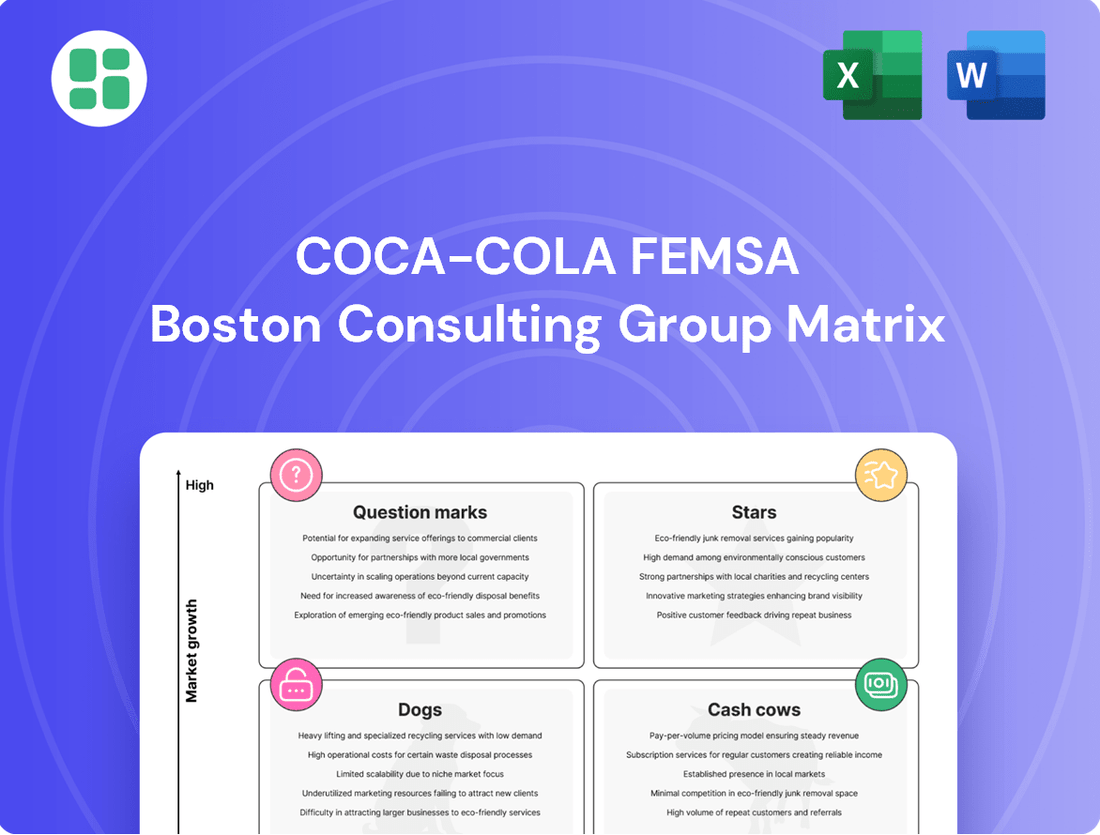

Coca-Cola FEMSA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola FEMSA Bundle

Coca-Cola FEMSA's BCG Matrix reveals a dynamic portfolio, showcasing which brands are driving growth and which require careful management. Understand the strategic implications of their product positioning to anticipate market shifts.

This preview offers a glimpse into Coca-Cola FEMSA's strategic landscape. Purchase the full BCG Matrix to unlock detailed quadrant analysis, actionable insights into market share and growth rates, and a clear roadmap for optimizing their beverage empire.

Stars

Coca-Cola Zero Sugar stands out as a Star within Coca-Cola FEMSA's portfolio, signifying robust growth and expanding market share in the low-calorie beverage category. Its success is driven by a clear alignment with evolving consumer demands for healthier alternatives, all while benefiting from the established power of the Coca-Cola brand.

