China Taiping Insurance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Taiping Insurance Bundle

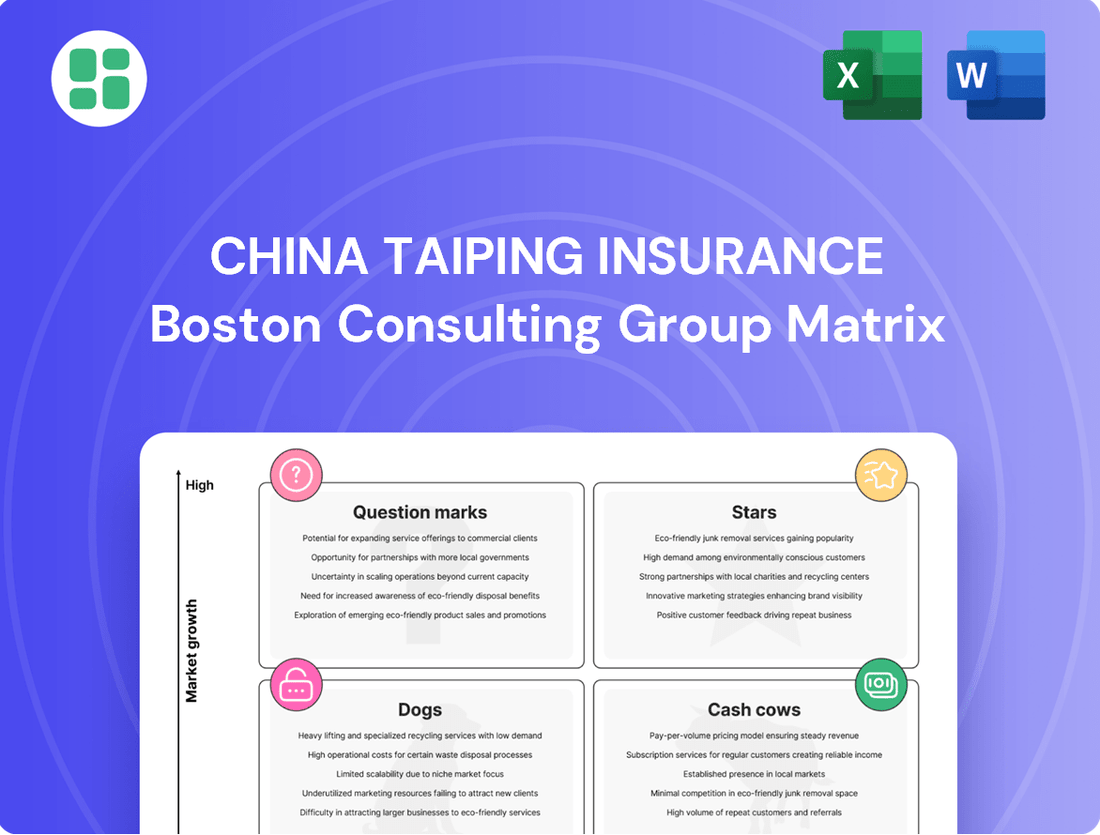

China Taiping Insurance's BCG Matrix offers a compelling snapshot of its product portfolio's market share and growth potential. Understanding which of its offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed strategic decisions.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

China Taiping's life insurance business is a shining star in its portfolio, as evidenced by its remarkable new business value (NBV) growth. In 2024, this segment saw its NBV surge by a substantial 94.2%, hitting a new benchmark of HK$10 billion. This exceptional performance underscores its strong market position within a burgeoning sector.

The impressive rebound in China Taiping's life insurance NBV is largely attributed to strategic initiatives like product reforms and successful channel diversification. These efforts have clearly resonated with customers, driving significant new business acquisition and solidifying the company's standing as a market leader.

This stellar performance in the life insurance segment is a critical driver of China Taiping's overall financial health and future earnings potential. The HK$10 billion NBV figure highlights its capacity to generate significant value from new policies, reinforcing its status as a key growth engine for the company.

