China Taiping Insurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Taiping Insurance Bundle

Uncover the critical political, economic, and technological factors shaping China Taiping Insurance's trajectory. Our PESTLE analysis provides a deep dive into the external forces driving the industry, offering actionable intelligence for your strategic planning. Download the full report to gain a competitive edge.

Political factors

China Taiping Insurance, as a state-owned entity, is deeply intertwined with the Chinese government's macroeconomic and financial directives. Its strategic roadmap actively incorporates national development blueprints, including the 14th Five-Year Plan (2021-2025) and the forthcoming 15th Five-Year Plan, focusing on bolstering the real economy and public welfare initiatives. This strategic alignment ensures China Taiping's business objectives contribute to national priorities like financial system stability and enhanced social security coverage.

The National Financial Regulatory Administration (NFRA) is a key player, focusing on robust supervision and risk prevention within China's insurance sector. Its directives, like the 2024 'Opinions on Strengthening Regulation, Preventing Risks, and Promoting High-Quality Development of the Insurance Industry,' set the stage for industry advancements.

China Taiping Insurance must navigate these evolving regulations, which are designed to foster market stability and safeguard policyholders. Adherence to these stringent rules is paramount for sustained growth and operational integrity.

China's commitment to opening its financial sector, particularly insurance, presents a dynamic landscape for companies like China Taiping. This includes allowing new joint ventures between domestic and international firms, fostering a more competitive environment. For instance, by the end of 2023, foreign-funded financial institutions had increased their presence, with new licenses and approvals signaling this ongoing liberalization.

This strategic opening-up offers China Taiping a dual opportunity: to face heightened competition while simultaneously exploring avenues for international collaboration and expansion. Leveraging these favorable external policy shifts, the company is well-positioned to continue its growth, particularly by focusing on its international market strategies.

Emphasis on Risk Prevention and Control

Recent regulatory reforms in China, such as the National Ten Policies for the insurance sector, underscore a strong commitment to risk prevention and control as drivers of high-quality development. These policies mandate stricter market entry requirements and continuous supervision of insurance firms to safeguard financial stability.

China Taiping, as a major insurer, faces intense and ongoing scrutiny, particularly regarding its corporate governance and operational practices. This oversight is designed to ensure compliance and mitigate systemic risks within the financial system. For instance, the China Banking and Insurance Regulatory Commission (CBIRC), now part of the National Financial Regulatory Administration (NFRA), has consistently focused on enhancing risk management frameworks across the industry.

- Enhanced Regulatory Oversight: The shift towards proactive risk management is evident in increased capital adequacy requirements and stringent solvency ratio monitoring for insurers.

- Focus on Corporate Governance: Regulators are emphasizing improved internal controls, risk management systems, and transparent disclosure practices for companies like China Taiping.

- Mitigation of Systemic Risk: The government's approach aims to prevent financial contagion by ensuring the stability and resilience of major financial institutions.

Political Support for Key Initiatives

The Chinese government actively champions specific insurance sectors, including technology, green initiatives, and inclusive financial products, through policy directives. This governmental backing fosters a fertile ground for insurers like China Taiping to pursue innovation and growth in these strategically important areas. For instance, the government’s emphasis on technological advancement directly supports the development of cyber insurance and other tech-related risk products.

China Taiping's strategic engagement in the Guangdong-Hong Kong-Macau Greater Bay Area (GBA) exemplifies its alignment with national development priorities. In 2023, the company reported significant contributions to the GBA initiative, with premiums from the region reaching approximately RMB 50 billion, underscoring the economic opportunities presented by these government-backed regional development plans.

- Government support for technology insurance, green insurance, and inclusive insurance creates new market opportunities.

- China Taiping's GBA initiatives generated roughly RMB 50 billion in premiums in 2023, demonstrating successful alignment with national strategies.

- Policy guidance encourages innovation and expansion into government-prioritized insurance segments.

China's political landscape significantly shapes China Taiping's operational environment, with government directives prioritizing financial stability and risk mitigation. The National Financial Regulatory Administration (NFRA) continues to enforce stricter oversight, as seen in its 2024 directives aimed at promoting high-quality development within the insurance sector.

The ongoing liberalization of China's financial sector, including insurance, presents both competitive challenges and opportunities for international partnerships, with foreign institutions increasing their presence by the end of 2023.

