Coeur Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coeur Mining Bundle

Unlock the core of Coeur Mining's operational genius with our comprehensive Business Model Canvas. Discover how they forge valuable partnerships, deliver essential mineral products, and maintain a competitive edge in the global market.

This isn't just an overview; it's your strategic roadmap to understanding Coeur Mining's success. Dive into their customer relationships, revenue streams, and cost structures to glean actionable insights for your own ventures.

Don't miss out on this in-depth analysis. Purchase the full Coeur Mining Business Model Canvas today and gain the competitive intelligence you need to thrive.

Partnerships

Coeur Mining's operations depend on a robust network of equipment and technology suppliers. These partners provide everything from heavy machinery for extraction to sophisticated processing technology and crucial software for data analysis and operational management.

These collaborations are vital for Coeur to maintain high levels of efficiency and uptime. For instance, in 2024, Coeur continued its focus on modernizing its fleet and processing facilities, leveraging supplier innovations to improve mineral recovery rates and reduce operational costs across its key North American mines.

By working closely with these specialized suppliers, Coeur Mining ensures access to cutting-edge automation and safety enhancements. This strategic reliance on technology providers helps Coeur stay ahead in a competitive industry, optimizing performance and ensuring the safe, productive extraction of valuable mineral resources.

Coeur Mining's strategic alliances with government and regulatory bodies are crucial for operational continuity. These partnerships facilitate the acquisition and retention of vital permits and licenses, enabling exploration and extraction. For instance, in 2023, Coeur maintained its operating permits across its key sites, demonstrating effective engagement with relevant authorities in the United States, Canada, and Mexico.

Compliance with stringent environmental, health, and safety standards is a cornerstone of Coeur's business model, fostered through collaboration with these governmental entities. This proactive engagement ensures adherence to regulations, supporting responsible mining practices. Coeur's commitment to sustainability is reflected in its ongoing dialogue with regulators to navigate evolving compliance requirements.

Coeur Mining actively cultivates robust relationships with local communities and Indigenous groups, recognizing these partnerships as fundamental to its social license to operate. In 2024, the company continued its commitment to transparent communication and community development programs, investing in initiatives designed to create shared value. For instance, at its Palmarejo operation in Mexico, Coeur has a long-standing engagement with local communities, focusing on projects that support education and economic diversification, aiming to ensure a sustainable and mutually beneficial presence.

Financial Institutions and Investors

Coeur Mining's financial health and growth trajectory are significantly shaped by its relationships with financial institutions and investors. These partnerships are fundamental for securing the substantial capital needed for exploration, operational enhancements, and strategic acquisitions. For instance, as of the first quarter of 2024, Coeur Mining reported total debt of approximately $804 million, highlighting the reliance on debt financing from banks and other lenders.

These relationships provide Coeur Mining with access to crucial capital markets, enabling the company to tap into both debt and equity financing. This access is vital for funding large-scale projects, such as the development of new mines or significant upgrades to existing facilities. The company's ability to attract and retain investment from a diverse base, including institutional investors and individual shareholders, underpins its capacity to manage its capital structure effectively and maintain financial flexibility.

- Bank Financing: Coeur Mining maintains credit facilities with various financial institutions, providing a revolving source of funds for working capital and general corporate purposes.

- Investment Firms: Partnerships with investment firms facilitate equity offerings and private placements, crucial for raising capital for major projects.

- Individual Investors: A strong base of individual investors, cultivated through effective investor relations, provides stability and broad market support.

- Debt Markets: Access to corporate bond markets allows Coeur to diversify its financing options and manage its debt maturity profile.

Exploration and Development Partners

Coeur Mining actively seeks joint ventures and strategic alliances with other exploration and development firms. This approach allows them to share the significant financial and operational risks inherent in discovering and developing new precious metals deposits. For instance, in 2024, Coeur continued to evaluate potential partnerships to advance its pipeline of exploration projects, aiming to leverage specialized geological expertise and capital.

These collaborations are crucial for accelerating the discovery and development of new resources, thereby expanding Coeur's overall portfolio and future production capacity. By pooling resources and knowledge, Coeur can more efficiently bring promising projects from exploration through to production, enhancing its long-term growth prospects.

Key aspects of these partnerships often revolve around specific geological regions where multiple companies possess complementary interests or expertise in advanced exploration technologies. This focused approach maximizes the chances of success and streamlines the development process.

For example, in 2024, Coeur Mining reported progress on joint exploration initiatives in regions known for their high potential for gold and silver discoveries, underscoring the practical application of this strategy.

- Risk Sharing: Partnerships distribute the substantial financial and operational burdens associated with exploration and development.

- Expertise Leverage: Collaborations allow Coeur to tap into specialized geological knowledge and technological capabilities of partners.

- Portfolio Expansion: Joint ventures facilitate access to a broader range of promising projects, enhancing future production potential.

- Accelerated Development: Strategic alliances can speed up the timeline from discovery to commercial production.

Coeur Mining's success hinges on strong ties with its suppliers of equipment, technology, and services. These partnerships are vital for accessing advanced machinery, processing innovations, and essential software, ensuring operational efficiency and cost-effectiveness. In 2024, Coeur continued to invest in modernizing its mining fleet and processing plants, working with key suppliers to boost mineral recovery and reduce operational expenses at its North American sites.

Collaborations with financial institutions and investors are critical for securing the substantial capital required for exploration, operational upgrades, and strategic growth. As of Q1 2024, Coeur Mining's debt stood at approximately $804 million, illustrating its reliance on debt financing from banks and lenders to fund its extensive operations and development projects.

