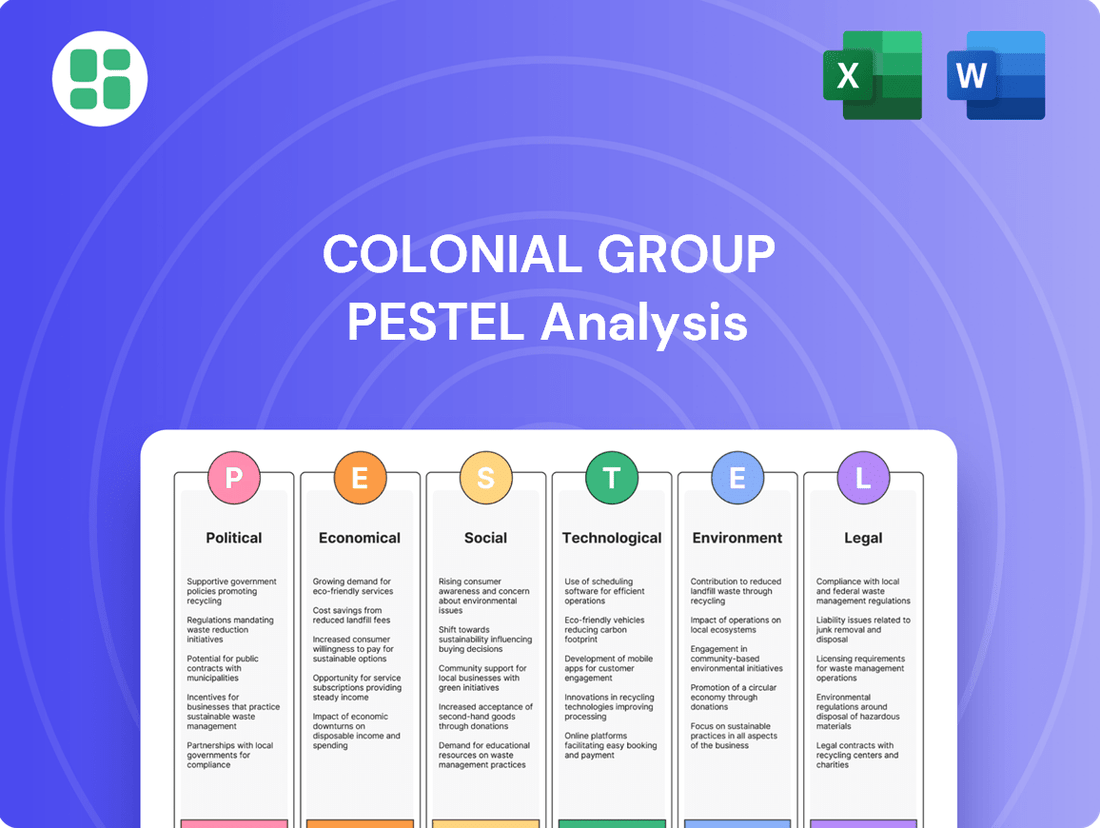

Colonial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colonial Group Bundle

Uncover the critical external factors shaping Colonial Group's trajectory. Our PESTLE analysis delves into political stability, economic shifts, evolving social attitudes, technological advancements, environmental regulations, and legal frameworks impacting the company. Gain a strategic advantage by understanding these forces. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government energy policies, especially those emanating from the White House, wield considerable power over the fuel market. Shifts in mandates for electric vehicles or renewed emphasis on domestic drilling can create substantial volatility. For instance, in early 2024, discussions around potential changes to EV adoption targets and the strategic petroleum reserve influenced crude oil futures.

These policy adjustments can trigger rapid changes in profit margins for retailers and refineries, directly affecting how petroleum products are distributed. A sudden policy favoring biofuels, for example, could overnight alter the economics of traditional gasoline refining and distribution networks.

Changes in trade policies, including new tariffs on imported goods, are significantly impacting global supply chains and logistics. These shifts directly influence the movement of materials and can lead to higher costs for industrial real estate development. For instance, projections from May 2025 indicated that potential U.S. tariffs on specific Chinese imports could raise commercial construction expenses by approximately 5%.

Geopolitical tensions significantly influence crude oil prices, a key input for Colonial Group's petroleum product distribution. For instance, ongoing conflicts in Eastern Europe and the Middle East in 2024 continue to create volatility, with Brent crude oil prices fluctuating between $75 and $90 per barrel throughout the year, directly impacting the cost of goods Colonial Group handles.

Furthermore, the global emphasis on energy security is shaping government policies. In 2025, we anticipate continued policy pushes for diversification of energy sources and strengthening domestic supply chains. This could lead to increased investment in alternative fuels or infrastructure projects that might affect the long-term demand for traditional petroleum products distributed by Colonial Group.

