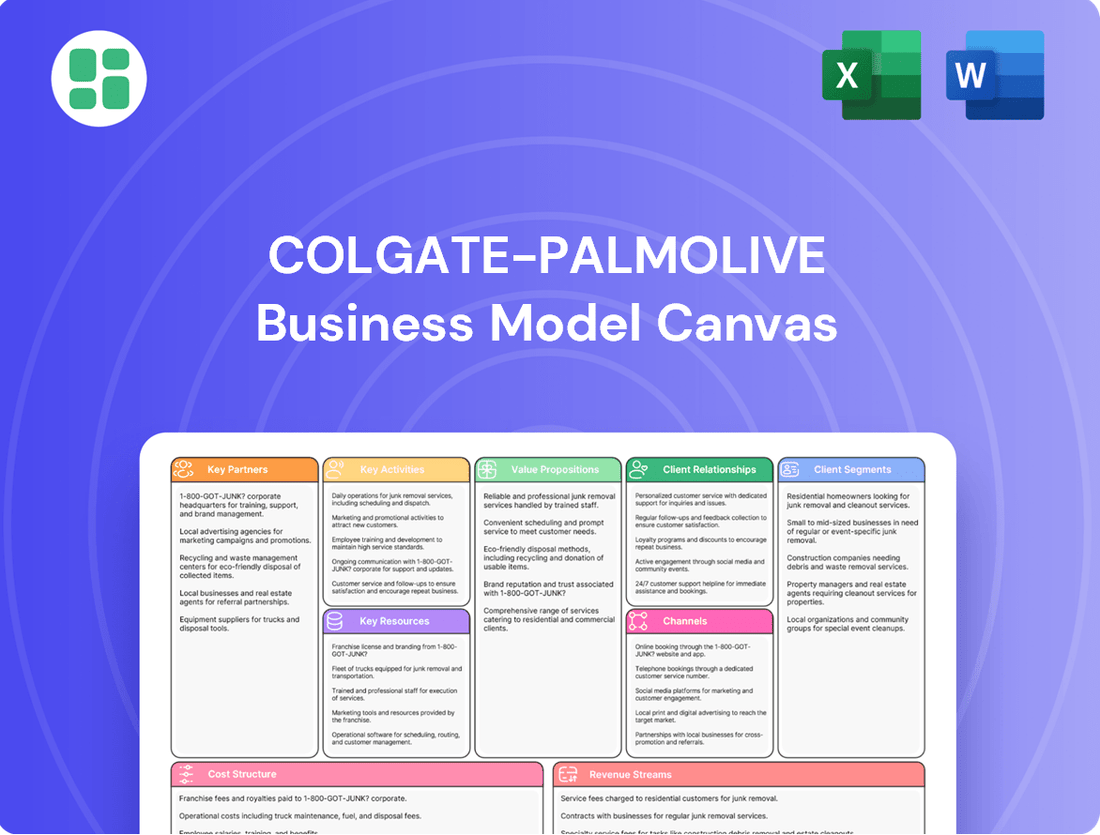

Colgate-Palmolive Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colgate-Palmolive Bundle

Unlock the strategic blueprint behind Colgate-Palmolive's enduring success with our comprehensive Business Model Canvas. This detailed analysis illuminates their customer relationships, revenue streams, and key resources that drive global brand recognition. Discover the core components that make Colgate-Palmolive a leader in consumer goods.

Dive into the specifics of how Colgate-Palmolive builds value, reaches its vast customer base, and manages its cost structure. Our full Business Model Canvas provides an in-depth, actionable view of their operations, perfect for anyone looking to understand and replicate their market dominance. Get the full picture today!

Partnerships

Colgate-Palmolive's success hinges on its extensive network of retailers and distributors. This includes major supermarket chains, hypermarkets, pharmacies, and increasingly, online retailers. These partnerships are vital for making their oral care, personal care, and home care products readily available to consumers across the globe.

In 2024, Colgate-Palmolive continued to leverage these relationships to drive sales and market share. For instance, their strong presence in emerging markets is often facilitated by local distributors adept at navigating diverse retail landscapes. This widespread distribution ensures that millions of households can access their trusted brands daily.

Colgate-Palmolive cultivates strategic alliances with a diverse array of suppliers for essential raw materials, packaging, and manufacturing components. These partnerships are crucial for upholding product quality, bolstering supply chain resilience, and advancing sustainability objectives in sourcing and waste reduction.

In 2024, maintaining strong supplier relationships remains paramount. For instance, the company's commitment to sustainable sourcing, as highlighted in its 2023 ESG report, relies heavily on these collaborations to ensure ethically and environmentally sound material acquisition, impacting the cost and availability of key ingredients like fluoride for toothpaste and active ingredients for oral care products.

Colgate-Palmolive collaborates with dental professionals and healthcare organizations worldwide, leveraging programs like 'Bright Smiles, Bright Futures' to champion oral health education. These partnerships are crucial for gaining professional endorsements and building consumer trust in their dental care products.

Through its Hill's Pet Nutrition brand, Colgate-Palmolive partners with veterinarians and animal welfare organizations via the Hill's Food, Shelter & Love program. This strategic alliance ensures the delivery of specialized pet nutrition and strengthens the brand's reputation for animal health expertise.

Sustainability Initiatives and NGOs

Colgate-Palmolive actively engages with environmental organizations, NGOs, and industry alliances like the Ellen MacArthur Foundation. These partnerships are crucial for advancing their sustainability agenda, focusing on areas such as sustainable packaging and waste reduction.

These collaborations are instrumental in driving progress toward significant goals, including achieving net-zero carbon emissions and increasing the use of recyclable packaging materials. For instance, by 2023, Colgate-Palmolive reported that over 98% of its packaging was designed for recyclability, reuse, or refill, demonstrating the tangible impact of these alliances.

