Colgate-Palmolive Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colgate-Palmolive Bundle

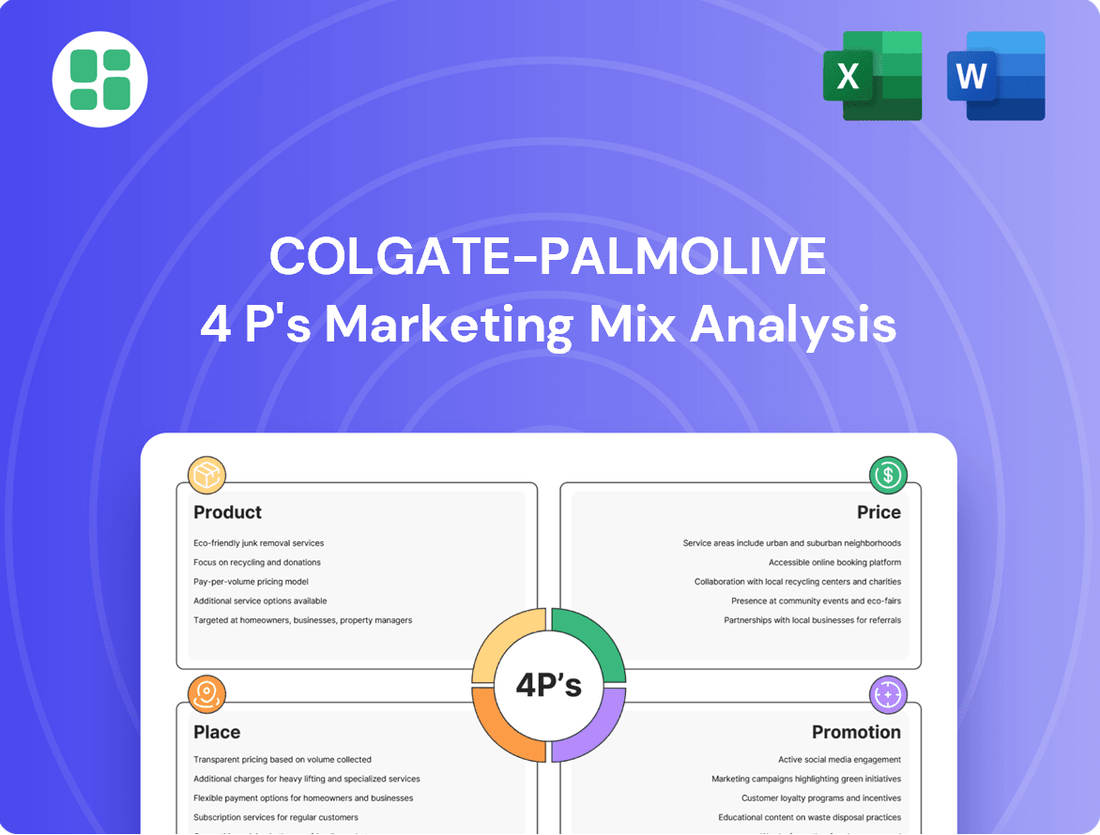

Colgate-Palmolive masterfully blends its product innovation, strategic pricing, widespread distribution, and impactful promotions to maintain its global dominance. Discover how their iconic brands, from toothpaste to dish soap, are positioned for maximum consumer appeal and market penetration.

Unlock the secrets behind Colgate-Palmolive's enduring success with a comprehensive 4Ps Marketing Mix Analysis. This in-depth report details their product portfolio, pricing tactics, extensive distribution channels, and persuasive promotional campaigns, offering actionable insights for your own business strategies.

Go beyond the surface and gain a complete understanding of Colgate-Palmolive's marketing engine. This ready-to-use analysis provides a detailed breakdown of their Product, Price, Place, and Promotion strategies, saving you valuable research time and offering a powerful framework for learning and application.

Product

Colgate-Palmolive boasts a remarkably diverse portfolio, encompassing oral care, personal care, home care, and pet nutrition. This breadth allows them to serve a wide range of consumer needs across the globe, from everyday essentials to specialized products. For instance, brands like Colgate toothpaste, Palmolive dish soap, and Hill's Science Diet pet food represent distinct market segments they dominate.