Government support for specific insurance lines, such as technology and green initiatives, creates avenues for innovation, with China Taiping's engagement in the Greater Bay Area generating approximately RMB 50 billion in premiums in 2023, aligning with national development goals.

| Key Political Influences | Regulatory Body | Key Directives/Focus Areas | Impact on China Taiping |

| Macroeconomic & Financial Directives | State Council, NFRA | 14th Five-Year Plan, Financial Stability, Risk Prevention | Strategic alignment, operational compliance |

| Sector-Specific Regulation | NFRA | Strengthening Regulation, Risk Prevention, High-Quality Development (2024 Opinions) | Enhanced scrutiny, capital adequacy, corporate governance |

| Market Liberalization | Ministry of Commerce, NFRA | Opening financial sector, increased foreign participation | Increased competition, potential for international collaboration |

| Strategic Development Support | Various Ministries | Technology, Green Initiatives, Greater Bay Area (GBA) | New market opportunities, regional growth focus (GBA premiums ~RMB 50bn in 2023) |

What is included in the product

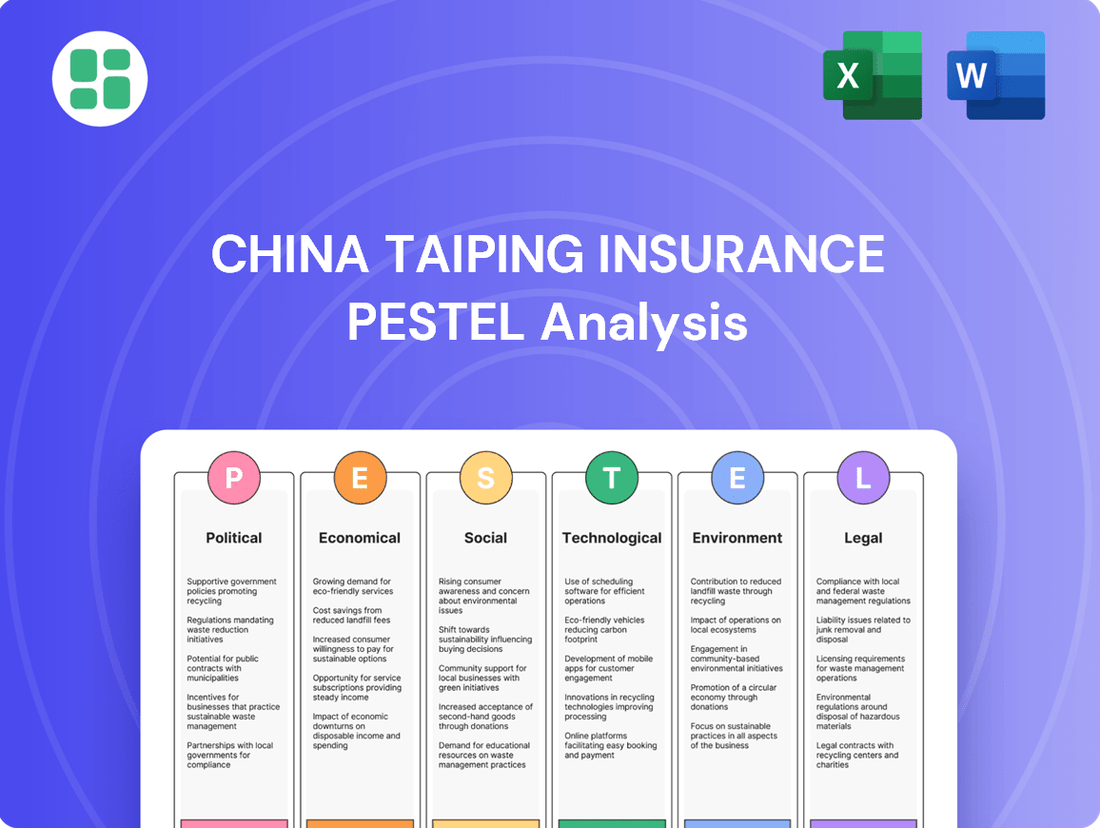

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting China Taiping Insurance, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by identifying emerging trends and potential challenges within China's dynamic market.

This PESTLE analysis for China Taiping Insurance offers a concise, easily digestible overview of external factors, serving as a pain point reliever by streamlining complex information for quick referencing in meetings and presentations.