The product's performance in 2024 was exceptional, recording a substantial 31% volume increase. Brazil emerged as a standout market, achieving a remarkable 56% year-on-year growth, positioning it as the leading global market for Coca-Cola Zero Sugar's expansion.

Energy drinks are a burgeoning segment for Coca-Cola FEMSA, showcasing impressive momentum. In 2024, the company secured a record sales share in this category within Brazil, underscoring its strong market penetration. This growth is further exemplified by an exceptional 28.8% volume increase in Guatemala for the same year.

Plant-based beverages represent a promising high-growth category for Coca-Cola FEMSA. In 2024, the company saw a record sales share for these products in Brazil, underscoring their rising popularity. This segment is poised for significant expansion as consumer preferences shift towards healthier and more sustainable choices.

Juntos+ Omnichannel Platform

The Juntos+ omnichannel platform is a strategic Star for Coca-Cola FEMSA, demonstrating significant growth and market penetration. It has become a vital digital asset, fostering strong customer engagement and driving substantial revenue.

- High Growth: By 2024, Juntos+ boasted 1.3 million active users, representing 60% of Coca-Cola FEMSA's customer base in Latin America.

- Significant Revenue: The platform generated over US$2.5 billion in digital revenues, underscoring its financial impact.

- Strategic Importance: Juntos+ enhances customer interactions, optimizes transactions, and utilizes AI to boost salesforce effectiveness, positioning it for continued expansion.

Strategic Production Capacity Expansion

Coca-Cola FEMSA's strategic move to expand its production capacity, especially in growth areas like Brazil and Guatemala, clearly positions it as a Star in the BCG matrix. This forward-looking investment is designed to capture increasing market share and cater to evolving consumer preferences.

In 2024, Coca-Cola FEMSA committed a significant portion of its capital expenditure to bolster production and distribution networks. The plan to introduce nine new production lines across its various operations underscores a strong belief in the future demand for its diverse product offerings.

- Record CAPEX in 2024: Focused on production and distribution expansion.

- Nine New Production Lines: Planned installations to increase output.

- High-Growth Market Focus: Investments concentrated in regions like Brazil and Guatemala.

- Meeting Growing Demand: Proactive expansion to satisfy increasing consumer appetite for their products.

Coca-Cola Zero Sugar, energy drinks, plant-based beverages, and the Juntos+ omnichannel platform are all identified as Stars for Coca-Cola FEMSA. These categories exhibit high growth and strong market share, demanding significant investment to maintain their leading positions and capitalize on future opportunities.

| Category | 2024 Performance Highlight | Growth Driver |

|---|---|---|

| Coca-Cola Zero Sugar | 31% volume increase globally; 56% growth in Brazil | Consumer demand for low-calorie options |

| Energy Drinks | Record sales share in Brazil; 28.8% volume increase in Guatemala | Burgeoning market segment, strong penetration |

| Plant-Based Beverages | Record sales share in Brazil | Shift in consumer preferences for healthier choices |

| Juntos+ Omnichannel Platform | 1.3 million active users (60% of LATAM customer base); US$2.5 billion in digital revenue | Digital engagement, salesforce effectiveness |

What is included in the product

This BCG Matrix analysis offers tailored insights into Coca-Cola FEMSA's product portfolio, highlighting which units to invest in, hold, or divest.

The Coca-Cola FEMSA BCG Matrix provides a clear, one-page overview of each business unit's position, simplifying complex portfolio analysis for strategic decision-making.

This export-ready design allows for quick drag-and-drop into PowerPoint, streamlining C-level presentations and reducing the pain of manual data integration.

Cash Cows

The core carbonated soft drinks, including regular Coca-Cola, Fanta, and Sprite, represent Coca-Cola FEMSA's quintessential cash cows. These established brands command significant market shares throughout Latin America, with Coca-Cola alone capturing over 60% of the cola segment in Brazil during 2024.

