Cognizant SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognizant Bundle

Cognizant's market position is shaped by its robust digital transformation capabilities and strong client relationships, but it also faces intense competition and evolving technology landscapes. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Cognizant's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cognizant's strong performance in key industry verticals, particularly Financial Services and Healthcare, is a significant strength. These sectors are major revenue drivers for the company, showcasing its deep expertise and ability to provide specialized solutions.

This industry focus allows Cognizant to cultivate robust client relationships within high-value segments, leading to consistent revenue growth. For instance, in the first quarter of 2024, Cognizant reported that its Financial Services segment revenue grew 1.5% year-over-year, and its Healthcare segment saw a 3.8% increase, demonstrating continued market penetration and client trust.

Cognizant's strategic focus on AI and digital transformation is a significant strength, directly addressing the market's increasing need for technology modernization. The company is actively investing in AI-led platforms and making strategic acquisitions, such as Thirdera and Belcan, to bolster its service offerings in these critical areas.

This commitment is designed to position Cognizant to capitalize on the growing demand for enterprise-grade generative AI solutions. By aligning its portfolio with these evolving client needs, Cognizant is building a strong foundation for future growth in a rapidly digitizing global economy.

Cognizant demonstrates a powerful ability to win substantial client engagements, consistently translating into impressive bookings growth. This strength is clearly illustrated by their record trailing 12-month bookings reaching $27.8 billion. The company's success in securing these large contracts underscores client trust and points to a healthy foundation for future revenue streams.

Global Presence and Diverse Service Portfolio

Cognizant's expansive global presence, operating in 48 countries as of early 2024, is a significant strength. This broad reach, coupled with a robust portfolio covering digital, technology, consulting, and operations services, enables the company to serve a wide array of client needs worldwide. This diversification allows Cognizant to capitalize on international market growth and effectively manage regional economic fluctuations.

The company's diverse service offerings are a key advantage, allowing it to act as a comprehensive partner for clients navigating complex digital transformations. This breadth of services, from cloud migration to AI implementation, positions Cognizant to capture market share across various technology segments. For instance, in Q1 2024, Cognizant reported strong demand in its digital engineering and cloud services, highlighting the relevance of its diverse portfolio.

- Global Footprint: Operations in 48 countries, providing access to diverse talent pools and markets.

- Comprehensive Service Portfolio: Encompasses digital, technology, consulting, and operations, catering to end-to-end client needs.

- Market Adaptability: Ability to leverage international growth and mitigate regional risks through diversified operations and service offerings.

Healthy Financial Position and Shareholder Returns

Cognizant consistently demonstrates robust financial health, underscored by strong operating cash flow and sustained profitability. This financial stability underpins its commitment to rewarding shareholders.

The company's performance in the first half of 2025 reflects this strength, with reported increases in net income and operating margins. For instance, Q1 2025 saw a net income of $600 million, a 7% increase year-over-year, while Q2 2025 reported operating margins of 15.2%, up from 14.8% in the prior year's second quarter.

Further solidifying its shareholder return strategy, Cognizant has enhanced its capital return program for 2025. The company plans to return approximately $3.0 billion to shareholders through a combination of share repurchases and dividends, signaling management's confidence in its ongoing financial resilience and future prospects.

- Strong Cash Flow Generation: Cognizant consistently generates substantial operating cash flow, enabling strategic investments and shareholder returns.

- Improved Profitability: The company reported positive trends in net income and operating margins in Q1 and Q2 2025, indicating efficient operations.

- Enhanced Shareholder Returns: A planned $3.0 billion return to shareholders via buybacks and dividends highlights financial strength and confidence.

Cognizant's ability to secure large client contracts is a key strength, evidenced by its trailing 12-month bookings reaching $27.8 billion. This demonstrates significant client trust and provides a solid base for future revenue. The company's strategic investments in AI and digital transformation, including acquisitions like Thirdera and Belcan, further bolster its position in high-demand technology areas.

| Metric | Value (as of H1 2025) | Year-over-Year Change |

|---|---|---|

| Trailing 12-Month Bookings | $27.8 billion | N/A |

| Q1 2025 Net Income | $600 million | +7% |

| Q2 2025 Operating Margin | 15.2% | +0.4 percentage points |

| Planned Shareholder Returns (2025) | $3.0 billion | N/A |

What is included in the product

Delivers a strategic overview of Cognizant’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Cognizant's competitive landscape, helping to identify and address strategic vulnerabilities.

