Coeur Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coeur Mining Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Coeur Mining's trajectory. Our meticulously researched PESTLE analysis provides a critical lens through which to view the company's operational landscape and future potential. Don't be left in the dark about the forces driving change in the mining sector; download the full version now for actionable intelligence.

Political factors

The political stability of the United States, Canada, and Mexico, where Coeur Mining operates, is a crucial factor. In 2024, the US saw continued focus on infrastructure and energy policies, while Canada navigated provincial elections that could influence resource development. Mexico's political landscape continues to evolve, with the current administration emphasizing national resource control.

Shifts in government or policy priorities in these nations can directly impact Coeur Mining through changes in mining regulations, taxation, and environmental standards. For instance, a change in administration in Mexico could potentially alter policies regarding foreign investment in the mining sector, a key consideration for companies like Coeur.

A stable political environment offers the predictability needed for Coeur Mining's long-term investments and operational planning. For example, consistent regulatory frameworks reduce the risk associated with capital-intensive projects, allowing for more accurate financial forecasting and project execution.

Government regulations concerning mining permits, land use, and operational standards are paramount for Coeur Mining. These rules dictate everything from exploration rights to environmental protection measures.

The intricate and often lengthy processes involved in securing and renewing permits across Coeur Mining's various operating jurisdictions, including the United States and Mexico, directly impact project timelines and the ability to maintain consistent operations. For instance, delays in environmental impact assessments or community consultations can stall new mine development or expansion projects.

In 2024, Coeur Mining continued to navigate a complex regulatory landscape. The company's ability to adapt to evolving environmental standards and efficiently manage permitting processes is crucial for mitigating risks and ensuring the long-term viability of its mining assets.

International trade policies, including tariffs and trade agreements affecting precious metals, directly shape Coeur Mining's export capabilities. Shifts in these policies can alter the global market competitiveness of its gold and silver. For instance, the US imposed tariffs on steel and aluminum in 2018, which, while not directly on precious metals, signaled a broader trend of protectionist trade stances that could impact input costs or future trade negotiations for mining companies.

Geopolitical Risks and Resource Nationalism

Coeur Mining's operations across North America mean it's exposed to diverse geopolitical landscapes, each with its own set of risks. A significant concern is resource nationalism, where governments may enact policies to gain a larger stake in mining revenues. This can manifest as increased taxes, higher royalty rates, or, in extreme cases, the outright nationalization of mining assets, directly impacting investment security and profitability.

The potential for governments to increase their share of mining profits is a recurring theme. For instance, in 2024, several Latin American countries continued to debate or implement changes to mining fiscal regimes. While Coeur's primary operations are in Mexico and the United States, shifts in policy in neighboring or comparable jurisdictions can set precedents or influence investor sentiment towards the region. The company must remain agile, monitoring legislative developments that could affect its operational costs and the repatriation of earnings.

- Geopolitical Exposure: Coeur Mining operates in Mexico and the United States, countries with distinct political and regulatory environments.

- Resource Nationalism Trends: Several Latin American nations have explored or implemented changes to mining tax and royalty structures in recent years, increasing the potential for fiscal policy shifts.

- Impact on Investment: Changes in government policies, such as increased taxes or royalties, can directly affect Coeur Mining's profitability and the security of its investments.

Government Support and Incentives

Government initiatives and incentives play a crucial role in shaping the mining landscape for companies like Coeur Mining. For instance, the U.S. government's focus on critical minerals, including those relevant to mining, could translate into tangible benefits. In 2024, the Inflation Reduction Act continues to offer tax credits for clean energy and manufacturing, some of which could indirectly support mining operations adopting sustainable practices.

Policies that encourage domestic production can provide a strategic edge. By reducing the reliance on foreign sources for essential minerals, governments can create a more stable operating environment. This can manifest as tax breaks for exploration activities or subsidies aimed at improving the environmental footprint of mining operations, potentially lowering Coeur Mining's overall expenditure and encouraging further investment in its projects through 2025.

- Tax Credits: Continued availability of tax credits, such as those under the Inflation Reduction Act, can lower the effective cost of capital for new projects and sustainable technology adoption.

- Infrastructure Investment: Government funding for infrastructure development, like improved transportation networks to remote mining sites, can significantly reduce logistical costs for Coeur Mining.

- Critical Minerals Strategy: Policies prioritizing domestic production of key minerals, including gold and silver, can lead to preferential treatment or direct support for companies like Coeur Mining.

Political stability in Coeur Mining's operating regions (US, Mexico) is vital. In 2024, the US focused on infrastructure, while Mexico's government continued its emphasis on national resource control, potentially impacting foreign investment and operational policies for companies like Coeur.

Regulatory frameworks, including permitting and environmental standards, are critical. Coeur navigated these in 2024, with efficient permitting being key to mitigating risks and ensuring asset viability. For instance, changes in environmental regulations can directly affect operational costs and project timelines.