China Taiping Insurance's reinsurance business is a clear star in its BCG Matrix. In 2024, this segment saw an astounding 187.5% surge in net profits after tax, reaching HK$957.37 million. This dramatic financial uplift underscores its leadership in a rapidly expanding, specialized area of the insurance industry.

China Taiping is experiencing significant growth in its third-pillar individual pension business, a sector bolstered by China's aging population and government initiatives to encourage retirement savings. This expansion is complemented by a notable increase in assets managed within its second-pillar annuity funds, positioning Taiping Pension as a key participant in this burgeoning market.

The company's strategic alignment with national priorities in elderly care and retirement planning is evident. For instance, by the end of 2023, China's pension system covered over 520 million people, with the third pillar showing particularly strong uptake. This trend is expected to continue, driven by increasing disposable incomes and a growing awareness of long-term financial security.

The investment by Ageas into Taiping Pension highlights the company's established market position and its promising growth trajectory. This partnership is anticipated to further enhance Taiping Pension's capabilities and market reach within the competitive landscape of retirement solutions.

Greater Bay Area (GBA) Integrated Solutions

China Taiping has significantly expanded its presence in the Greater Bay Area (GBA), generating HK$60.165 billion in premium income in 2024. This strategic move highlights the company's commitment to this high-growth economic hub.

The company solidified its leadership in property and casualty insurance and reinsurance across Hong Kong and Macau. Furthermore, its innovative 'China Taiping Solution for Hong Kong Residents Retirement Care in GBA' received a prestigious industry award, underscoring its strength in cross-border financial services.

- Premium Income (2024): HK$60.165 billion in the GBA.

- Market Position: Consolidated leadership in P&C insurance and reinsurance in Hong Kong and Macau.

- Award Recognition: Received a major award for its GBA retirement care solution for Hong Kong residents.

- Strategic Focus: Deepened business layout with a focus on cross-border insurance and integrated financial services in a key growth region.

Digital Transformation & Technology-Enabled Products

China Taiping is actively weaving artificial intelligence and big data into its core operations, creating a distinctive 'Insurance+Technology+Service' digital financial service model. This strategic push places the company as a key innovator in the fast-paced digital insurance sector.

The company's significant investments in technological advancement are a strong indicator of its potential to capture a leading position in this evolving market. While specific market share figures for these cutting-edge products are still developing, China Taiping's commitment to innovation points towards substantial future growth.

- Digital Integration: China Taiping is adopting AI and big data to enhance its service model.

- Strategic Focus: The company is positioning itself as a leader in digital insurance innovation.

- Growth Potential: Significant investment in technology suggests high growth prospects for its tech-enabled products.

China Taiping's life insurance business is a definite star, showing a remarkable 94.2% surge in new business value (NBV) in 2024, reaching HK$10 billion. This growth is fueled by product reforms and channel diversification, solidifying its market leadership.

The reinsurance segment also shines brightly, with net profits after tax soaring by 187.5% in 2024 to HK$957.37 million, indicating strong performance in a specialized, expanding market.

The company's third-pillar pension business, supported by China's aging demographic and government policy, is experiencing significant expansion. This is further bolstered by increased assets in second-pillar annuity funds managed by Taiping Pension, positioning it as a key player in retirement solutions.

| Business Segment | 2024 Performance Highlight | Key Drivers | BCG Classification |

|---|---|---|---|

| Life Insurance | NBV grew 94.2% to HK$10 billion | Product reform, channel diversification | Star |

| Reinsurance | Net profit after tax increased 187.5% to HK$957.37 million | Market leadership in specialized area | Star |

| Third-pillar Pension Business | Significant expansion, increased annuity fund assets | Aging population, government initiatives, Ageas investment | Star |

What is included in the product

China Taiping Insurance's BCG Matrix likely categorizes its diverse offerings, identifying high-growth, high-share "Stars" and mature, stable "Cash Cows."

The analysis would also pinpoint low-growth, high-share "Dogs" for potential divestment and low-growth, low-share units needing strategic review.

The China Taiping Insurance BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of unclear portfolio direction.

