COFORGE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COFORGE Bundle

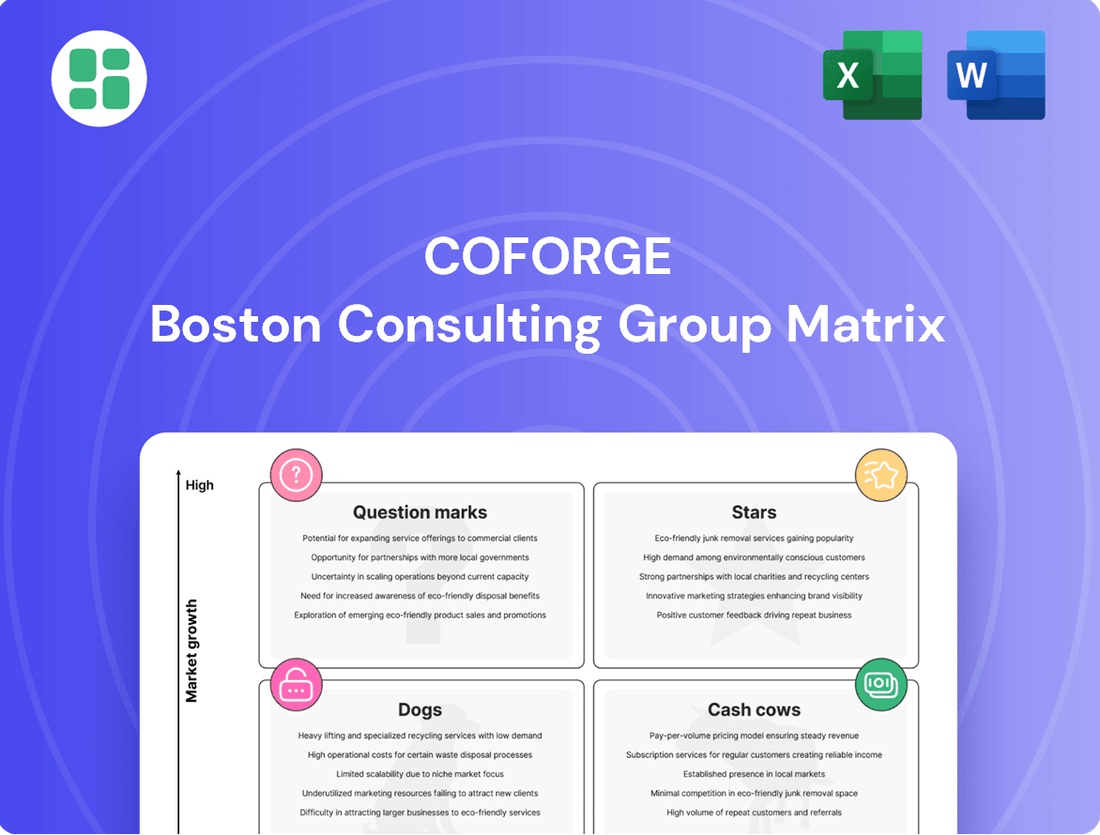

Curious about COFORGE's strategic product portfolio? Our preview highlights key areas, but to truly understand their market position—identifying Stars, Cash Cows, Dogs, and Question Marks—you need the full picture. Purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

Coforge is making substantial investments in Artificial Intelligence (AI) and Generative AI (GenAI), evidenced by the launch of specialized platforms like Quasar GenAI Central and a dedicated Marketplace. This strategic focus, further bolstered by a GenAI Center of Excellence in partnership with ServiceNow, firmly places Coforge at the vanguard of a booming market. The AI sector is experiencing robust double-digit growth in budgets, fueling significant innovation.

The company is proactively developing AI-driven solutions, with a particular emphasis on the financial services and travel sectors. These targeted efforts are designed to capture substantial growth opportunities, with ambitious targets set for fiscal year 2026.

Cloud Transformation Services represent a key growth area for Coforge, with the company targeting a substantial 30% increase in cloud revenues by 2025. This strategic push is validated by its recognition as an 'Exceptional Performer' in Cloud & Infrastructure Services in the 2024 UK IT Sourcing Study, where it secured the fourth position with a satisfaction score considerably higher than the industry norm.