The company's strategy involves continuous expansion, particularly in premium product lines and venturing into new categories. This diversification mitigates risk and captures growth opportunities in evolving consumer preferences. In 2024, Colgate-Palmolive continued to invest in innovation, aiming to strengthen its market position in high-growth areas and cater to an increasingly sophisticated consumer base.

Colgate-Palmolive heavily relies on science-led innovation to create products that resonate with current consumer needs and keep them ahead of the competition. This commitment is evident in their continuous development of advanced oral care solutions, such as whitening toothpastes and improved cooling technologies. For 2024, the company projected investments in R&D to support these innovations, with a focus on expanding their premium oral care portfolio.

This dedication to scientific advancement extends to their pet nutrition segment, where specialized formulas are developed to cater to specific health and dietary requirements. A prime example of this forward-thinking approach is the planned 2025 relaunch of Colgate Total. This refresh will introduce enhanced formulations across their toothpaste, manual toothbrush, and mouthwash product lines, reflecting ongoing research into oral health efficacy.

Colgate-Palmolive is actively pursuing a premiumization strategy, aiming to capture consumers willing to pay more for enhanced benefits and quality. This is evident in their oral care segment, with lines like Colgate Total and Visible White offering advanced formulations that command higher price points.

This focus on premium offerings is a key driver for revenue growth and brand perception. For instance, the company's investment in premium pet food, highlighted by the acquisition of Prime100, signals a commitment to this high-value market segment, aligning with consumer trends towards specialized and premium pet nutrition.

Sustainability in Design

Colgate-Palmolive's product strategy heavily emphasizes sustainability, especially concerning packaging. This focus is crucial for meeting evolving consumer expectations and regulatory pressures. The company is actively working to reduce its environmental footprint through innovative design choices.

A key initiative is the transition of its entire toothpaste portfolio to recyclable tubes. For instance, in India, Colgate-Palmolive aims for 100% recyclable tubes by 2025, having already reached 50% by the fiscal year 2023-24. This demonstrates tangible progress in their sustainability goals.

- Recyclable Tubes: Targeting 100% recyclable toothpaste tubes globally by 2025.

- India Progress: Achieved 50% recyclable tubes in India by FY 2023-24, with a 2025 goal.

- Material Innovation: Actively exploring new packaging materials to reduce plastic waste.

- Reduced Packaging: Investigating methods for product delivery with less material overall.

Global and Localized Offerings

Colgate-Palmolive masterfully balances global brand recognition with localized product variations. This strategy ensures that while the core Colgate identity remains consistent, specific product formulations and marketing messages resonate deeply within diverse regional markets. For instance, the company might offer specialized toothpaste formulations catering to specific dental concerns prevalent in certain countries or adapt packaging to local aesthetic preferences. This adaptability is crucial for maintaining relevance and driving sales across its extensive global footprint, which spans over 200 countries.

The company’s commitment to localized offerings is evident in its diverse product portfolio. This approach allows Colgate-Palmolive to effectively tap into varied consumer behaviors and cultural nuances, ensuring that its products are not just universally recognized but also locally appreciated. This dual strategy leverages global economies of scale while fostering strong local market penetration.

- Global Brand Consistency: Maintaining a unified brand image and quality standards worldwide.

- Localized Product Development: Adapting formulations, flavors, and packaging to meet regional tastes and needs.

- Tailored Marketing Strategies: Implementing campaigns that reflect local cultural values and consumer priorities.

- Market Penetration: Operating in over 200 countries demonstrates the successful execution of this dual approach.

Colgate-Palmolive's product strategy centers on a diverse portfolio, innovation, and premiumization, with a strong emphasis on sustainability. The company offers a wide array of products across oral care, personal care, home care, and pet nutrition, ensuring broad market coverage. Innovation is driven by science, leading to advanced formulations, particularly in oral care, with a focus on premium segments like whitening and specialized pet food.

The company is actively transitioning its toothpaste portfolio to recyclable tubes, aiming for global completion by 2025, with significant progress already made in markets like India. This commitment to sustainability extends to exploring new packaging materials and reducing overall packaging waste, reflecting a response to consumer demands and regulatory trends.

