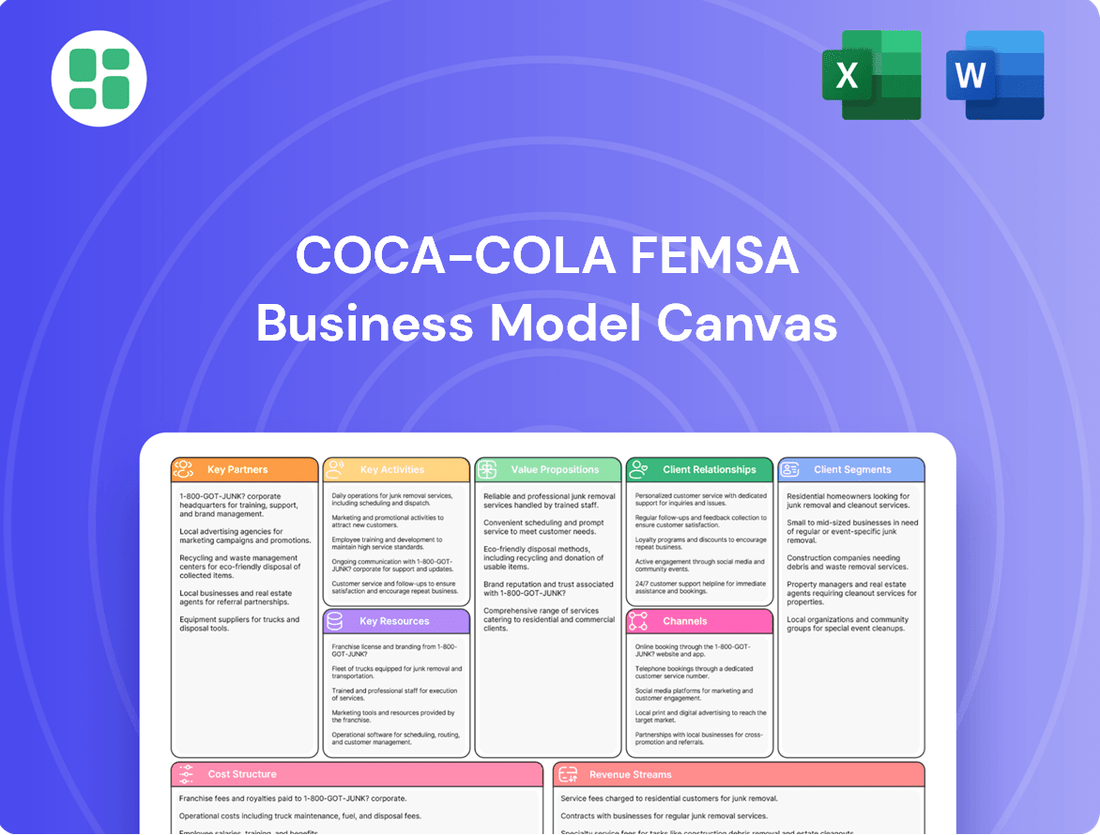

Coca-Cola FEMSA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola FEMSA Bundle

Unlock the strategic blueprint behind Coca-Cola FEMSA's massive beverage empire. This Business Model Canvas reveals how they leverage vast distribution networks, strong brand partnerships, and efficient operations to dominate markets. Discover their customer segments, value propositions, and revenue streams.

Ready to dissect the success of a global leader? Dive into the full Coca-Cola FEMSA Business Model Canvas, detailing their key resources, activities, and cost structures. This comprehensive analysis is your key to understanding how they achieve scale and profitability. Download it now to gain actionable insights for your own business strategy.

Partnerships

The Coca-Cola Company (TCCC) is Coca-Cola FEMSA's most crucial partner, as KOF operates as the world's largest franchise bottler of TCCC beverages. This foundational relationship provides KOF with exclusive rights to manufacture, market, and distribute TCCC's extensive portfolio of beverages across its vast operational territories.

This strategic alliance is vital for Coca-Cola FEMSA, ensuring unparalleled brand access and consistent marketing support from TCCC. The partnership also facilitates collaborative efforts in product innovation, allowing KOF to introduce new offerings aligned with global consumer trends and TCCC's strategic direction.

Coca-Cola FEMSA's business model hinges on its relationships with raw material and packaging suppliers. These partnerships are crucial for securing key inputs such as sweeteners, flavor concentrates provided by The Coca-Cola Company, and a wide array of packaging materials including PET bottles, glass bottles, and aluminum cans. In 2024, the company continued to prioritize these relationships to ensure consistent product quality and manage costs effectively, which is vital given the scale of their operations across multiple Latin American countries.

Coca-Cola FEMSA's extensive retail and distribution network is the backbone of its market presence. This includes a vast array of supermarkets, convenience stores such as FEMSA's own OXXO chain, countless small local shops, and diverse food service establishments.

These partners are the direct interface with the end consumer, ensuring products reach shelves and are accessible for purchase. In 2024, Coca-Cola FEMSA's distribution reached over 2.6 million points of sale across its operating territories, highlighting the critical role of these relationships in driving sales and achieving deep market penetration.

Technology and Digital Platform Providers

Coca-Cola FEMSA's strategic alliances with technology and digital platform providers are crucial for its evolving business model. These partnerships are essential for developing and enhancing its omnichannel platform, Juntos+. This platform aims to streamline customer interactions and sales processes across various channels.

The company actively collaborates with tech firms to integrate advanced AI capabilities, which are vital for optimizing operations and personalizing customer experiences. Furthermore, partnerships extend to providers of salesforce automation tools, directly impacting sales team efficiency and market reach.

In 2024, Coca-Cola FEMSA continued to invest in digital transformation, with technology partnerships forming a core component. For instance, their focus on data-driven decision-making relies heavily on the insights generated through these collaborations. These efforts are designed to improve everything from supply chain management to direct consumer engagement.

- Omnichannel Platform Development: Collaborations with technology firms to build and improve the Juntos+ platform, enhancing customer reach and sales efficiency.