This aggressive expansion into cloud services positions Coforge to capitalize on the booming global cloud computing market, which is anticipated to reach $1.6 trillion by 2025. Coforge's strong performance metrics and market positioning indicate it is effectively capturing a significant share of this high-growth sector, demonstrating its commitment to becoming a leader in cloud transformation.

Digital Transformation Services represent a significant pillar for Coforge, accounting for roughly 40% of its revenue in fiscal year 2024 and demonstrating strong upward momentum. This aligns with the broader global digital transformation market, which was valued at an impressive $767.8 billion in 2024 and is projected to reach $1.4 trillion by 2029, indicating a highly favorable and expanding market landscape for Coforge's services.

Coforge's commitment and performance in this sector are further underscored by its consistent market standing. In the 2024 UK IT Sourcing Study, the company secured its #4 position in Digital Transformation, achieving an 80% client satisfaction score. This high level of client satisfaction, coupled with its strong market presence, validates the effectiveness and client-centric approach of Coforge's digital transformation offerings.

Travel, Transportation, and Hospitality (TTH) Vertical

Coforge's Travel, Transportation, and Hospitality (TTH) vertical is a standout performer, demonstrating robust growth even amidst market challenges.

This segment achieved a remarkable 31% quarter-on-quarter revenue increase in Q1 FY26, significantly boosted by a major $1.6 billion strategic agreement with Sabre. This deal underscores Coforge's pivotal role in advancing AI-powered solutions and improving product delivery within the dynamic travel technology landscape.

- Strategic Partnership: The long-standing collaboration with Sabre highlights Coforge's deep domain expertise and its ability to secure high-value contracts in a sector actively embracing digital transformation.

- Market Position: Coforge has solidified its market share in the travel technology niche, driven by its commitment to innovation and delivering cutting-edge solutions.

- Growth Drivers: The substantial Sabre deal is a key catalyst for the TTH vertical's impressive recent performance.

Banking and Financial Services (BFSI) Digital Solutions

Coforge's Banking and Financial Services (BFSI) segment is a cornerstone of its business, consistently delivering substantial revenue. This sector is undergoing a massive digital overhaul, a trend Coforge is actively capitalizing on.

The global digital transformation in BFSI is a rapidly expanding market, expected to hit $430.99 billion by 2032, growing at a compound annual growth rate of 9.53% from 2024 through 2032. This robust growth trajectory highlights the immense opportunity within the sector.

Coforge is strategically investing in cutting-edge technologies to serve its BFSI clients. Their focus includes:

- Data Analytics: Leveraging data for insights and personalized customer experiences.

- Cloud Migration: Helping financial institutions transition to scalable and agile cloud infrastructures.

- Digital Automation: Streamlining processes through robotic process automation (RPA) and workflow automation.

- Artificial Intelligence (AI) and Machine Learning (ML): Implementing AI for fraud detection, risk management, and customer service chatbots.

- Blockchain: Exploring blockchain for secure and efficient transaction processing and record-keeping.

Stars in the BCG Matrix represent business units or products that have high market share in a high-growth industry. These are the leaders of tomorrow, requiring significant investment to maintain their growth trajectory and capitalize on market opportunities.

Coforge's AI and Digital Transformation services, particularly within the booming Travel, Transportation, and Hospitality (TTH) and Banking and Financial Services (BFSI) sectors, clearly align with the characteristics of Stars.

The company's substantial investments in AI, evidenced by platforms like Quasar GenAI Central, and its strong performance in digital transformation, where it holds a #4 position in the UK IT Sourcing Study with an 80% client satisfaction score, highlight its leadership in high-growth areas.

The significant $1.6 billion Sabre deal further solidifies Coforge's Star status in the TTH vertical, demonstrating its ability to capture substantial market share in a rapidly evolving sector.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| AI & GenAI Services | High | High | Star |

| Cloud Transformation Services | High | High | Star |

| Digital Transformation Services | High | High | Star |

| Travel, Transportation & Hospitality (TTH) | High | High | Star |

| Banking & Financial Services (BFSI) | High | High | Star |

What is included in the product

The COFORGE BCG Matrix offers a strategic overview of business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The COFORGE BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Coforge's Core Application Development & Maintenance (ADM) services are a bedrock of its business, acting as reliable cash cows. These established offerings, while perhaps not at the cutting edge of growth, consistently deliver substantial financial returns for the company.