- Partnerships with environmental groups like the Ellen MacArthur Foundation.

- Focus on sustainable packaging and waste reduction initiatives.

- Commitment to net-zero carbon emissions and increased recyclability.

- By 2023, over 98% of Colgate-Palmolive packaging was designed for recyclability, reuse, or refill.

Research and Development Institutions

Colgate-Palmolive actively collaborates with universities and research organizations to drive innovation across its product lines. This includes advancing scientific understanding in areas like oral health, personal care, home cleaning, and pet nutrition.

These partnerships are crucial for developing cutting-edge technologies and enhancing product effectiveness. For instance, collaborations help Colgate-Palmolive stay ahead of evolving consumer demands and scientific discoveries, maintaining a strong market position.

- Academic Collaborations: Partnerships with universities foster foundational research into new ingredients and formulations.

- Scientific Advancement: Research institutions contribute to Colgate-Palmolive's understanding of consumer health and wellness trends.

- Innovation Pipeline: These alliances are vital for creating next-generation products in oral care, personal care, home care, and pet nutrition.

- Competitive Edge: By leveraging external expertise, Colgate-Palmolive ensures its products meet the highest standards of efficacy and consumer satisfaction.

Colgate-Palmolive's strategic alliances with key retailers and distributors globally are fundamental to its market reach. In 2024, the company continued to strengthen these relationships to ensure widespread product availability, particularly in burgeoning markets where local distribution expertise is paramount.

Collaborations with suppliers are critical for maintaining product quality and advancing sustainability goals, impacting the cost and availability of essential ingredients. The company's commitment to ethical sourcing, as detailed in its 2023 ESG report, directly relies on these supplier partnerships.

Partnerships with dental professionals and academic institutions drive innovation and consumer trust in oral care products. The 'Bright Smiles, Bright Futures' program exemplifies this, while research collaborations ensure Colgate-Palmolive stays at the forefront of scientific advancements in its product categories.

What is included in the product

A comprehensive business model detailing Colgate-Palmolive's global reach, focusing on diverse consumer segments and leveraging extensive distribution channels to deliver trusted oral care and household products.

This model emphasizes strong brand equity and innovation as key value propositions, supported by efficient cost structures and strategic partnerships to maintain market leadership.

Colgate-Palmolive's Business Model Canvas offers a structured approach to identify and address consumer pain points in oral care and home hygiene, streamlining product development and market entry.

It provides a clear framework to pinpoint unmet needs and design solutions, making it easier to navigate the complexities of the consumer goods market.

Activities

Colgate-Palmolive's commitment to Research and Development is a cornerstone of its strategy, fueling innovation in oral care, personal care, and home care. In 2024, the company continued to prioritize R&D spending, aiming to develop next-generation products that meet growing consumer demands for efficacy, natural ingredients, and sustainability. This focus ensures they remain at the forefront of the industry, anticipating and shaping market trends.

A significant portion of Colgate-Palmolive's R&D efforts in 2024 was directed towards creating more sustainable product options, including recyclable packaging and biodegradable formulations. They also invested in understanding and responding to specialized consumer needs, such as products for sensitive teeth or advanced whitening technologies. These advancements are vital for maintaining brand loyalty and capturing new market segments.

The company's R&D pipeline is designed to introduce both incremental improvements and breakthrough innovations. For instance, in 2024, they launched new toothpaste variants with enhanced ingredient profiles and explored novel delivery systems for oral hygiene. This continuous cycle of research and product development is key to their competitive advantage and long-term growth.

Colgate-Palmolive operates a vast network of manufacturing facilities worldwide, churning out everything from toothpaste and soap to pet food. Their 2024 operations emphasize streamlining production for their diverse product lines, ensuring consistent quality and safety across the globe.

A core focus for Colgate-Palmolive's manufacturing is achieving high efficiency while minimizing environmental impact. They are actively pursuing targets for zero-waste operations and low-impact production processes across their global sites, reflecting a commitment to sustainability in their 2024 operational strategy.

Colgate-Palmolive invests heavily in extensive global marketing and advertising to solidify its iconic brands like Colgate, Palmolive, and Hill's. This commitment is crucial for maintaining high brand recognition and fostering deep consumer loyalty across diverse markets.

In 2024, the company continued its strategic allocation of advertising spending, aiming to boost brand health and increase household penetration. Digital platforms and sophisticated analytics are key tools, enabling Colgate-Palmolive to precisely target varied customer segments and maximize the impact of its campaigns.

Sales and Distribution

Colgate-Palmolive's sales and distribution activities are central to its global reach, focusing on managing an extensive network to deliver products efficiently to consumers worldwide. This includes cultivating strong relationships across diverse sales channels.

Key to this is strategic channel management, encompassing partnerships with traditional retailers, wholesale distributors, burgeoning e-commerce platforms, and specialized professional channels. The company must ensure its products are readily available wherever consumers shop.

Optimizing the global supply chain is a constant endeavor, aiming to enhance agility and drive operational efficiencies. This ensures timely product availability and cost-effectiveness across its vast operations.

In 2023, Colgate-Palmolive reported net sales of $17.5 billion, underscoring the scale of its distribution efforts. The company actively manages its presence in over 200 countries and territories, demonstrating the complexity and breadth of its sales and distribution operations.

- Global Network Management: Overseeing a complex web of sales and distribution channels across 200+ countries.

- Channel Partnerships: Maintaining relationships with retailers, wholesalers, e-commerce, and professional outlets.

- Supply Chain Optimization: Continuously improving logistics for agility and efficiency.