Weaknesses

Cognizant's fiscal year 2025 guidance points to a potential slowdown in its organic growth rate, a shift from the stronger performance seen in earlier periods. This cautious projection from management could signal underlying concerns about the global economic climate and its influence on client spending.

The company's outlook suggests that achieving future revenue targets might increasingly rely on strategic acquisitions rather than solely organic expansion, highlighting a potential challenge in maintaining momentum. For instance, while Cognizant reported a 0.7% year-over-year revenue increase to $14.4 billion in the first quarter of 2024, their full-year 2024 revenue growth forecast remained at 1% to 3%, indicating a more measured pace.

The IT services industry is exceptionally competitive, and Cognizant faces significant margin pressures, especially from Indian IT service providers who often engage in aggressive pricing strategies. This intense competition can erode profitability as companies vie for market share.

Cognizant's operating margin for 2023 stood at 14.4%, which was indeed below the industry average for many of its peers in the large-cap IT services space. This metric underscores the impact of competitive pricing and rising labor costs on the company's bottom line, necessitating ongoing efforts to enhance operational efficiency and value delivery.

Cognizant's performance isn't uniformly strong across all its business segments. While it maintains a solid footing in areas like Financial Services and Healthcare, other sectors such as Communications, Media, and Technology have shown less consistent results, with some periods experiencing revenue declines.

This unevenness across its diverse client portfolio can lead to fluctuations in overall revenue. For instance, while the company reported strong growth in its Financial Services segment in early 2024, its Communications, Media, and Technology segment saw a slowdown in the same period, impacting overall growth figures.

Challenges with Employee Attrition and Return-to-Office Mandates

Cognizant has grappled with significant employee attrition, with voluntary departures notably increasing in late 2024. This trend, coupled with the company's issuance of warnings to staff concerning compliance with return-to-office mandates, presents a considerable challenge.

These factors can negatively impact employee morale and the company's ability to retain top talent. Such issues can directly affect operational efficiency, potentially leading to disruptions in service delivery and delays in project completion, which are critical for a service-oriented business like Cognizant.

- Increased Voluntary Attrition: Voluntary attrition rates saw a rise in late 2024, impacting workforce stability.

- Return-to-Office Compliance Issues: Warnings issued to staff regarding RTO compliance suggest potential friction and dissatisfaction with workplace policies.

- Impact on Morale and Retention: These combined issues can lower employee morale and make it harder to retain skilled professionals.

- Operational Efficiency Concerns: Reduced morale and higher attrition can lead to decreased productivity and potential project delays.

Reliance on Acquisitions for Growth

A significant portion of Cognizant's recent revenue expansion, especially noticeable in 2024, has been fueled by key acquisitions such as Thirdera and Belcan. This reliance on inorganic growth presents a potential vulnerability.

If Cognizant faces challenges in achieving robust organic growth or struggles with the effective integration of these acquired businesses, its overall growth trajectory could be hampered. For instance, while Thirdera contributed significantly to the Q1 2024 results, the company must ensure continued organic momentum.

- Acquisition Dependency: Revenue growth in 2024, notably from Thirdera and Belcan, underscores a reliance on inorganic expansion.

- Integration Risk: Potential difficulties in smoothly integrating acquired companies could impede future performance.

- Organic Growth Imperative: The need to demonstrate strong internal revenue generation remains critical alongside acquisition strategies.

Cognizant's reliance on acquisitions for growth, exemplified by the 2024 contributions of Thirdera and Belcan, introduces integration risks and highlights a potential weakness in organic revenue generation. Should these acquired entities not perform as expected or if integration proves challenging, the company's overall growth could be significantly impacted.

Furthermore, the company faces intense competition, particularly from Indian IT firms employing aggressive pricing strategies, which puts pressure on Cognizant's operating margins. Its 2023 operating margin of 14.4% lagged behind industry averages, underscoring this challenge.

Increased voluntary attrition in late 2024, coupled with compliance issues related to return-to-office mandates, suggests potential internal friction that could affect employee morale and the retention of key talent, impacting operational efficiency and service delivery.

Cognizant's performance is also uneven across its business segments; while Financial Services and Healthcare remain strong, sectors like Communications, Media, and Technology have experienced revenue slowdowns, creating volatility in its overall financial results.