Colgate-Palmolive's product approach involves balancing global brand consistency with localized variations to cater to diverse regional tastes and needs. This dual strategy allows for economies of scale while ensuring strong local market penetration and consumer relevance across its operations in over 200 countries.

| Product Strategy Element | Description | Key Initiatives/Examples | 2024/2025 Focus |

|---|---|---|---|

| Portfolio Diversity | Broad range of products across oral, personal, home care, and pet nutrition. | Colgate toothpaste, Palmolive dish soap, Hill's Science Diet. | Expansion in premium lines and new categories. |

| Innovation & Premiumization | Science-led development of advanced and higher-priced products. | Colgate Total, Visible White, premium pet food acquisitions (e.g., Prime100). | Strengthening premium oral care, investing in R&D. |

| Sustainability | Focus on eco-friendly packaging and reduced environmental impact. | 100% recyclable toothpaste tubes by 2025, exploring new materials. | Achieving recyclable tube goals, reducing plastic waste. |

| Localization | Adapting products and marketing to regional preferences. | Specialized formulations for specific dental concerns, tailored packaging. | Enhancing local market penetration and consumer resonance. |

What is included in the product

This analysis offers a comprehensive examination of Colgate-Palmolive's Product, Price, Place, and Promotion strategies, providing actionable insights into their market positioning.

It's designed for professionals seeking a data-driven understanding of Colgate-Palmolive's marketing mix, grounded in real-world practices.

Simplifies complex marketing strategies by clearly outlining Colgate-Palmolive's Product, Price, Place, and Promotion, alleviating the pain point of deciphering intricate brand tactics.

Provides a clear, actionable framework for understanding how Colgate-Palmolive addresses consumer needs, easing the burden of identifying effective market penetration strategies.

Place

Colgate-Palmolive boasts an extensive global distribution network, reaching consumers in over 200 countries. This vast reach ensures their oral care, personal care, and home care products are readily available, whether through traditional supermarkets, hypermarkets, or local pharmacies. In 2023, the company continued to refine its supply chain to maintain efficient product flow, a critical component of its market penetration strategy.

Colgate-Palmolive is actively investing in its e-commerce capabilities, aiming to create a smooth and intuitive online purchasing journey for consumers. This strategic push is crucial given the increasing shift towards digital channels.

By 2024, e-commerce represented a substantial 15% of Colgate-Palmolive's total sales, underscoring the growing importance of this channel. The company is committed to enhancing its digital presence through direct-to-consumer initiatives and collaborations with key e-commerce and quick-commerce partners.

Colgate-Palmolive employs a sophisticated diversified channel strategy, extending beyond traditional mass retail to include specialized avenues like veterinary clinics for its premium Hill's Pet Nutrition brand. This multi-pronged approach significantly enhances customer convenience and product accessibility, ensuring availability across various consumer touchpoints. For instance, Hill's Pet Nutrition's presence in over 100 countries underscores the global reach of this strategy.

Supply Chain Optimization

Colgate-Palmolive prioritizes supply chain efficiency to boost customer satisfaction and sales. The company is actively pursuing new productivity programs to streamline its worldwide operations, cut overhead, and refine its organizational framework.

These initiatives include significant investments in advanced automation, such as automated packing and palletizing robots, to improve speed and reduce errors. For instance, in 2023, Colgate-Palmolive reported a 4% increase in productivity, partly driven by these supply chain enhancements.

- Global Network Streamlining: Ongoing efforts to optimize logistics and distribution networks worldwide.

- Automation Investments: Deployment of robots in packing and palletizing to increase efficiency and reduce labor costs.

- Productivity Gains: Targeting sustained improvements in operational efficiency, with a reported 4% productivity increase in 2023.

- Cost Reduction Focus: Aiming to lower overhead and improve the overall cost structure of the supply chain.

Penetration in Emerging Markets

Colgate-Palmolive's strategy heavily relies on expanding its presence in emerging markets, recognizing their substantial growth potential driven by increasing incomes and growing populations. The company is actively working to deepen its penetration in these regions by adapting its products and distribution methods to local needs.

This focus is evident in their consistent investment in these areas. For instance, in 2023, emerging markets continued to be a significant contributor to Colgate-Palmolive's overall revenue growth, with specific regions showing double-digit percentage increases in sales for key oral care categories.

- Localized Product Development: Offering products tailored to specific regional needs and price points, such as smaller pack sizes or formulations suited to local water conditions.

