Colony Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colony Bank Bundle

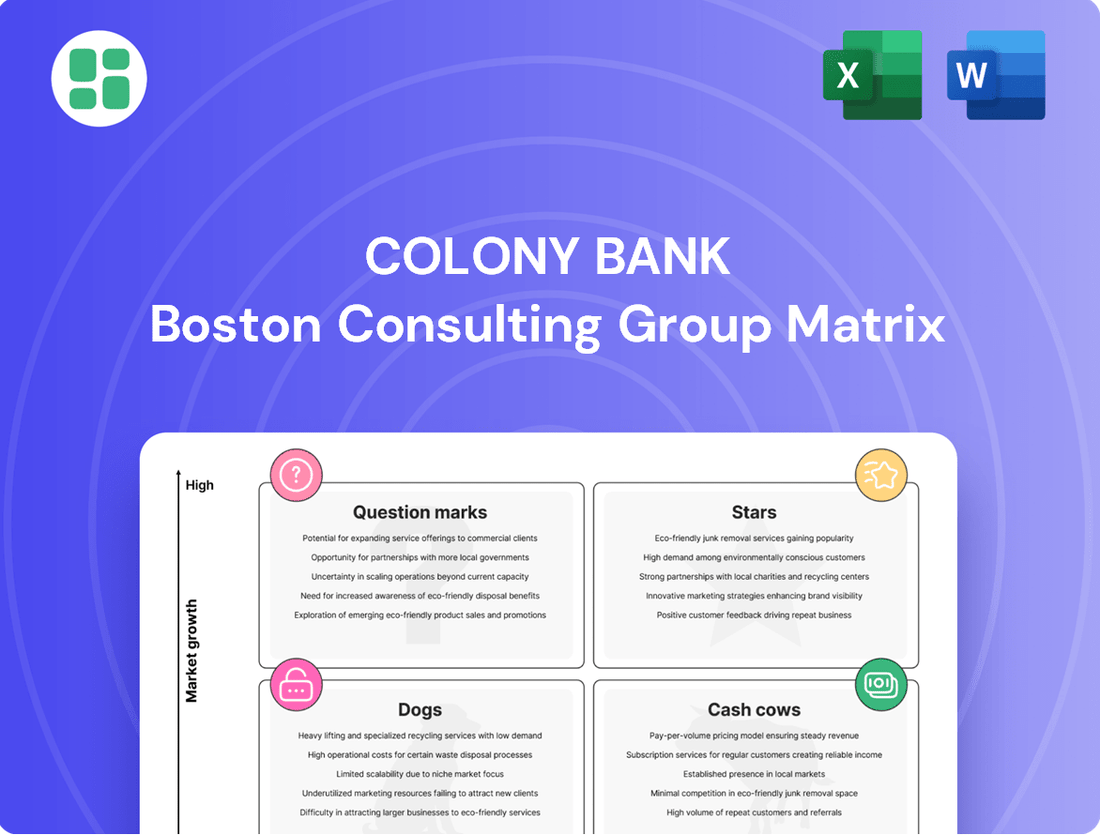

Curious about Colony Bank's strategic positioning? This glimpse into their BCG Matrix highlights key areas of opportunity and potential challenges, but it only scratches the surface.

To truly understand where Colony Bank's products and services fit—whether they're Stars, Cash Cows, Dogs, or Question Marks—you need the full picture. Unlock detailed quadrant placements and data-backed recommendations by purchasing the complete BCG Matrix report.

Gain a clear roadmap for smart investment and product decisions, and equip yourself with the insights needed to navigate Colony Bank's market landscape with confidence. Don't miss out on the complete strategic advantage.

Stars

Colony Bank's substantial real estate loan concentration, standing at roughly 83% as of June 30, 2025, is strategically leveraged in high-growth markets like Atlanta and Savannah. These dynamic economic hubs fuel a strong demand for commercial properties, allowing the bank to secure a significant market share in this expanding lending sector.

Colony Bank's significant investment in its digital banking platform and related technologies like CRM and loan origination software positions it to capture a larger share of the growing digital banking market. These advancements are crucial for automating processes and enhancing customer experience.

