Coinbase Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coinbase Bundle

Curious about the engine driving Coinbase's success in the digital asset space? This Business Model Canvas breaks down their core customer segments, value propositions, and revenue streams, offering a clear view of their strategic advantage.

Discover how Coinbase leverages key partnerships and channels to deliver its services, all while managing a complex cost structure. This comprehensive canvas is your key to understanding their operational blueprint.

Ready to gain a competitive edge? Download the full Coinbase Business Model Canvas to unlock actionable insights and accelerate your own strategic planning.

Partnerships

Coinbase strategically partners with established financial institutions and banks to create vital fiat-to-crypto on- and off-ramps. These collaborations are essential for allowing users to easily deposit and withdraw traditional currencies, effectively linking the crypto world with traditional finance. For instance, in 2023, Coinbase continued to deepen its relationships with major banks to ensure smooth transaction processing, a critical component for user adoption.

Coinbase's engagement with blockchain protocol developers is crucial for expanding its digital asset offerings and integrating new features. This allows Coinbase to list a wider array of cryptocurrencies, support staking for various proof-of-stake networks, and actively participate in the decentralized finance (DeFi) landscape. For instance, by partnering with developers of protocols like Solana and Polygon, Coinbase can offer users access to these growing ecosystems.

Coinbase collaborates with top cybersecurity and regulatory compliance firms to bolster its platform's security and adherence to global regulations. These alliances are vital for fortifying its defenses against threats and ensuring user data and assets are protected. For instance, in 2023, Coinbase reported a significant investment in enhanced security measures, underscoring the importance of these partnerships.

Payment Processors and E-commerce Platforms

Coinbase actively partners with major payment processors and e-commerce platforms, like Shopify, to broaden the acceptance and utility of cryptocurrencies. These strategic alliances are crucial for integrating digital assets into everyday commerce, making it easier for consumers to spend crypto and for businesses to accept it.

These collaborations are instrumental in driving the real-world adoption of cryptocurrencies by simplifying transactions. By integrating Coinbase's services, merchants can offer crypto payment options, potentially attracting a new customer base and streamlining the checkout process for their buyers. This also benefits consumers by providing more flexible payment methods.

- Expanded Reach: Partnerships with platforms like Shopify allow Coinbase to tap into millions of merchants and consumers globally, significantly increasing the practical use cases for cryptocurrencies.

- Streamlined Transactions: Integrations simplify the payment process, reducing friction for both buyers and sellers and making crypto payments as seamless as traditional methods.

- Lower Fees: These integrations can lead to more competitive transaction fees compared to traditional payment rails, offering cost savings for businesses and potentially consumers.

- Driving Adoption: By facilitating everyday transactions, these partnerships play a vital role in normalizing cryptocurrency usage and fostering broader adoption of digital assets in the economy.

Custodial Service Providers

Coinbase, while robust in its own institutional custody, strategically partners with other specialized crypto custodians. These alliances are crucial for expanding security protocols, bolstering insurance coverage, and extending geographical reach, thereby serving a wider array of institutional clients with unique demands.

These collaborations are vital for meeting the stringent security and regulatory requirements of large-scale investors. For instance, by integrating with third-party custodians, Coinbase can offer enhanced cold storage solutions and diversified insurance policies, providing unparalleled peace of mind for those holding significant digital asset portfolios.

- Enhanced Security: Partnerships allow for the adoption of best-in-class cold storage and multi-signature technologies, minimizing the risk of digital asset theft.

- Broader Insurance Coverage: Collaborations can lead to more comprehensive insurance policies that protect client assets against a wider range of potential risks.

- Geographical Expansion: Working with custodians in different regions helps Coinbase navigate diverse regulatory landscapes and cater to global institutional demand.

Coinbase's key partnerships extend to blockchain infrastructure providers and wallet developers, crucial for seamless integration and user experience. These collaborations ensure Coinbase can support a wider array of digital assets and facilitate easy asset management for its users. For example, Coinbase's integration with Ledger in 2023 enhanced hardware wallet support, providing users with more secure options for storing their crypto.

These partnerships are vital for expanding the utility and accessibility of cryptocurrencies. By working with wallet developers, Coinbase can ensure its platform is compatible with various user preferences and security needs, fostering broader adoption. This also allows for easier participation in decentralized applications and services.

Coinbase also engages with data analytics firms and market intelligence providers to offer robust insights and reporting to its institutional clients. These collaborations provide valuable market data, helping clients make informed trading and investment decisions. In 2023, Coinbase's institutional arm leveraged advanced analytics to provide tailored market reports.

| Partner Type | Purpose | Example/Impact |

|---|---|---|

| Financial Institutions/Banks | Fiat on/off-ramps | Facilitate smooth fiat transactions, enabling user access to crypto. |

| Blockchain Protocol Developers | Asset listing and feature integration | Expand digital asset offerings, support staking, and integrate new blockchain technologies. |

| Cybersecurity & Compliance Firms | Platform security and regulatory adherence | Fortify defenses, protect user data, and ensure global compliance. |

| Payment Processors/E-commerce | Crypto payment acceptance | Integrate crypto into everyday commerce, simplifying transactions for merchants and consumers. |

| Specialized Crypto Custodians | Enhanced security and reach | Expand security protocols, bolster insurance, and serve global institutional clients. |

| Wallet Developers | Integration and user experience | Support diverse user preferences and security needs, facilitating asset management. |

What is included in the product

A detailed breakdown of Coinbase's strategy, outlining its key customer segments, value propositions, and revenue streams, all within the classic 9 Business Model Canvas blocks.

This model offers a strategic overview of Coinbase's operations, highlighting its competitive advantages and potential for growth in the cryptocurrency market.