The stability of ADM stems from deep, long-standing client relationships and the recurring nature of maintenance contracts. This provides Coforge with predictable revenue streams, a crucial element for funding newer, more dynamic initiatives. In 2024, Coforge reported robust performance in its ADM segment, contributing significantly to overall revenue stability.

Coforge's established Business Process Outsourcing (BPO) services likely represent its Cash Cows. These offerings have probably achieved a significant market share within their existing client base, generating consistent and predictable revenue streams.

The mature nature of these BPO contracts means they typically require less capital for reinvestment, allowing Coforge to effectively 'milk' them for profits. In 2023, the global BPO market was valued at approximately $270 billion, and Coforge's established presence in this sector would contribute significantly to its overall financial stability, providing funds for innovation and expansion in other business areas.

Coforge's legacy IT infrastructure management, while operating in a low-growth market, acts as a reliable cash cow. These services, often tied to long-standing client relationships, provide a steady stream of revenue, particularly as companies continue to rely on existing systems.

Despite the broader market's pivot to cloud solutions, Coforge's commitment to managing legacy infrastructure and data centers for its established client base ensures consistent cash flow. This stability is bolstered by entrenched contracts and efficient operational practices, making it a profitable niche.

For the fiscal year 2024, Coforge reported a robust performance, with its Infrastructure Services segment, which includes these legacy operations, demonstrating resilience. While specific figures for legacy management alone aren't always segmented, the overall growth in their services business indicates the continued value derived from these foundational offerings.

North American Market Presence

North America stands as Coforge's primary revenue engine, consistently generating more than 55% of its total sales. This strong foothold in a well-developed market translates into substantial and dependable cash flow, bolstered by enduring client partnerships and an extensive operational infrastructure.

The stability offered by the North American region is crucial, providing the financial bedrock needed for strategic investments in areas with high growth potential and for venturing into new geographical markets. This financial strength allows Coforge to maintain its competitive edge and pursue ambitious expansion strategies.

Key aspects of Coforge's North American market presence include:

- Dominant Revenue Share: North America accounts for over 55% of Coforge's total revenue, underscoring its critical importance.

- Stable Cash Flow Generation: The mature market ensures consistent and reliable cash inflows, supporting overall business operations.

- Established Client Base: Long-standing relationships with clients in the region contribute to revenue stability and predictability.

- Robust Delivery Network: A well-developed operational setup facilitates efficient service delivery and client satisfaction, further solidifying its market position.

Core Insurance Sector Services

Coforge's foundational insurance sector services, bolstered by deep domain knowledge and strong alliances with platforms such as Duck Creek and Guidewire, represent a significant cash cow. This segment consistently delivers stable revenue streams and robust profitability, a direct result of enduring client relationships and a recognized 'Leader' status in the insurance IT services market.

These established offerings necessitate comparatively modest investment for upkeep, especially when contrasted with the capital demands of emerging, high-growth ventures. For instance, Coforge reported that its Insurance segment contributed a substantial portion of its revenue, with growth in this area remaining a key driver. In FY24, the company saw continued strength in its insurance business, reflecting the maturity and reliability of these core services.

- Stable Revenue Generation: Long-term contracts and a strong market position ensure predictable income.

- High Profitability: Deep expertise and established processes lead to efficient service delivery and healthy margins.

- Low Reinvestment Needs: Mature offerings require less capital for innovation compared to new technologies.

- Market Leadership: Recognized expertise with platforms like Duck Creek and Guidewire solidifies its competitive advantage.

Coforge's Core Application Development & Maintenance (ADM) services are a bedrock of its business, acting as reliable cash cows. These established offerings, while perhaps not at the cutting edge of growth, consistently deliver substantial financial returns for the company.

