Cognizant Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognizant Bundle

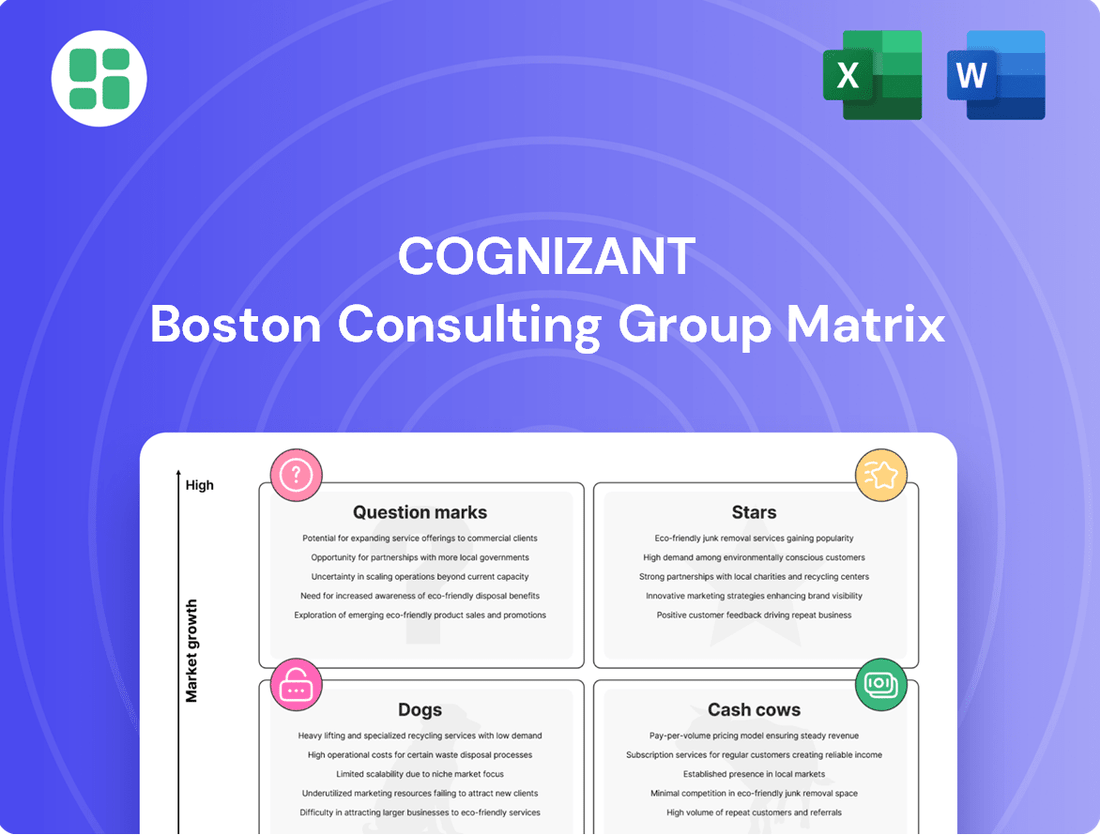

Unlock the strategic potential of this company's product portfolio with a clear view of its Stars, Cash Cows, Dogs, and Question Marks. This preview offers a glimpse into the power of the BCG Matrix, but for actionable insights and a complete strategic roadmap, purchase the full version today.

Stars

Generative AI and AI-led transformation services are a significant growth driver for Cognizant, reflecting substantial investments in AI platforms and expertise. The company reported over 2,500 early Generative AI client engagements in Q2 2025, a notable jump from the previous quarter, indicating strong market traction. This surge is supported by nearly 30% of Cognizant's code now being AI-generated, showcasing deep integration and capability.

Cloud modernization and cloud-native transformation are key growth drivers for Cognizant, reflecting the broad market shift towards cloud adoption. Services like Cognizant Skygrade are in high demand as clients seek to streamline operations and enhance agility in dynamic markets. This segment is vital for businesses aiming to leverage the full potential of cloud technologies.

