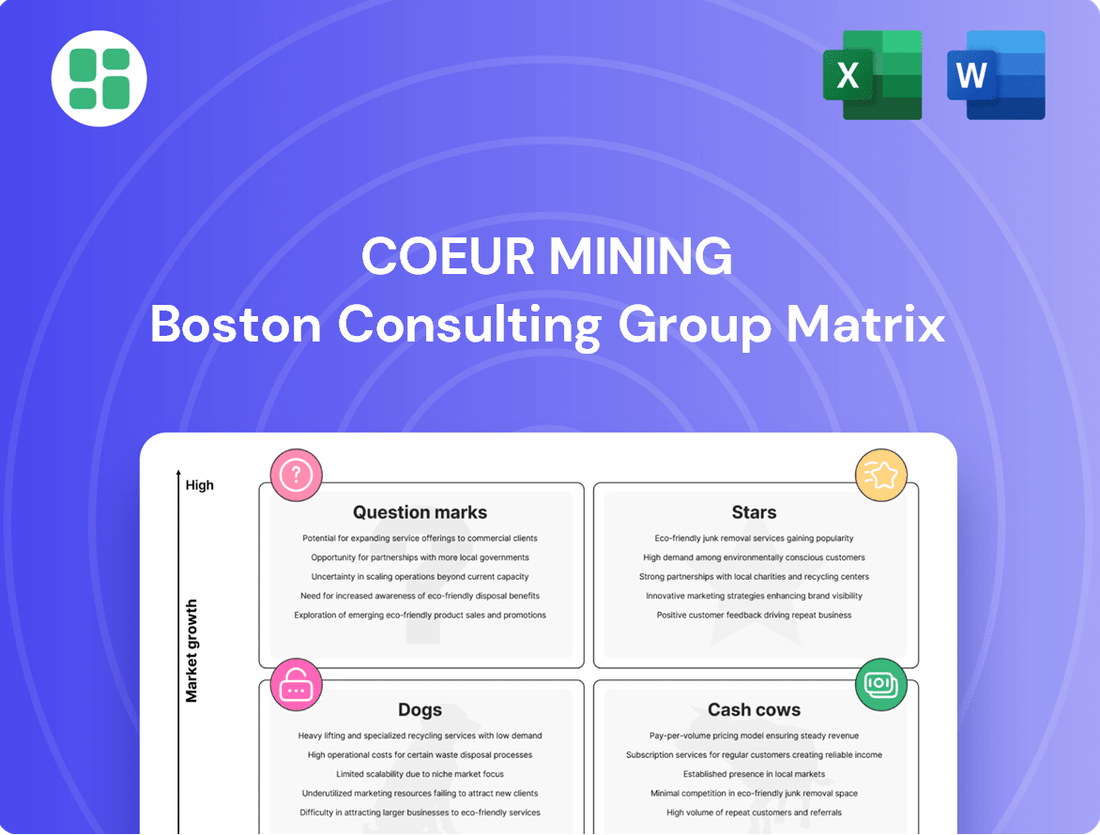

Coeur Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coeur Mining Bundle

Explore the strategic positioning of Coeur Mining's diverse portfolio through its BCG Matrix. Understand which assets are driving growth and which require careful consideration.

This preview offers a glimpse into Coeur Mining's market standing. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, identify your Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights for optimizing your investment strategy.

Stars

The Rochester mine's expansion in Nevada, reaching commercial production by March 31, 2024, is set to make it the largest domestic source of refined silver. This development is a significant catalyst for Coeur Mining, projecting record operational and financial performance in 2025 with substantial boosts in silver and gold output.

With its ramp-up to 32 million tons per year on track, Rochester represents a high-growth, high-market share star in Coeur's portfolio. This expansion is crucial for the company's strategic positioning and future revenue generation.

The acquisition of SilverCrest Metals, specifically the Las Chispas silver-gold operation in Sonora, Mexico, has cemented Coeur Mining's position as a premier global silver producer. This strategic move significantly bolsters Coeur's asset base, with Las Chispas expected to be a major contributor to the company's silver and gold output through 2025 and beyond.

Las Chispas is recognized as a crown jewel within Coeur's portfolio, characterized by its high-grade mineralization and low operating costs. This operation is anticipated to generate substantial free cash flow, underscoring its importance to Coeur's financial performance and future growth trajectory.