Same Document Delivered

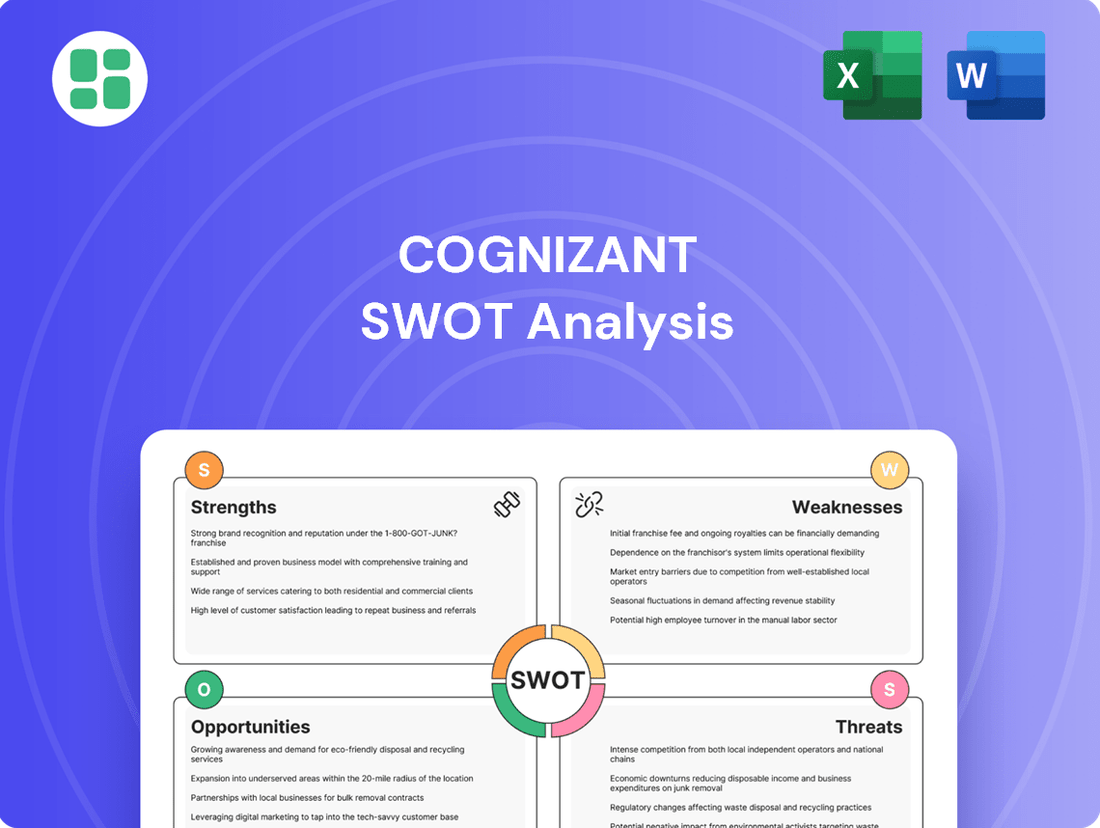

Cognizant SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Cognizant's strategic position.

This is a real excerpt from the complete document, showcasing the comprehensive insights into Cognizant's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The rapid expansion of AI and digital transformation across all sectors provides a prime opportunity for Cognizant. As companies worldwide prioritize modernizing their systems, the demand for expert assistance in these areas is soaring. This trend directly aligns with Cognizant's strategic focus and service offerings.

Cognizant is well-positioned to leverage this trend, having made significant investments in AI-focused initiatives like its AI Research Lab and Agent Foundry. These efforts are designed to capture a share of the burgeoning global AI services market, which analysts predict will see robust expansion in the coming years, offering substantial revenue potential.

Cognizant's expansion into emerging markets presents a significant growth opportunity. Targeting regions such as Asia-Pacific, Latin America, and burgeoning R&D hubs like the Philippines, Vietnam, Thailand, and China can unlock substantial new client bases and revenue streams.

These markets offer not only diversification but also potential cost efficiencies in service delivery, a critical factor in the competitive IT services landscape. For instance, the IT-BPM sector in the Philippines has seen consistent growth, with revenues projected to reach $30 billion by 2025, indicating a fertile ground for expansion.

Cognizant's strategic partnerships are a significant opportunity for growth. By forming alliances with key technology providers and other service firms, Cognizant can broaden its service portfolio, extend its market presence, and accelerate innovation. For instance, its expanded collaborations with giants like Google Cloud, Salesforce, and Pegasystems are crucial for delivering advanced, end-to-end solutions that meet evolving client demands.

Increasing Need for Cybersecurity and Data Analytics Services

The escalating demand for robust cybersecurity and advanced data analytics solutions presents a significant growth avenue for Cognizant. Enterprises are channeling increased investment into these domains, recognizing their criticality in safeguarding sensitive information and deriving actionable insights from vast datasets.

