Coinbase Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coinbase Bundle

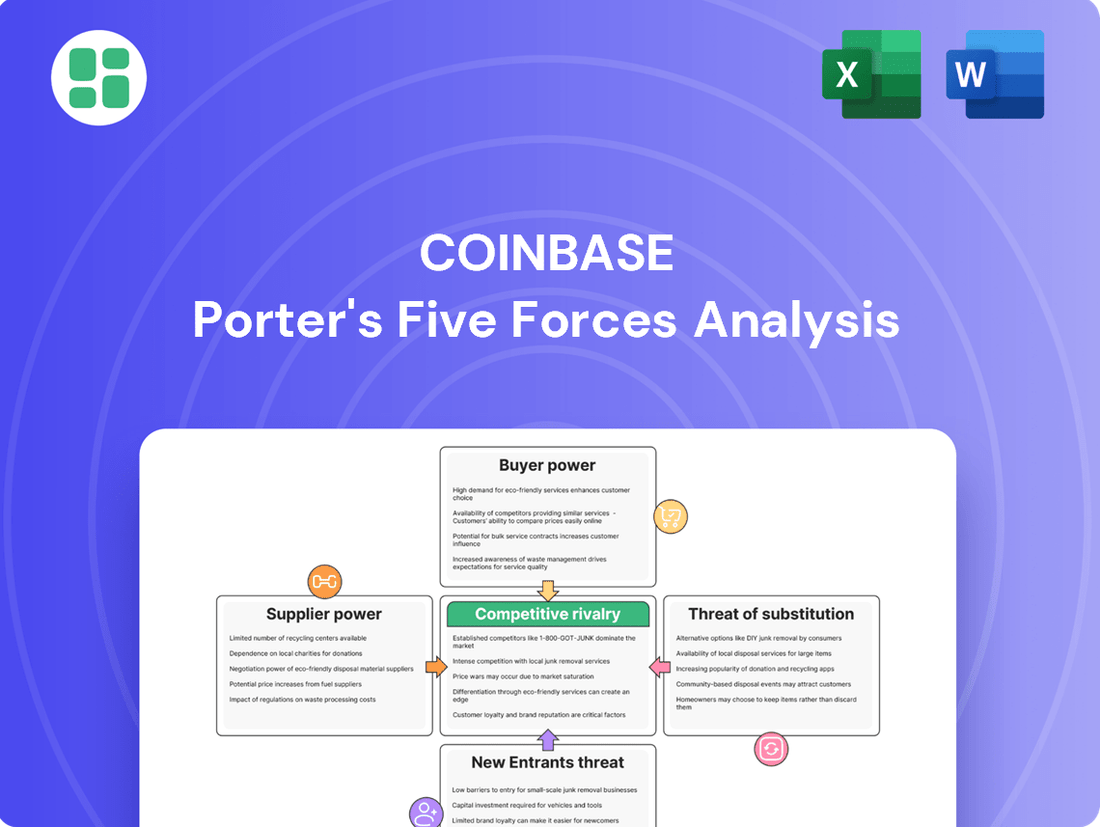

Coinbase operates in a dynamic crypto exchange landscape, facing moderate threats from new entrants due to high capital requirements and regulatory hurdles. However, the bargaining power of buyers (traders) is significant, as they can easily switch between platforms. The threat of substitutes, while present in alternative investment vehicles, is currently less pronounced for core crypto trading.

The full Porter's Five Forces Analysis reveals the real forces shaping Coinbase’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Coinbase's reliance on blockchain networks like Bitcoin and Ethereum means it depends on the underlying infrastructure. While these networks are largely decentralized, concentrated groups like large mining pools or significant node operators can represent a form of supplier power. For instance, in 2024, large mining pools continue to control substantial portions of hash rate for major proof-of-work blockchains, potentially giving them leverage.

However, the inherent open-source and decentralized design of most blockchain protocols significantly mitigates this supplier power. The ease with which new nodes can be established and the distributed nature of many operations make it challenging for any single entity or small group to unilaterally dictate terms or significantly impact Coinbase's operational costs or access to these networks.