Cognizant's cybersecurity services, particularly its AI-driven Neuro® Cybersecurity platform, are positioned as Stars in the BCG Matrix. The escalating sophistication of cyber threats makes these offerings essential for businesses worldwide. In 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the immense demand for advanced solutions like Cognizant's.

The integration of AI within Neuro® Cybersecurity allows Cognizant to offer proactive threat detection and response, a critical differentiator in a rapidly evolving threat landscape. This focus on innovation and high-growth potential solidifies its Star status, as clients increasingly prioritize robust digital defenses to ensure business continuity and maintain customer trust.

Industry-Specific Digital Solutions (e.g., Health Sciences, Financial Services)

Cognizant's deep industry and domain expertise, especially in Health Sciences and Financial Services, enables the creation of specialized digital solutions that foster substantial growth. These sectors demonstrated robust revenue expansion in the second quarter of 2025.

Large deal wins in these verticals underscore client trust and Cognizant's leading market position. The company's skill in customizing digital transformation for unique industry requirements enhances the value of these solutions.

- Health Sciences: Reported strong revenue growth in Q2 2025, driven by demand for digital health platforms and data analytics.

- Financial Services: Saw significant revenue increases in Q2 2025, fueled by digital transformation initiatives in banking and insurance.

- Specialized Solutions: Cognizant's ability to tailor digital offerings to specific industry needs, such as AI-powered diagnostics in health or blockchain in finance, drives client adoption.

- Market Leadership: Large deal wins in these sectors in the first half of 2025 indicate strong client confidence and Cognizant's established market presence.

Product Engineering and Digital Engineering Services

Cognizant's Product Engineering and Digital Engineering Services are a strong contender in the BCG matrix, likely positioned as a Star. This segment benefits from Cognizant's strategic acquisitions, including Belcan and Mobica, which bolster its capabilities in areas like smart products and connected mobility. The demand for transforming from chip to cloud remains exceptionally high, driving growth in this sector.

The company demonstrates significant practice maturity in product and digital engineering, allowing it to capitalize on the increasing need for advanced engineering solutions. This expertise is crucial for clients looking to innovate across the entire product lifecycle. Cognizant's investment in these areas reflects a commitment to leading a rapidly expanding market.

- Market Growth: The global product engineering services market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $2.4 trillion by 2028, growing at a CAGR of around 9.8%.

- Acquisition Impact: The acquisition of Belcan in early 2024, for instance, significantly expanded Cognizant's aerospace, defense, and automotive engineering capabilities, adding approximately $800 million in annual revenue.

- Digital Transformation Focus: Companies are increasingly investing in digital engineering to accelerate product development cycles and enhance customer experiences, with a particular emphasis on IoT and AI integration.

- Cognizant's Position: Cognizant's integrated approach, from concept to cloud, and its deep domain expertise in sectors like automotive and industrial, solidify its leadership in this high-demand, high-growth segment.

Cognizant's Generative AI and AI-led transformation services are firmly positioned as Stars. The company reported over 2,500 early Generative AI client engagements in Q2 2025, a significant increase, demonstrating robust market adoption. Nearly 30% of Cognizant's code is now AI-generated, highlighting deep integration and capability.

Cybersecurity services, particularly the AI-driven Neuro® Cybersecurity platform, are also Stars. The global cybersecurity market exceeded $200 billion in 2024, underscoring the demand for advanced solutions. Neuro®'s AI integration enables proactive threat detection, a crucial differentiator.

Product Engineering and Digital Engineering Services, bolstered by acquisitions like Belcan in early 2024, are Stars. Belcan added approximately $800 million in annual revenue, enhancing aerospace and automotive capabilities. The global product engineering market is projected to exceed $2.4 trillion by 2028.

| Service Area | BCG Category | Key Growth Drivers | Supporting Data/Facts |

| Generative AI & AI Transformation | Star | High client demand, AI-driven code generation | Over 2,500 early GenAI engagements (Q2 2025); ~30% code AI-generated |

| Cybersecurity (Neuro® Platform) | Star | Escalating cyber threats, AI-powered defense | Global cybersecurity market >$200 billion (2024) |

| Product & Digital Engineering | Star | Strategic acquisitions, digital transformation needs | Belcan acquisition (early 2024) added ~$800M revenue; Market projected >$2.4T by 2028 |

What is included in the product

Strategic guidance on resource allocation, identifying which business units to invest in, hold, or divest.