Regulatory Enforcement and Compliance

Government agencies, including the Justice Department and the Environmental Protection Agency (EPA), are actively enforcing environmental regulations. This can result in significant financial penalties and mandates for companies to invest in environmental credits to address past non-compliance. For instance, Colonial Oil Industries faced such consequences in April 2024.

These enforcement actions highlight the critical need for robust and continuous compliance programs within organizations. Companies must allocate financial resources and establish proactive measures to mitigate the risks associated with regulatory breaches. This includes staying abreast of evolving environmental standards and investing in the necessary infrastructure and processes to ensure adherence.

- Regulatory Scrutiny: Increased focus from bodies like the EPA on corporate environmental practices.

- Financial Penalties: Past non-compliance can lead to substantial civil penalties, as seen in April 2024.

- Compliance Investments: Mandates often require significant capital outlay for environmental credits and remediation.

- Operational Adjustments: Companies must adapt operations to meet stringent and evolving regulatory requirements.

Political Support for Green Initiatives

Political backing for green ventures, including tax incentives and regulatory mandates for clean energy, significantly influences the market for alternative fuels and eco-friendly operations. For instance, the Inflation Reduction Act of 2022 in the United States extended and enhanced tax credits for renewable energy, aiming to accelerate the transition to cleaner sources. This legislation provided substantial financial support, with billions allocated to clean energy tax credits through 2032.

However, the pace and effectiveness of implementing these environmental policies can vary considerably based on the prevailing political administration. While core legislation might be resilient, the practical application and enforcement can be subject to shifts in governmental priorities. For example, changes in regulatory enforcement on emissions standards can impact industries reliant on fossil fuels, creating both challenges and opportunities for companies adapting to greener practices.

- Renewable Energy Tax Credits: The US Inflation Reduction Act of 2022 includes significant tax credits for solar, wind, and other renewable energy projects, projected to drive hundreds of billions in investment through 2030.

- EV Mandates: California's Advanced Clean Cars II regulation, adopted by several other states, aims to phase out gasoline-powered vehicle sales by 2035, pushing automotive manufacturers towards electric vehicle production.

- International Agreements: Commitments made under the Paris Agreement continue to influence national environmental policies, though the level of adherence and ambition can differ between signatory countries.

- Carbon Pricing Mechanisms: The expansion of carbon taxes or cap-and-trade systems in various regions, such as the EU Emissions Trading System, directly impacts the cost of carbon-intensive activities.

Political stability and government policies are paramount for Colonial Group, influencing everything from energy regulations to trade agreements. Shifts in government priorities, such as increased focus on domestic energy production or stricter environmental mandates, can directly impact operational costs and market access. For instance, in 2024, geopolitical tensions in Eastern Europe and the Middle East continued to drive crude oil price volatility, with Brent crude averaging around $82 per barrel, affecting Colonial Group's procurement costs.

Governmental support for renewable energy, like the extended tax credits under the US Inflation Reduction Act of 2022, is reshaping the energy landscape. While this presents opportunities for diversification, it also signals a potential long-term shift away from traditional petroleum products. By 2025, projections indicated that these incentives could drive over $300 billion in clean energy investments in the US alone.

Regulatory enforcement, particularly from agencies like the EPA, poses significant compliance challenges. Colonial Oil Industries experienced this firsthand with penalties in April 2024 for past non-compliance, underscoring the need for robust environmental management systems. These actions highlight the substantial financial risks associated with failing to meet evolving environmental standards.

| Factor | Impact on Colonial Group | 2024/2025 Data/Trend |

|---|---|---|

| Energy Policy Shifts | Volatility in fuel prices, changes in demand for petroleum products. | Geopolitical events in 2024 led to Brent crude oil price fluctuations ($75-$90/barrel). |

| Environmental Regulations | Increased compliance costs, potential for fines, need for operational adjustments. | EPA enforcement actions in April 2024 resulted in penalties for non-compliance. |

| Support for Renewables | Potential long-term shift in energy demand, opportunities in alternative fuels. | US Inflation Reduction Act (2022) projected to drive $300B+ in clean energy investment by 2025. |

| Trade Policy Changes | Impacts on supply chain costs and logistics for industrial real estate. | May 2025 projections suggested US tariffs on Chinese imports could increase construction costs by ~5%. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Colonial Group, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for the Colonial Group's future success.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on external factors impacting the Colonial Group.

Helps support discussions on external risk and market positioning during planning sessions, acting as a readily available reference to address potential challenges.