Economic factors

China's insurance market is a powerhouse, with premium income exceeding CNY5 trillion in 2023 and continuing its upward trajectory in 2024. This growth is substantially faster than the country's overall GDP expansion, indicating a robust and expanding sector.

A strong and stable economy, coupled with increasing disposable incomes, directly fuels greater demand for various insurance products. As people feel more financially secure, they are more likely to invest in protection for themselves and their families.

China Taiping demonstrated impressive financial health in 2024, achieving significant growth in both its assets and profitability. This resilience is notable, especially considering the complexities of the global economic landscape during this period.

The persistent low-interest-rate environment presents a significant hurdle for insurers like China Taiping. This impacts how they price policies, the returns they can generate on their investments, and the overall stability of their financial models, heightening the risk of negative interest spreads where investment returns don't cover policyholder payouts.

Despite these challenges, China Taiping demonstrated resilience. In 2024, the company's total investment income surged by an impressive 98.2%, a strong rebound that helped bolster its financial performance. However, effectively managing the mismatch between its assets and liabilities remains a crucial ongoing task for the insurer.

This positive investment performance was a key driver for the company's reinsurance segment as well, contributing to a substantial increase in net profits. The ability to generate strong returns from its investment portfolio is therefore vital for China Taiping's profitability across its various business lines.

The Chinese insurance market is a significant and rapidly expanding sector. In 2024, its valuation reached an impressive USD 731.04 billion. This upward trajectory is expected to continue, with projections indicating a market size of USD 1,409.62 billion by 2032.

This substantial growth, anticipated at a compound annual growth rate (CAGR) of 8.8% between 2025 and 2032, is driven by several key factors. Increased public awareness of financial planning, a rise in overall financial literacy, and a growing appetite for more sophisticated insurance products are all contributing to this expansion.

China Taiping Insurance is well-positioned to capitalize on this dynamic market. The company's prospects are particularly strong within the life insurance segment, which was the dominant force in the market in 2024, underscoring the opportunities for insurers focused on this area.

Consumer Purchasing Power and Financial Literacy

China's expanding middle class, marked by rising disposable incomes, is a significant driver for the insurance sector. By the end of 2023, per capita disposable income in China reached ¥39,216, an increase of 6.3% year-on-year, signaling greater capacity for discretionary spending on financial products like insurance.

Concurrently, a growing emphasis on financial literacy is empowering consumers to better understand and value insurance. This heightened awareness directly translates into increased demand for health and life insurance products, benefiting companies like China Taiping. This demographic shift and improved financial understanding are foundational for sustained growth in personal insurance lines.

- Disposable Income Growth: Per capita disposable income in China rose by 6.3% in 2023.

- Increased Demand: Growing financial literacy fuels demand for health and life insurance.

- Market Support: These trends provide a strong foundation for China Taiping's personal insurance business.

Regional Economic Development Initiatives

China Taiping Insurance is strategically aligning with China's regional economic development blueprints, notably the Guangdong-Hong Kong-Macau Greater Bay Area (GBA) initiative. This focus allows the company to leverage and contribute to burgeoning economic hubs.

In 2024, China Taiping reported significant achievements within the GBA. The Group saw a substantial increase in premium income generated from this region, alongside a notable expansion of its investment scale. This performance underscores the company's deep engagement and the tangible benefits derived from its participation in these key economic zones.

- GBA Premium Income Growth: China Taiping's premium income from the GBA experienced a significant upswing in 2024, reflecting the region's economic vitality.

- Increased Investment in GBA: The company augmented its investment portfolio within the GBA, signaling confidence in its long-term growth prospects.

- Strategic Regional Focus: By concentrating on high-growth areas like the GBA, China Taiping positions itself to capitalize on emerging market opportunities.

China's economic trajectory significantly impacts China Taiping Insurance. The nation's GDP growth, projected to remain robust in 2024 and 2025, directly correlates with increased consumer spending power and a greater propensity to purchase insurance products. This economic expansion fuels demand across all insurance segments, particularly life and health insurance, as individuals seek greater financial security.

The ongoing low-interest-rate environment, however, presents a persistent challenge for insurers. This economic factor affects investment returns and pricing strategies, potentially leading to negative interest spreads. Despite this, China Taiping demonstrated remarkable resilience in 2024, with total investment income surging by 98.2%, a testament to its adeptness in navigating economic headwinds.