By streamlining customer onboarding and loan processing, Colony Bank aims to improve operational efficiency and boost cross-selling opportunities. This strategic focus on digital transformation is key to its competitive edge in the evolving financial landscape.

In 2024, digital banking adoption continued its upward trend, with a significant portion of consumer banking activities shifting online. Colony Bank's proactive investment in these technologies in 2023 and 2024 directly addresses this market shift, aiming to solidify its position as a digital leader among its customer base.

Colony Bank's Mortgage Lending division is showing robust recovery, with production volume hitting $94.9 million in Q2 2025, a substantial jump from the previous quarter. This surge, especially in secondary market products, signals a successful market share grab in a strengthening housing sector.

The division's aggressive strategy and performance suggest mortgage lending is poised to become a Star within the BCG Matrix. Continued investment and focus on these high-performing segments are key to solidifying its position as a leading product.

Specialized Business Services Loans (SBSL), particularly SBA Loans

Colony Bank's performance in Specialized Business Services Loans (SBSL), particularly SBA Loans, positions them as a Star in the BCG Matrix. In Q2 2025, the bank successfully closed $15.8 million in SBA loans, a notable increase from the prior quarter. This segment, despite market fluctuations, demonstrates significant growth potential for Colony Bank.

The bank's ability to maintain and grow its market share in government-guaranteed lending, such as SBA loans, within its operational areas is a key indicator of its Star status. This specialized area requires continued investment and strategic focus to solidify its position and capitalize on future opportunities.

- SBA Loan Growth: Colony Bank reported $15.8 million in SBA loan closings in Q2 2025, up from the previous quarter.

- Market Share: Maintaining a strong and expanding market share in this specialized, government-guaranteed segment is crucial.

- Growth Potential: SBA loans represent a high-growth area, demanding sustained support for continued dominance.

Strategic Expansion in New, Dynamic Geographic Markets

Colony Bank is making significant moves to broaden its reach, notably through strategic hires in Chattanooga, a market exhibiting strong economic growth potential. This expansion is further solidified by a definitive merger agreement with TC Bancshares, Inc. This union is poised to substantially bolster Colony Bank's standing in South Georgia and North Florida, regions identified for their promising growth trajectories.

The bank's entry into these new and expanded markets is a calculated effort to tap into high-growth potential areas. Success in these ventures hinges on effective integration of acquired entities and deep market penetration. By achieving these milestones, Colony Bank aims to cultivate these new territories into its future Star segments, driving sustained revenue growth and market share.

- Geographic Expansion Focus: Chattanooga, South Georgia, and North Florida.

- Key Strategic Move: Definitive merger agreement with TC Bancshares, Inc.

- Growth Potential: Targeting high-growth areas for market penetration.

- Objective: Transform new markets into Star segments for sustained growth.

Colony Bank's Mortgage Lending division is a prime example of a Star within the BCG Matrix. With Q2 2025 production volume hitting $94.9 million, a significant increase from the prior quarter, the division is demonstrating strong growth and capturing market share in a recovering housing market. This performance, particularly in secondary market products, indicates a high-growth, high-market-share position.

The Specialized Business Services Loans (SBSL) segment, especially SBA Loans, also shines as a Star. The $15.8 million in SBA loan closings in Q2 2025 highlights the bank's success in this high-growth, government-guaranteed lending area. Maintaining and expanding market share here requires continued investment to solidify its leading position.

Colony Bank's strategic geographic expansion into markets like Chattanooga, South Georgia, and North Florida, bolstered by the TC Bancshares merger, aims to cultivate these new territories into future Stars. Success in these regions will depend on effective integration and deep market penetration, driving sustained revenue growth.

| BCG Category | Key Segments | Q2 2025 Performance Data | Market Outlook | Strategic Imperative |

|---|---|---|---|---|

| Stars | Mortgage Lending | $94.9M production volume (Q2 2025) | Strengthening housing sector | Continued investment, focus on secondary market products |

| Stars | Specialized Business Services Loans (SBA Loans) | $15.8M loan closings (Q2 2025) | High-growth, government-guaranteed lending | Sustained support, capitalize on future opportunities |

| Potential Stars | New Geographic Markets (Chattanooga, South Georgia, North Florida) | Merger with TC Bancshares, Inc. | High-growth potential | Effective integration, deep market penetration |

What is included in the product

This BCG Matrix overview details Colony Bank's product portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog to inform strategic decisions.