Coinbase's internal development of its core exchange, wallet, and custody technologies significantly curbs the bargaining power of technology suppliers. By maintaining a strong in-house tech capability, Coinbase minimizes its dependence on external software and technology vendors, a key factor in reducing supplier leverage.

While specialized security and compliance tools may necessitate external sourcing, these are often available from multiple vendors or have become commoditized. This availability of alternatives further weakens the bargaining position of any single technology supplier.

Coinbase's reliance on traditional banking systems for fiat currency transactions highlights the significant bargaining power of its banking partners. These institutions, acting as crucial suppliers, dictate terms around compliance, transaction fees, and partnership availability, directly influencing Coinbase's operational costs and efficiency. For instance, the need for robust anti-money laundering (AML) and know-your-customer (KYC) protocols means banks can impose stringent requirements.

The fees charged by banks and payment processors for deposits and withdrawals represent a direct cost for Coinbase, which can be passed on to users or absorbed, impacting profitability. As of early 2024, the landscape of banking partnerships remains dynamic, with companies like Coinbase actively seeking to diversify and strengthen these relationships to mitigate supplier leverage. Coinbase's strategic partnerships, such as their collaboration with PNC Bank, underscore the ongoing efforts to secure stable and cost-effective fiat on/off-ramp solutions.

Data and Analytics Providers

Coinbase relies on data and analytics providers for crucial market insights, security monitoring, and to ensure regulatory compliance. The availability of numerous providers in this sector typically moderates their bargaining power. For instance, in 2024, the global market for data analytics was projected to reach over $300 billion, indicating a highly competitive landscape where Coinbase can leverage choices.

This competitive environment allows Coinbase to negotiate terms and potentially switch providers if necessary, limiting any single supplier's ability to dictate pricing or conditions. The sheer volume of data analytics firms means that while the services are essential, the concentration of power among suppliers is generally low.

- Competitive Market: The data and analytics sector is crowded with many players, offering Coinbase multiple options.

- Negotiating Leverage: Coinbase can negotiate favorable terms due to the availability of alternative suppliers.

- Low Switching Costs: While integration requires effort, the ability to switch providers exists, keeping supplier power in check.

- Essential but Not Exclusive: Data services are vital, but no single provider holds a monopoly on the necessary insights for Coinbase.

Talent and Human Capital

The bargaining power of suppliers, particularly concerning talent and human capital, is a significant factor for Coinbase. The specialized nature of the cryptocurrency and blockchain industry creates a high demand for skilled engineers, cybersecurity experts, and legal/compliance professionals. This scarcity of top talent in a niche market grants employees considerable bargaining power, potentially driving up labor costs for Coinbase.

Coinbase's success hinges on its ability to attract and retain this specialized workforce. For instance, in 2023, Coinbase continued to invest in its workforce, with employee compensation and benefits representing a substantial portion of its operating expenses. The company's strategic hiring and retention efforts are critical for maintaining its competitive edge, fostering innovation, and ensuring operational efficiency in a rapidly evolving technological landscape.

- High Demand for Niche Skills: The cryptocurrency and blockchain sectors require highly specialized technical and legal expertise, making skilled professionals valuable assets.

- Talent Scarcity and Wage Inflation: Limited availability of experienced talent in this field can lead to increased salary expectations and higher recruitment costs for companies like Coinbase.

- Strategic Importance of Human Capital: Coinbase's ability to secure and keep top talent directly impacts its capacity for innovation, product development, and regulatory compliance.

Coinbase's bargaining power with suppliers is influenced by several key areas. While the decentralized nature of blockchain technology generally limits supplier power from network infrastructure providers, traditional banking partners hold significant leverage due to their essential role in fiat transactions. The competitive landscape for data and analytics providers also moderates their influence, allowing Coinbase to negotiate favorable terms.