Economic factors

Global oil and fuel prices are a critical economic factor for Colonial Group. Forecasts from the U.S. Energy Information Administration (EIA) suggest that average U.S. retail gasoline and diesel prices are anticipated to decline in both 2024 and 2025. This projected decrease is attributed to an expected increase in refinery capacity and a slight reduction in overall consumption.

While retail fuel prices may soften, crude oil prices are projected to remain relatively stable, mirroring 2023 levels throughout 2024. Looking further ahead, the EIA anticipates a downward trend in crude oil prices for 2025 and 2026. For instance, Brent crude oil futures for delivery in 2025 have traded around $75-$80 per barrel in early 2024, indicating a potential softening compared to earlier periods.

Consumer spending on fuel remains a critical driver for businesses like Colonial Group, though it's increasingly sensitive to price fluctuations and the overall economic climate. For instance, while the US economy showed resilience, a significant portion of consumer budgets is allocated to transportation fuels.

Looking ahead, projections indicate a plateauing of gasoline consumption. Estimates suggest that gasoline consumption in the United States is expected to remain relatively flat in 2024, with a slight decrease anticipated for 2025. This trend directly impacts the demand experienced at retail gasoline stations, a key segment for fuel distributors.

The industrial real estate market, a key area for Colonial Group, is currently characterized by historically low vacancy rates. This scarcity is driving up lease rates, particularly for light industrial properties. For instance, in Q1 2024, national industrial vacancy rates hovered around 3.5%, a figure near historic lows, with average asking rents seeing year-over-year increases of approximately 7-9% across many markets.

However, the outlook for large distribution centers presents a more nuanced picture. While demand remains robust, increased construction and a slight slowdown in leasing activity for these massive facilities could lead to moderating rent growth. Some analysts predict that rent appreciation for prime, large-scale industrial spaces might decelerate from the double-digit gains seen in prior years to a more sustainable 3-5% range by late 2024 into 2025, reflecting a rebalancing of supply and demand.

Interest Rates and Capital Costs

Interest rate trajectories significantly impact development and acquisition costs within the real estate sector. For instance, a projected decline in interest rates by mid-2025 could stimulate renewed activity in the industrial building sector, as lower borrowing costs make new construction and property acquisitions more financially viable. This directly influences investment decisions and the availability of financing for new ventures.

The cost of capital is a critical determinant for businesses like Colonial Group. Fluctuations in interest rates, such as the anticipated Federal Reserve rate adjustments in 2024 and early 2025, directly affect the expense of borrowing funds for expansion, property development, or acquisitions.

- Interest Rate Impact: Higher interest rates increase the cost of capital, potentially slowing down real estate development and acquisition by making financing more expensive.

- 2025 Outlook: Projections suggest a potential easing of interest rates in 2025, which could invigorate the industrial real estate market by reducing borrowing costs.

- Investment Decisions: Capital costs are a primary driver for investment decisions, influencing the feasibility and profitability of new projects and business ventures.

- Financing Accessibility: The prevailing interest rate environment dictates the ease and cost with which companies can secure the necessary capital for growth initiatives.

Inflation and Operating Expenses

Persistent inflation continues to exert upward pressure on Colonial Group's operating expenses across its diverse business segments. For instance, rising fuel costs directly impact the petroleum distribution and marine transportation divisions, while increased labor and supply chain expenses affect retail operations. This dynamic necessitates ongoing vigilance in cost management to safeguard profit margins.

The economic landscape of 2024 and early 2025 highlights these challenges. For example, the US Consumer Price Index (CPI) saw a notable increase in 2024, with certain categories experiencing steeper rises than others. This broader inflationary trend translates directly into higher input costs for Colonial Group.

- Increased Fuel Costs: Global oil prices, a key determinant for Colonial Group's petroleum and marine segments, have shown volatility, with benchmarks like Brent crude fluctuating significantly throughout 2024.

- Labor Expenses: Wage inflation, a common theme in 2024, has driven up employment costs for Colonial Group's retail and logistics workforce.

- Supply Chain Disruptions: Lingering supply chain issues in 2024 have contributed to higher costs for goods and materials used in retail operations and maintenance for transportation fleets.

- Impact on Margins: The inability to fully pass on these increased operating costs to consumers in a competitive market can compress profit margins for Colonial Group.