- AI and Automation Integration: Partnerships focused on embedding AI for data analytics and salesforce automation tools to boost productivity and customer insights.

- Digital Transformation Support: Leveraging tech providers to drive digital initiatives, ensuring competitiveness in an increasingly digitized market.

Logistics and Transportation Providers

Coca-Cola FEMSA relies on a robust network of logistics and transportation providers to ensure its products reach consumers efficiently across diverse markets. These partnerships are fundamental to managing its vast distribution infrastructure, which spans multiple countries and requires intricate route optimization and timely deliveries. For instance, in 2024, the company continued to leverage specialized third-party logistics (3PL) providers for warehousing and last-mile delivery, aiming to reduce transit times and operational costs.

These collaborations are critical for maintaining product availability and freshness, especially in geographically challenging regions. By working with experienced transport companies, Coca-Cola FEMSA can navigate complex supply chains, ensuring that its beverages are where consumers want them, when they want them. This strategic reliance on external logistics expertise allows the company to focus on its core manufacturing and marketing operations.

Key aspects of these partnerships include:

- Fleet Management: Utilizing specialized transportation fleets, including refrigerated trucks, to maintain product quality during transit.

- Route Optimization: Employing advanced logistics software to plan the most efficient delivery routes, reducing fuel consumption and delivery times.

- Warehousing and Storage: Partnering with facilities that offer temperature-controlled storage and efficient inventory management systems.

- Cross-Border Logistics: Engaging providers with expertise in international shipping and customs regulations to facilitate seamless cross-country distribution.

Coca-Cola FEMSA's key partnerships extend to financial institutions and technology providers, crucial for operational efficiency and digital advancement. In 2024, the company continued to secure financing and explore innovative payment solutions, enhancing its financial agility. Collaborations with technology firms bolster its omnichannel strategy, Juntos+, and integrate AI for optimized operations and customer engagement.

| Partner Type | Role | 2024 Impact/Focus |

|---|---|---|

| The Coca-Cola Company (TCCC) | Exclusive Bottler, Brand Access, Marketing Support | Foundation of KOF's beverage portfolio and global brand alignment. |

| Suppliers (Raw Materials & Packaging) | Securing Key Inputs (sweeteners, concentrates, PET, glass, aluminum) | Ensuring consistent quality and cost management across vast operations. |

| Retailers & Distributors (incl. OXXO) | Point-of-Sale Reach, Consumer Interface | Facilitating access to over 2.6 million points of sale in 2024. |

| Technology & Digital Platforms | Omnichannel Platform (Juntos+), AI Integration, Sales Automation | Driving digital transformation and data-driven decision-making. |

| Logistics & Transportation Providers | Distribution Network Management, Last-Mile Delivery | Ensuring efficient product availability and freshness across diverse markets. |

What is included in the product

Coca-Cola FEMSA's Business Model Canvas focuses on efficient beverage production and distribution across diverse markets, leveraging strong brand partnerships and extensive retail networks to reach a broad customer base.

Coca-Cola FEMSA's Business Model Canvas offers a clear, one-page snapshot of their complex operations, simplifying the identification of key value propositions and customer segments to alleviate the pain of understanding a vast beverage distribution network.

This concise, shareable format of Coca-Cola FEMSA's Business Model Canvas effectively addresses the pain point of information overload by condensing their extensive strategy into an easily digestible and adaptable tool for rapid analysis and strategic alignment.

Activities

Beverage production and bottling form the bedrock of Coca-Cola FEMSA's operations, encompassing the meticulous manufacturing, stringent quality assurance, and efficient packaging of its extensive beverage portfolio. This includes not only Coca-Cola's iconic brands but also a diverse array of other popular beverages tailored to local tastes.

In 2023, Coca-Cola FEMSA managed a vast network of production facilities, demonstrating a commitment to operational efficiency and strategic capacity growth to consistently meet evolving consumer demand across its operating regions. This focus ensures product availability and upholds brand integrity.

Coca-Cola FEMSA's extensive distribution and logistics are a core activity, managing a vast network to deliver beverages to millions of points of sale across Latin America and the Philippines. This involves sophisticated warehousing and inventory control to ensure product availability.

In 2024, Coca-Cola FEMSA continued to optimize its logistics, leveraging technology to enhance efficiency in its complex supply chain operations. Their commitment to reaching diverse geographical areas underscores the importance of this key activity for market penetration and sales volume.

Coca-Cola FEMSA's marketing and sales execution focuses on driving demand through targeted campaigns and promotions. In 2024, the company continued to leverage digital platforms, including its Juntos+ initiative, to enhance customer engagement and build brand loyalty across its extensive beverage portfolio.

Effective execution involves managing a diverse range of products, from sparkling soft drinks to water and juices, ensuring each segment receives appropriate marketing support. This strategic approach aims to maintain and grow market share in competitive environments.

Supply Chain Management

Coca-Cola FEMSA’s supply chain management is crucial for its operational success, focusing on optimizing every step from acquiring raw ingredients to getting beverages into consumers' hands. This involves careful procurement of materials like sugar, water, and packaging, alongside robust management of relationships with a vast network of suppliers. In 2024, the company continued to invest in advanced logistics and distribution networks to ensure timely delivery and minimize spoilage, a critical factor in the beverage industry.

Key activities within this segment include:

- Procurement and Sourcing: Securing high-quality raw materials and packaging at competitive prices from reliable suppliers.

- Logistics and Distribution: Efficiently managing transportation, warehousing, and inventory to ensure product availability across diverse markets.

- Supplier Relationship Management: Building and maintaining strong partnerships with suppliers to ensure consistent quality and mitigate risks.

- Adaptability to Disruptions: Developing strategies to manage unforeseen challenges, such as weather events or geopolitical issues, that could impact supply or delivery.

Innovation and Portfolio Development

Coca-Cola FEMSA actively innovates its product offerings to align with changing consumer tastes and health trends. This involves introducing new beverage options, such as low-sugar and zero-sugar varieties, and exploring emerging categories to broaden market appeal.