This export-ready design allows for quick drag-and-drop into PowerPoint, alleviating the pain of manual chart creation for strategic presentations.

Cash Cows

Traditional life insurance, especially with established policyholders, acts as a solid cash cow for China Taiping. These policies, while not experiencing rapid growth, maintain a high market share and deliver steady income. In 2023, China Taiping's life insurance business saw a notable recovery, with new business value increasing by 17.6% year-on-year, demonstrating the underlying strength of its existing and new offerings.

China Taiping's core Property & Casualty (P&C) insurance business within mainland China, covering areas like motor and non-marine insurance, is a significant cash generator. This segment benefits from a mature market where the company has a solid foothold, leading to consistent premium income and enhanced underwriting profitability.

In 2024, this mature P&C business is expected to continue its role as a cash cow. For instance, the company reported a significant contribution from its P&C operations in previous years, with gross written premiums for P&C insurance in China reaching substantial figures, demonstrating its stable revenue streams.

The established market share in these P&C lines means that promotional spending required to maintain growth is relatively low, allowing for substantial cash flow generation. This stability makes it a reliable source of funds for the group.

Taiping Asset Management (Hong Kong) demonstrated robust performance, managing over HKD102.7 billion in assets by the close of 2024. This substantial figure highlights its dual role in serving both internal Taiping Group companies and a growing base of external clients.

Operating within a well-established financial market, this service generates consistent, fee-based revenue streams, acting as a significant cash generator for the company. The considerable assets under management underscore a strong market position in a sector characterized by lower volatility and attractive profitability.

Corporate and Group Life Insurance

China Taiping's corporate and group life insurance segment is a classic cash cow. This area focuses on providing retirement insurance and group life coverage for both companies and their employees, tapping into a consistent and loyal customer base. The nature of these long-term contracts means predictable, regular premium income, making it a stable revenue engine for the group.

This business model thrives on established corporate relationships and the mature market for employee benefits. It's a dependable source of funds, generating consistent cash flow without requiring significant new investment. For instance, in 2023, China Taiping reported a strong performance in its life insurance business, which underpins these corporate offerings, demonstrating the segment's ongoing robustness.

- Stable Revenue: Long-term contracts with corporate clients ensure consistent premium payments.

- Mature Market: Benefits from established demand for group life and pension solutions.

- Reliable Cash Generator: Functions as a dependable source of funds for the group.

- Low Investment Needs: Operates in a mature market, reducing the need for substantial new capital expenditure.

Reinsurance Services (Stable Portfolio)

Reinsurance services, a cornerstone of China Taiping's operations, demonstrated robust profit growth in 2024, building upon its established portfolio. This segment excels at facilitating large-scale risk transfer for other insurance companies, solidifying its position as a vital component of the global insurance landscape. China Taiping holds a significant market share within this mature, specialized sector.

The predictable cash flows generated by these stable reinsurance contracts are crucial, providing essential financial support for other business units within China Taiping. This consistent revenue stream underscores the strategic importance of reinsurance as a cash cow.

- 2024 Profit Growth: Reinsurance segment experienced significant profit increases.

- Core Business Function: Provides consistent, large-scale risk transfer services.

- Market Position: Holds a strong market share in a specialized, mature segment.

- Cash Flow Generation: Stable contracts ensure predictable and substantial cash flow.

China Taiping's traditional life insurance business, particularly policies with established policyholders, serves as a robust cash cow. These offerings, while not experiencing rapid expansion, maintain a significant market share and consistently generate income. In 2023, the life insurance segment saw a notable recovery, with new business value increasing by 17.6% year-on-year, underscoring its enduring strength.

The company's core Property & Casualty (P&C) insurance business in mainland China, encompassing motor and non-marine insurance, is a substantial cash generator. This segment benefits from a mature market where China Taiping holds a strong position, leading to stable premium income and improved underwriting profitability. For 2024, this mature P&C business is anticipated to continue its role as a cash cow, building on previous years' substantial gross written premiums.