- Sales Performance: Achieving $17.5 billion in net sales in 2023 through effective distribution strategies.

Supply Chain Management and Optimization

Colgate-Palmolive's key activities in supply chain management and optimization are centered on streamlining its global operations. This involves strategic sourcing of high-quality raw materials and components, ensuring cost-effectiveness and reliability. For instance, in 2023, the company continued to invest in supplier diversity and sustainability initiatives across its network.

Logistics management is another critical component, focusing on efficient transportation and warehousing to deliver products to consumers worldwide. This includes optimizing shipping routes and inventory levels to minimize lead times and costs. Colgate-Palmolive aims for an agile supply chain that can quickly adapt to changing consumer needs and market dynamics.

- Strategic Sourcing: Ensuring reliable and cost-effective procurement of raw materials and packaging.

- Logistics and Distribution: Efficiently moving finished goods from manufacturing to retail points globally.

- Inventory Management: Balancing stock levels to meet demand while minimizing holding costs and waste.

- Supply Chain Resilience: Building robustness against disruptions, as demonstrated by ongoing efforts to diversify sourcing and enhance visibility.

Colgate-Palmolive's key activities are deeply rooted in innovation and global reach. The company's extensive R&D efforts in 2024 focused on developing sustainable products and catering to specialized consumer needs, ensuring a pipeline of advanced oral, personal, and home care items. Simultaneously, their vast manufacturing operations work to produce these goods efficiently and with minimal environmental impact across numerous global facilities.

Delivered as Displayed

Business Model Canvas

The Colgate-Palmolive Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive analysis details their customer segments, value propositions, channels, and revenue streams, providing a clear roadmap of their operational strategy. You'll gain full access to this professionally structured content, ready for immediate application or further customization.

Resources

Colgate-Palmolive's key resources include a powerful portfolio of globally recognized brands like Colgate, Palmolive, and Hill's Pet Nutrition. These brands are not just names; they are built on decades of consumer trust and association with quality, forming a significant intangible asset. This brand equity is fundamental to the company's market presence and its ability to command consumer loyalty.

Beyond brand names, Colgate-Palmolive's intellectual property encompasses patents, trademarks, and proprietary formulas. These elements protect its product innovations and manufacturing processes, offering a competitive edge. For instance, patents on advanced toothpaste formulations or unique packaging designs contribute directly to market leadership and differentiation in a crowded consumer goods landscape.

The strength derived from these global brands and intellectual property is directly reflected in financial performance. In 2023, Colgate-Palmolive reported net sales of $17.4 billion, with its oral care segment, heavily reliant on the Colgate brand, being a primary driver. This brand power enables the company to pursue premiumization strategies, allowing for higher pricing and sustained market share gains, as seen in its consistent performance in key global markets.

Colgate-Palmolive operates a significant global manufacturing and distribution network. This extensive infrastructure, comprising numerous plants and distribution centers, is fundamental to its ability to serve over 200 countries and territories efficiently.

In 2024, the company continued to invest in optimizing this physical backbone. These investments aim to enhance operational efficiency, reduce lead times, and support sustainability initiatives by streamlining logistics and production processes across its worldwide operations.

Colgate-Palmolive's global workforce, a critical asset, includes highly skilled researchers, engineers, marketing and sales experts, and operational staff. Their collective knowledge and commitment drive innovation and the effective execution of business strategies.

In 2023, Colgate-Palmolive reported a total workforce of approximately 34,000 employees worldwide, underscoring the scale of its human capital. This diverse talent pool is essential for maintaining the company's competitive edge in the global consumer goods market.

The company actively invests in programs designed to motivate employees and cultivate a culture of diversity, equity, and inclusion. These initiatives are crucial for attracting and retaining top talent, fostering a dynamic work environment, and ensuring the company's long-term success.

Financial Capital

Colgate-Palmolive's strong financial health is a cornerstone of its business model, enabling robust operations and strategic growth. This financial strength is evident in its consistent ability to generate substantial net sales and manage its cost structure effectively. For instance, in 2023, Colgate-Palmolive reported net sales of $19.46 billion, demonstrating its significant market presence and revenue-generating capability.

This financial capital directly fuels the company's capacity for investment. It allows Colgate-Palmolive to allocate resources towards key growth areas, such as innovation in oral care and home care products, as well as ongoing productivity initiatives. Furthermore, this strong financial footing provides the necessary capital for potential strategic acquisitions and ensures the ability to deliver returns to shareholders.

- Net Sales: $19.46 billion in 2023, highlighting significant revenue generation.

- Cash Flow Generation: Consistent ability to produce strong operating cash flow supports investments and operational needs.

- Access to Capital: A solid financial standing provides reliable access to external financing when needed for strategic purposes.

- Investment Capacity: Financial resources are deployed into R&D, marketing, and operational improvements to drive future growth.

Technology and Data Analytics

Colgate-Palmolive leverages advanced technology across its operations. This includes state-of-the-art R&D equipment for product innovation and modern production machinery to ensure manufacturing efficiency. Digital platforms are also crucial for managing its global supply chain and customer interactions.

Sophisticated data analytics and artificial intelligence are increasingly vital resources. These capabilities enable Colgate-Palmolive to optimize volume, revenue, and profit margins. For instance, in 2023, the company reported net sales of $19.36 billion, with strategic use of data analytics playing a role in achieving this growth.

- R&D Equipment: Facilitates the development of new oral care and personal care products.

- Production Machinery: Enhances efficiency and quality control in manufacturing plants worldwide.

- Digital Platforms: Support e-commerce, supply chain management, and direct-to-consumer engagement.

- Data Analytics & AI: Drive insights into consumer behavior, market trends, and operational improvements.