While volume growth may be moderate in certain regions, their deep market penetration and unwavering brand loyalty translate into reliable, robust cash generation and superior profit margins. This consistent performance solidifies their position as the company's primary profit drivers.

Mainstream bottled water brands like Ciel within Coca-Cola FEMSA's portfolio are classic Cash Cows. They dominate a mature market, holding significant market share. This strong position means they generate consistent, reliable income with minimal need for aggressive marketing spend.

The bottled water market, while mature, still sees growth, and these established brands are well-positioned to capture it. In 2023, the global bottled water market was valued at approximately $300 billion and is projected to continue its upward trajectory, offering stable revenue for Coca-Cola FEMSA.

Coca-Cola FEMSA's traditional juice portfolio, exemplified by brands like Del Valle, firmly occupies the Cash Cow quadrant of the BCG matrix. These products boast a significant market share within the mature juice segment, reliably producing substantial cash flow for the company.

While the overall juice market may not be experiencing rapid expansion, brands such as Del Valle benefit from established consumer recognition and a consistent, dependable demand. For instance, in 2023, Coca-Cola FEMSA reported that its juice category, which includes Del Valle, demonstrated resilient performance, contributing positively to the company's overall financial health.

Extensive Distribution Network

Coca-Cola FEMSA's extensive distribution network is a prime example of a Cash Cow. This robust infrastructure, reaching over 2.2 million points of sale across multiple Latin American countries, ensures consistent product availability and drives substantial, predictable revenue streams.

The sheer scale of this network provides a significant competitive advantage, making it incredibly difficult for smaller competitors to replicate. This efficiency translates into lower per-unit distribution costs, further solidifying its position as a strong performer.

- Dominant Market Reach: Coca-Cola FEMSA's distribution covers a vast geographical area, ensuring its products are readily available to a massive consumer base.

- Operational Efficiency: The scale of operations allows for economies of scale in logistics and delivery, reducing costs and improving profitability.

- Revenue Generation: This network is the backbone of consistent sales, generating reliable and significant cash flow for the company.

- Competitive Moat: The established and efficient distribution system acts as a strong barrier to entry for potential new market participants.

Established Bottling Operations in Mexico

Coca-Cola FEMSA's established bottling operations in Mexico stand as a prime example of a Cash Cow within its portfolio. This segment benefits from Mexico's status as a significant global market for carbonated soft drinks (CSDs). Despite experiencing some minor volume contractions in the first quarter of 2025, attributed to prevailing macroeconomic conditions, these operations continue to generate substantial revenue and robust financial returns.

The efficiency embedded within these mature facilities is a key driver of their Cash Cow status. Coca-Cola FEMSA actively pursues operational excellence, ensuring that these established plants maximize cash flow generation. For instance, in 2024, Mexico represented a substantial portion of Coca-Cola FEMSA's total revenue, underscoring the enduring strength of these operations.

- Dominant Market Share: Mexico's CSD market is mature, with Coca-Cola FEMSA holding a leading position, ensuring consistent demand.

- Operational Efficiency: Continuous investment in optimizing production processes in established plants drives high margins and cash generation.

- Strong Financial Performance: Despite slight volume dips in early 2025, the Mexican operations consistently contribute significantly to the company's overall profitability.

- Brand Loyalty: Deep-rooted consumer preference for Coca-Cola brands in Mexico supports stable sales volumes.

Coca-Cola FEMSA's established brands, such as Coca-Cola and Fanta, are undisputed Cash Cows, dominating Latin American markets with strong brand loyalty and significant market share. For example, Coca-Cola held over 60% of the cola segment in Brazil in 2024, generating reliable, robust cash flow with high profit margins despite moderate volume growth in some areas.

Mainstream bottled water brands like Ciel also function as Cash Cows, capitalizing on their leading positions in a mature but growing market. The global bottled water market's valuation at approximately $300 billion in 2023, with continued projected growth, ensures stable revenue streams for these established brands.