Strategic alliances with other mining and exploration firms are essential for sharing the significant risks and costs associated with discovering and developing new mineral deposits. These joint ventures allow Coeur to leverage specialized geological expertise and capital, accelerating project advancement and expanding its future production capabilities, with progress reported in joint exploration initiatives in high-potential gold and silver regions during 2024.

| Key Partnership Type | Description | 2024 Relevance/Data |

|---|---|---|

| Equipment & Technology Suppliers | Provide machinery, processing tech, software. | Focus on fleet modernization and processing facility upgrades to improve recovery and reduce costs. |

| Financial Institutions & Investors | Provide capital through debt and equity. | Q1 2024 Debt: ~$804 million; crucial for funding exploration and operational enhancements. |

| Joint Venture Partners | Share risks and expertise in exploration and development. | Evaluating partnerships to advance exploration projects; progress in joint initiatives in gold/silver regions. |

What is included in the product

This Business Model Canvas outlines Coeur Mining's strategy of operating high-quality, low-cost precious metals mines, focusing on efficient production and strategic growth in North and South America.

It details their customer segments (primarily metal purchasers), key resources (mines, skilled workforce), and revenue streams (metal sales) to achieve sustainable profitability.

Coeur Mining's Business Model Canvas offers a streamlined approach to visualizing complex operational strategies, simplifying the identification of key value propositions and customer segments for efficient resource allocation.

Activities

Coeur Mining's primary activities revolve around extracting gold and silver from its operational mines located in the United States, Canada, and Mexico. These operations encompass the essential steps of drilling, blasting, loading, and hauling ore, utilizing both open-pit and underground mining techniques. The company's ability to efficiently and safely manage these core processes is crucial for achieving its production goals and controlling operational expenses.

In 2023, Coeur Mining reported total gold equivalent ounces (GEO) production of 396,084 GEO, with silver production totaling 12.7 million silver ounces. The Kensington mine in Alaska, for instance, produced 44,586 gold ounces in 2023, while the Palmarejo complex in Mexico yielded 112,210 gold ounces and 7.7 million silver ounces during the same period.

Coeur Mining's mineral processing and refining activities are crucial for transforming raw ore into marketable precious metals. This involves a series of physical and chemical treatments like crushing, grinding, and leaching to extract gold and silver. For instance, in 2023, Coeur's processing operations were instrumental in producing 338,747 ounces of silver and 136,869 ounces of gold.

The company often transports processed concentrates or doré bars to external refiners for final purification, ensuring the highest quality output. A primary focus here is on optimizing recovery rates, meaning how much of the valuable metal is successfully extracted from the ore, and simultaneously controlling processing costs to maintain healthy profit margins.

Coeur Mining actively pursues exploration to discover new precious metal deposits and grow its existing resource base. This crucial activity involves detailed geological surveys, extensive drilling programs, and rigorous feasibility studies to determine the economic potential of new mining opportunities or expansions of current operations. For instance, in 2023, Coeur continued its exploration efforts across its key assets, investing significant capital to expand known mineralized zones and test new targets, aiming to ensure the long-term sustainability of its operations.

Environmental, Social, and Governance (ESG) Management

Coeur Mining's key activities in Environmental, Social, and Governance (ESG) management are centered on minimizing its operational footprint and fostering sustainable practices. This involves rigorous environmental stewardship, with a focus on responsible water usage and the safe management of tailings. In 2023, Coeur reported a 3% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to 2022, demonstrating progress in their decarbonization efforts.

Ensuring the safety and well-being of its workforce is paramount. Coeur Mining implements comprehensive safety protocols across all its operations, aiming for zero harm. The company's Total Recordable Injury Frequency Rate (TRIFR) in 2023 was 0.75, a significant improvement and a testament to their commitment to employee safety.

Fostering positive community relations is another critical activity. This includes engaging with local stakeholders, supporting community development initiatives, and respecting indigenous rights. Coeur Mining's investment in community programs in 2023 totaled over $3 million, highlighting their dedication to social impact.

These ESG activities are crucial for maintaining investor confidence and securing the social license to operate. Coeur Mining's commitment to these principles is reflected in its ongoing efforts to improve environmental performance, enhance safety standards, and contribute positively to the communities where it operates.

- Environmental Stewardship: Implementing robust water management, responsible tailings disposal, and biodiversity protection programs. In 2023, Coeur achieved a 3% reduction in Scope 1 and 2 GHG emissions intensity.

- Employee Safety: Prioritizing a zero-harm workplace through comprehensive safety protocols and training. The company recorded a TRIFR of 0.75 in 2023.

- Community Engagement: Investing in local communities and fostering positive relationships with stakeholders. Over $3 million was invested in community programs in 2023.

- Sustainable Operations: Integrating ESG principles to enhance investor confidence and maintain social license to operate.

Sales and Marketing of Precious Metals

Coeur Mining's sales and marketing of precious metals focuses on selling refined gold and silver to a diverse customer base, including bullion dealers, industrial consumers, and financial institutions. This involves actively monitoring global precious metal markets to strategically time sales and secure optimal pricing. For instance, in the first quarter of 2024, Coeur reported an average realized gold price of $2,054 per ounce and an average realized silver price of $23.70 per ounce, reflecting their market engagement.

Maintaining robust relationships with these buyers is crucial for ensuring a stable and predictable revenue stream from the company's mining operations. This customer focus helps Coeur navigate market volatility and maximize the value of its output.

- Sales Channels: Bullion dealers, industrial users, financial institutions.

- Market Monitoring: Active tracking of global precious metal markets for pricing and timing optimization.

- Revenue Stream: Cultivating strong buyer relationships to ensure consistent sales.

- 2024 Performance Snapshot: Q1 2024 realized gold price averaged $2,054/oz; realized silver price averaged $23.70/oz.

Coeur Mining's key activities are centered on the extraction and processing of gold and silver, supported by ongoing exploration to expand its resource base. The company also prioritizes robust Environmental, Social, and Governance (ESG) practices, including environmental stewardship, employee safety, and community engagement. Finally, Coeur actively manages the sales and marketing of its precious metals to diverse customers, optimizing pricing through market monitoring.