Colgate-Palmolive's key resources are its powerful global brands, intellectual property, extensive manufacturing and distribution network, skilled workforce, strong financial capital, and advanced technology. These elements collectively enable the company to maintain market leadership and drive innovation in the consumer goods sector.

Value Propositions

Colgate-Palmolive's trusted quality and efficacy are cornerstones of its business model, particularly evident in its oral care segment. Brands like Colgate Total are recognized for their scientifically formulated products that deliver comprehensive oral health benefits, fostering deep consumer trust.

This commitment extends to other divisions, such as Hill's Pet Nutrition, where specialized dietary solutions are backed by scientific research and proven efficacy. In 2023, Colgate-Palmolive reported net sales of $17.5 billion, reflecting the market's continued confidence in its high-quality product offerings.

Colgate-Palmolive’s product portfolio is deeply rooted in delivering tangible health and wellness advantages, aiming to enhance consumers' daily lives. For instance, their oral care range actively combats cavities and promotes healthier gums, directly addressing prevalent dental concerns.

The company’s commitment to science-backed innovation is a cornerstone of its value proposition. This approach allows Colgate-Palmolive to develop products that effectively meet evolving consumer health needs, setting them apart in crowded marketplaces.

Beyond human health, Colgate-Palmolive extends its wellness focus to pet nutrition, offering specialized diets designed to support the overall well-being of companion animals. This broadens their appeal and reinforces their dedication to health across different life stages.

Colgate-Palmolive is increasingly focusing on sustainability, a key value proposition for consumers. This includes ambitious goals like reducing plastic waste and achieving net-zero carbon emissions by 2040, building on their 2025 Sustainability & Social Impact Strategy.

The company's efforts to offer recyclable packaging and encourage sustainable consumer habits directly appeal to a growing segment of environmentally aware shoppers. For instance, their 2023 ESG report highlighted a 15% reduction in packaging's carbon footprint compared to a 2020 baseline.

Convenience and Accessibility

Colgate-Palmolive’s vast global distribution network ensures its products are readily available to consumers across diverse markets. This extensive reach makes it convenient for shoppers to find trusted brands like Colgate toothpaste and Palmolive dish soap in numerous retail settings.

Consumers can easily access these everyday essentials whether they shop at traditional brick-and-mortar stores or through burgeoning e-commerce platforms. This accessibility is a cornerstone of their value proposition, meeting daily needs efficiently.

For instance, in 2024, Colgate-Palmolive continued to leverage its presence in over 200 countries and territories, solidifying its position as a convenient and accessible choice for billions of consumers worldwide. Their strategic placement in both traditional and digital channels ensures product availability aligns with modern consumer shopping habits.

- Global Reach: Products available in over 200 countries and territories.

- Omnichannel Presence: Accessible through traditional retail and e-commerce platforms.

- Brand Trust: Well-known brands like Colgate and Palmolive offer immediate recognition and convenience.

- Daily Needs Fulfillment: Ensures essential personal care and home cleaning products are consistently available.

Innovation and Premiumization

Colgate-Palmolive’s commitment to innovation and premiumization is a cornerstone of its value proposition, enabling it to command higher prices and foster customer loyalty. The company consistently rolls out new products that boast advanced features or cater to specific consumer needs, thereby differentiating itself in a competitive market.

This strategy is evident in product lines like their advanced whitening toothpastes and specialized pet food formulations. For instance, in 2024, the company continued to invest in R&D to bring forth enhanced oral care solutions, aiming to capture a larger share of the premium segment within the global oral care market, which is projected to reach over $40 billion by 2025.

- Innovation Drives Premium Pricing: Colgate-Palmolive leverages new technologies and formulations to justify premium pricing, allowing for higher profit margins.

- Targeting Niche Demands: The company develops specialized products, such as sensitive teeth formulas or unique pet food diets, to meet specific consumer needs and capture niche markets.

- Organic Sales Growth: By focusing on premiumization, Colgate-Palmolive aims to achieve sustainable organic sales growth, as seen in its consistent performance in key emerging markets throughout 2024.

- Brand Perception: Continuous innovation reinforces Colgate-Palmolive's image as a leader in oral and personal care, enhancing brand equity and customer trust.

Colgate-Palmolive's value proposition centers on delivering trusted, science-backed health and wellness solutions for both people and pets. Their extensive global reach and omnichannel presence ensure widespread accessibility to their well-known brands, fulfilling essential daily needs for consumers worldwide.

The company's commitment to innovation drives premium pricing and targets niche demands, fostering brand loyalty and sustainable organic sales growth. This focus on advanced formulations and specialized products, like those in their oral care and pet nutrition segments, reinforces their image as a market leader.

Sustainability is also a key differentiator, with Colgate-Palmolive actively working to reduce its environmental impact through initiatives like plastic waste reduction and carbon emission targets.

In 2023, Colgate-Palmolive achieved net sales of $17.5 billion, underscoring the market's confidence in its diverse and high-quality product portfolio. The company's continued investment in R&D in 2024 aims to further capture the premium segment of the growing global oral care market.

| Value Proposition Pillar | Key Aspects | Supporting Data/Examples |

| Health & Wellness Solutions | Science-backed efficacy, oral care benefits, pet nutrition | Colgate Total's comprehensive oral health benefits; Hill's Pet Nutrition's specialized diets |

| Global Accessibility | Extensive distribution, omnichannel availability | Presence in over 200 countries and territories; availability via retail and e-commerce |

| Innovation & Premiumization | Advanced formulations, niche product development | Investment in R&D for enhanced oral care; premium pricing justified by new features |

| Sustainability Commitment | Environmental impact reduction, responsible packaging | Goals for plastic waste reduction and net-zero carbon emissions by 2040; 15% reduction in packaging's carbon footprint (2023 vs. 2020) |

Customer Relationships

Colgate-Palmolive cultivates brand loyalty by consistently providing high-quality oral care and personal hygiene products. Their enduring presence in homes globally, built over decades, fosters a profound sense of familiarity and trust, encouraging repeat purchases and sustained brand preference.

