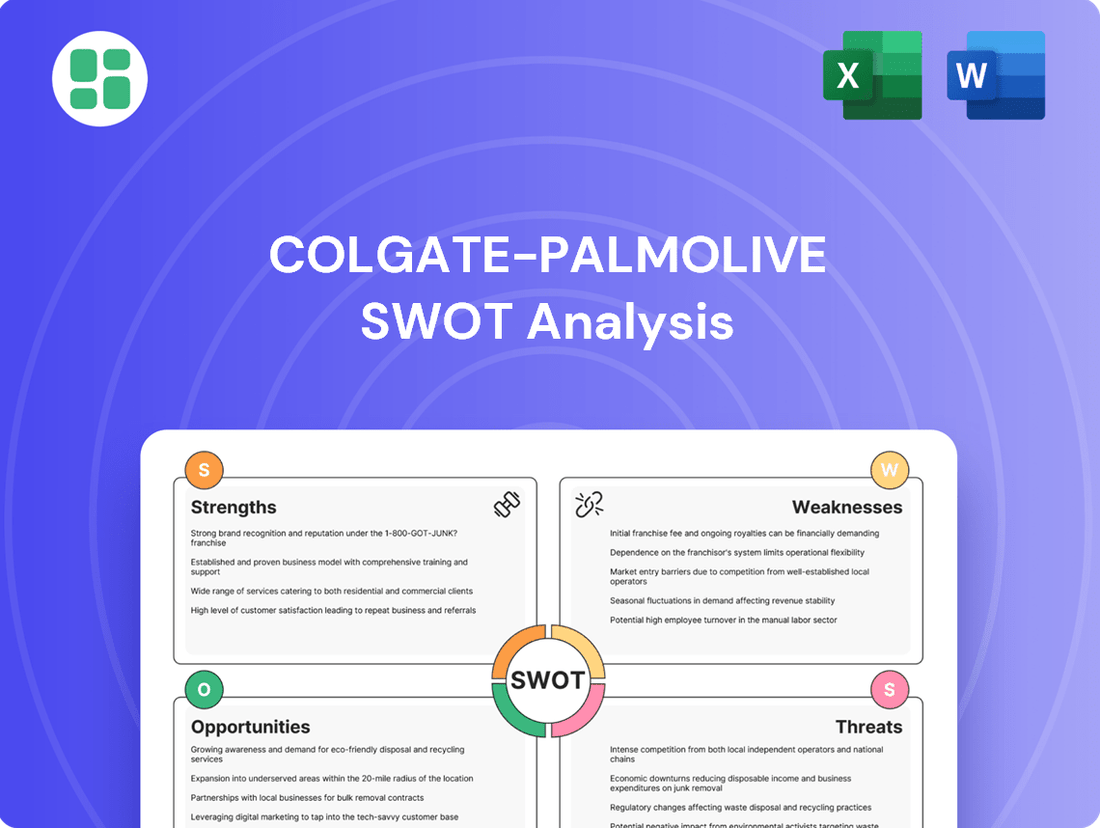

Colgate-Palmolive SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colgate-Palmolive Bundle

Colgate-Palmolive boasts strong brand recognition and a vast global distribution network, but faces intense competition and evolving consumer preferences. Our comprehensive SWOT analysis delves into these critical factors, revealing opportunities for innovation and potential threats to market share.

Want the full story behind Colgate-Palmolive's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Colgate-Palmolive enjoys unparalleled global brand recognition, a cornerstone of its market leadership. Its flagship toothpaste brand commands an impressive global market share exceeding 40% as of early 2025, with manual toothbrushes also holding over 30%.

This deep-seated consumer trust, cultivated across more than 200 countries, translates into a substantial competitive edge. The company's sustained commitment to robust advertising campaigns and brand health initiatives continuously fortifies its dominant market standing.

Colgate-Palmolive's strength lies in its broad and resilient product range, covering oral care, personal care, home care, and a growing pet nutrition division. This diversification acts as a buffer against economic fluctuations, ensuring a stable revenue flow across different consumer spending categories.