In 2024, the company continued to focus on portfolio optimization and the launch of new products. For instance, it has been expanding its portfolio of water and functional beverages, responding to a growing consumer demand for healthier options.

- Product Diversification: Expanding into new beverage segments beyond traditional carbonated soft drinks.

- Health and Wellness Focus: Introducing low-sugar, zero-sugar, and functional beverage options.

- Packaging Innovation: Developing more sustainable and consumer-friendly packaging solutions.

- Market Responsiveness: Launching products that cater to specific regional preferences and emerging consumer demands.

Coca-Cola FEMSA's key activities revolve around its core business of beverage production, bottling, and distribution. This includes managing a vast operational network to ensure efficient manufacturing and quality control across its diverse product portfolio. The company also places significant emphasis on robust supply chain management, from raw material procurement to final delivery, a critical element for its market presence.

In 2024, Coca-Cola FEMSA continued to refine its distribution and logistics, employing technology to boost efficiency across its extensive supply chain. Their marketing and sales efforts in 2024 focused on leveraging digital channels, such as the Juntos+ initiative, to deepen customer engagement and foster brand loyalty.

Product innovation is another vital activity, with the company actively developing new offerings, including healthier options like low-sugar and functional beverages, to meet evolving consumer preferences. For example, in 2024, they expanded their range of water and functional drinks.

Coca-Cola FEMSA’s commitment to sustainability is also a key operational pillar, influencing packaging choices and operational efficiencies.

| Key Activity | 2023 Performance Highlight | 2024 Focus/Trend |

|---|---|---|

| Beverage Production & Bottling | Operated a vast network of production facilities. | Continued operational efficiency and capacity optimization. |

| Distribution & Logistics | Managed a vast network delivering to millions of points of sale. | Leveraged technology to enhance supply chain efficiency. |

| Marketing & Sales Execution | Utilized digital platforms for customer engagement. | Continued focus on digital engagement and brand loyalty initiatives. |

| Supply Chain Management | Ensured timely delivery and minimized spoilage. | Invested in advanced logistics and distribution networks. |

| Product Innovation | Expanded portfolio with low-sugar and functional beverages. | Continued portfolio optimization and new product launches in water and functional categories. |

What You See Is What You Get

Business Model Canvas

The Coca-Cola FEMSA Business Model Canvas you're previewing is the genuine article, offering a comprehensive overview of their strategic framework. This is not a sample; it's a direct representation of the exact document you'll receive upon purchase, ensuring complete transparency and immediate usability.

Resources

The Coca-Cola trademark portfolio, encompassing sparkling beverages, juices, water, and plant-based options, is a cornerstone of Coca-Cola FEMSA's business. This immense brand equity translates into significant consumer loyalty, a critical asset in competitive markets.

Globally recognized brands like Coca-Cola, Sprite, and Fanta are central to Coca-Cola FEMSA's market leadership. In 2024, the company continued to leverage these iconic names to drive sales and maintain its strong position across its operating territories.

Coca-Cola FEMSA's extensive manufacturing and bottling infrastructure is a cornerstone of its business. This network includes numerous modern production facilities and bottling plants strategically located across its operating territories, enabling efficient, large-scale production and consistent product quality.

These physical assets are continuously upgraded and expanded to enhance efficiency and meet growing demand. For instance, in 2023, the company invested significantly in its manufacturing capabilities, reflecting a commitment to maintaining a competitive edge through advanced operational capacity.

Coca-Cola FEMSA operates an extensive distribution network, a critical component of its business model. This network includes numerous distribution centers strategically located to serve vast territories efficiently. In 2023, the company managed over 3,000 distribution routes, demonstrating the sheer scale of its operations.

A substantial fleet of vehicles is the backbone of this distribution system. This fleet ensures timely and widespread delivery of Coca-Cola FEMSA's diverse beverage portfolio to millions of customers, from large retailers to small corner stores. The company's commitment to maintaining and optimizing this fleet directly impacts its market penetration and customer satisfaction.

Human Capital and Expertise

Coca-Cola FEMSA's extensive and skilled workforce is a cornerstone of its operations. This human capital spans critical areas like manufacturing, where efficiency and quality control are paramount, through to sales and marketing, driving brand presence and consumer engagement. Their collective expertise ensures the smooth execution of complex logistics and effective management across diverse markets.

The dedication and adaptability of this team are directly linked to the company's ability to navigate evolving market trends and maintain its competitive edge. For instance, in 2024, Coca-Cola FEMSA continued to invest in training and development programs, aiming to enhance the skills of its over 24,000 employees across Latin America and the Philippines. This focus on human capital is essential for maintaining operational excellence and driving strategic initiatives.

- Skilled Workforce: Over 24,000 employees in 2024, covering manufacturing, sales, marketing, logistics, and management.

- Expertise: Crucial for operational efficiency, quality control, and market responsiveness.

- Adaptability: Essential for navigating dynamic market conditions and implementing strategic changes.

- Investment in Development: Ongoing commitment to training programs to enhance employee capabilities.

Digital Platforms and Technology (e.g., Juntos+)

Coca-Cola FEMSA leverages proprietary digital platforms, such as Juntos+, as a crucial resource. These platforms are designed to foster deeper customer engagement and optimize operational workflows.

Advanced analytics capabilities, integrated with these digital tools, allow for more sophisticated market insights and data-driven decision-making. This technology directly contributes to improved salesforce efficiency and streamlined order processing.

- Juntos+ Platform: Enhances direct engagement with bottlers and clients, facilitating communication and transaction efficiency.

- Advanced Analytics: Drives insights into consumer behavior and market trends, informing strategic planning.

- Salesforce Efficiency: Digital tools empower sales teams with real-time data and order management capabilities, boosting productivity.

- Streamlined Operations: Technology reduces friction in the order-to-delivery cycle, improving overall supply chain performance.