Colgate-Palmolive cultivates strong customer relationships through impactful community engagement, exemplified by its renowned 'Bright Smiles, Bright Futures' initiative. This program has reached over 1.4 billion children worldwide since its inception, providing crucial oral health education and resources.

These educational programs extend beyond mere product promotion, underscoring Colgate's dedication to social responsibility and empowering communities with knowledge for healthier lives. Such efforts build enduring goodwill and a positive brand image, fostering loyalty among consumers and stakeholders alike.

Colgate-Palmolive actively connects with consumers across digital avenues like social media and its own platforms, offering product information and promptly addressing questions. This direct engagement is crucial for understanding evolving consumer needs and fostering brand loyalty.

The company leverages these digital touchpoints to build communities and provide essential support, ensuring a positive customer experience with its diverse product lines. In 2024, digital marketing spend for consumer goods companies like Colgate-Palmolive continued to rise, underscoring the importance of these channels for consumer relationships.

Professional Endorsement and Recommendation

Colgate-Palmolive cultivates trust for specialized offerings like oral care and pet nutrition through endorsements from dental professionals and veterinarians. This professional validation is crucial for health-focused or prescription-based items, offering a credible foundation for consumer decisions.

- Professional Endorsements: Dental professionals recommend Colgate's oral care products, and veterinarians endorse Hill's Pet Nutrition, building significant consumer confidence.

- Trust and Credibility: This reliance on expert opinion is particularly vital for products addressing health needs, reinforcing Colgate-Palmolive's market position.

- Partnership Benefits: Strong relationships with professional bodies ensure that Colgate-Palmolive products are seen as reliable and effective solutions.

Responsiveness to Consumer Trends

Colgate-Palmolive excels at maintaining strong customer relationships by actively listening and adapting to changing consumer preferences. This includes a focus on sustainability, natural ingredients, and specialized health benefits, ensuring their offerings align with current values.

The company's agility in product development and marketing keeps them relevant in a dynamic market. For instance, in 2024, Colgate-Palmolive continued to expand its portfolio of natural and sustainable oral care options, responding to a growing consumer demand for eco-friendly products.

- Consumer Trend Adaptation: Colgate-Palmolive actively monitors and incorporates consumer desires for sustainable packaging and natural ingredients into its product lines.

- Market Relevance: This responsiveness ensures that marketing campaigns and new product launches resonate with contemporary consumer values and needs.

- Product Innovation: The company's commitment to adapting to trends, such as the demand for plant-based formulations, directly strengthens its connection with its customer base.

Colgate-Palmolive fosters deep customer relationships through consistent quality and a strong community presence, notably with its 'Bright Smiles, Bright Futures' program, which has educated over 1.4 billion children globally. They also leverage digital platforms for direct engagement, adapting to consumer trends like sustainability and natural ingredients, as seen in their 2024 product expansions.

| Customer Relationship Aspect | Description | Example/Data Point |

|---|---|---|

| Brand Loyalty & Trust | Built through decades of consistent quality and familiarity. | Enduring presence in global households. |

| Community Engagement | Social responsibility initiatives foster goodwill. | 'Bright Smiles, Bright Futures' educated over 1.4 billion children. |

| Digital Engagement | Direct interaction via social media and company platforms. | Increased digital marketing spend in 2024 by consumer goods companies. |

| Professional Endorsements | Credibility through expert recommendations. | Dental professionals recommend Colgate oral care products. |

| Adaptation to Trends | Responding to consumer demand for sustainability and natural ingredients. | Expansion of natural and sustainable oral care options in 2024. |

Channels

Colgate-Palmolive leverages mass retailers and supermarkets as its core distribution channels, reaching a vast consumer base for its everyday essentials. These outlets, including giants like Walmart and Kroger, are crucial for the high-volume sales that define the consumer packaged goods sector. In 2024, these channels continue to be the primary touchpoints for consumers seeking oral care, personal care, and home care products, ensuring widespread availability and convenience.

Pharmacies and drugstores are crucial channels for Colgate-Palmolive, offering a direct line to health-conscious consumers. These outlets are ideal for its oral care and personal care products, aligning with their focus on health and wellness. In 2024, the global drugstore market was valued at approximately $350 billion, underscoring the significant reach these channels provide.

Colgate-Palmolive leverages a robust network of e-commerce platforms, encompassing its dedicated brand websites and partnerships with major online retailers. This multichannel approach is crucial for engaging with a digitally savvy consumer base, providing enhanced convenience and access to a wider array of products.

The company’s e-commerce growth is a strategic imperative, reflecting evolving consumer purchasing behaviors. In 2024, online sales represented a significant and growing portion of Colgate-Palmolive's revenue, demonstrating the channel's increasing importance in its overall sales strategy and direct-to-consumer engagement.

Professional (Dentists, Veterinarians)

Colgate-Palmolive leverages professional channels like veterinary clinics and dental offices for specialized products such as Hill's Pet Nutrition and premium oral care lines. These channels are vital for expert endorsements and reaching consumers seeking science-backed, high-quality items. In 2023, Hill's Pet Nutrition saw significant growth, contributing to Colgate-Palmolive's overall sales performance.