The pet nutrition segment, featuring brands like Hill's Science Diet and Prescription Diet, has been a standout performer, consistently driving growth and contributing a substantial portion to Colgate-Palmolive's overall sales. For instance, in the first quarter of 2024, Colgate-Palmolive reported a 7.5% increase in net sales, with their Pet Nutrition division showing particularly robust performance.

Colgate-Palmolive consistently showcases impressive financial health, with gross profit margins hovering around 60% in 2024 and continuing this trend into Q1 2025. This financial resilience, coupled with steady earnings per share growth, underpins the company's operational stability. Such strong financial footing allows Colgate-Palmolive to confidently pursue strategic investments aimed at fostering future expansion and innovation.

Extensive Global Distribution Network

Colgate-Palmolive's extensive global distribution network is a significant strength, allowing it to operate in over 200 countries and territories. This vast reach ensures access to diverse markets, from bustling cities to remote villages, connecting the company with a broad consumer base. The company's ability to navigate these varied markets highlights its operational prowess and deep consumer engagement worldwide.

This widespread presence is crucial for adapting products to local tastes and needs, a key factor in maintaining market share. For instance, in 2023, Colgate-Palmolive reported net sales of $17.9 billion, a testament to the effectiveness of its global reach. Its capacity to serve consumers across such a wide geographic spectrum underscores its logistical capabilities and market penetration.

- Global Reach: Operates in over 200 countries and territories.

- Market Access: Serves both urban and rural areas effectively.

- Consumer Connection: Facilitates deep engagement with a vast global consumer base.

- Adaptability: Enables product customization for local preferences.

Commitment to Innovation and Sustainability

Colgate-Palmolive demonstrates a robust commitment to innovation, evident in its continuous product development. The company is actively expanding its portfolio with natural and organic ingredients, aligning with growing consumer preferences. For instance, in 2023, Colgate launched several new oral care products featuring plant-based ingredients, catering to this trend.

Sustainability is a core pillar of Colgate-Palmolive's strategy. The company has set a significant goal to make all packaging recyclable, reusable, or compostable by 2025, alongside a commitment to reduce its use of virgin plastic. This proactive approach to environmental responsibility not only bolsters its brand image but also resonates strongly with an increasing segment of environmentally aware consumers.

- Innovation Drive: Ongoing investment in R&D fuels new product introductions, including those with natural and organic components.

- Sustainability Goals: Aiming for 100% recyclable, reusable, or compostable packaging by 2025, coupled with virgin plastic reduction targets.

- Brand Enhancement: These initiatives improve brand perception and attract consumers prioritizing eco-friendly products.

Colgate-Palmolive's primary strength is its commanding global brand recognition, particularly in oral care, with its flagship toothpaste brand holding over 40% of the global market share as of early 2025. This deep-rooted consumer trust, built across more than 200 countries, provides a significant competitive advantage, reinforced by consistent, robust advertising and brand health initiatives.

The company's diversified product portfolio, spanning oral care, personal care, home care, and a rapidly growing pet nutrition segment, offers resilience against economic downturns. The pet nutrition division, featuring brands like Hill's Science Diet, has been a key growth driver, contributing substantially to overall sales. For instance, in Q1 2024, net sales increased by 7.5%, with Pet Nutrition showing particularly strong performance.

Financially, Colgate-Palmolive exhibits remarkable strength, maintaining gross profit margins around 60% in 2024 and continuing this trend into early 2025. This financial stability, coupled with consistent earnings per share growth, enables strategic investments in expansion and innovation.

Colgate-Palmolive's extensive global distribution network, reaching over 200 countries, is a critical asset. This vast reach allows for effective market penetration in both urban and rural areas, fostering deep consumer engagement and enabling product adaptation to local preferences. Net sales reached $17.9 billion in 2023, reflecting the success of this expansive network.

