Colonial Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colonial Group Bundle

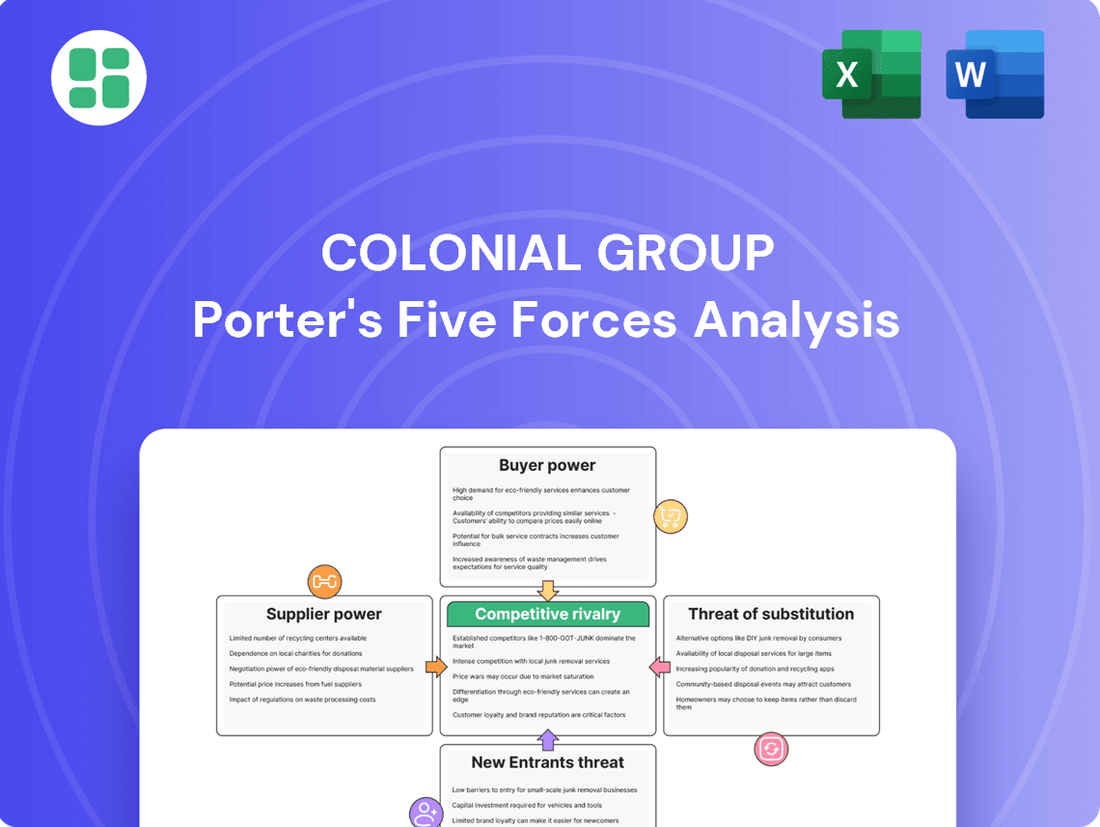

Porter's Five Forces analysis reveals Colonial Group operates within an industry shaped by moderate buyer power and the constant threat of substitutes. Understanding these dynamics is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Colonial Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key suppliers, especially for crude oil and refined petroleum products, presents a significant bargaining power challenge for Colonial Group. In 2024, the global oil market is characterized by a limited number of major producing nations and large integrated oil companies, which can translate to fewer options for Colonial to source its primary inputs.

The bargaining power of suppliers for Colonial Group is significantly influenced by switching costs. For Colonial Group's primary commodities like petroleum, the expenses involved in changing suppliers can be considerable. These costs often encompass the negotiation of new agreements, the reconfiguration of logistics and transportation networks, and the potential for operational disruptions during the transition period.

In 2024, the global average cost to switch major enterprise resource planning (ERP) systems, which often handle supply chain management, can range from $150,000 to $750,000, illustrating the magnitude of such transitions. For Colonial Group, a shift in petroleum suppliers could involve substantial upfront investments in new storage facilities or modifications to existing ones, alongside the costs of re-establishing relationships and quality assurance protocols. These high switching costs empower suppliers by making it more difficult and expensive for Colonial Group to seek alternative sources, thereby strengthening the suppliers' ability to dictate terms and prices.