These professional relationships are key to driving growth for Colgate-Palmolive's specialized segments. For instance, veterinary recommendations significantly influence pet food purchasing decisions, a market where Hill's Pet Nutrition holds a strong position. The company's focus on these channels ensures that its advanced product offerings reach the intended, discerning customer base.

- Veterinary Clinics: Essential for distributing Hill's Pet Nutrition, where professional endorsement drives sales.

- Dental Offices: Key for recommending advanced oral care products, enhancing brand trust.

- Pet Specialty Stores: Provide a targeted environment for premium pet nutrition products.

- Expert Recommendations: Crucial for building credibility and driving adoption of specialized offerings.

Wholesalers and Institutional Sales

Colgate-Palmolive leverages wholesalers and institutional sales to reach a broad market. This includes supplying products to smaller retailers, convenience stores, and large institutional clients such as hotels, hospitals, and educational facilities.

This strategy is crucial for ensuring comprehensive market penetration, especially in areas with many small, independent shops or for entities requiring bulk product acquisition. For instance, in 2024, the company continued to optimize its distribution networks to enhance product availability in these diverse segments.

- Wholesaler Reach: Extends product availability to numerous small retail outlets and convenience stores, increasing accessibility for consumers.

- Institutional Clients: Serves hotels, hospitals, schools, and other institutions, capturing significant bulk purchase opportunities.

- Market Coverage: Ensures widespread product presence, particularly in fragmented retail environments and for businesses with high volume needs.

- Distribution Efficiency: Optimizes supply chains to efficiently deliver products across various institutional and smaller retail channels.

Colgate-Palmolive's strategic use of direct-to-consumer (DTC) channels, including its own websites and subscription services, allows for deeper customer engagement and data collection. This approach bypasses traditional intermediaries, fostering brand loyalty and enabling personalized marketing efforts.

In 2024, the company continued to invest in its digital infrastructure to enhance the DTC experience, offering convenience and exclusive benefits to its online customers. This direct connection is vital for understanding consumer preferences and adapting product offerings accordingly.

The company's e-commerce strategy is a significant growth driver, with online sales showing robust year-over-year increases. This trend highlights the increasing consumer preference for digital shopping and Colgate-Palmolive's successful adaptation to this shift.

Colgate-Palmolive's expansion into emerging markets relies heavily on local distributors and partnerships. These entities possess crucial on-the-ground knowledge and established networks, facilitating market entry and product penetration in diverse regions.

| Channel Type | Key Characteristics | 2024 Significance | Example Brands |

|---|---|---|---|

| Mass Retailers & Supermarkets | High volume, broad consumer reach | Primary sales driver for everyday essentials | Colgate, Palmolive, Ajax |

| Pharmacies & Drugstores | Health-focused consumers, expert recommendations | Key for oral care and personal care products | Colgate, Pro-Health |

| E-commerce Platforms | Digital engagement, convenience, data collection | Rapidly growing revenue stream, direct-to-consumer | Company websites, Amazon |

| Professional Channels | Expert endorsement, specialized products | Drives sales for premium and health-oriented items | Hill's Pet Nutrition, Colgate Sensitive Pro-Relief |

| Wholesalers & Institutional Sales | Broad market penetration, bulk purchasing | Ensures availability in smaller retailers and institutions | Colgate, Palmolive (B2B) |

Customer Segments

Colgate-Palmolive's core customer base is global households, a massive segment seeking essential oral, personal, and home care items. This includes everyone from individuals to families across all income brackets, prioritizing hygiene and well-being. The company's ambitious goal is to reach six out of every ten households globally, highlighting its broad market penetration strategy.

Colgate-Palmolive, through its Hill's Pet Nutrition division, focuses on pet owners who prioritize specialized, high-quality nutrition for their cats and dogs, often seeking veterinary recommendations. This segment comprises pet parents deeply invested in their animals' health, addressing specific dietary requirements, and embracing premium pet care products.

In 2023, Hill's Pet Nutrition reported net sales of $5.1 billion, highlighting the significant market for premium pet food. This growth reflects a strong consumer trend towards viewing pets as family members, driving demand for science-backed, health-focused pet food options.

Furthermore, Hill's dedication to supporting animal shelters, a program that has donated over $300 million worth of pet food since its inception, strongly appeals to this customer segment, reinforcing their commitment to brands that align with their values and extend care to a wider pet community.

Health-conscious consumers represent a crucial segment for Colgate-Palmolive, actively seeking personal care products that offer specific health advantages. This includes a strong demand for advanced cavity protection, improved gum health, sensitivity relief, and formulations featuring natural ingredients. These consumers often look for products backed by scientific research or recommended by dental professionals.

Colgate-Palmolive directly addresses these preferences through product innovation, exemplified by the Colgate Total line, which is designed to deliver comprehensive oral health benefits. In 2023, the global oral care market, a key area for this segment, was valued at over $50 billion, with a significant portion driven by consumers willing to pay a premium for scientifically advanced or health-focused solutions.

Environmentally-Conscious Consumers

Colgate-Palmolive is increasingly appealing to environmentally-conscious consumers who prioritize sustainable products. This segment actively seeks out items featuring recyclable packaging, water-saving formulas, and ethically sourced ingredients. The company's commitment to sustainability directly resonates with this growing market demand.

- Growing Demand: Over 70% of consumers globally state they are willing to pay more for sustainable brands, a trend Colgate-Palmolive is capitalizing on.

- Product Innovation: Initiatives like recyclable toothpaste tubes and concentrated formulas directly address this segment's preferences.

- Strategic Alignment: Colgate-Palmolive's 2025 Sustainability & Social Impact Strategy explicitly targets and supports the values of these consumers.