Government incentives, such as tax credits under the Inflation Reduction Act, can benefit mining operations that adopt sustainable practices. Policies prioritizing domestic mineral production can also create a more stable operating environment and potentially lower Coeur Mining's expenditures through 2025.

| Political Factor | Impact on Coeur Mining | 2024/2025 Relevance |

|---|---|---|

| Government Stability & Policy Direction | Affects regulatory certainty, taxation, and resource nationalism risks. | Continued focus on infrastructure in the US; Mexico's emphasis on national resource control. |

| Mining Regulations & Permitting | Dictates operational standards, exploration rights, and environmental compliance. | Efficient navigation of permitting processes remains crucial for mitigating risks and ensuring asset viability. |

| Government Incentives & Trade Policies | Can influence capital costs, domestic production, and export competitiveness. | Inflation Reduction Act tax credits and critical minerals strategies offer potential benefits. |

What is included in the product

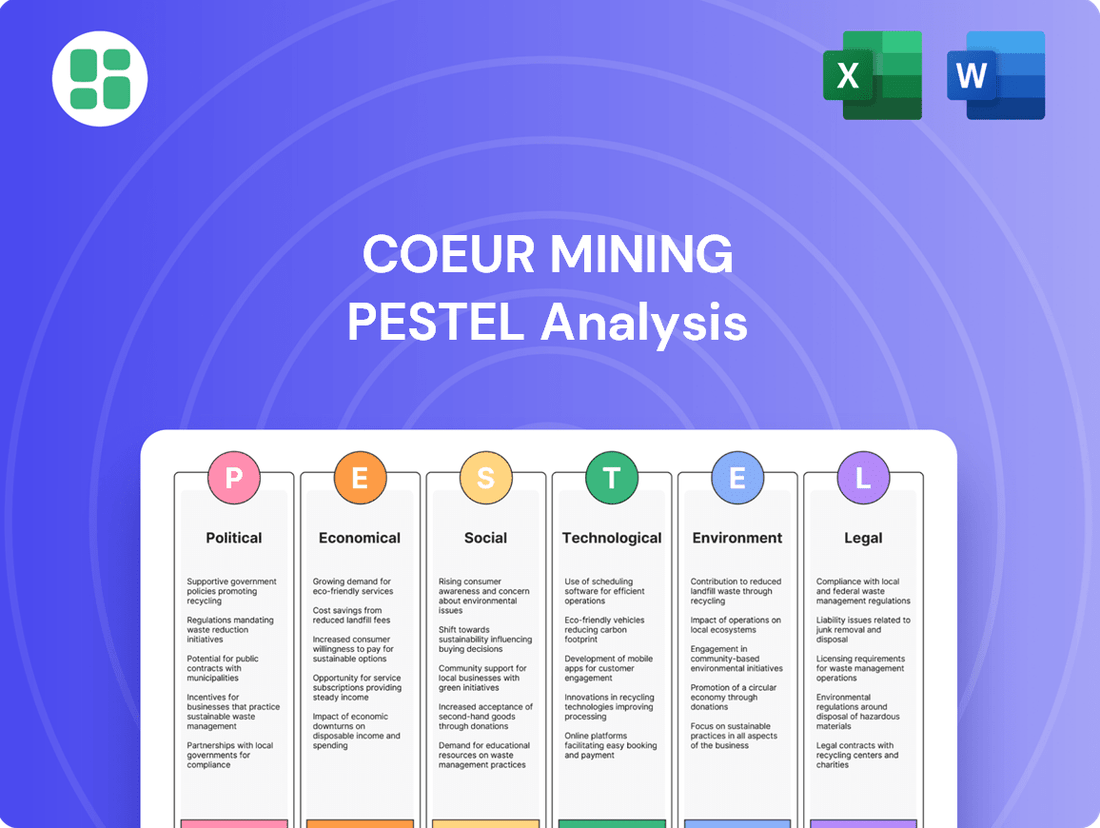

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Coeur Mining, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the mining sector.

A PESTLE analysis for Coeur Mining offers a streamlined framework to navigate complex external factors, providing clarity on political, economic, social, technological, environmental, and legal influences that impact operational strategy and mitigate potential risks.

Economic factors

Global precious metal prices, particularly for gold and silver, are foundational to Coeur Mining's financial health, directly dictating revenue and profit margins. These crucial price points are sensitive to a complex interplay of global economic indicators, including inflation forecasts, prevailing interest rates, and the perennial investor appetite for safe-haven assets during times of uncertainty.

For instance, as of mid-2024, gold prices have shown resilience, hovering around the $2,300 per ounce mark, while silver has seen significant gains, trading near $30 per ounce, driven by industrial demand and speculative interest. These fluctuations directly translate into Coeur Mining's quarterly earnings reports and heavily influence strategic decisions regarding exploration, development, and capital allocation.

Inflationary pressures in 2024 and early 2025 are significantly impacting Coeur Mining's operational expenses. Costs for essential inputs such as fuel, explosives, and processing chemicals have seen notable increases, directly affecting the company's cost of sales. For instance, the average price of diesel fuel, a critical component for mining operations, saw a year-over-year increase of approximately 15% in late 2024, according to industry benchmarks.