Delivered as Displayed

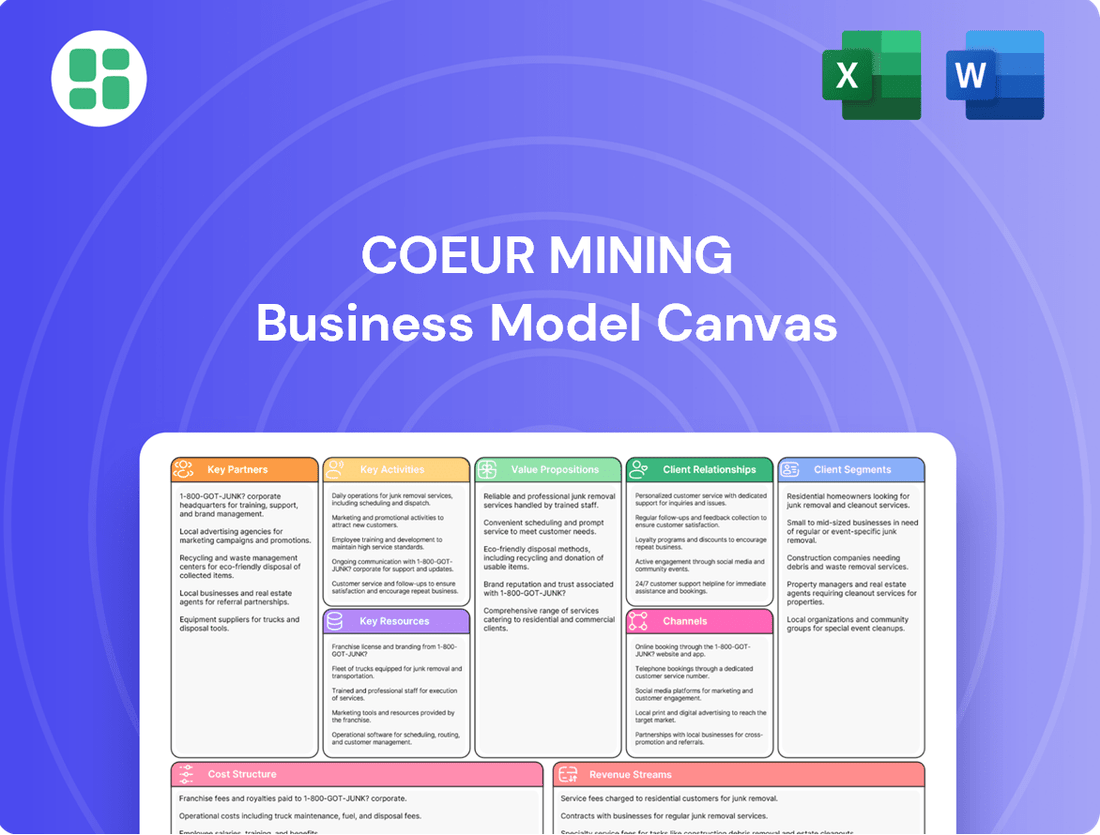

Business Model Canvas

The Coeur Mining Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed canvas, ready for your strategic planning.

Resources

Coeur Mining's bedrock is its substantial gold and silver mineral reserves and resources, primarily situated in North America. These geological holdings are the direct engine for future production and the generation of revenue.

As of December 31, 2023, Coeur reported proven and probable reserves totaling 1.4 million ounces of gold and 106.5 million ounces of silver. Additionally, measured and indicated resources stood at 2.3 million gold ounces and 165.8 million silver ounces, with inferred resources adding another 2.2 million gold ounces and 199.5 million silver ounces, underscoring the vast potential.

Sustaining and growing these vital reserves is paramount, achieved through ongoing, diligent exploration programs and the strategic conversion of resources into mineable reserves, ensuring the long-term viability of operations.

Coeur Mining's operations are underpinned by substantial capital-intensive assets, including excavators, haul trucks, and sophisticated processing plants. In 2023, the company reported capital expenditures of $264.5 million, a significant portion of which was directed towards maintaining and upgrading these critical mining equipment and infrastructure assets to ensure operational efficiency and production capacity.

The ongoing maintenance and modernization of this heavy machinery and associated infrastructure, such as power generation and water management systems, are paramount. These investments directly impact Coeur's ability to extract and process minerals effectively, representing a core component of their operational capacity and a significant driver of their overall investment in the business.

Coeur Mining’s operations rely heavily on a highly skilled workforce. This includes specialized professionals like geologists, mining engineers, and metallurgists, crucial for effective exploration and resource management. Their technical prowess directly impacts the efficiency and success of mining operations.

Experienced operational and executive management forms another vital resource. Their expertise in mine planning, safety protocols, and financial oversight is indispensable for Coeur’s strategic direction and day-to-day efficiency. For instance, in 2023, Coeur reported a total workforce of approximately 2,000 employees, highlighting the scale of human capital required.

Attracting and retaining this top talent is paramount for maintaining operational excellence. The company's ability to secure and keep individuals with deep expertise in exploration, mine development, and financial management is a key differentiator, directly influencing profitability and sustainable growth.

Permits, Licenses, and Concessions

Coeur Mining's ability to operate hinges on securing essential government-issued permits, licenses, and mineral concessions. These legal rights grant access to and the authority to mine on valuable land. For instance, in 2024, Coeur continued to navigate the complex regulatory landscape for its various projects, ensuring ongoing compliance to maintain operational continuity.

These entitlements are absolutely vital for every stage of the mining process, from initial exploration to full-scale development and extraction. Without them, no mining activities can legally commence or continue. The company's commitment to regulatory adherence is a cornerstone of its operational strategy, mitigating risks of costly disruptions.