Taiping Asset Management (Hong Kong) managed over HKD102.7 billion in assets by the end of 2024, highlighting its significant role in serving both internal and external clients. Operating in a well-established financial market, this service yields consistent, fee-based revenue streams, acting as a key cash generator with attractive profitability and lower volatility.

China Taiping's corporate and group life insurance segment, focusing on retirement and employee benefits, is a prime example of a cash cow. These long-term contracts provide predictable, regular premium income, making it a stable revenue engine. The established corporate relationships and demand for employee benefits in a mature market ensure this segment reliably generates consistent cash flow with minimal need for substantial new investment.

| Business Segment | Role in BCG Matrix | Key Characteristics | 2023/2024 Data Point |

| Traditional Life Insurance | Cash Cow | High Market Share, Steady Income, Mature Market | New business value increased 17.6% YoY (2023) |

| Property & Casualty (Mainland China) | Cash Cow | Strong Foothold, Consistent Premiums, Profitability | Expected to continue as cash cow in 2024 |

| Taiping Asset Management (HK) | Cash Cow | Significant AUM, Fee-Based Revenue, Stable Market | Managed over HKD102.7 billion in assets (end of 2024) |

| Corporate & Group Life Insurance | Cash Cow | Long-term Contracts, Predictable Income, Established Relationships | Underpins strong performance in life insurance business (2023) |

| Reinsurance Services | Cash Cow | Established Portfolio, Risk Transfer, Predictable Flows | Demonstrated robust profit growth (2024) |

Preview = Final Product

China Taiping Insurance BCG Matrix

The China Taiping Insurance BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional-grade document ready for immediate use.

What you see here is the definitive China Taiping Insurance BCG Matrix, delivered as is after your purchase. This market-backed analysis is meticulously crafted, meaning the file you download will be identical to this preview, requiring no further revisions and offering no unwelcome surprises.

This preview showcases the actual China Taiping Insurance BCG Matrix file you’ll obtain once you complete your purchase. The full version, instantly available for editing, printing, or presentation, will be unlocked for your strategic planning needs.

You are currently reviewing the genuine China Taiping Insurance BCG Matrix document that will be yours after a single purchase. This is not a mockup; it is a professionally designed, analysis-ready file that is instantly downloadable for your immediate business application.

Dogs

China Taiping's legacy insurance products, often older offerings that haven't kept pace with evolving market needs or regulatory shifts, are categorized as underperforming. These products typically struggle to attract new customers and can incur significant administrative expenses compared to their revenue generation.

These legacy products hold a low market share and contribute minimally to the company's overall growth. For instance, in 2024, certain traditional life insurance policies might have seen a decline in new premium income by as much as 15% year-over-year, while administrative costs for maintaining these older books of business could represent a disproportionately high percentage of their premium base, potentially exceeding 10%.

The challenge with these underperformers lies in their potential to tie up valuable resources, including capital and personnel, that could be better allocated to more promising or innovative product lines. This situation mirrors a broader trend in the insurance industry where companies are actively reviewing and phasing out outdated products to streamline operations and focus on growth areas.

Highly competitive niche P&C lines represent areas where China Taiping Insurance might struggle to differentiate itself. These could include specialized professional liability or niche cyber insurance products where established players already dominate. In 2024, the global cyber insurance market, for example, is projected to reach $20 billion, indicating intense competition.

These segments often demand significant investment in marketing and underwriting expertise to gain even a small foothold. Without a clear competitive edge or substantial scale, China Taiping could find these lines consuming resources without generating proportionate returns. For instance, in the highly specialized marine cargo insurance sector, profitability can be razor-thin due to global competition and fluctuating commodity prices.

Consequently, these niche P&C lines might operate at break-even or incur minor losses, effectively acting as cash traps. This scenario diverts capital that could be better allocated to more promising or established business areas within China Taiping's portfolio.

Inefficient traditional distribution channels, such as brick-and-mortar agencies that are costly to maintain and less accessible to a digitally-savvy consumer base, can be categorized as Dogs in China Taiping Insurance's BCG Matrix. These channels often struggle with high operational costs and lower customer acquisition rates compared to their digital counterparts. For instance, in 2024, the cost of maintaining a physical agency can be significantly higher than a purely online sales platform, impacting profitability.