Professional Users and Institutions

Colgate-Palmolive's professional users and institutions segment encompasses dental professionals, veterinarians, and various institutional buyers. This business-to-business channel is vital for product endorsement, driving professional recommendations, and facilitating specialized sales. For instance, dental hygienists and dentists often recommend Colgate professional-line toothpastes and mouthwashes, directly influencing consumer purchasing decisions.

The company provides tailored product lines and educational resources to meet the specific needs of these professional groups. This includes items like professional dental cleaning pastes, fluoride treatments, and specialized oral care products for sensitive patients or those with specific dental conditions. In 2024, Colgate continued its focus on these segments, aiming to strengthen its position through continued innovation and professional outreach programs.

- Dental Professionals: Key influencers and recommenders of oral hygiene products, utilizing and endorsing Colgate's professional-grade offerings.

- Veterinarians: Important channel for pet oral care products, with veterinarians recommending specific Colgate brands for animal dental health.

- Institutional Buyers: Entities like hospitals, schools, and government agencies that purchase oral care products in bulk for their populations.

- Product Endorsement and Education: This segment leverages professional endorsement and company-provided educational materials to build trust and drive product adoption.

Colgate-Palmolive serves a broad spectrum of global households seeking everyday essentials in oral, personal, and home care. This core segment prioritizes hygiene and well-being across all income levels, with the company aiming for widespread penetration. Additionally, a significant and growing segment comprises health-conscious consumers actively seeking personal care products with specific health benefits, often influenced by professional recommendations and scientific backing.

The company also caters to pet owners, particularly those investing in premium, science-backed nutrition for their animals, as evidenced by Hill's Pet Nutrition's $5.1 billion in net sales in 2023. Furthermore, environmentally-conscious consumers are a key demographic, driving demand for sustainable packaging and formulations, a trend supported by Colgate-Palmolive's stated 2025 sustainability goals.

| Customer Segment | Key Characteristics | 2023/2024 Data/Insights |

|---|---|---|

| Global Households | Seeking essential oral, personal, home care; prioritize hygiene. | Company aims to reach 6 in 10 households globally. |

| Health-Conscious Consumers | Desire specific health advantages (cavity protection, gum health); value scientific backing. | Global oral care market valued over $50 billion in 2023; premium segment growth. |

| Pet Owners (Premium Nutrition) | Prioritize specialized, high-quality pet nutrition; view pets as family. | Hill's Pet Nutrition net sales of $5.1 billion in 2023. |

| Environmentally-Conscious Consumers | Seek sustainable packaging, water-saving formulas, ethical sourcing. | Over 70% of consumers willing to pay more for sustainable brands. |

| Professional Users & Institutions | Dental professionals, veterinarians, hospitals, schools; rely on endorsements. | Colgate continues focus on professional outreach and innovation in 2024. |

Cost Structure

Colgate-Palmolive's cost of goods sold (COGS) is a substantial part of its expenses, encompassing raw materials, packaging, and the direct labor involved in manufacturing its oral care, personal care, and home care products. For instance, in 2023, the company reported a gross profit margin of approximately 58.7%, indicating the significant portion of revenue consumed by COGS.

The company is keenly aware that fluctuations in commodity prices, especially for key ingredients like fats and oils used in its soaps and personal care items, can directly affect COGS. Tariffs and import duties also add to this cost. To counter these pressures, Colgate-Palmolive actively pursues productivity initiatives aimed at optimizing its supply chain and manufacturing processes to keep COGS in check.

Colgate-Palmolive invests heavily in marketing and advertising to foster brand recognition and stimulate consumer desire across its diverse product lines worldwide. This substantial expenditure encompasses a mix of traditional advertising channels, contemporary digital marketing efforts, and various sales promotion initiatives designed to capture and retain market attention.

In 2023, the company's selling, general and administrative expenses, which include significant marketing outlays, totaled $6.2 billion. This strategic allocation of resources is crucial for reinforcing brand equity and expanding household penetration for its oral care, personal care, and home care products.

Colgate-Palmolive's Selling, General, and Administrative (SG&A) expenses cover a wide array of non-production costs, including sales team compensation, executive salaries, marketing initiatives, and research and development for new products. In 2023, SG&A expenses represented approximately 23.5% of net sales, reflecting significant investment in brand building and innovation.

To manage these costs effectively, Colgate-Palmolive has actively pursued productivity initiatives. These programs are designed to streamline operations, optimize its global supply chain, and reduce administrative overhead. For instance, the company’s "Framework for Growth" strategy, ongoing since 2020, aims to deliver substantial cost savings through these efficiency drives.

Research and Development (R&D) Costs

Colgate-Palmolive consistently invests in Research and Development (R&D) as a core operational expense. This ongoing investment fuels the creation of novel products, the enhancement of current offerings, and the exploration of emerging technologies. For instance, in 2023, Colgate-Palmolive reported R&D expenses of $450 million, underscoring its commitment to innovation.

These R&D expenditures are critical for maintaining a competitive advantage in the fast-evolving consumer goods market. By addressing changing consumer preferences and leveraging scientific breakthroughs, the company ensures its product pipeline remains relevant and appealing. This proactive approach is a significant driver for future revenue growth and the ability to command premium pricing for its innovations.

- Continuous Investment: R&D spending is a perpetual cost for product innovation and technological advancement.

- Competitive Edge: Innovation through R&D is vital for staying ahead in the market and meeting consumer demands.

- Growth Driver: R&D is instrumental in Colgate-Palmolive's strategy for future expansion and premium product positioning.

- 2023 R&D Spend: The company allocated $450 million to R&D in 2023, highlighting its dedication to innovation.

