Cheetah Mobile SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheetah Mobile Bundle

Cheetah Mobile showcases impressive global reach and a robust user base, but faces intense competition and evolving market dynamics. Our comprehensive SWOT analysis delves into these critical factors, providing a nuanced view of their strategic landscape.

Want the full story behind Cheetah Mobile's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cheetah Mobile has significantly broadened its business beyond its original utility apps. The company now boasts a diverse portfolio encompassing mobile games, AI-driven solutions, and even robotic products. This diversification across internet services and hardware sales creates multiple revenue streams, mitigating risks associated with over-reliance on any single market.

The company's internet segment remains a robust contributor, demonstrating strong revenue growth and improved profit margins. This stable performance provides a solid foundation and financial capacity to support the development and expansion of its newer, more innovative ventures in AI and robotics.

Cheetah Mobile has strategically pivoted towards artificial intelligence and robotics, a move that positions them to capture significant growth in these burgeoning markets. Their investments in Large Language Model (LLM) technologies and the development of service robots underscore this commitment.

The company's foresight is evident in its focus on AI and robotics, sectors projected for substantial expansion. For instance, the global AI market was valued at approximately $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 37% through 2030, according to various industry reports.

A key demonstration of this strength is the introduction of AgentOS, a sophisticated voice interaction system designed for service robots. This innovation highlights Cheetah Mobile's ambition to be a leader in the increasingly important field of voice-enabled robotics, a segment expected to see robust adoption in customer service and hospitality sectors.

Cheetah Mobile has showcased a remarkable turnaround in its financial standing. The company reported a substantial 41.7% year-over-year revenue increase in Q4 2024, followed by another strong 36.1% year-over-year growth in Q1 2025. This upward trend highlights effective operational strategies and market adaptation.

Furthermore, the company has significantly reduced its operating and net losses, indicating improved efficiency and cost management. As of March 31, 2025, Cheetah Mobile maintained a healthy cash reserve exceeding $230 million, ensuring robust liquidity for future endeavors and strategic investments.

Strategic Acquisition in Robotics Sector

Cheetah Mobile's strategic acquisition of a 75.8% controlling stake in UFACTORY, a profitable collaborative robotics company, is a major strength. This move significantly accelerates their commercialization efforts in the robotics sector, bolstering their product offerings with UFACTORY's established technology.

This acquisition not only enhances Cheetah Mobile's product portfolio but also provides access to UFACTORY's robust international market presence and proven technological capabilities. This integration is poised to sharpen Cheetah Mobile's competitive edge and expand its market reach within the dynamic robotics industry.

- Strategic Robotics Expansion: Acquisition of a 75.8% stake in UFACTORY, a profitable robotics provider.

- Accelerated Commercialization: Strengthens Cheetah Mobile's strategy for bringing robotics products to market.

- Enhanced Product Portfolio: Integrates UFACTORY's lightweight collaborative robotic arms, adding significant value.

- Market Access and Technology: Leverages UFACTORY's international presence and proven technology for competitive advantage.

Established Global Presence and Operational Expertise

Cheetah Mobile's established global presence and operational expertise are significant strengths. With years of experience navigating the competitive mobile application market, the company has honed its ability to develop and monetize internet products worldwide.

Despite facing challenges with its utility apps, Cheetah Mobile's internet business remains a substantial revenue driver. This demonstrates a continued capacity to manage extensive user bases and effectively generate advertising income, a skill transferable to new ventures.

For instance, in the first quarter of 2024, Cheetah Mobile reported total revenues of RMB 370.9 million (approximately $51.0 million), with a significant portion attributed to its internet services. This ongoing revenue generation underscores their operational resilience and market understanding.

This deep-seated experience in global operations and user engagement provides a solid foundation for their strategic expansion into emerging sectors like AI and robotics, allowing them to leverage existing infrastructure and knowledge.

Cheetah Mobile's strategic pivot into AI and robotics is a significant strength, positioning the company for future growth in high-demand sectors. Their acquisition of a 75.8% stake in UFACTORY, a profitable collaborative robotics company, significantly accelerates their commercialization efforts and enhances their product portfolio with established technology and international market access.