- Distribution Network Expansion: Building robust distribution channels that reach both urban and rural areas, often partnering with local distributors to ensure product availability.

- Affordability and Value: Introducing value-oriented product lines and promotional strategies to appeal to a broader consumer base with varying purchasing power.

- Brand Building: Investing in targeted marketing campaigns that resonate with local cultures and consumer habits to build strong brand loyalty.

Colgate-Palmolive's place strategy centers on broad accessibility, ensuring its products are available everywhere from major supermarkets to small local shops. They also leverage e-commerce, with online sales making up a significant 15% of their total revenue by 2024, reflecting a strong digital push.

Their distribution is diverse, even reaching veterinary clinics for their pet nutrition line, demonstrating a commitment to meeting consumers wherever they shop. Emerging markets are a key focus, with investments aimed at tailoring distribution and product offerings to local needs and increasing income levels.

| Distribution Channel | Key Characteristics | 2023/2024 Data/Focus |

|---|---|---|

| Traditional Retail (Supermarkets, Hypermarkets) | Wide availability, high foot traffic | Continued focus on shelf space and promotions |

| E-commerce | Growing importance, direct-to-consumer initiatives | 15% of total sales by 2024; investment in online user experience |

| Specialty Retail (e.g., Vet Clinics) | Targeted reach for specific brands (Hill's Pet Nutrition) | Presence in over 100 countries for Hill's |

| Emerging Markets | Focus on penetration, adapting to local needs | Significant contributor to revenue growth in 2023, with double-digit sales increases in key categories |

What You Preview Is What You Download

Colgate-Palmolive 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Colgate-Palmolive's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use.

Promotion

Colgate-Palmolive has strategically ramped up its advertising investments to bolster brand strength, introduce new products, and capture a larger slice of the market. This focus on promotion is a key driver of their sustained growth.

During the second quarter of fiscal year 2025, the company saw a notable 17.8% surge in advertising expenditures. A significant portion, 65%, of this increased ad spend is now directed towards digital channels, indicating a forward-thinking approach to consumer engagement.

This substantial commitment to advertising underscores Colgate-Palmolive's dedication to cultivating robust brand equity and ensuring their products remain top-of-mind for consumers in a competitive landscape.

Colgate-Palmolive is significantly shifting its marketing spend towards digital channels, with a substantial portion of its advertising budget now dedicated to online platforms. This strategic pivot reflects a broader industry trend and Colgate-Palmolive's commitment to evolving its promotional strategies.

The company is actively utilizing connected TV, robust social media engagement, and sophisticated first-party data collection to refine its audience targeting and enhance personalization. These efforts are designed to move beyond traditional advertising methods and connect with consumers in more dynamic ways.

In 2024, digital advertising spending by consumer packaged goods (CPG) companies like Colgate-Palmolive is projected to continue its upward trajectory, with many increasing their digital allocations by over 10% year-over-year, according to industry analysts.

Colgate-Palmolive actively partners with dental and veterinary professionals, a strategy that significantly bolsters product credibility. These collaborations leverage the inherent trust and authority these professionals hold with consumers.

A prime example is Colgate's 'The Oral Health Movement' in India, a partnership with the Indian Dental Association. This initiative offers free dental screenings and consultations, directly associating the brand with professional oral health care and reinforcing expert endorsement.

These endorsements are crucial for building consumer confidence, particularly in health-related products. By aligning with credible health organizations and professionals, Colgate-Palmolive effectively communicates its commitment to well-being and product efficacy.

Purpose-Driven Campaigns

Colgate-Palmolive leverages purpose-driven campaigns as a key element of its marketing mix, directly connecting its brand to societal well-being. These initiatives underscore the company's commitment to a healthier future, resonating with consumers who increasingly value corporate social responsibility.

A prime example is the Bright Smiles, Bright Futures program, which has educated millions of children globally on oral hygiene. In 2024, the program continued its outreach, aiming to reach an additional 5 million children. This focus on community health impact extends to campaigns that highlight how Colgate products contribute to overall wellness, not just individual oral care.

- Purpose Alignment: Campaigns directly link product benefits to Colgate-Palmolive's mission of promoting global health and well-being.