Coinbase's Business Model Canvas offers a clear, structured approach to understanding and communicating its strategy, effectively relieving the pain point of complex business model analysis.

It provides a digestible, one-page snapshot of Coinbase's core components, simplifying the often-daunting task of grasping a digital asset exchange's operations.

Activities

Coinbase dedicates significant resources to the continuous development and maintenance of its core exchange platform. This involves ongoing updates to user interfaces for better accessibility and the optimization of trading engines to ensure speed and efficiency, crucial for its diverse user base.

Infrastructure scaling is a key activity, allowing Coinbase to handle substantial trading volumes, as evidenced by periods of high market activity. For instance, during peak times in 2024, the platform successfully managed millions of transactions, demonstrating its robust architecture.

The rollout of new features and services, such as enhanced staking options or improved security protocols, is also a critical component. These developments aim to provide a seamless and reliable user experience, reinforcing Coinbase's position as a leading digital asset exchange.

Coinbase's key activities heavily feature the implementation and ongoing enhancement of sophisticated security protocols. This includes employing cold storage solutions for the majority of digital assets, mandatory two-factor authentication for user accounts, and advanced fraud detection systems to safeguard against unauthorized access and transactions.

A significant focus is placed on actively managing the inherent risks tied to the cryptocurrency market's volatility and the ever-present threat of cyberattacks. By proactively addressing these challenges, Coinbase aims to preserve user confidence and ensure the integrity of the assets entrusted to its platform.

This commitment extends to maintaining stringent internal controls and adhering to recognized security standards, such as SOC 2 Type 2 compliance, which was successfully achieved by Coinbase in 2024, demonstrating a robust framework for data security and operational integrity.

Coinbase dedicates significant resources to navigating the intricate and ever-changing global regulatory environment. This includes rigorous adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, a critical component of its operations. In 2023, Coinbase reported spending $347 million on legal and regulatory matters, highlighting the substantial investment required to maintain compliance across its international operations.

Securing and maintaining licenses in numerous jurisdictions is a core activity, enabling Coinbase to offer its services legally worldwide. This proactive approach to licensing is fundamental to its strategy for global expansion and market access. By the end of 2023, Coinbase held over 200 licenses or registrations globally.

Engaging proactively with policymakers and regulators is another key activity, shaping the future of digital asset regulation. This dialogue helps Coinbase stay ahead of evolving rules and advocate for clear, supportive frameworks. Such engagement is crucial for fostering trust and ensuring the long-term viability of its business model.

Customer Support and Education

Coinbase prioritizes robust customer support to handle a wide range of user inquiries and technical issues, aiming to build trust and loyalty. In 2024, the company continued to invest in its support infrastructure, offering multiple channels for assistance.

Educational programs are a cornerstone of Coinbase's strategy. Initiatives like Coinbase Earn, which rewards users for learning about different cryptocurrencies, saw continued engagement throughout 2024, contributing to a more knowledgeable user base. This approach not only helps users understand complex financial products but also drives adoption of new digital assets.

- Customer Support: Providing timely and effective assistance across various platforms to resolve user queries and technical challenges.

- Educational Initiatives: Offering resources like Coinbase Earn to educate users on cryptocurrencies and blockchain technology, fostering engagement and understanding.

- User Empowerment: Equipping customers with the knowledge to navigate the digital asset space confidently, leading to a more informed and active community.

Product Innovation and Expansion

Coinbase's commitment to product innovation is a cornerstone of its strategy, driving growth beyond its core exchange services. The company actively invests in research and development to introduce new features and expand its ecosystem.

This focus is evident in offerings like Coinbase Advanced, designed for more sophisticated trading, and the continuous expansion of staking opportunities, allowing users to earn rewards on their digital assets. Coinbase also caters to institutional clients with its robust custody solutions, ensuring secure management of large digital asset holdings.

Furthermore, Coinbase is exploring emerging sectors within the digital asset space, including decentralized finance (DeFi) and non-fungible tokens (NFTs), aiming to capture future market trends. Strategic acquisitions, such as the reported acquisition of derivatives exchange Deribit in late 2023 for approximately $150 million, further bolster its market position and product capabilities.

- Product Innovation: Development of Coinbase Advanced for enhanced trading experiences.

- Staking Expansion: Broadening opportunities for users to earn rewards on digital assets.

- Institutional Offerings: Providing high-grade custody solutions for institutional investors.

- Emerging Markets: Exploration and integration of DeFi and NFT functionalities.

- Strategic Acquisitions: Enhancing market presence and capabilities through targeted acquisitions like Deribit.

Coinbase's key activities revolve around platform development and security, regulatory compliance, and customer engagement. These encompass maintaining a robust trading infrastructure, implementing advanced security measures, navigating complex global regulations, and fostering user understanding through educational programs.

