COFORGE Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COFORGE Bundle

COFORGE navigates a competitive IT services landscape where buyer power and the threat of substitutes significantly influence its strategic positioning. Understanding these dynamics is crucial for anticipating market shifts and maintaining a competitive edge.

The complete report reveals the real forces shaping COFORGE’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Coforge's reliance on highly skilled talent, particularly in burgeoning fields like AI and cloud computing, presents a significant challenge. The limited availability of professionals with expertise in these critical areas directly impacts the company's operational capacity and project execution.

This scarcity empowers individual employees and specialized recruitment firms, allowing them to command higher salaries and more favorable terms. For instance, in 2024, the intense demand for AI specialists saw average salaries rise by approximately 15%, a direct reflection of this heightened bargaining power.

Coforge's reliance on niche technology vendors for highly specialized solutions grants these suppliers significant bargaining power. When a particular technology is unique and not readily available from multiple sources, these vendors can dictate terms and pricing, as substitution is difficult for Coforge.

For instance, while Coforge partners with broad providers like Microsoft and Salesforce, its ability to deliver cutting-edge services in specific domains might hinge on a few specialized software or platform providers. This dependence allows these niche vendors to potentially charge premium prices, impacting Coforge's cost structure.

The IT sector has experienced a notable wave of mergers and acquisitions among technology and service providers. This trend can consolidate power within the supply chain, potentially increasing the bargaining leverage of remaining key suppliers. For instance, in 2023, the IT services market saw significant M&A activity, with deals valued in the billions, indicating a growing concentration among certain vendors.

Impact of Wage Inflation in Key Geographies

Given Coforge's substantial presence in North America, a region often experiencing significant wage inflation, the company faces increased operational costs. For instance, in 2024, many IT hubs in the US saw average salary increases for tech roles ranging from 5% to 10% due to high demand and a competitive talent market.

This upward pressure on compensation directly impacts Coforge's cost of service delivery. To maintain its competitive edge and attract skilled professionals in these key geographies, the company must often match or exceed prevailing salary benchmarks, potentially squeezing profit margins if these costs aren't effectively passed on or offset.

- North American Revenue Contribution: In fiscal year 2024, North America represented approximately 48% of Coforge's total revenue, highlighting the financial significance of this market.

- IT Sector Wage Growth: Reports from 2024 indicated average salary growth in the US IT sector was around 7.5%, a key benchmark for Coforge's talent acquisition costs.

- Talent Retention Costs: Increased competition for skilled IT professionals in 2024 led to higher retention bonuses and benefits packages, adding to Coforge's employee-related expenses.

Vendor Lock-in Risks with Proprietary Platforms

While Coforge utilizes a diverse technology stack, reliance on specific proprietary platforms from key vendors can introduce vendor lock-in risks. This situation could hinder Coforge's ability to switch to more cost-effective or advanced solutions without facing substantial switching costs or operational disruptions. For instance, if a significant portion of Coforge's service delivery relies on a single vendor's specialized software, that vendor gains considerable bargaining power.

Managing these supplier relationships is paramount for Coforge to maintain flexibility and control costs. The potential for increased pricing or less favorable terms from a locked-in supplier directly impacts Coforge's profitability and competitive positioning. As of early 2024, the IT services industry continues to see consolidation among major software providers, potentially amplifying vendor power for those offering niche or highly integrated solutions.

- Vendor Lock-in: Deep integration with proprietary platforms can limit Coforge's flexibility.

- Switching Costs: Migrating away from locked-in solutions can be expensive and disruptive.

- Supplier Power: Dependence on specific vendors increases their bargaining leverage.

- Mitigation Strategy: Proactive vendor management is crucial to counter supplier power.

The bargaining power of suppliers for Coforge is influenced by the concentration of specialized technology providers and the demand for niche skills. When Coforge relies on a limited number of vendors for critical software or platforms, these suppliers can leverage their position to negotiate higher prices or less favorable terms. This is particularly true for unique solutions not easily replicated by competitors.