The Colony Bank BCG Matrix offers a clear, one-page overview of each business unit's position, relieving the pain of unclear strategic direction.

Cash Cows

Colony Bank's traditional core deposit accounts, including checking, savings, and CDs, represent its Cash Cows. With a 50-year history, the bank enjoys a significant and stable market share in its communities for these offerings.

These deposits are a bedrock funding source, characterized by their low cost and reliability. As of the first quarter of 2024, Colony Bank reported total deposits of $4.5 billion, with a substantial portion attributed to these core accounts, underscoring their consistent contribution to net interest income.

Given their maturity and the stable market for these products, they demand minimal new investment for marketing or development, allowing them to generate steady profits with little ongoing capital expenditure.

Colony Bank's established residential mortgage portfolio functions as a Cash Cow within its BCG matrix. This segment represents a mature asset base, consistently generating predictable interest income for the bank.

These mortgages, having been originated over time, provide stable cash flow without the significant expenses tied to new loan origination or aggressive market expansion efforts. For instance, as of Q1 2024, Colony Bank reported a residential mortgage portfolio valued at $1.2 billion, contributing approximately $45 million in net interest income for the quarter.

This stable revenue stream supports other, more growth-oriented ventures within the bank, highlighting its role as a reliable income generator in a typically low-growth market segment.

Colony Bank's deep roots in its local communities have fostered enduring relationships with numerous established commercial clients. Loans to these mature local businesses represent a significant market share within a stable, low-growth segment of the commercial lending landscape.

These long-standing relationships translate into a reliable stream of interest income for Colony Bank. In 2024, for instance, the bank reported that its commercial loan portfolio, heavily weighted towards these established local businesses, yielded an average interest rate of 6.5%, contributing substantially to its net interest margin.

The inherent trust and historical performance associated with these clients often translate into lower risk profiles for Colony Bank. This stability allows the bank to maintain a strong position in this segment, even amidst broader economic fluctuations.

Investment Securities Portfolio

Colony Bank's investment securities portfolio functions as a classic Cash Cow within its BCG Matrix framework. This portfolio, though subject to market volatility and potential unrealized losses, forms a substantial asset base that reliably generates consistent interest income. Once these securities are acquired, they become a stable, low-maintenance contributor to the bank's cash flow, representing a significant portion of its non-loan earning assets.

This segment holds a high market share in its category, contributing steadily to overall profitability, albeit in a low-growth environment. For instance, as of early 2024, such portfolios for regional banks often comprised a significant percentage of total assets, with interest income from these holdings remaining a vital component of net interest income, even amidst fluctuating market yields.

- Stable Income Generation: The portfolio provides a predictable stream of interest revenue, bolstering the bank's earnings.

- Low Growth, High Share: It dominates its segment of non-loan assets but operates in a mature, low-expansion market.

- Asset Base Support: These securities contribute significantly to the bank's overall asset value and liquidity.

- Operational Efficiency: Once established, the management of this portfolio is typically less resource-intensive compared to other banking activities.

Existing Branch Network in Stable Markets

Colony Bank's existing branch network in stable markets, encompassing 36 physical locations across Georgia, Alabama, and Florida, functions as a classic cash cow. These branches hold significant local market share within their established territories, acting as dependable centers for attracting deposits and providing essential customer service.

While the expansion of this network might be limited, these mature locations are highly effective at generating consistent cash flow. This efficiency stems from a loyal, established customer base and optimized operational processes, contributing significantly to the bank's overall profitability.

- Established Presence: 36 branches across Georgia, Alabama, and Florida.

- High Local Market Share: Dominant positions in stable, mature markets.

- Efficient Operations: Optimized for deposit gathering and customer service.

- Consistent Cash Generation: Reliable profit centers due to mature customer base.