Cognizant is well-positioned to capitalize on this trend, leveraging its established expertise in artificial intelligence, sophisticated analytics, and comprehensive cybersecurity services. The continuous rise in data volumes, coupled with the ever-evolving landscape of cyber threats, necessitates businesses seeking resilient and intelligent solutions, directly aligning with Cognizant's strategic focus.

- Market Growth: The global cybersecurity market is projected to reach $345.4 billion by 2026, growing at a CAGR of 13.4%.

- Data Analytics Adoption: By 2025, businesses are expected to generate over 180 zettabytes of data globally, fueling the need for analytics services.

- Cognizant's Investment: Cognizant has been actively expanding its capabilities in AI and data analytics, including strategic acquisitions to bolster its offerings in these high-demand areas.

- Client Demand: A significant portion of Cognizant's recent revenue growth has been attributed to its digital transformation services, which heavily incorporate cybersecurity and data analytics.

Leveraging Agentic AI for Hyperproductivity

The rise of agentic AI, which refers to AI systems capable of independent action and goal achievement, presents a significant opportunity for Cognizant. This technology allows for more sophisticated automation and a boost in productivity for clients. For instance, Cognizant can leverage these advanced AI capabilities to help businesses fundamentally rethink their operational models, leading to enhanced efficiency and the creation of new market avenues.

Cognizant is well-positioned to capitalize on this trend. By developing and implementing agentic AI solutions, the company can enable enterprises to achieve hyperproductivity. This could translate into tangible benefits, such as a projected 20-30% increase in operational efficiency for early adopters, as reported by industry analysts in late 2024. Such advancements are crucial for clients seeking to stay competitive in a rapidly evolving digital landscape.

- Enhanced Client Value: Agentic AI allows Cognizant to offer solutions that go beyond traditional automation, driving deeper business transformation for clients.

- New Service Offerings: The development of agentic AI capabilities opens doors for new, high-value consulting and implementation services in AI-driven operational redesign.

- Market Leadership: Early and effective adoption of agentic AI can solidify Cognizant's position as a leader in AI-powered business solutions, attracting clients seeking cutting-edge innovation.

- Productivity Gains: By enabling clients to reimagine work, workplaces, and the workforce, agentic AI can unlock significant productivity gains, potentially boosting client ROI by 15-25% in key areas by 2025.

The increasing global demand for digital transformation and AI integration presents a substantial opportunity for Cognizant. Companies worldwide are actively seeking to modernize their IT infrastructures and adopt advanced technologies, a trend that directly plays to Cognizant's strengths and strategic investments in areas like AI and cloud services. This surge in demand is expected to continue through 2025 and beyond, offering significant revenue growth potential.

Cognizant's focus on expanding into emerging markets, such as Asia-Pacific and Latin America, provides a fertile ground for new client acquisition and revenue diversification. These regions are experiencing rapid economic growth and increasing adoption of digital technologies, creating a strong demand for IT services. For example, the IT-BPM sector in the Philippines alone was projected to reach $30 billion in revenues by 2025, highlighting the lucrative nature of these markets.

The company's strategic partnerships with leading technology providers like Google Cloud, Salesforce, and Microsoft are crucial for expanding its service portfolio and market reach. These collaborations enable Cognizant to offer integrated, end-to-end solutions that address complex client needs in areas such as cloud migration, data analytics, and cybersecurity, thereby enhancing its competitive edge and client value proposition.

The escalating need for robust cybersecurity and advanced data analytics solutions represents another significant growth avenue. As data volumes surge and cyber threats evolve, businesses are prioritizing investments in these critical areas. Cognizant's established expertise in AI, sophisticated analytics, and comprehensive cybersecurity services positions it to effectively meet this demand, with the global cybersecurity market projected to reach $345.4 billion by 2026.

| Opportunity Area | Market Projection/Data Point | Cognizant's Relevance |

|---|---|---|

| Digital Transformation & AI | Global AI services market expected to grow significantly through 2025. | Aligns with Cognizant's core strategy and investments. |

| Emerging Markets Expansion | Philippines IT-BPM sector projected at $30B revenue by 2025. | Offers diversification and new client bases. |

| Strategic Partnerships | Collaborations with Google Cloud, Salesforce, Microsoft. | Enables comprehensive, integrated solutions. |

| Cybersecurity & Data Analytics | Global cybersecurity market to reach $345.4B by 2026. | Addresses critical enterprise needs with existing expertise. |

Threats

Cognizant operates in a highly competitive IT services sector, contending with global powerhouses like Accenture and prominent Indian firms such as Tata Consultancy Services (TCS) and Infosys. This crowded market demands constant innovation and strategic pricing to secure and grow its customer base.