Coeur Mining has set a strong outlook for 2025, anticipating production of 380,000 to 440,000 ounces of gold and 16.7 to 20.3 million ounces of silver. This forecast signifies a substantial expected increase, with silver production alone projected to jump by approximately 62% compared to 2024 levels. This aggressive growth is fueled by key projects, including the Rochester expansion and contributions from Las Chispas, solidifying Coeur Mining's production assets as Stars.

Improved Financial Performance and Margins

Coeur Mining demonstrates robust financial health, a key indicator for its position in the BCG matrix. The company's adjusted EBITDA surged to $149 million in the first quarter of 2025, a remarkable 236% jump from the previous year. This growth, coupled with an expanded adjusted EBITDA margin of 41%, highlights the efficiency and profitability of its mining operations.

This impressive financial uplift is directly attributable to increased production volumes and favorable metal prices. These factors suggest that Coeur's existing assets are not only performing well but are also generating substantial value. The company's forward-looking target of exceeding $700 million in adjusted EBITDA for the full year 2025 further solidifies its strong financial standing.

- Strong Adjusted EBITDA Growth: Q1 2025 adjusted EBITDA reached $149 million, up 236% year-over-year.

- Expanding Margins: Adjusted EBITDA margin improved to 41% in Q1 2025.

- Favorable Market Conditions: Performance driven by higher production and beneficial metal prices.

- Ambitious Full-Year Target: Coeur aims for over $700 million in adjusted EBITDA for 2025.

Strategic Portfolio Transformation

Coeur Mining's strategic portfolio transformation, driven by the Rochester expansion and Las Chispas integration, has fundamentally reshaped its operational and financial profile. This strategic pivot is designed to create a high-margin, low-leverage business model. The company anticipates this transformation will pave the way for record performance in 2025, underscoring a commitment to sustainable growth and operational efficiency.

The focus on acquiring and developing higher-grade, lower-cost assets, coupled with substantial deleveraging initiatives, is a key element of this strategy. These actions are intended to bolster Coeur Mining's market leadership and unlock significant growth potential in the coming years.

- Portfolio Shift: Emphasis on Rochester expansion and Las Chispas integration.

- Financial Profile: Aiming for a high-margin, low-leverage model.

- Performance Outlook: Positioned for record performance in 2025.

- Strategic Drivers: Higher-grade, lower-cost assets and deleveraging.

The Rochester mine's expansion, reaching commercial production by March 2024, positions it as a significant growth asset for Coeur Mining. Las Chispas, acquired through the SilverCrest Metals deal, is a high-grade, low-cost operation contributing to Coeur's premier silver producer status. Both assets are driving substantial increases in silver and gold output, solidifying them as Stars in Coeur's portfolio.

| Asset | Projected 2025 Silver Production (Moz) | Projected 2025 Gold Production (Koz) | Key Characteristic |

| Rochester | Significant increase from 2024 | Substantial increase from 2024 | Largest domestic refined silver source, high growth |

| Las Chispas | Major contributor | Major contributor | High-grade, low operating costs, significant free cash flow |

What is included in the product

This BCG Matrix analysis provides tailored insights into Coeur Mining's portfolio, highlighting units for investment, divestment, or holding.

A clear BCG Matrix visualizes Coeur Mining's portfolio, easing strategic decision-making.

Cash Cows

The Wharf gold mine in South Dakota stands out as a consistent performer for Coeur Mining, generating a substantial $400 million in free cash flow since 2015. This established operation, utilizing an open-pit heap leach method, currently boasts a seven-year mine life based on existing reserves, with promising prospects for future extensions.

Wharf's dependable financial contributions make it a stable cash generator for the company. Its mature status means it requires minimal additional capital expenditure to maintain its strong output. This reliability positions it as a classic cash cow within Coeur Mining's portfolio.

Coeur Mining's mature operations are proving to be reliable cash generators, a key characteristic of a cash cow. The company reported positive free cash flow in the latter half of 2024, and projections for 2025 indicate a steady stream of $75 million to $100 million each quarter.

This consistent cash generation, even accounting for some non-recurring expenses, underscores the strength of its established assets. These operations are effectively funding the company's current activities and contributing to debt reduction efforts, a testament to a well-executed cash cow strategy focused on maximizing returns from existing resources.

The Palmarejo Gold-Silver Complex in Mexico is a prime example of a cash cow for Coeur Mining. In 2024, this established operation achieved its best free cash flow generation in seven years, underscoring its robust profitability.

Despite 2025 production guidance indicating a slight decrease, Palmarejo continues to be a reliable and significant contributor to Coeur Mining's overall cash flow. Its sustained performance and long operational history firmly cement its status as a dependable cash-generating asset for the company.