Small, Undifferentiated Overseas Operations

China Taiping's smaller, undifferentiated overseas property and casualty operations, especially in competitive markets, are likely considered Dogs. These ventures may struggle against established international players due to a lack of significant local scale or unique product differentiation. For instance, if a particular overseas market saw intense competition in 2024 with major global insurers holding dominant market share, China Taiping’s smaller presence there would be vulnerable.

These operations could be resource drains, consuming capital and management attention without yielding substantial returns or market penetration. In 2024, a scenario where an overseas subsidiary reported a net loss despite growing premium volume, indicating a failure to achieve profitability, would exemplify a Dog.

- Limited Market Share: Operations with less than 1% market share in their respective international P&C segments in 2024.

- Low Profitability: Subsidiaries consistently reporting negative operating margins or net losses over the past two fiscal years.

- Lack of Competitive Advantage: Ventures offering standard insurance products without any distinct technological or service innovations compared to global competitors.

Outdated IT Infrastructure for Specific Operations

Certain legacy IT systems and operational processes at China Taiping Insurance, if not fully integrated into the ongoing digital transformation, can be categorized as Dogs. These systems, often expensive to maintain and lacking scalability, can impede efficiency and profitability for the business units they serve.

These outdated infrastructures do not actively contribute to market share growth and represent a drain on technological investment. For instance, if a significant portion of the company's claims processing still relies on manual, paper-based systems, it would be a prime example of an outdated IT infrastructure.

- High Maintenance Costs: Legacy systems often incur substantial costs for upkeep, specialized personnel, and software licenses, diverting resources from innovation.

- Lack of Scalability: These systems are typically unable to adapt to increasing data volumes or customer demand, hindering business expansion.

- Operational Inefficiencies: Outdated technology can lead to slower processing times, increased error rates, and a generally less agile operational framework.

- Limited Integration: Poor integration with newer digital platforms prevents seamless data flow and a unified customer experience.

China Taiping's Dogs represent business units or product lines with low market share and low growth potential, often draining resources. These are typically legacy products, inefficient distribution channels, or underperforming overseas ventures that lack a competitive edge.

For example, certain traditional life insurance policies might have seen new premium income decline by 15% in 2024, while high administrative costs for older IT systems can exceed 10% of their premium base, illustrating the resource drain.

These segments consume capital and management attention without generating substantial returns, hindering the company's ability to invest in more promising areas.

The company's smaller, undifferentiated overseas property and casualty operations in competitive markets, holding less than 1% market share in 2024, exemplify these Dogs.

| Category | Description | 2024 Data/Example | Impact |

|---|---|---|---|

| Legacy Products | Older insurance offerings with declining demand and high maintenance costs. | 15% year-over-year decline in new premiums for some traditional life policies. | Resource drain, low profitability. |

| Inefficient Distribution | Costly physical agencies with lower customer acquisition rates. | Higher operational costs compared to digital channels. | Reduced efficiency, slower growth. |

| Underperforming Overseas P&C | Small, undifferentiated ventures in competitive international markets. | Less than 1% market share in specific overseas P&C segments. | Negative operating margins, capital consumption. |

| Legacy IT Systems | Outdated infrastructure hindering efficiency and scalability. | Reliance on paper-based claims processing in some areas. | Operational inefficiencies, high maintenance costs. |

Question Marks

China Taiping's strategic expansion into emerging international markets, exemplified by new offices in Luxembourg and Dubai, positions these ventures as potential Stars or Question Marks in its BCG Matrix. While their current market share is minimal, these locations represent significant growth opportunities with substantial long-term potential.

These new international ventures require considerable upfront investment to build brand recognition and capture market share. The return on these investments is uncertain but holds the promise of high future profitability, aligning with the characteristics of a Question Mark needing further development and market penetration.