The IT talent market in 2024 continued to exhibit strong demand for specialized skills, especially in areas like AI and cloud. This scarcity of qualified professionals empowers individuals and recruitment agencies, leading to increased salary expectations and benefits. For instance, reports from 2024 indicated that average salaries for AI engineers in key tech hubs saw an increase of around 15% year-over-year, directly impacting Coforge's talent acquisition costs.

Mergers and acquisitions within the IT sector also play a role, consolidating the supplier landscape and potentially strengthening the leverage of remaining key players. For example, significant M&A activity in 2023 saw major software vendors combine, leading to fewer, larger entities with greater market influence.

| Factor | Impact on Coforge | 2024 Data/Trend |

|---|---|---|

| Specialized Technology Dependence | Increased pricing power for niche vendors | Reliance on proprietary platforms for advanced services |

| Talent Scarcity (AI/Cloud) | Higher salary demands from skilled professionals | 15% average salary increase for AI specialists in 2024 |

| IT Sector Consolidation | Enhanced bargaining power for remaining key suppliers | Billions in IT M&A deals in 2023 |

What is included in the product

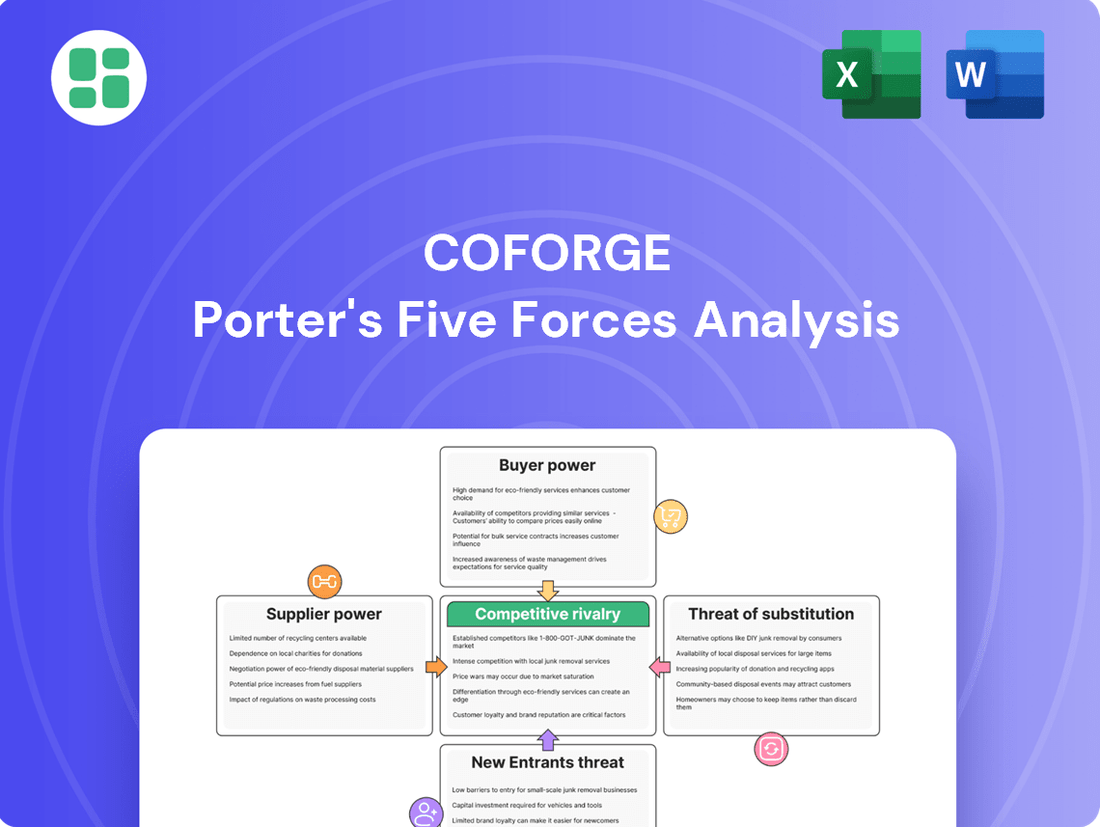

This Porter's Five Forces analysis for COFORGE meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the IT services sector.