However, the scarcity of specialized talent in the blockchain and crypto space grants employees substantial bargaining power, driving up labor costs. Coinbase's internal development of core technologies also effectively reduces reliance on external software vendors, further diminishing supplier leverage in that domain.

| Supplier Type | Bargaining Power Level | Reasoning |

|---|---|---|

| Blockchain Networks (Infrastructure) | Low | Decentralized nature, ease of node establishment |

| Banking Partners (Fiat On/Off-Ramps) | High | Essential for fiat transactions, regulatory requirements |

| Data & Analytics Providers | Moderate | Competitive market, multiple providers |

| Technology Vendors (Software/Tools) | Low | In-house development, commoditized offerings |

| Human Capital (Specialized Talent) | High | Scarcity of niche skills, high demand |

What is included in the product

This analysis unpacks the competitive landscape for Coinbase, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its business model.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, revealing opportunities to strengthen Coinbase's market position.

Customers Bargaining Power

For everyday users, moving between different crypto exchanges is often quite simple, particularly when dealing with popular digital currencies like Bitcoin and Ethereum. Many platforms provide very similar services, and the process of shifting assets from one to another is generally uncomplicated, although blockchain transaction fees can present a small obstacle.

This ability for retail customers to easily switch platforms significantly enhances their bargaining power. It compels exchanges to remain competitive by offering attractive fee structures and a wide array of features to retain their user base.

Institutional clients, like hedge funds and corporations, often face substantial hurdles when considering a change in their custody and prime brokerage providers. These entities typically have intricate systems already integrated with their current platform, alongside stringent regulatory compliance protocols that are time-consuming and costly to replicate elsewhere. For instance, a significant portion of institutional assets under custody might be tied to specific reporting frameworks or security measures unique to a provider.

The complexity of migrating large volumes of digital assets and the associated data, coupled with the need for seamless operational continuity, significantly elevates switching costs. This operational and compliance burden effectively diminishes the bargaining power of these institutional clients. In 2024, the digital asset custody market saw continued growth, with major players managing billions in assets, underscoring the deep entrenchment of existing relationships and the difficulty of transitioning.

Coinbase's active traders and institutional clients exhibit significant fee sensitivity. This means they closely monitor and compare trading costs across different platforms. For instance, while Coinbase offers robust security and user-friendliness, its fee structure has often been higher than many decentralized exchanges or newer entrants in the crypto market.

This sensitivity directly impacts Coinbase's bargaining power. When fees are perceived as too high, price-conscious customers can easily switch to competitors offering lower transaction costs. This was particularly evident in 2023, where increased competition and market downturn pressured many exchanges, including Coinbase, to re-evaluate their fee models to retain user volume.

Regulatory Clarity and Security Demands

Customers, especially in light of recent market turbulence and security breaches, are increasingly focused on regulatory adherence and strong security. Coinbase's commitment to regulatory compliance and its advanced security features are major attractions for cautious investors and institutional clients.

This heightened demand for safety and compliance means customers are less willing to accept lower standards, thereby increasing their bargaining power. They can leverage these demands to seek out platforms that meet their stringent requirements.

- Regulatory Focus: Following events like the FTX collapse in late 2022, investor confidence in unregulated crypto platforms waned.

- Security as a Differentiator: Coinbase's proactive security investments, including its SOC 2 compliance, appeal to a significant segment of the market.

- Institutional Demand: Major financial institutions entering the crypto space in 2024 are demanding robust compliance and security, giving them considerable leverage.

Diverse Product Needs (Staking, NFTs, DeFi)

Customers are no longer satisfied with just buying and selling cryptocurrencies. They want a full-service digital asset experience, including staking for yield, exploring non-fungible tokens (NFTs), and participating in decentralized finance (DeFi) protocols. This broadens their needs significantly.

Coinbase's strategic move to offer a diverse product suite, extending beyond simple spot trading, is crucial. For instance, in Q4 2023, Coinbase reported subscription and services revenue of $397 million, a notable portion of which stems from staking and custodial services. This diversification directly addresses the varied demands of its user base, fostering loyalty among those seeking a one-stop shop for their crypto activities.

- Growing Demand for Staking Services: Users are increasingly seeking ways to earn passive income on their crypto holdings through staking.