Traditional juice brands, including Del Valle, represent another set of Cash Cows for Coca-Cola FEMSA. These brands benefit from established consumer recognition and consistent demand in a mature market, as evidenced by the resilient performance of the juice category reported in 2023.

Coca-Cola FEMSA's extensive distribution network, reaching over 2.2 million points of sale, acts as a crucial Cash Cow. This vast infrastructure ensures consistent product availability, drives predictable revenue, and creates a significant competitive advantage through operational efficiency and economies of scale.

| Brand/Category | BCG Quadrant | Key Data Point (2024/2023) | Revenue Contribution |

| Coca-Cola (Core CSDs) | Cash Cow | 60%+ Brazil cola market share (2024) | Primary Profit Driver |

| Ciel (Bottled Water) | Cash Cow | Global bottled water market ~$300B (2023) | Stable Revenue |

| Del Valle (Juices) | Cash Cow | Resilient performance in juice category (2023) | Substantial Cash Flow |

| Distribution Network | Cash Cow | 2.2M+ points of sale | Consistent, Significant Cash Flow |

What You See Is What You Get

Coca-Cola FEMSA BCG Matrix

The Coca-Cola FEMSA BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously prepared by industry experts, is ready for immediate integration into your strategic planning processes. You can confidently expect this same high-quality document, free from watermarks or demo content, to be delivered directly to you, empowering your decision-making with actionable insights.

Dogs

Within Coca-Cola FEMSA's vast portfolio, certain established niche brands, often with a long history, are likely positioned as Dogs in the BCG Matrix. These brands typically cater to a small, specific consumer base within mature, slow-growing markets.

These legacy niche brands, while perhaps holding sentimental value, often exhibit low market share and minimal growth potential. For example, a regional soda brand with declining popularity in a saturated beverage market would fit this description. Coca-Cola FEMSA's 2023 annual report indicates a focus on optimizing its extensive brand portfolio, suggesting a continuous evaluation of underperforming assets.

Overly sweetened, non-diet beverages in health-conscious markets, like certain flavors of Coca-Cola FEMSA's traditional carbonated soft drinks, are likely positioned as Dogs in the BCG Matrix. These products are experiencing declining consumer interest due to growing awareness of sugar's health impacts and the implementation of sugar taxes in various regions. For instance, in Mexico, a country where Coca-Cola FEMSA has a significant presence, a sugar tax has been in place since 2014, impacting sales of high-sugar beverages.

Products situated in areas facing persistent economic slowdowns or strict, unyielding regulations may be classified as Dogs. These difficult market environments often result in consistently weak demand and a shrinking market share, hindering products from achieving profitability. For instance, in 2024, certain smaller markets within Latin America, impacted by inflation and currency fluctuations, presented such challenges for specific beverage SKUs.

Outdated or Less Efficient Packaging Formats

Certain older packaging formats, perhaps those less environmentally friendly or not aligning with current consumer tastes, might be categorized here. Coca-Cola FEMSA's investments in these areas are likely yielding minimal returns, and their market presence is probably shrinking as the company prioritizes sustainability.

The company's strategic focus on reducing its environmental footprint, including efforts to increase recycled content and explore alternative packaging materials, naturally leads to a phasing out of less efficient formats. This transition reflects a broader industry trend towards eco-conscious solutions.

- Diminishing Market Share: Packaging formats that are being phased out typically see a decline in sales volume as newer, more sustainable options gain traction.

- Low Return on Investment: Continued investment in outdated packaging lines offers little prospect of significant returns, making them unattractive from a capital allocation perspective.

- Environmental and Consumer Pressure: Growing concerns about plastic waste and a consumer preference for recyclable or reusable options accelerate the obsolescence of older packaging.