Gain actionable insights into competitive pressures with a visually intuitive framework, simplifying complex market dynamics for strategic advantage.

Customers Bargaining Power

Coforge's client base exhibits a notable concentration, with its top 10 clients accounting for a significant 53% of its revenue in fiscal year 2023. This means a few large customers hold considerable sway in their dealings with the company.

This concentration of large clients directly translates into increased bargaining power for these customers. They can leverage their substantial business volume to negotiate more favorable pricing, dictate service levels, and influence contract terms, potentially impacting Coforge's profitability.

The IT services sector is a crowded arena, with giants like Accenture, Infosys, TCS, and Wipro, alongside many specialized firms. This sheer volume of options means clients have significant leverage, readily shifting to another provider if Coforge's offerings or costs don't meet their expectations.

This intense competition forces Coforge to constantly refine its services and pricing strategies to remain attractive. For instance, in 2023, the global IT services market was valued at approximately $1.3 trillion, underscoring the fierce battle for market share.

Customers are increasingly pushing for pricing models tied to results, moving away from standard time-and-material agreements. This trend is particularly strong in digital transformation initiatives, where clients want to see tangible business value before full payment.

This shift significantly boosts customer bargaining power. By linking payments directly to project success and measurable outcomes, clients transfer more risk to service providers like Coforge. For instance, in the IT services sector, a growing number of contracts are incorporating performance-based bonuses or penalties, reflecting this demand.

Coforge, therefore, faces pressure to clearly articulate and deliver a strong return on investment (ROI) for its clients. Demonstrating how their services translate into concrete business improvements and financial gains is crucial for securing and retaining business in this evolving market landscape.

High Switching Costs in Digital Transformation

While customers possess numerous options in the IT services market, the intricate nature of digital transformation solutions often leads to significant switching costs. These costs arise from deep integration into a client's core business processes, making it challenging and expensive to transition to a new provider once a project is underway. This can diminish customer bargaining power, particularly for ongoing engagements, fostering client stickiness for companies like Coforge.

Coforge actively cultivates long-term relationships and secures multi-year agreements, which inherently leverage these high switching costs. For instance, in 2024, Coforge reported a robust order book, indicating a strong pipeline of multi-year deals where clients are less likely to switch due to the embedded nature of the services. This strategy helps to lock in revenue streams and reduce the immediate impact of customer price sensitivity.

- High Integration Costs: Digital transformation projects often involve re-engineering critical business systems, making a provider change disruptive and costly.

- Learning Curve and Expertise: Clients invest in understanding a specific provider's methodology and technology stack, creating a barrier to switching.

- Data Migration Challenges: Moving vast amounts of data and ensuring its integrity during a transition adds another layer of complexity and expense.

- Long-Term Contracts: Coforge's focus on multi-year deals, common in the IT services sector, inherently limits a customer's ability to easily exit.

Client-Led Digital Transformation Imperatives

Customers are increasingly dictating the pace of digital transformation, expecting personalized solutions that tackle their unique problems and elevate their overall experience. This shift means clients are often setting the direction, pushing for innovation and clear value, which naturally boosts their bargaining power.

Coforge's approach directly addresses this by embedding consultants within client organizations. This allows for a deeper, on-the-ground understanding of evolving customer demands, enabling proactive identification and resolution of needs. For instance, in 2024, Coforge reported that over 70% of its client engagements involved co-creation of digital solutions, directly reflecting this client-led imperative.