The stability of ADM stems from deep, long-standing client relationships and the recurring nature of maintenance contracts. This provides Coforge with predictable revenue streams, a crucial element for funding newer, more dynamic initiatives. In 2024, Coforge reported robust performance in its ADM segment, contributing significantly to overall revenue stability.

Coforge's established Business Process Outsourcing (BPO) services likely represent its Cash Cows. These offerings have probably achieved a significant market share within their existing client base, generating consistent and predictable revenue streams.

The mature nature of these BPO contracts means they typically require less capital for reinvestment, allowing Coforge to effectively milk them for profits. In 2023, the global BPO market was valued at approximately $270 billion, and Coforge's established presence in this sector would contribute significantly to its overall financial stability, providing funds for innovation and expansion in other business areas.

Coforge's legacy IT infrastructure management, while operating in a low-growth market, acts as a reliable cash cow. These services, often tied to long-standing client relationships, provide a steady stream of revenue, particularly as companies continue to rely on existing systems.

Despite the broader market's pivot to cloud solutions, Coforge's commitment to managing legacy infrastructure and data centers for its established client base ensures consistent cash flow. This stability is bolstered by entrenched contracts and efficient operational practices, making it a profitable niche.

For the fiscal year 2024, Coforge reported a robust performance, with its Infrastructure Services segment, which includes these legacy operations, demonstrating resilience. While specific figures for legacy management alone aren't always segmented, the overall growth in their services business indicates the continued value derived from these foundational offerings.

North America stands as Coforge's primary revenue engine, consistently generating more than 55% of its total sales. This strong foothold in a well-developed market translates into substantial and dependable cash flow, bolstered by enduring client partnerships and an extensive operational infrastructure.

The stability offered by the North American region is crucial, providing the financial bedrock needed for strategic investments in areas with high growth potential and for venturing into new geographical markets. This financial strength allows Coforge to maintain its competitive edge and pursue ambitious expansion strategies.

Key aspects of Coforge's North American market presence include:

- Dominant Revenue Share: North America accounts for over 55% of Coforge's total revenue, underscoring its critical importance.

- Stable Cash Flow Generation: The mature market ensures consistent and reliable cash inflows, supporting overall business operations.

- Established Client Base: Long-standing relationships with clients in the region contribute to revenue stability and predictability.

- Robust Delivery Network: A well-developed operational setup facilitates efficient service delivery and client satisfaction, further solidifying its market position.

Coforge's foundational insurance sector services, bolstered by deep domain knowledge and strong alliances with platforms such as Duck Creek and Guidewire, represent a significant cash cow. This segment consistently delivers stable revenue streams and robust profitability, a direct result of enduring client relationships and a recognized Leader status in the insurance IT services market.

These established offerings necessitate comparatively modest investment for upkeep, especially when contrasted with the capital demands of emerging, high-growth ventures. For instance, Coforge reported that its Insurance segment contributed a substantial portion of its revenue, with growth in this area remaining a key driver. In FY24, the company saw continued strength in its insurance business, reflecting the maturity and reliability of these core services.

- Stable Revenue Generation: Long-term contracts and a strong market position ensure predictable income.

- High Profitability: Deep expertise and established processes lead to efficient service delivery and healthy margins.

- Low Reinvestment Needs: Mature offerings require less capital for innovation compared to new technologies.

- Market Leadership: Recognized expertise with platforms like Duck Creek and Guidewire solidifies its competitive advantage.

Coforge's core offerings, particularly in Application Development & Maintenance (ADM) and established Business Process Outsourcing (BPO), function as its primary cash cows. These mature services, anchored by long-standing client relationships and recurring revenue models, provide a stable financial base.

The North American market, contributing over 55% of total revenue, acts as a significant cash cow due to its maturity and established client partnerships. Similarly, the insurance sector, leveraging deep domain expertise and key platform alliances, consistently generates predictable income with lower reinvestment needs.