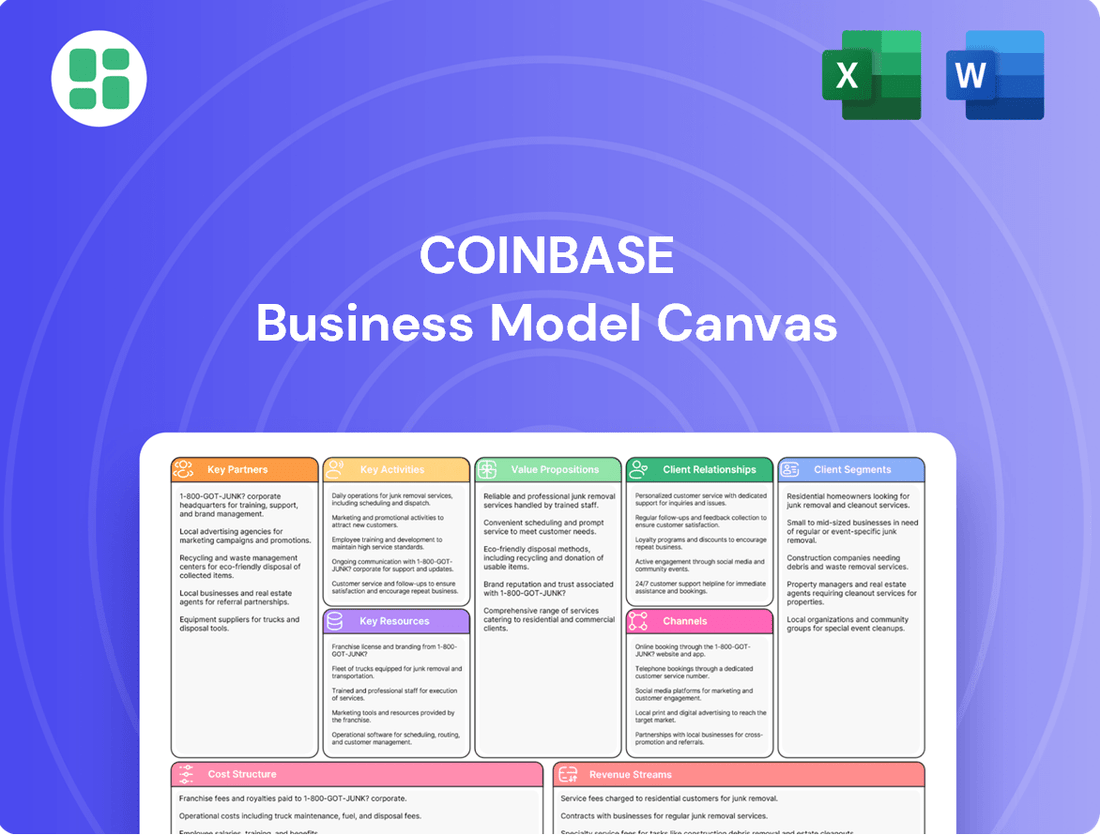

Preview Before You Purchase

Business Model Canvas

The Coinbase Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally formatted Business Model Canvas, ready for your immediate use. No alterations or placeholders exist; what you see is precisely what you'll download, ensuring full transparency and immediate value.

Resources

Coinbase's proprietary technology platform is the engine driving its operations, featuring a robust trading engine capable of handling significant volume and a secure wallet infrastructure that safeguards user assets. This advanced technology underpins its ability to efficiently execute transactions and manage a diverse range of digital assets across various blockchain networks.

The platform's scalability is crucial, allowing Coinbase to accommodate rapid growth in user numbers and trading activity. In the first quarter of 2024, Coinbase reported a substantial increase in trading volume, highlighting the platform's capacity to manage high transaction throughput and maintain performance under peak loads.

Its comprehensive API services are another key component, enabling seamless integration for institutional clients and developers. This allows for sophisticated trading strategies and the development of new applications leveraging Coinbase's infrastructure, further expanding its ecosystem and service offerings.

Coinbase's brand reputation is a cornerstone of its business model, built on a foundation of security, reliability, and a commitment to regulatory compliance within the often-volatile cryptocurrency market. This strong reputation acts as a powerful differentiator, attracting and retaining a loyal user base who value a trusted platform for their digital asset transactions.

The company's status as a publicly traded entity, listed on the Nasdaq under the ticker COIN, further bolsters this trust. In 2024, Coinbase continued to emphasize its adherence to stringent financial regulations, a key factor for institutional investors and a growing segment of retail users seeking a more secure and regulated environment for cryptocurrency engagement.

Coinbase's human capital is a cornerstone of its operations, featuring a highly skilled workforce. This includes top-tier engineers, crucial cybersecurity experts, diligent compliance officers, and insightful market strategists. Their collective knowledge is fundamental to the company's success.

The expertise of these employees in areas like blockchain technology, financial markets, and the ever-evolving regulatory landscape directly fuels innovation. It also ensures the company operates smoothly and effectively tackles complex industry challenges. For instance, in 2023, Coinbase reported significant investments in its engineering and product teams, aiming to enhance user experience and expand its offerings.

The talent pool at Coinbase is indispensable for its sustained growth and competitive edge. As of early 2024, the company continued to prioritize attracting and retaining top talent, recognizing that employee skills are directly linked to its ability to develop new products and maintain its leadership position in the digital asset industry.

Financial Capital and Liquidity

Coinbase's substantial financial capital, including significant cash reserves and robust access to funding, is the bedrock of its operations. This financial muscle enables the company to support its high-volume trading platforms and pursue strategic growth initiatives. For instance, as of the first quarter of 2024, Coinbase reported a substantial cash and cash equivalents balance, bolstering its ability to navigate market fluctuations and invest in future development.

This financial strength is not just about day-to-day operations; it's a key enabler for strategic moves. Coinbase can leverage its capital to make critical investments, such as enhancing its technology infrastructure or expanding into new geographic markets. Furthermore, this liquidity is paramount for weathering the inherent volatility of the cryptocurrency market, ensuring the platform remains stable and reliable for its users.

The company's financial resources also fuel ambitious growth strategies, including potential acquisitions and international expansion efforts. By maintaining a strong financial position, Coinbase is well-equipped to capitalize on opportunities that arise in the rapidly evolving digital asset landscape. This allows them to solidify their market position and drive long-term value for stakeholders.

- Cash and Equivalents: As of Q1 2024, Coinbase held approximately $4.1 billion in cash, cash equivalents, and crypto assets on its balance sheet, providing significant operational flexibility.

- Access to Funding: Coinbase has demonstrated its ability to raise capital through various means, including its public offering and potential debt financing, ensuring ongoing access to necessary funds.

- Market Resilience: The company's financial reserves are crucial for absorbing the impact of market downturns, maintaining liquidity for customer withdrawals and operational continuity.

- Strategic Investments: Financial capital supports investments in product development, regulatory compliance, and potential M&A activities to expand its ecosystem and offerings.

Extensive Cryptocurrency Asset Portfolio

Coinbase's extensive cryptocurrency asset portfolio is a foundational element of its business model. This includes support for major digital currencies such as Bitcoin and Ethereum, alongside a continually expanding array of altcoins. For instance, as of early 2024, Coinbase offers trading for well over 200 different digital assets, demonstrating significant breadth.

This wide selection of supported cryptocurrencies is crucial for attracting and retaining a diverse user base. It allows investors to explore various market opportunities and hedge their portfolios, catering to both established and emerging digital asset interests. The sheer volume of tradable assets directly correlates with platform engagement and transaction volume.

- Broad Asset Support: Coinbase lists a vast number of cryptocurrencies, far exceeding many competitors, providing users with extensive choice.

- Investor Diversification: The diverse portfolio enables users to diversify their digital asset holdings, mitigating risk and pursuing varied investment strategies.

- Trading Opportunities: A larger selection of assets means more potential trading pairs and market movements, increasing the platform's utility for active traders.

- Market Relevance: By continuously adding new and popular altcoins, Coinbase stays relevant in the fast-evolving crypto landscape, attracting users interested in the latest digital innovations.

Coinbase's intellectual property, encompassing its proprietary trading technology, secure wallet architecture, and unique algorithms, forms a critical resource. This intellectual property is protected through patents and continuous innovation, ensuring a competitive edge in the digital asset space.

The company's brand recognition and customer trust are invaluable intangible assets. Coinbase has cultivated a reputation for security and compliance, which is vital for attracting both retail and institutional clients. This strong brand equity, built over years of operation, is a significant differentiator in the crowded crypto market.

Coinbase's strategic partnerships and existing customer base are also key resources. Collaborations with financial institutions and technology providers expand its reach and service capabilities. The vast network of users on its platform provides a strong foundation for introducing new products and services, as seen with its growing institutional client segment in 2024.

Value Propositions

Coinbase prioritizes security, offering a robust environment for digital asset management. This includes advanced measures like cold storage for the majority of digital assets, two-factor authentication, and insurance protection, all contributing to user confidence in a volatile market.

The platform's commitment to security is underscored by its proactive approach to regulatory compliance, which builds essential trust with its diverse user base. By adhering to stringent standards, Coinbase aims to mitigate perceived risks associated with cryptocurrency transactions.

Coinbase's platform is intentionally built for ease of use, welcoming everyone from crypto newcomers to seasoned traders with its straightforward design and simple signup. This approach significantly reduces the intimidation factor for those wanting to explore digital assets. In 2024, Coinbase reported a substantial increase in active users, highlighting the success of its accessible interface in drawing a broader audience into the crypto space.

Coinbase offers access to a vast array of digital assets, extending far beyond the most well-known cryptocurrencies like Bitcoin and Ethereum. This extensive selection empowers users to build diversified portfolios, mitigating risk and exploring various investment opportunities within the digital asset space.

Beyond simple trading, Coinbase provides a comprehensive suite of services tailored to different user needs. These include staking, which allows users to earn rewards on their holdings, institutional-grade custody solutions for secure asset management, and a self-custodial wallet for greater control over private keys.

In 2024, Coinbase continued to expand its asset listings, with over 200 supported cryptocurrencies by mid-year, reflecting its commitment to providing diverse investment options. This broad selection is a key differentiator, attracting a wide range of investors from retail to institutional.

Liquidity and Efficient Trading

Coinbase's platform offers deep liquidity, allowing users to buy and sell digital assets quickly and at favorable prices. This is a major draw for active traders who need to execute orders without significant slippage. In 2024, Coinbase reported average daily trading volumes that consistently placed it among the top global cryptocurrency exchanges, demonstrating its robust market presence and the efficiency of its trading infrastructure.

The platform caters to both retail and institutional clients, providing advanced trading tools and APIs for sophisticated order management. This ensures that even large trades can be executed effectively, minimizing market impact. For instance, its order book depth in major trading pairs like BTC-USD remained substantial throughout 2024, reflecting high user participation and the availability of counterparties.

- High Trading Volumes: Facilitates rapid execution of buy and sell orders.

- Deep Liquidity: Ensures competitive pricing and minimal slippage for users.

- Advanced Trading Tools: Empowers experienced traders with sophisticated execution capabilities.

- Efficient Order Execution: Critical for active traders to capitalize on market movements.

Regulatory Clarity and Compliance

Coinbase prioritizes operating with a strong emphasis on regulatory compliance across numerous jurisdictions. This commitment provides users and institutions with a legitimate and transparent avenue to engage with the cryptocurrency market.

By adhering to regulations, Coinbase significantly reduces regulatory uncertainty, making it a favored platform for those who require a regulated environment for their digital asset activities. This proactive approach builds trust and facilitates broader institutional adoption.

- Regulatory Adherence: Coinbase actively works to comply with evolving regulations in key markets, aiming to provide a secure and lawful platform.

- Reduced Uncertainty: This focus on compliance minimizes the risk of sudden regulatory changes impacting users and their assets.

- Institutional Trust: A compliant framework is crucial for attracting and retaining institutional investors and partners.

- Global Reach: Navigating diverse regulatory landscapes allows Coinbase to offer its services to a wider international audience.

Coinbase's value proposition centers on security, ease of use, and a broad range of digital assets. Its commitment to robust security measures, including cold storage and two-factor authentication, builds user trust. The platform's intuitive design makes it accessible to both novice and experienced users, a strategy that proved successful in 2024 with increased user adoption.

Furthermore, Coinbase offers a diverse selection of over 200 cryptocurrencies as of mid-2024, enabling portfolio diversification. Beyond trading, it provides staking and institutional-grade custody, catering to varied investor needs. This comprehensive offering, coupled with deep liquidity and advanced trading tools for both retail and institutional clients, solidifies its market position.

Customer Relationships

Coinbase leverages automated self-service options, including an extensive FAQ section and AI-powered chatbots, to empower users. This allows customers to quickly find answers to common queries and resolve straightforward issues without direct human interaction. In 2024, Coinbase reported a significant portion of customer inquiries were successfully handled through these automated channels, reducing wait times and improving overall user experience.

Coinbase offers dedicated customer support channels to assist users with their cryptocurrency needs. For more complex issues, they provide email, phone support, and live chat options, though access can sometimes be limited. This human-centric approach is vital for resolving specific account or transaction problems and fostering user trust.

Premium subscribers to Coinbase can often expect enhanced support, potentially including faster response times or more specialized assistance. This tiered support model aims to cater to different user needs and commitment levels, reinforcing the value proposition for those who invest more in the platform.

Coinbase actively cultivates its user base through robust community engagement, primarily via social media platforms and dedicated online forums. This approach encourages direct user interaction, making it easier to gather valuable feedback and foster a sense of belonging. For instance, in 2023, Coinbase reported a significant increase in social media mentions, indicating growing community activity.

Furthermore, Coinbase's commitment to user education is a cornerstone of its customer relationship strategy. Programs like Coinbase Learn and Coinbase Earn are designed to demystify cryptocurrency and blockchain technology, empowering users with knowledge. This educational focus not only deepens user understanding but also cultivates loyalty by aligning the platform with users' learning journeys, contributing to a strong, informed community.

Personalized Services for Institutional Clients

Coinbase offers institutional clients a high-touch customer relationship model. This includes dedicated account management, ensuring a single point of contact for complex needs. These relationships are built on understanding the unique operational and regulatory landscapes faced by large financial entities.

Tailored solutions are a cornerstone of Coinbase's approach to institutional business. This means developing customized custody solutions that meet specific security and operational requirements, and providing direct trading access designed for high-volume, institutional-grade execution. By mid-2024, Coinbase reported significant growth in its institutional client base, underscoring the demand for these specialized services.

- Dedicated account managers for each institutional client.

- Customized custody solutions and direct trading access.

- Specialized support teams addressing complex financial needs.

- Focus on building robust and reliable partnerships with high-value clients.

Loyalty Programs and Subscriptions

Coinbase cultivates customer loyalty through tiered subscription services, most notably Coinbase One. This program offers tangible benefits designed to reward frequent users and encourage deeper engagement with the platform. For instance, Coinbase One subscribers typically enjoy zero trading fees on certain transactions, which can significantly reduce costs for active traders.

- Coinbase One offers benefits like zero trading fees and boosted staking rewards.

- These programs are designed to incentivize user loyalty and increase engagement.

- Subscription services create a stronger bond with active and high-volume users.

- By providing added value, Coinbase aims to retain its most dedicated customers.

Coinbase's customer relationships are a blend of automated efficiency and personalized engagement. For everyday users, self-service options like extensive FAQs and AI chatbots handle many queries, a strategy that proved effective in 2024 with a high percentage of inquiries resolved automatically. For more complex needs, email, phone, and live chat are available, though access can vary. Premium tiers, such as Coinbase One, offer enhanced support and benefits like zero trading fees, fostering loyalty among active users.

| Customer Segment | Relationship Type | Key Features/Data (2024) |

|---|---|---|

| Retail Users | Self-service, Community Engagement | High volume of automated support resolutions; significant increase in social media activity and forum participation. |

| Premium Subscribers (e.g., Coinbase One) | Personalized, Loyalty Programs | Zero trading fees, boosted staking rewards; designed to incentivize retention and deeper platform engagement. |

| Institutional Clients | High-touch, Dedicated Support | Dedicated account managers, customized custody solutions, specialized financial support; significant growth in this segment reported mid-2024. |

Channels

Coinbase's primary customer touchpoints are its user-friendly web platform and a robust mobile application. These digital channels are the gateway for users to engage with a wide array of services, from simple cryptocurrency purchases to more complex trading and asset management.

The accessibility of these platforms is crucial, allowing Coinbase to serve a broad user base, from beginners to experienced traders. In the first quarter of 2024, Coinbase reported 116 million verified users, highlighting the significant reach of its digital infrastructure.

Coinbase heavily utilizes digital advertising across platforms like Google, Facebook, and Twitter to reach potential customers. These campaigns focus on Coinbase's key selling points: security, user-friendliness, and its wide range of crypto assets. For instance, in 2023, Coinbase continued its strategy of broad visibility, building on the significant impact of its 2022 Super Bowl ad, which aimed to demystify crypto for a mainstream audience.

Coinbase leverages strategic partnerships with financial institutions and fintech innovators to reach new customers and enhance its service offerings. For instance, integrations with popular payment methods like Apple Pay allow millions of users to seamlessly interact with Coinbase's platform, expanding its accessibility.

Collaborations with e-commerce giants such as Shopify are crucial. By integrating Coinbase commerce solutions, Shopify merchants can easily accept cryptocurrency payments, opening up new revenue streams and exposing a vast user base to digital assets. This strategic move in 2024 significantly broadens Coinbase's market penetration.