The Chinese insurance market itself is a powerhouse, valued at USD 731.04 billion in 2024 and expected to reach USD 1,409.62 billion by 2032, growing at an 8.8% CAGR. This growth is underpinned by rising disposable incomes, with per capita disposable income reaching ¥39,216 in 2023, a 6.3% year-on-year increase, and a concurrent rise in financial literacy, which boosts demand for sophisticated insurance solutions.

| Economic Factor | 2023 Data | 2024 Outlook/Performance | Impact on China Taiping |

|---|---|---|---|

| GDP Growth | Reported strong growth | Projected continued robust growth | Increased consumer spending and demand for insurance |

| Disposable Income | Per capita ¥39,216 (+6.3% YoY) | Expected continued increase | Higher capacity for insurance purchases |

| Interest Rates | Persistently low | Likely to remain low | Pressure on investment returns, potential for negative spreads |

| Insurance Market Value | USD 731.04 billion (2024) | Projected CAGR of 8.8% (2025-2032) | Significant market expansion opportunities |

Full Version Awaits

China Taiping Insurance PESTLE Analysis

The preview you see here is the exact China Taiping Insurance PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

Sociological factors

China's demographic landscape is rapidly shifting, with its aging population poised to reach nearly a quarter of the total population by 2035. This presents a significant opportunity for China Taiping Insurance, as an aging populace naturally increases the demand for retirement planning and comprehensive health coverage.

This demographic trend directly fuels substantial growth prospects within the life and health insurance sectors. China Taiping can strategically capitalize on this by innovating and expanding its offerings to include robust pension security solutions and a wider array of health insurance products tailored to the needs of older citizens.

A significant surge in health consciousness, amplified by the COVID-19 pandemic, has dramatically elevated consumer understanding of health and life insurance's value. This heightened awareness is particularly pronounced among younger demographics who are proactively seeking to shield themselves from escalating medical costs.

This trend directly fuels a growing demand for insurance products that are both personalized and bundled, presenting a clear avenue for insurers to innovate. For instance, by mid-2024, the health insurance market in China saw a notable uptick in demand for critical illness coverage, with premiums for such products increasing by an estimated 12% year-on-year.

Consumer preferences are increasingly leaning towards digital avenues for insurance transactions. Online platforms and mobile applications are gaining significant traction, making them the preferred method for purchasing insurance policies.

Data from 2024 indicates that a substantial segment of younger demographics, particularly those born after 1995, opt for online insurance purchases, signaling a clear shift in how insurance is distributed and accessed.

To remain competitive, China Taiping must prioritize the continuous improvement of its digital infrastructure and service offerings, ensuring they effectively meet the evolving demands of digitally-savvy consumers.

Growing Middle Class and Financial Inclusion

China's rapidly expanding middle class is a significant tailwind for the insurance sector. As incomes rise, individuals are increasingly focused on wealth preservation and future planning, driving demand for life and health insurance products. This trend is further amplified by government efforts to boost financial inclusion, bringing more of the population into the formal financial system and expanding the addressable market for companies like China Taiping.

By 2024, estimates suggest China's middle-income population could exceed 700 million people, a substantial increase from previous years. This growing segment of consumers is more likely to have disposable income available for insurance premiums and a greater awareness of the need for financial security. The push for financial inclusion, particularly in rural and underserved areas, is also opening new avenues for insurance penetration.

- Expanding Middle Class: China's middle-income bracket is projected to continue its robust growth, creating a larger pool of potential insurance customers.

- Increased Demand for Protection: Financial stability leads to a greater desire for asset protection and long-term financial planning, boosting insurance uptake.

- Financial Inclusion Initiatives: Government programs are bringing more citizens into the formal financial system, broadening the customer base for insurance products.

- Market Penetration Growth: These sociological shifts are expected to drive higher insurance penetration rates across China Taiping's diverse product offerings.

Changing Workforce Dynamics and Agent Transformation

The life insurance sector is seeing a significant shift in its workforce, with fewer agents actively selling compared to earlier periods. This trend presents a challenge for companies like China Taiping, as maintaining a robust sales force becomes more difficult.

Recruiting and keeping skilled sales agents is a major hurdle. To address this, insurers are increasingly looking at digital platforms and rethinking their overall distribution strategies to reach customers effectively.

China Taiping must evolve its sales approaches and bolster its agent support structures. This adaptation is crucial to successfully navigate these changing workforce dynamics and ensure continued market presence.