Coca-Cola FEMSA's key resources include its powerful brand portfolio, extensive manufacturing and bottling infrastructure, a vast distribution network, a skilled and dedicated workforce, and proprietary digital platforms. These elements collectively enable the company to efficiently produce, market, and deliver a wide range of beverages across its operating territories, ensuring strong market presence and customer satisfaction.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Brand Portfolio | Globally recognized trademarks like Coca-Cola, Sprite, Fanta. | Drives consumer loyalty and market leadership; continued leverage in 2024. |

| Manufacturing & Bottling Infrastructure | Extensive network of modern production and bottling plants. | Enables large-scale, efficient production and consistent quality; continuous upgrades. |

| Distribution Network | Strategically located distribution centers and a large vehicle fleet. | Ensures timely, widespread delivery to millions of customers; over 3,000 routes managed in 2023. |

| Skilled Workforce | Over 24,000 employees in manufacturing, sales, marketing, logistics. | Essential for operational excellence and market responsiveness; investment in training in 2024. |

| Digital Platforms & Analytics | Proprietary tools like Juntos+ and advanced data analytics. | Enhances customer engagement, salesforce efficiency, and data-driven decision-making. |

Value Propositions

Coca-Cola FEMSA's commitment to widespread availability means its products are readily accessible to consumers across its vast operational territories. This extensive reach is a cornerstone of its value proposition, ensuring brand presence in virtually every corner of its markets.

The company's robust distribution network is a critical enabler, reaching millions of points of sale, from small convenience stores to large supermarkets. This logistical prowess guarantees that consumers can easily find and purchase their preferred Coca-Cola beverages, a key factor in driving consistent sales and brand loyalty.

In 2024, Coca-Cola FEMSA continued to leverage this widespread availability, with its distribution network serving an estimated 2.9 million points of sale across Latin America and the Philippines. This impressive scale underscores the company's ability to meet demand efficiently and maintain a strong market presence.

Coca-Cola FEMSA's diverse beverage portfolio is a cornerstone of its value proposition, encompassing sparkling, still, and increasingly, plant-based options. This breadth ensures they can cater to a vast array of consumer preferences and consumption occasions, from refreshing sodas to hydrating waters and healthier alternatives.

In 2024, this strategy is particularly crucial as consumer demand continues to diversify. The company's commitment to offering choices for every lifestyle, including low-sugar and no-sugar variants, directly addresses evolving health consciousness. For instance, their sparkling beverage segment remains dominant, but growth in still beverages, including water and juices, is a key focus.

Consumers trust Coca-Cola FEMSA for products that consistently meet high-quality standards, a direct result of leveraging globally recognized and trusted Coca-Cola brands. This reliability is a cornerstone of their value proposition, ensuring that every purchase delivers the expected taste and quality.

This unwavering consistency fosters deep consumer loyalty and builds significant confidence in the brand's offerings. For instance, in 2023, Coca-Cola FEMSA reported net revenue of approximately 237.7 billion Mexican pesos, demonstrating the scale at which this trust translates into market presence and continued consumer engagement.

Convenience and Affordability

Coca-Cola FEMSA prioritizes convenience and affordability by offering a wide range of packaging sizes and tiered pricing. This strategy ensures their products are accessible to a broad consumer base, a key factor in maintaining market leadership, especially in emerging economies.

In 2024, Coca-Cola FEMSA continued to leverage its extensive distribution network, making its beverages readily available across diverse geographic regions. This accessibility, coupled with varied price points, directly addresses the varying purchasing power of consumers, reinforcing their value proposition.

- Broad Accessibility: Coca-Cola FEMSA's distribution reaches over 2 million points of sale, ensuring widespread availability.

- Flexible Pricing: Offering single-serve bottles alongside larger family-sized options caters to different budget needs.

- Market Share Defense: The affordability focus is crucial for competing effectively in price-sensitive markets, a strategy that has historically protected and grown their market share.

Sustainability and Responsible Practices

Coca-Cola FEMSA's dedication to sustainability is a core value proposition. They actively engage in water stewardship, aiming to replenish 100% of the water used in their beverages by 2025. This commitment resonates deeply with environmentally aware consumers and investors alike.

The company is also making strides in renewable energy, with plans to source 100% of its electricity from renewable sources by 2030. This focus on clean energy reduces their environmental footprint and enhances brand reputation.

Waste reduction is another critical area, with Coca-Cola FEMSA striving for 100% recycled or renewable packaging by 2030. In 2023, they achieved a significant milestone by incorporating an average of 28% recycled PET in their plastic bottles across Latin America.

- Water Stewardship: Commitment to replenish 100% of water used by 2025.

- Renewable Energy: Target of 100% renewable electricity by 2030.

- Waste Reduction: Aiming for 100% recycled or renewable packaging by 2030.

- Recycled Content: Achieved 28% average recycled PET in Latin American bottles in 2023.

Coca-Cola FEMSA's value proposition centers on delivering a diverse portfolio of beverages that cater to a wide range of consumer preferences and occasions. This includes their well-known sparkling drinks, a growing selection of still beverages like water and juices, and options addressing health-conscious consumers, such as low-sugar variants. This broad offering ensures strong market penetration and adaptability to evolving consumer tastes.

The company's extensive distribution network is a key differentiator, making products accessible across millions of points of sale. This logistical strength ensures consistent availability, a critical factor for brand loyalty and sales volume, particularly in 2024 where they served approximately 2.9 million points of sale across their territories.

Furthermore, Coca-Cola FEMSA builds value through consistent quality and trusted brands, fostering deep consumer loyalty. This is evident in their 2023 net revenue of approximately 237.7 billion Mexican pesos, showcasing the financial impact of this trust. They also prioritize affordability through varied packaging and pricing strategies, making their products accessible to a broad economic spectrum.