The company's dedication to innovation is evident in its continuous product development, including a focus on natural and organic ingredients, as seen with new oral care launches in 2023. Furthermore, its commitment to sustainability, with a goal for all packaging to be recyclable, reusable, or compostable by 2025 and a reduction in virgin plastic use, enhances brand image and appeals to environmentally conscious consumers.

| Key Strength | Metric/Data Point | Impact |

|---|---|---|

| Brand Dominance (Oral Care) | >40% global market share (toothpaste, early 2025) | Unparalleled consumer trust and competitive edge |

| Diversified Portfolio | Growth in Pet Nutrition segment | Revenue stability and resilience |

| Financial Health | ~60% gross profit margin (2024) | Supports investment in growth and innovation |

| Global Distribution | Operations in >200 countries | Broad market access and consumer engagement |

| Innovation & Sustainability | 100% recyclable/reusable/compostable packaging goal by 2025 | Enhanced brand reputation and consumer appeal |

What is included in the product

Analyzes Colgate-Palmolive’s competitive position through key internal and external factors, detailing its strong brand portfolio and global reach alongside potential market saturation and evolving consumer preferences.

Offers a clear, actionable framework for identifying and addressing Colgate-Palmolive's strategic challenges and opportunities.

Weaknesses

Colgate-Palmolive's significant dependence on its oral care segment, which represented approximately 43% of its net sales in 2023 and projected to be similar in 2024, poses a notable weakness. This concentration makes the company susceptible to shifts in consumer preferences or increased competition within this core market. A decline in oral care performance could disproportionately affect Colgate-Palmolive's overall financial results.

As a global powerhouse, Colgate-Palmolive's extensive international sales expose it directly to the unpredictable swings of foreign exchange rates. These currency fluctuations can significantly impact the company's reported financial performance.

In the first quarter of 2024, for instance, adverse currency movements acted as a headwind, negatively affecting net sales and diluted earnings per share. This ongoing challenge requires constant vigilance and sophisticated risk management strategies to mitigate potential financial damage.

Colgate-Palmolive operates in a highly competitive consumer goods landscape, contending with giants like Procter & Gamble and Unilever, as well as agile local brands. This rivalry frequently triggers price adjustments and escalates marketing investments, thereby squeezing profit margins. For instance, in 2023, the global oral care market, a key segment for Colgate, saw intense promotional activity impacting pricing strategies.

Challenges in Meeting Sustainability Targets

Colgate-Palmolive faces challenges in achieving its ambitious 2025 sustainability goals, particularly regarding packaging circularity. The company has openly stated potential difficulties in meeting targets for flexible packaging, an area where industry-wide hurdles persist.

Despite significant efforts, the objective of making all packaging recyclable, reusable, or compostable by 2025 remains a complex undertaking. Furthermore, a one-third reduction in virgin plastic usage by the same deadline is proving to be a substantial industry-wide challenge.

- Packaging Circularity: Colgate-Palmolive may not fully meet its 2025 targets for flexible packaging circularity.

- Virgin Plastic Reduction: Achieving a one-third reduction in virgin plastic by 2025 is a significant industry-wide challenge.

- Consumer Perception: Failure to meet these targets could potentially affect consumer trust in the company's environmental commitments.

Potential for Slowdown in Category Growth

The broader consumer staples sector is facing a noticeable slowdown in category growth, which could present a hurdle for Colgate-Palmolive in sustaining its past growth trajectories. This cooling of demand might spark fiercer competition for market share in markets that are either stagnant or contracting.

This environment could also complicate Colgate-Palmolive's ability to implement price increases without risking a decline in sales volumes, potentially putting pressure on profit margins. For instance, in 2024, several major consumer staples companies reported single-digit volume growth, a stark contrast to earlier periods.

- Slowing Category Growth: The overall consumer staples market is experiencing a deceleration, impacting the potential for rapid expansion.

- Intensified Competition: Stagnant or shrinking markets will likely lead to increased competition for existing market share.

- Pricing Power Constraints: Raising prices may become more challenging without negatively impacting sales volumes and profitability.