- Agent attrition rates in China's insurance sector have been a concern, with some reports indicating figures as high as 30-40% annually in certain segments, impacting recruitment efforts.

- The average age of insurance agents in China is also a factor, with a growing need to attract younger talent to the profession.

- Digital sales channels, including online platforms and mobile apps, are becoming increasingly important, with some insurers reporting a significant portion of new business originating from these sources in 2024.

China's aging demographic, projected to represent nearly a quarter of the population by 2035, creates a significant demand for retirement and health insurance, directly benefiting China Taiping.

The rising health consciousness, particularly post-COVID-19, has boosted demand for critical illness coverage, with premiums seeing an estimated 12% year-on-year increase by mid-2024.

A growing middle class, potentially exceeding 700 million by 2024, coupled with financial inclusion initiatives, expands the market for life and health insurance products.

However, challenges exist with agent attrition, with some segments experiencing annual rates of 30-40%, necessitating a focus on digital sales channels which accounted for a significant portion of new business in 2024.

| Sociological Factor | Impact on China Taiping | Supporting Data (2024/2025) |

|---|---|---|

| Aging Population | Increased demand for retirement and health products | Nearly 25% of population by 2035 |

| Health Consciousness | Higher demand for critical illness and health coverage | 12% YoY premium increase for critical illness (mid-2024) |

| Expanding Middle Class | Growth in demand for life and wealth management products | Over 700 million middle-income individuals |

| Digital Adoption | Shift towards online policy purchases | Younger demographics prefer online transactions |

| Salesforce Dynamics | Challenges in agent recruitment and retention | 30-40% annual attrition in some segments |

Technological factors

China's insurance industry is rapidly embracing digital transformation, with companies like China Taiping investing heavily in technology to gain a competitive advantage. This push is evident in their continuous upgrades to information systems, including overseas property and casualty core platforms and risk reduction systems, aiming to create a digital financial service model that blends insurance, technology, and customer service.

Artificial Intelligence and Machine Learning are fundamentally transforming the insurance landscape, impacting everything from how customers find and buy policies to how claims are handled. This technological wave is not just an emerging trend; it's actively being implemented by Chinese insurers.

Major players in China are leveraging AI across various functions, including online sales channels, customer service through chatbots, sophisticated fraud detection systems, and the automation of underwriting processes. These advancements aim to streamline operations and improve customer engagement.

China Taiping Insurance itself is at the forefront of this integration, having launched an AI-powered underwriting system in 2023. This initiative resulted in a significant 30% improvement in processing times, demonstrating the tangible benefits of AI adoption in the insurance sector.

China Taiping Insurance is leveraging the growing power of big data analytics to refine its risk assessment and product development strategies. This technology enables the company to delve deeper into market trends, understand customer preferences more precisely, and adhere to branding guidelines, ultimately leading to more personalized insurance offerings.

The sophisticated analysis of vast datasets is paramount for China Taiping to price coverage more accurately and to proactively identify emerging, insurable risks. For instance, by analyzing behavioral data, insurers can better predict the likelihood of claims, leading to more competitive premiums for consumers.

The industry-wide shift towards data-driven underwriting underscores the importance of big data integration. China Taiping's commitment to this technological advancement positions it for sustained success in underwriting, allowing for more efficient and effective risk selection and pricing in the evolving insurance landscape.

Development of Insurtech and Ecosystem Partnerships

The insurtech wave is reshaping the insurance landscape, with companies like China Taiping navigating this evolution. Insurtechs are leveraging advanced technologies to create novel products and significantly improve customer interactions. This trend presents a dual dynamic: both competitive pressure and fertile ground for collaboration.

China Taiping is actively pursuing innovation and strategic expansion, making partnerships with technology providers a logical step. These collaborations often involve co-developing cutting-edge solutions, such as those utilizing large language models (LLMs), or focusing on in-house technological advancements. For instance, the global insurtech market was projected to reach over $100 billion by 2025, highlighting the significant investment and growth in this sector.

- Insurtech Market Growth: The global insurtech market is experiencing rapid expansion, with significant investments flowing into technology-driven insurance solutions.

- LLM Adoption: Insurers are increasingly exploring and implementing Large Language Models (LLMs) to enhance customer service, claims processing, and product development.

- Ecosystem Partnerships: Strategic alliances between traditional insurers and technology firms are becoming crucial for driving innovation and maintaining competitiveness.