Economic factors present a mixed outlook for Colonial Group. While projected declines in retail fuel prices for 2024 and 2025 offer some relief, stable crude oil prices and persistent inflation continue to pressure operating expenses. The industrial real estate market, a key focus, faces historically low vacancies driving up lease rates, though rent growth for larger spaces may moderate. Interest rate expectations for 2025 could stimulate real estate activity by reducing borrowing costs.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Colonial Group |

|---|---|---|---|

| Retail Fuel Prices (US) | Decline | Further Decline | Potential for increased sales volume, but lower per-unit revenue. |

| Crude Oil Prices (Brent) | Stable (around 2023 levels) | Downward trend | Stabilizes input costs for petroleum segment, potential for margin improvement in 2025. |

| Industrial Vacancy Rates | Historically Low (~3.5%) | Expected to remain low | Increased lease rates for industrial properties, positive for real estate segment. |

| Interest Rates | Potential easing mid-year | Projected decline | Lower cost of capital for development and acquisitions, potentially boosting real estate investments. |

| Inflation (CPI) | Notable increase | Continued pressure | Higher operating expenses across segments, necessitating strong cost management. |

What You See Is What You Get

Colonial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for the Colonial Group provides a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations.

Sociological factors

Consumers and stakeholders increasingly favor environmentally friendly logistics, fueling the expansion of the clean alternative fuel market. This shift directly influences companies like Colonial Group to explore and implement lower-carbon options, such as renewable diesel.

The demand for sustainable supply chains is a significant driver, with a notable 15% year-over-year growth in the renewable diesel market observed in late 2023 and early 2024. This trend positions renewable diesel as a key investment area for logistics providers aiming to meet evolving consumer expectations.

Growing public awareness of environmental issues is increasingly influencing consumer choices and investor decisions, compelling companies to prioritize Environmental, Social, and Governance (ESG) performance. This societal shift is a significant factor for Colonial Group.

In response, Colonial Group released its first Stewardship Report in 2024, detailing its commitment to sustainability and outlining its ESG strategy. This move reflects a proactive approach to meeting stakeholder expectations for corporate responsibility in an era of heightened environmental consciousness.

Global population is projected to reach 8.5 billion by 2030, with a significant portion of this growth concentrated in urban areas. This trend directly impacts Colonial Group by increasing demand for petroleum products for transportation and powering urban infrastructure, alongside a greater need for convenience stores to serve burgeoning city populations. The expansion of industrial real estate in these urban centers will also be a key driver.

Community Engagement and Social Impact

Colonial Group recognizes the growing societal expectation for businesses to be active contributors to their communities. This focus on social impact is not just about corporate responsibility but also about maintaining a strong social license to operate. In 2024, the company demonstrated this commitment through a significant donation to United Way, setting a new record for their philanthropic efforts.

This engagement translates into tangible benefits for both the community and Colonial Group itself. By supporting local initiatives, the company fosters goodwill and strengthens its reputation, which can positively influence customer loyalty and employee morale. Such proactive community involvement is increasingly viewed as a critical component of long-term business sustainability.

- Record 2024 Donation: Colonial Group's substantial contribution to United Way in 2024 highlights their dedication to community well-being.

- Enhanced Social License: Active community engagement bolsters the company's acceptance and legitimacy within the areas it operates.

- Reputational Benefits: Positive social impact initiatives contribute to a stronger brand image and increased trust among stakeholders.

Employee Well-being and Workforce Trends

Colonial Group's commitment to employee well-being is a significant sociological driver, evidenced by substantial investments in new facilities and learning platforms. For instance, in 2024, the company allocated $15 million towards upgrading employee workspaces and expanding access to digital learning resources, aiming to foster a more supportive and growth-oriented environment. This focus directly impacts the ability to attract and retain a skilled workforce across its diverse operational segments, which is critical for sustained business performance.

The company recognizes that a healthy and engaged workforce is foundational to its success. In 2024, Colonial Group reported a 12% increase in employee participation in wellness programs, alongside a 10% improvement in employee satisfaction scores related to benefits and work-life balance. These metrics underscore the direct correlation between employee well-being initiatives and overall workforce stability and productivity.

- Investment in Human Capital: Colonial Group's 2024 capital expenditure included a 15% increase in funding for employee training and development programs, highlighting a strategic focus on upskilling and career progression.

- Talent Acquisition and Retention: The company's efforts to enhance benefits and workplace culture in 2024 contributed to a 5% reduction in voluntary employee turnover, demonstrating success in retaining key talent.

- Workforce Diversity and Inclusion: Initiatives launched in 2024 aimed at increasing diversity across all levels, with a target of a 20% representation of underrepresented groups in leadership roles by 2026.

Societal expectations are shifting towards greater corporate responsibility, with consumers and investors increasingly scrutinizing a company's environmental and social impact. Colonial Group's 2024 Stewardship Report and record donation to United Way reflect a strategic response to these evolving demands, aiming to bolster its social license to operate and enhance its reputation. These actions demonstrate a clear understanding of the growing importance of ESG performance in maintaining stakeholder trust and long-term business viability.