- NFT Marketplaces and Integration: The popularity of NFTs necessitates platforms that can facilitate their discovery, purchase, and sale.

- DeFi Access and Tools: Customers want seamless integration with DeFi protocols for lending, borrowing, and yield farming.

- Comprehensive Digital Asset Hub: Coinbase's ability to consolidate these diverse needs into a single platform strengthens its customer retention.

For everyday users, switching between crypto exchanges is generally straightforward, especially for popular assets like Bitcoin. This ease of movement amplifies customer bargaining power, pushing exchanges to offer competitive fees and features to retain users.

Institutional clients, however, face significant switching costs due to integrated systems and complex regulatory requirements, which reduces their bargaining power. In 2024, the digital asset custody market saw continued growth, highlighting the difficulty for these clients to transition.

Coinbase's active traders and institutional clients are highly sensitive to fees, often comparing costs with competitors offering lower rates. This price sensitivity was evident in 2023, prompting exchanges like Coinbase to adjust fee models to maintain user volume.

Customers are increasingly prioritizing regulatory compliance and robust security, especially after past market turbulence. Coinbase's strong stance on these aspects appeals to cautious investors, giving them leverage to demand high standards from platforms.

Full Version Awaits

Coinbase Porter's Five Forces Analysis

This preview shows the exact Coinbase Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the cryptocurrency exchange market. This detailed analysis is ready for your immediate use.

Rivalry Among Competitors

Coinbase operates in a fiercely competitive cryptocurrency exchange market, characterized by a high number of global and regional players. Major centralized exchanges such as Binance, Kraken, and Bybit, alongside a multitude of smaller platforms, constantly challenge Coinbase for market share and user engagement.

This intense rivalry means that companies like Coinbase must continuously innovate and offer compelling value propositions to retain and attract customers in a fragmented landscape. The sheer volume of competitors intensifies the pressure on pricing, product development, and customer service.

Coinbase faces intense price competition, with many rivals offering lower trading fees. This pressure forces Coinbase to re-evaluate its pricing, particularly for its higher-volume users, to stay competitive in the market.

The ongoing fee compression directly impacts Coinbase's transaction revenue, a core income source. This reality underscores the company's strategic push to diversify its revenue streams, with subscription services becoming increasingly important.

The cryptocurrency exchange landscape is a hotbed of innovation, with platforms relentlessly introducing new features to capture market share. This includes everything from sophisticated trading interfaces and a wider array of altcoin options to attractive staking yields and deeper integration with decentralized finance (DeFi) protocols. For instance, as of early 2024, many exchanges are actively expanding their derivatives offerings, a trend exemplified by Coinbase's strategic acquisition of Deribit, aiming to bolster its position in this high-growth segment.

Regulatory Compliance as a Differentiator

Coinbase's commitment to robust regulatory compliance, particularly in the United States, serves as a significant competitive advantage. This adherence to stringent legal frameworks acts as a barrier to entry for many smaller, less capitalized, or offshore cryptocurrency exchanges that may not have the resources or willingness to navigate these complex requirements.

By operating within established legal boundaries, Coinbase builds trust and credibility, attracting institutional investors and a substantial segment of risk-averse retail customers. This focus on legitimacy is crucial in an industry often perceived as volatile and uncertain, differentiating Coinbase from competitors with less transparent operations.

- Regulatory Moat: Coinbase's proactive engagement with regulators, including its registration as a money services business with FinCEN, establishes a strong regulatory moat.

- Institutional Appeal: In 2023, institutional trading volumes on Coinbase reached $173 billion, underscoring the platform's attractiveness to larger, more regulated entities seeking compliance.

- Customer Trust: A significant portion of Coinbase's user base, particularly those with larger holdings, prioritizes platform security and regulatory adherence, which Coinbase actively promotes.

Brand Reputation and Trust

Coinbase's brand reputation is a cornerstone of its competitive strength, built on perceived security, reliability, and a commitment to regulatory compliance, particularly within the United States. This established trust is a powerful differentiator in the volatile cryptocurrency space, an industry frequently marred by scams and security breaches.