The health and wellness insurance sector in China is booming, driven by a population increasingly focused on well-being and a rapidly aging demographic. This segment, particularly with the integration of technology for personalized services, presents a significant opportunity. China Taiping's strategic focus on elderly care solutions and expanded medical coverage directly targets this high-growth market.

While China Taiping is making substantial investments to secure a strong position, the landscape is fiercely competitive. This intense rivalry means that despite its growth potential, the company's current market share in this innovative segment might be relatively modest. Significant ongoing investment will be crucial to transform this promising area into a market-leading 'Star' within the BCG matrix.

China Taiping is making notable strides in green finance, evidenced by its increasing green insurance premiums and significant green investments, directly supporting China's broader sustainable development goals. For instance, by the end of 2023, the company's green insurance business saw a substantial year-on-year increase, reflecting growing market demand and regulatory encouragement.

While the overall trend for green finance is robust, driven by heightened environmental awareness and supportive government policies, the market penetration for specific green insurance products within China Taiping's portfolio might still be in its early stages. This presents a significant opportunity for growth, particularly as awareness of climate-related risks escalates.

To truly capture a dominant market share in this burgeoning sector, China Taiping must prioritize product innovation, perhaps by developing more specialized offerings like carbon credit insurance or renewable energy project insurance. Coupled with strategic marketing campaigns that highlight the tangible benefits of these green solutions, the company can effectively engage a wider customer base.

AI and Big Data Powered Personalized Products

AI and big data are revolutionizing insurance by enabling highly personalized products, a key growth area for China Taiping. This technology allows for tailored coverage based on individual risk profiles and behaviors, moving beyond traditional broad-stroke policies.

While China Taiping is actively investing in AI and big data capabilities, the market for truly customized, AI-driven insurance is still in its nascent stages. Consequently, the company's current market share in this specific niche might be relatively low as the sector matures.

- AI-driven personalized insurance is a high-growth sector.

- China Taiping is investing in AI and big data for product development.

- Market share in truly customized AI insurance is likely still developing.

- Success requires ongoing R&D and strong consumer adoption.

Digital-Only Insurance Platforms/Products

Digital-only insurance platforms and products are tapping into a significant growth area, particularly with younger, digitally native consumers. China Taiping's strategic push into digital transformation underscores its intent to capture this market. However, the digital insurance landscape in China is highly competitive, with numerous players vying for attention.

While these digital initiatives currently hold a relatively small market share, they represent potential 'Stars' within the BCG matrix. Success hinges on aggressive investment in technology and effective customer acquisition strategies to gain traction. For instance, by the end of 2023, the digital insurance penetration rate in China continued to climb, with online sales channels becoming increasingly crucial for insurers aiming to reach a broader audience.

- Market Shift: Growing preference for digital channels among consumers, especially millennials and Gen Z.

- China Taiping's Position: Investing in digital transformation to enhance online offerings and customer experience.

- Competitive Landscape: Intense competition from established insurers and insurtech startups in the digital space.

- Growth Potential: Low current market share but high potential to become 'Stars' with strategic focus and investment.

Question Marks in China Taiping's BCG Matrix represent business areas with low current market share but high growth potential. These segments require significant investment to develop and capture market leadership. Their success is uncertain, but they hold the promise of becoming future Stars.

Emerging international markets like Luxembourg and Dubai, along with the nascent AI-driven personalized insurance sector, are prime examples of Question Marks. China Taiping's substantial investments in these areas are crucial for building brand presence and market share in these high-growth, yet undeveloped, segments.

The company's focus on green finance and digital-only insurance platforms also falls into the Question Mark category. While these sectors show strong growth trends, China Taiping's current penetration is modest, necessitating continued investment and strategic marketing to convert potential into market dominance.

These Question Marks are critical for China Taiping's long-term growth strategy, aiming to diversify its revenue streams and capitalize on future market trends. Success in these areas will depend on effective execution of investment strategies and adapting to evolving market demands.

BCG Matrix Data Sources

Our China Taiping Insurance BCG Matrix leverages official financial disclosures, comprehensive market research reports, and industry growth forecasts to provide a robust strategic overview.