- Customer-Driven Digital Agendas: Clients are not just recipients of digital services but active architects of their own digital futures, demanding bespoke solutions.

- Enhanced Negotiation Leverage: This proactive client stance translates into increased pressure for innovative, value-focused offerings, strengthening their position in negotiations.

- Coforge's On-Site Strategy: The company's commitment to placing consultants at client sites facilitates a granular understanding of these evolving demands, fostering agile responses.

- Impact on Service Delivery: This client-centric model ensures that Coforge’s digital transformation services are directly aligned with market needs, driving mutual success.

Coforge's customer bargaining power is influenced by client concentration, with the top 10 clients contributing 53% of revenue in FY23. This means a few large clients can negotiate better terms, impacting profitability. The competitive IT services landscape, valued at approximately $1.3 trillion in 2023, provides clients with numerous alternatives, further enhancing their leverage.

However, high switching costs associated with deep integration in digital transformation projects can mitigate this power. Coforge's strategy of securing multi-year agreements, supported by a strong order book in 2024, leverages these costs to lock in revenue and reduce price sensitivity.

Clients are increasingly driving digital transformation agendas, demanding personalized solutions and pushing for value-based pricing, which strengthens their negotiation position. Coforge's approach of embedding consultants on-site and co-creating solutions, with over 70% of engagements involving this in 2024, directly addresses these client-led imperatives.

| Factor | Impact on Customer Bargaining Power | Coforge's Mitigation Strategy |

|---|---|---|

| Client Concentration | High (Top 10 clients = 53% revenue FY23) | Diversification efforts, long-term relationships |

| Competitive Landscape | High (Global IT services market ~$1.3T in 2023) | Service differentiation, competitive pricing |

| Switching Costs | Low to Moderate (High for deep integration) | Multi-year contracts, embedded solutions |

| Customer-Driven Agendas | High (Demand for personalized, value-based solutions) | On-site consultants, co-creation (70%+ engagements in 2024) |

Preview Before You Purchase

COFORGE Porter's Five Forces Analysis

This preview showcases the complete COFORGE Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises. You can confidently acquire this comprehensive strategic tool, knowing it accurately reflects the insights you'll gain for informed decision-making.

Rivalry Among Competitors

Coforge navigates a highly competitive IT services landscape, contending with formidable global giants such as Accenture, TCS, Infosys, and Wipro. These established players command substantial market share and wield vast resources, creating a challenging environment for smaller firms seeking to capture new business.

The sheer scale and established client networks of these industry leaders intensify the rivalry for contracts and market dominance. This intense competition is a defining characteristic of the IT services sector, which is anticipated to grow significantly, with projections suggesting the global IT services market could reach around $1.2 trillion by 2025.

Coforge’s deliberate focus on niche sectors like banking, insurance, and travel, coupled with its strong emphasis on digital transformation, creates a unique market position. This specialization allows Coforge to offer tailored solutions that resonate deeply with clients in these specific industries.

However, this niche focus doesn't eliminate competitive rivalry. Other IT service providers also possess robust capabilities and dedicated practices within these same high-growth verticals, meaning Coforge constantly contends with rivals who understand these specialized markets equally well.

Coforge’s key competitive advantage lies in its capacity to deliver industry-specific digital solutions. For instance, in the banking sector, the company’s ability to implement advanced digital banking platforms and AI-driven customer service solutions differentiates it from competitors offering more generic IT services.

The competitive landscape in these digital transformation areas is intense. Many firms are vying for market share, and the ability to innovate and adapt quickly to evolving client needs in areas like cloud migration and data analytics is paramount. This means Coforge must continuously invest in its talent and technology to maintain its edge.

The IT services industry, including companies like Coforge, faces intense rivalry driven by the relentless pace of technological change. Emerging technologies such as artificial intelligence, cloud computing, and automation are not just trends; they are fundamental shifts that require constant adaptation. Companies that fail to innovate risk becoming obsolete quickly.