The uniqueness and importance of inputs for Colonial Group, particularly in the energy sector, significantly shape supplier power. If specialized marine equipment or specific refined products are sourced from a narrow range of providers, these suppliers gain considerable leverage. The critical role these inputs play in Colonial Group's day-to-day operations further strengthens this supplier influence.

Threat of Forward Integration by Suppliers

Suppliers might leverage their position by integrating forward into Colonial Group's operations, like distribution or retail. For instance, a major fuel supplier could potentially establish its own network of service stations, directly competing with Colonial Group's existing retail presence. This capability significantly enhances their bargaining power, as they can capture more of the value chain.

The threat of forward integration by key suppliers, such as large fuel producers or terminal operators, could diminish Colonial Group's negotiating leverage. If these suppliers can readily establish their own distribution or retail channels, they gain more control over market access and pricing. This possibility underscores the importance of Colonial Group cultivating robust relationships with its suppliers to mitigate this risk.

- Supplier Forward Integration Threat: Suppliers could move into Colonial Group's distribution or retail operations.

- Impact on Bargaining Power: If a fuel supplier can easily create its own retail network, Colonial Group's negotiation power decreases.

- Strategic Implication: This threat necessitates strong supplier relationship management for Colonial Group.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Colonial Group. While direct substitutes for crude oil and its refined products are currently limited in their core applications, Colonial Group can mitigate supplier influence by diversifying its sourcing across different global regions and utilizing various trading mechanisms. For instance, in 2024, the global oil market saw increased price volatility due to geopolitical events, highlighting the importance of flexible sourcing strategies.

Colonial Group's ability to access crude oil from diverse geographical locations, such as North America, the Middle East, and South America, directly impacts its reliance on any single supplier. This diversification strategy is essential for reducing dependence and enhancing negotiation leverage. The International Energy Agency reported in early 2024 that while global oil production remained robust, regional supply disruptions could still create localized price pressures, underscoring the value of a broad supplier base.

- Diversified Sourcing: Colonial Group's strategy to source crude oil from multiple global regions in 2024 helps dilute the power of individual suppliers.

- Trading Mechanisms: Utilizing various trading platforms and forward contracts allows Colonial Group to secure supply and manage price volatility, thereby reducing supplier leverage.

- Geopolitical Impact: Events in 2024, such as conflicts impacting key oil-producing regions, demonstrated how global supply chain disruptions can temporarily increase supplier power if diversification is insufficient.

- Strategic Importance: Maintaining a robust and diversified supply chain is a critical operational strategy for Colonial Group to counter potential supplier price increases or supply interruptions.

The bargaining power of suppliers for Colonial Group is amplified by the concentration of key players in the crude oil and refined products market. In 2024, a limited number of major oil-producing nations and large integrated companies means fewer sourcing options for Colonial, giving these suppliers greater leverage in price negotiations.

High switching costs further bolster supplier power. For Colonial Group, changing petroleum suppliers involves significant expenses related to new agreements, logistics adjustments, and potential operational interruptions, making it costly to seek alternatives.

The critical nature and limited substitutability of essential inputs, such as specific refined petroleum products, grant suppliers considerable influence. When these inputs are vital and sourced from a narrow provider base, suppliers can dictate terms more effectively.

| Factor | Impact on Colonial Group | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Increases supplier leverage due to fewer alternatives | Global oil market dominated by a few major producers |

| Switching Costs | Deters Colonial from changing suppliers, strengthening supplier position | Significant investment required for new logistics and agreements |

| Input Uniqueness/Importance | Empowers suppliers of critical, specialized products | Reliance on specific refined products for operations |

| Threat of Forward Integration | Suppliers entering distribution/retail weakens Colonial's negotiation power | Potential for fuel producers to establish their own retail networks |

What is included in the product

Analyzes the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitute products relevant to Colonial Group's strategic positioning.

Instantly visualize competitive pressures with a dynamic five forces dashboard, enabling rapid identification of key threats and opportunities.

Customers Bargaining Power

Colonial Group serves a wide array of customers, from everyday drivers at its retail gas stations to large industrial and marine transport clients needing bulk fuel. This diversity means customer price sensitivity varies significantly across segments.

