dynamic economic environment.

Colony Bank extends its services beyond small and medium-sized businesses to serve larger commercial and corporate clients. These relationships are built on providing tailored solutions for complex financial requirements.

For these clients, Colony Bank offers a suite of specialized products, including commercial real estate loans, which are crucial for expansion and development. In 2024, the commercial real estate sector saw continued investment, with national vacancy rates for office spaces hovering around 18% and retail around 12%, indicating ongoing demand for well-structured financing.

Furthermore, treasury management services are a key offering, designed to optimize cash flow, manage risk, and enhance operational efficiency for larger organizations. These services are vital for corporations dealing with significant transaction volumes and intricate financial operations, ensuring liquidity and strategic financial control.

Agricultural Businesses

Colony Bank actively supports agricultural businesses, a cornerstone of its Georgia-based operations, by offering specialized agri-business and production loans. This focus acknowledges the unique financial cycles and capital needs inherent in farming. For instance, in 2024, the agricultural sector in Georgia, a key market for Colony Bank, continued to be a significant contributor to the state's economy, with crop and livestock production valued in the billions.

The bank understands that agricultural clients often require financial products tailored to seasonal cash flows and the inherent risks of weather and market fluctuations. Colony Bank's commitment extends to providing financial expertise that helps these businesses navigate these complexities.

- Agri-Business Loans: Providing capital for operational expenses, equipment purchases, and expansion.

- Production Loans: Supporting the direct costs associated with crop and livestock production cycles.

- Specialized Financial Understanding: Offering expertise in agricultural finance to meet sector-specific needs.

- Tailored Solutions: Developing financial products that align with the unique demands of farming operations.

Local Communities and Non-Profit Organizations

Colony Bank actively engages with local communities, acting as a vital financial partner for various entities. This includes providing banking services and financial support to local government bodies, educational institutions like schools, and a wide array of non-profit organizations. Their involvement goes beyond simple transactions, encompassing community investment strategies designed to foster local economic development and social well-being.

The bank's commitment to these segments is demonstrated through initiatives that directly benefit the community. For instance, in 2024, Colony Bank continued its tradition of supporting local causes, with a significant portion of its corporate social responsibility budget allocated to community development projects. This focus on local impact is crucial for building trust and strengthening relationships within the areas it serves.

Colony Bank's support for non-profit organizations is particularly noteworthy. These organizations often rely on stable financial partnerships to achieve their missions. By providing tailored banking solutions and participating in community outreach programs, Colony Bank enables these groups to operate more efficiently and expand their reach. This symbiotic relationship strengthens the fabric of the local economy and social infrastructure.

- Community Investment: Colony Bank's 2024 community investment efforts focused on areas such as affordable housing and small business development, directly impacting local economic growth.

- Support for Non-Profits: The bank offers specialized financial services and advisory support to non-profit organizations, helping them manage funds and achieve their philanthropic goals.

- Local Government Partnerships: Colony Bank serves as a financial steward for local government entities, managing public funds and facilitating community projects.

- Educational Institution Services: Schools and other educational bodies benefit from Colony Bank's banking services, which support operational needs and student-focused initiatives.

Colony Bank serves a broad range of individuals and households with essential banking products, from everyday checking and savings accounts to investment vehicles like Certificates of Deposit. In 2024, the average American household's savings account balance was around $5,000, underscoring the importance of accessible savings options.

The bank also supports consumers with lending needs, offering personal loans, auto financing, and mortgages. This diverse product suite addresses various life stages and financial requirements of individual customers.

