Coca-Cola FEMSA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola FEMSA Bundle

Coca-Cola FEMSA operates in a dynamic beverage market, where understanding the competitive landscape is crucial. Factors like the bargaining power of buyers and the threat of new entrants significantly shape its strategic decisions.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Coca-Cola FEMSA’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Coca-Cola Company's near-monopoly on concentrate production, with 98.7% of global output controlled internally, grants it immense power over bottlers like Coca-Cola FEMSA. This proprietary ingredient is non-negotiable for producing Coca-Cola branded beverages, inherently limiting Coca-Cola FEMSA's ability to negotiate terms for this essential input.

Coca-Cola FEMSA's operational efficiency is significantly influenced by the bargaining power of its suppliers, particularly for critical raw materials. The company depends on a small pool of global suppliers for essential inputs like sugar, aluminum cans, and plastic packaging. For example, the global market for beverage concentrates is dominated by a mere 3-4 major providers, and the supply of packaging materials typically involves only 5-6 key global manufacturers.

This limited supplier base grants these entities substantial leverage in price negotiations and contract terms. The high switching costs associated with finding and onboarding new suppliers for specialized inputs mean Coca-Cola FEMSA has less flexibility to change providers. Consequently, suppliers can dictate more favorable terms, potentially impacting Coca-Cola FEMSA's cost of goods sold and overall profitability.

Significant switching costs for Coca-Cola FEMSA mean that changing suppliers for essential raw materials and packaging is not a simple task. It requires considerable investment in terms of both money and time.

These transition costs can be quite high, with estimates suggesting around $15.2 million per supplier change. Furthermore, the process of qualifying a new supplier is lengthy, typically taking 18 to 24 months, and involves stringent technical certification requirements, limiting flexibility.

Consequently, these substantial switching costs diminish Coca-Cola FEMSA's ability to easily negotiate better terms with its current suppliers, thereby strengthening the suppliers' bargaining power.

Raw Material Price Volatility

Raw material price volatility significantly impacts Coca-Cola FEMSA's costs. Key inputs like sugar, aluminum, and plastic experience annual price swings, which can range from 7% to 15%. This fluctuation grants suppliers greater leverage, allowing them to pass on higher expenses and potentially squeeze Coca-Cola FEMSA's profit margins.

- Sugar Price Fluctuations: Annual price variations for sugar can reach 12-15%, directly affecting beverage production costs.

- Aluminum Cost Volatility: The price of aluminum, crucial for cans, typically sees an 8-10% annual fluctuation.

- Plastic Resin Instability: Plastic, used in bottles, experiences price movements of approximately 7-9% each year.

- Supplier Leverage: These price swings empower suppliers to demand higher prices, impacting Coca-Cola FEMSA's procurement expenses and overall profitability.

Supplier Guiding Principles and Compliance

Coca-Cola FEMSA's commitment to ethical and sustainable sourcing is evident in its Supplier Guiding Principles (SGP). New suppliers must agree to these guidelines, a process often managed through platforms like EcoVadis, which assesses supplier performance. This rigorous vetting process, while promoting responsible business practices, also means that suppliers who consistently meet these high standards can find themselves in a stronger negotiating position.

By demanding adherence to specific ethical and environmental criteria, Coca-Cola FEMSA implicitly elevates the standing of suppliers who are already compliant. For instance, in 2024, companies with strong sustainability ratings, often verified by third parties like EcoVadis, are increasingly sought after. This focus can limit the readily available alternatives for Coca-Cola FEMSA, potentially increasing the bargaining power of those suppliers who are well-aligned with the company's principles.

- Supplier Guiding Principles (SGP) implementation.

- Compliance evaluation via platforms like EcoVadis.

- New suppliers required to commit to SGP.

- Ethical and sustainable sourcing as a prerequisite.

The bargaining power of suppliers for Coca-Cola FEMSA is considerable, primarily due to the concentrated nature of key input markets and high switching costs. For instance, the global market for beverage concentrates is dominated by a few major providers, and packaging material supply often involves a limited number of global manufacturers. This limited competition allows suppliers to exert significant influence over pricing and contract terms.