Sustainability is increasingly integrated into their value proposition, with commitments like replenishing 100% of water used by 2025 and aiming for 100% recycled or renewable packaging by 2030. In 2023, they achieved 28% average recycled PET in their plastic bottles in Latin America, demonstrating tangible progress.

| Value Proposition Element | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Beverage Portfolio Diversity | Caters to varied tastes and needs | Includes sparkling, still, and healthier options. |

| Widespread Accessibility | Extensive reach to consumers | Serves ~2.9 million points of sale in 2024. |

| Brand Trust & Quality | Fosters consumer loyalty | Net revenue of ~237.7 billion MXN in 2023. |

| Affordability & Convenience | Accessible to broad consumer base | Varied packaging sizes and tiered pricing. |

| Sustainability Commitment | Appeals to eco-conscious consumers | 28% average recycled PET in bottles (2023). |

Customer Relationships

Coca-Cola FEMSA cultivates customer connections via its Juntos+ platform, blending physical and digital interactions. This approach streamlines ordering processes and offers loyalty incentives, directly engaging a broad customer base, especially small retailers.

Through Juntos+, Coca-Cola FEMSA reported a significant increase in digital engagement in 2024, with over 1.5 million small retailers actively using the platform for orders and information. This digital push aims to enhance customer loyalty and streamline the supply chain.

Coca-Cola FEMSA’s dedicated sales and distribution teams are crucial for maintaining strong connections with over 2 million points of sale across its territories. These teams don't just deliver products; they actively build personal relationships with retailers, offering vital merchandising support and ensuring optimal product placement. This direct engagement is key to efficient stock management and driving sales at the crucial last mile.

Coca-Cola FEMSA cultivates customer relationships through extensive mass marketing initiatives. These campaigns are designed to foster deep brand loyalty and an emotional bond with consumers across its vast operating territories. In 2024, the company continued to invest significantly in advertising and promotional activities to maintain its strong market presence.

Customer Service and Support

Coca-Cola FEMSA prioritizes responsive customer service to manage inquiries and resolve issues, fostering satisfaction for both business clients and end-users. This dedication to support is crucial for nurturing robust customer relationships across its diverse markets.

In 2024, the company continued to invest in digital channels and training for its customer service teams. These efforts aim to enhance the speed and effectiveness of issue resolution, reflecting a commitment to customer-centricity.

- Enhanced Digital Support: Coca-Cola FEMSA has been expanding its online self-service options and chatbot capabilities to provide instant assistance for common queries.

- Dedicated Account Management: For its key business clients, the company maintains dedicated account managers who offer personalized support and strategic advice.

- Feedback Integration: Customer feedback gathered through various touchpoints is systematically analyzed and used to refine service protocols and product offerings.

- Training and Development: Continuous training programs ensure that customer service representatives are equipped with the latest product knowledge and problem-solving skills.

Loyalty Programs and Incentives

Coca-Cola FEMSA actively cultivates customer loyalty through programs like Premia Juntos+. This initiative rewards consumers for their repeat purchases across its diverse beverage portfolio, driving sustained engagement and brand affinity. The program is designed to foster a sense of community and provide tangible benefits, encouraging customers to remain part of the Coca-Cola FEMSA ecosystem.

These loyalty programs are instrumental in gathering crucial consumer data. By tracking purchase patterns and preferences, Coca-Cola FEMSA gains valuable insights that inform product development, marketing strategies, and promotional activities. This data-driven approach allows for more personalized customer experiences and targeted outreach, ultimately strengthening the customer relationship.

- Premia Juntos+: A key loyalty program rewarding repeat purchases.

- Consumer Insights: Programs provide valuable data on purchasing habits and preferences.

- Brand Engagement: Fosters deeper connections with Coca-Cola FEMSA's brand portfolio.

Coca-Cola FEMSA's customer relationships are built on a multi-faceted approach, combining digital platforms like Juntos+ with extensive in-person sales and distribution networks. The company actively engages over 2 million points of sale through dedicated teams, fostering personal connections and providing merchandising support. Mass marketing campaigns further solidify brand loyalty and emotional bonds with consumers.

Digital initiatives, such as the Juntos+ platform, saw over 1.5 million small retailers actively engaging in 2024, enhancing ordering efficiency and loyalty. Loyalty programs like Premia Juntos+ reward repeat purchases, generating valuable consumer data that informs personalized marketing and product development, strengthening overall brand affinity.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Digital Engagement | Juntos+ Platform | Over 1.5 million small retailers actively using the platform. |

| Direct Sales & Support | Dedicated Sales Teams | Engaging over 2 million points of sale with merchandising support. |

| Loyalty & Retention | Premia Juntos+ Program | Drives repeat purchases and gathers consumer insights. |

| Customer Service | Responsive Support & Digital Channels | Enhanced speed and effectiveness of issue resolution. |

Channels

Traditional retail outlets form the backbone of Coca-Cola FEMSA's distribution, reaching consumers through a vast network that includes supermarkets, hypermarkets, and convenience stores like OXXO. This extensive reach is crucial for ensuring broad market penetration and accessibility across diverse geographies.

These channels are vital for capturing impulse purchases and catering to everyday needs, making Coca-Cola FEMSA's products readily available. In 2024, Coca-Cola FEMSA continued to leverage these traditional channels, which represent a significant portion of their sales volume, particularly in emerging markets where they are often the primary source of consumer goods.

In 2024, Coca-Cola FEMSA's Food Service and On-Premise channel continued to be a vital distribution network, supplying beverages to a wide array of establishments like restaurants, bars, hotels, and schools. This segment is designed for immediate consumption, catering to specific consumer experiences where beverages are enjoyed at the point of sale.

This channel is critical for driving immediate sales and reinforcing brand presence in environments where consumers actively seek refreshment. For instance, in 2023, Coca-Cola FEMSA reported that its comprehensive beverage portfolio reached millions of consumers daily through these on-premise locations, highlighting its significant market penetration.