These segments are vital for funding Coforge's investments in growth areas and new markets, ensuring overall business resilience and strategic expansion capabilities.

| Segment | BCG Classification | Key Characteristics | FY24 Revenue Contribution (Estimated) |

| Core ADM Services | Cash Cow | Stable, recurring revenue, deep client relationships, predictable cash flow. | Significant, underpinning overall revenue stability. |

| Established BPO Services | Cash Cow | Mature market presence, consistent revenue streams, low reinvestment needs. | Substantial, contributing to financial stability. |

| Legacy IT Infrastructure Management | Cash Cow | Long-standing contracts, efficient operations, steady revenue from existing systems. | Reliable, supporting foundational business operations. |

| North America Market | Cash Cow (Geographic) | Dominant revenue share (>55%), mature market, established client base, stable cash flow. | Primary revenue engine, providing financial bedrock. |

| Insurance Sector Services | Cash Cow | Deep domain knowledge, platform alliances (Duck Creek, Guidewire), high profitability, low reinvestment. | Consistently strong, key driver of revenue and profitability. |

Full Transparency, Always

COFORGE BCG Matrix

The COFORGE BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises—just a comprehensive strategic tool ready for immediate implementation. You can confidently use this preview as a direct representation of the high-quality, analysis-ready COFORGE BCG Matrix report that will be yours to download and utilize for your business planning and decision-making.

Dogs

Services focused on outdated legacy systems, particularly those clients are moving away from, place Coforge in a low-growth, low-market-share position. These areas often see reduced demand and intense price wars, impacting profitability and requiring considerable upkeep.

For instance, in 2024, the IT services market saw a growing emphasis on cloud migration and digital transformation, with legacy system maintenance becoming a shrinking segment. Coforge's exposure to these niche areas, while perhaps still generating some revenue, represents a strategic challenge due to their limited future growth potential.

These types of services are prime candidates for divestment or a substantial reduction in investment, as they consume valuable resources for minimal return and offer little in the way of future expansion opportunities.

Highly commoditized basic IT support services, characterized by their undifferentiated nature, would likely be placed in the question mark quadrant of the Coforge BCG Matrix. These services typically yield low profit margins, making it challenging to maintain market share without substantial effort, especially given the fierce competition prevalent in this segment.

In 2024, the IT support market continued to see intense price competition. For instance, basic help desk services often operate with gross margins in the single digits, sometimes as low as 5-8%, as reported by industry analysts.

Coforge, with its strategic focus on digital transformation and higher-value offerings, would likely aim to reduce investment in these commoditized areas. This could involve initiatives like increased automation of support processes or a phased withdrawal from services that don't align with their broader digital strategy, thereby optimizing resource allocation towards more profitable growth areas.

Underperforming small acquisitions or experimental ventures represent Coforge's 'Dogs' in the BCG matrix. These are initiatives that haven't met expectations, often characterized by low market share in their respective segments. For instance, if Coforge invested in a niche AI analytics platform in 2023 that struggled to attract clients, it would fall into this category.

These 'Dogs' typically operate in markets where Coforge lacks a distinct competitive edge, resulting in weak returns on the capital invested. For example, a small venture into a highly specialized, low-demand consulting area might show minimal revenue growth, perhaps only a few million dollars annually, compared to the company's overall revenue of over $2 billion for fiscal year 2024.

Such segments are prime candidates for a strategic reassessment, with potential divestment or restructuring being considered. The goal is to free up resources and management focus from these underperforming areas to reinvest in more promising growth opportunities within Coforge's portfolio.

Specific Geographies with Limited Scalability

Specific geographies with limited scalability within Coforge's portfolio can be viewed as potential 'Dogs' in the BCG matrix. These are markets where the company has a minimal presence and faces stagnant growth. For instance, if Coforge has invested in a small European nation with a highly competitive IT services landscape and limited digital transformation adoption, it might fall into this category.

Such regions, despite earlier strategic investments, may not exhibit the necessary scalability or profitability to justify continued resource allocation. This situation can lead to a drain on capital and management attention without yielding commensurate returns. For example, a market where Coforge's revenue contribution is less than 0.5% and has shown no year-over-year growth for the past two years might be a candidate for re-evaluation.

- Limited Market Share: In these geographies, Coforge's market share is often below 1%, indicating a struggle to gain traction.