Retail customers, for instance, are typically very price-sensitive, often making purchasing decisions based on the lowest available price at the pump. In contrast, industrial and commercial clients, while still mindful of cost, may place a higher value on consistent supply, reliability, and integrated services when selecting a fuel provider.

For example, in 2024, average gasoline prices at the pump fluctuated, with retail consumers actively seeking out the most competitive offerings. This contrasts with the purchasing patterns of large fleet operators, who might negotiate contracts based on volume and service level agreements, demonstrating a different calculus of price sensitivity.

Colonial Group's customer concentration, particularly within its bulk distribution and marine transportation divisions, significantly impacts customer bargaining power. A reliance on a few major clients in these sectors grants them considerable leverage to negotiate pricing and terms, potentially squeezing Colonial Group's profit margins.

For instance, if a substantial percentage of Colonial Group's bulk distribution revenue, which represented approximately 40% of its total revenue in 2023, originates from a handful of large industrial buyers, these buyers can exert considerable pressure. This concentrated customer base allows them to demand better rates or threaten to switch suppliers, a scenario less likely in Colonial Group's more fragmented retail fuel distribution network.

Customers of Colonial Group face a significant number of substitute products and services across its diverse operations, directly enhancing their bargaining power. For instance, in the retail gasoline market, the presence of numerous competing gas stations means consumers can easily switch based on price or convenience, a common observation in the highly fragmented U.S. gasoline market where thousands of independent stations operate.

Similarly, for bulk fuel supply, alternative distributors exist, allowing large industrial or commercial clients to solicit bids from multiple providers, thereby negotiating more favorable terms. This competitive landscape for fuel distribution is a persistent factor influencing pricing and service agreements.

In the realm of marine transport and logistics, Colonial Group contends with other shipping companies and alternative transportation modes. The ability for customers to shift cargo to rail, truck, or other pipeline networks, depending on cost, speed, and capacity, further amplifies their leverage in securing competitive rates and service levels.

Customer Information and Transparency

The bargaining power of Colonial Group's customers is significantly influenced by the information and price transparency available to them. As of 2024, the ease with which consumers can compare gasoline prices across different stations, often aided by mobile applications and online platforms, directly enhances their ability to negotiate or switch providers. This transparency extends to an increasing awareness of the underlying logistics and transportation costs, putting pressure on Colonial Group to justify its pricing.

This heightened customer awareness forces Colonial Group to differentiate itself beyond just price. The company must increasingly focus on delivering value-added services, such as reliability, convenience, and customer service, to maintain its competitive edge. Operational efficiency also becomes paramount, as reducing internal costs allows Colonial Group to absorb some of the price pressures without compromising profitability.

- Information Accessibility: Customers can easily compare gasoline prices via apps and online, increasing their leverage.

- Logistics Transparency: Growing awareness of transportation costs empowers customers to question pricing.

- Strategic Response: Colonial Group must emphasize value-added services and operational efficiency to counter customer bargaining power.

Threat of Backward Integration by Customers

The threat of backward integration by Colonial Group's customers, especially large industrial clients, significantly amplifies their bargaining power. If Colonial Group's pricing or service quality falters, a major customer might explore developing their own fuel storage or logistics infrastructure, directly competing with Colonial Group's core business.

This potential for customers to bring operations in-house compels Colonial Group to maintain competitive pricing and reliable service delivery. For instance, if a key client, representing a substantial portion of Colonial Group's revenue, were to invest in its own terminal facilities, it could directly impact Colonial Group's market share and profitability.

- Customer Integration Risk: Large industrial customers, such as major fuel distributors or industrial manufacturers, possess the capital and expertise to potentially build their own storage and transportation assets.

- Cost and Reliability Drivers: The decision for a customer to integrate backward is often driven by perceived inefficiencies, high costs, or unreliable service from Colonial Group.

- Market Pressure: In 2024, the energy logistics sector saw increased scrutiny on operational costs. A hypothetical scenario where a client saves 5-10% by building its own infrastructure could be a strong motivator.

Colonial Group's customers wield significant bargaining power due to the availability of numerous substitutes and the ease with which they can switch providers. In 2024, the retail fuel market saw consumers readily comparing prices via apps, while industrial clients could solicit bids from multiple bulk fuel distributors. This competitive landscape, coupled with increasing transparency around logistics costs, forces Colonial Group to focus on value-added services and operational efficiency to retain its customer base.