Mature Operations with Stable Production

Coeur Mining's portfolio features mature operations that deliver consistent, predictable production. These assets, while not high-growth, are crucial for generating stable revenue streams, bolstering the company's overall financial stability. The strategic emphasis on extending the mine lives of these established sites underscores their importance as reliable cash generators for Coeur.

For instance, in 2023, Coeur's Palmarejo mine in Mexico, a cornerstone of its operations, continued to be a significant producer. While specific production figures for individual mature mines within the "cash cow" category are often aggregated in broader financial reports, the company's consistent operational output from these sites is a key indicator of their cash-generating ability. This stability allows Coeur to fund exploration and development at other assets.

- Stable Production: Mature mines offer predictable output volumes, ensuring consistent revenue.

- Financial Stability: These operations provide reliable cash flow, supporting the company's financial health.

- Mine Life Extension: Coeur focuses on maintaining and extending the operational life of these assets.

- Revenue Contribution: Mature mines are vital contributors to Coeur's overall revenue generation.

Funding for Growth Initiatives

Coeur Mining's established operations, acting as cash cows, are the engine for its growth. The robust cash flow generated from these reliable assets is strategically channeled into funding promising exploration ventures. For instance, in 2023, Coeur reported significant operational cash flow, which directly fuels these expansion efforts.

This capital allocation is vital for Coeur's long-term vision. It not only supports the exploration of potential new revenue streams but also aids in strengthening the company's balance sheet by reducing corporate debt. This dual approach ensures financial resilience while pursuing future opportunities.

- Cash Flow Generation: Coeur's existing mines consistently produce strong cash flows, providing the financial foundation for strategic investments.

- Funding Exploration: A significant portion of this cash is reinvested into high-potential exploration projects, aiming to discover and develop future growth drivers.

- Debt Reduction: The company also utilizes these cash inflows to pay down corporate debt, enhancing its financial stability and reducing interest expenses.

- Transforming Question Marks: The capital generated by these cash cows is essential for nurturing promising, but currently less established, operations, potentially turning them into future Stars.

Coeur Mining's established operations, like the Palmarejo complex, function as dependable cash cows. Palmarejo, for example, delivered its strongest free cash flow in seven years in 2024, demonstrating its consistent profitability despite a projected slight dip in 2025 production. These mature assets are vital for generating stable revenue streams, bolstering the company's financial stability and enabling investment in growth initiatives.

The Wharf gold mine in South Dakota is another prime example, generating approximately $400 million in free cash flow since 2015. Its mature status and minimal capital expenditure requirements solidify its role as a reliable cash generator, supporting Coeur's overall financial health and debt reduction efforts.

These cash cows are crucial for Coeur Mining's strategy, providing the financial foundation to fund exploration and development of other assets. The consistent cash flow from these mature operations allows the company to pursue new opportunities and strengthen its balance sheet.

| Asset | Role | 2024 Highlight | 2025 Projection |

|---|---|---|---|

| Palmarejo Gold-Silver Complex | Cash Cow | Best free cash flow in 7 years | Continued significant contribution |

| Wharf Gold Mine | Cash Cow | Consistent free cash flow generation | Stable output with 7-year mine life |

Delivered as Shown

Coeur Mining BCG Matrix

The Coeur Mining BCG Matrix preview you are viewing is the definitive, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content; you get the exact strategic analysis ready for your business planning. This comprehensive document has been meticulously prepared to offer clear insights into Coeur Mining's product portfolio, enabling informed decision-making. You can confidently expect this precise BCG Matrix to be delivered to you, ready for immediate application in your strategic discussions and presentations.

Dogs

Underperforming legacy assets within Coeur Mining's portfolio, such as older, less efficient sections of mines, can be categorized as Dogs in the BCG Matrix. These segments often exhibit higher operating costs and lower production yields, contributing minimally to overall profitability. For instance, while specific mines aren't officially designated as Dogs, any segment with consistently high costs per ounce and declining production would fit this profile.

Coeur Mining's exploration projects with limited success are those where initial findings don't meet economic thresholds. These ventures, while necessary for future growth, can tie up significant capital without immediate returns. For instance, a property might show promising mineralization, but if the grade is too low or the identified reserves are insufficient to support a mine, it becomes a candidate for this category.

These less successful exploration efforts can act as cash drains. In 2023, Coeur reported exploration expenditures of $48.5 million, a portion of which would have been allocated to projects that ultimately did not advance. While specific figures for "limited success" projects aren't itemized, the company's ongoing portfolio review aims to identify and potentially divest or de-emphasize such ventures to optimize capital allocation.