These carefully chosen alliances act as indirect channels, driving user acquisition and increasing the utility of Coinbase's products by embedding them within existing, trusted digital ecosystems. The company's focus on these integrations underscores its strategy to make digital currency more accessible and integrated into everyday commerce.

Public Relations and Media Coverage

Coinbase actively uses public relations to craft its story, announce new offerings, and react to market shifts, aiming for favorable media attention. Its position as a publicly traded entity and commitment to regulatory adherence frequently draw considerable media scrutiny, boosting its profile and trustworthiness.

This strategic media engagement is crucial for building and maintaining public confidence in Coinbase's operations and its role within the evolving digital asset landscape. For instance, in the first quarter of 2024, Coinbase reported significant user growth, which was widely covered across financial news outlets, further solidifying its market presence.

- Media Narrative Shaping: Coinbase proactively communicates its vision and product developments to key media outlets, influencing public perception.

- Public Trust and Credibility: As a publicly listed company, its transparent communication and regulatory focus attract media coverage that enhances its credibility.

- Market Response and Visibility: Positive media attention around new product launches or regulatory milestones directly impacts user acquisition and brand visibility.

API and Developer Tools

Coinbase's API and developer tools are crucial for expanding its ecosystem. These offerings, like OnChainKit and the Base blockchain, empower third-party developers to build innovative applications and integrate Coinbase's robust infrastructure into their own platforms and services. This collaborative approach significantly broadens the utility and reach of Coinbase's technology.

This channel is a key driver for the growth of decentralized applications (dApps) and new financial products built on blockchain technology. By providing accessible tools, Coinbase cultivates a vibrant developer community, fostering innovation that extends far beyond its own direct offerings. For instance, the development of dApps on Base has seen significant traction, with the network processing millions of transactions daily as of mid-2024.

- API Access: Enables seamless integration of Coinbase's trading, custody, and payment functionalities into external applications.

- Developer Tools: Provides SDKs, documentation, and sandboxes for efficient application development.

- OnChainKit: A suite of tools designed to simplify on-chain data analysis and interaction.

- Base Network: A Layer 2 scaling solution built with the Ethereum ecosystem in mind, fostering dApp development.

Coinbase's channels are primarily digital, encompassing its user-friendly web and mobile platforms that serve as the main interaction points for customers. These platforms facilitate everything from simple crypto purchases to advanced trading, reaching a vast audience. By the first quarter of 2024, Coinbase had amassed 116 million verified users, underscoring the extensive reach of its digital infrastructure.

Customer Segments

Retail investors, a cornerstone of Coinbase's business model, encompass a vast spectrum from absolute beginners to seasoned crypto traders. This segment is characterized by its sheer volume, representing the largest user base for the platform.

Coinbase addresses the diverse needs of these individual users by offering a range of products, from user-friendly interfaces for first-time crypto purchases to sophisticated trading platforms with advanced charting tools and a broad selection of digital assets. As of early 2024, Coinbase reported over 100 million verified users, highlighting the significant reach within this customer segment.

Institutional investors and businesses, including hedge funds and asset managers, represent a crucial customer segment for Coinbase. These entities require robust, enterprise-grade cryptocurrency services. In 2024, Coinbase reported significant growth in its institutional client base, with assets under custody for these clients reaching tens of billions of dollars, underscoring their reliance on Coinbase for secure digital asset management.

These sophisticated clients demand more than just basic trading; they are looking for secure custody solutions, high-volume trading capabilities, and access to specialized financial products such as derivatives and index funds. Coinbase Prime and Coinbase Custody are tailored offerings designed to meet these complex institutional needs, providing the infrastructure and security necessary for large-scale digital asset operations.

Coinbase directly supports developers and blockchain projects by providing the essential infrastructure needed to build and launch on-chain applications, products, and protocols. This includes access to robust APIs and innovative Layer 2 solutions like Base.

These tools empower developers to create new decentralized finance (DeFi) and Web3 experiences, fostering innovation within the broader crypto ecosystem. For instance, Base, launched in 2023, has rapidly grown, processing millions of transactions and attracting a significant developer community, demonstrating Coinbase's commitment to this segment.

High-Net-Worth Individuals

High-net-worth individuals represent a crucial customer segment for Coinbase, seeking specialized services for their substantial digital asset holdings. These clients often require more than standard retail offerings, demanding enhanced security protocols and personalized support to manage complex portfolios. For instance, a significant portion of Coinbase's institutional custody solutions are utilized by this demographic, underscoring their need for robust, tailored asset management. Coinbase One, their premium subscription service, also appeals to these individuals, providing benefits like zero trading fees and priority support, reflecting their demand for exclusive features.

- Bespoke Services: Tailored advice and management for large digital asset portfolios.

- Enhanced Security: Advanced safeguarding measures for significant investments.

- Private Client Support: Dedicated assistance for managing high-value accounts.

- Premium Offerings: Utilization of services like Coinbase One and institutional custody.

Global Users in Regulated Markets

Coinbase actively pursues users in over 100 countries, with a strategic emphasis on regions possessing established or evolving cryptocurrency regulations. This focus on regulatory adherence is crucial for its international growth strategy.

By prioritizing compliance, Coinbase is positioned to serve a wider global audience, fostering economic freedom while diligently adhering to diverse local legal requirements. This approach underpins their commitment to responsible expansion.

- Global Reach: Operates in over 100 countries.

- Regulatory Focus: Targets markets with clear or developing crypto regulations.

- Strategic Priority: International expansion is a key driver for growth.

- Compliance Advantage: Adherence to local laws facilitates market access.

Coinbase serves a broad range of customer segments, from individual retail investors to large institutions and even developers building on blockchain technology. This diversification allows Coinbase to capture value across different levels of the cryptocurrency ecosystem.

Retail investors represent the largest user base, with over 100 million verified users as of early 2024, seeking accessible ways to buy, sell, and store digital assets. Institutional clients, including hedge funds and asset managers, require sophisticated services like secure custody and high-volume trading, with assets under custody for these clients reaching tens of billions of dollars in 2024.

Developers and blockchain projects are supported through infrastructure like APIs and Layer 2 solutions such as Base, which has seen significant transaction volume and developer adoption since its 2023 launch. High-net-worth individuals are also a key segment, utilizing premium services like Coinbase One and specialized custody solutions for their substantial digital asset portfolios.

| Customer Segment | Key Characteristics | Coinbase Offerings | 2024 Data Point |

| Retail Investors | Beginner to experienced traders, high volume | User-friendly interface, advanced trading tools, broad asset selection | Over 100 million verified users |

| Institutional Investors | Hedge funds, asset managers, businesses | Coinbase Prime, Coinbase Custody, derivatives, index funds | Tens of billions in institutional assets under custody |

| Developers & Projects | Building on blockchain | APIs, Layer 2 solutions (Base) | Base processing millions of transactions |

| High-Net-Worth Individuals | Large digital asset holdings, demand for security and support | Coinbase One, private client support, institutional custody | Significant utilization of premium and custody services |

Cost Structure

Coinbase dedicates significant resources to its technology infrastructure and ongoing development. These costs encompass cloud computing services, maintaining physical data centers, and the extensive work involved in software development to enhance user experience and introduce new features. For instance, in 2023, Coinbase reported $996 million in technology and development expenses, highlighting the substantial investment required to support its global operations and competitive edge.

Operating in the digital asset space means significant investment in regulatory compliance and legal counsel. Coinbase, for instance, dedicates substantial resources to legal teams and compliance personnel to navigate the intricate web of global Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These costs are not optional; they are fundamental to maintaining operational legitimacy and avoiding severe penalties. For example, in 2023, Coinbase reported spending billions on legal and compliance efforts, a figure expected to remain high as regulatory landscapes continue to evolve.

Coinbase dedicates substantial resources to its sales, marketing, and customer acquisition efforts, recognizing their critical role in growth. These costs encompass a wide range of activities, from broad advertising campaigns designed to build brand awareness to more targeted initiatives aimed at bringing new users onto the platform. For instance, in 2023, Coinbase reported $1.4 billion in operating expenses, a significant portion of which is allocated to these growth-driving functions.

The company actively invests in strategic advertising across various channels to maintain its market presence and attract new customers in the highly competitive cryptocurrency landscape. Referral programs also play a part, incentivizing existing users to bring in new ones, thereby creating a cost-effective acquisition loop. These expenditures are essential for expanding Coinbase's user base and solidifying its position as a leading digital asset exchange.

Personnel and Operational Costs

Personnel and operational costs represent a significant component of Coinbase's business model. These expenses encompass employee salaries, comprehensive benefits packages, and general administrative overhead. Even with a remote-first approach, costs associated with maintaining infrastructure, software, and essential operational support remain substantial.

The company's growth trajectory directly impacts these costs, particularly as headcount expands to support new initiatives and increased user activity. In 2023, Coinbase reported total operating expenses of $3.7 billion, a notable decrease from $5.6 billion in 2022, reflecting efforts to manage costs amidst market fluctuations.

- Employee Compensation: Salaries and benefits for a global workforce are a primary driver of personnel costs.

- Operational Infrastructure: This includes technology platforms, cybersecurity, and customer support systems.

- General & Administrative: Legal, compliance, marketing, and office-related expenses fall under this category.

- Headcount Growth: Expansion in engineering, product, and compliance teams directly correlates with rising personnel expenses.

Security and Insurance Costs

Coinbase dedicates substantial resources to security infrastructure. This includes advanced technologies like cold storage for the majority of digital assets and multi-factor authentication to safeguard user accounts. These investments are ongoing, reflecting the dynamic nature of cybersecurity threats and the need for constant vigilance.

Furthermore, Coinbase maintains comprehensive insurance policies to protect customer funds. This coverage acts as a critical safety net, offering recourse in the unlikely event of a security breach or loss of assets. The commitment to these insurance measures underscores Coinbase's dedication to user asset protection and fostering trust within its ecosystem.

- Security Infrastructure: Significant investment in cold storage, multi-factor authentication, and ongoing cybersecurity enhancements.

- Insurance Coverage: Policies in place to insure user funds against certain types of losses, bolstering trust and asset protection.

- Operational Costs: These security and insurance expenditures represent a material component of Coinbase's operating expenses, essential for maintaining platform integrity and user confidence.

Coinbase's cost structure is heavily influenced by its technology and development investments, aiming to maintain a competitive edge and enhance user experience. For instance, in 2023, technology and development expenses reached $996 million, underscoring the commitment to platform innovation and infrastructure. These costs are crucial for supporting a wide range of services in the rapidly evolving digital asset market.

Operating expenses, including personnel, marketing, and general administrative costs, form another significant portion of Coinbase's expenditure. In 2023, total operating expenses were $3.7 billion, a decrease from $5.6 billion in 2022, reflecting efforts to optimize spending. These costs are essential for scaling operations, acquiring new users, and ensuring regulatory compliance.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

|---|---|---|

| Technology & Development | 996 | Cloud services, data centers, software development |

| Operating Expenses (Total) | 3,700 | Personnel, marketing, G&A, legal, compliance |

| Marketing & Sales | Estimated 1,400 (portion of OpEx) | Advertising, user acquisition, referral programs |

Revenue Streams

Coinbase's main income comes from fees it charges for cryptocurrency transactions. This includes buying, selling, and converting digital assets. Both individual investors and larger institutions pay these fees.

The amount of the fee depends on a few things, like how much crypto is being traded and how the trade is made. For instance, a maker-taker fee structure is common, where different fees apply depending on whether you add liquidity to the market or take it away. Retail trading is a significant contributor to this revenue stream.

In the first quarter of 2024, Coinbase reported that trading volume increased, leading to higher transaction fee revenue. This highlights the direct correlation between market activity and Coinbase's core earnings. For example, in Q1 2024, total trading volume reached $228 billion, a substantial jump from the previous year.

Coinbase's subscription and services revenue encompasses a variety of offerings beyond simple trading fees. This includes income from Coinbase One subscriptions, which provide enhanced benefits to users, as well as staking services where customers earn rewards on their cryptocurrency holdings. For institutional clients, custodial fees represent a significant portion of this segment, reflecting the trust placed in Coinbase for secure asset management.

This diversified revenue stream has demonstrated robust growth, offering a more predictable and less volatile income source compared to the often-cyclical transaction fees. For instance, in the first quarter of 2024, subscription and services revenue reached $306 million, a notable increase from previous periods, highlighting its growing importance to Coinbase's overall financial health. Stablecoin-related income also contributes to this segment, further diversifying its earnings base.

Coinbase generates significant interest income by holding stablecoins, most notably USDC. This revenue stream is directly tied to the growth in stablecoin usage and balances on the platform, demonstrating a clear correlation between user activity and Coinbase's earnings. For instance, in Q1 2024, Coinbase reported substantial interest income from its crypto asset holdings, including stablecoins, contributing to its overall profitability.

Custody Fees from Institutional Clients

Custody fees from institutional clients represent a substantial revenue stream for Coinbase, particularly through its Coinbase Prime offering. These fees are generated by providing secure, institutional-grade custody solutions for significant investors and businesses holding digital assets. For example, in the first quarter of 2024, Coinbase reported that institutional trading volumes and custody balances contributed to its overall revenue, reflecting the ongoing demand for these specialized services.

These services typically involve substantial minimum deposit requirements and annual custody charges, establishing a predictable and robust income source. This segment is crucial for Coinbase's strategy to serve the growing institutional market. The company's ability to attract and retain large clients underscores the trust placed in its security infrastructure and regulatory compliance.

- Institutional Custody: Secure storage of digital assets for large investors and businesses.

- Revenue Driver: Annual custody fees and potential transaction-related charges contribute significantly.

- Coinbase Prime: This service line is a primary vehicle for delivering institutional custody solutions.

- Market Trust: The ability to attract and retain institutional clients highlights confidence in Coinbase's security and compliance.

Blockchain Rewards (Staking)

Coinbase generates revenue through blockchain rewards, specifically by facilitating staking services for proof-of-stake cryptocurrencies. They act as an intermediary, allowing users to earn passive income on their digital assets while taking a commission on the rewards. This service is particularly attractive to users seeking yield on their crypto holdings.

This revenue stream is further amplified for Coinbase One subscribers, who often benefit from reduced fees or enhanced staking rewards. For instance, in Q1 2024, Coinbase reported a significant portion of its revenue coming from trading fees, but staking services are a growing contributor to its diversified income model.

- Staking as a Service: Coinbase earns a commission on staking rewards generated by users through its platform.

- Passive Income for Users: The service enables users to earn passive income on their cryptocurrency holdings.

- Coinbase One Enhancement: Premium subscribers often receive preferential terms on staking services.

- Growing Revenue Stream: Staking rewards represent an increasingly important, recurring revenue source for Coinbase, complementing its trading-based income.

Coinbase's revenue streams are multifaceted, extending beyond just trading fees to include a growing subscription and services segment. This diversification helps to create a more stable income base, less susceptible to the volatility of cryptocurrency markets. In the first quarter of 2024, subscription and services revenue reached $306 million, demonstrating its increasing importance.

Interest income from stablecoin holdings, such as USDC, is another key revenue generator. This income is directly linked to the platform's user activity and the amount of stablecoins held. Furthermore, institutional custody services, particularly through Coinbase Prime, generate significant revenue via annual fees for secure asset storage, reflecting strong demand from larger clients.

Coinbase also earns revenue from blockchain rewards by facilitating staking services, where users can earn passive income on their crypto. This service, often enhanced for Coinbase One subscribers, provides a recurring revenue stream that complements trading-based income. For example, Q1 2024 saw substantial interest income from crypto asset holdings, including stablecoins.

| Revenue Stream | Description | Q1 2024 Contribution (Approx.) | Key Drivers |

|---|---|---|---|

| Trading Fees | Fees from buying, selling, and converting crypto. | Majority of revenue | Trading volume, market volatility |

| Subscription & Services | Coinbase One subscriptions, staking services, other platform features. | $306 million | User adoption of premium services, staking participation |

| Interest Income | Earnings from holding stablecoins and other crypto assets. | Significant contributor | Stablecoin balances, interest rate environment |

| Custody Fees | Fees for secure storage of digital assets for institutional clients. | Substantial | Institutional client growth, assets under custody |

| Blockchain Rewards | Commissions earned on staking rewards facilitated for users. | Growing contributor | Staking participation, network growth |

Business Model Canvas Data Sources

The Coinbase Business Model Canvas is informed by a blend of internal financial data, extensive market research reports, and analysis of competitive landscapes. These sources provide the foundation for understanding customer segments, value propositions, and revenue streams.