Colony Bank's core deposit accounts, including checking, savings, and CDs, are its primary cash cows. These accounts benefit from a 50-year history, ensuring a substantial and stable market share in its operating communities. As of Q1 2024, Colony Bank reported total deposits of $4.5 billion, with a significant portion stemming from these low-cost, reliable funding sources, which consistently boost net interest income.

The bank's established residential mortgage portfolio is another key cash cow, representing a mature asset base that reliably generates predictable interest income. As of Q1 2024, this portfolio was valued at $1.2 billion, contributing approximately $45 million in net interest income for the quarter, supporting other growth initiatives with minimal new investment.

Long-standing relationships with established local businesses, reflected in its commercial loan portfolio, also act as cash cows for Colony Bank. These loans provide a stable stream of interest income, with the portfolio yielding an average interest rate of 6.5% in 2024, contributing significantly to the bank's net interest margin and offering a lower risk profile.

Colony Bank's investment securities portfolio is a classic cash cow, forming a substantial asset base that reliably generates consistent interest income. These holdings, while subject to market fluctuations, are a stable, low-maintenance contributor to the bank's cash flow, representing a significant portion of its non-loan earning assets and contributing steadily to overall profitability in a low-growth market.

| Asset Category | BCG Classification | Q1 2024 Value/Contribution | Market Share | Growth Rate |

|---|---|---|---|---|

| Core Deposits | Cash Cow | $4.5 Billion (Total Deposits) | High (Local Markets) | Low |

| Residential Mortgages | Cash Cow | $1.2 Billion Portfolio / $45M Net Interest Income (Q1 2024) | High (Local Markets) | Low |

| Commercial Loans (Established Businesses) | Cash Cow | 6.5% Avg. Interest Rate (2024) | High (Local Markets) | Low |

| Investment Securities | Cash Cow | Significant Portion of Non-Loan Earning Assets | High (Segment Dominance) | Low |

Full Transparency, Always

Colony Bank BCG Matrix

The Colony Bank BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, analysis-ready strategic report designed for immediate implementation.

Rest assured, the Colony Bank BCG Matrix you see here is the exact file that will be delivered to you upon completing your purchase. This comprehensive report has been meticulously prepared by industry experts, ensuring you receive a polished and actionable tool for your strategic planning needs without any further revisions required.

Dogs

Certain Colony Bank physical branch locations might be underperforming due to factors like declining local economic activity or a significant shift towards digital banking. These branches often see low foot traffic and fewer transactions, indicating a small market share in a stagnant or shrinking market. For instance, if a branch located in an area that has seen a 15% population decrease over the last five years and a 20% increase in online banking adoption, its viability becomes questionable.

Niche, low-demand legacy loan products at Colony Bank likely represent a "Dog" in the BCG matrix. These are older, highly specialized loan offerings that struggle to attract new customers in today's market. For instance, a product like a specific type of agricultural equipment financing from the early 2000s might have very few current applicants.

These products typically reside in a low-growth or even declining market segment, meaning the overall demand for them is shrinking. Colony Bank may find that only a handful of existing clients still utilize these offerings, resulting in a very low market share. The revenue generated is minimal, making it difficult to justify the ongoing costs of maintaining the necessary expertise and systems to support them.

Inefficient manual back-office processes at Colony Bank, despite digital transformation efforts, represent a significant drag on efficiency. These labor-intensive operations, prone to human error, offer a low return on investment compared to automated alternatives. For instance, in 2024, financial institutions globally reported that manual data entry alone could cost up to $5 per transaction, a stark contrast to automated systems.

Very Low-Balance or Dormant Deposit Accounts

Very low-balance or dormant deposit accounts at Colony Bank represent a category that is unlikely to be a significant contributor to growth or profitability. These accounts often carry a higher cost to serve than the revenue they generate, due to administrative overhead and compliance requirements. For instance, in 2024, many community banks, including those similar to Colony Bank, reported that accounts with balances under $100 often cost more to maintain than they earned in interest income.