The Cognizant BCG Matrix offers a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Traditional Application Development and Maintenance (ADM) continues to be a bedrock for Cognizant, representing a significant portion of its revenue. These services are essential for clients needing to keep their existing IT systems running smoothly and updated. In 2024, ADM services, while not experiencing the hyper-growth of newer digital offerings, still benefit from Cognizant's substantial market share and deep-rooted client partnerships, ensuring a predictable and robust cash flow.

Cognizant's managed infrastructure services, a cornerstone of their offerings, include the management of IT infrastructure and cloud environments. This segment is a classic Cash Cow, characterized by its high market share in a mature industry. These services are vital for clients, ensuring operational stability and cost-effectiveness, which translates into consistent and significant revenue for Cognizant.

In 2024, Cognizant's strong position in managed infrastructure services continued to be a significant revenue driver. While the market for these services is mature, Cognizant's focus on automation and efficiency improvements within this segment allows them to maintain profitability and generate substantial cash flow. This strategic approach ensures that these established services remain a reliable source of income.

Cognizant's Business Process Outsourcing (BPO) in mature sectors, such as finance and healthcare, represents a significant cash cow. These established services benefit from a vast client base and optimized, scaled operations, leading to high profit margins.

The steady profitability from these BPO services is further bolstered by minimal promotional investment requirements. In 2023, Cognizant reported that its digital, cloud, and analytics services grew significantly, but its traditional BPO segments continued to provide a stable revenue stream, underpinning its overall financial strength.

Legacy ERP Implementation and Support

Cognizant's legacy ERP implementation and support services function as a solid cash cow within its business portfolio. While the demand for new, cutting-edge ERP systems might be higher, the ongoing need for maintaining, upgrading, and integrating existing, well-established ERP platforms for large enterprises provides a predictable and stable revenue stream.

This segment benefits from Cognizant's deep-seated expertise and long-standing client relationships, which solidify its market position. The continued reliance of numerous major corporations on these foundational systems ensures a consistent demand for specialized support and enhancement services.

- Stable Revenue: Legacy ERP services contribute consistent income, unlike more volatile growth markets.

- Large Client Base: Many large enterprises continue to depend on established ERP systems, ensuring ongoing demand.

- Expertise Advantage: Cognizant's extensive experience in this area helps maintain market share and client loyalty.

- Market Share: In 2024, the global ERP market was valued at approximately $50 billion, with a significant portion attributed to maintenance and support of existing systems.

Basic Consulting and Advisory Services

Cognizant's foundational consulting and advisory services act as a stable cash cow within its business portfolio. These offerings, which focus on core strategic planning and operational enhancements, consistently generate revenue by addressing essential client needs. For instance, in 2023, Cognizant reported significant revenue from its consulting segment, reflecting the ongoing demand for these fundamental services.

These services are crucial for maintaining robust client relationships, providing a reliable income stream even when newer, more innovative solutions are being developed. They support clients in areas like process optimization and digital readiness assessments, which are evergreen requirements for businesses. This steady performance underscores their role as a dependable revenue generator.

- Steady Revenue Stream: Cognizant's basic consulting services consistently contribute to its financial stability.

- Client Relationship Management: These foundational offerings help maintain and deepen relationships with existing clients.

- Operational Improvements: Services focus on enhancing fundamental business operations and strategic planning.

- 2023 Performance: Cognizant's consulting division demonstrated strong performance in 2023, highlighting the value of these core services.

Cognizant's Application Development and Maintenance (ADM) services, a cornerstone of its business, represent a significant cash cow. These services, essential for maintaining existing client IT systems, benefit from Cognizant's substantial market share and deep client relationships. In 2024, ADM continued to provide a predictable and robust cash flow, even as newer digital offerings experienced higher growth rates.