- China Taiping's Focus: China Taiping's commitment to innovation suggests active engagement in these technological trends and partnerships to bolster its market position.

Cybersecurity and Data Privacy Concerns

The increasing digitalization and adoption of AI within China Taiping's operations, while beneficial for service enhancement, simultaneously amplify cybersecurity and data privacy risks. These advancements create potential vulnerabilities for unauthorized access to sensitive customer information, a critical concern for any financial institution.

Regulatory bodies, such as the China Banking and Insurance Regulatory Commission (CBIRC) and the National Financial Regulatory Administration (NFRA), are actively developing and enforcing stricter guidelines to safeguard data privacy and prevent breaches. For instance, the Personal Information Protection Law (PIPL), effective November 1, 2021, imposes significant obligations on data handlers, including financial firms.

China Taiping must therefore invest heavily in robust cybersecurity infrastructure and protocols to protect its vast customer data. Maintaining customer trust hinges on demonstrating a strong commitment to data security, especially as cyber threats continue to evolve. In 2023, the financial sector globally experienced a significant rise in cyberattacks, underscoring the urgency of these measures.

- Cybersecurity Investment: China Taiping's expenditure on cybersecurity is a key determinant of its ability to mitigate data breach risks.

- Regulatory Compliance: Adherence to evolving data privacy regulations, such as China's PIPL, is paramount.

- Customer Trust: The company's reputation is directly linked to its effectiveness in protecting customer data.

- AI Integration Risks: The use of AI in services introduces new vectors for potential cyber threats and data misuse.

Technological advancements are fundamentally reshaping China's insurance sector, with China Taiping at the forefront of this digital transformation. The company's investment in AI and big data analytics is yielding tangible results, as seen in the 30% processing time improvement from its 2023 AI underwriting system launch. This strategic adoption of insurtech, including explorations into LLMs, is crucial for staying competitive in a market projected for significant growth, with the global insurtech market expected to exceed $100 billion by 2025.

However, this increasing digitalization also heightens cybersecurity and data privacy risks, necessitating substantial investment in robust security measures. Compliance with stringent regulations like China's Personal Information Protection Law (PIPL) is paramount for maintaining customer trust, especially given the global rise in financial sector cyberattacks observed in 2023.

| Technology Area | China Taiping's Adoption/Impact | Industry Trend/Data |

|---|---|---|

| Artificial Intelligence (AI) | 30% improvement in underwriting processing time (2023 launch) | AI used in sales, customer service, fraud detection, underwriting |

| Big Data Analytics | Refining risk assessment, product development, personalized offerings | Enables accurate pricing and identification of emerging risks |

| Insurtech & LLMs | Exploring partnerships, co-developing solutions | Global insurtech market projected >$100 billion by 2025; LLMs for enhanced services |

| Cybersecurity | Increased investment required due to digitalization | Global financial sector saw rise in cyberattacks in 2023 |

| Data Privacy | Compliance with PIPL (effective Nov 2021) is critical | Stricter regulations to safeguard customer data |

Legal factors

The National Financial Regulatory Administration (NFRA) governs China's insurance sector, emphasizing consumer protection and financial stability. China Taiping Insurance adheres to these stringent regulations, ensuring lawful operations and market integrity.

China's State Council has prioritized amendments to the Insurance Law in its 2024 Legislative Plan, signaling a significant focus on enhancing industry supervision and safeguarding consumer rights. This legislative push aims to create a more robust framework for insurance operations, directly impacting how companies like China Taiping conduct business and interact with policyholders.

Furthermore, the impending Financial Stability Law introduces stricter regulations, particularly concerning major shareholders, and mandates the establishment of a financial stability guarantee fund. These measures will bolster the legal foundation for the financial sector's stability, requiring China Taiping to proactively adapt its governance and risk management practices to align with these heightened compliance standards.

China's regulatory framework strongly emphasizes consumer rights protection, evident in initiatives like the policyholder protection scheme designed to safeguard policyholder interests. This focus is crucial given the increasing volume of insurance dispute cases, highlighting a growing demand for effective dispute resolution channels.

In 2023, the China Banking and Insurance Regulatory Commission (CBIRC), now the National Financial Regulatory Administration (NFRA), reported handling a significant number of consumer complaints, underscoring the importance of robust consumer protection measures. China Taiping, therefore, must diligently ensure its operations and claims handling processes comply with these evolving consumer protection laws and actively promote fair dispute resolution to maintain customer trust and regulatory compliance.