- Community Impact: Initiatives like Bright Smiles, Bright Futures demonstrate a tangible commitment to improving community health outcomes, particularly for children.

- Consumer Resonance: Purpose-driven marketing appeals to a growing consumer base prioritizing ethical and socially conscious brands, enhancing brand loyalty and perception.

- Brand Differentiation: By focusing on societal impact, Colgate-Palmolive differentiates itself in a competitive market, building a stronger emotional connection with its audience.

Integrated Brand Storytelling

Colgate-Palmolive weaves a consistent brand narrative across all touchpoints, highlighting product advantages and unique selling propositions. This integrated approach ensures a cohesive message that resonates with consumers. For example, their 'Everyday Yay' campaign for the Hello brand uses charming and imaginative advertisements on video and social media to transform ordinary moments into delightful experiences.

This storytelling strategy is crucial for building brand loyalty and differentiation in a competitive market. In 2024, Colgate-Palmolive's investment in integrated marketing communications is expected to further strengthen its market position. The company reported net sales of $17.0 billion for the full year 2023, indicating continued consumer engagement with their brand messaging.

- Consistent Brand Narrative: Colgate-Palmolive employs integrated brand storytelling to communicate product benefits effectively.

- Campaign Example: The 'Everyday Yay' campaign for Hello aims to add magic to daily routines through playful content.

- Channel Integration: Storytelling spans video and social platforms, ensuring a unified brand voice.

- Financial Context: In 2023, Colgate-Palmolive achieved $17.0 billion in net sales, underscoring the impact of their marketing efforts.

Colgate-Palmolive's promotional strategy heavily emphasizes digital channels, with a significant portion of its advertising budget now allocated to online platforms. This strategic pivot, with a 65% increase directed towards digital in Q2 FY25, reflects a commitment to evolving consumer engagement methods.

The company actively leverages connected TV, social media, and first-party data for enhanced audience targeting and personalization, moving beyond traditional advertising. This approach is crucial as digital ad spending by CPGs like Colgate-Palmolive is projected to grow by over 10% year-over-year in 2024.

Colgate-Palmolive also builds credibility through partnerships with dental and veterinary professionals, exemplified by initiatives like The Oral Health Movement in India. These endorsements are vital for consumer confidence, especially in health-related products.

Purpose-driven campaigns, such as the Bright Smiles, Bright Futures program which aims to educate 5 million children in 2024, are central to their marketing. This focus on societal well-being and community impact resonates with consumers and differentiates the brand.

| Marketing Tactic | Focus Area | Key Initiative/Data Point | Impact/Goal |

|---|---|---|---|

| Digital Advertising | Online Channels | 65% of increased ad spend in Q2 FY25 | Enhanced consumer engagement & personalization |

| Professional Endorsements | Health Professionals | The Oral Health Movement (India) | Builds consumer confidence & product credibility |

| Purpose-Driven Campaigns | Social Well-being | Bright Smiles, Bright Futures (aiming for 5M children in 2024) | Differentiates brand & fosters consumer loyalty |

| Integrated Brand Narrative | Storytelling | 'Everyday Yay' campaign for Hello | Strengthens brand equity and market position |

Price

Colgate-Palmolive utilizes a multifaceted pricing strategy, blending competitive pricing with value-based approaches and segmentation. This ensures their products are positioned attractively against rivals while highlighting the superior benefits consumers receive. For instance, during 2024, the company likely adjusted pricing across its oral care portfolio, considering inflation and competitor moves, aiming to maintain market share and perceived value.

Colgate-Palmolive is adeptly using its pricing power to fuel growth and offset rising costs. This strategic pricing approach has been a key driver in expanding the company's profit margins. For instance, in the first quarter of 2025, pricing saw a solid increase of 1.5% compared to the previous year.

By combining these carefully considered price adjustments with robust productivity initiatives, Colgate-Palmolive is reinforcing its operational efficiency and further enhancing its margin expansion goals. This dual strategy ensures the company remains competitive while delivering value to shareholders.

Colgate-Palmolive frequently employs premium pricing for its innovative products, a strategy supported by consistent R&D and new product introductions that customers perceive as high-value. This approach is evident in their oral care segment, where advanced formulations justify higher price points.