Annual price fluctuations for critical raw materials like sugar (up to 15%), aluminum (up to 10%), and plastic resins (up to 9%) further empower suppliers. These price swings enable them to pass on increased expenses to Coca-Cola FEMSA, potentially impacting profitability. Furthermore, the rigorous vetting process for new suppliers, including adherence to ethical and sustainability standards, can limit alternatives and strengthen the position of compliant suppliers.

| Input Material | Annual Price Fluctuation (Approx.) | Supplier Concentration | Switching Costs (Est. per change) |

|---|---|---|---|

| Sugar | 12-15% | High | N/A |

| Aluminum Cans | 8-10% | Limited Global Manufacturers | $15.2 million |

| Plastic Packaging | 7-9% | Limited Global Manufacturers | $15.2 million |

| Beverage Concentrates | N/A (Proprietary) | 3-4 Major Providers | Very High (Technical & Contractual) |

What is included in the product

This analysis of Coca-Cola FEMSA's competitive landscape reveals the intensity of rivalry, the power of buyers and suppliers, and the barriers to entry and substitutes impacting its market position.

Identify and quantify competitive pressures, enabling proactive strategy adjustments to mitigate threats and capitalize on opportunities.

Visualize the interplay of forces, simplifying complex market dynamics for clearer strategic planning and communication.

Customers Bargaining Power

Coca-Cola FEMSA's extensive reach, touching 375,000 retail points, 47,000 restaurants, and 3,500 major distributors, highlights significant customer volume. However, this vast network also means large entities like Walmart, a major Coca-Cola purchaser, wield considerable bargaining power. In 2022, Walmart alone bought $9.5 billion worth of Coca-Cola products, giving them leverage to negotiate better pricing and terms, potentially impacting Coca-Cola FEMSA's profitability.

Coca-Cola FEMSA benefits significantly from strong brand loyalty among end consumers. This deep-seated affinity for Coca-Cola's iconic beverages, a testament to decades of marketing and product quality, acts as a powerful buffer against the bargaining power of even large retailers. Consumers actively seek out these familiar brands, ensuring consistent demand that retailers cannot easily ignore.

The sheer recognition and emotional connection consumers have with the Coca-Cola trademark, with global consumer awareness reported at a remarkable 94%, translate into a product that is essential for most beverage distributors and retailers. This inherent demand reduces the leverage that individual buyers or even large retail chains possess in dictating terms, as delisting Coca-Cola products would likely result in a loss of customer traffic for the retailer.

Coca-Cola FEMSA is strategically mitigating customer bargaining power through its Juntos+ omnichannel platform. This digital initiative, which boasted 1.3 million monthly active users in 2024, covering over 60% of its customer base, fosters stronger relationships. By leveraging AI, Juntos+ personalizes offerings and streamlines interactions, thereby increasing customer loyalty and reducing their ability to demand lower prices or better terms.

Diverse Customer Segments

Coca-Cola FEMSA serves a wide array of customers globally, meaning no single customer group holds significant sway. This broad reach across different sales channels is a key strength. For instance, in 2024, retail chains accounted for 45% of Coca-Cola FEMSA's revenue, while restaurants and food service represented 22%.

Further diversification comes from convenience stores, making up 18% of sales, and vending machines contributing 10%. This distribution across various customer segments significantly dilutes the bargaining power of any individual customer or segment, as the company is not overly dependent on any one source of demand.

- Retail Chains: 45% of 2024 revenue.

- Restaurants/Food Service: 22% of 2024 revenue.

- Convenience Stores: 18% of 2024 revenue.

- Vending Machines: 10% of 2024 revenue.

Customer-Centric Strategy

Coca-Cola FEMSA's customer-centric strategy directly addresses the bargaining power of customers. By positioning itself as a preferred commercial platform and ally, the company aims to foster loyalty and interdependence. This approach is evident in initiatives like providing microcredit to small retailers, which strengthens their operational capacity and, in turn, their relationship with Coca-Cola FEMSA.

This focus on customer integration is crucial in mitigating customer bargaining power. When customers rely on Coca-Cola FEMSA not just for products but for growth solutions and financial support, their ability to demand lower prices or switch suppliers diminishes. For instance, in 2023, Coca-Cola FEMSA reported significant growth in its small and medium-sized business segment, a testament to the success of its customer-focused initiatives.

- Customer-Centric Culture: Coca-Cola FEMSA strives to be the preferred commercial partner, enhancing customer loyalty.

- Innovation and Technology Adoption: The company invests in new solutions to better serve its diverse customer base.

- Support Programs: Initiatives like microcredit for small retailers build interdependence and reduce customer price sensitivity.

- Relationship Deepening: By integrating with customer needs, Coca-Cola FEMSA aims to create stronger, less price-sensitive relationships, thereby reducing their bargaining power.

While Coca-Cola FEMSA's vast customer base, reaching 375,000 retail points, might suggest diffused power, large entities like Walmart, which purchased $9.5 billion worth of Coca-Cola products in 2022, can still exert significant influence through bulk purchasing. However, the company mitigates this through robust brand loyalty, with 94% global consumer awareness for the Coca-Cola trademark, making its products indispensable for retailers and reducing individual buyer leverage.

Coca-Cola FEMSA's diversification across customer segments in 2024, with retail chains at 45% of revenue, restaurants at 22%, and convenience stores at 18%, prevents any single group from dominating negotiations. Furthermore, its Juntos+ omnichannel platform, boasting 1.3 million monthly active users in 2024, fosters direct customer relationships and loyalty, lessening price sensitivity.

| Customer Segment | 2024 Revenue Share | Key Mitigation Strategy |

|---|---|---|

| Retail Chains | 45% | Brand loyalty, Juntos+ platform |

| Restaurants/Food Service | 22% | Product essentiality, diversified demand |

| Convenience Stores | 18% | Broad customer reach, microcredit initiatives |

| Vending Machines | 10% | Product ubiquity, strong consumer demand |

Preview the Actual Deliverable

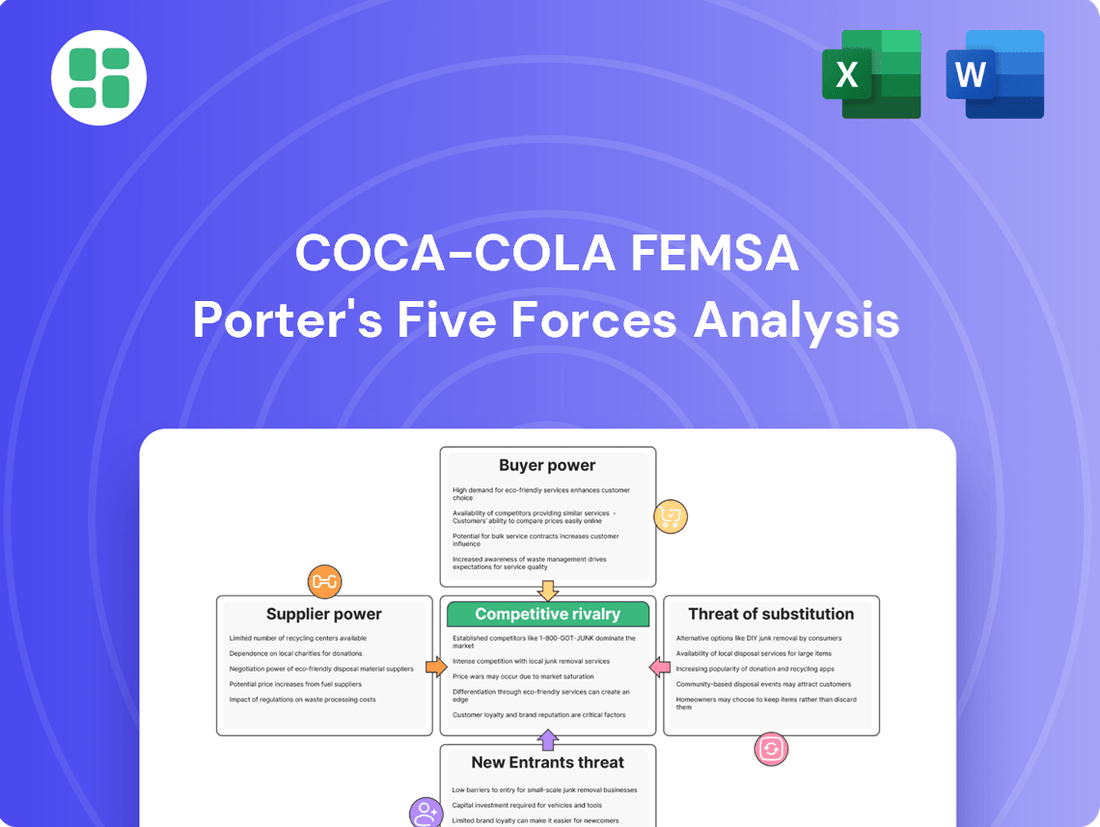

Coca-Cola FEMSA Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Coca-Cola FEMSA, detailing the competitive landscape and strategic positioning within the beverage industry. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for your business insights.

Rivalry Among Competitors

Coca-Cola FEMSA commands a formidable presence, recognized as the largest Coca-Cola bottler globally by sales volume. In 2024, it secured a substantial 56% volume share within Latin America's carbonated soft drinks market, underscoring its dominant position in key territories.

Despite this strength, the competitive landscape is fiercely contested. Coca-Cola FEMSA contends with global powerhouses such as PepsiCo and Danone, alongside robust regional and local bottlers who actively vie for market share, making incremental gains a challenging endeavor.

Coca-Cola FEMSA actively engages in product innovation, introducing an average of 6.5 new products annually. This relentless pursuit of new offerings, including a strengthened non-carbonated beverage lineup, directly fuels competitive rivalry within the beverage sector.

The constant need for companies like Coca-Cola FEMSA to innovate and diversify their product portfolios intensifies competition. This strategy aims to capture evolving consumer tastes and maintain market share against rivals who are also actively developing new beverages.

Competitive rivalry in the beverage industry is fierce, with major players like Coca-Cola FEMSA constantly engaging in aggressive pricing and extensive marketing to capture market share. This intense competition often involves promotional activities and discounts to attract and retain consumers. For instance, in 2024, the global non-alcoholic beverage market saw significant marketing spend, with major companies investing billions in advertising and sponsorships to build brand loyalty and differentiate their offerings.

Fragmented Regional Markets and Local Players

While global brands like Coca-Cola FEMSA are prominent, the beverage industry in many of its operating regions is characterized by a significant presence of strong local and regional players. This fragmentation means that competitive rivalry isn't solely a battle against other multinational corporations, but also against established companies deeply embedded in specific market cultures and consumer preferences.

For instance, in Mexico, a crucial market for Coca-Cola FEMSA, Grupo GEPP, the bottler for PepsiCo, presents a direct and formidable challenge. Additionally, Grupo Jumex, a leading producer of juices and nectars, competes for consumer attention and market share in the non-carbonated beverage segment. In Colombia, Postobón stands out as a major domestic competitor, offering a wide range of beverages that resonate with local tastes and traditions.

- Grupo GEPP is a significant competitor in Mexico, holding the bottling rights for PepsiCo products.

- Grupo Jumex, also a key player in Mexico, competes strongly in the juice and nectar market.

- Postobón is a major domestic rival in Colombia, offering a diverse portfolio of beverages.

Scale and Distribution Network as a Competitive Advantage

Coca-Cola FEMSA's sheer scale, evidenced by its 56 manufacturing plants and 256 distribution centers, translates into substantial cost efficiencies in both production and logistics. This vast operational footprint, which serves 2.2 million points of sale, presents a formidable barrier to entry for smaller competitors attempting to replicate its reach and cost structure.

The intense competition within the beverage industry is somewhat mitigated by Coca-Cola FEMSA's robust distribution network and operational prowess. These factors not only enhance its market leadership but also serve as a significant competitive differentiator.

- Massive Scale: Operates 56 manufacturing plants and 256 distribution centers.

- Extensive Reach: Serves 2.2 million points of sale.

- Cost Advantages: Achieves significant cost efficiencies in manufacturing and distribution.

- Competitive Barrier: The extensive network is difficult for smaller rivals to replicate.

Competitive rivalry is a defining characteristic for Coca-Cola FEMSA, marked by intense battles for market share against both global giants like PepsiCo and strong regional players such as Grupo GEPP in Mexico and Postobón in Colombia. This rivalry is amplified by continuous product innovation, with Coca-Cola FEMSA introducing an average of 6.5 new products annually, a strategy mirrored by its competitors to capture evolving consumer preferences.

The sheer scale of Coca-Cola FEMSA, operating 56 plants and 256 distribution centers serving 2.2 million points of sale in 2024, creates significant cost efficiencies and acts as a formidable barrier to entry. Despite this, aggressive pricing and extensive marketing campaigns, including substantial investments in advertising and sponsorships in 2024, remain critical tools for differentiation and consumer retention in this highly saturated market.

| Competitor | Key Market Presence | Product Focus |

|---|---|---|

| PepsiCo (via Grupo GEPP) | Mexico | Carbonated soft drinks, snacks |

| Danone | Global, significant in water and dairy | Bottled water, dairy beverages |

| Grupo Jumex | Mexico | Juices and nectars |

| Postobón | Colombia | Carbonated soft drinks, juices, water |

SSubstitutes Threaten

Consumers are increasingly prioritizing health and wellness, leading them to scrutinize the sugar content and perceived healthfulness of beverages. This trend is a significant threat to traditional carbonated soft drinks, like those in Coca-Cola FEMSA's portfolio.

In 2024, the global market for healthy beverages, including functional drinks and plant-based alternatives, continued its robust expansion, outpacing the growth of the traditional soda market. This shift means consumers are actively seeking out options perceived as better for them, directly impacting demand for sugary beverages.

This growing health consciousness in Latin America, a key market for Coca-Cola FEMSA, presents a direct challenge to their core sparkling beverage business. The company must adapt by offering a wider range of healthier options to mitigate the impact of consumers choosing substitutes.

The beverage market is brimming with choices beyond traditional sodas, including a significant presence of bottled water, various teas, fruit juices, and increasingly popular sports and plant-based drinks. In 2024, the global non-alcoholic beverage market continued its robust expansion, with water alone projected to capture a substantial portion of consumer spending, estimated to reach over $300 billion by the end of the year. This wide spectrum of alternatives directly challenges Coca-Cola FEMSA by offering consumers readily available and often healthier or more specialized options, thereby intensifying the pressure to retain market share.

Consumers can easily switch between various beverage options, including water, juices, teas, and other carbonated drinks, with minimal effort or expense. This lack of significant switching costs means that if Coca-Cola FEMSA's products become less appealing due to price, taste, or perceived health benefits, consumers can readily opt for alternatives. For instance, the growing popularity of functional beverages and premium waters in 2024 offers readily available substitutes that consumers can adopt without financial penalty.

Growth of Non-Carbonated and Functional Beverages

The burgeoning market for non-carbonated and functional beverages poses a significant threat of substitutes for Coca-Cola FEMSA. This segment is experiencing robust growth, with the plant-based beverage market alone anticipated to reach $123.5 billion by 2027. While Coca-Cola FEMSA is strategically expanding its non-carbonated offerings, the sheer pace of innovation and increasing consumer preference for these alternatives present a persistent challenge.

This trend is further amplified by the diversification of substitute products available to consumers.

- Expanding Health Consciousness: Consumers are increasingly prioritizing health and wellness, driving demand for beverages perceived as healthier alternatives to traditional carbonated soft drinks.

- Innovation in Functional Beverages: The functional beverage market, encompassing products with added health benefits like vitamins, probiotics, or energy boosters, is rapidly evolving, offering a wide array of substitutes.

- Plant-Based Alternatives: The surge in plant-based diets has fueled the growth of non-dairy milk alternatives and other plant-based beverages, directly competing with Coca-Cola FEMSA's core product lines.

- Private Label and Niche Brands: The proliferation of private label brands and smaller, niche beverage companies offering unique flavor profiles and health benefits further fragments the market and increases the availability of substitutes.

'B Brand' and Private Label Options

Coca-Cola FEMSA contends with a significant threat from 'B brand' producers and private label offerings, especially in markets like Central America. These alternatives frequently present comparable products at considerably lower prices. This dynamic directly impacts price-sensitive consumers, who might opt for affordability over established brand recognition, thereby increasing the substitution threat.

For instance, in 2024, private label beverage sales in several Latin American countries saw continued growth, capturing market share from premium brands. These private label options often leverage lower production costs and less extensive marketing budgets, allowing them to undercut prices. This competitive pressure forces established players like Coca-Cola FEMSA to carefully consider their pricing strategies and value propositions to retain market share against these more economical substitutes.

- Lower Price Points: 'B brands' and private labels typically offer beverages at a discount compared to major brands.

- Product Similarity: Many substitute products mimic the taste and quality of leading brands.

- Price Sensitivity: Consumers prioritizing cost over brand loyalty are more likely to switch to these alternatives.

- Market Penetration: In certain Central American nations, these substitutes have gained considerable traction, impacting market share.

The threat of substitutes for Coca-Cola FEMSA is substantial, driven by evolving consumer preferences towards healthier options and the wide array of available alternatives. In 2024, the global market for healthy beverages continued its strong growth, with consumers actively seeking out drinks perceived as better for them, directly impacting demand for traditional sodas.

This trend is amplified by the sheer volume of beverage choices, including bottled water, teas, juices, and functional drinks, all readily available with minimal switching costs. For example, the global non-alcoholic beverage market saw continued expansion in 2024, with water alone projected to capture significant consumer spending, exceeding $300 billion.

Furthermore, the rise of 'B brands' and private labels, particularly in markets like Central America, presents a pricing challenge. These alternatives often offer comparable products at lower price points, as seen in 2024 where private label beverage sales continued to grow in several Latin American countries, capturing market share from premium brands due to their lower production and marketing costs.

| Beverage Category | 2024 Market Trend | Impact on Coca-Cola FEMSA |

|---|---|---|

| Healthy Beverages (e.g., functional, plant-based) | Robust Growth, Consumer Preference Shift | Increased demand for alternatives, pressure on traditional soda sales |

| Bottled Water | Significant Market Share, Continued Expansion | Direct competition for consumer hydration spending |

| Private Label & 'B Brands' | Growing Market Penetration, Price Sensitivity | Price competition, potential erosion of market share due to lower price points |

Entrants Threaten

The beverage bottling industry, particularly at the scale operated by Coca-Cola FEMSA, necessitates substantial capital for production facilities, bottling equipment, and widespread distribution infrastructure. As of 2023, Coca-Cola FEMSA managed 53 plants with a production capacity reaching 4.1 billion unit cases per year, underscoring the immense financial commitment required.

This significant upfront investment acts as a formidable barrier, deterring new companies from entering the market due to the sheer financial resources needed to establish a competitive presence and replicate existing operational scale.

Coca-Cola FEMSA's established distribution and logistics networks present a significant barrier to new entrants. The company reaches an impressive 2.2 million points of sale across its operating territories, a testament to its robust and efficient supply chain. Building a comparable network requires immense capital investment, extensive local market knowledge, and considerable time, making it exceptionally difficult for newcomers to compete effectively on distribution reach and speed.

The threat of new entrants for Coca-Cola FEMSA is significantly mitigated by its strong brand loyalty and recognition. The Coca-Cola brand itself is a global icon, deeply ingrained in consumer habits and preferences worldwide. This established equity makes it incredibly difficult for newcomers to gain a foothold.

Consumers often exhibit a strong preference for familiar and trusted brands, and Coca-Cola has cultivated this loyalty over decades. For instance, in 2024, Coca-Cola continued to be one of the most valuable brands globally, a testament to its enduring appeal. This deep-seated trust means potential new beverage companies would need substantial resources and highly innovative offerings to even begin to challenge this loyalty.

Access to Raw Materials and Concentrate

New entrants into the beverage market, particularly those aiming to compete with Coca-Cola FEMSA, face significant hurdles in securing consistent and competitively priced access to essential raw materials. The primary challenge lies in obtaining the proprietary concentrate, which is exclusively supplied by The Coca-Cola Company (TCCC). This exclusivity creates a substantial barrier, as TCCC's stringent control over its secret formula and distribution channels prevents unauthorized replication or sourcing by potential competitors.

Furthermore, TCCC's long-standing and robust relationships with other key suppliers of ingredients like sweeteners, carbonation, and packaging materials further consolidate its supply chain advantage. These established partnerships often result in preferential pricing and guaranteed supply, making it exceedingly difficult for new entrants to match Coca-Cola FEMSA’s input costs or ensure the same level of quality and reliability. For instance, in 2023, the global sugar market experienced price volatility, with benchmark prices fluctuating significantly, highlighting the importance of secure and cost-effective sourcing agreements that established players like Coca-Cola FEMSA already possess.

- Concentrate Control: The Coca-Cola Company's exclusive ownership and distribution of its core beverage concentrate is a primary barrier to entry, limiting new players' ability to produce comparable products.

- Supplier Relationships: TCCC's deep-rooted partnerships with raw material suppliers, including those for sweeteners and packaging, provide cost and supply chain advantages that are difficult for new entrants to replicate.

- Economies of Scale: Coca-Cola FEMSA benefits from massive economies of scale in purchasing raw materials, allowing them to negotiate lower prices than any new, smaller competitor could achieve.

- Quality Consistency: Access to TCCC-approved, high-quality raw materials ensures product consistency, a standard that new entrants would struggle to meet without similar established supply chains and quality control measures.

Regulatory and Compliance Hurdles

The threat of new entrants for Coca-Cola FEMSA is significantly shaped by regulatory and compliance hurdles, especially given its extensive operations across Latin America and the Philippines. New players must contend with a patchwork of differing national laws, including specific taxes on sugary beverages and evolving environmental mandates. For instance, Mexico, a key market for FEMSA, has implemented sugar taxes, with the excise tax on high-sugar drinks contributing MXN 25.7 billion (approximately USD 1.4 billion) to federal revenues in 2023.

Navigating these diverse legal frameworks presents a substantial barrier. Potential entrants would face considerable upfront investment in legal counsel, compliance officers, and adapting production processes to meet varied standards. This complexity and associated cost make it challenging for smaller or less established companies to enter and compete effectively with a company like Coca-Cola FEMSA, which has decades of experience managing these regulatory landscapes.

- Diverse Regulatory Environments: Coca-Cola FEMSA operates in countries with unique tax laws, particularly those targeting sugar-sweetened beverages, and varying environmental regulations.

- Compliance Costs: New entrants must invest heavily in understanding and adhering to these complex and often changing legal requirements across multiple jurisdictions.

- Market Entry Barriers: The significant legal and compliance overhead acts as a deterrent, increasing the cost and difficulty for new companies to establish a foothold in the market.

The threat of new entrants for Coca-Cola FEMSA is considerably low due to the immense capital required for operations, including bottling plants and distribution networks. In 2023, Coca-Cola FEMSA operated 53 plants with a production capacity of 4.1 billion unit cases, illustrating the substantial financial commitment needed to compete at this scale.

Furthermore, the company's deeply entrenched brand loyalty, bolstered by Coca-Cola's global recognition as one of the most valuable brands in 2024, presents a significant hurdle for newcomers. Building a comparable distribution network, reaching 2.2 million points of sale, also demands extensive capital and time.

Exclusive access to Coca-Cola's proprietary concentrate and strong supplier relationships for raw materials and packaging further solidify these barriers, making it difficult for new entrants to match cost efficiencies and quality standards.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment in plants, equipment, and distribution. (e.g., 53 plants in 2023) | Deters entry due to massive upfront costs. |

| Brand Loyalty | Strong consumer preference for established brands like Coca-Cola. (e.g., Top global brand value in 2024) | New entrants struggle to gain market share against trusted brands. |

| Distribution Network | Extensive reach to millions of sales points. (e.g., 2.2 million points of sale) | Replicating this infrastructure is capital-intensive and time-consuming. |

| Supply Chain Control | Exclusive concentrate access and strong supplier relationships. | New entrants face challenges in sourcing key inputs and achieving cost parity. |

Porter's Five Forces Analysis Data Sources

Our Coca-Cola FEMSA Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Coca-Cola FEMSA's annual reports, investor presentations, and SEC filings. This is supplemented by industry-specific market research reports from firms like Euromonitor and IBISWorld, as well as macroeconomic data from sources such as the World Bank and national statistical agencies.