Coforge's strategic move to establish a Generative AI Center of Excellence and forge partnerships with key players like ServiceNow directly addresses this competitive pressure. These investments are vital for developing cutting-edge solutions and maintaining relevance in a market where clients increasingly demand advanced digital capabilities. Competitors are also channeling significant resources into these same technological frontiers, intensifying the race to lead.

For instance, in 2024, the global IT services market saw continued robust growth, with a significant portion of spending allocated to digital transformation initiatives heavily reliant on these emerging technologies. Coforge's proactive stance in AI and automation is therefore not just about staying competitive; it's about capturing market share in a segment that is expected to dominate future IT spending.

Pricing Pressure and Margin Management

The IT services sector is characterized by fierce competition, which naturally translates into significant pricing pressure. This intense rivalry directly impacts companies like Coforge, forcing them to carefully manage their profit margins. For instance, in 2024, Coforge is targeting an operating margin of 15%, a figure that underscores the delicate balance required to remain competitive while ensuring profitability.

To navigate this challenging landscape, Coforge must implement robust strategies. Effective cost control measures are paramount, allowing the company to absorb some of the pricing pressures. Simultaneously, focusing on delivering value-added services becomes crucial. These enhanced offerings differentiate Coforge from competitors and justify premium pricing, helping to sustain healthy margins despite the aggressive market dynamics.

- Intense Rivalry: The IT services market sees numerous players, leading to competitive pricing strategies.

- Margin Management: Coforge aims for a 15% operating margin in 2024, highlighting the need for careful profitability control.

- Cost Efficiency: Implementing strict cost controls is essential to offset pricing pressures.

- Value-Added Services: Differentiating through superior services helps maintain margins and competitive advantage.

Talent Acquisition and Retention Challenges

The intense competition for skilled talent significantly fuels rivalry within the IT services sector. Companies like Coforge must actively compete to secure top-tier professionals capable of delivering sophisticated digital solutions, directly impacting their ability to innovate and execute client projects effectively.

Coforge's substantial workforce, exceeding 33,000 employees as of fiscal year 2025, underscores the critical nature of talent acquisition and retention. A robust and skilled employee base is fundamental to Coforge's operational capacity and future growth trajectory, influencing its competitive advantage.

- Talent as a Differentiator: Skilled professionals are the backbone of digital transformation services, making their availability and quality a key battleground for IT firms.

- Workforce Size Matters: Coforge's employee count of over 33,000 in FY25 highlights the scale of operations and the constant need to manage and grow its human capital.

- Retention is Key: High attrition rates can cripple service delivery and increase recruitment costs, making retention strategies a crucial component of competitive strategy.

Competitive rivalry in the IT services sector is fierce, with established giants and agile specialists vying for market share. Coforge, like its peers, faces intense pressure from large-cap IT firms and niche players alike, particularly in high-growth areas like digital transformation. This constant competition necessitates continuous innovation and strategic differentiation to maintain market position.

The drive for talent is a significant aspect of this rivalry, as firms compete to attract and retain skilled professionals crucial for delivering advanced digital solutions. Coforge's workforce, exceeding 33,000 employees by fiscal year 2025, reflects the scale of this human capital competition.

Pricing pressures are inherent due to the crowded market, forcing companies like Coforge to maintain operational efficiency and focus on value-added services. For 2024, Coforge targets a 15% operating margin, underscoring the delicate balance between competitive pricing and profitability.

| Key Competitors | Market Focus | Competitive Tactics |

|---|---|---|

| Accenture, TCS, Infosys, Wipro | Broad IT Services, Digital Transformation | Scale, Established Client Networks, Full-Service Offerings |

| Niche IT Service Providers | Specialized Verticals (e.g., Banking, Insurance, Travel) | Deep Domain Expertise, Tailored Digital Solutions |

| Emerging Tech Specialists | AI, Cloud, Automation, Data Analytics | Cutting-Edge Technology, Rapid Innovation, Talent Acquisition |

SSubstitutes Threaten

Clients increasingly possess the capability to develop and enhance their internal IT departments, directly substituting the need for external providers like Coforge. Many businesses are prioritizing digital transformation, leading them to invest in building in-house expertise for critical areas such as application development, cloud management, and data analytics. This growing internal capacity can significantly reduce the demand for outsourced IT services.