The company's financial turnaround is also a key strength, with substantial year-over-year revenue increases reported in Q4 2024 (41.7%) and Q1 2025 (36.1%). This, coupled with reduced operating losses and a healthy cash reserve exceeding $230 million as of March 31, 2025, provides the financial stability needed for continued investment and expansion.

Cheetah Mobile's established global presence and operational expertise in the internet services market provide a robust foundation. Their ability to manage large user bases and generate advertising income, as evidenced by RMB 370.9 million in total revenues in Q1 2024, demonstrates operational resilience and market understanding transferable to new ventures.

| Metric | Q1 2024 | Q4 2024 (YoY Growth) | Q1 2025 (YoY Growth) | As of March 31, 2025 |

|---|---|---|---|---|

| Total Revenue (RMB) | 370.9 million | N/A | N/A | N/A |

| Revenue Growth | N/A | 41.7% | 36.1% | N/A |

| Cash Reserve | N/A | N/A | N/A | > $230 million |

| UFACTORY Stake | N/A | N/A | 75.8% | N/A |

What is included in the product

Analyzes Cheetah Mobile’s competitive position through key internal and external factors, highlighting its strengths in mobile utility and content, while also addressing weaknesses in diversification and threats from intense market competition and regulatory changes.

Highlights Cheetah Mobile's core strengths and weaknesses to mitigate risks and capitalize on opportunities.

Weaknesses

Cheetah Mobile continues to grapple with the fallout from past controversies, notably the 2020 Google Play ban for advertising policy violations and the 2022 U.S. Securities and Exchange Commission charges against its CEO and former President for insider trading. These events have left a lingering reputational stain, potentially eroding user trust and hindering new business collaborations.

Cheetah Mobile continues to grapple with persistent net losses, even as its revenue shows upward momentum. For the first quarter of 2025, the company reported a net loss attributable to shareholders amounting to RMB33.4 million, which translates to approximately US$4.6 million. This ongoing profitability challenge underscores the need for robust cost control measures and enhanced operational efficiency to achieve sustainable financial health.

The full-year 2024 results further highlight this weakness, with Cheetah Mobile posting a non-GAAP net loss of RMB202.1 million (US$27.7 million). While the company has made strides in narrowing its operating losses, the ultimate goal of consistent net profitability remains an area requiring significant strategic focus and execution.

The artificial intelligence and robotics fields are incredibly crowded. Major technology companies and agile startups are pouring billions into research and development, creating a dynamic and fast-paced environment. This intense competition means that even with strategic investments, Cheetah Mobile faces established players with significant financial backing and entrenched market presence.

For Cheetah Mobile, this translates into a constant challenge to differentiate its offerings and capture substantial market share. While the company is actively pursuing growth in AI and robotics, the sheer scale of investment from competitors, such as Google's substantial AI research budget or Amazon's robotics initiatives, makes achieving a dominant position particularly difficult, especially in mature markets.

Complexity of Hardware-Software Integration in Robotics

Cheetah Mobile's move into robotics, a field demanding intricate hardware-software integration, poses a significant hurdle. Unlike their established software-centric mobile app business, robotics requires seamlessly blending advanced AI with physical systems. This integration is inherently complex, demanding specialized engineering talent and significant research and development expenditure.

The substantial R&D investment and specialized expertise needed for robotics hardware-software integration can translate to higher operational costs. For instance, a report by Statista in late 2024 indicated that the average R&D spending for companies in the advanced manufacturing and robotics sector can be upwards of 15% of revenue, a considerable increase from typical software-only ventures. This complexity can also slow down the pace of large-scale commercial application compared to software-only products, potentially impacting market entry timelines and revenue generation.

- Technical Challenges: Integrating sophisticated AI algorithms with the physical mechanics and sensors of robots requires overcoming complex interoperability issues.

- R&D Investment: Companies like Cheetah Mobile must allocate substantial capital to research and development, potentially diverting resources from other core competencies.

- Market Adoption: The inherent complexity can lead to longer development cycles and higher initial product costs, potentially hindering widespread market adoption compared to simpler software solutions.

- Expertise Gap: A shortage of engineers with combined expertise in AI, mechanical engineering, and embedded systems can create bottlenecks in development and deployment.