Vending machines are a crucial touchpoint for Coca-Cola FEMSA, strategically positioned in high-traffic locations such as office buildings, transit stations, and entertainment venues. These machines provide immediate access to a wide range of Coca-Cola products, directly addressing the needs of consumers seeking on-the-go refreshment. In 2024, Coca-Cola FEMSA continued to leverage its extensive vending machine network to capture impulse purchases and maintain brand visibility in key urban and suburban markets.

Digital Platforms (Juntos+ e-commerce)

The Juntos+ platform acts as Coca-Cola FEMSA's direct-to-customer (D2C) e-commerce gateway, enabling retailers to conveniently place their orders online. This digital channel is instrumental in streamlining operations and broadening the company's market presence.

By leveraging artificial intelligence, Juntos+ aims to elevate the customer experience, offering personalized interactions and efficient order management. This focus on digital engagement is a key component of their strategy to adapt to evolving consumer and business purchasing habits.

- D2C E-commerce: Juntos+ facilitates direct online ordering for retailers.

- Efficiency Gains: Digital ordering reduces manual processes and speeds up transactions.

- Expanded Reach: The platform allows KOF to connect with a wider network of businesses.

- AI Integration: Artificial intelligence is employed to enhance customer service and platform functionality.

Wholesale and Sub-Distributors

Coca-Cola FEMSA leverages wholesale and sub-distributor channels to effectively penetrate diverse markets and customer segments. This strategy is particularly crucial in reaching more remote areas or niche markets where direct distribution might be less efficient.

These partnerships allow for optimized logistics and expanded market coverage, ensuring that Coca-Cola FEMSA products are accessible to a wider consumer base. For instance, in 2024, the company continued to refine its distribution network, with a significant portion of its sales volume being managed through these indirect channels, contributing to its overall market share in key territories.

- Extended Reach: Sub-distributors and wholesalers provide access to markets that might be logistically challenging for direct distribution, increasing product availability.

- Logistical Efficiency: By partnering with local entities, Coca-Cola FEMSA can optimize transportation and warehousing costs, especially in geographically dispersed regions.

- Market Penetration: These channels are vital for tapping into smaller retail outlets and specific customer segments that might not be served through traditional direct sales routes.

- 2024 Focus: The company's ongoing investments in its distribution infrastructure in 2024 included strengthening relationships with these indirect partners to enhance service levels and market responsiveness.

Coca-Cola FEMSA's distribution strategy is multifaceted, utilizing a blend of traditional retail, food service, vending, direct-to-consumer e-commerce via Juntos+, and wholesale/sub-distributor networks. This comprehensive approach ensures broad market penetration and accessibility across diverse geographies and consumer segments. In 2024, the company continued to optimize these channels, with traditional retail and indirect distribution playing significant roles in sales volume and market share expansion.

| Channel Type | Key Characteristics | 2024 Strategic Focus | Impact on Sales |

|---|---|---|---|

| Traditional Retail | Supermarkets, convenience stores (e.g., OXXO), hypermarkets | Leveraging for impulse buys and everyday needs, crucial in emerging markets | Significant portion of sales volume, broad market penetration |

| Food Service & On-Premise | Restaurants, bars, hotels, schools | Catering to immediate consumption, reinforcing brand presence | Millions of consumers reached daily, driving immediate sales |

| Vending Machines | High-traffic locations (offices, transit, venues) | Capturing impulse purchases, maintaining brand visibility in urban/suburban markets | Immediate access for on-the-go consumers |

| D2C E-commerce (Juntos+) | Online ordering platform for retailers, AI-enhanced customer experience | Streamlining operations, expanding market presence, personalized interactions | Efficient order management, broader business network connection |

| Wholesale & Sub-Distributors | Reaching remote areas, niche markets, smaller retailers | Optimizing logistics, expanding market coverage, strengthening indirect partnerships | Crucial for market share in key territories, enhanced service levels |

Customer Segments

Mass market consumers represent Coca-Cola FEMSA's largest and most diverse customer base, spanning all socio-economic strata within its operating territories. These individuals and households rely on Coca-Cola trademark beverages for daily refreshment, moments of enjoyment, and as a staple in their consumption habits.

To effectively serve this broad segment, Coca-Cola FEMSA offers an extensive portfolio of products, including sparkling beverages, juices, water, and other non-alcoholic options. This variety ensures that a wide range of preferences and needs are met, from value-conscious buyers to those seeking premium experiences.

In 2024, Coca-Cola FEMSA's commitment to the mass market is evident in its extensive distribution network, reaching millions of points of sale across Latin America. For instance, the company's operations in Mexico alone serve a population of over 128 million people, highlighting the sheer scale of this customer segment.

Coca-Cola FEMSA's retail customer segment is incredibly broad, encompassing everything from the corner convenience store to massive hypermarket chains. These businesses are vital for getting Coca-Cola FEMSA's products into the hands of consumers across its operating territories.

In 2024, Coca-Cola FEMSA's extensive distribution network served over 2 million points of sale, a testament to the sheer volume and diversity of its retail partners. This includes a significant number of small and medium-sized enterprises, which form the backbone of many local economies.

For larger retailers like Walmart or Soriana, Coca-Cola FEMSA provides tailored solutions, including promotional support and optimized inventory management. These relationships are crucial for maximizing sales volume and ensuring consistent product availability on shelves, especially during peak seasons.

Restaurants, cafes, and fast-food chains are a cornerstone customer segment for Coca-Cola FEMSA. These businesses depend on a consistent and diverse beverage supply to enhance their menus and satisfy customer demand. In 2024, the global food service industry continued its robust recovery, with many establishments actively seeking reliable partners like Coca-Cola FEMSA to ensure product availability and variety.

Institutional and Commercial Clients

Coca-Cola FEMSA serves a broad range of institutional and commercial clients. These include educational institutions like schools and universities, as well as corporate offices, hospitals, and other commercial establishments. These customers typically procure beverages in bulk for their staff, students, or visitors, often utilizing vending machine services.

In 2024, Coca-Cola FEMSA's commitment to this segment is evident in its distribution network, which facilitates large-scale deliveries. The company's strategy involves providing convenient beverage solutions tailored to the needs of these organizations, ensuring consistent supply and product availability.

