COFORGE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COFORGE Bundle

Coforge demonstrates strong capabilities in digital transformation and a robust client base, but faces intense competition and the need for continuous innovation. Our comprehensive SWOT analysis delves into these dynamics, providing you with a clear roadmap to leverage their strengths and navigate potential challenges.

Ready to unlock the full strategic potential of Coforge? Purchase our in-depth SWOT analysis to gain actionable insights, understand their competitive edge, and identify future growth opportunities, all presented in an editable format perfect for your strategic planning.

Strengths

Coforge has shown impressive financial strength, with significant year-over-year revenue increases. For fiscal year 2025, the company announced revenues of US$1.45 billion, representing a robust 32.0% growth when adjusted for currency fluctuations. This strong performance, coupled with a notable rise in net profit, underscores Coforge's capacity to win and deliver substantial projects, navigating a complex economic landscape effectively.

Coforge's strength lies in its deep domain expertise within specialized sectors such as Banking and Financial Services (BFS), Insurance, and Travel. This focused approach allows them to cultivate profound knowledge and deliver highly customized solutions, differentiating them from broader IT competitors.

This niche strategy has translated into tangible success. For instance, in the fiscal year ending March 31, 2024, Coforge reported a significant portion of its revenue coming from its BFS and Travel, Transportation, and Logistics (TTL) segments, underscoring the effectiveness of their specialized focus in driving client engagement and securing high-value engagements.

Coforge demonstrates exceptional strength through its substantial order book and consistent deal momentum. The company achieved a remarkable order intake of $2.1 billion in the fourth quarter of fiscal year 2025, a testament to its growing market presence.

This impressive performance was highlighted by a significant Total Contract Value (TCV) deal worth $1.56 billion, showcasing Coforge's ability to secure large-scale engagements. The executable order book for the upcoming 12 months is equally robust, reaching $1.5 billion.

This represents a substantial 47.7% increase year-on-year, providing Coforge with excellent revenue visibility. Such a strong pipeline instills confidence in the company's future growth trajectory and its capacity to deliver on future projects.

Strategic Acquisitions and Integration Capabilities

Coforge has a strong history of acquiring and integrating companies, notably SLK Global and Cigniti Technologies. These strategic moves have broadened its service offerings and market presence, directly contributing to revenue increases and better profit margins. For instance, the Cigniti acquisition in 2023 was a significant step in bolstering its digital transformation and cloud capabilities.

The company's effectiveness in integrating these acquisitions is a key strength. By successfully merging operations, Coforge has demonstrated its capacity to unlock synergies and realize the full potential of its acquisitions, enhancing overall operational efficiency and market competitiveness.

- Strategic Acquisitions: Proven success with Cigniti Technologies and SLK Global, expanding service portfolios and market reach.

- Integration Capabilities: Demonstrated ability to effectively integrate acquired entities, realizing synergies and improving financial performance.

- Revenue & Margin Growth: Acquisitions have directly contributed to top-line growth and enhanced profitability.

Commitment to Innovation and Emerging Technologies

Coforge demonstrates a strong commitment to innovation by actively investing in and leveraging emerging technologies. This includes a significant focus on areas like Artificial Intelligence (AI), Generative AI (GenAI), cloud computing, and automation, all aimed at enhancing its service portfolio and driving digital transformation for clients.

The company's dedication to cutting-edge solutions is evident in initiatives such as the establishment of a GenAI Center of Excellence, a strategic collaboration with ServiceNow. This center is designed to explore and implement advanced GenAI capabilities across various business functions.

Further solidifying its position in technological advancement, Coforge has developed over 200 real-world AI-led solutions. This impressive number highlights their practical application of AI to solve complex business challenges and deliver tangible value to their clientele, positioning them as future-ready in a rapidly evolving tech landscape.

- Investment in AI and GenAI: Coforge is actively integrating AI and GenAI into its offerings.

- GenAI Center of Excellence: A collaboration with ServiceNow to pioneer GenAI applications.

- Extensive AI Solutions: Development of over 200 real-world AI-led solutions showcases practical expertise.