Dependence on Advertising for Core Business

Cheetah Mobile's core operations remain heavily reliant on advertising, which constituted 68% of its total revenue in the fourth quarter of 2024. This significant dependence exposes the company to the inherent volatility of the global advertising market. Changes in advertising platform policies or increased user adoption of ad-blocking software could directly impact its primary revenue source.

Cheetah Mobile's reliance on advertising revenue, which represented 68% of its total income in Q4 2024, makes it vulnerable to shifts in the digital advertising landscape and user behavior. This concentration risk is amplified by the ongoing profitability challenges, as evidenced by a net loss of RMB33.4 million (US$4.6 million) in Q1 2025 and RMB202.1 million (US$27.7 million) for the full year 2024, indicating that revenue growth alone is not translating into sustainable net income.

The company's foray into robotics and AI, while strategic, presents significant technical hurdles and requires substantial R&D investment. This complex hardware-software integration demands specialized talent and can lead to higher operational costs and longer market entry times compared to its software-based offerings. Furthermore, intense competition from well-funded tech giants in these advanced fields makes differentiation and market share acquisition a formidable challenge.

Lingering reputational damage from past issues, including the 2020 Google Play ban and 2022 SEC charges against its executives, continues to affect user trust and potential business partnerships. This tarnished image, coupled with the financial strain of persistent net losses, creates a challenging environment for growth and recovery.

Preview Before You Purchase

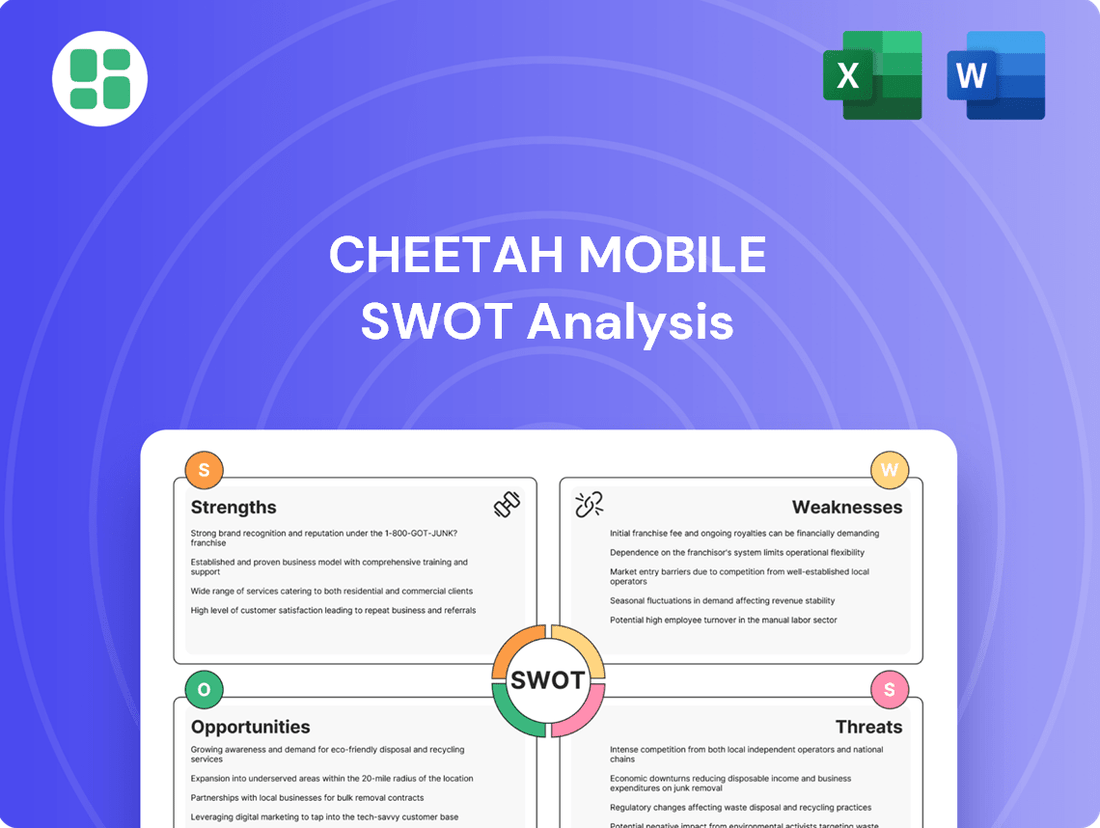

Cheetah Mobile SWOT Analysis

The preview below is taken directly from the full Cheetah Mobile SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of its Strengths, Weaknesses, Opportunities, and Threats.