In 2024, the trend of companies strengthening their in-house digital capabilities continued. For instance, a significant number of enterprises across various sectors reported increased spending on digital transformation initiatives, with a notable portion allocated to building internal talent pools for cloud and data science roles. This strategic shift directly presents a substitute threat to IT service providers by diminishing the reliance on external support for core digital functions.

The rise of low-code/no-code (LCNC) platforms presents a significant threat of substitution for traditional IT services, including those offered by companies like Coforge. These platforms allow businesses to build applications with little to no traditional coding, democratizing software development. For instance, Gartner predicted that by the end of 2024, LCNC development would account for over half of new application development. This trend enables clients to bring more development in-house, potentially reducing their reliance on external service providers for custom software solutions.

As automation and AI technologies advance, they present a significant threat of substitution for traditional IT services. These sophisticated tools can directly replace human-led processes and established IT support functions, impacting areas like business process outsourcing and application maintenance. Indeed, projections suggest AI could automate between 60% and 70% of current worker tasks, a substantial shift that could lead clients to adopt these solutions independently to drive cost efficiencies.

Standardized SaaS and Cloud-Based Solutions

The increasing availability of standardized Software-as-a-Service (SaaS) and cloud-based enterprise solutions presents a significant threat of substitution for companies like Coforge. These readily available, often subscription-based platforms offer a wide range of functionalities, from customer relationship management to enterprise resource planning, diminishing the perceived need for highly customized application development and ongoing maintenance services. This trend is particularly impactful as businesses increasingly favor agile, product-engineering approaches over bespoke IT projects.

For instance, the global SaaS market was projected to reach over $270 billion in 2024, showcasing the scale of these readily available alternatives. Companies can leverage these platforms to quickly deploy essential business functions without the extensive investment and time required for custom builds. This can directly impact demand for Coforge's traditional service offerings in application modernization and digital transformation, pushing clients towards more off-the-shelf, integrated solutions.

- Market Dominance of Cloud Platforms: Major cloud providers offer extensive suites of integrated services, acting as powerful substitutes for fragmented, custom-developed solutions.

- Cost-Effectiveness of SaaS: Standardized SaaS solutions often come with predictable pricing models and lower upfront costs compared to custom development, making them attractive to a broad range of businesses.

- Rapid Deployment and Scalability: Off-the-shelf SaaS and cloud solutions can be implemented much faster than bespoke systems, allowing businesses to adapt to market changes more quickly.

- Focus on Core Competencies: By adopting standardized solutions, businesses can redirect IT resources and focus on their core business activities rather than managing complex software development.

Consulting Firms Focused Purely on Strategy

The threat of substitute consulting services for Coforge is significant, particularly from pure-play strategy firms. These specialized consultancies can offer digital transformation roadmapping, leaving clients to manage implementation independently or with niche providers. This fragmentation challenges Coforge's integrated, end-to-end service model.

For instance, a client might engage a firm like McKinsey or BCG for a high-level digital strategy, then opt for internal IT teams or smaller, agile vendors for the actual execution. This bifurcated approach can bypass the need for a single, comprehensive service provider. In 2024, the consulting market saw continued demand for specialized digital strategy expertise, with firms like Accenture and Deloitte also heavily competing in this space, often offering both strategic and implementation services, thereby increasing competitive pressure.

Coforge aims to mitigate this threat by emphasizing its unique blend of deep industry domain knowledge coupled with robust technology implementation capabilities. This integration allows Coforge to not only define strategy but also to execute it effectively, offering a more holistic solution than pure-play strategy consultants. The company's focus on specific verticals, such as banking and financial services, allows it to build specialized expertise that is harder for generalist strategy firms to replicate.