The company’s ‘Chair to Sink’ whitening range exemplifies this, offering a spectrum of products from accessible daily options to more intensive, professional-grade treatments. This tiered pricing reflects the differentiated benefits and technological advancements embedded in each product, allowing them to capture a wider market segment willing to pay for enhanced efficacy.

For example, the Colgate Optic White Pro Series toothpaste, launched in 2023, entered the market at a premium compared to standard whitening toothpastes, reflecting its advanced enamel-safe whitening technology. This aligns with the broader trend of consumers increasingly seeking scientifically backed, high-performance personal care items.

Global Pricing Variations

Colgate-Palmolive's pricing strategy is highly localized, reflecting the diverse economic conditions and competitive pressures across its global markets. This approach ensures that its oral care and personal care products are both accessible and competitively positioned in each region. For instance, pricing in emerging markets often differs significantly from that in developed economies to cater to varying purchasing power and local competition.

The company actively monitors and adjusts prices to account for fluctuations in foreign exchange rates, which can impact profitability and product affordability. This dynamic pricing management is crucial for maintaining market share and ensuring consistent revenue streams. In 2023, the company reported net sales of $19.3 billion, with pricing contributing positively to organic sales growth across its segments.

Key factors influencing Colgate-Palmolive's global pricing decisions include:

- Local Market Affordability: Adjusting prices based on the average disposable income and consumer spending habits in specific countries.

- Competitive Benchmarking: Setting prices in relation to key competitors' offerings in each market to remain attractive.

- Cost of Goods Sold: Incorporating local manufacturing, distribution, and import/export costs, including tariffs and taxes.

- Brand Perception and Value: Pricing to reflect the perceived quality and brand equity of Colgate-Palmolive products in different cultural contexts.

Strategic Revenue Growth Management

Colgate-Palmolive is actively managing revenue by focusing on pricing strategies as inflationary pressures ease, aiming to maintain strong profitability. This approach is crucial for ensuring the company can continue investing in its brands and developing new products.

The company's commitment to revenue growth management is supported by strategic cost-cutting initiatives and productivity programs. These efforts are designed to improve operating leverage and boost cash flow, which are essential for funding future growth opportunities and innovation pipelines.

- Revenue Growth Focus: Colgate-Palmolive prioritizes revenue growth management, adapting pricing strategies as inflation moderates to secure ongoing profitability.

- Cost Efficiency: Strategic cost-cutting plans and productivity programs are in place to enhance operating leverage and cash flow generation.

- Investment Capacity: Improved cash flow allows for sustained investment in brand building and product innovation, a cornerstone of their marketing strategy.

- Profitability Maintenance: These combined efforts aim to ensure continued profitability even as economic conditions evolve, supporting long-term financial health.

Colgate-Palmolive leverages pricing as a core tool for growth, with a 1.5% increase in pricing observed in Q1 2025 contributing to sales. This strategy, combined with productivity efforts, aims to expand profit margins. The company balances competitive pricing with value-based approaches, especially for innovative products like the Colgate Optic White Pro Series, which launched at a premium.

Pricing is highly localized, adapting to regional affordability and competition, as seen in the $19.3 billion net sales reported in 2023 where pricing positively impacted organic growth. This global approach considers factors like disposable income, competitor pricing, and brand perception.

Colgate-Palmolive is actively managing revenue through strategic pricing, particularly as inflation eases, to maintain profitability and fund innovation. This revenue growth management is supported by cost-cutting and productivity programs designed to boost operating leverage and cash flow.

| Metric | 2023 Data | 2024/2025 Outlook/Trends |

|---|---|---|

| Net Sales | $19.3 billion | Positive organic sales growth driven by pricing |

| Pricing Impact (Q1 2025) | N/A | +1.5% increase |

| Profit Margin Strategy | Focus on pricing power | Continued expansion through pricing and productivity |

| Product Launch Pricing | Premium for advanced formulations (e.g., Optic White Pro Series) | Sustained premium pricing for high-value innovations |

4P's Marketing Mix Analysis Data Sources

Our Colgate-Palmolive 4P's Marketing Mix Analysis leverages a robust combination of official company disclosures, including SEC filings and annual reports, alongside detailed industry reports and competitive benchmarks. This approach ensures our insights into their product portfolio, pricing strategies, distribution networks, and promotional activities are grounded in factual, up-to-date information.