This is the actual Cheetah Mobile SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the company's internal capabilities and external market factors.

You’re viewing a live preview of the actual Cheetah Mobile SWOT analysis file. The complete version becomes available after checkout, providing actionable insights for strategic planning.

Opportunities

The global AI and robotics market is experiencing robust growth, with projections indicating a significant expansion in the coming years. For instance, the International Federation of Robotics reported that the service robot market alone saw a 10% increase in sales in 2023, reaching over 14 million units. Cheetah Mobile's strategic moves, including its investment in AgentOS and the acquisition of UFACTORY, directly tap into this burgeoning sector. This positions the company to capitalize on the increasing demand for automated solutions across various industries.

Cheetah Mobile's focus on developing scalable robotics solutions and practical AI tools offers a clear path for commercialization. The company's commitment to utility-focused AI can unlock new revenue streams by addressing specific needs in both enterprise and consumer markets. This strategic direction aligns with market trends that favor AI applications providing tangible benefits and efficiency gains, potentially leading to significant market share capture.

Cheetah Mobile can significantly boost its internet business monetization by deeply integrating advanced AI and Large Language Models (LLMs) into its current offerings, like utility apps and games. This strategic move can lead to a more personalized user experience, with AI-driven content recommendations and highly targeted advertising. For instance, during the first half of 2024, companies leveraging AI for ad targeting saw an average uplift of 15-20% in click-through rates, a trend Cheetah Mobile can capitalize on.

This enhanced user engagement, driven by AI-powered personalization, directly translates into more effective monetization strategies. By offering more relevant content and ads, Cheetah Mobile can expect a substantial increase in both advertising revenue and income from value-added services. Industry reports from late 2024 indicate that businesses with strong AI integration in their ad platforms experienced revenue growth rates exceeding 25% year-over-year, showcasing the immense potential for Cheetah Mobile.

Cheetah Mobile's robotic ventures are already making waves internationally, notably becoming the leading service robot provider in Italy. This existing foothold is crucial as the company plans a European headquarters in Germany, signaling a commitment to further expansion within a region with burgeoning demand for automation solutions.

The strategic acquisition of UFACTORY significantly bolsters this international opportunity. UFACTORY brings with it substantial existing revenue streams from overseas markets, instantly enhancing Cheetah Mobile's global reach and product portfolio in the service robotics sector.

By targeting new geographic regions that are experiencing a heightened demand for service robots, Cheetah Mobile can unlock considerable growth potential. This expansion strategy leverages the increasing global acceptance and adoption of robotics across various industries, from logistics to hospitality.

Strategic Partnerships and Acquisitions in Tech Ecosystem

Cheetah Mobile can further bolster its technological prowess and market footprint through strategic alliances and acquisitions, mirroring its successful UFACTORY collaboration. Engaging with forward-thinking firms in AI, IoT, and specialized sectors presents a clear path to new revenue generation and a more robust competitive stance in the dynamic tech arena. For instance, a 2024 trend shows significant investment in AI startups, with venture capital funding reaching billions globally, highlighting the potential for high-impact partnerships.

These moves can lead to tangible benefits:

- Accelerated Innovation: Gaining access to cutting-edge technologies and talent pools.

- Expanded Market Access: Penetrating new customer segments and geographic regions.

- Diversified Product Portfolio: Offering a broader range of integrated solutions.

- Enhanced Competitive Edge: Strengthening its position against larger, established players in the tech ecosystem.

Development of Enterprise-Facing AI Solutions

Cheetah Mobile's strategic pivot towards enterprise-facing AI solutions represents a substantial growth avenue. This shift leverages their AI expertise to address business needs, moving away from the unpredictable consumer market. By offering tailored AI applications and robust multi-cloud management platforms, the company can access a more lucrative and stable business-to-business (B2B) sector.