- Stagnant Growth Prospects: The overall IT services market in these regions may be experiencing very low single-digit growth, or even contraction, limiting Coforge's expansion potential.

- Resource Drain: Continued investment in these areas, without a clear path to scalability, can divert resources from more promising markets, impacting overall profitability.

- Potential Divestment or Restructuring: Companies often consider divesting from or significantly restructuring operations in these 'Dog' markets to reallocate capital more effectively.

Divested Business Units (e.g., AdvantageGo)

The divestment of Coforge's AdvantageGo business in April 2025 signals a strategic move to shed underperforming or non-core assets. This action aligns with the principles of a BCG Matrix, where such divested units are often categorized as Dogs.

Dogs represent business units with low market share in slow-growing industries. They typically generate little profit and can consume valuable resources that could be better allocated to Stars or Question Marks with higher growth potential. For instance, in 2024, many technology firms reviewed their portfolios, divesting non-essential software or services to streamline operations and focus on AI and cloud computing advancements.

- Divestment Rationale: AdvantageGo’s sale likely stems from its inability to achieve significant market share or growth, making it a financial drain.

- BCG Matrix Classification: As a Dog, AdvantageGo would have exhibited low relative market share and low market growth.

- Strategic Impact: The divestiture frees up capital and management focus for more promising areas within Coforge's portfolio, potentially boosting overall profitability and strategic agility.

Coforge's 'Dogs' represent business segments with low market share in industries experiencing slow growth, often characterized by underperforming acquisitions or niche geographies. These units typically generate minimal profits and can tie up valuable resources. For example, a small, experimental venture into a highly specialized consulting area might show minimal revenue growth, perhaps only a few million dollars annually, compared to the company's overall revenue of over $2 billion for fiscal year 2024.

The divestment of Coforge's AdvantageGo business in April 2025 exemplifies this classification, signaling a strategic move to shed assets that struggled to achieve significant market share or growth, thereby acting as a financial drain.

These 'Dog' segments are prime candidates for divestment or restructuring to free up capital and management focus for more promising growth opportunities within Coforge's portfolio, ultimately aiming to optimize resource allocation and enhance overall profitability.

Geographies with limited scalability, where Coforge has a minimal presence and faces stagnant growth, can also be classified as 'Dogs'. For instance, a market where Coforge's revenue contribution is less than 0.5% and has shown no year-over-year growth for the past two years might be a candidate for re-evaluation.

Question Marks

Coforge's acquisition of Cigniti Technologies in 2024-2025 is a strategic move to expand into high-growth sectors like retail, hi-tech, and healthcare. These new verticals represent potential 'Question Marks' as Coforge's presence within them is currently limited.

While these sectors promise substantial growth in digital services, Coforge's market share in these specific niches is still developing. The company faces the challenge of significant investment in integration and market penetration to elevate these new capabilities.

Coforge is strategically expanding into high-growth areas such as Southeast Asia and select European countries by 2025, aiming to leverage increasing IT expenditure. These new territories represent significant potential, but Coforge's current market presence is minimal.

These new geographic market expansions are considered question marks within the BCG matrix. They require substantial upfront investment to establish brand awareness and acquire key clients, crucial for future market penetration and growth.

Coforge's ventures into emerging technologies like quantum computing and advanced IoT represent significant long-term bets. These areas, while holding immense future potential, currently exhibit minimal market adoption, meaning Coforge's market share in these nascent fields is understandably low. These explorations are characterized by substantial research and development outlays, with their commercial viability and scalability still under evaluation.

Highly Specialized GenAI Applications in New Industries

Coforge's highly specialized GenAI applications in emerging industries represent a strategic play for future growth, positioning them as potential stars in nascent markets. These innovative solutions, while currently in early adoption phases, are designed to address niche challenges within rapidly expanding sectors, requiring substantial investment to cultivate market share.

These experimental GenAI ventures are focused on industries where Coforge's market presence is less developed, or for highly specific, complex problems. For instance, in 2024, Coforge announced a partnership to develop GenAI-powered diagnostic tools for rare diseases, a market projected to reach $15 billion by 2030. Such initiatives, though demanding significant R&D expenditure, aim to capture early mover advantages in high-potential future markets.