These accounts typically fall into the Dogs quadrant of the BCG Matrix. This signifies a low market share within a low-growth market segment. The minimal balances mean they contribute very little to the bank's overall deposit base, and their inactivity suggests a lack of engagement or value from the customer relationship. Banks often review these accounts for potential consolidation or closure to streamline operations.

- Low Revenue Generation: These accounts contribute minimally to Colony Bank's interest income.

- High Servicing Costs: Administrative and compliance expenses often exceed the revenue generated.

- Negligible Market Share: They represent a small portion of valuable customer relationships in a slow-growth market.

- Operational Inefficiency: Managing these accounts can detract from resources that could be focused on more profitable areas.

Non-Core, Non-Strategic Asset Holdings

Non-core, non-strategic asset holdings within Colony Bank’s BCG Matrix would represent assets that don't directly contribute to its primary lending activities or future growth plans. Think of things like certain types of underperforming real estate or investments in businesses outside of the bank's core financial services sector. These assets often tie up valuable capital without generating the kind of returns needed to compete effectively.

These holdings typically fall into a low market share, low growth quadrant. For instance, a bank might hold a portfolio of legacy equipment or outdated technology that is no longer essential for its operations. In 2024, many financial institutions were actively divesting such assets to free up capital for more strategic investments. A report from S&P Global Market Intelligence in late 2024 indicated that U.S. banks were increasingly shedding non-performing loans and non-strategic asset portfolios to improve capital efficiency.

- Low Yielding Fixed Assets: Examples include older branch properties not slated for modernization or sale, or machinery used in ancillary services no longer offered.

- Less Liquid Investments: Holdings in private equity funds or venture capital deals that are not aligned with the bank's core financial services strategy and have long lock-up periods.

- Non-Strategic Business Units: Subsidiaries or divisions that operate outside the bank's primary lending and deposit-taking functions, such as a small insurance brokerage that no longer fits the overall business model.

- Capital Tied Up: These assets represent capital that could be deployed in higher-return activities, such as expanding digital banking services or investing in new lending technologies.

Dogs in the BCG matrix represent business units or products with low market share in a low-growth industry. For Colony Bank, this could include legacy products with declining customer bases or underperforming physical branches in stagnant markets. These segments require minimal investment but also generate little profit, often consuming resources without significant returns.

For instance, Colony Bank's niche, low-demand legacy loan products are prime examples of "Dogs." These offerings, like specific agricultural financing from the early 2000s, have few new applicants and reside in shrinking market segments. The minimal revenue generated struggles to justify the costs of maintaining specialized expertise and systems, making them a net drain on resources.

Similarly, very low-balance or dormant deposit accounts at Colony Bank fit the "Dog" profile. In 2024, many community banks found that accounts with balances under $100 cost more to maintain than they earned in interest. These accounts have a low market share in a slow-growth segment and their inactivity signals a lack of customer engagement, often leading banks to consider consolidation or closure to improve efficiency.

| Category | Description | BCG Classification | Market Growth | Market Share |

| Legacy Loan Products | Niche, outdated loan offerings with few new customers. | Dog | Low/Declining | Low |

| Underperforming Branches | Physical locations with low foot traffic and transactions. | Dog | Stagnant/Shrinking | Low |

| Dormant Deposit Accounts | Accounts with very low balances or inactivity. | Dog | Low | Low |

| Non-Core Assets | Assets not aligned with core business strategy. | Dog | Low | Low |

Question Marks

Colony Bank's expansion into advanced wealth management services targets a high-growth segment, reflecting a strategic move into a market with significant potential. This initiative positions the bank to capture a larger share of affluent clients seeking sophisticated financial planning and investment solutions.

The bank's current market share in these specialized services might be low, but the investment in expertise and technology aims to shift this. For instance, the global wealth management market was valued at approximately $10.5 trillion in assets under management (AUM) in 2023, with projections indicating continued robust growth.

By successfully developing these advanced offerings, Colony Bank could transform this business unit from a question mark into a star within its BCG matrix portfolio. This would signify strong growth and a leading market position, driven by client demand for comprehensive financial stewardship.