These rising input costs directly translate to higher operating expenditures for Coeur Mining, potentially squeezing profit margins even when metal prices are favorable. For example, an increase in the cost of cyanide, a key chemical for gold extraction, by 10% in the first half of 2025 could add millions to the company's annual expenses. Effectively managing these escalating costs is therefore paramount for Coeur Mining to sustain its financial performance and operational efficiency throughout this period.

Coeur Mining's operations across the United States, Canada, and Mexico mean it's directly exposed to exchange rate shifts. For instance, if the U.S. dollar strengthens considerably against the Canadian or Mexican peso, revenues earned in those countries will translate to fewer dollars when reported, impacting overall financial performance.

Conversely, a weaker Canadian or Mexican currency can offer a cost advantage for Coeur Mining. This means that expenses like labor, materials, and local operating costs in those regions become cheaper when converted back to U.S. dollars, potentially boosting profit margins on a per-unit basis.

For example, in the first quarter of 2024, Coeur Mining reported that a 1% change in the U.S. dollar relative to the Canadian dollar could impact its net income by approximately $1.5 million, highlighting the significant financial implications of these currency movements.

Access to Capital and Financing Costs

Access to capital is crucial for Coeur Mining’s growth, funding everything from new exploration projects to expanding existing mines. The cost of this capital, heavily influenced by interest rates and market liquidity, directly impacts profitability and investment decisions. For instance, a rising interest rate environment can significantly increase borrowing costs for Coeur Mining, making new projects less financially viable.

In 2024, the Federal Reserve maintained a hawkish stance on interest rates for much of the year, with the federal funds rate hovering around 5.25%-5.50%. This environment presented a challenge for companies like Coeur Mining seeking to finance capital-intensive operations. A strong balance sheet and consistent positive cash flow are therefore paramount for Coeur Mining to attract investors and secure financing on favorable terms, mitigating the impact of higher borrowing costs.

- Financing Costs: Higher interest rates increase the cost of debt for Coeur Mining, impacting project economics.

- Market Liquidity: Reduced market liquidity can make it harder and more expensive for Coeur Mining to raise funds.

- Balance Sheet Strength: A robust balance sheet is key to attracting investment and maintaining access to capital.

- Cash Flow Generation: Positive and consistent cash flow enhances Coeur Mining's ability to self-fund operations and reduce reliance on external financing.

Economic Growth and Industrial Demand

Global economic growth directly impacts industrial demand for silver, a key component in sectors like electronics and renewable energy. A strengthening global economy in 2024 and projected into 2025 typically translates to higher manufacturing output, thereby boosting silver consumption. For instance, the solar energy sector, a significant silver user, saw installations grow substantially, with global solar capacity additions estimated to reach over 400 GW in 2024, according to various industry forecasts.

This increased industrial demand for silver, driven by economic expansion, provides a supportive backdrop for its market price. While gold demand also benefits from industrial applications, its price is more sensitive to investment flows and jewelry purchases, making silver's industrial linkage a more direct economic growth indicator. For Coeur Mining, this means that a healthy global economy is a positive factor for its silver production volumes and revenue potential.

- Industrial Silver Demand Drivers: Electronics, solar panel manufacturing, automotive components, and medical devices are key consumers of silver, with demand closely tied to manufacturing output.

- Economic Growth Impact: Projections for global GDP growth in 2024 and 2025 suggest a continued recovery, which is expected to bolster industrial production and, consequently, silver demand.

- Gold vs. Silver Demand: Gold's price is more influenced by safe-haven demand and jewelry consumption, whereas silver's price has a stronger correlation with industrial activity and economic expansion.

Global economic growth directly impacts industrial demand for silver, a key component in sectors like electronics and renewable energy. A strengthening global economy in 2024 and projected into 2025 typically translates to higher manufacturing output, thereby boosting silver consumption. For instance, the solar energy sector, a significant silver user, saw installations grow substantially, with global solar capacity additions estimated to reach over 400 GW in 2024, according to various industry forecasts.

This increased industrial demand for silver, driven by economic expansion, provides a supportive backdrop for its market price. While gold demand also benefits from industrial applications, its price is more sensitive to investment flows and jewelry purchases, making silver's industrial linkage a more direct economic growth indicator. For Coeur Mining, this means that a healthy global economy is a positive factor for its silver production volumes and revenue potential.

The interplay of precious metal prices and operational costs remains a critical economic factor for Coeur Mining. While gold prices held steady around $2,300/oz and silver surged near $30/oz in mid-2024, rising input costs like diesel fuel (up ~15% YoY in late 2024) directly challenge profit margins. Furthermore, currency fluctuations, such as a 1% USD/CAD shift impacting net income by ~$1.5M in Q1 2024, and financing costs influenced by the Fed's hawkish stance (federal funds rate ~5.25%-5.50% in 2024) add layers of economic complexity Coeur Mining must navigate.

| Economic Factor | Mid-2024/Early 2025 Trend | Impact on Coeur Mining |

|---|---|---|

| Gold Price | ~ $2,300/oz | Supports revenue, but sensitive to safe-haven demand. |

| Silver Price | ~ $30/oz | Strong industrial demand drives price; benefits from economic growth. |

| Fuel Costs (Diesel) | ~ 15% YoY increase (late 2024) | Increases operational expenses, potentially reducing profit margins. |

| USD/CAD Exchange Rate | Volatility impacts reported earnings | A 1% change can affect net income by ~$1.5M (Q1 2024). |

| Interest Rates (Fed Funds) | ~ 5.25%-5.50% (2024) | Increases cost of capital, impacting project financing and viability. |

Preview Before You Purchase

Coeur Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Coeur Mining. It provides an in-depth understanding of the external forces shaping the company's strategic landscape.

