Coinbase Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coinbase Bundle

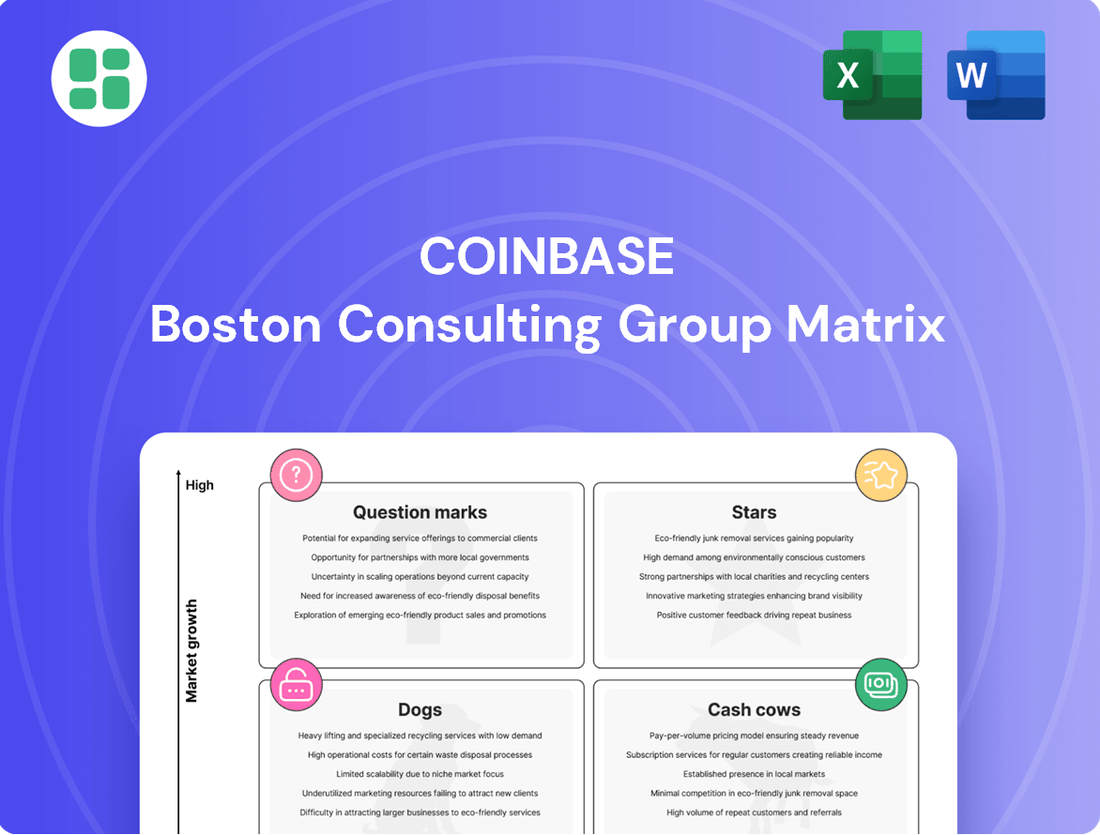

Curious about Coinbase's strategic positioning? This preview hints at its market dynamics, but the full BCG Matrix unlocks the complete picture. Discover which of Coinbase's offerings are Stars, Cash Cows, Dogs, or Question Marks, and gain actionable insights to navigate the crypto landscape.

Don't miss out on the detailed quadrant analysis and data-driven recommendations that will empower your investment and product decisions. Purchase the full Coinbase BCG Matrix report today to transform your strategic planning and secure a competitive edge.

Stars

Coinbase's staking services for Proof-of-Stake cryptocurrencies are a key growth driver, tapping into a rapidly expanding crypto segment. The company's established user base and reputation for security position it well to attract significant capital into these high-yield offerings.

This segment is experiencing robust demand, with Coinbase continuously enhancing its staking options. For instance, by the end of 2023, Coinbase reported that staking services contributed a substantial portion of its total revenue, demonstrating the service's financial impact and its potential for continued expansion as more networks adopt staking.

Coinbase Institutional, particularly through its Prime offering, is a key growth driver for Coinbase, fitting squarely into the Star category of the BCG Matrix. The increasing embrace of digital assets by institutional investors fuels a substantial demand for secure and compliant trading and custody services, a niche Coinbase Prime expertly addresses. This segment is experiencing rapid expansion as traditional finance continues its integration with digital assets, solidifying Coinbase's leadership position.

Base, Coinbase's Layer 2 blockchain, is strategically positioned to capture significant market share in the burgeoning Web3 ecosystem. Its focus on low transaction costs and developer accessibility aims to attract a wide range of decentralized applications and users. By mid-2024, the total value locked (TVL) in Base had surpassed $2 billion, demonstrating strong early adoption and growth momentum.

Global Expansion into Developed Crypto Markets

Coinbase's strategic push into developed markets with clear crypto regulations is a key growth driver. By entering regions like parts of Europe and Asia where digital asset interest is high and regulatory frameworks are becoming clearer, Coinbase can capitalize on burgeoning demand. This expansion taps into new user segments and increases overall trading volume.

In 2024, Coinbase has been actively pursuing this strategy, aiming to solidify its presence in these lucrative territories. For instance, the company has focused on obtaining licenses and building out local operations in key European Union countries, anticipating a significant influx of institutional and retail investors as regulations mature.

- Market Penetration: Targeting developed economies with established financial infrastructure and increasing crypto awareness.

- Regulatory Advantage: Focusing on jurisdictions with clear and supportive regulatory frameworks to ensure long-term operational stability.

- User Acquisition: Leveraging brand recognition to attract new users and capture market share in these growing regions.

- Revenue Diversification: Expanding revenue streams through increased trading fees and potential new product offerings tailored to these markets.

Advanced Trading Products (e.g., Derivatives)

The cryptocurrency derivatives market, encompassing futures and options, is a rapidly expanding frontier. Professional traders are increasingly turning to these sophisticated instruments to manage risk and leverage positions, driving significant market growth.

Coinbase's strategic expansion into advanced trading products, such as derivatives, places it squarely within this high-growth segment. This focus is designed to attract institutional and experienced retail traders seeking more complex trading strategies.

The potential revenue from capturing a larger share of this derivatives market is substantial. However, it necessitates ongoing investment in technology, compliance, and product development to stay competitive.

- Market Growth: The global crypto derivatives market saw trading volumes exceed trillions of dollars in 2023, indicating strong demand for these products.

- Coinbase's Position: Coinbase's introduction of futures and perpetual contracts aims to capture a significant portion of this institutional and advanced retail trading activity.

- Revenue Potential: Derivatives trading typically generates higher fee revenue per dollar traded compared to spot trading, offering a lucrative avenue for Coinbase.

- Investment Needs: Continued investment in regulatory clarity, platform stability, and user experience is crucial for Coinbase to solidify its standing in this competitive space.

Coinbase's staking services are a high-growth, high-market-share offering, fitting the 'Star' category. This segment benefits from increasing adoption of Proof-of-Stake networks and Coinbase's established trust. By the end of 2023, staking contributed significantly to Coinbase's revenue, highlighting its star status and potential for continued growth as the crypto landscape evolves.

What is included in the product

This BCG Matrix overview will analyze Coinbase's offerings, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The Coinbase BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of unclear portfolio management.

Cash Cows

Coinbase's core retail spot trading for Bitcoin and Ethereum is its undeniable cash cow. This fundamental service, allowing everyday users to buy and sell these major cryptocurrencies, consistently delivers high-margin transaction fees, solidifying its position as the company's most stable and profitable revenue stream. Despite the maturing growth rate of this specific segment, its substantial market share ensures a reliable and significant cash flow with comparatively modest ongoing marketing expenditures.

Coinbase's collaboration with Circle on USD Coin (USDC) is a prime example of a cash cow within its business model. This partnership generates consistent revenue through interest earned on the reserves backing USDC, a stablecoin with robust adoption and steady usage.

The high and stable demand for USDC translates into a significant and reliable income source for Coinbase. This positions USDC as a high-market share, low-growth asset that consistently fuels the company's profitability, acting as a dependable generator of cash flow.

Coinbase's custody services for major digital assets, especially for institutional clients, represent a robust Cash Cow. These offerings provide a secure and highly trusted environment for safeguarding substantial cryptocurrency holdings, generating consistent, high-margin fees.

While the initial explosive growth phase of institutional adoption might be moderating, the established client base ensures a predictable and steady revenue stream. For instance, in Q1 2024, Coinbase reported $224 billion in total assets on platform, a significant portion of which is held in custody, underpinning the stability of this segment.

Listing Fees for Established Tokens

Coinbase's listing fees for established tokens represent a significant cash cow within its business model, aligning with the BCG Matrix's concept of mature, high-market-share products generating substantial profits with minimal reinvestment needs.

As a premier platform, Coinbase commands premium fees for listing tokens that have already demonstrated traction and meet rigorous compliance and technical standards. This makes the listing process a lucrative, high-margin revenue stream for Coinbase. For instance, while specific figures are proprietary, industry analyses suggest that listing fees for major exchanges can range from hundreds of thousands to millions of dollars per token, depending on the project's maturity and the desired level of integration.

- High Revenue Generation: Listing fees contribute significantly to Coinbase's top line, capitalizing on the demand from established crypto projects seeking enhanced visibility and liquidity.

- Low Operational Cost: Once the listing infrastructure and vetting processes are established, the ongoing operational costs associated with adding new, pre-vetted tokens are relatively low.

- Market Dominance: Coinbase's strong market position allows it to charge substantial fees, reflecting the immense value and access a listing provides to its user base.

Coinbase Wallet (Core Self-Custody Functionality)

Coinbase Wallet's core self-custody feature, enabling users to securely manage their major cryptocurrencies, is a cornerstone of its appeal and a significant driver of user adoption. This fundamental offering has solidified its position as a trusted solution for retail investors prioritizing control over their digital assets.

While Coinbase continuously innovates with new features that might be considered Question Marks in the BCG matrix, the underlying wallet service itself has captured a substantial market share. This strong market position is a testament to its reliability and user-friendliness in the self-custody space.

The wallet acts as a sticky product, fostering deep user engagement within the broader Coinbase ecosystem. Its stability provides a reliable foundation for users to access and utilize other Coinbase services, reinforcing customer loyalty and retention.

- High Adoption: Coinbase Wallet is a leading self-custody solution, with millions of active users securing their digital assets.

- Market Share: It holds a significant share of the retail self-custody wallet market, demonstrating strong user trust and preference.

- Ecosystem Stickiness: The wallet enhances user retention by integrating seamlessly with other Coinbase products and services.

- Revenue Stability: As a foundational product, it provides a stable platform that supports revenue generation from other offerings.

Coinbase's established retail spot trading for Bitcoin and Ethereum is a prime example of a cash cow. This core service, with its high transaction volumes, generates consistent, high-margin revenue. Despite the segment's growth maturing, its substantial market share ensures predictable cash flow with relatively low marketing investment.

The USD Coin (USDC) partnership with Circle functions as a significant cash cow. Coinbase earns revenue from interest on reserves backing USDC, a stablecoin with widespread adoption and consistent usage. This stable, high-market-share asset provides reliable cash generation for the company.

Coinbase's institutional custody services for major digital assets are a strong cash cow. These services offer secure storage for substantial crypto holdings, generating consistent, high-margin fees. As of Q1 2024, Coinbase held $224 billion in assets on its platform, highlighting the scale and stability of this segment.

| Product/Service | BCG Category | Key Characteristics | Supporting Data (as of Q1 2024) |

|---|---|---|---|

| Retail Spot Trading (BTC/ETH) | Cash Cow | High transaction volume, mature growth, stable revenue | Significant portion of total trading volume |

| USD Coin (USDC) | Cash Cow | High adoption, stablecoin reserves, interest income | Consistent revenue stream from reserves |

| Institutional Custody | Cash Cow | Secure asset storage, high-margin fees, established clients | $224 billion total assets on platform |

Delivered as Shown

Coinbase BCG Matrix

The Coinbase BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic insight, will be delivered to you without any watermarks or demo content, ready for immediate application in your business planning.

Rest assured, the Coinbase BCG Matrix report you see here is the identical, final version that will be sent to you after completing your purchase. It represents a professionally crafted strategic tool, offering a clear breakdown of Coinbase's product portfolio, and will be instantly available for download and use.

What you are previewing is the actual, unedited Coinbase BCG Matrix document that will be yours once purchased. This means you'll receive a complete, analysis-ready file that you can directly utilize for presentations, strategic decision-making, or further internal review.

The Coinbase BCG Matrix document you are currently reviewing is the precise file you will download after your purchase. This preview showcases the professional design and analytical depth of the complete report, ensuring you know exactly what strategic asset you are acquiring.

Dogs

Coinbase's NFT marketplace, despite early enthusiasm, finds itself in a challenging position within the BCG Matrix, likely categorized as a Dog. While Coinbase invested heavily, the platform has struggled to gain traction against dominant players, failing to secure a significant market share. This underperformance is exacerbated by a general cooling of the NFT market, with trading volumes seeing a substantial decline throughout 2023 and into early 2024.

The current state of Coinbase's NFT marketplace reflects a low-growth market segment where the company also holds a low market share. This combination means resources are being allocated to a product that isn't generating substantial returns, a hallmark of a Dog in the BCG framework. For instance, while the peak of NFT trading in 2021 saw billions in monthly volume, by late 2023 and early 2024, this figure had fallen dramatically, impacting all marketplaces, including Coinbase's.

Within Coinbase's extensive crypto offerings, certain older or less prominent altcoins see very little trading activity and thus generate minimal revenue. For instance, while specific figures for low-volume coins are proprietary, the overall market for many smaller altcoins has struggled to gain traction, with some experiencing daily trading volumes in the tens of thousands of dollars, a stark contrast to major cryptocurrencies.

Despite their low revenue generation, maintaining these listings still involves ongoing operational, compliance, and technological expenses for Coinbase. These costs are associated with ensuring the security and integrity of the platform for every listed asset, regardless of its trading volume.

These assets fall into a low-growth, low-market share category. They consume valuable resources without making a substantial contribution to Coinbase's overall profitability, positioning them as prime candidates for a strategic review, potentially leading to delisting to optimize resource allocation.

Coinbase's portfolio includes several experimental or niche products that haven't captured significant market share. These ventures, often launched with the hope of tapping into new user segments or innovative technologies, have generally struggled to achieve profitability or widespread adoption. For instance, some localized staking services or early-stage blockchain integrations, while technically interesting, did not resonate with the broader user base.

These underperforming products typically reside in the Dogs quadrant of the BCG Matrix, characterized by low growth and low market share. They represent investments that have not yielded the expected returns, potentially draining resources without contributing to Coinbase's overall growth strategy. The company must carefully manage these assets, deciding whether to divest, pivot, or continue minimal support.

Underperforming International Market Ventures

Underperforming international market ventures represent Coinbase's 'Dogs' in the BCG matrix. These are markets where significant investment has been made, but traction remains minimal. This can be due to fierce local competition, navigating intricate regulatory landscapes, or simply lower rates of cryptocurrency adoption. For instance, while Coinbase has a global presence, certain smaller European or Asian markets might fall into this category, consuming resources without generating substantial revenue or market share gains. In 2023, the company continued to focus on optimizing operations in its existing markets, signaling a potential re-evaluation of less successful international ventures.

These ventures can become cash traps, demanding capital for operations and compliance without delivering the expected returns. The challenge lies in identifying when to divest or significantly restructure these operations. For example, if a particular country's regulatory framework becomes overly burdensome or if local competitors have established an insurmountable lead, continued investment might not be strategically sound. The company's financial reports often detail international segment performance, which can highlight these areas of concern.

- Limited Market Share: Ventures in markets with low crypto adoption rates struggle to gain meaningful user bases.

- High Operating Costs: Navigating complex local regulations and compliance can significantly increase expenses.

- Intense Local Competition: Established local exchanges or platforms may present a formidable barrier to entry.

- Resource Drain: Capital and management attention are diverted from more promising growth opportunities.

Legacy Internal Systems or Redundant Infrastructure

Legacy internal systems or redundant infrastructure within a company like Coinbase represent assets that are no longer contributing significantly to growth or competitive advantage. These are the technological relics that consume valuable resources without offering a clear return on investment. For instance, older database systems or outdated customer relationship management platforms might require substantial upkeep but don't support new product development or enhanced user experiences.

These legacy components often drain IT budgets and personnel, diverting them from more strategic initiatives. In 2024, companies are increasingly focused on digital transformation, making outdated systems a significant drag on progress. For example, a financial institution might find that its legacy trading platform, while functional, cannot support the real-time data processing required for modern algorithmic trading strategies, leading to a loss of market share.

The challenge with such assets is their potential to hinder innovation and scalability. Consider a scenario where a company's core infrastructure cannot handle increased user traffic, directly impacting revenue potential during peak periods. This was a common issue for many online services during periods of rapid growth before they invested in modern cloud-based solutions.

- Resource Drain: Legacy systems often require specialized, and sometimes scarce, IT expertise for maintenance, diverting skilled personnel from innovation.

- Lack of Competitive Edge: Outdated technology rarely provides a competitive advantage in today's fast-paced digital landscape.

- Scalability Issues: Inability to scale efficiently with demand can directly limit revenue growth and customer satisfaction.

- High Maintenance Costs: Ongoing support and patching for aging systems can represent a significant, non-productive operational expense.

Coinbase's NFT marketplace, despite initial investment, struggles with low market share and a declining NFT market, positioning it as a Dog. Similarly, certain low-volume altcoins and underperforming international ventures also fit this category, consuming resources without significant returns.

These "Dogs" represent areas where Coinbase has invested but hasn't achieved substantial traction or profitability. The company must strategically manage these assets, considering divestment or restructuring to optimize resource allocation towards more promising growth areas. For instance, the NFT market saw a significant drop in trading volumes from its 2021 peak, impacting all participants.

Legacy internal systems also fall into the Dog category, requiring maintenance without contributing to competitive advantage or innovation. In 2024, the focus on digital transformation makes these outdated systems a considerable drag on progress, potentially hindering scalability and increasing operational costs.

The following table illustrates the characteristics of Coinbase's "Dogs" based on the BCG Matrix framework:

| Category | Market Growth | Market Share | Example | Strategic Consideration |

|---|---|---|---|---|

| Dogs | Low | Low | Coinbase NFT Marketplace | Divest or minimize investment |

| Dogs | Low | Low | Low-volume Altcoins | Delist or consolidate |

| Dogs | Low | Low | Underperforming International Ventures | Restructure or exit |

| Dogs | Low | Low | Legacy Internal Systems | Modernize or replace |

Question Marks

Coinbase's strategic focus on new DeFi integrations positions it within a rapidly expanding market, but user adoption for complex dApps may lag. While the total value locked (TVL) in DeFi protocols reached over $200 billion in early 2024, Coinbase's direct engagement with these advanced protocols is still developing.

Successfully capturing market share in this segment necessitates substantial investment in user education to demystify complex dApps and ensure seamless integration. Coinbase also faces the challenge of robust risk management in a dynamic DeFi landscape, a critical factor for sustained growth and user trust.

Coinbase Ventures, as part of its strategic investment approach, focuses on early-stage blockchain and cryptocurrency startups. This sector is characterized by rapid growth potential alongside significant inherent risks. For instance, in 2024, venture capital funding in crypto remained robust, though selective, with a notable emphasis on infrastructure and DeFi projects.

While some Coinbase Ventures investments could mature into future Stars, many are likely to remain Question Marks. These are companies that show promise but haven't yet demonstrated a clear path to substantial market share or direct profitability for Coinbase. This portfolio segment demands ongoing scrutiny to determine the optimal allocation of resources.

The capital deployed into these ventures represents a portfolio of Question Marks, each requiring rigorous evaluation. Decisions regarding continued investment, strategic pivots, or potential divestment are critical for managing risk and optimizing the overall venture portfolio's performance. By mid-2024, Coinbase Ventures had a diverse portfolio, with a significant portion still in the early, uncertain stages of development.

Web3 gaming is a burgeoning sector, experiencing rapid growth and attracting substantial investment, with the global blockchain gaming market projected to reach $132.2 billion by 2028, according to Statista. Coinbase's current presence in this nascent field, while potentially growing, likely represents a small market share as the ecosystem is still developing. This positions Web3 gaming as a potential star or question mark for Coinbase, depending on their strategic focus and execution.

Expansion into Highly Regulated or Untapped International Markets

Expanding into highly regulated or untapped international markets, such as parts of Asia, Africa, and Latin America, offers significant long-term growth prospects. These regions often have large populations with limited access to traditional financial services and a rapidly growing interest in digital technologies.

Coinbase's current presence in these emerging markets is likely minimal, necessitating substantial investment. This investment would focus on tailoring strategies to local needs, navigating complex regulatory landscapes, and educating potential users about cryptocurrency. For instance, in 2024, many African nations saw a surge in crypto adoption, with Nigeria leading in transaction volume, highlighting the potential but also the need for localized approaches.

- High Growth Potential: Untapped markets offer access to large, unbanked populations eager for digital financial solutions.

- Significant Investment Required: Localized strategies, regulatory compliance, and market education demand considerable resources.

- Regulatory Hurdles: Navigating diverse and often stringent regulations in new territories is a key challenge.

- Market Education: Building trust and understanding of cryptocurrency is crucial for user adoption in these regions.

Advanced AI/Machine Learning Crypto Tools and Services

The integration of AI and machine learning into cryptocurrency is a rapidly evolving area, promising enhanced trading, analytics, and security. Coinbase's ventures in this space, while innovative, are likely in their nascent stages, reflecting a significant investment in research and development rather than established market dominance. These advanced tools and services represent a strategic bet on future growth, positioning Coinbase to potentially lead in a technologically driven sector.

Coinbase's AI/ML offerings, though promising, would currently fall into the 'Question Marks' category of the BCG Matrix. This signifies high growth potential within the market but a low current market share for Coinbase's specific products. For instance, while the broader AI in finance market was projected to reach $25.6 billion by 2026, Coinbase's share of AI-driven crypto tools would be a fraction of that. Significant ongoing investment in R&D is crucial to capture this future market.

- High Growth Potential: The overall market for AI in financial services, including crypto, is expanding rapidly.

- Low Market Share: Coinbase's specific AI/ML crypto tools are new and have not yet captured substantial market share.

- Significant R&D Investment: Continued investment is necessary to develop and refine these advanced capabilities.

- Future Leadership: Success in this area could establish Coinbase as a leader in AI-powered crypto services.

Question Marks represent areas where Coinbase is investing in high-growth potential markets but currently holds a low market share. These ventures require significant capital and strategic focus to develop into Stars. For example, Coinbase's foray into Web3 gaming, a market projected to reach $132.2 billion by 2028, is a prime example of a Question Mark. Similarly, their investments in emerging markets and AI/ML applications in crypto, while promising, are in early stages with substantial R&D investment needed.

These segments, like DeFi integrations and AI-driven tools, are characterized by rapid market expansion but demand considerable resources for user education, regulatory navigation, and technological advancement. Coinbase's strategic allocation of capital to these areas underscores a long-term vision for market leadership, acknowledging the inherent risks and the need for sustained effort to convert potential into market dominance.

The key challenge for these Question Marks lies in their transition to Stars. This requires not only continued investment but also successful execution in capturing market share and achieving profitability. By mid-2024, a significant portion of Coinbase Ventures’ portfolio was still in these uncertain, early-stage development phases, highlighting the critical nature of ongoing evaluation and strategic decision-making for optimizing the venture portfolio's performance.

Coinbase's strategic investments in areas like AI/ML for crypto tools, while promising, currently represent Question Marks. The broader AI in finance market was projected to reach $25.6 billion by 2026, but Coinbase's specific share in AI-driven crypto tools is nascent. Significant ongoing R&D is vital to capture this future market, aiming to establish leadership in technologically advanced crypto services.

| BCG Category | Coinbase Example | Market Growth | Market Share | Investment Need | Strategic Outlook |

|---|---|---|---|---|---|

| Question Mark | Web3 Gaming | High (Projected $132.2B by 2028) | Low | High | Develop to Star or Divest |

| Question Mark | Emerging Markets (e.g., Africa) | High (Growing crypto adoption) | Low | High (Localization, regulation) | Develop to Star or Divest |

| Question Mark | AI/ML in Crypto | High (AI in finance market growing) | Low | High (R&D intensive) | Develop to Star or Divest |

| Question Mark | DeFi Integrations | High (TVL over $200B in early 2024) | Low/Developing | High (User education, risk management) | Develop to Star or Divest |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Coinbase's financial data, cryptocurrency market research, and official regulatory filings to ensure reliable, high-impact insights.