- Educational Institutions: Supplying beverages for cafeterias, events, and student consumption.

- Corporate Offices: Providing refreshments for employees and business meetings, often through vending or direct delivery.

- Healthcare Facilities: Offering beverage options for patients, visitors, and staff within hospitals and clinics.

- Other Commercial Entities: Catering to a diverse range of businesses requiring beverage services for their operations or customer base.

Vending Machine Operators

Vending machine operators represent a key customer segment for Coca-Cola FEMSA, acquiring beverages for placement in their automated retail units. These operators often manage networks of machines in high-traffic areas such as office buildings, transit hubs, and educational institutions, catering to consumers seeking immediate access to refreshments. This segment is crucial for extending product availability to convenience-focused consumption points. In 2024, the global vending machine market was projected to reach over $120 billion, highlighting the significant reach of this distribution channel.

These operators are distinct from broader retail partnerships, focusing specifically on the logistics and management of vending machines. Their purchasing decisions are driven by factors like product popularity, profit margins, and the operational efficiency of stocking and maintaining their machines. Coca-Cola FEMSA's engagement with this segment involves ensuring a consistent supply of popular beverages and potentially offering tailored product assortments to meet the specific demands of different vending locations.

- Dedicated Vending Machine Operators: Businesses that specialize in the operation and stocking of vending machines.

- Convenience-Oriented Consumption: Focus on locations where consumers need quick and easy access to beverages.

- High-Traffic Locations: Targeting areas like offices, schools, and public transport for maximum product visibility and sales.

- Product Assortment and Margins: Operators select products based on consumer demand and profitability, making Coca-Cola FEMSA's diverse portfolio attractive.

Coca-Cola FEMSA's customer segments are diverse, encompassing individual consumers, retail businesses, food service establishments, and institutional clients. The mass market represents the largest group, relying on the company's wide array of beverages for daily consumption. Retail partners, ranging from small corner stores to large supermarket chains, are critical for product accessibility.

Food service providers like restaurants and cafes depend on Coca-Cola FEMSA for their beverage offerings, enhancing customer dining experiences. Additionally, institutional clients, including schools and corporate offices, procure beverages in bulk, often utilizing vending services. Vending machine operators form a distinct segment, managing networks of machines in high-traffic areas to offer convenient refreshment options.

In 2024, Coca-Cola FEMSA's operational reach extended to over 2 million points of sale across its territories, underscoring the breadth of its customer base. The company's strategy involves tailored approaches, from bulk deliveries for institutions to promotional support for major retailers, ensuring consistent product availability and meeting varied consumer preferences.

| Customer Segment | Description | 2024 Relevance |

|---|---|---|

| Mass Market Consumers | Broadest base, all socio-economic levels, daily consumption. | Millions of individuals across Latin America. |

| Retail Partners | Convenience stores to hypermarkets. | Over 2 million points of sale served. |

| Food Service | Restaurants, cafes, fast-food chains. | Key for menu enhancement and customer satisfaction. |

| Institutional/Commercial | Schools, offices, hospitals. | Bulk purchases for staff, students, visitors. |

| Vending Machine Operators | Manage machines in high-traffic locations. | Focus on convenience and immediate access. |

Cost Structure

Raw materials and ingredients, including sweeteners like high-fructose corn syrup and sugar, alongside essential water and proprietary concentrates, represent a substantial part of Coca-Cola FEMSA's expenses. For instance, in 2023, global sugar prices saw significant volatility, impacting ingredient costs.

Packaging materials, such as PET bottles, glass bottles, and aluminum cans, also form a major cost component. The company's reliance on these materials means that their market prices directly influence the overall cost structure.

Manufacturing and production costs are a significant component for Coca-Cola FEMSA, encompassing the operational expenses of its extensive bottling plant network. These include essential utilities like electricity and water, alongside the ongoing costs of machinery maintenance and the depreciation of valuable production equipment.

In 2023, Coca-Cola FEMSA reported cost of goods sold of approximately Ps. 174.9 billion (US$10.3 billion), a substantial portion of which is attributable to these manufacturing and production expenses. Achieving efficiency within these production processes is absolutely critical for effectively managing and controlling these costs, directly impacting the company's overall profitability and competitive pricing strategies.

Coca-Cola FEMSA's extensive distribution network necessitates significant outlays for transportation, fuel, and warehousing. These costs are a direct consequence of their vast geographic reach and the need to keep products readily available. In 2024, efficient fleet management and route optimization remain paramount to controlling these substantial operational expenses.

Marketing, Advertising, and Sales Expenses

Coca-Cola FEMSA dedicates substantial resources to marketing, advertising, and sales. These costs are crucial for maintaining brand visibility and stimulating consumer demand across its vast beverage portfolio.

In 2023, Coca-Cola FEMSA's selling, general, and administrative expenses, which encompass these marketing and sales efforts, were approximately 27.7% of its net revenue. This significant allocation reflects the competitive nature of the beverage industry and the company's strategy to build and sustain strong brand equity.

- Brand Building: Significant investments in advertising campaigns and promotional activities are key to reinforcing brand loyalty and attracting new customers.

- Sales Force: The company maintains a large sales force, incurring costs for salaries, commissions, and training to ensure effective market penetration and customer relationships.

- Market Penetration: These expenses are directly tied to driving sales volume and expanding market share in diverse geographic regions.

- Competitive Landscape: High marketing and sales expenditures are a necessity to compete effectively against both global and local beverage brands.

Labor and Administrative Costs

Labor and administrative costs represent a significant portion of Coca-Cola FEMSA's expenses, encompassing salaries, wages, and benefits for its extensive workforce. This includes everyone from production line workers to sales teams and corporate management.

In 2024, Coca-Cola FEMSA's total employee compensation and benefits are a key driver of its operational expenditure. These costs are essential for maintaining a skilled and motivated workforce across its vast distribution network and manufacturing facilities.