Coforge's financial performance is a significant strength, marked by substantial revenue growth and increasing profitability. For the fiscal year 2025, the company reported revenues of US$1.45 billion, a robust 32.0% increase when adjusted for currency. This growth, coupled with a rise in net profit, demonstrates their capability to secure and execute large projects effectively.

The company's order book and deal momentum are exceptionally strong, with a fourth-quarter fiscal year 2025 order intake of $2.1 billion. This includes a notable Total Contract Value (TCV) deal of $1.56 billion, and an executable order book of $1.5 billion for the next 12 months, reflecting a 47.7% year-on-year increase and strong revenue visibility.

Coforge excels in specialized sectors like Banking and Financial Services (BFS) and Travel, Transportation, and Logistics (TTL), where they possess deep domain expertise. This focus allows for tailored solutions that differentiate them from competitors and drive client engagement.

Strategic acquisitions, such as Cigniti Technologies and SLK Global, have broadened Coforge's service offerings and market presence, directly contributing to revenue and margin growth. Their proven ability to integrate these acquisitions effectively unlocks synergies and enhances competitiveness.

A key strength is Coforge's commitment to innovation, with significant investments in AI, GenAI, cloud, and automation. Their establishment of a GenAI Center of Excellence in collaboration with ServiceNow and the development of over 200 real-world AI-led solutions highlight their forward-thinking approach.