Managed infrastructure services are another key cash cow for Cognizant, leveraging its high market share in a mature industry. These services ensure operational stability and cost-effectiveness for clients, translating into consistent revenue for Cognizant. The company's focus on automation within this segment in 2024 helped maintain profitability and generate substantial cash flow.

Cognizant's Business Process Outsourcing (BPO) in established sectors like finance and healthcare also functions as a cash cow. These services benefit from a large client base and optimized operations, leading to high profit margins. While digital services grew significantly in 2023, traditional BPO segments provided a stable revenue stream, underpinning overall financial strength.

Legacy ERP implementation and support services are a solid cash cow, addressing the ongoing need for maintaining and upgrading existing systems for large enterprises. Cognizant's deep expertise and long-standing client relationships solidify its market position in this segment, ensuring consistent demand. The global ERP market, valued at approximately $50 billion in 2024, includes a substantial portion attributed to maintenance and support of existing systems.

| Service Area | BCG Category | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Application Development & Maintenance (ADM) | Cash Cow | High market share, mature market, predictable revenue | Continued stable cash flow, strong client base |

| Managed Infrastructure Services | Cash Cow | Mature industry, operational stability focus, cost-effectiveness | Profitability maintained through automation, consistent revenue |

| Business Process Outsourcing (BPO) - Mature Sectors | Cash Cow | Large client base, scaled operations, high profit margins | Stable revenue stream, underpinning financial strength |

| Legacy ERP Implementation & Support | Cash Cow | Deep expertise, long-term client relationships, ongoing demand | Consistent demand for maintenance and upgrades |

Full Transparency, Always

Cognizant BCG Matrix

The Cognizant BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report, meticulously crafted by industry experts, provides a clear framework for analyzing your business portfolio's strategic positioning. Upon completion of your purchase, you will gain immediate access to this fully editable and professionally formatted BCG Matrix, ready for immediate integration into your strategic planning processes.

Dogs

Cognizant might possess service lines focused on older, specialized technologies with diminishing market interest. These offerings are likely situated in markets experiencing slow growth and limited avenues for future development.

Allocating significant resources to these segments would probably generate meager returns, suggesting they are prime candidates for divestment or a gradual discontinuation. For instance, if a significant portion of Cognizant's revenue in 2024 was tied to supporting mainframe systems for a shrinking client base, these would be classified as Dogs.

In the realm of highly commoditized IT support services, Cognizant likely finds itself in a challenging position within the BCG matrix. These are areas where the market is saturated, and distinguishing one provider from another becomes exceedingly difficult. Think of basic helpdesk functions or routine system maintenance; many companies can offer these, driving down prices and profitability.

Consequently, Cognizant's market share in these specific, commoditized IT support segments might be relatively low. The intense competition means it's hard to capture a significant piece of the pie, and the low margins inherent in these services don't offer much incentive for aggressive investment. For instance, in 2024, the global IT support market, while growing, sees significant pressure on pricing for basic services, with average contract values often being modest.

These segments often represent a drain on resources rather than a source of growth. Cognizant would likely adopt a strategy of minimizing further investment here, aiming to maintain existing client relationships without pouring in substantial capital. The goal is to avoid these areas becoming cash traps, where money is continuously spent with little return, allowing resources to be redirected to more promising growth areas.

Underperforming regional or niche acquisitions, if they haven't integrated well or captured their target markets, fall into this category. For instance, a tech firm acquiring a specialized software company that fails to achieve projected revenue growth, perhaps only reaching 60% of its initial market penetration goals within two years, would be a prime example.

These acquisitions can become resource drains, consuming capital and management attention without yielding the anticipated market share or financial returns. A situation where an acquisition was expected to contribute 5% to overall company revenue but instead contributes only 2% after three years highlights this issue.

Such underperformers often undergo rigorous strategic reviews, with divestiture being a likely outcome to optimize resource allocation and focus on more promising ventures. Companies might consider selling off these units if they consistently fail to meet even revised performance metrics, such as a return on investment below 8% annually.

Non-Core, Non-Strategic Offerings

Non-core, non-strategic offerings within Cognizant's portfolio, those not directly supporting its digital transformation, AI, and industry-specific solutions, would be categorized here. These are often smaller business units with a low market share, potentially diverting valuable resources and management attention away from more growth-oriented segments.

