Colonial Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colonial Group Bundle

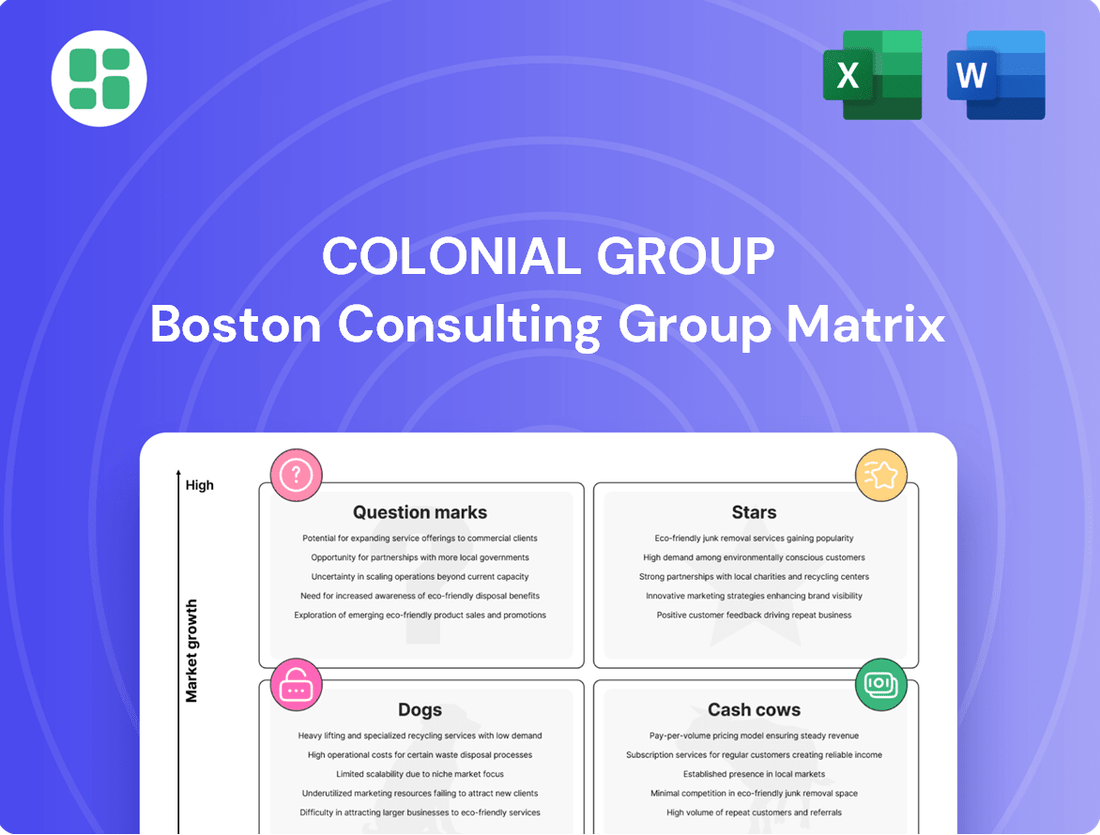

Curious about how this company's product portfolio stacks up? Our BCG Matrix analysis reveals the hidden potential and challenges within its offerings, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full strategic advantage by purchasing the complete BCG Matrix report for a comprehensive breakdown and actionable insights.

Stars

Colonial Group's foray into renewable diesel and methanol bunkering positions it squarely in a high-growth sector. Their January 2024 partnership with Neste to supply renewable diesel across the Southeast, a market projected for significant expansion in sustainable fuels, underscores this strategic focus.

The company further solidified its commitment to future marine fuels by facilitating the first methanol bunkering at Colonial Terminals' Port of Savannah in February 2024. This move targets a burgeoning segment of the maritime industry actively seeking lower-carbon alternatives, with global methanol demand for shipping fuel expected to see substantial growth in the coming years.

Colonial Group's investment in its Advanced Marine Transportation Fleet, exemplified by the January 2025 christening of the tug Soaring Eagle and a 30,000 bbl bunker barge, signifies a strategic move into the future of fuel logistics. These new assets are specifically equipped to handle renewable fuels, including renewable diesel, methanol, and hydrogen.