| Metric | FY25 (USD Billion) | YoY Growth (Constant Currency) |

|---|---|---|

| Revenue | 1.45 | 32.0% |

| Q4 Order Intake | 2.1 | N/A |

| 12-Month Executable Order Book | 1.5 | 47.7% |

What is included in the product

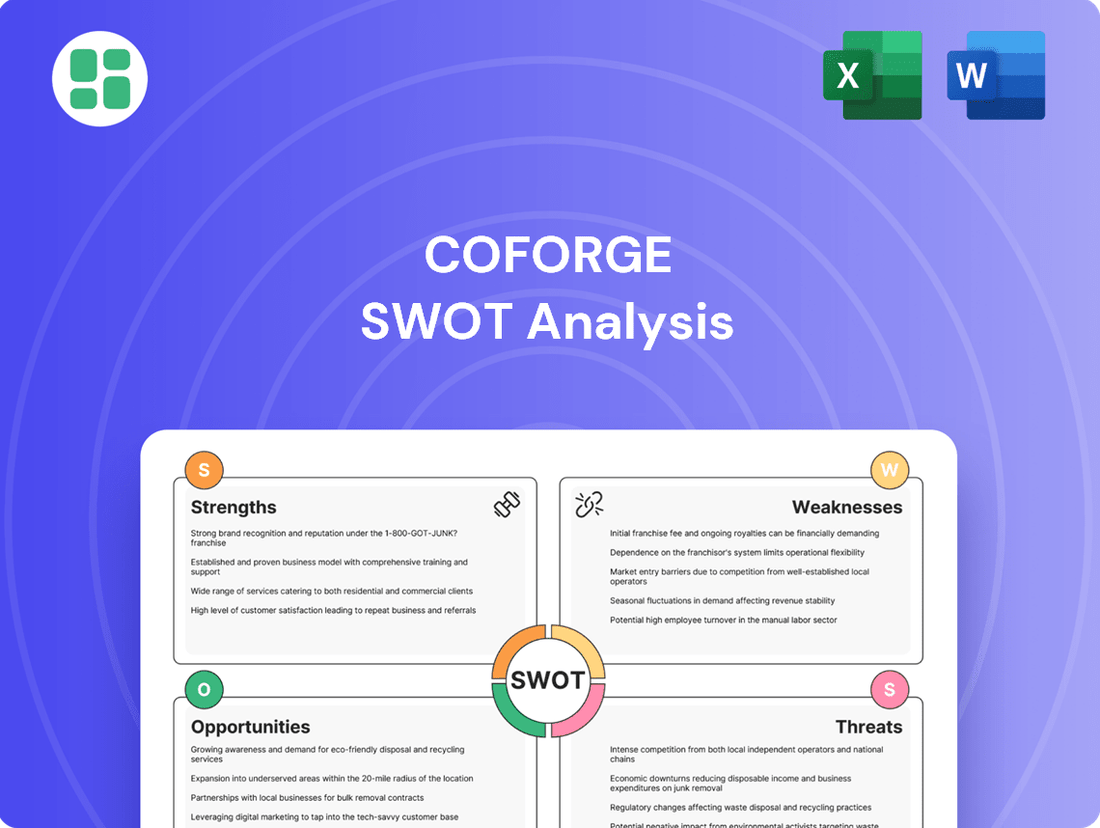

Delivers a strategic overview of COFORGE’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats to inform future decision-making.

Simplifies complex strategic landscapes by clearly identifying internal capabilities and external market dynamics.

Offers a structured framework to pinpoint and address potential business challenges before they escalate.

Weaknesses

Coforge's significant dependence on the North American market, which accounts for roughly 56% of its revenue, presents a notable weakness. This concentration is higher than the typical reliance seen across the Indian IT sector.

This over-reliance makes Coforge vulnerable to economic fluctuations and intensified competition within North America. While diversification offers a clear growth avenue, the current geographical concentration poses a risk.

Coforge faces a significant weakness in customer concentration risk, particularly after securing large deals like the $1.5 billion agreement with Sabre. While this deal is a major revenue driver, it ties a substantial portion of future earnings to the performance and continued satisfaction of this single client.

This dependency makes Coforge susceptible to the financial health or strategic shifts of Sabre. Any disruption, such as a change in Sabre's outsourcing strategy or a downturn in their business, could disproportionately impact Coforge's revenue and profitability, highlighting a critical vulnerability in its client portfolio.

While Coforge has shown improved profitability, it has faced sequential declines in EBIT margins and net profit in certain quarters of FY24, partly due to transaction costs. This highlights a challenge in consistently expanding margins, especially when the company is investing in new technologies and pursuing acquisitions.

Integration Risks from Acquisitions

Coforge's strategy of inorganic growth through acquisitions, while often successful, introduces persistent integration risks. These challenges can manifest as difficulties in merging disparate company cultures, integrating complex technological infrastructures, and achieving the anticipated financial and operational synergies. For example, in the fiscal year ending March 31, 2024, Coforge completed several acquisitions, and the successful assimilation of these entities remains a key focus for realizing their full value.

The potential for cultural clashes between acquired teams and Coforge's existing workforce can hinder collaboration and slow down the adoption of new processes. Furthermore, the technical complexities involved in integrating diverse IT systems and platforms can lead to operational disruptions and increased costs if not managed meticulously. The company's ability to effectively navigate these hurdles directly impacts its operational efficiency and overall financial performance post-acquisition.

- Cultural Assimilation: Merging different organizational cultures can lead to friction and reduced employee productivity.

- Technology Integration: Challenges in aligning diverse IT systems can result in operational inefficiencies and increased IT expenditure.

- Synergy Realization: Failure to achieve projected cost savings and revenue enhancements from acquisitions can negatively impact profitability.

- Management Bandwidth: Extensive acquisition activity can strain management's capacity to focus on core business operations and organic growth initiatives.

Competition from Larger IT Giants

Coforge faces significant headwinds from established IT giants as it seeks to grow, especially in crucial markets like North America. These larger competitors often boast deeper pockets and more extensive client networks, making it harder for Coforge to land and expand substantial deals. For instance, in the fiscal year ending March 2024, Coforge reported total revenue of approximately $1.1 billion, while larger players like TCS or Infosys generated revenues exceeding $25 billion, highlighting the scale disparity.

The inherent advantage of these larger IT service providers lies in their established market presence and extensive resources. They typically have longer-standing relationships with major enterprises, which translates into a significant competitive edge when bidding for large, complex projects. This can limit Coforge's ability to secure and scale high-value contracts, impacting its growth trajectory.