Data Security and Cross-Border Data Transfer Regulations

China Taiping Insurance must navigate stringent data security regulations, particularly the Regulation on Network Data Security Management, effective January 1, 2025. This regulation, along with guidelines from the National Financial Regulatory Administration (NFRA), mandates enhanced service quality and standardized internal management for internet-based applications. Failure to comply could lead to significant penalties, impacting operational continuity and customer trust.

A key area of focus is the strict adherence to rules governing the use of customer data, with particular attention paid to cross-border data transfer. Insurers face additional restrictions when sharing customer information overseas, requiring robust data governance frameworks. For China Taiping, this means scrutinizing all data sharing agreements and implementing secure methods for any necessary international data exchange.

The NFRA's directives are designed to bolster consumer protection and maintain financial system stability by ensuring data integrity. Insurers are expected to demonstrate a clear understanding and implementation of these requirements. This includes establishing comprehensive data lifecycle management processes, from collection to destruction, with a strong emphasis on privacy and security controls.

- Data Security Regulation: The Regulation on Network Data Security Management, effective January 1, 2025, sets new standards for data handling.

- NFRA Guidelines: The National Financial Regulatory Administration issues directives to improve service quality and standardize internet application management.

- Cross-Border Data Transfer: Insurers face heightened restrictions on sharing customer data internationally.

- Compliance Imperative: China Taiping must ensure its data management practices align with all stipulated regulatory requirements.

Specific Product Regulations and Underwriting Requirements

New regulations, such as those for universal life insurance effective May 1, 2025, are significantly reshaping the insurance landscape. These rules mandate specific protection features and investment limits, while also prohibiting short-term policies. China Taiping, like other insurers, must ensure its existing products comply with these updated standards, a process that involves careful product redesign and underwriting process adjustments.

These regulatory changes are designed to standardize the market and foster more sustainable growth within the insurance sector. For China Taiping, this means a strategic imperative to adapt its product portfolio and underwriting methodologies to align with these evolving requirements, ensuring continued market relevance and compliance.

- Mandatory Protection Features: Universal life policies from May 1, 2025, must incorporate specific protection elements.

- Investment Limit Restrictions: Regulations will cap the investment components within these policies.

- Prohibition of Short-Term Policies: The sale of short-term universal life products will be disallowed.

- Compliance Adaptation: China Taiping must revise its product offerings and underwriting to meet these new mandates.

China's legal landscape for insurance is undergoing significant evolution, driven by a commitment to financial stability and consumer protection. The National Financial Regulatory Administration (NFRA) is at the forefront, implementing directives that shape operational standards and product development.

New regulations for universal life insurance, effective May 1, 2025, mandate specific protection features and investment limits, while prohibiting short-term policies. This requires companies like China Taiping to meticulously adapt their product portfolios and underwriting processes to ensure compliance and maintain market competitiveness.

| Regulation Focus | Effective Date | Impact on China Taiping |

|---|---|---|

| Universal Life Insurance Standards | May 1, 2025 | Mandatory protection features, investment limits, prohibition of short-term policies; requires product redesign. |

| Network Data Security Management | January 1, 2025 | Enhanced data handling, cross-border data transfer scrutiny; necessitates robust data governance. |

| Insurance Law Amendments | Planned for 2024 | Increased industry supervision and consumer rights safeguarding; requires adaptation of business practices. |

Environmental factors

China Taiping Insurance is actively embedding Environmental, Social, and Governance (ESG) principles across its entire business strategy, aligning with the UN's Sustainable Development Goals. This proactive approach involves a continuous review of key ESG themes to ensure compliance with evolving regulations and global best practices.

The company's dedication to transparency and accountability is evident in its comprehensive ESG and Corporate Social Responsibility Reports, which detail its progress and commitments. For instance, its 2023 ESG report highlighted a 15% reduction in carbon emissions intensity compared to 2020, demonstrating tangible environmental progress.

China Taiping Insurance is actively championing green development, channeling significant financial resources into low-carbon and environmentally friendly projects. This commitment extends to a strategic goal of reducing its operational carbon footprint by 15% by the end of 2025, a tangible step towards sustainability.