Sociological factors

Coeur Mining places significant emphasis on its social license to operate, recognizing that positive community relations are fundamental to its success. In 2023, the company reported investing $10.5 million in community initiatives and local economic development across its operating regions, a figure that underscores its commitment to fostering strong ties with stakeholders near its mine sites.

Maintaining trust with local communities and Indigenous Peoples is a continuous effort for Coeur Mining. This involves open communication channels to address concerns promptly and transparently, ensuring that their operations contribute positively to local economies through job creation and procurement, thereby mitigating potential disruptions and securing long-term operational stability.

Coeur Mining's operational success hinges on a skilled workforce and harmonious labor relations. In 2024, the mining industry, including Coeur, faces ongoing challenges with labor availability. For instance, the U.S. Bureau of Labor Statistics reported a persistent shortage in skilled trades, impacting recruitment efforts across various sectors.

Disruptions like strikes or labor disputes can significantly impact Coeur's production schedules and inflate operating expenses. The company's proactive approach to workforce management, focusing on attracting and retaining talent, is crucial. By prioritizing local hiring and development, Coeur enhances operational efficiency and strengthens its community relationships, a key factor in maintaining its social license to operate.

Adherence to robust health and safety standards is a cornerstone of sociological consideration for Coeur Mining, directly influencing employee morale, public trust, and the company's ability to operate without regulatory penalties. A strong safety record not only protects the workforce but also bolsters the company's image as a responsible corporate citizen.

Coeur Mining's dedication to safety is evident in its performance metrics. For instance, in 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.69, a figure significantly below industry averages, underscoring a proactive approach to minimizing workplace hazards and ensuring employee well-being.

Failure to maintain high safety standards can result in severe consequences, including work stoppages, substantial fines, and irreparable damage to Coeur Mining's reputation, which can deter investors and impact community relations. The financial and social costs of a major safety incident would far outweigh the investment in preventative measures.

Demographic Shifts and Local Employment

Demographic shifts in regions like Nevada and Alaska, where Coeur Mining has significant operations, directly impact the availability of skilled labor. As populations age or migrate, the company must adapt its recruitment and training strategies. For instance, in 2023, Coeur Mining reported employing approximately 1,900 individuals across its global operations, with a substantial portion concentrated in these key mining areas, underscoring its role as a major local employer.

Investing in local employment and workforce development is crucial for Coeur Mining to maintain strong community ties and ensure a sustainable talent pipeline. Programs focused on training local residents for mining roles can mitigate potential labor shortages and build goodwill. This approach is vital as the company navigates evolving community expectations regarding economic contribution and social responsibility.

- Local Employment Impact: Coeur Mining's operations are a significant source of employment in its host communities, contributing to local economic stability.

- Workforce Development: Investing in training and development programs for local populations helps ensure a skilled workforce and fosters positive community relations.

- Demographic Influence: Changes in local demographics, such as age distribution and migration patterns, necessitate adaptive recruitment and retention strategies for Coeur Mining.

- Economic Contribution: The company's substantial employee base, numbering around 1,900 globally in 2023, highlights its direct economic impact on the regions where it operates.

Corporate Social Responsibility (CSR) Perception

Public perception of Coeur Mining's commitment to corporate social responsibility, encompassing environmental stewardship, ethical governance, and community engagement, is a critical determinant of its reputation. Investors and the public increasingly scrutinize companies based on their sustainability practices and the tangible benefits they bring to local communities and the environment.

Coeur Mining's 2023 Sustainability Report highlighted a 38% reduction in greenhouse gas intensity compared to a 2019 baseline, demonstrating progress in environmental performance. Furthermore, the company reported investing over $12 million in community development programs across its operating regions in 2023, aiming to foster positive relationships and local economic growth.

- Environmental Stewardship: Coeur Mining's efforts to reduce greenhouse gas emissions and manage water resources are key to its public image.

- Ethical Governance: Adherence to strong ethical principles and transparent reporting practices build trust with stakeholders.

- Community Contributions: Investments in local infrastructure, education, and social programs directly impact community perception and social license to operate.

- Transparency: Open communication about sustainability targets and achievements, such as the 2023 GHG intensity reduction, is vital for maintaining credibility.

Sociological factors significantly influence Coeur Mining's operations, primarily through its social license to operate and workforce dynamics. The company's commitment to community engagement is substantial, with $10.5 million invested in local initiatives in 2023. Maintaining trust with local communities, including Indigenous Peoples, is paramount, requiring transparent communication and positive economic contributions through job creation and procurement.