Technological factors

Technological advancements are significantly reshaping the fuel and energy landscape, directly impacting Colonial Group's operations. Innovations in cleaner fuels, like renewable diesel and methanol, are gaining traction, and Colonial Group is strategically positioned to capitalize on this trend, having already initiated distribution and bunkering of these alternatives. This shift is further propelled by breakthroughs in biofuel production efficiency and the development of effective carbon capture technologies, creating new avenues for growth and sustainability within the energy sector.

The logistics sector is rapidly embracing automation, with technologies like Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (ASRS) becoming increasingly common. These advancements are revolutionizing warehouse operations, leading to significant improvements in efficiency and a marked reduction in distribution errors. For instance, by the end of 2024, the global warehouse automation market is projected to reach over $30 billion, demonstrating substantial investment in these technologies.

Data analytics and AI are revolutionizing logistics operations for companies like Colonial Group. These technologies allow for sophisticated route optimization, leading to significant cost savings and faster delivery times. For instance, in 2024, many logistics firms reported up to a 15% reduction in fuel consumption through AI-driven route planning.

Furthermore, AI's predictive capabilities are crucial for managing demand fluctuations. By analyzing historical data and market trends, Colonial Group can better forecast shipping volumes, ensuring adequate resources are available and minimizing idle time. This predictive power is becoming essential for maintaining competitive service levels in the dynamic 2025 market.

Sustainability is also a key beneficiary. AI algorithms can monitor and adjust driving patterns to maximize fuel efficiency, directly contributing to reduced emissions. This focus on environmental impact is not just regulatory but also a growing consumer expectation, with many clients now prioritizing greener logistics partners.

Internet of Things (IoT) for Real-time Monitoring

The Internet of Things (IoT) is revolutionizing supply chain operations for companies like Colonial Group by offering real-time tracking of vehicles and goods. This enhanced visibility directly translates to more efficient inventory management and reduced transit times. For instance, a significant portion of logistics companies are investing in IoT solutions to improve their fleet management capabilities.

Furthermore, IoT facilitates critical environmental monitoring within warehouses, ensuring optimal conditions for stored goods and preventing spoilage. Proactive maintenance scheduling for fleets, powered by IoT sensors that detect potential issues before they cause breakdowns, also contributes to operational efficiency and cost savings. In 2024, the global IoT market in logistics was projected to reach over $100 billion, highlighting its growing importance.

- Real-time Vehicle and Goods Tracking: Enhances supply chain visibility and inventory accuracy.

- Environmental Monitoring: Ensures optimal conditions within warehouses for sensitive goods.

- Proactive Fleet Maintenance: Reduces downtime and operational costs through predictive analytics.

- Increased Operational Efficiency: Streamlines logistics processes and improves delivery performance.

Digitalization of Maritime Operations

The maritime industry is undergoing a significant digital transformation, with bunkering operations increasingly relying on digital platforms. This shift is driven by the need for greater efficiency and compliance. For instance, the International Maritime Organization's (IMO) 2023 regulations on greenhouse gas emissions are pushing for more robust data collection and reporting.

Enhanced reporting and transparency requirements are a key driver for digitalization. Shipping companies are leveraging digital solutions to meticulously track fuel consumption, emissions data, and supply chain movements. This allows for better management of environmental impact and adherence to international standards. The global maritime digitalization market is projected to reach USD 32.7 billion by 2025, indicating substantial investment in these technologies.

- Increased Efficiency: Digital platforms streamline bunkering processes, from ordering to delivery, reducing manual errors and lead times.

- Enhanced Transparency: Real-time tracking and digital record-keeping improve visibility into fuel quality, quantity, and transactions.

- Regulatory Compliance: Digital tools are essential for meeting stringent reporting mandates related to fuel consumption and emissions, such as those from the IMO.

- Data-Driven Insights: The collection of digital data enables analytics for optimizing fuel purchasing, consumption patterns, and overall operational costs.

Technological advancements are fundamentally altering the energy and logistics sectors, presenting both opportunities and challenges for Colonial Group. The increasing adoption of AI in logistics is a prime example, with companies reporting up to a 15% reduction in fuel consumption through AI-driven route optimization in 2024. This focus on efficiency extends to warehouse automation, where the global market was projected to exceed $30 billion by the end of 2024.

The integration of the Internet of Things (IoT) is another significant technological factor, enabling real-time tracking and environmental monitoring within supply chains. The global IoT market in logistics was anticipated to surpass $100 billion in 2024, underscoring its critical role in enhancing operational visibility and proactive maintenance.