- Targeting niche markets: Developing GenAI for personalized drug discovery in the biopharmaceutical sector, a market expected to grow by 15% annually through 2027.

- Early-stage adoption: Focusing on GenAI for predictive maintenance in advanced manufacturing, where initial pilot projects are underway with key industry players.

- Investment for traction: Allocating significant capital in 2024 towards refining GenAI algorithms for complex financial modeling in decentralized finance (DeFi), aiming to establish a strong foothold.

- Future market potential: Exploring GenAI applications in sustainable agriculture technology, addressing needs for precision farming and resource optimization, a sector anticipated to see substantial investment in the coming years.

Targeted Solutions for Mid-Market Enterprises in New Segments

Coforge is strategically developing new, tailored digital solutions for mid-market enterprises entering segments where its competitive presence is currently limited. This approach acknowledges the significant growth potential inherent in the mid-market, which often requires dedicated investment to capture market share.

These targeted solutions are designed to address specific unmet needs within these emerging segments. For instance, Coforge might be focusing on digital transformation platforms for mid-sized manufacturing firms looking to adopt Industry 4.0 technologies, or specialized cloud migration services for mid-market healthcare providers navigating regulatory complexities.

The success of these initiatives, while promising, carries inherent risks. Establishing a strong foothold in new markets necessitates considerable investment in marketing, sales, and product adaptation. For example, a recent report indicated that mid-market companies investing in digital transformation saw an average revenue uplift of 7% in 2024, but only after an initial 18-month period of focused effort and investment.

- Targeted Digital Solutions: Development of bespoke digital platforms and services for mid-market enterprises in nascent or underserved market segments.

- Market Entry Strategy: Focus on segments where Coforge aims to build a stronger competitive presence, leveraging tailored offerings.

- Growth Opportunity: Recognition of the mid-market's high growth potential, balanced with the need for significant market penetration efforts.

- Risk and Reward: Acknowledging the substantial marketing and sales investment required, leading to uncertain but potentially high returns on investment.

Coforge's expansion into new geographic regions, such as Southeast Asia and select European countries by 2025, represents a strategic 'Question Mark' in the BCG matrix. These markets offer increasing IT expenditure opportunities, but Coforge's current market share is minimal, necessitating significant upfront investment to build brand awareness and secure key clients for future growth.

Similarly, Coforge's ventures into emerging technologies like quantum computing and advanced IoT are also 'Question Marks.' These areas have immense future potential but currently exhibit low market adoption, meaning Coforge's market share is understandably low. These initiatives require substantial R&D spending with commercial viability still under evaluation.

Coforge's targeted digital solutions for mid-market enterprises entering new segments also fall into the 'Question Mark' category. While the mid-market offers significant growth potential, capturing market share requires dedicated investment in marketing, sales, and product adaptation, with initial efforts often taking 18 months to show revenue uplift.

The acquisition of Cigniti Technologies in 2024-2025 positions Coforge to enter high-growth sectors like retail, hi-tech, and healthcare. These are considered 'Question Marks' due to Coforge's limited existing presence, requiring significant investment for integration and market penetration to capitalize on the substantial growth promised in digital services.

| Business Area | BCG Category | Strategic Focus | Investment Need | Market Potential |

|---|---|---|---|---|

| Southeast Asia & Select European Markets (by 2025) | Question Mark | Market penetration, brand building | High (marketing, sales, localization) | Growing IT expenditure |

| Quantum Computing & Advanced IoT | Question Mark | R&D, early-stage development | Very High (research, talent acquisition) | High (long-term disruptive potential) |

| GenAI for Niche Applications (e.g., Rare Diseases) | Question Mark | Targeted R&D, early adopter acquisition | High (algorithm refinement, pilot programs) | High (specific, high-value problem solving) |

| Mid-Market Digital Solutions | Question Mark | Product tailoring, market entry | Medium-High (sales, marketing, adaptation) | Significant (underserved segments) |

| Retail, Hi-Tech, Healthcare (post-Cigniti acquisition) | Question Mark | Integration, market share growth | High (synergies, cross-selling) | High (digital transformation demand) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.