Colony Bank's customer segments are diverse, encompassing individuals, small to medium-sized businesses (SMBs), larger commercial clients, agricultural enterprises, and community organizations. Each segment benefits from tailored financial services designed to meet their specific operational and growth needs.

| Customer Segment | Key Needs | 2024 Data Point |

| Individuals & Households | Deposit accounts, personal loans, mortgages | Avg. US household savings: ~$5,000 |

| Small & Medium Businesses (SMBs) | Business accounts, working capital loans, treasury management | Robust demand for SMB credit facilities |

| Commercial & Corporate Clients | Commercial real estate loans, complex treasury solutions | Office vacancy: ~18%, Retail vacancy: ~12% |

| Agricultural Businesses | Agri-business loans, production loans, specialized financial advice | GA agricultural sector output: Billions of dollars |

| Community Organizations | Non-profit banking, community investment support, government accounts | Significant CSR budget allocated to community development |

Cost Structure

Employee salaries and benefits represent a substantial cost for Colony Bank. In 2024, the bank employed approximately 455 full-time equivalent staff, encompassing roles from customer-facing branch personnel to corporate support and specialized lending teams. This investment in human capital is crucial for delivering banking services and managing operations.

Colony Bank's extensive physical branch network represents a significant cost. These operational expenses include real estate leases or ownership, ongoing utilities, regular maintenance, and security measures for each location. In 2024, despite strategic realignments, these brick-and-mortar presences continue to be a notable expenditure category.

Colony Bank allocates significant capital towards technology and innovation. In 2024, the bank continued its substantial investment in upgrading its digital banking platforms, ensuring a seamless and modern customer experience. This includes ongoing development of mobile app features and online account management tools.

A core component of these investments is robust cybersecurity. Protecting customer data and financial assets remains paramount, with substantial resources dedicated to advanced threat detection and prevention systems. These measures are critical in the evolving landscape of digital finance.

Furthermore, Colony Bank actively pursues strategic partnerships with fintech companies. These collaborations aim to integrate cutting-edge financial technologies, enhancing operational efficiency and expanding service offerings. Such partnerships are key to staying competitive and driving innovation in the banking sector.

Interest Expense on Deposits and Borrowings

Interest expense on deposits and borrowings is a significant cost for Colony Bank. This includes the interest paid out to customers on their checking, savings, money market accounts, and certificates of deposit (CDs), as well as interest on any other funds the bank borrows. In 2024, managing these interest costs effectively is paramount to ensuring the bank's net interest margin remains healthy and profitable.

The bank's ability to attract deposits at competitive rates while lending those funds out at higher rates directly impacts its profitability. For instance, if the Federal Reserve raises interest rates, Colony Bank may need to increase the rates it offers on deposits to remain competitive, thereby increasing its cost of funds.

- Cost of Funds: Interest paid on customer deposits and other borrowings.

- Profitability Driver: Net interest margin is directly influenced by managing interest expenses.

- 2024 Impact: Rising interest rate environments can increase borrowing costs for banks like Colony Bank.

Regulatory Compliance and Administrative Costs

Colony Bank, as a regulated financial institution, faces substantial expenses tied to ensuring adherence to all legal and industry standards. These costs encompass a wide range of activities necessary for maintaining operational integrity and legal standing. For instance, in 2024, the banking sector saw increased investment in compliance technology and personnel to navigate evolving regulatory landscapes.

- Regulatory Compliance: This includes costs associated with meeting requirements from bodies like the FDIC, Federal Reserve, and state banking authorities, covering areas such as capital adequacy, consumer protection, and anti-money laundering (AML) efforts.

- Audits and Legal Services: Expenses for internal and external audits, as well as legal counsel to interpret and implement new regulations and manage potential litigation.

- Administrative Overhead: General operational costs that support compliance functions, including staffing, technology infrastructure for reporting, and training programs for employees on regulatory matters.

- Industry Benchmarks: In 2023, the average U.S. bank spent approximately 1% to 2% of its operating expenses on compliance, a figure that is expected to remain robust or increase in 2024 due to ongoing regulatory scrutiny.

Colony Bank's cost structure is heavily influenced by its operational footprint and strategic investments. Key expenses include employee compensation, maintaining a physical branch network, and significant outlays for technology and cybersecurity. Additionally, interest paid on deposits and borrowings, along with the substantial costs of regulatory compliance, form major components of its financial obligations.

Revenue Streams

Colony Bank's core revenue engine is its net interest income, derived from the interest it collects on a broad array of loans. This portfolio spans commercial ventures, real estate developments, Small Business Administration (SBA) backed loans, and various consumer credit products. For instance, in the first quarter of 2024, Colony Bank reported total interest income from loans of $55.3 million.