Sustainability and Compliance Costs

Colgate-Palmolive's cost structure includes significant investments in sustainability and compliance. These expenses are crucial for meeting environmental targets, such as developing more recyclable packaging and shifting towards renewable energy sources. For instance, in 2023, the company reported progress on its 2030 goals, including increasing the use of recycled plastic in its packaging.

Regulatory compliance, quality assurance, and ensuring ethical sourcing also add to these costs. These operational necessities are fundamental to maintaining consumer trust and brand integrity.

- Sustainable Packaging Development: Costs related to research and implementation of recyclable, compostable, or reduced-plastic packaging solutions.

- Renewable Energy Transition: Investments in solar, wind, or other renewable energy sources for manufacturing facilities and operations.

- Waste Management and Reduction: Expenses associated with minimizing waste generation and responsibly managing disposal processes.

- Regulatory Adherence and Quality Control: Costs for meeting diverse global regulations, product testing, and maintaining high quality standards.

Colgate-Palmolive's cost structure is dominated by Cost of Goods Sold (COGS), which includes raw materials, packaging, and direct labor. In 2023, COGS represented a significant portion of their revenue, as indicated by a gross profit margin of approximately 58.7%. The company also incurs substantial Selling, General, and Administrative (SG&A) expenses, totaling $6.2 billion in 2023, with marketing and advertising being a major component of this outlay. Furthermore, Research and Development (R&D) is a continuous investment, with $450 million allocated in 2023 to drive product innovation and maintain a competitive edge.

| Expense Category | 2023 Data (USD Millions) | Significance |

|---|---|---|

| Cost of Goods Sold (COGS) | Implied from Gross Profit Margin (approx. 41.3% of net sales) | Direct costs of manufacturing oral, personal, and home care products. |

| Selling, General & Administrative (SG&A) | 6,200 | Includes marketing, advertising, salaries, and operational overhead. |

| Research & Development (R&D) | 450 | Investment in new product development and technological advancements. |

Revenue Streams

Colgate-Palmolive's primary engine for revenue generation is the sale of its diverse portfolio of consumer goods. This includes essential oral care items like toothpaste and toothbrushes, personal care products such as soaps and deodorants, and home care essentials like dishwashing liquids and cleaning agents. This broad product offering forms the bedrock of the company's financial success.

In fiscal year 2024, this segment was exceptionally strong, contributing a significant 77.7% to Colgate-Palmolive's overall revenue. This highlights the dominant role these everyday consumer products play in the company's business model and its ability to capture a substantial share of the market.

Hill's Pet Nutrition is a powerhouse for Colgate-Palmolive, bringing in significant revenue through its specialized pet food offerings. This includes everything from everyday healthy options to crucial prescription diets designed for specific health needs. In fiscal year 2024, this segment alone accounted for a substantial 22.3% of the company's total revenue, highlighting its importance and continued growth trajectory.

Colgate-Palmolive's global market sales are a cornerstone of its revenue generation, with a significant contribution from its extensive international operations. This broad geographic footprint enables the company to tap into both established and developing economies, fostering consistent revenue expansion.

In 2023, Colgate-Palmolive reported net sales of $17.0 billion. The company highlighted widespread organic sales growth across its various divisions and product categories throughout the year, underscoring the strength of its global market penetration.

Premium and Innovation-Driven Sales

Colgate-Palmolive's revenue is increasingly fueled by premium and innovative product sales. This strategy focuses on science-led advancements and premiumization, allowing the company to achieve higher profit margins and boost sales within its established product lines. New product introductions are a significant contributor to this revenue stream.

In 2023, Colgate-Palmolive reported net sales of $17.47 billion, with innovation playing a key role in driving volume and net sales growth. The company's emphasis on premium offerings, such as advanced oral care solutions, directly contributes to this revenue generation.

- Premiumization: Focus on higher-priced, enhanced benefit products.

- Innovation: New product launches are critical revenue drivers.

- Margin Capture: Science-led innovation supports higher profit margins.

- Growth Driver: Premium and innovative products contribute to incremental sales growth.

Volume and Pricing Growth

Colgate-Palmolive drives revenue by increasing the number of products sold and making smart pricing decisions across its diverse range. The company actively seeks to balance these two levers – volume and price – to ensure consistent revenue expansion. This dual approach is crucial for maintaining its market position and profitability.

Organic sales growth, a key performance indicator for Colgate-Palmolive, directly reflects the success of this strategy. In the first quarter of 2024, Colgate-Palmolive reported a 7.1% increase in organic sales, demonstrating the effectiveness of their volume and pricing initiatives. This growth was notably strong in emerging markets, where volume increases played a significant role.

- Volume Growth: Increasing the quantity of products sold to consumers.

- Pricing Growth: Implementing strategic price adjustments on products.

- Balanced Approach: Maintaining a healthy mix of volume and price increases for sustainable revenue.

- Organic Sales: A key metric reflecting the combined impact of volume and pricing on revenue, excluding acquisitions and divestitures.

Colgate-Palmolive's revenue streams are robust, primarily driven by the sale of consumer goods in oral care, personal care, and home care. The company also benefits significantly from its specialized pet nutrition segment, Hill's Pet Nutrition. Strategic premiumization and innovation in product offerings are key to their sustained financial performance.

| Revenue Segment | 2023 Net Sales (USD Billions) | 2024 Q1 Organic Sales Growth |

|---|---|---|

| Total Company | 17.47 | 7.1% |

| Oral, Personal, Home Care | 13.57 (approx. 77.7% of 2023 revenue) | N/A |

| Hill's Pet Nutrition | 3.90 (approx. 22.3% of 2023 revenue) | N/A |

Business Model Canvas Data Sources

The Colgate-Palmolive Business Model Canvas is informed by a robust blend of financial disclosures, extensive market research, and internal strategic planning documents. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and strategic direction.