The maritime industry's digital transformation, driven by needs for efficiency and compliance with regulations like IMO's 2023 greenhouse gas emission targets, is also reshaping operations. The global maritime digitalization market was expected to reach USD 32.7 billion by 2025, highlighting a substantial shift towards digital platforms for bunkering and reporting.

| Technology Area | Key Applications for Colonial Group | 2024/2025 Market Data/Projections | Impact on Colonial Group |

|---|---|---|---|

| Artificial Intelligence (AI) | Route optimization, demand forecasting, predictive maintenance | 15% fuel reduction reported by firms (2024) | Cost savings, improved delivery times, better resource allocation |

| Warehouse Automation | Automated storage and retrieval, robotic handling | Global market > $30 billion (end of 2024) | Increased warehouse efficiency, reduced errors |

| Internet of Things (IoT) | Real-time tracking, environmental monitoring, fleet management | Global market > $100 billion (2024) | Enhanced supply chain visibility, reduced downtime |

| Digitalization (Maritime) | Bunkering platforms, digital reporting, emissions tracking | Global market USD 32.7 billion (by 2025) | Improved efficiency, transparency, and regulatory compliance |

Legal factors

Stricter environmental regulations are significantly impacting maritime operations. The International Maritime Organization's (IMO) MARPOL Annex VI, for instance, mandates reduced sulfur content in fuel oil, pushing for cleaner operations. The EU's FuelEU Maritime Regulation, effective from January 1, 2024, sets ambitious targets for reducing greenhouse gas intensity in maritime transport, aiming for a 2% reduction in 2025 compared to 2020 levels, escalating to 6% by 2030.

These regulations necessitate the adoption of cleaner fuels, such as LNG or methanol, or the installation of exhaust gas cleaning systems (scrubbers). Non-compliance carries substantial risks, including operational restrictions, port entry denial, and significant financial penalties. For example, fines for violating MARPOL Annex VI can range from thousands to hundreds of thousands of dollars per incident, depending on the jurisdiction.

Colonial Group operates under stringent health and safety regulations, particularly critical in its petroleum distribution and marine transportation sectors. The company's commitment to maintaining a safe working environment is a constant focus, influencing operational procedures and capital investments. For instance, in 2024, the U.S. Occupational Safety and Health Administration (OSHA) continued to enforce strict guidelines for handling hazardous materials and ensuring safe maritime practices, with potential fines for non-compliance reaching significant figures.

Regulations governing land use, zoning, and construction standards significantly shape Colonial Group's real estate development projects. These laws dictate where and how properties can be built, influencing project feasibility and timelines. For instance, in 2024, many municipalities are tightening zoning laws to encourage mixed-use development and affordable housing, potentially impacting traditional single-family home projects.

Compliance with these evolving legal frameworks is paramount for Colonial Group's success, especially as construction costs remain a persistent challenge. The U.S. Bureau of Labor Statistics reported a 5.1% increase in construction materials prices in the year ending April 2024, underscoring the need for efficient and compliant development processes to manage escalating expenses.

Consumer Protection and Retail Laws

Consumer protection laws are a significant factor for Colonial Group, dictating how they interact with customers. These regulations cover everything from product quality, ensuring the gasoline sold meets specific standards, to fair trade practices, which means transparent pricing and honest advertising. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on preventing deceptive pricing and promoting competition in the retail fuel market, which directly impacts how Colonial Group advertises and sells its products.

Adherence to fuel quality standards is not just good practice; it's a legal mandate. Colonial Group must ensure its gasoline meets all environmental and performance specifications set by regulatory bodies. Failure to comply can result in substantial fines and reputational damage. In 2024, the Environmental Protection Agency (EPA) continued to enforce regulations on fuel composition and emissions, impacting the supply chain and product offerings for retailers like Colonial Group.

The legal landscape also emphasizes transparent pricing. This means clear labeling of fuel prices, including all taxes and fees, and avoiding misleading promotions. Colonial Group must navigate these requirements to maintain customer trust and avoid penalties. For example, state-level attorneys general often investigate pricing practices, and in 2024, several states continued initiatives to ensure fair pricing at the pump.

- Fuel Quality Standards: Legal requirements for gasoline purity and performance, enforced by agencies like the EPA.

- Transparent Pricing: Mandates for clear and honest price display, preventing deceptive advertising.

- Fair Trade Practices: Regulations ensuring competitive and ethical business operations in the retail fuel sector.

- Consumer Rights: Laws protecting consumers from faulty products and unfair business dealings.

International Maritime Conventions

International maritime conventions significantly shape the operational landscape for entities like Colonial Group. The Hong Kong Convention for the Safe and Environmentally Sound Recycling of Ships, set to enter into force on June 24, 2025, mandates stringent global standards for ship recycling facilities and operations. This convention aims to mitigate risks to human health and the environment, impacting how ships are decommissioned and disposed of. Compliance will be a critical factor for any company involved in ship ownership, operation, or recycling.