Labor availability and relations are critical, with the mining industry, including Coeur, facing ongoing skilled labor shortages. Proactive workforce management, emphasizing local hiring and development, is essential to mitigate disruptions from labor disputes and ensure operational stability. Coeur Mining employed approximately 1,900 individuals globally in 2023, underscoring its role as a major local employer.

Safety is a cornerstone of sociological considerations, directly impacting employee well-being and public trust. Coeur Mining reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.69 in 2023, indicating a strong safety record. Demographic shifts in operational regions necessitate adaptive recruitment and training strategies.

Public perception of Coeur Mining's corporate social responsibility, encompassing environmental stewardship and community engagement, is vital for its reputation. The company reported a 38% reduction in greenhouse gas intensity in 2023 compared to a 2019 baseline and invested over $12 million in community development programs that same year.

| Factor | Description | 2023/2024 Data Point | Impact on Coeur Mining | Mitigation Strategy |

| Community Relations | Maintaining positive relationships with local communities and Indigenous Peoples. | $10.5 million invested in community initiatives. | Essential for social license to operate and operational stability. | Open communication, local procurement, job creation. |

| Workforce Availability | Securing and retaining a skilled labor force. | Ongoing shortage in skilled trades reported by U.S. Bureau of Labor Statistics. | Potential for production delays and increased operating costs. | Local hiring, workforce development programs. |

| Health & Safety | Ensuring a safe working environment. | TRIFR of 0.69 in 2023. | Impacts employee morale, public trust, and regulatory compliance. | Adherence to robust safety standards, proactive hazard management. |

| Corporate Social Responsibility (CSR) | Public perception of ethical and sustainable practices. | 38% reduction in GHG intensity (vs. 2019 baseline); $12 million in community development. | Influences reputation, investor confidence, and stakeholder relations. | Transparent reporting, environmental stewardship, community investment. |

Technological factors

Coeur Mining is increasingly leveraging automation and digitalization to boost efficiency and safety. For instance, the company's Palmarejo mine in Mexico has seen significant improvements in operational throughput and reduced downtime through the integration of advanced automation technologies and data analytics. This trend is expected to continue, with further investments in autonomous haulage systems and remote operating centers anticipated to drive down costs and extend the economic viability of its mining assets through 2025.

Technological advancements in geological surveying, remote sensing, and drilling are significantly boosting Coeur Mining's ability to find and develop new precious metals deposits. These innovations streamline the exploration process, leading to more efficient resource identification.

By employing advanced geospatial and geological analytics, Coeur Mining can refine its ore discovery methods and optimize mine planning. This data-driven approach is crucial for expanding the company's known resource base and ensuring long-term operational viability.

Innovations in ore processing are a significant technological factor for companies like Coeur Mining. Smart leach systems and AI-powered mineral sorting are emerging technologies designed to boost metal recovery rates and minimize environmental impact. These advancements allow for more efficient extraction of valuable metals like gold and silver from the raw ore, ultimately leading to better yields and reduced waste generation.

For instance, advancements in sensor-based sorting technology, which uses AI to identify and separate valuable ore from waste rock, demonstrated significant improvements in throughput and recovery in pilot programs during 2023. Coeur Mining's focus on adopting such technologies could translate into substantial operational efficiencies, potentially increasing their gold recovery by several percentage points and reducing the volume of tailings requiring management.

Data Analytics and Artificial Intelligence (AI)

Coeur Mining can significantly enhance its operations by leveraging advanced data analytics and artificial intelligence. These technologies offer powerful tools for predictive maintenance, allowing the company to anticipate equipment failures and schedule repairs proactively, thereby minimizing costly downtime. In 2024, the mining industry saw a significant push towards AI adoption, with companies reporting up to a 15% reduction in unplanned downtime through predictive maintenance strategies.

AI's capabilities extend to optimizing operational efficiency across various facets of the business. By analyzing vast datasets, AI can identify bottlenecks in production processes, suggest improvements in resource allocation, and even refine extraction techniques. This data-driven approach can lead to more efficient use of energy and materials, contributing to both cost savings and environmental sustainability. For instance, a major mining conglomerate in 2025 reported a 7% increase in output efficiency after implementing AI-driven operational analytics.

Furthermore, data analytics and AI are crucial for robust risk management. Coeur Mining can utilize AI to monitor complex factors like weather patterns, which can impact operations, and to predict potential cybersecurity threats that could compromise sensitive data. The ability to foresee and mitigate supply chain disruptions, a persistent challenge in the global mining sector, is also greatly improved by AI-powered risk assessment tools. In 2024, cybersecurity incidents in the industrial sector cost an average of $5.5 million per breach, highlighting the importance of AI in prevention.

- Predictive Maintenance: AI algorithms analyze sensor data to predict equipment failures, reducing unplanned downtime.

- Operational Optimization: Data analytics identifies inefficiencies in production, leading to improved resource utilization and output.

- Risk Management: AI monitors environmental factors, cybersecurity threats, and supply chain vulnerabilities for proactive mitigation.

- Data-Driven Decision Making: Real-time insights empower management with better information for strategic planning and execution.