To thrive amidst this intense rivalry, Cognizant must consistently deliver differentiated services and adapt its pricing models. For instance, Accenture reported revenues of $64.1 billion for fiscal year 2023, while TCS posted ₹226,815 crore (approximately $27.2 billion) for FY24, highlighting the scale of competitors Cognizant must outmaneuver.

Ongoing macroeconomic uncertainties, such as elevated capital costs and persistent inflation, are causing businesses to scale back on discretionary IT investments. This cautious approach directly impacts Cognizant by potentially slowing revenue growth and shifting client priorities from large-scale transformation projects to more immediate cost-saving measures.

For instance, in the first quarter of 2024, Cognizant's revenue saw a slight decline of 0.4% year-over-year, reaching $4.41 billion, partly attributed to clients re-evaluating their spending in response to economic headwinds. This trend suggests a challenging environment where the demand for extensive IT overhauls may be tempered by a focus on operational efficiency and budget optimization.

Cognizant, like many in the IT services sector, faces significant cybersecurity risks. Handling vast amounts of sensitive client data makes the company a prime target for cyberattacks. A successful breach could lead to substantial financial penalties, severe reputational damage, and a loss of client trust, impacting future business opportunities.

The threat landscape is constantly evolving, and maintaining cutting-edge cybersecurity defenses is a continuous challenge. Reports of alleged data leaks in the industry underscore the persistent nature of these threats. For Cognizant, robust security protocols and rapid incident response are critical to mitigating these risks and protecting client information.

Impact of AI on Traditional IT Services

The increasing sophistication of Artificial Intelligence (AI) poses a significant threat to traditional IT services by automating many routine tasks. This automation can directly reduce the demand for legacy IT support and maintenance services, impacting revenue streams for companies like Cognizant. For instance, AI-powered chatbots and automated diagnostic tools can handle a substantial volume of customer queries and system troubleshooting, areas that previously required human intervention.

To counter this, Cognizant needs to proactively adapt its workforce and service offerings. This involves reskilling employees to focus on higher-value, AI-integrated solutions rather than purely transactional tasks. The company's strategy must emphasize a pivot towards developing and managing AI-driven platforms, data analytics, and specialized consulting to remain competitive and relevant in this evolving market. Failure to adapt could lead to a decline in market share as clients increasingly opt for AI-native solutions.

- AI Automation Threat: AI's ability to automate routine IT tasks like help desk support and basic system monitoring directly challenges traditional service models.

- Demand Reduction: This automation can lead to a decreased demand for legacy IT services, potentially impacting Cognizant's revenue from these areas.

- Workforce Adaptation: Cognizant must invest in reskilling its workforce to handle more complex, AI-centric roles and services.

- Strategic Pivot: A successful strategy involves shifting focus to AI-driven solutions, advanced analytics, and specialized consulting to maintain market relevance.

Talent Retention and Wage Inflation

The intense competition for tech talent, especially in cutting-edge fields like artificial intelligence, is fueling significant wage inflation. This makes it harder for companies like Cognizant to keep their best people. For instance, in 2024, the average salary for AI engineers in the US saw an estimated increase of 15-20% compared to the previous year, according to industry reports.

If Cognizant cannot match these rising compensation expectations or provide compelling career growth paths, it risks higher employee turnover. This attrition directly impacts project delivery timelines and the overall quality of services offered to clients. In 2023, IT services firms, on average, experienced attrition rates of around 20%, a figure that could worsen if talent retention strategies aren't robust.

- Rising Demand for AI Specialists: The market for AI and machine learning professionals is exceptionally tight, driving up salary expectations.

- Competitive Compensation Pressures: Cognizant faces pressure to increase wages to retain talent against aggressive offers from competitors.

- Impact of Attrition on Service Delivery: High employee turnover can disrupt project continuity and degrade service quality for clients.

- Talent Development as a Retention Tool: Investing in upskilling and clear career progression is crucial to combatting retention challenges.

The increasing sophistication of Artificial Intelligence (AI) presents a significant threat by automating routine IT tasks, potentially reducing demand for traditional services. This necessitates a strategic pivot towards AI-driven solutions and reskilling the workforce to handle more complex roles. Furthermore, intense competition for specialized tech talent, particularly in AI, is driving wage inflation, making talent retention a critical challenge with potential impacts on service delivery quality and project timelines.

SWOT Analysis Data Sources

This Cognizant SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry commentary to ensure a well-rounded and accurate strategic assessment.