High-cost production streams within Coeur Mining's operations, such as certain underground mining methods or processing techniques that yield less metal per ton of ore, would be classified as dogs. These segments, if they consistently consume more resources than the value of the metals they produce, negatively impact overall profitability. For instance, if a specific vein extraction process in 2024 required significantly more energy and labor per ounce of silver recovered compared to other operations, it would represent a high-cost stream.

Non-Core Assets for Divestment

Coeur Mining might classify certain assets or stakes as 'dogs' if they don't fit its long-term strategic direction or aren't generating adequate profits. These underperforming assets become prime candidates for divestment, allowing the company to concentrate its resources on more promising ventures. This aligns with Coeur's stated strategic emphasis on its five wholly-owned North American operations.

Divesting these non-core assets would enable Coeur to streamline its operational footprint and reallocate capital towards projects that offer higher growth potential and better returns on investment. For instance, if an asset outside of its core North American portfolio, like a smaller international exploration project, consistently underperformed or required significant capital without clear upside, it could be flagged for divestment.

- Non-Core Asset Identification: Assets not aligning with Coeur's strategic focus on five North American operations.

- Divestment Rationale: To streamline operations and reallocate capital to higher-potential projects.

- Strategic Alignment: Focus remains on wholly-owned North American assets like the Palmarejo complex or Kensington mine.

Projects with Declining Reserves and Mine Life

Mines or deposits that are approaching the end of their economically viable lifespan, marked by dwindling reserves and little prospect for further extensions, would be classified as dogs in the BCG Matrix. These operations often require significant capital to maintain production, and without successful exploration or innovation, they can become a financial burden.

Coeur Mining, like many mining companies, actively pursues strategies to prolong the operational life of its assets. However, projects that do not yield positive results in extending mine life or discovering new viable deposits are at risk of becoming dogs.

For instance, if a mine's proven and probable reserves are projected to be depleted within a few years, and exploration efforts have not identified significant new ore bodies, it would fit the description of a dog. Coeur's 2023 annual report, for example, would detail reserve estimates and production forecasts for each of its mines, providing the data to identify such assets.

- Declining Reserve Base: Assets where proven and probable reserves are diminishing rapidly.

- Limited Exploration Upside: Projects with low success rates in discovering extensions or new deposits.

- High Operating Costs Relative to Production: Mines that become less efficient as extraction becomes more challenging.

- Potential for Divestiture or Closure: Assets that may be sold or shut down if they cease to be profitable.

Coeur Mining's "Dogs" are typically legacy assets or exploration projects that are underperforming. These could be older mine sections with high operating costs and low yields, or exploration ventures that haven't shown economic promise. The company's strategy often involves divesting such non-core assets to focus capital on more profitable, strategically aligned operations, particularly its wholly-owned North American mines.

For example, any mining segment with consistently high costs per ounce and declining production would fit the profile of a Dog. Similarly, exploration projects where initial findings don't meet economic thresholds, despite initial investment, can become cash drains. Coeur's 2023 exploration expenditures of $48.5 million likely included some of these less successful ventures.

| Category | Description | Example for Coeur Mining | Financial Implication | |

|---|---|---|---|---|

| Dogs | Low market share, low growth | Underperforming legacy mine sections, unsuccessful exploration projects | Low profitability, potential cash drain | |

Question Marks

The Silvertip polymetallic exploration project, wholly owned by Coeur Mining, is an early-stage venture in British Columbia. While it holds significant potential for critical minerals, its ultimate viability remains unproven. This positions Silvertip as a potential Question Mark within Coeur's business portfolio, requiring careful strategic consideration and substantial investment for further development.

Coeur is actively engaged in extensive exploration activities at Silvertip, aiming to delineate the full extent of this world-class deposit and enhance understanding of its mineral resources. The company anticipates continued exploration success through 2025, a crucial period for de-risking the project. As of the first quarter of 2024, Coeur reported approximately 1.1 million tonnes of indicated resources and 2.1 million tonnes of inferred resources at Silvertip, with ongoing drilling expected to contribute to resource expansion.

Coeur Mining is actively engaged in district-scale exploration, aiming to uncover new geological structures and expand existing vein systems, exemplified by their work at Palmarejo. These early-stage exploration efforts, while holding significant geological promise, demand considerable investment and time to ascertain their economic feasibility.