For instance, if Cognizant had a legacy IT maintenance service with minimal growth prospects and a declining market share, it would fit this description. Such offerings might have generated around $50 million in revenue in 2024 but contributed negligibly to the company's strategic objectives. The focus would be on divesting these to streamline operations and boost overall portfolio performance.

- Low Market Share: These segments typically hold a small percentage of their respective markets, often below 5%.

- Strategic Misalignment: They do not contribute to Cognizant's stated goals in digital, AI, or specific industry verticals.

- Resource Drain: Management time and capital are often consumed without commensurate strategic returns.

- Divestment Target: The primary strategy for these offerings is usually sale or discontinuation to improve portfolio efficiency.

Legacy On-Premise Software Customization

Legacy on-premise software customization, as a segment for companies like Cognizant, is increasingly viewed as a Dog in the BCG matrix. This is primarily because the broader market trend strongly favors cloud-based solutions, diminishing the demand for extensive, on-premise customizations and ongoing maintenance.

While a residual demand for these older systems exists, particularly in specific industries or for organizations with unique compliance needs, it represents a shrinking market. Cognizant's market share within this declining segment might be relatively small, as resources are more strategically allocated to high-growth cloud services.

Given this landscape, legacy on-premise software customization is a category that requires minimal new investment. The focus here is on managing existing contracts efficiently and potentially migrating clients to more modern, cloud-native offerings rather than expanding capabilities in this area.

- Declining Market Share: The global market for on-premise software is projected to see a compound annual growth rate (CAGR) of -2.5% through 2028, indicating a contraction.

- Shift to Cloud: By the end of 2024, it's estimated that over 90% of enterprises will be using a hybrid or multi-cloud strategy, further reducing the reliance on purely on-premise solutions.

- Resource Allocation: Companies like Cognizant are prioritizing investments in areas such as AI, cloud migration, and digital transformation, which offer higher growth potential.

- Low Investment Focus: For legacy on-premise customization, the strategy typically involves maintaining existing service levels and exploring opportunities for client transition rather than significant new development.

Dogs represent business units or service lines within Cognizant that operate in low-growth markets and possess a low market share. These are often legacy offerings or highly commoditized services where competition is fierce and margins are thin.

For instance, basic IT infrastructure maintenance or support for older, non-strategic software systems would likely fall into this category. In 2024, the market for these types of services often sees minimal growth, perhaps in the low single digits annually, with Cognizant's share being a small fraction of this stagnant pie.

The strategic approach for Dogs is typically to minimize investment, harvest any remaining cash flow, and ultimately divest or discontinue these offerings. This frees up resources to be reallocated to more promising areas like digital transformation or AI services.

A prime example could be a legacy data center management service for a declining industry. If this segment generated $75 million in revenue in 2024 but had a negative or near-zero growth rate and required significant operational overhead, it would be a classic Dog.

| Business Unit/Service Line | Market Growth Rate (2024) | Cognizant's Market Share | Strategic Recommendation |

|---|---|---|---|

| Legacy Mainframe Support | -3% | 4% | Divest/Discontinue |

| Commoditized IT Helpdesk | 1% | 6% | Minimize Investment, Harvest |

| On-Premise Software Customization (Non-Core) | -2% | 3% | Divest/Discontinue |

Question Marks

Cognizant's foray into agentic AI, exemplified by its Cognizant Agent Foundry and the recent launch of AI Training Data Services, signals a strategic push into a market with substantial projected growth. This sector is anticipated to expand significantly in the coming years, with some analysts predicting the global AI market to reach hundreds of billions of dollars by 2025-2026.

Despite this promising outlook, Cognizant's agentic AI and data services are currently in their nascent stages of client adoption, resulting in a relatively low market share. The company's substantial investments are aimed at nurturing these offerings, recognizing that considerable effort and capital will be needed to transform them from potential question marks into future market leaders, or Stars, within the BCG matrix.