TC Bancshares' acquisition, anticipated to finalize in Q4 2025, positions Colony Bank for expansion into South Georgia and North Florida. These regions present significant growth opportunities, though Colony Bank's current market penetration there is minimal. The bank's strategic objective will be to leverage this acquisition to build a stronger presence.

Colony Bank's current market share in these newly targeted geographies is effectively zero, placing TC Bancshares in the 'Question Mark' category of the BCG Matrix. This designation highlights the high potential of these new markets but also the substantial investment and strategic effort required to establish a competitive foothold and achieve growth.

Colony Bank's strategic investment in digital infrastructure signals a strong inclination towards forging partnerships with emerging fintech firms or launching novel digital financial products. This forward-thinking approach aims to capture the dynamic needs of customers within a rapidly advancing technological environment.

While these digital ventures are positioned in high-growth sectors, Colony Bank's initial market penetration in these specialized, cutting-edge niches would likely be minimal. This positions them as potential 'question marks' within the BCG matrix, requiring careful strategic consideration and investment to grow their market share.

Specialized Lending to Emerging Industries

Colony Bank's strategy in specialized lending to emerging industries, such as renewable energy startups or niche technology ventures in Georgia, positions it within the Question Marks quadrant of the BCG Matrix. These sectors offer substantial growth potential but currently represent a small market share for the bank.

The bank must invest heavily in developing deep industry knowledge and executing targeted marketing campaigns to cultivate these nascent segments. For instance, the renewable energy sector in the Southeast saw significant investment in 2024, with Georgia attracting over $1 billion in new projects, indicating a fertile ground for specialized lending.

- High Growth Potential: Emerging industries often experience rapid expansion, offering significant revenue opportunities.

- Low Market Share: Initially, Colony Bank will likely hold a small percentage of the market in these specialized areas.

- Investment Required: Success hinges on substantial investment in industry expertise and tailored financial products.

- Path to Stars: Strategic focus and effective execution can transform these Question Marks into Stars, driving future growth.

Expanded Cybersecurity and Business Advisory Services

Colony Bank's expansion into cybersecurity and business advisory services positions it to capture a significant portion of the growing demand from small and medium-sized enterprises (SMEs) seeking specialized support. This move aligns with a market trend where businesses increasingly outsource these critical functions. For instance, the global cybersecurity market was projected to reach $345.4 billion in 2024, indicating substantial revenue potential.

While Colony Bank's existing customer base provides a natural entry point, its current market share within these highly specialized advisory domains would likely be minimal. This necessitates strategic investment in talent acquisition and technology to build credibility and capacity. The bank's ability to scale these offerings will be crucial for achieving meaningful market penetration and generating substantial non-interest income.

- Market Opportunity: SMEs are increasingly vulnerable and seeking expert guidance in cybersecurity and business strategy.

- Growth Potential: The global cybersecurity market is experiencing robust growth, offering significant revenue streams.

- Investment Required: Establishing a strong presence in these advisory services will demand strategic investment in specialized expertise and infrastructure.

- Competitive Landscape: Colony Bank will face competition from established consulting firms, requiring differentiation and value-added services.

Colony Bank's ventures into new, high-growth markets, such as specialized lending to emerging industries and expansion into new geographic regions via acquisitions, are currently classified as Question Marks. These areas represent significant future potential but require substantial investment to build market share.

The bank's strategic focus on these nascent segments, including digital financial products and advisory services for SMEs, acknowledges their high growth trajectory but also their current low market penetration for Colony Bank. Success in these areas will depend on targeted investments and strategic execution to convert them into future Stars.

The bank's expansion into advanced wealth management and cybersecurity/business advisory services also falls into the Question Mark category. While these sectors show strong growth, Colony Bank's initial market share is minimal, necessitating significant investment in expertise and technology to gain traction.

Colony Bank's strategic positioning in new markets and specialized services highlights its pursuit of future growth drivers, albeit with the inherent risks associated with low initial market share. These Question Marks are critical for the bank's long-term portfolio diversification and potential market leadership.

BCG Matrix Data Sources

Our Colony Bank BCG Matrix is constructed using comprehensive financial statements, detailed market research, and competitor performance data to provide a clear strategic overview.