Key resources in this category include:

- Exploration Permits: Authorizing geological surveys and initial resource assessment.

- Mining Licenses: Granting the right to extract minerals from a specific area.

- Environmental Permits: Ensuring operations meet ecological standards and regulations.

- Operating Concessions: Long-term agreements for mineral extraction rights, often involving government revenue sharing.

Financial Capital and Liquidity

Coeur Mining's access to robust financial capital is a cornerstone of its operations. This includes maintaining healthy cash reserves, securing credit facilities, and leveraging equity financing to fund everything from daily operations to ambitious expansion projects and crucial exploration initiatives. For instance, as of the first quarter of 2024, Coeur Mining reported cash and cash equivalents of approximately $215 million, demonstrating a solid liquidity position to support its strategic objectives.

The company's financial health directly impacts its ability to navigate market fluctuations and invest in future growth. Strong liquidity ensures Coeur Mining can meet its financial obligations, fund capital expenditures, and pursue new opportunities without undue strain. This financial resilience is critical for sustained development and shareholder value.

- Financial Capital Access: Coeur Mining relies on a mix of cash reserves, credit lines, and equity to fund its mining and exploration activities.

- Operational Funding: This capital is essential for covering day-to-day expenses, investing in new equipment, and advancing exploration programs.

- Liquidity and Resilience: Maintaining strong financial health and ample liquidity allows Coeur Mining to withstand market volatility and pursue growth opportunities.

- 2024 Financial Snapshot: In Q1 2024, the company held approximately $215 million in cash and cash equivalents, underscoring its financial capacity.

Coeur Mining's key resources are its significant gold and silver reserves, strategically located in North America. These reserves, as of December 31, 2023, totaled 1.4 million gold ounces and 106.5 million silver ounces in proven and probable categories, with substantial additional resources. The company also possesses substantial capital-intensive assets, including mining equipment and processing plants, with 2023 capital expenditures of $264.5 million supporting these operations.

A highly skilled workforce, comprising geologists, engineers, and experienced management, is critical to Coeur's success. In 2023, the company employed approximately 2,000 individuals. Furthermore, access to essential government permits, licenses, and mineral concessions is vital for legal mining operations, with ongoing regulatory navigation in 2024. Finally, robust financial capital, including approximately $215 million in cash and cash equivalents as of Q1 2024, underpins all operational and developmental activities.

| Resource Category | Description | 2023/2024 Data Point | Significance |

|---|---|---|---|

| Mineral Reserves & Resources | Gold and silver deposits in North America | 1.4M oz Gold (P&P Reserves) 106.5M oz Silver (P&P Reserves) |

Foundation for future production and revenue. |

| Physical Assets | Mining equipment, processing plants, infrastructure | $264.5M Capital Expenditures (2023) | Enables efficient extraction and processing of minerals. |

| Human Capital | Skilled workforce, management expertise | Approx. 2,000 Employees (2023) | Drives exploration, operations, and strategic direction. |

| Legal & Regulatory Entitlements | Permits, licenses, concessions | Ongoing regulatory navigation (2024) | Authorizes and sustains mining operations. |

| Financial Capital | Cash, credit facilities, equity | ~$215M Cash & Equivalents (Q1 2024) | Funds operations, investments, and growth initiatives. |

Value Propositions

Coeur Mining ensures a steady flow of gold and silver, crucial for investors, industries, and jewelry makers. Their mines in North America, like the Palmarejo complex in Mexico and the Rochester mine in Nevada, are key to this consistent supply. In 2023, Coeur Mining reported total silver production of 13.2 million ounces and gold production of 377,000 ounces, highlighting their capacity to deliver these valuable metals.

Coeur Mining differentiates itself by producing precious metals through operations that prioritize environmental and social responsibility. This commitment is demonstrated through rigorous safety protocols, dedicated environmental stewardship, and active community engagement at its mining sites.

The company's sustainability efforts are transparently communicated in its responsibility reports, making its ethically sourced materials attractive to investors and consumers who value responsible business practices. For instance, Coeur's 2023 Sustainability Report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to a 2019 baseline.

For investors, Coeur Mining presents compelling growth potential fueled by consistent exploration triumphs and astute strategic acquisitions. The company actively seeks to broaden its resource holdings and enhance production capacity, presenting an attractive investment thesis centered on future value creation. This commitment is exemplified by the recent acquisition of the Las Chispas mine, a significant step in expanding their operational footprint.

Operational Excellence and Cost Efficiency

Coeur Mining is dedicated to achieving operational excellence, which translates into the efficient and cost-effective production of precious metals. This focus is crucial for maximizing profit margins and ensuring strong financial performance.

The company actively pursues continuous improvement initiatives across its mining operations. Strategic investments in its assets are key to enhancing productivity and reducing costs, ultimately benefiting shareholders through improved returns.

- Operational Excellence: Coeur Mining's commitment to efficient production processes aims to lower per-unit costs.

- Cost Efficiency: Strategic investments and continuous improvement drive down operational expenses.

- Margin Maximization: Enhanced efficiency directly contributes to wider profit margins on precious metal sales.

- Shareholder Value: Improved financial performance stemming from operational efficiency leads to better returns for investors.

Strategic North American Asset Base

Coeur Mining's strategic North American asset base is a cornerstone of its value proposition, offering investors a diversified portfolio of gold and silver operations primarily situated in the United States, Canada, and Mexico. This concentrated geographical focus significantly mitigates geopolitical risks, a critical consideration in the global mining sector. For instance, in 2024, the company continued to emphasize its North American operations, with key assets like the Palmarejo complex in Mexico and the Rochester mine in Nevada forming substantial parts of its production profile.