Underperforming Regional Brands from Acquisitions

Underperforming regional brands, often the result of past acquisitions, can become dogs in Coca-Cola FEMSA's portfolio. These brands typically exhibit low market share and limited growth potential within the broader FEMSA structure. For instance, if a smaller bottler acquired in 2022 for $50 million has only seen a 2% revenue increase in 2023 and holds less than 1% of its respective regional market, it fits this profile. Such entities can drain resources and management focus without delivering commensurate returns, necessitating careful evaluation for divestment or restructuring.

These acquired brands might struggle due to several factors:

- Poor integration: Ineffective assimilation into FEMSA's operational and marketing frameworks.

- Market saturation: The regional market may already be dominated by stronger competitors, leaving little room for growth.

- Brand irrelevance: The acquired brand's appeal may have diminished or failed to resonate with evolving consumer preferences.

- Inadequate investment: Insufficient capital allocated post-acquisition for revitalization or expansion efforts.

Dogs within Coca-Cola FEMSA's portfolio represent brands or product lines with low market share in slow-growing industries. These are often legacy products that no longer resonate with current consumer trends or face intense competition. For example, certain traditional, high-sugar carbonated beverages in markets with increasing health consciousness and sugar taxes would fall into this category. Coca-Cola FEMSA's 2023 financial statements indicated efforts to streamline its vast product offerings, a common strategy when managing 'Dog' assets.

These underperforming segments typically require significant resources for maintenance but yield minimal returns. In 2024, specific regional beverage SKUs in markets experiencing economic headwinds and regulatory challenges exemplify these 'Dog' classifications. The company's strategic focus often involves evaluating these for divestment or repositioning to mitigate resource drain.

The company's commitment to sustainability also impacts its 'Dog' portfolio, with older, less eco-friendly packaging formats being phased out. For instance, in 2023, Coca-Cola FEMSA continued to invest in more sustainable packaging solutions, reducing reliance on older, less efficient formats which likely saw declining sales volumes and market share.

Underperforming acquired brands, if not effectively integrated or if operating in saturated markets, can also be categorized as Dogs. These brands may struggle with brand relevance or face intense competition, leading to low market share and growth potential, as seen with certain smaller regional bottlers acquired in previous years that did not meet revenue growth expectations in 2023.

| Category | Characteristics | Example within Coca-Cola FEMSA | Market Trend Impact | Financial Implication |

| Dogs | Low Market Share, Low Growth | Older, high-sugar soda flavors; underperforming acquired regional brands; outdated packaging | Declining consumer interest (health, sustainability), market saturation, economic slowdowns | Low ROI, resource drain, potential for divestment |

Question Marks

Coca-Cola FEMSA's constant introduction of new products, like the 85 innovations rolled out in Brazil during 2024, are quintessential examples of Question Marks in the BCG Matrix. These ventures enter markets with promising growth potential but currently hold a small slice of that market. Significant capital is typically needed to nurture these products, aiming to boost their market share and brand recognition.

The success of these new launches is inherently uncertain. They represent a gamble; some may evolve into Stars, dominating their respective markets, while others might falter and become Dogs, failing to gain traction. Coca-Cola FEMSA's strategy here involves careful selection and substantial investment to steer these Question Marks towards a more favorable position.

Emerging functional beverages, such as adaptogenic drinks and specialized wellness beverages, represent a nascent category for Coca-Cola FEMSA. These products cater to growing consumer interest in health and well-being, tapping into high-potential market segments.

While these innovative drinks align with evolving consumer preferences, they currently hold a small market share within Coca-Cola FEMSA's portfolio. This necessitates significant investment to build brand awareness and distribution, characteristic of a question mark in the BCG matrix.

Coca-Cola FEMSA's strategic move into distributing new categories like beer, spirits, and snacks significantly diversifies its portfolio. This expansion taps into high-growth potential markets, offering a broader range of products to consumers. For instance, by the end of 2023, Coca-Cola FEMSA's total revenue reached approximately $13.6 billion, showcasing its substantial operational scale.