This reputation translates into a significant competitive advantage, as customers often prioritize platforms they believe will safeguard their assets. For instance, in 2023, Coinbase reported over 110 million verified users, underscoring the widespread trust placed in the platform.

However, the landscape is dynamic. Recent security incidents, while not unique to Coinbase, serve as a stark reminder that even established players must remain vigilant. The ongoing need to reinforce security measures and maintain transparency is crucial to sustaining this hard-won trust against evolving threats.

- Brand Trust: Coinbase's reputation for security and regulatory adherence is a key differentiator.

- User Base: Over 110 million verified users as of 2023 demonstrates significant customer trust.

- Industry Volatility: The crypto sector's susceptibility to scams and hacks amplifies the value of a trusted brand.

- Ongoing Vigilance: Recent security events highlight the continuous need for robust security and transparency to maintain trust.

The cryptocurrency exchange market is intensely competitive, with numerous global and regional players vying for market share. Coinbase faces direct competition from giants like Binance, Kraken, and Bybit, alongside many smaller platforms, all pushing for user engagement and trading volume.

This rivalry forces constant innovation in features and pricing. For example, many exchanges in early 2024 expanded derivatives offerings, a move Coinbase also pursued through acquisitions to stay competitive.

Fee compression is a significant factor, directly impacting Coinbase's transaction revenue and driving its strategy to diversify income through subscription services.

| Competitor | Key Offerings | 2023 Trading Volume (Est.) |

|---|---|---|

| Binance | Broad asset listings, futures, staking | $10 Trillion+ |

| Kraken | Strong security, margin trading, staking | $150 Billion+ |

| Bybit | Derivatives, copy trading, NFTs | $1 Trillion+ |

SSubstitutes Threaten

Decentralized exchanges (DEXs) such as Uniswap present a growing threat by enabling direct peer-to-peer crypto trading, bypassing intermediaries and appealing to users prioritizing privacy and self-custody. While historically limited by liquidity and user experience, ongoing developments in Layer 2 scaling solutions and improved interfaces are making DEXs more competitive. For instance, by mid-2024, total value locked (TVL) across major DEXs like Uniswap v3 and Curve Finance has consistently exceeded $50 billion, indicating significant user adoption and trading volume that could divert users from centralized platforms.

Direct crypto ownership via self-custody wallets presents a significant threat of substitution for Coinbase's custodial services. Users can bypass exchanges altogether by holding their digital assets in hardware or software wallets, eliminating counterparty risk and gaining complete control. This is particularly appealing for long-term holders seeking maximum security and autonomy over their investments.

As the cryptocurrency market matures, traditional financial institutions are increasingly entering the space. For instance, the approval and launch of Bitcoin ETFs in early 2024, such as those from BlackRock and Fidelity, provided a new, regulated avenue for investors to gain exposure to Bitcoin. This integration of digital assets into conventional finance offers an alternative investment pathway, potentially diminishing the reliance of some investors on dedicated crypto exchanges for their digital asset needs.

Peer-to-Peer (P2P) Trading Platforms

Peer-to-peer (P2P) trading platforms present a notable threat of substitutes for centralized exchanges like Coinbase. These platforms facilitate direct transactions between buyers and sellers, often bypassing the fees and stringent Know Your Customer (KYC) processes associated with regulated entities. This can appeal to users seeking greater privacy or operating in jurisdictions where centralized services face regulatory hurdles.

While P2P platforms generally exhibit lower liquidity and may offer a less seamless user experience compared to major exchanges, their ability to cater to specific user needs, such as anonymity and regulatory circumvention, carves out a distinct market segment. For instance, P2P platforms are particularly prevalent in regions with capital controls or where access to traditional financial systems is limited, directly impacting Coinbase's potential market penetration in those areas.

- Reduced Fees: P2P platforms often charge minimal to no transaction fees, contrasting with the percentage-based fees common on centralized exchanges.