- Resource Disparity: Larger competitors command significantly greater financial resources and human capital, enabling them to undertake larger projects and invest more heavily in R&D and talent acquisition.

- Client Relationships: Established IT giants benefit from long-term, deep-rooted relationships with key enterprise clients, often making it challenging for newer or smaller players to penetrate these accounts.

- Market Share: In key growth markets like North America, the market share held by the top-tier IT service providers is substantial, leaving a smaller, more contested space for companies like Coforge.

- Brand Recognition: The strong brand recognition and perceived stability of larger IT firms can influence client decisions, particularly for critical business transformation initiatives.

Coforge's substantial reliance on its top clients presents a significant vulnerability. The company's top 10 clients accounted for 47.7% of its revenue in FY24, indicating a high degree of customer concentration.

This concentration means that any adverse changes in the business or relationship with these key clients could disproportionately affect Coforge's financial performance.

The company's revenue streams are heavily weighted towards specific industries, with Financial Services and Travel, Transportation, and Logistics making up a significant portion of its business. This sector-specific focus can expose Coforge to risks associated with downturns or disruptions within these particular industries.

While Coforge has been investing in expanding its service offerings and geographic reach, it still faces the weakness of being a mid-sized player against much larger, more established competitors in the global IT services market. This can limit its ability to compete for the largest, most complex transformation projects.

| Weakness | Description | Impact |

| Customer Concentration | Top 10 clients represented 47.7% of FY24 revenue. | High dependence on a few large clients for revenue. |

| Industry Concentration | Significant revenue from Financial Services and Travel sectors. | Vulnerability to sector-specific downturns or shifts. |

| Competitive Landscape | Mid-sized player facing larger, established IT giants. | Challenges in securing very large, complex projects. |

| Acquisition Integration | Ongoing challenges in merging acquired entities and cultures. | Potential for operational inefficiencies and reduced synergy realization. |

Preview the Actual Deliverable

COFORGE SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an authentic look at the COFORGE SWOT analysis, ensuring transparency and quality. The complete, in-depth report is yours to download immediately after purchase.

Opportunities

The accelerating global demand for digital transformation is a prime opportunity for Coforge. As businesses worldwide prioritize modernizing operations and customer experiences, Coforge's expertise in application modernization, cloud migration, and data analytics directly addresses these needs. This trend is fueled by a strong market, with the global digital transformation market size projected to reach $10.4 trillion by 2025, according to Statista.

Coforge is well-positioned to capitalize on this shift, as companies across sectors like banking, insurance, and travel are actively seeking partners to implement digital solutions. For instance, many financial institutions are investing heavily in digital platforms to enhance customer engagement and operational efficiency, areas where Coforge has demonstrated strong capabilities. This creates a fertile ground for revenue growth and market share expansion.

The global market for artificial intelligence (AI) and generative AI (GenAI) is experiencing robust expansion, with increasing enterprise adoption driving significant budget allocations. This trend, coupled with sustained demand for cloud migration and enhanced cybersecurity measures, presents a prime opportunity for companies like Coforge.

Coforge's strategic investments in AI-driven platforms and its dedicated GenAI Center of Excellence are crucial for capturing this growth. By focusing on these high-demand technology segments, Coforge is well-positioned to deliver innovative solutions to its clients, thereby driving revenue and market share in a rapidly evolving digital landscape.

Coforge's strategic alliances with key players like Microsoft and Salesforce are pivotal for its growth. For instance, in Q4 FY24, Coforge reported a significant contribution from its partnerships, with revenue from top alliances growing robustly, indicating enhanced service capabilities and expanded market access.

These collaborations are crucial for joint solution development, allowing Coforge to integrate cutting-edge technologies and offer more comprehensive services. This synergy not only strengthens its competitive edge but also opens avenues for acquiring new clients by leveraging the partners' established market presence and customer bases.

Diversification of Client Base and Geographical Expansion

Coforge can significantly reduce its dependence on a few key clients by actively pursuing a broader customer portfolio. This strategic move not only spreads risk but also opens avenues for organic growth by capturing market share from competitors.