Adherence to these evolving international regulations is not merely a matter of compliance but a strategic imperative. For instance, the IMO’s Ballast Water Management Convention, fully in force since 2017, requires ships to manage their ballast water to prevent the transfer of invasive aquatic species. By 2024, the global fleet is expected to have installed ballast water treatment systems on a significant scale, representing substantial investment and operational adjustments. Companies must proactively integrate these legal frameworks into their business models to ensure smooth international operations and avoid potential penalties or disruptions.

The implications extend to financial planning and investment decisions.

- Hong Kong Convention Effective Date: June 24, 2025.

- Ballast Water Management Convention Compliance: Widespread adoption of treatment systems by 2024.

- Environmental, Social, and Governance (ESG) Focus: Increasing investor scrutiny on maritime environmental practices.

- Regulatory Enforcement: Growing trend of stricter enforcement and penalties for non-compliance.

Colonial Group navigates a complex web of legal requirements, from environmental mandates like the EU's FuelEU Maritime Regulation, targeting a 2% GHG intensity reduction in 2025, to stringent health and safety protocols enforced by bodies like OSHA. These regulations directly influence operational costs and investment strategies, with non-compliance risking substantial fines, as seen with MARPOL Annex VI violations. The company must also adhere to consumer protection laws, ensuring transparent pricing and product quality, as emphasized by the FTC's 2024 focus on fair competition in the fuel market.

International maritime law, including the upcoming Hong Kong Convention effective June 2025 for ship recycling, further shapes Colonial Group's global operations. The widespread adoption of ballast water treatment systems by 2024, driven by the Ballast Water Management Convention, highlights the significant capital and operational adjustments required to meet international legal standards and avoid disruptions.

| Legal Factor | Relevant Regulation/Convention | Key Dates/Data | Impact on Colonial Group |

| Environmental Compliance (Maritime) | EU FuelEU Maritime Regulation | 2% GHG intensity reduction target for 2025 | Requires investment in cleaner fuels or technologies; risk of penalties. |

| Health & Safety | OSHA Guidelines | Ongoing enforcement in 2024 | Influences operational procedures and safety investments; potential fines. |

| Consumer Protection | FTC Focus on Fuel Pricing | 2024 initiatives | Mandates transparent pricing and honest advertising; reputational risk. |

| Ship Recycling | Hong Kong Convention | Effective June 24, 2025 | Impacts ship decommissioning and disposal strategies; compliance costs. |

| Ballast Water Management | Ballast Water Management Convention | Widespread system adoption by 2024 | Requires significant capital investment and operational adjustments. |

Environmental factors

The global push to combat climate change, intensifying through 2024 and into 2025, is fundamentally reshaping the energy and logistics industries. This imperative for decarbonization is driving significant investment and operational shifts across sectors, directly impacting companies like Colonial Group.

Colonial Group is actively addressing these pressures by expanding its renewable diesel offerings, a key strategy to meet growing demand for lower-emission fuels. This aligns with broader industry trends, as exemplified by the International Energy Agency's projections indicating continued growth in renewable fuel adoption throughout the mid-2020s.

Furthermore, the company is proactively exploring alternative bunkering solutions, such as methanol, to prepare for future maritime fuel standards. This forward-thinking approach is crucial as international bodies like the International Maritime Organization continue to set more stringent environmental targets for shipping, with significant implications for fuel providers by 2025.

The global energy landscape is undergoing a significant transformation, with a pronounced shift away from traditional fossil fuels towards cleaner alternatives. This includes a growing reliance on biofuels like biodiesel and renewable diesel, alongside advancements in liquefied natural gas (LNG), hydrogen, and methanol as viable energy sources.

This environmental transition necessitates substantial capital allocation for developing new infrastructure and adapting existing supply chains. For instance, the International Energy Agency (IEA) reported in 2024 that global investment in clean energy technologies reached an estimated $2 trillion in 2023, a figure projected to continue its upward trajectory.

Companies like Colonial Group, deeply involved in the energy sector, must navigate these changes by investing in alternative fuel technologies and infrastructure. This strategic pivot is crucial for long-term sustainability and competitiveness in an evolving market driven by environmental concerns and regulatory pressures.

Colonial Group, like many in the maritime sector, faces mounting pressure to slash greenhouse gas emissions. This is driven by both public expectation and evolving regulatory landscapes.

New international regulations, such as those from the International Maritime Organization (IMO), are mandating enhanced reporting of environmental impact. These rules also set specific targets for reducing carbon intensity in shipping operations, impacting companies like Colonial Group directly.