- Anonymity Focus: Many P2P users prioritize privacy, making platforms that require less personal information an attractive alternative.

- Regulatory Arbitrage: P2P services can operate in a regulatory gray area, appealing to users in countries with strict cryptocurrency laws.

- Market Reach Impact: The existence of these substitutes can limit Coinbase's ability to capture users who prioritize these specific features over the convenience and security of a regulated platform.

Emerging Web3 and DeFi Protocols

The burgeoning Web3 and Decentralized Finance (DeFi) sectors present a significant threat of substitutes for traditional cryptocurrency exchanges like Coinbase. Protocols offering decentralized lending, borrowing, and yield farming provide alternative avenues for users to engage with digital assets, potentially bypassing centralized platforms for these specific functions.

As these DeFi applications continue to mature and improve their user experience, they are increasingly drawing users who might otherwise utilize Coinbase for core financial activities. For instance, by mid-2024, the total value locked (TVL) in DeFi protocols reached hundreds of billions of dollars, indicating substantial user adoption and capital allocation away from centralized entities for certain services.

- DeFi Lending & Borrowing: Protocols like Aave and Compound allow users to earn interest on deposited crypto or borrow assets, offering an alternative to holding assets on an exchange.

- Yield Farming: Users can stake or provide liquidity to DeFi protocols to earn rewards, presenting a yield generation strategy independent of exchange-based trading.

- User Experience Improvement: Ongoing development aims to simplify DeFi interfaces, making them more accessible to a broader audience, thus increasing their competitive appeal against centralized exchanges.

- Asset Diversification: Web3 and DeFi enable direct interaction with a wider array of digital assets and financial primitives, offering diversification opportunities beyond what a single exchange might list.

The threat of substitutes for Coinbase is multifaceted, encompassing decentralized alternatives, self-custody solutions, and the growing integration of digital assets into traditional finance. These substitutes offer users choices that can bypass Coinbase's services, impacting its market share and revenue streams.

Decentralized exchanges (DEXs) and DeFi protocols are gaining traction, with total value locked (TVL) in DeFi reaching hundreds of billions by mid-2024, indicating a significant shift of user activity away from centralized platforms for services like lending and yield farming. Furthermore, the emergence of regulated Bitcoin ETFs in early 2024 provides a familiar, albeit indirect, investment route for many, potentially reducing the need for direct exchange interaction.

| Substitute Type | Key Features | Impact on Coinbase | Relevant Data (Mid-2024) |

|---|---|---|---|

| Decentralized Exchanges (DEXs) | Peer-to-peer trading, self-custody, privacy | Diverts trading volume, reduces fee income | TVL > $50 billion across major DEXs |

| Self-Custody Wallets | Full control of assets, eliminates counterparty risk | Reduces demand for custodial services | Growing adoption among long-term holders |

| DeFi Protocols | Lending, borrowing, yield farming | Offers alternative yield generation, bypasses exchange functions | DeFi TVL in hundreds of billions |

| Traditional Financial Products (e.g., ETFs) | Regulated access to crypto exposure | Provides alternative investment pathway, reduces reliance on exchanges | Significant inflows into Bitcoin ETFs post-launch |

Entrants Threaten

The cryptocurrency exchange industry, particularly in well-regulated jurisdictions like the United States, presents formidable regulatory challenges. New entrants must navigate complex Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, secure necessary licenses, and bear substantial ongoing compliance costs. These intricate and frequently changing regulatory landscapes act as a significant deterrent, effectively shielding incumbent, compliant firms such as Coinbase from emerging competition.

Establishing a competitive cryptocurrency exchange demands significant capital. This includes robust technology infrastructure, advanced security measures, extensive marketing campaigns, and critically, ensuring deep liquidity to facilitate efficient trading for all participants. For instance, building out the necessary compliance and regulatory frameworks alone can represent a substantial upfront investment.

New entrants face a considerable hurdle in matching the liquidity provided by established players like Coinbase. This deep liquidity is paramount for attracting and retaining both individual retail traders and larger institutional investors, as it ensures orders can be filled quickly and at favorable prices, a key differentiator in a competitive market.