Colgate-Palmolive's heavy reliance on its oral care segment, which accounted for about 43% of its net sales in 2023, presents a significant vulnerability. This concentration means any downturn in oral care, perhaps due to changing consumer tastes or intense competition, could disproportionately harm the company's overall financial performance.

The company's extensive global operations expose it to considerable foreign exchange rate risks. Fluctuations in currency values can substantially impact reported earnings and sales figures, as seen in Q1 2024 when adverse currency movements negatively affected net sales and diluted earnings per share.

Colgate-Palmolive faces tough competition from major players like Procter & Gamble and Unilever, as well as smaller, agile brands, particularly in its core oral care market. This competitive pressure often leads to price wars and increased marketing spending, which can squeeze profit margins, a trend evident with heightened promotional activity in the oral care sector during 2023.

The company's ambitious 2025 sustainability goals, especially concerning packaging circularity and a one-third reduction in virgin plastic usage, are proving challenging. Industry-wide difficulties in achieving flexible packaging circularity and reducing virgin plastic could impact consumer perception of Colgate-Palmolive's environmental commitments.

Full Version Awaits

Colgate-Palmolive SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Colgate-Palmolive. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout. This ensures you receive the full, detailed report as presented.

Opportunities

Colgate-Palmolive is well-positioned to capitalize on the burgeoning consumer base in emerging markets. These regions, particularly in Asia and Latin America, are experiencing a rise in disposable incomes and a growing middle class, creating a fertile ground for oral care product expansion. For instance, in 2024, many emerging economies continued to show robust GDP growth, translating into increased consumer spending power.

The company's strategy of adapting product offerings to local preferences, combined with its established global brand equity, allows it to effectively penetrate these new markets. This localized approach, coupled with strong distribution networks, is crucial for capturing new customer segments and driving significant revenue growth. This strategic expansion is vital for offsetting slower growth trends observed in more mature, developed markets.

Consumer preference for natural, organic, and eco-friendly options is a significant trend, impacting personal and home care markets. Colgate-Palmolive can capitalize on this by expanding its sustainable product lines, like plant-based toothpastes and biodegradable toothbrushes, aligning with growing environmental consciousness. This strategic focus not only appeals to a conscious consumer base but also allows for premium pricing and strengthens brand identity in a competitive landscape.

The ongoing global surge in online shopping, with e-commerce sales projected to reach $7.5 trillion by 2027, offers Colgate-Palmolive a significant avenue to bolster its digital footprint and direct-to-consumer (DTC) capabilities. By strategically investing in its e-commerce platforms and employing data-driven, personalized marketing, the company can effectively connect with digitally native consumers and align with evolving shopping habits.

This digital transformation is not just about adapting; it's about expanding market reach and improving sales efficiency. For instance, in 2023, Colgate-Palmolive saw continued growth in its online channels, contributing to its overall revenue performance, demonstrating the tangible benefits of prioritizing digital engagement.

Innovation in Product Formats and Technology

Innovation in product formats and technology is a significant opportunity for Colgate-Palmolive. The company can capitalize on its robust research and development to launch novel items like toothpaste tablets and concentrated cleaning solutions. This aligns with growing consumer demand for convenience and eco-friendly options, reinforcing their market leadership and competitive advantage.

Colgate-Palmolive’s commitment to innovation is evident in its product pipeline. For instance, in 2023, the company continued to expand its offerings in oral care, a segment where it holds a dominant market share. This focus on new formats addresses consumer desire for reduced packaging waste and more efficient product usage.

- New Product Development: Introduction of toothpaste tablets and concentrated cleaning products to meet evolving consumer preferences.

- Sustainability Focus: Addressing consumer demand for reduced packaging and more sustainable consumption patterns.

- Market Leadership: Leveraging R&D to maintain and enhance its competitive edge in the FMCG sector.

- Consumer Needs: Catering to the increasing consumer desire for convenience and eco-conscious product solutions.

Strategic Acquisitions and Partnerships

Colgate-Palmolive's strategic acquisition of Prime100 in late 2023 for an undisclosed sum significantly bolstered its presence in the rapidly expanding premium pet food market. This move allows Colgate-Palmolive to tap into a segment projected for continued robust growth, diversifying its revenue streams beyond traditional oral care and personal hygiene products.

Beyond acquisitions, Colgate-Palmolive actively pursues partnerships and collaborations to foster innovation and operational enhancements. For instance, their investment in and partnership with digital health startups aim to integrate advanced technologies into consumer health offerings, potentially improving customer engagement and product efficacy. These strategic alliances are crucial for staying competitive and capturing opportunities in evolving market landscapes.

- Acquisition of Prime100: Enhanced presence in the high-growth premium pet food sector.

- Digital Health Partnerships: Integration of advanced technologies into consumer health products.

- Market Diversification: Entry into new and emerging market segments to drive sustained growth.

Colgate-Palmolive is well-positioned to capitalize on the burgeoning consumer base in emerging markets, particularly in Asia and Latin America, where rising disposable incomes fuel demand for oral care products. The company's localized product strategies and strong distribution networks are key to penetrating these regions, offering a vital avenue for growth beyond mature markets.

The increasing consumer preference for natural and sustainable products presents a significant opportunity for Colgate-Palmolive to expand its eco-friendly product lines. This aligns with growing environmental consciousness and allows for premium pricing, strengthening brand appeal.

The ongoing surge in e-commerce, with global online sales projected to exceed $7.5 trillion by 2027, offers Colgate-Palmolive a substantial opportunity to enhance its digital footprint and direct-to-consumer capabilities. Strategic investments in e-commerce platforms and data-driven marketing can effectively engage digitally native consumers.

Innovation in product formats, such as toothpaste tablets and concentrated cleaning solutions, addresses consumer demand for convenience and reduced packaging waste. Colgate-Palmolive’s robust R&D pipeline is crucial for maintaining market leadership and competitive advantage in these evolving consumer preferences.

The strategic acquisition of Prime100 in late 2023 significantly bolstered Colgate-Palmolive's presence in the rapidly expanding premium pet food market. This diversification into a high-growth segment, alongside digital health partnerships, aims to drive sustained revenue growth and capture opportunities in evolving market landscapes.

Threats

Colgate-Palmolive operates in a fiercely competitive market, contending with global powerhouses such as Procter & Gamble, Unilever, and Johnson & Johnson. This intense rivalry extends to regional players and private-label brands, creating a challenging environment for market share growth. For instance, in 2023, the oral care segment alone saw significant promotional activity from competitors, impacting pricing strategies.

Colgate-Palmolive's extensive global operations expose it to significant macroeconomic headwinds. For instance, persistent inflation in 2024 and projected for 2025, coupled with rising interest rates in key markets, can dampen consumer discretionary spending, directly impacting demand for its personal care and household products, particularly in price-sensitive emerging economies.

The company's reliance on international sales also makes it susceptible to foreign currency fluctuations. A strengthening US dollar, for example, can reduce the reported value of overseas earnings. In 2023, foreign currency translation negatively impacted Colgate-Palmolive's net sales by 1%.

Furthermore, ongoing geopolitical instability and the potential for increased trade barriers or tariffs introduce further uncertainty. These factors can escalate raw material and manufacturing costs, thereby squeezing profit margins and challenging the company's ability to maintain competitive pricing strategies.

Colgate-Palmolive faces significant threats from fluctuating commodity prices and supply chain disruptions. For instance, the cost of key raw materials like palm oil and plastics, essential for their product formulations and packaging, saw notable increases throughout 2024. This upward pressure directly impacts their production expenses, potentially squeezing gross profit margins if not effectively passed on to consumers.

Global events, including geopolitical tensions and shipping bottlenecks, continued to disrupt supply chains into 2025. These disruptions can lead to stockouts, increased freight costs, and delays in product delivery, challenging Colgate-Palmolive's ability to meet consumer demand consistently. Managing these volatile costs and ensuring a resilient supply network remains a critical operational hurdle for the company.

Changing Consumer Preferences and Health Trends

Evolving consumer preferences, especially the strong demand for natural, organic, and personalized oral care products, present a significant challenge for Colgate-Palmolive. The company's ability to quickly adapt its product portfolio to these shifts is crucial for maintaining its market position.

A slower response to these evolving tastes, or a perceived lack of innovation in high-growth segments like natural ingredients, could directly impact Colgate-Palmolive's market share. For instance, while the global natural personal care market is projected to reach over $34 billion by 2027, a failure to capture a significant portion of this growth in oral care could be detrimental.

- Shifting demand: Consumers increasingly seek products with fewer artificial ingredients and more transparency regarding sourcing.

- Competition: Smaller, agile brands specializing in natural or niche oral care solutions are gaining traction, potentially eroding Colgate-Palmolive's established customer base.

- Innovation lag: If Colgate-Palmolive's R&D pipeline doesn't align with emerging health trends, such as the focus on microbiome-friendly oral care, it risks falling behind competitors.

Regulatory Changes and Potential Litigations

Colgate-Palmolive operates across a global landscape, making it susceptible to a patchwork of evolving regulations concerning product safety, environmental impact, and marketing assertions. For instance, in 2024, the company, like many in the consumer goods sector, faced increased scrutiny regarding the sustainability claims of its packaging, with potential for regulatory action if these claims are not adequately substantiated and verifiable.

The risk of litigation, particularly concerning environmental disclosures or product ingredient transparency, presents a significant threat. A hypothetical class-action lawsuit in 2025, for example, could arise from allegations of misleading recyclability claims on its oral care products, potentially leading to substantial financial penalties and a blow to its brand image.

- Increased compliance costs: Adapting to diverse international regulations can elevate operational expenses.

- Reputational damage: Legal challenges or regulatory non-compliance can erode consumer trust.

- Operational disruptions: Fines or mandated changes can interrupt supply chains and product availability.

- Market access limitations: Failure to meet specific country regulations could restrict market entry or sales.

Intense competition from established giants and agile niche players poses a significant threat to Colgate-Palmolive's market share. For instance, in 2024, the oral care market saw aggressive promotional strategies from competitors, impacting pricing power. The company also faces macroeconomic volatility, with projected inflation and rising interest rates in 2025 potentially curbing consumer spending, particularly in emerging markets where price sensitivity is high.

Supply chain disruptions and fluctuating commodity prices remain a concern, with key raw material costs like palm oil seeing increases through 2024, impacting production expenses. Furthermore, evolving consumer preferences towards natural and organic products require rapid adaptation; a failure to innovate in these growing segments could cede market share, especially as the natural personal care market is expected to exceed $34 billion by 2027.

Regulatory landscapes are constantly shifting, demanding increased compliance costs and carrying the risk of reputational damage from litigation or non-compliance. For example, in 2024, scrutiny over sustainability claims on packaging intensified, with potential for fines if not substantiated. This complex regulatory environment can also lead to operational disruptions and market access limitations.

| Threat Category | Specific Challenge | Impact Example (2024/2025 Projection) |

|---|---|---|

| Competition | Aggressive pricing and promotional activities by rivals. | Erosion of market share in key oral care segments. |

| Macroeconomic Factors | Inflation and rising interest rates dampening consumer spending. | Reduced demand for non-essential personal care items. |

| Supply Chain & Commodities | Increased costs of raw materials (e.g., palm oil) and shipping. | Pressure on gross profit margins due to higher production expenses. |

| Consumer Preferences | Growing demand for natural and organic products. | Risk of falling behind competitors if product innovation lags. |

| Regulatory Environment | Stricter regulations on product safety, sustainability, and marketing. | Increased compliance costs and potential for litigation or fines. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Colgate-Palmolive's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure an accurate and insightful assessment.