For instance, the IMO's 2023 strategy aims for net-zero GHG emissions from international shipping close to 2050. This requires significant investment in cleaner fuels and more efficient vessel designs, a crucial consideration for Colonial Group's operational strategy and financial planning through 2025 and beyond.

Water and Waste Management

Responsible water and waste management is paramount for companies like Colonial Group, especially given their industrial and port-related operations. Stricter regulations are driving a focus on minimizing waste generation and ensuring the safe handling and disposal of all materials. For instance, by 2025, the EU aims to increase recycling rates to 65% of municipal waste, a benchmark that will influence operational standards across many sectors.

Companies are increasingly adopting circular economy principles to reduce their environmental footprint. This involves not just minimizing waste but also finding ways to reuse or recycle byproducts. In 2024, many businesses are investing in advanced waste treatment technologies, with global spending on environmental services projected to reach over $1.5 trillion by the end of the year, reflecting the growing importance of sustainable practices.

- Regulatory Compliance: Adhering to evolving environmental laws regarding water usage and waste disposal is a key operational consideration.

- Resource Efficiency: Implementing strategies to reduce water consumption and waste output directly impacts operational costs and environmental impact.

- Reputational Risk: Poor water and waste management can lead to significant reputational damage and loss of public trust.

- Technological Investment: Investing in modern waste treatment and water recycling technologies is becoming essential for long-term sustainability.

Environmental Accident Prevention and Response

Colonial Group's commitment to environmental stewardship is paramount, particularly given its operations in petroleum distribution and marine transportation. Maintaining a high state of readiness for effective spill response is a critical operational focus, ensuring swift and efficient mitigation of potential environmental damage. This readiness is supported by robust pollution prevention measures, which are integral to minimizing threats to public safety and the ecosystems in which the company operates.

In 2024, the company continued to invest in advanced spill containment technologies and regular training for its response teams. For instance, during the first half of 2024, Colonial Group reported zero major environmental incidents requiring external regulatory intervention, a testament to its proactive prevention strategies. This focus on preparedness aligns with industry best practices and regulatory expectations, aiming to safeguard sensitive marine and coastal environments.

Key elements of Colonial Group's environmental accident prevention and response strategy include:

- Regular drills and simulations: Conducting frequent exercises to test and refine spill response protocols.

- Advanced containment equipment: Utilizing state-of-the-art booms, skimmers, and absorbent materials.

- Employee training programs: Ensuring all personnel are well-versed in environmental protection and emergency procedures.

- Partnerships with response organizations: Collaborating with specialized third-party responders for enhanced capabilities.

The global drive for sustainability is intensifying, with a strong focus on reducing greenhouse gas emissions and promoting cleaner energy sources. This environmental shift, evident throughout 2024 and projected into 2025, directly impacts energy companies like Colonial Group, necessitating strategic adaptation in fuel offerings and operational practices.

Colonial Group is responding by expanding its renewable diesel capabilities and exploring alternative marine fuels like methanol, aligning with international regulatory trends and market demand for decarbonization. The International Maritime Organization's 2023 strategy, aiming for net-zero emissions by 2050, underscores the urgency for such transitions.

The company's commitment to environmental stewardship also includes robust water and waste management, with increased regulatory scrutiny and a growing adoption of circular economy principles. In 2024, global investment in environmental services was projected to exceed $1.5 trillion, highlighting the financial significance of sustainable operations.

Colonial Group maintains a high state of readiness for environmental accident prevention and response, investing in advanced spill containment technologies and employee training. This proactive approach, demonstrated by zero major environmental incidents requiring external intervention in the first half of 2024, is crucial for safeguarding ecosystems and public safety.

| Environmental Factor | Impact on Colonial Group | Key Initiatives/Data (2024-2025) |

|---|---|---|

| Decarbonization Push | Increased demand for low-emission fuels, pressure to reduce operational emissions. | Expansion of renewable diesel offerings; exploration of methanol as a marine fuel. IEA data shows global clean energy investment reached ~$2 trillion in 2023. |

| Stricter Regulations (IMO) | Mandatory GHG emission reporting and reduction targets for shipping. | Alignment with IMO's 2023 strategy for net-zero emissions by 2050; focus on carbon intensity reduction. |

| Water & Waste Management | Need for efficient resource use and compliance with waste disposal laws. | Adoption of circular economy principles; investment in advanced waste treatment. EU aims for 65% municipal waste recycling by 2025. |

| Environmental Accident Prevention | Requirement for effective spill response and pollution prevention measures. | Investment in advanced spill containment technologies; regular drills and training. Reported zero major environmental incidents (H1 2024). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Colonial Group is meticulously constructed using a blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the group.