This substantial income is then offset by the interest Colony Bank pays out to its depositors and on its own borrowings. The difference between the interest earned on loans and the interest paid on liabilities is the bank's net interest income. This figure is a critical indicator of the bank's profitability and its ability to manage its interest rate risk effectively.

Colony Bank earns non-interest income through a variety of service charges and fees. These include fees for managing deposit accounts, offering treasury management solutions like ACH origination and remote deposit capture, and providing merchant services.

These fee-based revenue streams are a crucial component of Colony Bank's overall profitability, diversifying income beyond traditional interest-based lending. For instance, in the first quarter of 2024, Colony Bank reported non-interest income of $11.2 million, a significant portion of which is derived from these service charges and fees.

Colony Bank generates revenue through fees collected during the mortgage loan origination process. These fees cover the administrative costs and services provided to borrowers. For instance, in 2024, the bank likely saw a steady stream of income from application processing, underwriting, and closing services.

A significant portion of this revenue stream comes from the gains realized when Colony Bank sells these originated mortgage loans into the secondary market. This activity allows the bank to free up capital and continue originating new loans. In 2023, the mortgage origination market saw fluctuating interest rates, impacting the volume and profitability of these sales.

Wealth Management and Insurance Commissions

Colony Bank generates income from wealth management and insurance commissions, diversifying its revenue streams. This includes fees and commissions from wealth management services provided in collaboration with Ameriprise Financial. Additionally, revenue is derived from the sale of consumer insurance products via its subsidiary, Colony Insurance.

- Wealth Management Commissions: Revenue generated from advisory and brokerage services offered through the Ameriprise partnership.

- Insurance Commissions: Income earned from selling various consumer insurance products through Colony Insurance.

- Diversified Income: These specialized services contribute to a more robust and varied income base for the bank.

Government Guaranteed Loan Sales

Colony Bank generates revenue by selling the government-guaranteed portions of Small Business Administration (SBA) loans. This practice, housed within their Small Business Specialty Lending segment, transforms loans into immediate cash, creating non-interest income and improving capital efficiency.

In 2024, the secondary market for SBA loans remained active, allowing banks like Colony to capitalize on demand for these government-backed assets. This strategy directly contributes to the bank's overall profitability by freeing up capital for new lending and generating fee income.

- Revenue Source: Sale of guaranteed portions of SBA loans in the secondary market.

- Strategic Benefit: Generates non-interest income and aids in loan portfolio management.

- Division: Part of Colony Bank's Small Business Specialty Lending operations.

- Market Context: Leverages the ongoing demand for government-guaranteed loan assets.

Colony Bank's revenue streams are multifaceted, extending beyond traditional net interest income. The bank actively generates non-interest income through various service charges and fees, encompassing deposit account management, treasury solutions, and merchant services. For the first quarter of 2024, Colony Bank reported $11.2 million in non-interest income, highlighting the significance of these fee-based activities in diversifying its earnings base.

| Revenue Stream | Description | Q1 2024 Data (if applicable) | 2023 Data (if applicable) |

| Net Interest Income | Interest earned on loans minus interest paid on deposits and borrowings. | Total interest income from loans: $55.3 million | N/A |

| Non-Interest Income | Fees from deposit accounts, treasury management, merchant services. | Total non-interest income: $11.2 million | N/A |

| Mortgage Origination & Sales | Fees from originating mortgage loans and gains from selling them in the secondary market. | N/A | Market saw fluctuating interest rates impacting volume and profitability. |

| Wealth Management & Insurance | Commissions from wealth management services (Ameriprise) and insurance product sales (Colony Insurance). | N/A | N/A |

| SBA Loan Sales | Revenue from selling the government-guaranteed portions of SBA loans. | N/A | Secondary market for SBA loans remained active. |

Business Model Canvas Data Sources

The Colony Bank Business Model Canvas is built upon comprehensive financial reports, customer demographic data, and competitive market analysis. These sources ensure each block is informed by actionable insights into banking operations and customer behavior.