Expanding its geographical footprint beyond its strong North American presence presents a substantial opportunity. By targeting and strengthening its position in regions like Europe and Asia Pacific, Coforge can tap into diverse economic cycles and customer needs.

For instance, as of Q4 FY24, Coforge reported that the Americas accounted for a significant portion of its revenue. This highlights the potential upside in diversifying revenue streams geographically. The company can leverage its existing capabilities to cater to the evolving digital transformation needs in these emerging markets.

- Geographic Diversification: Targeting growth in Europe and Asia Pacific to balance North American reliance.

- Client Base Expansion: Actively seeking new clients across various industries and sizes.

- Market Penetration: Deepening engagement in existing but under-leveraged international markets.

- Revenue Stream Resilience: Building a more robust financial model less susceptible to single-market downturns.

Talent Acquisition and Upskilling

Coforge can seize the opportunity to bolster its workforce by actively recruiting high-caliber professionals from leading tier-1 companies. This strategic talent acquisition, coupled with competitive incentive structures, is crucial for assembling a team with specialized skills. For instance, in fiscal year 2024, Coforge reported a significant increase in its employee base, underscoring its commitment to growth and talent expansion.

Implementing robust continuous upskilling programs is another key opportunity. By investing in employee development, Coforge can ensure its workforce remains at the forefront of technological advancements and industry best practices. A strong, employee-centric culture further enhances retention and cultivates a highly motivated and productive environment, directly impacting delivery excellence.

- Attract top talent from rival tier-1 firms.

- Develop strong incentive programs to retain skilled employees.

- Invest in continuous upskilling and reskilling initiatives.

- Foster an employee-centric culture to boost engagement and productivity.

Coforge's expanding service portfolio, particularly in areas like cloud, data analytics, and digital transformation, aligns with the growing global demand for these solutions. The company's focus on high-growth sectors such as banking, insurance, and healthcare positions it to capture significant market share as these industries continue their digital evolution.

The increasing adoption of AI and generative AI presents a substantial opportunity for Coforge to offer advanced solutions and services. By leveraging its strategic partnerships and investing in specialized talent, Coforge can solidify its position as a leader in these emerging technological domains, driving innovation and client value.

Coforge's strategic alliances with major technology providers like Microsoft and Salesforce are crucial for expanding its market reach and enhancing its service capabilities. These collaborations enable Coforge to co-create solutions and access new customer segments, thereby accelerating revenue growth and strengthening its competitive standing.

Geographic diversification, particularly into Europe and Asia Pacific, offers a significant avenue for growth and risk mitigation. By reducing its reliance on the North American market and tapping into the digital transformation needs of other regions, Coforge can build a more resilient revenue base.

Threats

The IT services landscape is fiercely competitive, with a multitude of global and regional companies vying for dominance. This crowded market often translates into significant pricing pressures, potentially affecting Coforge's profitability and its capacity to win new contracts, particularly for more standardized service offerings.

For instance, the IT services market is projected to reach $1.5 trillion by 2025, a testament to its growth but also its competitive intensity. Companies like Coforge must constantly innovate and differentiate to avoid being drawn into price wars, which can erode margins. In the fiscal year ending March 31, 2024, Coforge reported a revenue of approximately $2.1 billion, highlighting the scale of operations within this demanding sector.

A potential global economic slowdown, marked by persistent inflation and rising interest rates, poses a significant threat. This macroeconomic environment can lead to cautious IT spending from clients, directly impacting demand for Coforge's services and potentially dampening revenue growth projections for 2024 and 2025.

Geopolitical instability, including ongoing conflicts and trade tensions, further exacerbates these risks. Such uncertainties can disrupt supply chains, increase operational costs, and create a volatile business landscape, all of which could negatively affect Coforge's financial performance and market positioning.

The relentless pace of technological advancement poses a significant threat, as solutions developed today can rapidly become outdated. Coforge must maintain substantial investment in research and development to ensure its service portfolio remains current with emerging technologies, like AI and quantum computing.