The stability inherent in these operating jurisdictions translates directly into a more secure and predictable investment environment. This reduced political and regulatory uncertainty is a key differentiator, allowing for more reliable long-term planning and operational execution. Coeur's commitment to these regions underscores a strategy aimed at leveraging stable legal frameworks and established mining infrastructure.

Key aspects of this strategic advantage include:

- Geographic Diversification within North America: Operations spread across the U.S., Canada, and Mexico provide a balanced exposure to different mining environments and regulatory landscapes within a politically stable region.

- Reduced Geopolitical Risk: The company's primary focus on North America minimizes exposure to the heightened political and economic instability often found in other mining regions globally.

- Operational Stability and Predictability: Favorable legal frameworks and established infrastructure in its core operating countries contribute to more consistent and reliable production and financial performance.

Coeur Mining offers reliable access to essential precious metals like gold and silver, catering to diverse industrial and investment needs. Their operations in North America, including the Palmarejo complex in Mexico and the Rochester mine in Nevada, ensure a consistent supply. In the first quarter of 2024, Coeur reported silver production of 3.2 million ounces and gold production of 95,000 ounces, demonstrating their ongoing capacity.

Customer Relationships

Coeur Mining fosters strong investor relationships through consistent, transparent communication. This includes quarterly earnings calls, detailed annual reports, and investor presentations, ensuring stakeholders are well-informed about financial performance and operational progress. For instance, in the first quarter of 2024, Coeur Mining reported revenues of $215.2 million, demonstrating the tangible results of their operations that are shared with investors.

Coeur Mining cultivates enduring business-to-business relationships with key partners in the precious metals supply chain, including refiners, bullion dealers, and industrial consumers. These vital connections are primarily secured through direct sales contracts and meticulous negotiation processes, guaranteeing a steady outlet for the company's gold and silver output.

In 2024, Coeur Mining's ability to maintain these robust buyer relationships directly impacts its revenue stability. For instance, securing long-term offtake agreements with major refiners is crucial for predictable cash flow, especially when market prices fluctuate. The company's sales to third parties, which include these B2B relationships, represented a significant portion of its revenue, underscoring their importance.

Coeur Mining prioritizes community engagement, fostering open dialogue with local populations, indigenous groups, and stakeholders near its operational sites. This proactive approach includes community forums and targeted social investment programs. For instance, in 2023, Coeur invested over $5.5 million in community development initiatives across its operating regions, demonstrating a tangible commitment to shared value.

Building trust and maintaining a social license to operate are paramount. Coeur achieves this through transparent communication regarding its environmental and social performance, addressing community concerns directly. This open exchange ensures that the company's activities align with community expectations and contribute positively to local well-being.

Regulatory and Government Liaison

Coeur Mining actively engages with government agencies and regulatory bodies to ensure operational compliance and secure necessary permits. These relationships are vital for navigating the complex legal landscape of the mining sector, allowing the company to maintain its licenses and approvals.

- Government Liaison: Formal relationships are maintained with federal, state, and local government entities to facilitate permitting and regulatory approvals.

- Policy Contribution: Coeur participates in discussions and provides input on policies affecting the mining industry, aiming to foster a favorable operating environment.

- Compliance Assurance: Adherence to all relevant environmental, safety, and operational regulations is a cornerstone of these interactions, ensuring continued operational legitimacy.

- Permitting Navigation: The company's liaison efforts are critical for the timely acquisition and renewal of permits essential for exploration and production activities.

Employee and Labor Relations

Coeur Mining places significant emphasis on cultivating robust employee and labor relations, recognizing their direct impact on operational stability and productivity. This commitment is demonstrated through adherence to fair labor practices, the implementation of comprehensive safety programs, and the provision of avenues for professional growth and development.

A key aspect of Coeur Mining's approach is the prioritization of employee health and safety. In 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.65, reflecting a continued focus on minimizing workplace incidents and ensuring a secure environment for its workforce.

- Fair Labor Practices: Coeur Mining aims to maintain equitable compensation and benefits packages, fostering trust and loyalty among its employees.

- Safety Programs: The company invests in advanced safety training and protocols, striving for continuous improvement in reducing workplace hazards.

- Professional Development: Opportunities for skill enhancement and career advancement are provided to empower employees and support long-term engagement.

- Workforce Stability: Strong employee relations contribute to lower turnover rates and a more experienced, dedicated workforce, enhancing overall operational efficiency.

Coeur Mining's customer relationships are primarily built through direct sales to industrial consumers and refiners, secured via negotiated contracts. These B2B relationships are crucial for ensuring a consistent market for their gold and silver production. In 2024, the company's ability to maintain these partnerships directly supports revenue stability, especially when metal prices are volatile.

| Relationship Type | Key Engagement Method | Importance for Coeur | 2024 Focus |

|---|---|---|---|

| Industrial Consumers & Refiners | Direct Sales Contracts, Negotiation | Secures market for gold/silver output, revenue stability | Maintaining long-term offtake agreements |

| Investors | Quarterly Earnings Calls, Annual Reports | Transparency, financial performance communication | Detailed operational progress updates |

| Local Communities | Community Forums, Social Investment | Social license to operate, trust building | Continued investment in development initiatives |

Channels

Coeur Mining's primary sales channel involves direct engagement with refiners and bullion dealers. This approach is crucial for monetizing its gold and silver output, providing a straightforward path to market and ensuring efficient processing of its extracted precious metals.

These direct relationships are key to Coeur's business model, enabling large-volume transactions and the negotiation of competitive pricing for its products. For instance, in 2023, Coeur reported total gold sales of 336,696 ounces and silver sales of 13,436,926 ounces, underscoring the scale of these direct sales.

Coeur Mining’s investor relations website is a crucial channel, offering direct access to financial reports, press releases, and investor presentations. This platform ensures timely and comprehensive information delivery, supporting informed decision-making for both current and potential shareholders. It acts as a central hub for corporate transparency, providing essential data for analysis.

Coeur Mining actively utilizes financial news outlets and business media to disseminate crucial information. For instance, in Q1 2024, the company announced its first quarter earnings, highlighting production figures and financial performance. This strategic use of media ensures a wide reach among investors and financial analysts.

Industry publications and business news services are vital for Coeur Mining to communicate operational updates and strategic shifts. This constant flow of information keeps the market informed about the company's progress and future plans, fostering transparency and trust within the financial community.

The media coverage generated by these channels significantly boosts Coeur Mining's visibility. By proactively sharing news, the company informs a broad spectrum of market observers, including individual investors and institutional players, about its performance and strategic direction.

Industry Conferences and Investor Roadshows

Coeur Mining actively participates in key global mining conferences and investor forums. This engagement is crucial for direct interaction with institutional investors, financial analysts, and potential strategic partners. For instance, in 2024, the company presented its operational and financial updates at significant industry events, providing a platform to highlight its strategic initiatives and project pipeline.

These roadshows and conferences are instrumental in showcasing Coeur Mining's performance, exploration successes, and forward-looking growth strategy. The company leverages these opportunities for in-depth presentations and targeted one-on-one meetings, fostering relationships and building confidence among the investment community. Such interactions are vital for communicating the company's value proposition and future potential.

- Global Reach: Participation in events like the Denver Gold Forum and BMO Capital Markets Global Metals & Mining Conference.

- Investor Engagement: Direct dialogue with over 50 institutional investors and analysts during 2024 roadshows.

- Strategic Visibility: Showcasing advancements in projects like the expansion at the Silvertip mine.

- Partnership Opportunities: Networking to explore potential joint ventures and strategic alliances in the mining sector.

Sustainability Reports and Community Outreach Programs

Coeur Mining's annual Responsibility Report acts as a key channel for transparently sharing its environmental, social, and governance (ESG) performance. This report details initiatives and progress, reaching stakeholders like local communities, NGOs, and investors focused on sustainable practices.

The company actively engages in various community outreach programs, fostering direct relationships and demonstrating its commitment to social responsibility. These programs are crucial for building trust and ensuring alignment with community needs and expectations.

- Annual Responsibility Report: In 2023, Coeur Mining published its Responsibility Report, highlighting progress in areas such as greenhouse gas emissions reduction and water stewardship.

- Community Investment: The company invested approximately $1.8 million in community programs and initiatives across its operating regions in 2023, supporting education, health, and local economic development.

- Stakeholder Engagement: Through these channels, Coeur Mining aims to inform and engage a diverse group of stakeholders, including over 1,000 individuals participating in community meetings and consultations in 2023.

Coeur Mining leverages direct sales to refiners and bullion dealers for its precious metals, ensuring efficient monetization. The company also utilizes its investor relations website and financial news outlets to communicate performance and strategy, reaching a broad audience of stakeholders. Furthermore, participation in industry conferences and investor forums allows for direct engagement and relationship building within the financial community.

Customer Segments

Precious metal refiners and traders represent Coeur Mining's most direct customers, purchasing gold and silver concentrate or doré bars. These entities rely on a steady, high-quality supply to fuel their own refining processes and meet downstream market needs. Coeur's output is integral to their operations, serving as the raw material for their value-added activities.

Institutional and individual investors, including large investment funds, mutual funds, and individual shareholders, are a core customer segment for Coeur Mining. These investors are primarily focused on Coeur's financial performance, growth potential, and dividend policies. For instance, as of the first quarter of 2024, Coeur Mining reported total revenue of $219.9 million, demonstrating its operational output to these stakeholders.

Attracting and retaining these investors hinges on Coeur's commitment to transparency and consistent operational and financial performance. Investors closely scrutinize metrics like earnings per share, cash flow, and reserve estimates. Coeur's ability to deliver on its production targets and manage costs effectively directly impacts investor confidence and its stock valuation.

Industrial sectors like electronics, automotive, and medical rely on gold and silver for manufacturing, making them indirect but crucial customers for Coeur Mining. These industries' demand directly influences the market prices of precious metals, which in turn affects Coeur's financial performance and revenue streams. For example, the automotive sector's increasing adoption of electric vehicles, with their higher silver content in components, signals a growing demand that benefits suppliers like Coeur.

Employees and Contractors

Coeur Mining's employees and contractors represent a crucial internal customer segment, directly impacting operational efficiency and company reputation. Their reliance on Coeur for employment, safe working environments, equitable pay, and career advancement opportunities underscores their importance.

In 2023, Coeur Mining reported an average of 1,884 employees and contractors across its operations. The company's commitment to its workforce is reflected in its focus on safety metrics and employee development programs, which are essential for maintaining a productive and engaged team. For instance, in 2023, Coeur reported a Total Reportable Incident Frequency Rate (TRIFR) of 1.21, demonstrating a continued emphasis on workplace safety.

- Workforce Size: Coeur Mining employed an average of 1,884 individuals (employees and contractors) in 2023.

- Safety Focus: Achieved a Total Reportable Incident Frequency Rate (TRIFR) of 1.21 in 2023, highlighting a commitment to employee well-being.

- Operational Impact: The skills, dedication, and safety adherence of this segment are fundamental to achieving production targets and maintaining operational continuity.

Local Communities and Governments

Local communities and governments are vital stakeholders for Coeur Mining. They benefit significantly from the company's economic contributions, which include job creation, tax revenues, and royalty payments. For instance, in 2023, Coeur Mining's operations supported thousands of jobs directly and indirectly. These entities are also directly impacted by the environmental and social footprint of mining activities. Therefore, fostering strong relationships and maintaining responsible operational practices are paramount for ensuring continued support and operational stability.

The support of local communities and governments is not merely beneficial but essential for Coeur Mining's operational continuity. These groups have the power to influence permitting processes, regulatory approvals, and overall social license to operate. Coeur Mining actively engages in community development initiatives to build trust and shared value. For example, in 2023, the company invested in local infrastructure and social programs in the regions where it operates.

- Economic Impact: Coeur Mining's operations contribute to local economies through employment, taxes, and royalties, fostering regional development.

- Environmental and Social Governance: Responsible mining practices and community engagement are critical for maintaining positive relationships and operational permits.

- Stakeholder Support: The approval and cooperation of local communities and governments are fundamental for the long-term success and continuity of mining projects.

- Community Investment: Initiatives focused on local development and social well-being strengthen ties and ensure mutual benefit.

Government entities, both local and national, are key stakeholders for Coeur Mining. They benefit from tax revenues, royalties, and job creation stemming from Coeur's mining activities. For example, in 2023, Coeur Mining's operations significantly contributed to the economies of the regions where it operates through direct and indirect employment. These governmental bodies also play a crucial role in regulatory approvals and permitting, making their support essential for operational continuity.

The company's commitment to environmental stewardship and community development initiatives fosters positive relationships with these governmental stakeholders. Maintaining a strong social license to operate, which is heavily influenced by government perception, is paramount. Coeur's 2023 investments in local infrastructure and social programs underscore this commitment, aiming to create shared value and ensure long-term operational stability.

| Stakeholder Segment | Key Interests | Coeur's Engagement/Impact (2023 Data) |

|---|---|---|

| Government Entities (Local & National) | Tax revenues, royalties, job creation, regulatory compliance, environmental standards | Significant economic contribution through operations; investment in local infrastructure and social programs. |

Cost Structure

Coeur Mining's operating costs encompass the direct expenses of mining and processing ore, such as labor, energy, reagents, and maintenance. These are the day-to-day costs of keeping their operations running smoothly.

In the first quarter of 2024, Coeur Mining reported total cash costs per ounce of silver sold at $13.96. Their total production costs, including depreciation and amortization, were $17.89 per ounce of silver. For gold, cash costs were $1,091 per ounce, and total production costs were $1,365 per ounce.

General and administrative (G&A) expenses, which cover corporate overhead like salaries and administrative functions not directly tied to a specific mine, also form a significant part of these operating costs.

Coeur Mining dedicates substantial capital to exploration and development, a critical investment for future production. In 2023, the company reported exploration expenditures of $56.7 million, underscoring its commitment to discovering and advancing new mineral resources.

These expenditures cover geological surveys, extensive drilling campaigns, and the technical work needed to bring new ore bodies into production. Such investments are fundamental to replenishing Coeur's mineral reserves, ensuring the company's long-term viability and continued operational capacity.

Coeur Mining's capital expenditures are substantial, reflecting significant investments in maintaining and growing its mining operations. These expenditures cover everything from acquiring new machinery and upgrading existing facilities to developing entirely new mining sites. For instance, the company has made considerable outlays for the Rochester expansion project and the acquisition of Las Chispas, both critical for future production capacity.

In 2024, Coeur Mining's capital expenditures were projected to be in the range of $350 million to $380 million. This significant investment underscores the company's commitment to expanding its operational footprint and enhancing its asset base. These capital outlays are essential for ensuring long-term sustainability and driving future growth in a capital-intensive industry.

Environmental Compliance and Reclamation Costs

Coeur Mining incurs significant expenses to meet environmental standards, implement eco-friendly operations, and manage future mine closure responsibilities. These costs are essential for maintaining their license to operate and fulfilling their commitment to sustainability.

These expenditures cover vital areas such as advanced water treatment systems, ongoing upkeep of tailings storage facilities, and the extensive work required for land rehabilitation after mining activities cease. For instance, in 2023, Coeur Mining reported environmental expenditures and asset retirement obligations totaling approximately $39.1 million.

- Water Management: Costs for monitoring, treating, and managing water discharges to ensure they meet stringent regulatory limits.

- Tailings Facility Maintenance: Ongoing expenses for the safe and stable operation of tailings storage facilities, including monitoring and engineering assessments.

- Reclamation and Closure: Funds set aside and spent on rehabilitating disturbed land, restoring ecosystems, and closing mine sites responsibly.

- Regulatory Compliance: Investments in systems, personnel, and processes to ensure adherence to all applicable environmental laws and permits.

Taxes, Royalties, and Permitting Fees

Coeur Mining's cost structure is significantly impacted by taxes, royalties, and permitting fees. These are essential obligations for operating in the mining industry. For instance, in 2023, Coeur Mining reported total tax expense of $122.9 million, reflecting income taxes and other tax-related payments.

Royalties are paid to governments and sometimes private landowners, often calculated as a percentage of revenue or production. Permitting fees are also a recurring cost, necessary to secure and maintain the legal right to operate mines and exploration activities. These statutory payments are a direct and unavoidable component of their operational expenses.

- Income and Mining Taxes: Coeur Mining faces various tax liabilities, including corporate income taxes and specific mining taxes levied by different jurisdictions.

- Royalties: Payments made to governments or landowners, typically based on a percentage of sales revenue or production volume, are a significant cost.

- Permitting and Licensing Fees: Costs associated with obtaining and renewing permits for exploration, mining, and environmental compliance are ongoing expenses.

Coeur Mining’s cost structure is multifaceted, encompassing direct operating expenses, significant capital investments for growth, and crucial environmental and compliance outlays. These elements collectively define the financial backbone of their mining operations and future development strategies.

The company's operational costs are detailed by their all-in sustaining costs (AISC) and cash costs, which provide a granular view of their expenditures per ounce of metal produced. For example, in Q1 2024, Coeur reported AISC of $1,304 per ounce of gold and $19.00 per ounce of silver. These figures are critical for understanding the profitability of their current production.

Beyond day-to-day operations, substantial capital expenditures are allocated to expanding existing mines and developing new ones, such as the Rochester expansion. In 2024, these capital expenditures were projected between $350 million and $380 million, highlighting a strong commitment to asset enhancement and future output.

Environmental stewardship and regulatory compliance also represent a significant cost category. In 2023, environmental expenditures and asset retirement obligations amounted to approximately $39.1 million, covering areas like water management, tailings facility maintenance, and land reclamation.

| Cost Category | Q1 2024 (per oz) | 2023 (Total) |

| Silver Cash Costs | $13.96 | N/A |

| Silver Total Production Costs | $17.89 | N/A |

| Gold Cash Costs | $1,091 | N/A |

| Gold Total Production Costs | $1,365 | N/A |

| Exploration Expenditures | N/A | $56.7 million |

| Capital Expenditures (Projected 2024) | N/A | $350 - $380 million |

| Environmental & Asset Retirement Obligations | N/A | $39.1 million |

| Total Tax Expense | N/A | $122.9 million |

Revenue Streams

Gold sales are Coeur Mining's main engine for revenue. This comes from the refined gold extracted from their various mining operations. In the first quarter of 2024, Coeur Mining reported gold sales contributing significantly to their financial performance, with the average realized gold price at $2,069 per ounce.

Silver sales represent a significant revenue stream for Coeur Mining, stemming from its position as a substantial silver producer. In 2023, silver sales contributed approximately $402 million to the company's total revenue, highlighting its material impact on the top line.

Like its gold operations, revenue generated from silver is directly influenced by both the volume of silver produced and the prevailing market prices. For instance, the average realized price of silver in 2023 was $22.99 per ounce, a key factor in determining the overall revenue from this segment.

Coeur Mining’s operations often yield valuable by-products like zinc and lead, which are then sold to generate supplementary income. These sales, while secondary to their main precious metal focus, play a significant role in boosting overall financial performance.

For instance, in 2023, Coeur Mining reported that by-product credits, which include metals like zinc and lead, significantly offset their operating costs. These credits contributed to a lower net production cost per silver ounce, demonstrating the tangible financial benefit of these secondary revenue streams.

Hedging and Derivatives (if applicable)

While Coeur Mining's primary revenue comes from direct metal sales, like many in the industry, they might employ hedging and derivatives to manage price fluctuations. If Coeur utilizes these financial instruments, any realized gains or losses would contribute to their overall financial performance, acting as a supplementary revenue or cost factor. For instance, in 2023, Coeur Mining reported total revenue of $793.4 million, with the bulk derived from the sale of gold and silver. The impact of hedging, if any, would be a smaller component within this larger revenue picture.

These hedging activities, if undertaken, are typically designed to lock in prices for future production, thereby reducing the risk associated with volatile commodity markets. This can provide a more predictable revenue stream, even if it limits potential upside from price increases. Coeur Mining's financial statements would detail any significant gains or losses from derivative instruments, offering insight into their risk management strategies.

- Primary Revenue Source: Direct sales of gold and silver.

- Hedging Role: Potential for minor supplementary revenue or cost reduction through price risk management.

- 2023 Financials: Coeur Mining reported $793.4 million in total revenue.

- Transparency: Gains/losses from derivatives would be detailed in financial reports.

Strategic Asset Dispositions

Coeur Mining strategically generates revenue through the sale of non-core assets, such as exploration properties or stakes in existing mines. This opportunistic approach provides significant capital infusions.

These dispositions are not a regular part of daily operations but serve as a valuable source of funds. For instance, in 2024, Coeur Mining completed the sale of its Crown nickel project, realizing $15 million in cash. This capital was then allocated towards reducing outstanding debt and bolstering investment in its core, high-priority mining operations.

- Strategic Asset Dispositions: Revenue generated from selling non-core assets, exploration properties, or partial mine interests.

- Opportunistic Capital: Provides significant capital for debt reduction or investment in priority projects.

- 2024 Example: Sale of Crown nickel project yielded $15 million in cash.

Coeur Mining's revenue is primarily driven by the sale of its mined precious metals, gold and silver. These sales are directly tied to production volumes and the fluctuating market prices of these commodities. In the first quarter of 2024, the average realized gold price was $2,069 per ounce, and for the full year 2023, silver sales contributed approximately $402 million, with an average realized price of $22.99 per ounce.

Beyond its core precious metals, Coeur Mining also generates revenue from the sale of by-product metals such as zinc and lead. These sales, while secondary, provide a valuable boost to overall financial performance. In 2023, by-product credits significantly helped offset operating costs, demonstrating the tangible financial benefit of these supplementary revenue streams.

The company may also engage in hedging activities to manage price volatility, which can result in supplementary revenue or cost adjustments. Furthermore, Coeur Mining strategically sells non-core assets, like exploration properties, to generate capital. For instance, the sale of the Crown nickel project in 2024 brought in $15 million in cash, which was used to reduce debt and fund core operations.

| Revenue Stream | Primary Driver | 2023 Contribution (Approx.) | 2024 Data Point |

|---|---|---|---|

| Gold Sales | Production Volume & Market Price | Majority of $793.4M Total Revenue | Avg. Realized Price Q1 2024: $2,069/oz |

| Silver Sales | Production Volume & Market Price | $402 Million | Avg. Realized Price 2023: $22.99/oz |

| By-product Sales (Zinc, Lead) | Production Volume & Market Price | Offsetting Operating Costs | N/A (Integrated into cost reduction) |

| Asset Dispositions | Strategic Sales of Non-Core Assets | N/A (Opportunistic) | Crown Nickel Project Sale: $15 Million Cash |

Business Model Canvas Data Sources

The Coeur Mining Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research on precious metals, and strategic insights from operational reports. These diverse sources ensure each canvas block is populated with accurate, relevant, and actionable information.