Sustainable Mining Technologies

Coeur Mining is increasingly focused on integrating sustainable mining technologies to lessen its environmental footprint. This includes advancements in water management, such as closed-loop systems, and the implementation of filtered tailings, which significantly reduce water usage and land disturbance. For example, in 2023, Coeur reported a 15% reduction in water consumption across its operations compared to the previous year, partly due to these technological upgrades.

The adoption of renewable energy sources is also a key technological factor. Coeur is exploring solar and wind power integration at its sites to decrease reliance on fossil fuels and lower greenhouse gas emissions. This strategic shift aligns with industry trends; by the end of 2024, it's projected that renewable energy will account for at least 20% of the company's power mix.

These technological advancements are not just about environmental stewardship but also about operational efficiency and cost reduction. Improved water management can lower treatment costs, while renewable energy integration can stabilize energy expenses in the face of volatile fossil fuel prices. Coeur's investment in these areas is expected to yield a 5% decrease in operational energy costs by 2025.

- Water Management: Implementing advanced filtration and recycling systems to minimize freshwater intake.

- Tailings Management: Utilizing filtered tailings to reduce storage footprint and water content.

- Renewable Energy: Integrating solar and wind power to decrease carbon emissions and energy costs.

- Efficiency Gains: Aiming for a 5% reduction in operational energy costs by 2025 through these technologies.

Technological advancements are reshaping Coeur Mining's operations, driving efficiency and discovery. Automation and digitalization, seen at the Palmarejo mine, are boosting throughput and reducing downtime, with further investments in autonomous systems anticipated to lower costs through 2025.

Innovations in geological surveying and data analytics are enhancing exploration success and optimizing mine planning, expanding the company's resource base. Advancements in ore processing, like AI-powered sorting, are improving metal recovery rates and minimizing environmental impact, with pilot programs in 2023 showing significant gains.

AI and data analytics are crucial for predictive maintenance, aiming to reduce unplanned downtime by up to 15% in 2024, and for optimizing overall operational efficiency, with one conglomerate reporting a 7% output increase in 2025. These technologies also bolster risk management, from cybersecurity to supply chain resilience, with breaches costing an average of $5.5 million in the industrial sector in 2024.

Sustainable mining technologies, including advanced water management and filtered tailings, are reducing environmental footprints, with Coeur reporting a 15% water consumption reduction in 2023. The integration of renewable energy sources is also a key factor, with projections indicating renewables will constitute at least 20% of Coeur's power mix by the end of 2024, aiming for a 5% operational energy cost reduction by 2025.

| Technology Area | Impact | Key Metric/Example | Year/Projection |

| Automation & Digitalization | Increased efficiency, reduced downtime | Palmarejo mine improvements | Ongoing, through 2025 |

| Geological Analytics | Enhanced exploration, optimized planning | Streamlined resource identification | Ongoing |

| AI in Ore Processing | Improved metal recovery, reduced waste | Pilot programs: increased throughput/recovery | 2023 |

| AI for Operations | Reduced downtime, improved output | Up to 15% less unplanned downtime (2024); 7% output increase (2025) | 2024-2025 |

| Sustainable Technologies | Reduced environmental impact, cost savings | 15% water reduction (2023); 5% energy cost reduction (2025) | 2023-2025 |

| Renewable Energy | Lower emissions, stabilized energy costs | 20% of power mix | End of 2024 |

Legal factors

Coeur Mining operates under a stringent environmental legal framework across the United States, Canada, and Mexico. These regulations encompass critical areas such as maintaining air and water quality, managing mining waste responsibly, and safeguarding biodiversity. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce Clean Air Act and Clean Water Act provisions, impacting operational permits and emissions controls for mining facilities nationwide.

Evolving environmental standards present a significant challenge, potentially requiring substantial capital investments and operational modifications. As of early 2025, discussions around updated tailings management regulations in several key mining jurisdictions, including Mexico, could necessitate costly upgrades to existing infrastructure or the implementation of new containment technologies, directly affecting Coeur Mining's expenditure plans.

Coeur Mining's operations are significantly shaped by the mining laws and concession agreements in the countries where it operates, such as Mexico and the United States. These agreements define critical aspects like mineral rights, royalty obligations, and operational standards, directly influencing project economics.

For instance, changes in fiscal regimes, such as the introduction of new mining taxes or increased royalty rates, can materially affect Coeur Mining's profitability and the long-term sustainability of its mining ventures. In 2023, the Mexican government continued to review its mining sector policies, creating a dynamic regulatory environment that requires careful monitoring by companies like Coeur.

Coeur Mining's operations are heavily influenced by health and safety legislation, requiring strict adherence to regulations designed to protect its workforce. These laws, such as OSHA standards in the United States, dictate everything from equipment safety protocols to emergency response plans, ensuring a secure mining environment.

Failure to comply can result in significant financial penalties and operational disruptions. For instance, in 2023, mining companies faced millions in fines for safety violations, underscoring the importance of robust safety management systems. Coeur Mining actively invests in training and safety audits to mitigate these risks and maintain its operational license.