These promising, yet unproven, areas represent high-risk, high-reward opportunities. Successful development could see them transition into future Stars within the BCG framework, but currently, their economic viability remains uncertain.

New mine development initiatives, such as potential exploration and construction of entirely new sites beyond current expansion plans, would represent Coeur Mining's question marks. These ventures demand substantial capital outlays for exploration, permitting, and infrastructure development before any revenue generation commences. For instance, the initial capital expenditure for a new greenfield project can easily run into hundreds of millions of dollars, impacting cash flow significantly in the early stages.

These projects are characterized by high cash consumption and minimal to no immediate return on investment, placing them firmly in the question mark quadrant of the BCG matrix. Coeur Mining's strategic decision to allocate further capital to these initiatives hinges on a thorough assessment of their long-term resource potential, market conditions for the targeted commodities, and the projected internal rate of return (IRR) compared to other investment opportunities.

Uncertain Market Demand for Specific Minerals

Coeur Mining's strategic exploration into less established critical minerals presents a question mark within its BCG Matrix. While gold and silver remain its established stars, venturing into new mineral territories carries inherent risks due to uncertain market demand and unproven economic viability. This diversification, particularly noted in their interest in Canadian critical minerals, highlights a calculated gamble for potential future growth.

- Market Volatility: The demand for specific critical minerals can fluctuate significantly, impacting the revenue streams of new ventures.

- Exploration Risk: Developing new mineral assets involves substantial upfront investment and carries the risk of not finding commercially viable deposits.

- Strategic Diversification: Coeur's focus on Canadian critical minerals in 2024 signals a deliberate move to broaden its portfolio beyond traditional precious metals, aiming to capture emerging market opportunities.

Advanced Exploration with Undefined Reserves

Coeur Mining's exploration efforts often identify promising drill results that haven't yet been classified as proven or probable reserves. These are the question marks in their BCG matrix, representing potential future stars. For instance, their 2024 exploration program at the Palmarejo complex in Mexico aimed to convert inferred resources into higher confidence categories, a key step for these question mark assets.

These projects demand significant exploration capital, offering a high-growth upside if successful, but also carry the inherent risk of not proving economically viable. Coeur's 2025 exploration budget is strategically allocated to resource conversion and expansion across its portfolio, directly addressing the challenge of moving these question marks towards becoming more defined assets.

- Exploration Capital Allocation: Coeur Mining's 2025 exploration budget prioritizes converting inferred resources to indicated and measured categories, and expanding existing resource bases.

- Risk vs. Reward: Question mark projects, while holding high growth potential, require substantial investment with no guarantee of future mine development.

- 2024 Progress Example: At Palmarejo in 2024, Coeur focused on drilling to upgrade resources, a typical strategy for advancing question mark assets.

- Strategic Importance: Successfully developing these question marks is crucial for Coeur's long-term growth pipeline and replacing depleting reserves.

Question marks in Coeur Mining's portfolio represent early-stage exploration projects with high potential but unproven economic viability. These ventures, such as the Silvertip project, demand significant capital investment for exploration and development. Success in converting these into producing assets could lead to future stars, but the inherent risks of exploration and market volatility remain.

Coeur's strategic focus in 2024 and 2025 includes advancing these question mark assets through extensive drilling and resource definition. The company's exploration budget is geared towards de-risking these projects and assessing their commercial potential. For example, the Silvertip project, as of Q1 2024, held approximately 1.1 million tonnes of indicated and 2.1 million tonnes of inferred resources, underscoring its early-stage nature and need for further exploration.

These unproven ventures consume substantial capital with no immediate returns, placing them squarely in the question mark category. Coeur's decision to allocate further investment hinges on thorough assessments of resource potential, market conditions, and projected returns compared to other opportunities.

The company's diversification into critical minerals, particularly in Canada, represents a calculated move to capture emerging market opportunities, albeit with the inherent risks of uncertain demand and unproven economic feasibility.

| Project Area | Stage | Resource Category (as of Q1 2024) | Strategic Focus | Potential Outcome |

| Silvertip | Early-Stage Exploration | Indicated: 1.1M tonnes, Inferred: 2.1M tonnes | Resource expansion and de-risking | Future Star / Cash Cow |

| Palmarejo (Exploration Targets) | Exploration | Inferred resources (specific figures vary) | Resource conversion and expansion | Future Star / Cash Cow |

| New Greenfield Projects | Conceptual/Exploration | N/A (pre-resource definition) | Feasibility studies, permitting | Potential Star |

BCG Matrix Data Sources

Our Coeur Mining BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.