What You See Is What You Get

Colonial Group Porter's Five Forces Analysis

This preview showcases the complete Colonial Group Porter's Five Forces Analysis, providing a comprehensive assessment of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You can trust that this professionally formatted analysis is your exact deliverable, ready for immediate use and application.

Rivalry Among Competitors

Colonial Group faces a dynamic competitive environment. In the retail gasoline sector, it contends with a large number of independent operators alongside established chain-affiliated stations, creating a fragmented market. This sheer volume of players, each with varying pricing and service strategies, fuels intense rivalry.

The petroleum distribution and marine transportation segments present a different, yet equally challenging, competitive landscape. Here, Colonial Group competes against a mix of regional specialists and larger national entities. These competitors often possess significant economies of scale and established distribution networks, necessitating strategic differentiation for Colonial Group to maintain its market position.

The growth rate within the energy and logistics sectors directly impacts how fiercely companies compete. In areas where growth is sluggish, such as some mature segments of the energy market, businesses often find themselves in a tougher battle for existing customers and market share. This intensity can lead to price wars and reduced profitability for all involved.

Conversely, sectors experiencing rapid expansion, like certain renewable energy sub-sectors or specialized logistics services, can sometimes temper direct rivalry. Companies might focus more on capturing new opportunities rather than directly challenging established players. However, the energy sector, in particular, is navigating complex shifts in demand and technology, which can create unique competitive pressures even within growth phases.

For instance, in 2024, while global energy demand continued to rise, the pace and composition of that growth varied significantly by region and energy source. This dynamic landscape means that while overall growth might seem positive, specific sub-sectors could be experiencing intense competition as companies adapt to changing consumer preferences and regulatory environments.

Colonial Group's ability to differentiate its offerings, particularly beyond the core gasoline product, directly impacts competitive rivalry. While gasoline itself is a commodity, success hinges on factors like convenience store selection, effective loyalty programs, and specialized fleet services that can create a unique customer experience. For instance, in 2024, many fuel retailers are investing heavily in their convenience store segments, recognizing them as significant profit drivers and differentiation points.

The level of switching costs for Colonial Group's customers plays a crucial role in the intensity of competition. If customers can easily move to a competitor with minimal effort or cost, rivalry naturally increases. For example, if a customer can simply choose the nearest gas station without penalty or loss of benefits, they are more likely to shop around. Conversely, robust loyalty programs that offer tangible rewards can significantly raise these switching costs, fostering customer retention and reducing direct price competition.

High Fixed Costs and Exit Barriers

Colonial Group's operating sectors, like marine transportation and petroleum distribution, are characterized by substantial fixed costs. These costs stem from significant investments in infrastructure, vessels, and storage facilities. For instance, the average cost to build a new chemical tanker can range from $50 million to $100 million, representing a massive upfront capital outlay.

High exit barriers further intensify competitive rivalry. Specialized assets in marine transport, or long-term supply agreements in petroleum distribution, make it difficult and costly for companies to leave the market. This reluctance to exit, even during periods of low demand, often forces companies to engage in price competition to ensure asset utilization, potentially leading to price wars.

- High Capital Intensity: Industries like shipping require immense capital for vessel acquisition and port infrastructure, often exceeding billions of dollars for large fleets.

- Specialized Assets: The unique nature of tankers or specialized distribution terminals creates significant hurdles and costs for divestment or repurposing.

- Contractual Commitments: Long-term contracts with suppliers or customers can lock companies into operations, reducing flexibility and increasing the pressure to maintain market share through competitive pricing.

- Downturn Impact: During economic slowdowns, the inability to easily exit markets with high fixed costs and exit barriers can lead to prolonged periods of intense price competition and reduced profitability for all players.

Strategic Stakes and Aggressiveness of Competitors

The strategic importance of the energy and logistics sectors means competitors, including major national and international players, are highly aggressive in pursuing market share. This often translates into intense price competition and significant investment in marketing and expansion initiatives. For instance, in 2024, the global energy logistics market saw substantial capital expenditures, with companies like Maersk and major oilfield service providers actively seeking to consolidate their positions and expand their service offerings, directly impacting pricing dynamics for companies like Colonial Group.

Colonial Group must anticipate and effectively counter these aggressive tactics. The drive for market dominance by large energy conglomerates means that pricing strategies can be volatile, and new market entrants or service expansions by existing rivals can quickly alter the competitive landscape. Understanding these high strategic stakes is paramount for Colonial Group to maintain its competitive edge and profitability.

- High Strategic Stakes: Major energy and logistics firms view these markets as critical for their overall business strategy, driving aggressive pursuit of market share.

- Aggressive Competitive Actions: Expect intensified pricing wars, significant marketing campaigns, and rapid expansion efforts from key rivals.

- 2024 Market Dynamics: The global energy logistics market experienced considerable capital investment in 2024, indicating a strong competitive drive among major players.

- Need for Responsive Strategy: Colonial Group must be prepared with agile strategies to effectively respond to and mitigate the impact of competitor actions.

Colonial Group operates in markets with numerous competitors, ranging from independent operators to large national firms, creating a fragmented and intensely competitive environment. The fuel retail sector, in particular, sees rivalry driven by diverse pricing and service strategies. In petroleum distribution and marine transportation, Colonial Group faces established players with economies of scale and extensive networks, necessitating strong differentiation.

The intensity of rivalry is amplified by high capital intensity and specialized assets within Colonial Group's operating sectors, such as marine transportation, where acquiring a new chemical tanker can cost between $50 million and $100 million. High exit barriers further compel companies to compete aggressively on price to maintain asset utilization, especially during economic downturns. For instance, the global energy logistics market saw substantial capital expenditures in 2024, reflecting a strong competitive drive among major players seeking market share.

SSubstitutes Threaten

The primary threat of substitutes for Colonial Group's petroleum distribution and retail gasoline segments stems from the growing availability and adoption of alternative energy sources. This is a significant long-term challenge to their core business model.

The increasing popularity of electric vehicles (EVs) is a prime example, with global EV sales projected to reach over 16 million units in 2024, a substantial increase from previous years. Furthermore, the wider use of biofuels, like ethanol and biodiesel, offers another substitute for traditional gasoline, impacting demand.

Ongoing advancements in hydrogen fuel cell technology also present a future substitute. While still in earlier stages of widespread adoption, significant investment and research are being poured into hydrogen as a clean energy alternative for transportation.

Shifting consumer preferences toward sustainability pose a significant threat of substitutes for Colonial Group. Growing awareness of climate change is driving demand for greener energy alternatives. For instance, in 2024, global investment in renewable energy sources reached an all-time high, exceeding $500 billion, indicating a clear market shift away from traditional fossil fuels.

The performance and price of substitutes significantly influence the threat they pose. For instance, as electric vehicles (EVs) improve in range and charging speed while becoming more affordable, they become a more compelling alternative to traditional gasoline cars. In 2024, the average EV price in the US hovered around $50,000, a figure that is gradually decreasing with new model introductions and government incentives, making them increasingly competitive.

The economic viability and efficiency of alternative fuels like biofuels also play a crucial role in their market penetration. As these technologies mature and production costs fall, they present a stronger substitute threat to conventional energy sources in transportation and industry. For example, the global biofuel market was valued at over $150 billion in 2023 and is projected to see continued growth, indicating an increasing acceptance and viability of these alternatives.

Availability of Alternative Logistics Solutions

For Colonial Group's marine transportation and logistics services, substitutes primarily consist of other freight transport modes. These include rail, trucking, and air cargo, each offering different trade-offs in terms of efficiency, speed, cost, and reliability that influence customer choices. In 2024, the global logistics market saw continued investment in intermodal solutions, blending these transport types to optimize supply chains, with trucking alone accounting for a significant portion of freight movement in many developed economies.

The attractiveness of these alternatives is a direct threat. For instance, if trucking companies offer more competitive pricing or faster delivery times for certain routes, it can pull business away from marine transport, especially for shorter distances or time-sensitive cargo. Similarly, advancements in rail infrastructure can make it a more viable option for bulk goods that might otherwise travel by sea.

Emerging technological advancements also pose a potential threat. Innovations like drone delivery, while currently niche, could develop into viable substitutes for specific types of high-value or urgent shipments, bypassing traditional logistics networks entirely. The increasing efficiency and reach of these alternative methods directly impact the pricing power and market share of marine logistics providers like Colonial Group.

Key substitute considerations for Colonial Group include:

- Rail Freight: Offers cost-effectiveness for bulk commodities and long-haul inland transport.

- Road Trucking: Provides flexibility and door-to-door delivery, particularly for shorter routes and last-mile logistics.

- Air Cargo: Dominates for time-sensitive and high-value goods, despite higher costs.

- Emerging Technologies: Drones and autonomous vehicles could disrupt specific segments of the logistics market.

Regulatory and Technological Advancements

Government regulations are increasingly pushing industries towards greener alternatives. For instance, by the end of 2023, the U.S. Department of Energy projected that investments in clean energy technologies were on track to exceed $100 billion, signaling a significant shift that could favor substitutes for traditional energy sources. Mandates for improved energy efficiency in buildings and transportation directly encourage the adoption of alternative solutions, potentially impacting demand for Colonial Group's core offerings.

Technological advancements are also rapidly making substitutes more attractive. Breakthroughs in battery energy density, for example, have seen costs decline by over 90% in the last decade, making electric vehicles a more competitive option against internal combustion engines. Similarly, improvements in solar panel efficiency and wind turbine technology continue to lower the cost of renewable energy generation, presenting a growing threat to established energy providers.

- Regulatory Push: Government incentives and mandates for renewable energy adoption are accelerating the market for substitute products and services.

- Technological Leap: Innovations in areas like battery technology and renewable energy generation are making substitutes increasingly cost-effective and competitive.

- Market Shift: These combined forces are creating a dynamic environment where substitutes are becoming more viable, potentially disrupting traditional business models.

The threat of substitutes for Colonial Group is significant, driven by evolving consumer preferences and technological advancements. The increasing adoption of electric vehicles (EVs) is a prime example, with global EV sales projected to surpass 16 million units in 2024. This trend, coupled with growing investments in renewable energy sources, which exceeded $500 billion globally in 2024, directly challenges Colonial Group's traditional petroleum distribution and retail gasoline segments. Furthermore, alternative logistics solutions like enhanced rail and trucking networks offer competitive alternatives to Colonial Group's marine transportation services, particularly for shorter hauls and time-sensitive cargo.

| Substitute Category | Primary Impacted Segment | Key Drivers | 2024 Data/Trend |

|---|---|---|---|

| Electric Vehicles (EVs) | Petroleum Distribution & Retail Gasoline | Environmental concerns, falling battery costs, government incentives | Global EV sales projected > 16 million units |

| Renewable Energy Sources | Petroleum Distribution & Retail Gasoline | Climate awareness, technological innovation, investment | Global investment in renewables > $500 billion |

| Rail & Trucking Logistics | Marine Transportation & Logistics | Efficiency, cost-effectiveness, flexibility | Continued investment in intermodal solutions |

| Biofuels | Petroleum Distribution & Retail Gasoline | Sustainability mandates, energy diversification | Global biofuel market valued > $150 billion (2023) |

Entrants Threaten

The energy and logistics sectors, where Colonial Group operates, demand substantial upfront investment. For instance, building a new pipeline or acquiring a fleet of specialized transport vehicles can easily run into hundreds of millions, if not billions, of dollars. This immense capital requirement acts as a formidable barrier, significantly limiting the number of new companies that can realistically enter the market.

Existing players within the financial services sector, such as Colonial Group, have cultivated significant economies of scale. This translates into substantial cost advantages in areas like bulk purchasing of financial data, negotiating favorable terms with technology providers, and spreading fixed operational costs over a larger asset base. For instance, major financial institutions often secure lower transaction fees and better pricing on software licenses due to their sheer volume of business, something a new entrant would find challenging to replicate immediately.

Furthermore, the experience curve plays a crucial role. Colonial Group, having operated for years, has refined its processes, optimized its service delivery, and developed proprietary systems that enhance efficiency and reduce per-unit costs. This accumulated knowledge, often unquantifiable but deeply embedded in operations, allows for greater precision in risk management and more streamlined customer onboarding, giving them a competitive edge over newcomers who are still learning the intricacies of the market.

These established advantages create a formidable barrier to entry. A new financial firm would face immense difficulty competing on price or operational efficiency from the outset. They would likely incur higher initial costs for technology, marketing, and talent acquisition, making it hard to undercut established players or match their service levels without significant, sustained investment.

Colonial Group’s deeply entrenched distribution networks for petroleum products present a significant hurdle for potential new entrants. Building comparable infrastructure and securing reliable access to these vital supply chains is an enormous undertaking, particularly for essential commodities where consistent availability is paramount. For instance, in 2024, the sheer capital investment required to establish a nationwide logistics and storage network for refined fuels could easily run into billions of dollars, a cost prohibitive for most newcomers.

Regulatory Hurdles and Licensing Requirements

The energy and transportation sectors are characterized by significant regulatory hurdles and licensing requirements. For instance, obtaining necessary permits for operating in the energy sector, particularly in areas like renewable energy development, can involve extensive environmental impact assessments and approvals, which are often time-consuming and expensive. In 2024, the average time to secure all necessary permits for a new solar farm project in the United States could range from 12 to 24 months, with costs potentially reaching hundreds of thousands of dollars.

These compliance burdens act as a substantial barrier to entry for potential new competitors. Navigating a complex web of federal, state, and local regulations, including those related to safety standards, emissions, and transportation logistics, demands considerable expertise and financial resources. For example, trucking companies must adhere to regulations set by bodies like the Federal Motor Carrier Safety Administration (FMCSA), which include stringent requirements for driver hours, vehicle maintenance, and cargo security. Failure to comply can result in significant fines and operational disruptions, making it difficult for new, smaller players to compete with established firms that have already invested in robust compliance systems.

- Significant Capital Investment: New entrants must allocate substantial capital not only for operational assets but also for legal counsel and compliance officers to navigate the intricate regulatory framework.

- Extended Time-to-Market: The lengthy approval processes for licenses and permits can delay market entry, allowing established players to consolidate their market position and customer base.

- Ongoing Compliance Costs: Beyond initial setup, continuous adherence to evolving regulations, such as those related to carbon emissions or safety protocols, incurs ongoing operational expenses that new entrants may struggle to absorb.

Brand Loyalty and Customer Switching Costs

While some areas like retail gasoline might see less intense brand loyalty, Colonial Group's broader operations, particularly in bulk distribution and marine transport, likely benefit from well-established customer relationships. New competitors would face the challenge of breaking these existing loyalties and incurring significant costs to entice customers to switch. For instance, in the specialized marine fuel sector, long-term contracts and integrated service offerings can create substantial switching barriers.

These switching costs can manifest in several ways:

- Contractual Obligations: Existing customers may be locked into contracts with Colonial Group, requiring penalties for early termination.

- Operational Integration: Clients might have systems and processes deeply integrated with Colonial Group's services, making a change disruptive and costly.

- Relationship Value: The established trust and reliability built over years can be a significant, albeit intangible, switching cost for customers.

The threat of new entrants for Colonial Group is considerably low due to immense capital requirements and established economies of scale. Building infrastructure akin to Colonial's in energy and logistics demands billions, a prohibitive sum for most newcomers. For example, in 2024, the cost to construct a single, modern refinery can easily exceed $5 billion, a stark barrier.

Furthermore, Colonial Group benefits from significant cost advantages derived from its scale. This includes bulk purchasing power for fuel, operational efficiencies in transportation, and established relationships with suppliers and clients. A new entrant would struggle to match these cost efficiencies, making it difficult to compete on price. In 2024, major energy distributors often secured fuel purchase agreements at prices 3-5% lower than smaller, independent buyers due to volume commitments.

The energy sector also presents substantial regulatory and licensing hurdles. Obtaining permits for operations, environmental compliance, and transportation safety can be a lengthy and costly process, often taking years and millions in legal and consulting fees. For instance, securing all necessary permits for a new pipeline project in 2024 could involve over 50 distinct regulatory approvals at federal, state, and local levels.

These factors collectively create a formidable barrier to entry, protecting Colonial Group from significant new competition.

| Barrier Type | Description | Estimated Cost/Time (2024) |

|---|---|---|

| Capital Investment | Building new energy infrastructure (e.g., pipelines, storage) | Billions of dollars |

| Economies of Scale | Cost advantages from large-scale operations | 3-5% cost savings on fuel purchases |

| Regulatory Hurdles | Permits, environmental compliance, safety licenses | Millions of dollars and 1-5 years for approvals |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Colonial Group is built upon a foundation of diverse data sources, including company annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial statements. This blend ensures a comprehensive understanding of competitive pressures.