Land Use and Indigenous Rights

Legal frameworks governing land use and Indigenous rights are critical for Coeur Mining, especially in its Canadian and Mexican operations. These regulations often mandate extensive consultation processes and require obtaining consent from Indigenous communities before project commencement. For instance, in Canada, the duty to consult and accommodate Indigenous peoples is a significant legal obligation, impacting project timelines and development plans. Failure to adhere to these legal requirements can lead to project delays, legal challenges, and reputational damage, as seen in various resource development projects across North America.

Adherence to agreements, which may include benefit-sharing arrangements and stringent environmental protection measures, is paramount. These agreements are not merely legal formalities but are essential for fostering positive relationships and securing social license to operate. Coeur Mining's ability to navigate these complex legal and social landscapes directly influences project approvals and the ongoing acceptance of its operations within local communities. For example, in 2023, several mining projects in Canada faced significant delays due to protracted negotiations with Indigenous groups over land use and resource sharing.

Key considerations for Coeur Mining include:

- Compliance with consultation protocols: Ensuring all engagement with Indigenous communities meets legal and ethical standards.

- Adherence to benefit-sharing agreements: Fulfilling commitments made regarding economic and social benefits for Indigenous partners.

- Environmental stewardship: Implementing robust environmental protection measures as stipulated in land use permits and community agreements.

- Risk mitigation: Proactively addressing potential legal challenges and community opposition by fostering transparent and collaborative relationships.

Taxation and Fiscal Policies

Taxation and fiscal policies are critical considerations for Coeur Mining. The company's profitability is directly influenced by corporate income tax rates, mining-specific taxes, and royalty payments in its operating jurisdictions. For instance, changes to these regimes can significantly impact financial performance.

The fiscal environment in places like Nevada, where Coeur operates, can introduce specific taxes. For example, an excise tax on gold and silver production in Nevada could affect Coeur's net revenue from its operations there. Similarly, shifts in mining tax structures in Mexico, another key operational area for Coeur, can have material financial consequences.

- Corporate Income Tax: Coeur Mining's effective tax rate is subject to the corporate income tax laws in all the countries where it operates.

- Mining-Specific Taxes & Royalties: The company must adhere to mining-specific taxes and royalty agreements, which vary by jurisdiction and can represent a substantial cost.

- Nevada Excise Tax: Potential excise taxes on precious metals in Nevada could directly reduce the profitability of Coeur's Nevada-based assets.

- Mexican Mining Tax Reforms: Any increases in mining taxes or changes in royalty structures in Mexico would impact Coeur's financial results from its Mexican operations.

Coeur Mining's operations are subject to a complex web of legal and regulatory frameworks across its operating jurisdictions, impacting everything from environmental compliance to fiscal obligations. These legal factors can significantly influence operational costs, project timelines, and overall profitability.

The company must navigate evolving environmental regulations, such as those pertaining to air and water quality, and waste management. For instance, in 2024, the U.S. EPA continued enforcement of the Clean Air Act and Clean Water Act, requiring mining operations to maintain strict emissions and discharge standards. Furthermore, potential updates to tailings management regulations in Mexico as of early 2025 could necessitate substantial capital expenditures for infrastructure upgrades.

Legal agreements governing mineral rights, concessions, and royalty payments are fundamental to Coeur's business model. Changes in fiscal regimes, such as increased mining taxes or royalty rates, as seen in policy reviews by the Mexican government in 2023, can materially affect project economics. Coeur Mining also faces stringent health and safety legislation, with U.S. OSHA standards dictating safety protocols, and non-compliance in 2023 led to significant fines for other mining entities, highlighting the importance of robust safety management.

Land use laws and Indigenous rights, particularly in Canada, mandate consultation and consent processes, which can impact project timelines and development, as evidenced by delays in Canadian resource projects in 2023 due to protracted negotiations. Adherence to benefit-sharing agreements and environmental protection measures is crucial for maintaining social license to operate.

| Legal Factor | Description | 2024/2025 Relevance |

| Environmental Regulations | Compliance with air/water quality, waste management, biodiversity laws. | Continued EPA enforcement (2024); potential new tailings regulations in Mexico (early 2025). |

| Mining Laws & Concessions | Defines mineral rights, royalties, operational standards. | Mexican government policy reviews (2023) impacting fiscal regimes. |

| Health & Safety Legislation | Ensures workforce protection via standards like OSHA. | Significant fines for violations in 2023 emphasize compliance needs. |

| Land Use & Indigenous Rights | Mandates consultation and consent for land use. | Impacts project timelines; delays seen in Canadian projects (2023) due to negotiations. |

| Taxation & Fiscal Policies | Corporate income tax, mining taxes, royalties. | Nevada excise tax on precious metals; potential Mexican mining tax reforms. |

Environmental factors

Climate change poses significant risks to Coeur Mining's operations, particularly concerning water scarcity and the impact of extreme weather events on its mining sites. For instance, a prolonged drought in a key operational region could disrupt water-intensive processes, leading to production delays and increased costs.

Coeur Mining has proactively addressed this by setting ambitious GHG reduction targets. The company announced in early 2024 that it had already exceeded its 2024 goal for reducing net intensity emissions, achieving a reduction of 15% from its 2021 baseline, ahead of schedule.