- Threat of Substitutes: Pure-play strategy consulting firms offer an alternative for digital transformation roadmapping.

- Client Behavior: Clients may separate strategy development from implementation, engaging different vendors for each phase.

- Coforge's Response: Integration of deep domain knowledge with technology solutions to counter the fragmented approach.

- Market Context: Continued strong demand for digital strategy services in 2024, with intense competition from major consulting players.

The threat of substitutes for Coforge is multifaceted, encompassing clients' growing in-house capabilities, the rise of low-code/no-code platforms, and the increasing prevalence of standardized SaaS solutions.

In 2024, companies continued to bolster internal IT talent, particularly in cloud and data science, directly reducing reliance on external IT service providers. Furthermore, Gartner's prediction that low-code/no-code development would exceed half of new application development by year-end 2024 highlights how these platforms empower businesses to build applications internally, bypassing traditional IT service needs.

The global SaaS market's projected growth to over $270 billion in 2024 underscores the appeal of readily available, integrated solutions that diminish the demand for custom development and maintenance services offered by firms like Coforge.

Pure-play strategy consulting firms also pose a threat by offering digital transformation roadmapping, allowing clients to then manage implementation with internal teams or niche providers, fragmenting the market and challenging Coforge's end-to-end service model.

| Substitute Type | Key Characteristics | Impact on Coforge | 2024 Market Context |

|---|---|---|---|

| In-house IT Capabilities | Increased internal talent, focus on digital transformation | Reduced demand for outsourced IT services | Growing investment in internal digital talent pools |

| Low-Code/No-Code (LCNC) Platforms | Democratized software development, faster application building | Clients bypass custom development needs | Projected to account for over 50% of new app development |

| Standardized SaaS/Cloud Solutions | Off-the-shelf functionality, subscription-based | Diminished need for custom builds and maintenance | Global SaaS market projected over $270 billion |

| Pure-Play Strategy Consultants | Digital transformation roadmapping, specialized expertise | Clients may separate strategy from implementation | Continued strong demand for digital strategy services |

Entrants Threaten

While the overall IT services sector presents significant hurdles for newcomers, specific niches within digital transformation, particularly those centered on emerging technologies, exhibit considerably lower barriers to entry. This allows for the swift emergence of agile startups focused on specialized AI, cloud, or data solutions. These new players can quickly target distinct market segments, especially when the initial capital investment isn't a major deterrent.

The growing pool of skilled talent, especially in cutting-edge fields like artificial intelligence, coupled with substantial venture capital investments in technology startups, significantly lowers the barrier to entry for new competitors. These newcomers can rapidly develop expertise and capture market share by introducing novel products or agile business strategies. For instance, the demand for AI specialists saw a significant uptick in 2024, with many companies actively recruiting for these roles, indicating a readily available talent base for new entrants.

Coforge benefits from its established brand recognition and deep-rooted client relationships, particularly with Fortune 500 companies. These strong ties create a significant hurdle for new competitors attempting to break into the market. Building the necessary trust and securing substantial, intricate contracts requires a proven history and a solid industry standing, which new entrants often lack.

New players find it challenging to replicate the established reputation and client loyalty that companies like Coforge have cultivated over years. This makes it difficult for them to gain traction and compete for high-value projects, especially in sectors where trust and reliability are paramount. Coforge's strategic focus on specific industries, such as banking and financial services, allows it to develop profound domain expertise, further solidifying its competitive advantage and acting as a deterrent to potential new entrants.

Capital Requirements for Scale and Global Presence

The significant capital required to achieve the scale and global delivery presence necessary to compete with established IT services firms like Coforge presents a substantial barrier for new entrants. Building the necessary infrastructure, recruiting and training a vast workforce, and establishing a broad geographical reach demands considerable upfront investment, often in the hundreds of millions of dollars.

Newcomers struggle to match the operational capabilities and market penetration that companies like Coforge have cultivated over many years. Coforge's extensive network, spanning 23 countries and featuring 30 delivery centers, exemplifies the established footprint that new players must replicate, a feat that is capital-intensive and time-consuming.

- High Capital Outlay: New entrants need substantial funding to build global delivery centers and establish a significant workforce.

- Infrastructure Investment: Replicating Coforge's 30 delivery centers across 23 countries requires immense capital for real estate, technology, and operational setup.

- Competitive Disadvantage: Without comparable scale and reach, new firms face challenges in bidding for large, complex projects that demand global delivery capabilities.

Rapid Technological Advancements and Disruption

The threat of new entrants in the IT services sector, particularly for companies like Coforge, is significantly amplified by rapid technological advancements. Emerging technologies such as artificial intelligence (AI) and automation allow nimble startups to develop highly specialized, disruptive solutions that can bypass established service models and legacy systems. For instance, the increasing adoption of generative AI in software development and customer service could enable new players to offer highly efficient, cost-effective alternatives to traditional outsourcing. This necessitates continuous investment in R&D for Coforge to maintain its competitive edge.

Coforge must actively innovate and adapt its service portfolio to counter the potential disruption from these technologically advanced new entrants. The ability to quickly integrate cutting-edge technologies into its offerings is paramount. For example, by early 2025, many IT service providers are expected to have integrated AI-powered tools for code generation and testing, potentially reducing the need for manual labor in certain project phases. Companies that fail to keep pace risk being outmaneuvered by more agile, specialized competitors.

Sustained growth for Coforge hinges on its capacity for ongoing innovation. This includes not only adopting new technologies but also reimagining service delivery models. A key focus area for 2024 and beyond is the development of low-code/no-code platforms and AI-driven managed services, which can attract new customer segments and create new revenue streams. Companies that can demonstrate a clear path to leveraging these advancements will be better positioned to defend against new entrants.

- Technological Disruption: AI and automation enable new entrants to bypass traditional IT service models.

- Innovation Imperative: Coforge must continuously innovate to avoid being outmaneuvered by specialized tech-focused startups.

- Service Model Adaptation: Keeping pace with advancements in areas like AI-driven customer service is crucial for retaining market share.

- Investment in R&D: Ongoing investment in research and development is essential for Coforge to maintain its competitive position against emerging threats.

While Coforge benefits from established client relationships and brand recognition, the IT services landscape, particularly in digital transformation, sees lower barriers for specialized startups. These agile newcomers can leverage readily available talent, especially in AI, and significant venture capital to quickly gain traction. For instance, the demand for AI specialists saw a notable increase in 2024, indicating a talent pool accessible to new entrants.

The significant capital and infrastructure required to match Coforge's global presence, including its 30 delivery centers across 23 countries, present a substantial hurdle. New entrants often lack the scale and established reputation needed to secure large, complex projects that demand extensive delivery capabilities.

Rapid technological advancements, especially in AI and automation, empower nimble startups to offer disruptive, specialized solutions. Coforge must continuously innovate and adapt its service models, such as integrating AI-powered tools by early 2025, to counter these agile competitors and maintain its market position.

| Factor | Impact on Coforge | New Entrant Challenge |

|---|---|---|

| Talent Availability (AI Focus) | High demand in 2024 | Lowered barrier for specialized startups |

| Capital Investment | Significant for global scale | Major hurdle for new entrants |

| Technological Disruption | Necessitates continuous R&D | Opportunity for agile, specialized solutions |

| Brand Recognition & Client Loyalty | Strong competitive advantage | Difficult for new entrants to replicate |

Porter's Five Forces Analysis Data Sources

Our COFORGE Porter's Five Forces analysis is built upon a robust foundation of data, drawing from financial statements, investor relations materials, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.