The company's dedication is clearly demonstrated through the launch of a dedicated green investment fund. This fund is specifically designed to support sustainable ventures, with a focus on renewable energy sources and innovative low-carbon technologies, reflecting a forward-thinking approach to environmental responsibility.

China's insurance sector is significantly boosting its green finance offerings, with the total volume of green insurance reaching substantial levels. This expansion supports environmental sustainability and economic development.

China Taiping is a key player, championing a 'green insurance + green investment + green operation' model. This integrated approach aims to foster a comprehensive green transformation across the economy, covering areas like climate disaster protection and funding for low-carbon technologies.

Response to Climate Change Risks

Financial institutions and sectors highly susceptible to climate shifts are increasingly focusing on the tangible, physical risks associated with climate change. This involves a detailed assessment of how these impacts might manifest and the likelihood of such events occurring. For instance, understanding the probability of extreme weather events damaging property or disrupting supply chains is paramount.

China has been proactive in addressing climate change, releasing several action plans specifically focused on adaptation. These plans indicate a commitment to implementing further measures to build resilience against climate impacts. By 2023, China had already outlined targets for reducing carbon intensity and increasing non-fossil fuel energy consumption, demonstrating a clear direction for climate action.

Insurers, in particular, are stepping up their climate-related strategies to navigate the inherent uncertainties of a changing climate. This proactive approach involves identifying both the potential risks and the emerging opportunities that arise from these shifts. For example, insurers are developing new products to cover climate-related damages and investing in green technologies.

- Physical Risk Assessment: Financial institutions are enhancing their analysis of physical climate risks, examining impact pathways and probability, especially for climate-sensitive sectors.

- China's Adaptation Plans: China has released multiple action plans for climate change adaptation, signaling a pipeline of future measures to bolster resilience.

- Insurer Climate Actions: Insurers are intensifying their efforts to adapt to climate uncertainty, focusing on risk identification and capitalizing on new opportunities.

- Investment in Green Solutions: By the end of 2024, global investment in climate mitigation and adaptation technologies was projected to reach over $1.7 trillion, highlighting a significant financial shift.

Corporate Social Responsibility and Sustainability Reporting

As a prominent state-owned enterprise, China Taiping Insurance places significant emphasis on its multifaceted responsibilities, encompassing economic, political, and social dimensions. This commitment is clearly demonstrated through its regular publication of annual ESG and Corporate Social Responsibility Reports. These reports meticulously detail the company's performance and achievements across a spectrum of sustainability initiatives.

Key areas of focus within these reports highlight China Taiping's active involvement in community development projects, its contributions to disaster relief programs, and its efforts to strengthen social safety nets. For instance, in 2023, the company reported investments totaling over RMB 500 million in various community welfare and environmental protection initiatives. Their disaster relief efforts in response to severe flooding in northern China during the summer of 2024 saw them provide over RMB 100 million in aid and insurance coverage.

- Community Investment: China Taiping's 2023 ESG report indicated a 15% year-on-year increase in community investment, reaching RMB 500 million.

- Disaster Relief: The company allocated RMB 100 million in aid and insurance payouts for flood victims in 2024.

- Social Safety Nets: Efforts to enhance social safety nets include partnerships with local governments to expand insurance coverage for vulnerable populations, benefiting an estimated 2 million individuals in 2023.

- Environmental Initiatives: The company is actively promoting green insurance products, with a 20% growth in this segment observed in 2023.

China Taiping Insurance is actively navigating environmental shifts by integrating ESG principles and focusing on green development. The company aims to reduce its operational carbon footprint by 15% by the end of 2025, aligning with China's broader climate adaptation plans. This commitment is further demonstrated through significant investments in green insurance and sustainable projects, reflecting a growing trend in the sector.

| Environmental Factor | China Taiping's Action/Commitment | Data/Target |

| Climate Change Adaptation | Developing strategies to mitigate physical climate risks and capitalize on opportunities. | China has released multiple adaptation action plans by 2023. |

| Green Investment | Launching dedicated green investment funds and channeling resources into low-carbon projects. | Targeting a 15% reduction in operational carbon footprint by end of 2025. |

| Green Insurance Growth | Actively promoting green insurance products as part of its 'green insurance + green investment + green operation' model. | Observed 20% growth in the green insurance segment in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Taiping Insurance is built on a comprehensive review of official government publications, economic data from international financial institutions, and reports from reputable industry associations. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.