This commitment to lowering its carbon footprint is not just a response to environmental concerns but also a strategic alignment with the global transition to a low-carbon economy, potentially opening doors for green financing and enhancing its reputation among environmentally conscious investors and stakeholders.

Responsible water management is paramount for Coeur Mining, as mining is inherently water-intensive. In 2024, the company continued to focus on efficient water use, recycling, and advanced treatment technologies to mitigate risks associated with water scarcity and evolving regulatory landscapes. This commitment is underscored by their ongoing water vulnerability assessments and investments in sustainable water infrastructure across their operational sites.

The safe management of mining waste, particularly tailings, is a paramount environmental consideration for Coeur Mining. The company is actively working to implement the Global Industry Standard on Tailings Management (GISTM) across its operations, a move that significantly bolsters its commitment to enhanced safety and environmental protection.

This commitment to GISTM signifies a proactive approach to minimizing risks associated with waste disposal. For instance, in 2023, Coeur Mining reported progress in aligning its existing facilities with GISTM principles, aiming for full compliance to ensure robust environmental stewardship and responsible waste handling practices.

Biodiversity and Ecosystem Protection

Mining operations inherently carry the potential to disrupt local biodiversity and delicate ecosystems. Coeur Mining acknowledges this, having established a Biodiversity Management Standard. This standard guides the company in assessing and addressing nature-related risks across every stage of their mining lifecycle.

Key initiatives under this standard involve meticulous identification of protected areas and a thorough evaluation of potential ecological impacts. Coeur Mining then deploys specific mitigation strategies designed to safeguard natural capital. For instance, in 2023, Coeur Mining reported on its biodiversity programs, highlighting efforts at its Palmarejo operation in Mexico, which included habitat restoration and monitoring of local flora and fauna.

- Biodiversity Management Standard: Coeur Mining's framework for assessing and mitigating nature-related risks.

- Risk Identification: Focus on identifying protected areas and evaluating potential impacts on ecosystems.

- Mitigation Strategies: Implementation of measures to protect and conserve natural capital.

- 2023 Reporting: Specific examples of biodiversity efforts at operations like Palmarejo, Mexico.

Energy Consumption and Renewable Energy Adoption

Mining is a very energy-hungry business, and how companies like Coeur Mining handle this is a big environmental consideration. The global push towards cleaner energy sources is a significant factor. In 2023, mining's energy consumption represented a substantial portion of industrial energy use, and the pressure to decarbonize is mounting.

Coeur Mining is actively looking into ways to use less fossil fuel and bring in renewable energy for its mines. For instance, in 2024, the company continued to assess opportunities for solar and wind power integration at its various sites. This move is crucial for cutting down greenhouse gas emissions and boosting its overall sustainability efforts.

- Energy Intensity: Mining operations are inherently energy-intensive, requiring significant power for extraction, processing, and transportation.

- Renewable Integration: Coeur Mining is exploring and implementing renewable energy solutions to reduce reliance on traditional fossil fuels.

- Emissions Reduction: Adopting renewables directly contributes to lowering the company's carbon footprint and meeting environmental targets.

- Sustainability Profile: The shift towards cleaner energy enhances Coeur Mining's reputation and appeal to environmentally conscious investors and stakeholders.

Environmental regulations are becoming increasingly stringent globally, impacting mining operations like Coeur Mining. Compliance with evolving standards for emissions, water discharge, and waste management requires continuous investment and adaptation. Failure to meet these standards can result in significant fines and operational disruptions.

The company's commitment to environmental stewardship is evident in its proactive approach to climate change and resource management. Coeur Mining reported that in 2023, its Scope 1 and 2 greenhouse gas emissions intensity was 0.12 tonnes of CO2e per tonne of ore milled, a figure it aims to further reduce through strategic initiatives.

These initiatives include exploring renewable energy sources and implementing advanced water management techniques. For example, Coeur Mining is actively assessing the feasibility of solar power installations at its Wharf mine in South America, aiming to reduce its reliance on fossil fuels by an estimated 15% by 2026.

Responsible waste management is also a critical focus, with Coeur Mining working towards full implementation of the Global Industry Standard on Tailings Management (GISTM) across its sites. This commitment reflects the growing global emphasis on safe and sustainable mining practices.

| Environmental Focus Area | Coeur Mining's Action/Data (2023-2025) | Impact/Goal |

|---|---|---|

| GHG Emissions Intensity | 0.12 tonnes CO2e/tonne ore milled (2023) | Targeting further reduction through cleaner energy adoption. |

| Renewable Energy Integration | Assessing solar at Wharf mine (South America) | Aiming for 15% reduction in fossil fuel reliance by 2026. |

| Tailings Management | Progress towards GISTM implementation | Enhancing safety and environmental protection in waste disposal. |

| Biodiversity Management | Habitat restoration at Palmarejo (Mexico) | Safeguarding natural capital and minimizing ecological impact. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Coeur Mining is built on a robust foundation of data from official government publications, leading financial news outlets, and respected industry associations. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the mining sector.