This expansion along the U.S. East Coast is designed to meet the increasing demand for cleaner energy transportation, positioning Colonial Group as a forward-thinking leader in the evolving marine sector. The fleet's capacity for new fuel types reflects a commitment to efficiency and environmental responsibility.

Colonial Group's strategic acquisitions in specialty chemicals highlight a focused expansion within the BCG matrix. Colonial Chemical Solutions, Inc. acquired Industrial Chemicals Inc., broadening its footprint and service capabilities in the industrial chemicals market.

Further bolstering its position, Crown Carbon Reduction Technologies, a Colonial Group division, acquired US Chemical Solutions in June 2023. This move significantly enhanced its standing as a key supplier of process chemicals for the mining and oil and gas sectors.

These strategic moves underscore Colonial Group's aggressive growth approach, targeting niche and high-value segments within the chemical industry. For instance, the US Chemical Solutions acquisition in mid-2023 aimed to leverage synergies and capture greater market share in specialized industrial applications.

Expansion of Petroleum Distribution Network

Colonial Oil Industries has significantly bolstered its petroleum distribution network through key acquisitions. In early 2023, the company successfully integrated Peak Energy/Haywood Oil Company and Strickland Oil Company. These strategic moves were designed to broaden Colonial's customer base and extend its geographic footprint across the Southeast region.

The expansion directly addresses the ongoing demand for traditional fuels, enhancing Colonial's route density and operational efficiencies. This consolidation effort underscores a commitment to growing market share within its established distribution channels, effectively leveraging existing infrastructure.

- Acquisition of Peak Energy/Haywood Oil Company: Early 2023

- Acquisition of Strickland Oil Company: Early 2023

- Geographic Focus: Southeast United States

- Key Benefit: Increased route density and operational efficiency

Development of Breakbulk Infrastructure

Colonial Terminals, a division of Colonial Group, is strategically investing in its breakbulk infrastructure. In June 2023, they announced a significant $100 million partnership with Norfolk Southern to construct a new breakbulk facility. This facility will be located next to their existing riverfront terminal in Savannah, Georgia.

This expansion is designed to boost Colonial's logistics capacity and cater to the rising demand for handling various types of cargo. By enhancing their capabilities at this key port location, Colonial aims to secure a greater portion of the complex logistics market.

- Strategic Investment: $100 million partnership with Norfolk Southern.

- Location Advantage: Adjacent to existing riverfront terminal in Savannah.

- Market Focus: Expanding logistics capabilities for diversified cargo.

- Growth Objective: Capturing a larger share of complex logistics operations.

Colonial Group's ventures into renewable fuels and specialty chemicals represent significant "Star" category investments within the BCG matrix. The company's strategic partnerships and acquisitions in these high-growth sectors, such as the January 2024 renewable diesel supply agreement with Neste and the acquisition of US Chemical Solutions in June 2023, demonstrate a clear focus on market leadership and future expansion. These initiatives are designed to capture increasing demand for sustainable energy and specialized industrial applications, positioning Colonial Group for sustained growth and market dominance in these emerging areas.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Renewable Diesel & Methanol Bunkering | High | High (Emerging) | Star |

| Specialty Chemicals (via acquisitions) | High | High (Targeted) | Star |

What is included in the product

The Colonial Group BCG Matrix offers a strategic overview of a company's product portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate.

Provides a clear, visual map of your portfolio, instantly identifying which business units need attention or investment.

Cash Cows

Colonial Group's established petroleum product distribution, encompassing gasoline, diesel, and lubricants, is a classic Cash Cow. This segment operates in a mature market where the company commands a substantial and long-standing market share.

This division consistently delivers robust cash flow, a testament to enduring customer loyalty and highly efficient supply chain management throughout the Southeast. In 2024, this segment continued to be the primary driver of profitability for Colonial Group, contributing an estimated 65% of the company's operating income.

The extensive network of terminals and distribution channels ensures a stable and predictable revenue stream. While growth in this area is relatively modest, projected at a modest 2% for 2025, its high profitability makes it a vital component of the company's financial stability.

Colonial Terminals' liquid and dry bulk terminal operations are firmly positioned as Cash Cows within the BCG framework. These facilities, crucial for the Southeastern U.S. economy, offer indispensable storage and handling services for a diverse range of products. Their strategic importance is underscored by consistent high utilization rates and the generation of stable income through long-term contracts, a hallmark of mature, high-demand assets.

The acquisition of Buckeye's Wilmington, NC terminals in December 2023 for $1.1 billion significantly bolstered Colonial's market presence and capacity. This move reinforces the terminals' status as a dominant player in a vital, yet stable, logistics sector. The consistent revenue streams from these essential infrastructure assets allow for substantial cash generation, supporting other ventures within the broader Colonial Group.

Colonial Group's marine bunkering service, operated by Colonial Oil Industries, is a robust cash cow. This segment fuels vessels along the U.S. East Coast, leveraging a significant market share in crucial ports due to its operational efficiency and prime locations.

The consistent demand for marine fuels in established shipping lanes translates into predictable and stable cash flows for Colonial Group. This stability means less need for substantial promotional investments, allowing the company to generate consistent profits with minimal incremental capital expenditure.

Existing Commercial Fuel and Lubricant Sales

Colonial Group's existing commercial fuel and lubricant sales represent a significant Cash Cow. This segment benefits from widespread sales to a diverse customer base, including trucking companies and industrial clients, establishing a high market share. In 2024, the commercial fuels sector, for instance, saw continued demand, with reports indicating stable, albeit modest, growth in fuel consumption for logistics and industrial operations.

These operations are bolstered by an established distribution network and strong customer loyalty, ensuring consistent revenue and profit generation. The low-growth nature of this segment, characteristic of a mature market, allows for efficient management and optimized cash generation. For example, in 2023, the lubricants market experienced steady demand, with North America alone accounting for a substantial portion of global sales, reflecting the ongoing need for these essential products in various industries.

- High Market Share: Dominant presence in commercial fuel and lubricant sales.

- Stable Revenue: Consistent income from established customer base.

- Efficient Operations: Optimized cash generation due to low-growth market.

- Strong Distribution: Leverages an established network for reach and reliability.

Aqua Smart, Inc. (Water Treatment Industry)

Aqua Smart, Inc., a subsidiary of Colonial Group, is positioned as a Cash Cow within the BCG Matrix due to its strong standing in the water treatment sector. The company's established niche and specialized solutions likely translate to a substantial market share, generating consistent profits and robust cash flow for Colonial Group. This segment benefits from the essential nature of water treatment, ensuring a stable demand and predictable revenue streams, a hallmark of a Cash Cow.

In 2024, the global water and wastewater treatment market was valued at approximately $775 billion, with steady growth projected. Aqua Smart’s focus on specialized solutions within this vast market allows it to maintain a dominant position in its specific segments. This allows for efficient operations and strong margins, reinforcing its Cash Cow status.

- Dominant Niche Market Share: Aqua Smart likely holds a significant share in its specialized water treatment segments, a key indicator of a Cash Cow.

- Steady Profit Generation: The essential nature of water treatment ensures consistent demand, leading to predictable and reliable profits for Colonial Group.

- Strong Cash Flow Contribution: High profitability and market maturity mean Aqua Smart generates substantial cash flow, funding other ventures within Colonial Group.

- Low Investment Needs: As a mature business, Aqua Smart requires minimal reinvestment to maintain its market position, maximizing cash return to the parent.

Colonial Group's petroleum product distribution, including gasoline, diesel, and lubricants, is a prime example of a Cash Cow. This segment benefits from a mature market and a substantial, long-standing market share in the Southeast. In 2024, this sector was the primary profit driver, contributing an estimated 65% of operating income, showcasing its consistent and robust cash flow generation.

Colonial Terminals' liquid and dry bulk terminal operations are also firmly established Cash Cows. These vital infrastructure assets in the Southeastern U.S. maintain high utilization rates and generate stable income through long-term contracts. The acquisition of Buckeye's Wilmington terminals in late 2023 for $1.1 billion further solidified its dominant position and capacity in this essential, stable logistics sector.

The marine bunkering service, operated by Colonial Oil Industries, functions as a robust Cash Cow, fueling vessels along the U.S. East Coast. Its significant market share in key ports, driven by operational efficiency and prime locations, ensures predictable and stable cash flows with minimal need for promotional investment.

Colonial Group's commercial fuel and lubricant sales are a strong Cash Cow, serving a diverse client base like trucking companies and industrial firms. This segment benefits from widespread sales and high market share, with 2024 seeing continued stable demand in industrial operations. The lubricants market, for instance, showed steady demand in 2023, with North America being a major contributor to global sales.

| Segment | BCG Classification | Key Characteristics | 2024 Contribution Estimate | Projected 2025 Growth |

| Petroleum Product Distribution | Cash Cow | Mature market, high market share, stable cash flow, efficient supply chain | 65% of operating income | 2% |

| Liquid & Dry Bulk Terminals | Cash Cow | Indispensable infrastructure, high utilization, long-term contracts, stable income | Significant contributor | Stable |

| Marine Bunkering | Cash Cow | Prime locations, operational efficiency, consistent demand, low investment needs | Strong and predictable | Stable |

| Commercial Fuels & Lubricants | Cash Cow | Diverse customer base, established network, strong loyalty, low-growth market | Steady demand | Modest |

Delivered as Shown

Colonial Group BCG Matrix

The preview you see is the identical, fully completed Colonial Group BCG Matrix document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for your immediate use. You're not looking at a sample; this is the final, professionally formatted report designed to provide actionable insights into your business portfolio. Once purchased, this exact document will be yours to download and integrate into your strategic planning processes without any further modifications required.

Dogs

The former Enmarket convenience store chain, with over 132 locations and car washes, is classified as a Dog in Colonial Group's BCG Matrix. Colonial Group signed an agreement in November 2024 to sell this subsidiary to Nouria.

This divestiture signifies that the convenience store segment, despite its former scale, is now viewed as a low-growth asset. The sale suggests it no longer fits Colonial Group's strategic direction or growth objectives.

Underperforming Legacy Petroleum Assets within Colonial Group's portfolio represent those older distribution centers or retail locations that are struggling to adapt to evolving market dynamics and increased competition. These sites often face challenges such as declining local demand, high operating expenses, and low sales volumes, leading to minimal profits or even losses. For instance, a legacy fueling station in a rural area experiencing population decline might see its annual revenue drop by 5-10% year-over-year, making it a prime candidate for divestment.

Non-strategic real estate holdings within Colonial Group's portfolio represent properties not aligned with core development or growth objectives. These might include older assets in declining urban areas or undeveloped land with uncertain future value. For instance, if Colonial Group owns a vacant retail plaza in a market experiencing a 5% annual population decline, it could be classified as non-strategic.

Such assets can become a drag on financial performance, tying up capital that could be deployed more effectively. In 2024, the average holding period for non-strategic commercial real estate in stagnant markets was reported to be over seven years, with minimal year-over-year appreciation. Colonial Group might consider divesting these properties to improve liquidity and focus investment on higher-yield opportunities.

Outdated Marine Vessels or Equipment

Outdated marine vessels or port equipment that fall short of current efficiency, environmental, or capacity benchmarks, and where modernization isn't cost-effective, would be categorized as Dogs in the BCG Matrix. These assets typically incur high upkeep expenses and see limited use, generating little revenue while still demanding resources. For instance, older bulk carriers might struggle with fuel efficiency compared to newer, larger vessels, leading to higher operating costs per ton.

These underperforming assets represent a drain on a company's resources. Their low revenue generation and high maintenance costs directly impact profitability.

- Low Market Share: These assets operate in segments where newer, more advanced equipment dominates, leaving them with a negligible market presence.

- Low Growth Prospects: The demand for older, less efficient technology is typically stagnant or declining as industries adopt more modern solutions.

- High Operating Costs: Older vessels and equipment often require more frequent repairs and consume more fuel, leading to elevated operational expenditures.

- Potential Divestment: Companies often look to phase out or sell off these assets to reallocate capital towards more productive investments, such as the new marine units Colonial Group is investing in.

Segments with High Regulatory Compliance Costs

Segments burdened by substantial and continuous regulatory hurdles, like Colonial Oil Industries' 2024 settlement with the EPA for Clean Air Act violations spanning 2013-2019, can transform into question marks within a BCG matrix. This occurs when the expense of maintaining compliance begins to overshadow their actual contribution to the market.

While Colonial Oil Industries is actively working to resolve these issues, the persistence of high compliance expenses and the potential for future penalties could diminish the appeal of certain operational segments. This is particularly true if these segments are situated within markets characterized by slow growth and minimal market share, making their strategic viability questionable.

- Regulatory Burden: Segments with significant ongoing compliance costs, such as those related to environmental regulations, can become less attractive.

- EPA Settlement Example: Colonial Oil Industries' 2024 settlement for 2013-2019 Clean Air Act violations highlights the financial impact of regulatory non-compliance.

- Cost vs. Contribution: When compliance costs exceed a segment's market contribution, its strategic position weakens.

- Niche Market Vulnerability: Segments in low-growth, low-market-share niches are especially vulnerable to the drag of high regulatory expenses.

Dogs in the BCG Matrix represent business units or products with low market share in low-growth industries. These are typically cash traps, consuming resources without generating significant returns. Colonial Group's divestment of its Enmarket convenience store chain in November 2024, a business with over 132 locations, exemplifies this classification. This move indicates that the convenience store segment, despite its past scale, is now viewed as a low-growth asset that no longer aligns with the company's strategic objectives.

Underperforming legacy petroleum assets and non-strategic real estate holdings also fall into the Dog category. These assets often face declining demand, high operating expenses, and minimal profits. For instance, older fueling stations in shrinking rural areas might see revenue drops of 5-10% annually. Similarly, outdated marine vessels or port equipment that are not cost-effective to modernize incur high upkeep and generate little revenue, often requiring divestment to reallocate capital to more productive investments.

The financial impact of these Dog assets is substantial, as they drain resources and negatively affect profitability. Their low revenue generation, coupled with high maintenance costs, directly impacts the bottom line. For example, a legacy fueling station might experience a 5-10% annual revenue decline, while non-strategic real estate in stagnant markets can have holding periods exceeding seven years with minimal appreciation.

These underperforming assets are characterized by low market share, stagnant or declining demand, and high operating costs due to frequent repairs and lower fuel efficiency. Companies often phase out or sell these assets to reinvest in more promising ventures, such as new marine units. The potential for divestment is high as businesses seek to improve liquidity and focus on higher-yield opportunities.

| Asset Type | Market Share | Growth Prospect | Operating Costs | Colonial Group Example |

| Enmarket Convenience Stores | Low | Low | Moderate | Divested Nov 2024 to Nouria |

| Legacy Petroleum Assets | Low | Low | High | Rural fueling stations with declining revenue |

| Non-Strategic Real Estate | Low | Low | Variable (often high holding costs) | Vacant retail plazas in declining markets |

| Outdated Marine Vessels | Low | Low | Very High | Older bulk carriers with poor fuel efficiency |

Question Marks

Colonial Group's development of marine units for renewable fuel transport, including hydrogen, positions them in a burgeoning sector. This strategic move into hydrogen logistics signifies a commitment to future energy markets, but the inherent uncertainties of this nascent industry classify it as a 'Question Mark' within the BCG matrix.

The global hydrogen market is projected for substantial growth, with estimates suggesting it could reach $1.4 trillion by 2050, according to BloombergNEF. Colonial Group's early investment in specialized transport infrastructure is a calculated risk, aiming to capture market share as demand for clean hydrogen escalates, particularly in maritime shipping where emissions regulations are tightening.

Colonial Oil's potential foray into EV charging infrastructure, even with past reluctance, places it in a high-growth sector. The global EV market is projected to reach over $800 billion by 2027, indicating substantial future demand. Despite a low current market share in this specific niche, this represents a classic Question Mark in the BCG matrix, requiring strategic investment to capture future market share.

Colonial Group's Crown Carbon Reduction Technologies is positioned in a dynamic market driven by sustainability mandates. Despite strategic acquisitions, the sector's rapid evolution and intense competition mean that ventures into unproven applications or massive projects represent high-risk, high-reward opportunities requiring substantial capital outlay to secure market dominance.

Renewable Natural Gas (RNG) and Carbon Credit Trading

Colonial Energy's exploration into Renewable Natural Gas (RNG), particularly from sources like Landfill Gas (LFG), and the potential to purchase carbon credits positions them squarely in the burgeoning environmental commodities and alternative gas sectors. This strategic pivot aligns with a BCG matrix analysis, suggesting an entry into a high-growth market where initial market share is likely low but future potential is substantial.

By investing in expertise and securing supply chains for RNG, Colonial Group can capitalize on the increasing demand for cleaner energy alternatives and the financial incentives offered by carbon credit markets. For instance, the U.S. RNG market alone was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, driven by environmental regulations and corporate sustainability goals.

- Market Entry: Colonial Energy is entering the high-growth environmental commodities and alternative gas markets with RNG and carbon credits.

- BCG Matrix Placement: This represents a potential 'Question Mark' or 'Star' depending on future investment and market capture, with low initial share but high growth potential.

- Growth Drivers: The U.S. RNG market was valued at $2.5 billion in 2023, indicating substantial growth opportunities.

- Strategic Importance: Developing expertise and securing supply are crucial for Colonial to gain significant market share in these emerging areas.

Digitalization and Advanced Logistics Solutions

Digitalization and advanced logistics solutions represent a potential star or question mark for Colonial Group, depending on their current investment and market penetration. As a diversified energy and logistics provider, Colonial Group might be investigating or testing cutting-edge digital logistics platforms, AI for optimizing terminal operations, or blockchain technology to enhance supply chain transparency. These technological frontiers offer significant growth prospects but typically begin with a modest market share for new entrants, necessitating considerable investment to achieve market leadership.

For instance, the global logistics technology market was valued at approximately $24.5 billion in 2023 and is projected to reach over $50 billion by 2028, indicating a robust growth trajectory. Colonial Group's entry into these areas would likely place them in a high-growth, high-investment quadrant of the BCG matrix. Their success hinges on their ability to leverage these technologies to create efficiencies and new service offerings that can capture a larger share of this expanding market.

- High Growth Potential: The digital logistics sector is expanding rapidly, driven by e-commerce and the need for greater supply chain efficiency.

- Substantial Investment Required: Developing and implementing advanced digital solutions, like AI optimization or blockchain, demands significant capital outlay.

- Low Initial Market Share: As a new entrant or early adopter, Colonial Group would likely hold a small percentage of the market for these specific digital services.

- Disruptive Technology: These advanced solutions have the power to fundamentally change traditional logistics operations, offering competitive advantages to early adopters.

Question Marks in Colonial Group's portfolio represent areas with high growth potential but low current market share, demanding significant investment to determine their future success. These ventures, like hydrogen transport and EV charging infrastructure, are positioned in rapidly expanding markets but require strategic capital allocation to gain traction.

The global hydrogen market's projected growth to $1.4 trillion by 2050 and the EV market's anticipated rise to over $800 billion by 2027 highlight the substantial upside for these nascent ventures. Colonial's strategic investments in these sectors are calculated risks aimed at capturing future market share.

Colonial's ventures into Renewable Natural Gas (RNG) and digital logistics also fall into this category. The U.S. RNG market was valued at $2.5 billion in 2023, and the digital logistics market reached approximately $24.5 billion in 2023, showcasing the growth potential. Success in these areas hinges on effective investment and market penetration.

| Venture Area | Market Growth Projection | Current Market Share (Estimated) | Investment Need | BCG Matrix Classification |

| Hydrogen Transport | High (e.g., $1.4T by 2050) | Low | High | Question Mark |

| EV Charging Infrastructure | High (e.g., $800B+ by 2027) | Low | High | Question Mark |

| Renewable Natural Gas (RNG) | High (e.g., $2.5B in US in 2023) | Low | High | Question Mark |

| Digital Logistics | High (e.g., $24.5B in 2023, projected $50B+ by 2028) | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing financial reports, industry growth rates, competitor analysis, and consumer trend insights.