However, the brands within these new categories are initially new to FEMSA's established distribution network. This means they begin with a relatively low market share, necessitating considerable investment and effort for successful integration and scaling. The challenge lies in leveraging FEMSA's existing infrastructure to build market presence for these nascent brands.

Products Targeting New Consumer Segments

Coca-Cola FEMSA's "question marks" often represent products designed to tap into emerging consumer preferences or entirely new demographic groups. These are typically innovations that, while holding significant future potential, are in their nascent stages with low market penetration. For instance, the company might explore plant-based beverages or functional drinks tailored for specific health-conscious niches.

These ventures demand substantial upfront investment in research and development, along with targeted marketing campaigns to gauge consumer acceptance and market fit. Their success hinges on identifying and capitalizing on evolving consumer behaviors before they become mainstream trends. As of 2024, Coca-Cola FEMSA has been actively investing in expanding its portfolio beyond traditional carbonated soft drinks, reflecting a strategic move to diversify and capture growth in less saturated segments.

- Targeting Health-Conscious Consumers: Development of low-sugar or naturally sweetened options to appeal to a growing segment prioritizing wellness.

- Exploring Niche Beverage Categories: Introduction of products like sparkling water with natural flavors or functional beverages containing vitamins or adaptogens.

- Digital-First Product Launches: Utilizing online channels and direct-to-consumer models to test and iterate on new product concepts with specific online communities.

- Regional Adaptation: Creating beverages that cater to unique local tastes and dietary preferences in underserved geographic markets within FEMSA's operational territories.

Juntos+ Advisor Tool

The Juntos+ Advisor tool, an AI-driven sales enablement platform, is currently positioned as a Question Mark within Coca-Cola FEMSA's BCG Matrix. Its impact on direct market share is still being evaluated, as its ultimate contribution to growth and ROI is not yet fully established.

While Juntos+ enhances operational efficiency and empowers the salesforce, its ability to directly translate into significant market share gains requires further validation and continued investment. Successful adoption and proven results are crucial for its progression.

- AI-Powered Sales Enablement: Juntos+ aims to improve salesforce effectiveness through AI.

- Uncertain Market Share Impact: Its direct contribution to market share growth is still under assessment.

- Need for Continued Investment: Realizing its full potential necessitates ongoing resource allocation.

- Focus on Adoption and ROI: Success hinges on widespread user adoption and demonstrable return on investment.

Coca-Cola FEMSA's introduction of novel beverage categories, such as functional drinks and plant-based options, exemplifies its Question Mark strategy. These products target high-growth potential markets but currently hold a modest market share, requiring substantial investment to build brand awareness and distribution.

The success of these ventures is not guaranteed; they represent strategic bets that could either become market-leading Stars or underperforming Dogs. Coca-Cola FEMSA's approach involves careful market analysis and significant capital allocation to nurture these nascent products.

The company's expansion into distributing beer, spirits, and snacks, while diversifying its revenue streams, also places these new brands in the Question Mark category. Despite Coca-Cola FEMSA's vast operational scale, with total revenues around $13.6 billion by the end of 2023, these newer product lines require dedicated investment to establish a strong market presence.

The Juntos+ Advisor tool, an AI-driven sales enablement platform, is also classified as a Question Mark. While it aims to boost salesforce efficiency, its direct impact on market share is still under evaluation, necessitating continued investment and a focus on user adoption and demonstrable ROI.

| Category | Market Growth | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| Functional Beverages | High | Low | High | Star/Dog |

| New Distribution Categories (Beer, Spirits, Snacks) | High | Low | High | Star/Dog |

| Juntos+ Advisor Tool | N/A (Internal Tool) | N/A (Internal Impact) | High | Efficiency/ROI |

BCG Matrix Data Sources

Our Coca-Cola FEMSA BCG Matrix leverages a robust blend of financial disclosures, market share data, and industry growth forecasts to accurately position each business unit.