- Salaries and Wages: Direct compensation for all employees involved in production, sales, distribution, and administrative roles.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other welfare programs for employees.

- Administrative Overheads: Expenses related to the management and support functions, including office rent, utilities, and professional services.

Coca-Cola FEMSA's cost structure is heavily influenced by its significant investments in marketing and sales to maintain brand visibility and drive demand. In 2023, these selling, general, and administrative expenses represented approximately 27.7% of net revenue, highlighting the competitive nature of the beverage market. These costs are essential for brand building through advertising, supporting a large sales force, and ensuring effective market penetration across its diverse product lines and geographic regions.

| Cost Category | 2023 Impact (Approximate) | 2024 Focus |

|---|---|---|

| Raw Materials & Ingredients | Significant portion of Ps. 174.9 billion Cost of Goods Sold (COGS) | Managing volatility in sweetener and water costs |

| Packaging Materials | Major component of COGS | Optimizing procurement for PET, glass, and aluminum |

| Manufacturing & Production | Key driver of operational expenses | Enhancing efficiency in bottling plants, managing utilities and depreciation |

| Distribution & Logistics | Substantial outlays for transport and warehousing | Fleet management and route optimization for cost control |

| Marketing & Sales | 27.7% of Net Revenue | Sustaining brand equity and driving sales volume |

| Labor & Administrative | Essential for workforce management | Maintaining competitive compensation and benefits |

Revenue Streams

The sale of sparkling beverages is Coca-Cola FEMSA's bedrock revenue stream, driven by its extensive portfolio of iconic brands like Coca-Cola, Fanta, and Sprite. These effervescent drinks consistently represent the largest portion of both sales volume and overall revenue for the company. In 2023, Coca-Cola FEMSA reported total revenue of approximately $10.4 billion, with sparkling beverages forming the lion's share of this figure.

Coca-Cola FEMSA also generates significant revenue from its still beverage portfolio, encompassing a wide array of products beyond carbonated soft drinks. This includes juices, waters, and increasingly popular sports drinks like Powerade, as well as plant-based beverages. This diversification reflects a strategic response to evolving consumer preferences for healthier and more varied beverage choices.

In 2024, the demand for non-carbonated options continued its upward trajectory, contributing meaningfully to Coca-Cola FEMSA's overall sales. For instance, the company has been actively expanding its water brands and functional beverages, recognizing their growth potential. This segment's expansion is crucial for capturing market share among health-conscious consumers.

Coca-Cola FEMSA's revenue streams are notably diverse, stemming from sales across various channels like hypermarkets, supermarkets, smaller convenience stores, and the food service sector, which includes restaurants and fast-food chains. This multi-channel approach allows them to reach a broad consumer base.

The company's sales terms and pricing strategies are tailored to each specific channel. For instance, bulk purchases by large retailers or institutional clients might involve different pricing structures compared to sales to smaller, independent convenience stores.

In 2023, Coca-Cola FEMSA reported net revenue of approximately 257.6 billion Mexican pesos. This figure highlights the significant scale of their operations and the impact of their broad distribution network across multiple sales channels.

Digital Sales through Juntos+ Platform

Digital sales via the Juntos+ platform represent a growing revenue source for Coca-Cola FEMSA. This direct-to-customer channel enhances customer interaction and boosts overall sales figures.

The Juntos+ platform allows for direct orders, bypassing traditional distribution channels and capturing a larger share of the final sale price. This D2C approach is crucial for building brand loyalty and gathering valuable customer data.

- Juntos+ drives direct-to-consumer (D2C) sales, contributing to revenue growth.

- This platform enhances customer engagement and data collection.

- Digital orders through Juntos+ are becoming a significant revenue stream.

Ancillary Sales and Services

Beyond its primary beverage sales, Coca-Cola FEMSA diversifies its income through ancillary offerings. This includes providing and servicing vending machines and coolers, which are crucial for product visibility and accessibility. These services generate recurring revenue and strengthen customer relationships.

Leveraging its vast distribution infrastructure, Coca-Cola FEMSA also engages in the distribution of complementary products for third parties. This allows them to monetize their logistics network and reach, offering a valuable service to other companies while creating an additional revenue stream for themselves.

- Cooler and Vending Machine Services: Revenue generated from the placement, maintenance, and operation of vending machines and refrigeration units at retail locations.

- Third-Party Distribution: Income derived from utilizing their extensive logistics network to distribute non-Coca-Cola FEMSA branded products for other companies.

- Merchandise Sales: Potential revenue from selling branded merchandise or point-of-sale materials that enhance brand presence in retail environments.

Coca-Cola FEMSA's revenue is primarily driven by the sale of sparkling and still beverages, with sparkling drinks forming the largest segment. The company's portfolio includes iconic brands like Coca-Cola, Fanta, and Sprite, alongside juices, waters, and sports drinks. In 2023, Coca-Cola FEMSA reported net revenue of approximately 257.6 billion Mexican pesos, underscoring the scale of its beverage sales.

Digital sales through the Juntos+ platform are an increasingly important revenue stream, allowing for direct-to-consumer engagement and bypassing traditional channels. This D2C approach not only boosts sales but also facilitates valuable customer data collection. Ancillary services, such as vending machine operations and third-party distribution, further diversify income, leveraging the company's extensive logistics and market presence.

| Revenue Stream | Description | 2023 Impact (Illustrative) |

| Sparkling Beverages | Sales of carbonated soft drinks. | Largest revenue contributor. |

| Still Beverages | Sales of juices, waters, teas, and sports drinks. | Growing segment, reflecting consumer trends. |

| Digital Sales (Juntos+) | Direct-to-consumer sales via online platform. | Increasingly significant revenue source. |

| Ancillary Services | Vending machines, cooler services, and third-party distribution. | Diversifies income and leverages infrastructure. |

Business Model Canvas Data Sources

The Coca-Cola FEMSA Business Model Canvas is informed by a blend of internal financial data, extensive market research reports, and operational performance metrics. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework.