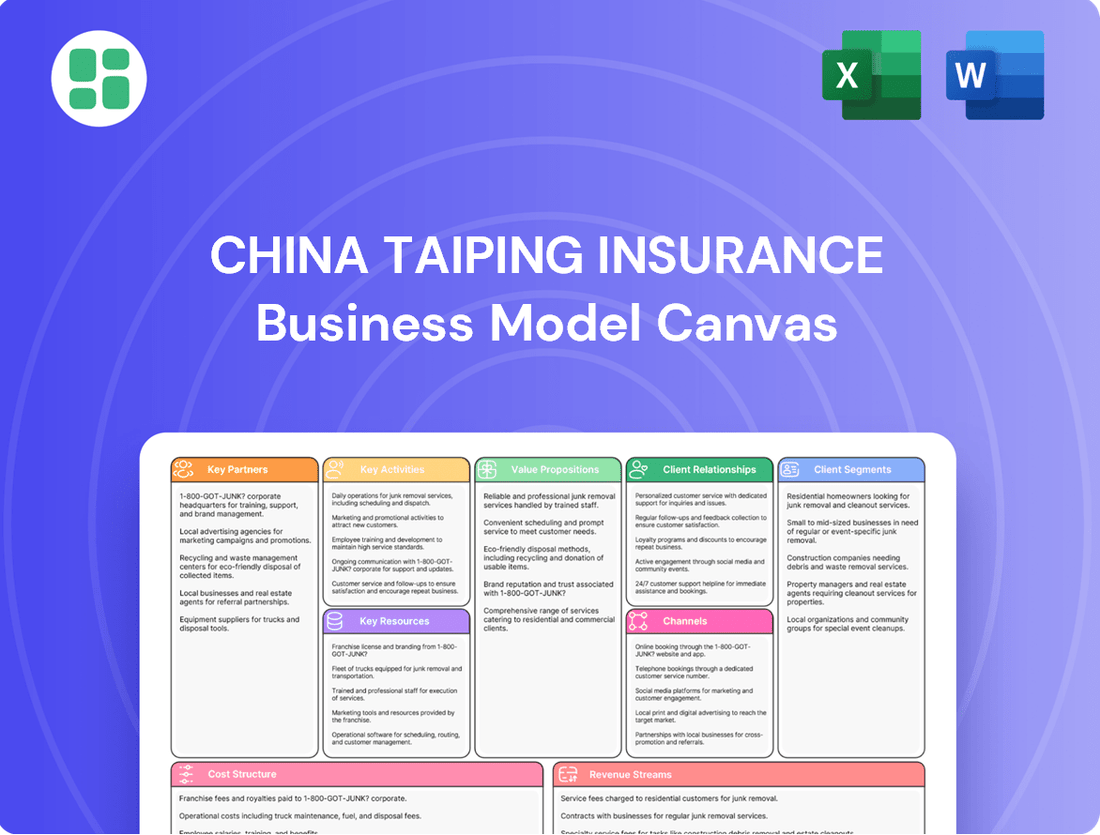

China Taiping Insurance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Taiping Insurance Bundle

Unlock the strategic blueprint behind China Taiping Insurance's market dominance with our comprehensive Business Model Canvas. This detailed analysis dissects their customer relationships, revenue streams, and key resources, offering invaluable insights for any business strategist. Discover how they achieve sustainable growth and competitive advantage.

Partnerships

China Taiping Insurance has cultivated robust relationships with its major clients, forming strategic alliances that are fundamental to its business model. By the close of 2024, the company had successfully established comprehensive synergy and cooperation with 123 large clients.

These significant partnerships are instrumental in unlocking ongoing collaborative value and broadening the scope of incentives offered. This includes the development of specialized programs, such as those linking insurance with sales initiatives and providing technology insurance solutions, thereby fostering deeper collaboration and mutual benefit.

China Taiping Insurance actively partners with a wide array of financial institutions, with a strong emphasis on bancassurance. This strategic alliance allows them to tap into the extensive customer networks of banks, significantly broadening their distribution reach and driving new business growth.

In 2024, the bancassurance channel demonstrated robust performance, contributing substantially to the company's new business value. These collaborations are crucial for market penetration, enabling China Taiping to access a wider customer base more efficiently and effectively.

The partnerships are designed to optimize profit-sharing mechanisms, ensuring mutual benefit and fostering long-term sustainability for these collaborative ventures. This approach highlights the importance of financial institutions as a cornerstone of China Taiping's distribution strategy.

China Taiping collaborates with a curated selection of highly-rated reinsurance companies to construct a robust reinsurance program. This strategic alliance is fundamental to diversifying its risk exposure and optimizing capital deployment, thereby bolstering its capacity to underwrite a broad spectrum of insurance products.

In 2024, China Taiping's reinsurance expenses amounted to approximately RMB 15.8 billion, underscoring the significant investment in these partnerships to manage substantial and intricate risks, ensuring the company's long-term financial resilience and operational continuity.

Technology and Innovation Partners

China Taiping Insurance actively pursues strategic alliances with technology providers and burgeoning fintech firms. These partnerships are crucial for bolstering its digital finance capabilities and driving innovation in product development and customer engagement. For instance, in 2024, the company continued its investment in digital transformation initiatives, aiming to integrate advanced technologies into its core operations, thereby enhancing efficiency and customer experience.

These collaborations are instrumental in upgrading the group's digital platforms and streamlining operational processes. By partnering with leading technology players, China Taiping ensures it remains at the forefront of digital finance trends, aligning with China's broader national strategies for technological advancement within the financial services industry.

The focus on technology and innovation partners directly supports the enhancement of product delivery mechanisms and the refinement of customer service offerings. This strategic approach allows China Taiping to introduce more sophisticated and user-friendly insurance products, meeting the evolving demands of its diverse customer base.

- Technology Finance Initiatives: Partnerships focused on leveraging technology for financial services, including areas like AI and big data analytics.

- Digital Finance Expansion: Collaborations with fintech companies to enhance online platforms, mobile services, and digital payment solutions.

- Operational Efficiency Gains: Joint efforts to implement new technologies that streamline underwriting, claims processing, and customer support.

- Innovation in Product Delivery: Working with tech partners to create and distribute innovative insurance products through digital channels.

Government and State-Owned Enterprises

China Taiping's relationship with the government and state-owned enterprises (SOEs) is a cornerstone of its business model, offering significant strategic advantages. The company actively aligns with national development agendas, such as supporting the 'Belt and Road' initiative and the 'Going Global' strategy for Chinese businesses. This deep integration allows China Taiping to provide crucial risk management and insurance solutions for major national projects and the overseas expansion of SOEs.

These collaborations are not merely supportive; they are integral to China Taiping's growth and market access. By partnering with SOEs and government bodies, the company gains preferential access to large-scale projects and a stable operational environment. For instance, in 2023, China Taiping continued to play a role in insuring infrastructure projects under the Belt and Road Initiative, contributing to the nation's global economic outreach.

The benefits of these key partnerships are multifaceted:

- Government Backing: Provides a stable foundation and enhances credibility, particularly for international ventures.

- Strategic Alignment: Facilitates participation in national development strategies, opening avenues for new business opportunities.

- Risk Mitigation for National Projects: Offers essential insurance and risk management services for large-scale, state-backed initiatives.

- Facilitated Expansion: Supports the 'Going Global' efforts of Chinese enterprises, including SOEs, by providing tailored financial and insurance products.

China Taiping Insurance leverages strategic alliances with a diverse range of partners to enhance its market reach and product offerings. These collaborations are crucial for expanding its distribution channels, particularly through bancassurance, and for managing risk via reinsurance. Furthermore, partnerships with technology firms drive digital transformation and innovation in customer engagement and product development.

The company's engagement with government entities and state-owned enterprises is also a vital component, providing strategic alignment with national development goals and facilitating access to large-scale projects. These key partnerships collectively bolster China Taiping's competitive position and operational resilience.

| Partner Type | 2024 Focus/Contribution | Strategic Importance |

| Major Clients | Cooperation with 123 large clients; development of specialized programs. | Unlocking ongoing collaborative value and broadening incentives. |

| Financial Institutions (Bancassurance) | Extensive customer networks, driving new business growth. | Broadening distribution reach and market penetration. |

| Reinsurance Companies | Reinsurance expenses of approx. RMB 15.8 billion. | Diversifying risk exposure and optimizing capital deployment. |

| Technology Providers/Fintech | Investment in digital transformation initiatives. | Bolstering digital finance capabilities and driving innovation. |

| Government & SOEs | Alignment with national development agendas (e.g., Belt and Road). | Facilitating participation in national strategies and risk mitigation for projects. |

What is included in the product

This Business Model Canvas provides a comprehensive overview of China Taiping's strategy, detailing its customer segments, channels, and value propositions with a focus on leveraging its extensive network and diverse product offerings to serve a broad demographic.

It reflects the real-world operations and plans of China Taiping, offering insights into competitive advantages and potential challenges across all nine classic BMC blocks, making it ideal for strategic analysis and stakeholder communication.

China Taiping's Business Model Canvas offers a clear, one-page snapshot that addresses the pain point of complexity by quickly identifying core components of their insurance operations.

It acts as a pain point reliever by providing a shareable and editable format, saving hours of formatting and structuring for teams to adapt and collaborate on their strategic insights.

Activities

China Taiping's core activities revolve around the meticulous underwriting of a broad spectrum of insurance products. This includes life, property and casualty, and pension insurance, ensuring comprehensive coverage for diverse needs.

The company actively manages policies from issuance through to servicing, encompassing crucial steps like risk assessment and premium collection. This diligent approach underpins their commitment to policyholder satisfaction and operational integrity.

In 2024, China Taiping reported a significant focus on enhancing business quality and operational efficiency within these key activities. This strategic emphasis aims to refine their underwriting processes and policy management for greater effectiveness and profitability.

China Taiping's key activity involves the diligent management of its substantial investment portfolio. By the close of 2024, these assets surpassed HK$1.7 trillion, a significant pool managed to generate consistent returns that underpin the company's insurance obligations.

This management encompasses a diverse range of investments, including debt and equity instruments, real estate ventures, and various other asset categories. The company adheres to a prudent investment philosophy, prioritizing stability through allocations to cash and high-quality investment-grade bonds.

The success of these investment operations is directly linked to China Taiping's overall financial health and profitability. Strong investment performance is therefore a critical driver for the business.

China Taiping Insurance places significant emphasis on claims processing, recognizing its crucial role in maintaining customer trust and satisfaction. The company strives for efficient and fair payouts, ensuring policyholders receive timely support when they need it most.

Beyond claims, customer service is a cornerstone of their strategy. Initiatives like digital service enhancements and customer appreciation events are implemented to foster stronger customer relationships and loyalty. This dedication to service quality is a key driver of their success.

Product Development and Innovation

China Taiping Insurance actively pursues product development, launching innovative and integrated financial solutions designed to meet changing customer demands. This includes a strategic focus on cross-border products and comprehensive retirement care solutions, reflecting a forward-looking approach to market needs.

The company's innovation efforts are particularly concentrated in specialized areas such as green insurance, catastrophe reinsurance, and insurance for strategic emerging industries. These initiatives aim to not only address emerging risks but also to capture new market opportunities and maintain a strong competitive advantage.

In 2024, China Taiping continued to emphasize digital transformation to enhance its product development lifecycle. For instance, the company reported a significant increase in the proportion of digitally distributed products, indicating a successful integration of technology into its innovation strategy. This digital push allows for faster iteration and more personalized product offerings.

- Continuous Product Development: Creating new and integrated financial solutions tailored to evolving customer needs, such as cross-border products and retirement care solutions.

- Strategic Focus Areas: Emphasis on green insurance, catastrophe reinsurance, and insurance for strategic emerging industries.

- Innovation for Competitive Edge: Utilizing innovation to maintain market leadership and expand product and service offerings.

- Digital Integration: Leveraging digital platforms to accelerate product development and enhance customer experience.

International Expansion and Cross-Border Operations

China Taiping is aggressively pursuing international expansion as a core growth strategy, recently establishing new representative offices in Luxembourg and Dubai. This global push aims to solidify its position in property and casualty insurance and reinsurance markets. The company is also focused on enhancing its established operations in Hong Kong and Macau.

A key element of this international development involves fostering cross-border collaboration. China Taiping is actively developing innovative insurance products and services designed to cater to the needs of a global clientele. This strategic initiative underscores the company's commitment to becoming a significant player in international insurance markets.

The company's international development strategy is a critical pillar for its long-term growth. For instance, in 2023, China Taiping's overseas business segment demonstrated robust performance, contributing to the group's overall financial strength and international reach.

- Global Network Expansion: New representative offices in Luxembourg and Dubai, alongside strengthened presence in Hong Kong and Macau.

- Core Competencies: Consolidation of advantages in Property & Casualty (P&C) insurance and reinsurance.

- Cross-Border Offerings: Development of collaborative products and services for international markets.

- Strategic Importance: International development is identified as a key pillar for China Taiping's growth strategy.

China Taiping's key activities include robust underwriting across life, property and casualty, and pension insurance. They also manage investments exceeding HK$1.7 trillion as of the end of 2024, focusing on diverse assets like debt, equity, and real estate.

Claims processing and customer service are paramount, with efforts to ensure efficient payouts and enhance customer relationships through digital services. Product development is another core activity, emphasizing innovation in areas like green insurance and digital distribution, with digitally distributed products seeing a significant increase in 2024.

International expansion is a strategic focus, with new offices in Luxembourg and Dubai, and a strong presence in Hong Kong and Macau, aiming to bolster their global P&C and reinsurance markets.

| Activity Area | Key Focus/Action | 2024 Data/Context |

|---|---|---|

| Underwriting & Policy Management | Comprehensive coverage, risk assessment, premium collection | Focus on enhancing business quality and operational efficiency. |

| Investment Management | Managing diverse assets to generate returns | Portfolio exceeded HK$1.7 trillion; prudent investment philosophy prioritizing stability. |

| Customer Service & Claims | Efficient claims processing, customer relationship enhancement | Commitment to timely support and digital service improvements. |

| Product Development & Innovation | Creating new financial solutions, specialized insurance | Emphasis on green insurance, catastrophe reinsurance, and digitally distributed products. |

| International Expansion | Global market penetration and cross-border offerings | New offices in Luxembourg and Dubai; robust overseas business performance in 2023. |

Full Version Awaits

Business Model Canvas

The China Taiping Insurance Business Model Canvas preview you are seeing is the actual, complete document you will receive upon purchase. This means you're getting a direct look at the professional, ready-to-use deliverable with all sections and content intact, ensuring no surprises and immediate usability.

Resources

China Taiping leverages its significant financial capital, with total assets reaching over HK$1.7 trillion and managed investment assets exceeding HK$2.3 trillion by the close of 2024. This substantial financial foundation, comprising diverse holdings like debt and equity securities and readily available cash, is crucial for its underwriting capabilities and maintaining solvency.

This strong capital position directly fuels the company's investment portfolio, enabling it to generate consistent investment income. The sheer scale of these assets underscores China Taiping's financial robustness and its capacity to absorb market fluctuations, thereby supporting its long-term strategic objectives.

China Taiping Insurance leverages a substantial workforce exceeding 62,000 employees. This human capital includes highly skilled actuaries, seasoned investment managers, and specialized IT professionals, forming the backbone of its operations.

The collective expertise across diverse insurance lines, sophisticated risk management techniques, and efficient financial operations is a paramount resource for the company. This deep knowledge base is crucial for navigating complex market dynamics and ensuring robust financial health.

To sustain its competitive edge, China Taiping places significant emphasis on continuous talent development and fostering knowledge exchange among its staff. This commitment to cultivating expertise ensures the delivery of superior service quality and drives ongoing innovation within the organization.

China Taiping's brand reputation, built since its founding in 1929, is a cornerstone of its business model. This long history as one of China's oldest insurance groups cultivates deep customer trust, a critical asset in an industry where reliability is key. Its consistent presence on the Fortune Global 500 list, a testament to its scale and stability, further solidifies this perception.

Extensive Distribution Network and Digital Platforms

China Taiping Insurance's extensive distribution network is a cornerstone of its business model, acting as a vital conduit to its customer base. This network isn't just a single channel; it's a carefully curated mix of traditional and modern approaches designed for maximum reach and customer engagement.

The company leverages a multi-pronged strategy that includes a vast army of agents, strategic partnerships with brokers, and established bancassurance relationships. This diverse array of touchpoints ensures that China Taiping can connect with a wide spectrum of customers, from individuals seeking personal coverage to businesses requiring corporate solutions. In 2024, the emphasis on digital platforms continued to grow, reflecting a broader industry trend towards online engagement and service delivery.

- Agent Network: A substantial force of dedicated agents remains a primary distribution channel, offering personalized service and product knowledge.

- Broker Partnerships: Collaborations with insurance brokers provide access to specialized markets and a broader client base.

- Bancassurance: Leveraging banking channels allows for convenient access to insurance products for bank customers.

- Digital Platforms: Increasing investment in online portals and mobile applications caters to evolving customer preferences for digital interaction and self-service.

Advanced Technology and Data Infrastructure

China Taiping Insurance heavily relies on its advanced information technology and data infrastructure to streamline operations, bolster risk management, and elevate customer service. This includes innovative mobile solutions for claims processing and policy management, making interactions seamless for policyholders.

Significant investments in financial technology and digital capabilities are paramount for fostering innovation, improving service quality, and informing strategic decisions. For instance, in 2023, China Taiping reported substantial spending on technology upgrades to enhance its digital presence and operational efficiency.

- Technology Investment: China Taiping's commitment to technological advancement is evident in its ongoing investments, aiming to maintain a competitive edge in the digital insurance landscape.

- Operational Efficiency: The advanced infrastructure supports faster claims processing and policy administration, directly impacting customer satisfaction and reducing operational costs.

- Data-Driven Decisions: Robust data analytics capabilities derived from this infrastructure enable more precise risk assessment and personalized product offerings.

- Customer Experience: Mobile claims and policy services are key components, reflecting the company's focus on providing convenient and accessible digital experiences.

China Taiping's key resources are its substantial financial capital, exceeding HK$1.7 trillion in total assets by the end of 2024, a vast workforce of over 62,000 employees with diverse expertise, and a strong, long-standing brand reputation built since 1929. These are complemented by an extensive distribution network encompassing agents, brokers, and bancassurance, as well as advanced IT and data infrastructure supporting digital operations and customer service.

| Resource Category | Specific Resources | Key Data/Metrics (as of end 2024) |

|---|---|---|

| Financial Capital | Total Assets | > HK$1.7 trillion |

| Human Capital | Employees | > 62,000 |

| Brand & Reputation | Founding Year | 1929 |

| Distribution Network | Channels | Agents, Brokers, Bancassurance, Digital Platforms |

| Technology & Data | IT Infrastructure | Advanced, supporting digital operations and data analytics |

Value Propositions

China Taiping provides a broad spectrum of financial and insurance services, encompassing life, property and casualty, pension, and asset management. This integrated approach caters to the varied requirements of both individuals and corporations, offering a one-stop shop for financial needs.

This extensive product portfolio simplifies financial planning for clients, enabling them to consolidate their insurance and investment needs with a single provider. In 2024, China Taiping reported a significant increase in its integrated service uptake, with over 30% of its new customers opting for at least two distinct product lines, highlighting the value of this comprehensive solution.

China Taiping Insurance offers robust risk protection, boasting over RMB137 trillion in societal risk protection by the close of 2023. This substantial coverage directly translates to enhanced financial security for its policyholders, providing a crucial safety net.

The company's financial stability is a cornerstone of its value proposition. Affirmations from strong credit ratings and a solid capital adequacy ratio demonstrate China Taiping's capacity to consistently fulfill its commitments to policyholders, fostering enduring customer trust.

China Taiping leverages its extensive network across mainland China, Hong Kong, and Macau to offer specialized cross-border insurance solutions. This includes products like the 'China Taiping Solution for Hong Kong Residents Retirement Care in GBA,' directly addressing the growing demand for integrated retirement planning in the Greater Bay Area.

This strategic focus allows the company to serve a clientele with international exposure, facilitating smooth transactions and policy management across different jurisdictions. In 2023, China Taiping reported significant growth in its international business segments, underscoring the demand for its cross-border capabilities.

Customer-Centric Service and Digital Convenience

China Taiping Insurance places a strong emphasis on a customer-centric approach, actively working to elevate the service experience. Initiatives like the annual China Taiping Customer Festival are designed to foster deeper engagement and satisfaction. This focus on the customer is a core element of their business model, aiming to build lasting relationships through improved interactions.

The company is also heavily invested in enhancing digital service efficiency, recognizing the growing demand for convenient and accessible solutions. A significant portion of claims and policy services are now handled through mobile platforms, showcasing a tangible commitment to digital innovation. This digital push ensures that customers can manage their policies and claims with ease, anytime and anywhere.

These efforts are geared towards providing a superior and readily accessible customer experience. For instance, in 2023, China Taiping reported a mobile claims ratio of 76.3% and a mobile policy service ratio of 88.5%, highlighting the success of their digital transformation in delivering convenience and responsiveness to policyholders.

- Customer-Centricity: Initiatives like the China Taiping Customer Festival aim to enhance customer engagement and satisfaction.

- Digital Convenience: High mobile claims (76.3% in 2023) and policy service (88.5% in 2023) ratios underscore a commitment to digital accessibility.

- Service Improvement: The focus is on creating a superior, responsive, and easily accessible service experience for all customers.

Long-term Value and Stability

China Taiping Insurance prioritizes building enduring value for both its shareholders and policyholders. This commitment is evident in its consistent delivery of stable investment returns and a robust financial performance. For instance, in 2023, the company reported a net profit attributable to shareholders of RMB 10.5 billion, showcasing its financial resilience.

The company's strategic focus on long-term growth is underpinned by its strict adherence to regulatory frameworks and ongoing efforts to refine its business operations. This dedication to stability fosters a sense of security, encouraging long-term commitment from its stakeholders. The insurer's solvency ratio, a key indicator of financial health, remained strong, exceeding regulatory requirements.

- Long-term Shareholder Value: Demonstrated by consistent profit generation and a commitment to sustainable growth strategies.

- Policyholder Security: Ensured through stable investment returns and a strong financial position, providing confidence in policy benefits.

- Regulatory Compliance: A cornerstone of operations, ensuring a stable and predictable business environment.

- Operational Optimization: Continuous improvement in business structure leads to enhanced efficiency and long-term development.

China Taiping offers a comprehensive suite of financial and insurance products, simplifying financial planning for individuals and corporations by providing a one-stop solution. This integrated approach is highly valued by customers, with over 30% of new clients in 2024 opting for multiple product lines. The company also provides substantial societal risk protection, exceeding RMB137 trillion by the end of 2023, ensuring enhanced financial security for its policyholders.

The insurer's value proposition is further strengthened by its financial stability, evidenced by strong credit ratings and a solid capital adequacy ratio, which builds enduring customer trust. Furthermore, China Taiping's specialized cross-border insurance solutions, such as those tailored for the Greater Bay Area, cater to a growing demand for international financial planning, with significant growth reported in its international business segments in 2023.

A customer-centric approach, enhanced by digital convenience, is central to China Taiping's strategy. High mobile claims (76.3% in 2023) and policy service (88.5% in 2023) ratios demonstrate their commitment to providing an accessible and responsive service experience. This focus on customer satisfaction is further supported by initiatives like the annual China Taiping Customer Festival, fostering deeper client relationships.

China Taiping is dedicated to building long-term value for shareholders and policyholders, demonstrated by its consistent profit generation, with a net profit of RMB 10.5 billion in 2023. Its adherence to regulatory frameworks and operational optimization ensures stability and fosters stakeholder confidence, with solvency ratios consistently exceeding regulatory requirements.

| Value Proposition | Description | Key Metric/Data Point |

| Integrated Financial Services | One-stop shop for life, P&C, pension, and asset management. | 30%+ of new customers chose multiple product lines in 2024. |

| Societal Risk Protection | Extensive coverage providing financial security. | Over RMB137 trillion in societal risk protection (end of 2023). |

| Financial Stability & Trust | Strong credit ratings and capital adequacy. | Strong solvency ratios exceeding regulatory requirements. |

| Cross-Border Solutions | Specialized products for international clients, e.g., GBA. | Significant growth in international business segments in 2023. |

| Customer-Centricity & Digitalization | Enhanced service experience via digital platforms. | 76.3% mobile claims ratio, 88.5% mobile policy service ratio (2023). |

| Long-Term Stakeholder Value | Consistent profit generation and operational efficiency. | RMB 10.5 billion net profit attributable to shareholders (2023). |

Customer Relationships

China Taiping cultivates deep customer loyalty through a vast network of individual agents and financial advisors. These professionals offer personalized guidance, understanding each client's unique needs to craft tailored insurance solutions. This direct, human touch is crucial for building lasting trust and rapport.

The effectiveness of these personal relationships is evident in the persistency ratios within China Taiping's individual agency channels. For instance, in 2023, the first-year persistency ratio for individual business reached an impressive 86.7%, indicating that a significant majority of customers continue their policies, a testament to the value derived from these advisor interactions.

China Taiping fosters strategic partnerships with its corporate clientele, providing dedicated account management and tailored financial solutions. This client-centric approach emphasizes understanding unique business requirements to deliver bespoke services, cultivating robust and enduring relationships. For instance, in 2024, the company reported engaging in strategic client cooperation with 123 large enterprise clients.

China Taiping Insurance is significantly boosting its digital self-service capabilities. In 2024, they continued to expand their mobile app functionalities, allowing customers to easily file claims, manage policies, and access account information anytime, anywhere. This focus on online engagement aims to improve efficiency and customer satisfaction by providing convenient, accessible tools for policy management.

Proactive Customer Service Initiatives

China Taiping Insurance actively cultivates strong customer relationships through proactive engagement. Initiatives like the annual China Taiping Day and China Taiping Customer Festival serve as key touchpoints, fostering a sense of community and significantly boosting brand loyalty. These events are designed for direct interaction, allowing the company to gather valuable feedback and demonstrate a commitment to customer satisfaction that extends far beyond routine policy management.

These customer-centric events are instrumental in building a deeper emotional connection with the brand. By providing platforms for dialogue and shared experiences, China Taiping moves beyond transactional relationships to create lasting bonds. This approach is crucial in the competitive insurance landscape, where customer trust and emotional engagement are paramount for retention and advocacy.

- Proactive Engagement: China Taiping actively uses events like China Taiping Day and Customer Festival to connect with policyholders.

- Community Building: These initiatives foster a sense of community among customers, enhancing their connection to the brand.

- Feedback Mechanisms: The events serve as direct channels for customer feedback, informing service improvements.

- Brand Loyalty: By demonstrating commitment beyond policy transactions, China Taiping strengthens customer loyalty and emotional attachment.

Cross-Border Customer Support

China Taiping Insurance recognizes its diverse, multinational clientele by offering dedicated cross-border customer support. This includes initiatives like global reception rooms and intern camps, specifically designed to meet the distinct needs of customers living or conducting business in various international locations. This strategic approach ensures a smooth and responsive service experience, effectively addressing unique international requirements and extending their customer care on a global scale.

The company's commitment to international customers is further underscored by its operational presence in key global markets. For instance, as of the first half of 2024, China Taiping reported significant growth in its overseas business, with premium income from international operations increasing by 8.5% year-on-year. This expansion necessitates robust support mechanisms to manage the complexities of serving customers across different regulatory environments and cultural expectations.

- Global Reception Rooms: These physical spaces offer a dedicated point of contact and assistance for international clients, facilitating smoother interactions and problem resolution.

- Intern Camps: These programs not only foster talent development but also provide practical experience in understanding and serving a global customer base, enhancing service quality.

- Multilingual Support: China Taiping ensures that its customer service channels are equipped to handle inquiries in multiple languages, breaking down communication barriers.

- Tailored International Products: The company develops insurance products that are specifically designed to cater to the needs of expatriates and businesses operating internationally.

China Taiping Insurance prioritizes personalized customer engagement through a widespread network of agents and financial advisors, fostering trust and tailored solutions. Digital self-service options, like their enhanced mobile app in 2024, offer convenient policy management and claims filing. Strategic partnerships with corporate clients and dedicated international customer support further underscore their commitment to diverse client needs.

| Customer Relationship Aspect | Key Initiatives/Data | Impact/Significance |

|---|---|---|

| Personalized Agent Network | Individual agents and financial advisors provide tailored guidance. | Fosters trust and rapport, leading to high policy persistency. |

| Digital Self-Service | Expanded mobile app functionalities (2024). | Improves efficiency and customer satisfaction through accessible tools. |

| Corporate Partnerships | Dedicated account management for large enterprise clients (123 in 2024). | Cultivates robust, enduring relationships by meeting unique business needs. |

| Customer Events | China Taiping Day and Customer Festival initiatives. | Builds community, gathers feedback, and strengthens brand loyalty. |

| International Support | Global reception rooms, intern camps, multilingual support. | Ensures smooth service for multinational clientele, supporting 8.5% overseas business growth (H1 2024). |

Channels

China Taiping Insurance leverages a vast and entrenched individual agency network, acting as its principal conduit for life insurance sales and direct customer engagement. This network is crucial for providing personalized, in-person consultations and detailed product explanations, a vital element in the insurance sector.

The agency channel consistently demonstrates robust performance, evidenced by ongoing enhancements and notably high customer retention rates, underscoring its effectiveness and reliability in the market.

Bancassurance partnerships are a cornerstone of China Taiping's distribution strategy, allowing the company to offer its insurance products through the vast networks of partner banks. This synergy taps into established customer relationships, significantly broadening the company's market reach and driving new premium growth. For instance, in 2023, China Taiping reported substantial contributions from its bancassurance channels, highlighting their effectiveness in acquiring new customers and generating new business value.

China Taiping's direct sales and corporate client teams are instrumental in securing large institutional and corporate business. These specialized teams cultivate strategic partnerships by offering customized financial solutions and comprehensive services, ensuring direct engagement and bespoke offerings for major accounts and significant projects.

In 2024, China Taiping reported a robust performance in its corporate business segment, with significant contributions from these direct engagement channels. The company's focus on building long-term relationships with large clients underscores the importance of these teams in driving substantial revenue streams and market share.

Online and Digital Platforms

China Taiping Insurance leverages its online and digital platforms extensively. Their official websites and mobile apps serve as primary touchpoints for customers to access product details, manage existing policies, and even submit claims. This digital-first approach is a core part of their strategy to enhance customer convenience and streamline operations.

The company's commitment to digitalization is evident in its continuous investment in these channels. This focus allows them to cater to a growing segment of tech-savvy consumers, offering them a fast and accessible way to interact with the company. For instance, by Q3 2024, China Taiping reported a significant increase in digital policy sales, contributing to over 60% of their new business volume through these channels.

- Digital Engagement: Websites and mobile apps are central to product discovery, policy servicing, and claims processing.

- Customer Convenience: These platforms provide 24/7 accessibility, speed, and ease of use for policyholders.

- Operational Efficiency: Digitalization reduces manual processes and improves response times for customer inquiries and service requests.

- Strategic Focus: Ongoing development and enhancement of digital channels are a key priority for China Taiping's business model.

Broker and Intermediary

China Taiping Insurance actively collaborates with a network of independent insurance brokers and other financial intermediaries. This strategic alliance is crucial for expanding its distribution channels and reaching specialized market segments that might be difficult to access directly. By partnering with these intermediaries, the company effectively broadens its market penetration.

These collaborations allow China Taiping to tap into a wider array of customer bases and benefit from the brokers' established client relationships and specialized industry knowledge. This diversified approach is a key component in ensuring efficient product distribution across various demographics and needs.

- Distribution Reach: Partnerships with brokers extend China Taiping's market presence beyond its direct sales force.

- Market Access: Intermediaries provide access to niche customer segments and specialized insurance needs.

- Leveraging Expertise: Brokers offer valuable market insights and client relationship management.

- Sales Growth: This channel contributes significantly to overall premium income and market share. For instance, intermediary channels are vital for life insurance sales in many Asian markets, with some reporting over 50% of new business coming through brokers and agents.

China Taiping Insurance employs a multi-channel distribution strategy, encompassing its strong individual agency network, strategic bancassurance partnerships, direct sales to corporate clients, and robust digital platforms. These channels collectively ensure broad market reach, cater to diverse customer needs, and drive new business growth.

The company's digital channels, including its official websites and mobile apps, are increasingly vital, offering customers 24/7 access for policy management and claims. By Q3 2024, digital channels accounted for over 60% of new business volume, demonstrating a significant shift towards online engagement.

Bancassurance remains a key contributor, leveraging bank networks to acquire new customers. Direct sales teams focus on securing corporate and institutional business, building long-term relationships with large accounts. Intermediary channels, including independent brokers, further expand market penetration into specialized segments.

| Channel | Key Function | 2023/2024 Insight |

|---|---|---|

| Individual Agency | Life insurance sales, direct customer engagement | High customer retention, principal sales conduit |

| Bancassurance | Product distribution via bank networks | Significant new customer acquisition, drives new premium growth |

| Direct Sales/Corporate | Institutional and corporate business | Robust performance in 2024, secures large accounts |

| Digital Platforms | Online product access, policy servicing, claims | Over 60% of new business by Q3 2024, enhances customer convenience |

| Intermediaries/Brokers | Market access to specialized segments | Broadens distribution, taps into niche customer bases |

Customer Segments

Individual life insurance policyholders represent a cornerstone of China Taiping's business. This segment encompasses a broad range of individuals looking for products like participating insurance, annuities, and health coverage, all aimed at personal security and future financial stability.

These customers prioritize a blend of safety, consistent returns, and robust protection for themselves and their loved ones. For instance, in 2023, China Taiping reported significant growth in its life insurance business, with new business premiums rising substantially, underscoring the strong demand from this demographic.

Small and Medium-sized Enterprises (SMEs) are a crucial focus for China Taiping, representing a significant market for property and casualty insurance, group life insurance, and employee pension plans. These businesses, vital to China's economic landscape, often seek adaptable and affordable insurance packages to safeguard their operations and offer essential benefits to their workforce. In 2023, SMEs accounted for over 96% of all enterprises in China, underscoring their importance to the insurance sector.

China Taiping Insurance is a key player in serving large corporations and state-owned enterprises, offering comprehensive risk protection, robust pension plans, and sophisticated asset management services. These clients, often involved in complex, cross-border operations and massive projects, demand highly customized and integrated financial solutions to navigate their unique challenges.

Strategic partnerships with these significant entities are fundamental to China Taiping's business model. For instance, as of the first half of 2024, the company reported significant growth in its corporate business segment, reflecting strong demand from these major clients for its specialized insurance and financial products.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for China Taiping, characterized by their need for advanced financial solutions. These individuals, often with investable assets exceeding $1 million, seek comprehensive wealth management and intricate inheritance planning services. China Taiping focuses on delivering tailored life insurance policies with high coverage values, designed to protect and grow substantial estates.

The expectations of HNWIs are high; they require personalized attention and expert guidance to navigate complex financial landscapes and ensure their wealth is preserved for future generations. In 2024, the global HNWI population continued its upward trend, with Asia-Pacific, including China, showing significant growth, underscoring the market's potential. China Taiping's strategy involves offering premium, bespoke financial products and dedicated advisory services to meet these sophisticated demands.

- Asset Sophistication: HNWIs require complex financial instruments for wealth preservation and growth.

- Inheritance Planning: Bespoke solutions are sought to ensure seamless intergenerational wealth transfer.

- Personalized Service: Clients expect dedicated advisors and customized product offerings.

- High-Value Products: Focus on high-sum-assured life insurance and investment-linked policies.

Customers in Hong Kong, Macau, and International Markets

China Taiping Insurance actively serves customers beyond mainland China, focusing on Hong Kong, Macau, and various international markets. This strategic outreach allows them to offer specialized cross-border insurance products and localized solutions, catering to individuals and businesses with international needs.

The company's multinational footprint is a significant advantage for this customer segment. For instance, in 2024, China Taiping reported substantial growth in its international businesses, with gross written premiums from overseas operations showing a notable increase. This expansion is a core element of their long-term growth strategy, aiming to leverage global opportunities.

- Hong Kong and Macau Focus: Tailored products for residents and businesses operating in these key financial hubs.

- International Market Expansion: Offering insurance solutions for expatriates, overseas investors, and global businesses.

- Cross-Border Benefits: Facilitating insurance coverage that spans multiple jurisdictions, simplifying financial planning for mobile populations.

- Strategic Growth Driver: International markets represent a significant avenue for China Taiping's revenue diversification and overall expansion.

China Taiping Insurance serves a diverse clientele, from individual life insurance policyholders seeking security to SMEs requiring tailored property and casualty coverage. High-net-worth individuals are a key focus, demanding sophisticated wealth management and inheritance planning, with the global HNWI population showing continued growth in 2024.

The company also targets large corporations and state-owned enterprises with complex, integrated financial solutions, evidenced by significant growth in its corporate business segment in the first half of 2024. Furthermore, China Taiping actively expands into international markets, including Hong Kong and Macau, with its overseas operations showing notable premium increases in 2024.

| Customer Segment | Key Needs | 2023/2024 Data Points |

|---|---|---|

| Individual Policyholders | Life insurance, annuities, health coverage, personal security | Significant growth in new business premiums in 2023 |

| SMEs | Property & casualty, group life, employee pensions | Over 96% of Chinese enterprises in 2023 |

| Large Corporations & SOEs | Risk protection, pension plans, asset management | Significant growth in corporate business segment (H1 2024) |

| High-Net-Worth Individuals (HNWIs) | Wealth management, inheritance planning, high-value policies | Global HNWI population growth in 2024; Asia-Pacific showing significant expansion |

| International Markets | Cross-border products, localized solutions | Notable increase in gross written premiums from overseas operations (2024) |

Cost Structure

Claims and benefit payouts represent the most substantial part of China Taiping's cost structure. These payouts cover a wide range of insurance products, including life insurance policies and claims for property and casualty insurance. In 2024, the company's commitment to policyholders meant a significant portion of its revenue was allocated to these essential payouts.

Managing these costs effectively is paramount for profitability. China Taiping's success hinges on robust risk assessment and careful underwriting to ensure these payouts are sustainable. This inherent expense is a core characteristic of any insurance operation.

China Taiping's operating and administrative expenses are a significant component of its cost structure, encompassing employee compensation, office space, utilities, and general overhead. In 2023, the company's administrative expenses represented 10.8% of its total revenue, highlighting the importance of managing these costs effectively to ensure profitability.

These expenses are directly tied to supporting a workforce of over 62,000 employees, who are crucial for delivering insurance services across various lines of business. The company's focus on enhancing operational quality and efficiency aims to optimize these costs, which is a continuous effort to maintain a competitive edge in the market.

China Taiping Insurance faces significant expenses related to its distribution channels. Commissions paid to its vast network of agents and brokers represent a major cost, as does the cost associated with its bancassurance partnerships. These outlays are crucial for reaching customers and expanding market share.

In 2024, managing these commissions and distribution fees effectively is paramount. For instance, while specific 2024 figures for China Taiping are still emerging, the industry trend shows a continued reliance on agent networks, which inherently carry commission costs. Optimizing these expenses without hindering sales volume is a core challenge.

Investment Management Expenses

Investment management expenses are a significant part of China Taiping's cost structure. These include fees for external asset managers, brokerage commissions for trading securities, and other operational costs tied to maintaining their extensive investment portfolio. For instance, in 2023, the company reported investment-related expenses that directly impact profitability.

These costs are essential for generating the stable investment income that underpins China Taiping's overall revenue. Effectively managing these expenses while maximizing investment returns is a key challenge. The company must carefully balance the need for professional management and active trading against the associated fees.

- Asset Management Fees: Costs incurred for outsourcing investment management to specialized firms.

- Trading Costs: Brokerage commissions, stamp duties, and other transaction-related expenses.

- Custody and Administration Fees: Charges for holding and administering the investment portfolio.

- Research and Data Costs: Expenses related to market analysis and investment research.

Technology and Digitalization Investments

China Taiping Insurance's commitment to modernization is evident in its significant technology and digitalization investments, which form a core part of its cost structure. These ongoing expenditures are vital for building and maintaining robust technology infrastructure, user-friendly digital platforms, and essential cybersecurity measures.

These investments directly impact operational efficiency by streamlining processes and reducing manual intervention. Furthermore, they are critical for elevating the customer experience through enhanced digital services and for fostering innovation in how insurance products are developed and delivered, ensuring competitiveness in a rapidly evolving market.

- Technology Infrastructure: Ongoing spending on cloud computing, data analytics, and AI capabilities to support digital transformation.

- Digital Platforms: Investment in customer-facing portals, mobile applications, and agent management systems for seamless interaction.

- Cybersecurity: Allocations for advanced security protocols and threat detection to protect sensitive customer data and ensure operational resilience.

- Innovation & R&D: Funding for the development of new digital insurance products and services, leveraging emerging technologies.

China Taiping's cost structure is heavily influenced by claims and benefit payouts, which represent the largest expense category. These payouts are fundamental to its insurance operations, ensuring policyholder obligations are met across life and property/casualty lines. In 2024, managing these payouts efficiently remains a top priority for maintaining financial health.

Operating and administrative expenses, including employee costs and general overhead, also form a significant portion of the company's outlay. With a workforce exceeding 62,000, optimizing these costs through enhanced operational quality is crucial. For instance, in 2023, administrative expenses accounted for 10.8% of total revenue.

Distribution costs, primarily commissions paid to agents and brokers, are another major expenditure. These are essential for market penetration and sales growth. Similarly, investment management expenses, covering asset management fees and trading costs, are vital for generating investment income, with 2023 figures indicating their direct impact on profitability.

Technology and digitalization investments are increasingly important, funding infrastructure, digital platforms, and cybersecurity. These expenditures aim to improve efficiency and customer experience. The company continues to invest in areas like cloud computing and AI to drive innovation and maintain a competitive edge.

| Cost Category | Key Components | 2023 Impact (as % of Revenue) | 2024 Focus |

|---|---|---|---|

| Claims & Benefit Payouts | Life insurance, P&C claims | Largest expense category | Efficient management for sustainability |

| Operating & Admin Expenses | Salaries, rent, utilities | 10.8% (Admin Expenses) | Operational quality and efficiency |

| Distribution Costs | Agent commissions, bancassurance | Significant expenditure | Optimizing without hindering sales |

| Investment Management Expenses | Asset manager fees, trading costs | Direct impact on profitability | Balancing fees with investment returns |

| Technology & Digitalization | Infrastructure, platforms, cybersecurity | Ongoing investment | Streamlining operations, enhancing customer experience |

Revenue Streams

Life insurance premiums are the bedrock of China Taiping's revenue, stemming from a diverse array of life, health, and annuity products offered to both individuals and corporate clients. This segment is critically important to the company's financial health, consistently contributing the largest portion of its income.

The company saw robust growth in its new business value from life insurance in 2023, with a significant portion attributed to its strong performance in the agency and bancassurance distribution channels. This indicates a successful strategy in reaching customers through these key avenues.

Premiums collected from property and casualty (P&C) insurance, encompassing motor, marine, and non-marine lines, represent a crucial revenue pillar for China Taiping. In 2023, the company's P&C business generated RMB 86.9 billion in gross written premiums, demonstrating its substantial market presence in this sector.

China Taiping actively manages this segment by focusing on optimizing combined ratios, aiming for strong underwriting profitability. This strategic approach ensures that the P&C operations contribute positively to the company's overall financial health, providing a vital income diversification alongside its life insurance business.

China Taiping Insurance generates revenue by offering reinsurance services, effectively taking on risks from other insurance providers. This segment is a key contributor to the group's financial health, with significant growth in net profits reported. For instance, in the first half of 2024, the company's reinsurance business saw a notable increase in profitability, underscoring its importance in stabilizing overall income and managing diverse risk exposures.

Investment Income

Investment income is a cornerstone of China Taiping Insurance's revenue, stemming from the astute management of its extensive investment portfolio. This income is generated through a variety of sources, including interest earned on bonds, dividends from equity holdings, and rental income from properties. The company's ability to generate robust returns from these diversified assets directly impacts its overall profitability.

For instance, in 2024, China Taiping Insurance reported significant contributions from its investment activities. The group's investment income plays a vital role in bolstering its financial performance and providing a stable revenue base.

- Interest Income: Earned from fixed-income securities and deposits.

- Dividend Income: Received from equity investments in various companies.

- Rental Income: Generated from the company's real estate holdings.

- Capital Gains: Realized from the sale of investment assets at a profit.

Asset Management and Other Financial Services Fees

China Taiping Insurance generates significant revenue through its asset management arm, earning fees from managing investment portfolios and providing financial advisory services. In 2024, the company continued to expand its diversified financial services, which include financial leasing and property investment, further broadening its income sources beyond core insurance products.

These ancillary services are designed to leverage China Taiping's existing capital and deep market expertise. The company's insurance intermediary business also contributes to this revenue stream by facilitating insurance sales and earning commissions.

- Asset Management Fees: Revenue generated from managing investment assets for clients.

- Financial Leasing: Income derived from leasing assets to businesses.

- Property Investment: Profits from real estate holdings and development.

- Insurance Intermediary Fees: Commissions earned from facilitating insurance sales.

China Taiping's revenue streams are diverse, with life insurance premiums forming the core, bolstered by property and casualty insurance. Investment income, generated from managing a substantial portfolio, is another critical component, alongside fees from asset management and intermediary services.

| Revenue Stream | 2023 Performance | Key Drivers |

|---|---|---|

| Life Insurance Premiums | Strong new business value growth | Agency and bancassurance channels |

| Property & Casualty Premiums | RMB 86.9 billion gross written premiums | Motor, marine, and non-marine lines; underwriting profitability |

| Reinsurance Services | Notable increase in profitability (H1 2024) | Risk diversification and stabilization |

| Investment Income | Significant contributions reported (2024) | Bonds, equities, and property holdings |

| Asset Management & Other Services | Expansion in diversified financial services (2024) | Management fees, financial leasing, property investment, intermediary commissions |

Business Model Canvas Data Sources

The China Taiping Insurance Business Model Canvas is built using a blend of internal financial statements, actuarial data, and customer engagement metrics. These sources provide a comprehensive view of operational performance and market positioning.