Cognizant's move into the Software-Defined Vehicle (SDV) space, exemplified by its partnership with Elektrobit, positions it in a sector projected for substantial growth. The automotive industry's shift towards software-centric functionalities means SDVs are a key future market. This strategic entry is crucial for long-term relevance in automotive technology.

While the SDV market presents a significant opportunity, Cognizant is in the early stages of establishing its footprint, meaning its current market share is relatively small. Building brand recognition and demonstrating capabilities will be key to increasing this share. This phase requires focused efforts to gain traction.

To effectively compete and capture a meaningful share in the SDV market, Cognizant must commit significant resources to research and development. Investing in advanced software platforms, AI capabilities, and cybersecurity for vehicles is paramount. Furthermore, forging strategic alliances with other technology providers and automakers will accelerate market penetration and innovation.

Cognizant's specialized Web3 and Metaverse consulting services likely reside in the Question Mark quadrant of the BCG Matrix. While these markets exhibit substantial growth potential, Cognizant's current market share in this niche is probably nascent, reflecting the early stage of these technologies.

These offerings are inherently exploratory, demanding considerable investment in building specialized expertise and proving tangible value to clients. Success hinges on early market adoption and the overall maturation of the Web3 and Metaverse ecosystems.

New Geographic Market Expansions

Cognizant's expansion into new, high-growth geographic markets where it currently has a limited presence would represent its question marks in the BCG Matrix. These markets offer significant potential for future revenue growth, but also carry higher risks and require substantial investment. For instance, in 2024, Cognizant continued its strategic focus on expanding its digital capabilities and market reach in emerging economies, aiming to capture a larger share of the growing IT services demand in regions like Southeast Asia and parts of Eastern Europe.

These ventures require substantial investment in local infrastructure, talent development, and client acquisition to gain market share. The outcome of these expansions is uncertain, as they face established competitors and varying regulatory environments. However, successful penetration could transform these question marks into future Stars, driving significant long-term value for Cognizant.

- Geographic Focus: Targeting high-growth emerging markets with limited current presence.

- Investment Needs: Significant capital required for local infrastructure, talent, and sales efforts.

- Risk Profile: High uncertainty due to competition and market entry challenges.

- Potential Outcome: Successful expansion could lead to future market leadership and revenue growth.

Proprietary Industry-Specific Platforms in Nascent Stages

Cognizant is actively investing in proprietary, industry-specific platforms, such as Cognizant Moment, designed to address evolving customer experience needs through advanced technologies like AI. These platforms, while targeting high-growth sectors, are in their early stages of market adoption, meaning their current market share is relatively low. This strategic push requires significant capital outlay to facilitate scaling and secure broad client acceptance.

The development of these nascent platforms represents a strategic move by Cognizant to capture future market share in specialized areas. For example, the Cognizant Moment platform aims to provide enhanced customer engagement solutions, a critical area for many businesses. However, the success of such initiatives hinges on their ability to demonstrate tangible value and achieve widespread adoption in a competitive landscape.

- Platform Development: Cognizant is launching proprietary platforms like Cognizant Moment.

- Technology Focus: These platforms leverage advanced technologies, including AI.

- Market Position: Currently, market adoption and share for these platforms are low.

- Investment Needs: Significant investment is required for scaling and client acceptance.

Cognizant's ventures into emerging technologies like agentic AI and Software-Defined Vehicles (SDVs) currently represent question marks on the BCG matrix. These areas offer substantial growth potential, but Cognizant's market share is still developing, necessitating significant investment to gain traction.

Similarly, its specialized Web3 and Metaverse consulting services, along with expansion into new geographic markets, are also classified as question marks. These initiatives require considerable capital and strategic effort to overcome inherent risks and uncertain outcomes, with the goal of eventually becoming market leaders.

Cognizant's proprietary platforms, such as Cognizant Moment, also fall into this category. While designed for high-growth sectors and leveraging AI, their current market adoption is low, demanding further investment to scale and prove their value proposition against competitors.

The company's strategic investments in these areas reflect a calculated approach to future growth, acknowledging the high risk and high reward associated with nascent markets and technologies. Success in these question mark areas could significantly reshape Cognizant's future market position.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.