Coinbase has cultivated a powerful brand, deeply associated with security and reliability, a crucial advantage in the volatile crypto space. This established trust, built over more than a decade, presents a significant hurdle for newcomers.

New entrants must overcome the substantial challenge of establishing credibility in a market where user security and the risk of scams are paramount concerns. Without this trust, attracting a substantial user base becomes an uphill battle, limiting their ability to compete effectively.

Technological Complexity and Cybersecurity Demands

The technological complexity and demanding cybersecurity requirements for operating a cryptocurrency exchange present a substantial barrier to entry for new players. Building and maintaining a secure, scalable platform capable of handling vast transaction volumes and protecting sensitive user data requires significant upfront investment and ongoing expertise.

New entrants must grapple with the intricate integration of blockchain technology, sophisticated trading engines, and robust anti-money laundering (AML) and know-your-customer (KYC) compliance systems. Failure in any of these areas, particularly cybersecurity, can lead to catastrophic data breaches and loss of user funds, instantly destroying a new exchange's credibility and market standing.

- High Capital Expenditure: Developing proprietary trading technology and advanced security protocols can cost tens of millions of dollars, a prohibitive sum for many startups.

- Talent Acquisition: Securing specialized talent in blockchain development, cryptography, and cybersecurity is competitive and expensive, further increasing operational costs.

- Regulatory Compliance: Meeting evolving global regulatory standards for digital asset exchanges adds another layer of complexity and cost, requiring continuous adaptation of technological infrastructure.

Network Effects and User Base Lock-in

Established cryptocurrency exchanges like Coinbase leverage powerful network effects. A larger user base directly translates to increased trading liquidity, making the platform more attractive to both retail and institutional investors. This creates a virtuous cycle where more users attract more liquidity, which in turn attracts even more users, solidifying Coinbase's market position.

While switching costs for individual users are relatively low in the crypto space, the sheer scale of Coinbase's ecosystem presents a significant hurdle for newcomers. As of 2024, Coinbase boasts over 105 million verified users globally, alongside substantial institutional trading volumes. This massive user base and activity generate a network effect that is difficult for new entrants to replicate, acting as a substantial barrier to entry.

- Network Effects: A larger user base attracts more liquidity, which attracts more users, creating a self-reinforcing loop.

- User Base Size: Coinbase had over 105 million verified users globally in 2024, a critical mass that deters new entrants.

- Institutional Volume: High trading volumes from institutional clients further enhance liquidity and platform attractiveness.

- Barrier to Entry: The combined effect of network effects and user base size creates a formidable challenge for new exchanges to gain traction.

The threat of new entrants in the cryptocurrency exchange market is significantly mitigated by high capital requirements and complex regulatory landscapes. New platforms must invest heavily in technology, security, and compliance, with estimated setup costs for robust infrastructure easily reaching tens of millions of dollars. Furthermore, navigating stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, alongside obtaining necessary licenses, presents a substantial and costly barrier.

Established players like Coinbase benefit from strong network effects, with over 105 million verified users globally as of 2024. This vast user base translates into deep liquidity, attracting both retail and institutional traders, a critical advantage that new entrants struggle to match. Building comparable brand trust and security credentials, which Coinbase has cultivated over a decade, is another formidable challenge for newcomers seeking to gain market traction.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for technology, security, and liquidity. | Prohibitive for many startups. |

| Regulatory Compliance | Navigating KYC/AML, licensing, and evolving rules. | High upfront and ongoing costs, complexity. |

| Network Effects & Liquidity | Established user base (e.g., Coinbase's 105M+ users in 2024) drives trading volume and liquidity. | Difficult for new entrants to attract users and offer competitive trading. |

| Brand & Trust | Cultivating a reputation for security and reliability in a risk-sensitive market. | Time-consuming and challenging to build credibility against established brands. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Coinbase leverages data from financial statements, analyst reports, and industry-specific market research to gauge competitive intensity. We also incorporate regulatory filings and news from leading financial publications to understand the landscape.