Failure to adapt quickly could lead to Coforge losing market share to nimbler competitors who more effectively leverage new technological paradigms. For instance, the increasing demand for cloud-native solutions and advanced analytics requires constant upskilling and strategic technology adoption.

Talent Attrition and Wage Inflation

The intense demand for specialized IT talent continues to fuel significant talent attrition and wage inflation within the sector. This presents a persistent challenge for companies like Coforge, even with recent improvements in their attrition figures. Keeping highly skilled employees engaged and managing the upward pressure on compensation are ongoing battles in this competitive landscape.

Coforge reported a voluntary attrition rate of 13.2% in Q4 FY24, an improvement from previous periods, yet the broader industry context suggests this remains a critical area to monitor. The ongoing need to attract and retain top-tier IT professionals means that wage inflation, driven by supply and demand dynamics, will likely continue to impact operational costs.

- Talent Demand: High demand for skilled IT professionals creates a competitive environment for talent acquisition.

- Attrition Rates: While improving, voluntary attrition remains a factor impacting operational stability and knowledge retention.

- Wage Inflation: Rising salary expectations for IT talent directly affect Coforge's employee cost structure.

- Retention Strategies: Continuous investment in employee engagement and competitive compensation packages are essential.

Regulatory and Compliance Risks

Coforge operates in a complex global landscape, making it susceptible to a variety of regulatory and compliance risks. Navigating differing legal frameworks across geographies, including stringent data privacy mandates like GDPR and evolving tax legislation, presents a continuous challenge. For instance, the company has faced scrutiny and potential financial implications from tax authorities in various jurisdictions, highlighting the direct impact of non-compliance.

The financial implications of failing to adhere to these regulations can be substantial. Penalties, fines, and legal costs can erode profitability, while reputational damage can deter clients and partners. Coforge's proactive approach to compliance is therefore crucial for maintaining operational stability and investor confidence.

- Diverse Regulatory Environments: Operating in over 20 countries means managing a patchwork of laws, from data protection in Europe to labor laws in Asia.

- Data Privacy Concerns: Adherence to regulations like GDPR and CCPA impacts how Coforge handles sensitive client data, with potential fines for breaches.

- Taxation Complexities: Changes in international tax treaties and local tax laws can create compliance burdens and financial liabilities.

- Reputational Risk: Non-compliance incidents, such as past tax disputes, can negatively affect Coforge's brand image and client trust.

The IT services market is intensely competitive, leading to pricing pressures that can impact Coforge's profitability and ability to secure new contracts. The projected market size of $1.5 trillion by 2025 underscores this competitive intensity, demanding continuous innovation from companies like Coforge to avoid margin erosion.

Economic slowdowns, marked by inflation and rising interest rates, pose a threat by potentially curbing client IT spending, which could dampen Coforge's revenue growth projections for 2024 and 2025. Geopolitical instability further amplifies these risks, creating volatile business conditions that could negatively affect financial performance.

Rapid technological advancements require substantial R&D investment to keep service portfolios current, as failure to adapt could lead to market share loss. The ongoing demand for specialized IT talent fuels talent attrition and wage inflation, impacting operational costs even with improvements in attrition rates.

| Threat Category | Specific Risk | Impact on Coforge | Example/Data Point |

|---|---|---|---|

| Market Competition | Pricing Pressure | Reduced Profitability, Contract Wins | IT Services Market projected at $1.5T by 2025 |

| Economic Factors | Reduced Client IT Spending | Dampened Revenue Growth | Inflation and rising interest rates in 2024-2025 |

| Technological Change | Obsolescence of Services | Loss of Market Share | Need for continuous investment in AI and cloud-native solutions |

| Talent Management | Wage Inflation & Attrition | Increased Operational Costs | Voluntary attrition rate of 13.2% in Q4 FY24 |

| Regulatory Compliance | Navigating Diverse Laws | Financial Penalties, Reputational Damage | Adherence to GDPR and evolving tax legislation |

SWOT Analysis Data Sources

This COFORGE SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry evaluations to provide an accurate and actionable strategic overview.