This move into enterprise AI is particularly opportune given the accelerating digital transformation across industries. Businesses are increasingly investing in AI to enhance efficiency, gain competitive advantages, and improve customer experiences. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, indicating immense potential for companies like Cheetah Mobile to capture market share.

- Targeting B2B: Developing custom AI solutions for enterprises offers higher margins than consumer-facing services.

- Multi-Cloud Management: Providing platforms for businesses to manage their cloud infrastructure addresses a critical need in the current IT landscape.

- Market Growth: The enterprise AI market is experiencing rapid expansion, driven by digital transformation initiatives worldwide.

- Diversification: This strategy reduces reliance on the volatile advertising revenue from its consumer-oriented products.

Cheetah Mobile's expansion into the global service robotics market, particularly in Europe with a planned headquarters in Germany, presents a significant growth opportunity. Their leading position in Italy, coupled with the acquisition of UFACTORY, which brings international revenue, positions them to capture demand in diverse regions embracing automation.

The company can leverage its AI and LLM expertise to enhance its internet business monetization, driving personalized user experiences and targeted advertising. This strategy aligns with industry trends showing substantial revenue uplifts for AI-integrated ad platforms, as seen in the 15-20% click-through rate increases reported in early 2024 for AI-driven ad targeting.

Cheetah Mobile's strategic pivot towards enterprise-facing AI solutions taps into the rapidly expanding B2B sector, driven by digital transformation. By offering custom AI applications and multi-cloud management platforms, they can access a more lucrative and stable market, capitalizing on the projected growth of the global AI market, which was valued at approximately $200 billion in 2023.

Threats

Cheetah Mobile faces escalating regulatory challenges globally, with data privacy laws like the EU's GDPR and California's CCPA intensifying scrutiny. These regulations can significantly restrict how the company collects and utilizes user data, directly impacting its targeted advertising strategies, a core revenue driver.

Past controversies surrounding data practices and alleged ad fraud have put Cheetah Mobile under a microscope, making it more vulnerable to stricter enforcement. A failure to comply with these evolving data privacy mandates could result in substantial financial penalties, potentially reaching millions of dollars, and could even lead to operational limitations that hinder business growth.

Changes in app store policies by dominant platforms like Google and Apple pose a significant threat to Cheetah Mobile's mobile application business. These shifts can impact app distribution, monetization strategies, and access to user data, directly affecting revenue streams.

The historical Google Play ban serves as a stark reminder of Cheetah Mobile's vulnerability to such policy changes. This incident demonstrated how quickly access to a substantial user base and a key revenue source can be abruptly cut off, highlighting the precariousness of relying on third-party platforms.

Cheetah Mobile faces the persistent threat of failing to achieve profitability in its new ventures, particularly in the demanding AI and robotics sectors. While the company has shown progress with revenue growth and reduced losses, these emerging areas require significant investment and face substantial market adoption hurdles.

The success of these capital-intensive segments hinges on their ability to achieve widespread commercial application and effectively manage the intricate integration of software and hardware. Should these new ventures falter, the resulting sustained losses could deplete financial reserves and erode investor trust, posing a significant risk to the company's overall financial health.

Aggressive Competition from Tech Giants and Startups

The AI and robotics landscape is intensely competitive, with major players like Alibaba and Tencent pouring significant resources into innovation. This aggressive investment from established tech giants poses a substantial threat, as they possess vast financial and technological advantages.

Furthermore, the constant emergence of nimble startups, often with highly specialized AI or robotics solutions, adds another layer of competitive pressure. Cheetah Mobile risks being outmaneuvered by these entities, which may offer more advanced technology or possess superior market access strategies. This dynamic makes it challenging for Cheetah Mobile to carve out and maintain a leading market position.

- Established tech giants like Alibaba and Tencent are aggressively investing in AI and robotics, creating a high-barrier-to-entry market.

- Emerging startups with specialized AI/robotics solutions can quickly gain traction, potentially disrupting existing market shares.

- Cheetah Mobile faces the risk of being outpaced technologically or out-marketed by competitors with greater resources and established distribution channels.

Economic Downturns and Reduced Advertising Spend

Economic downturns represent a significant threat to Cheetah Mobile. A global or regional recession, for instance, could trigger widespread cuts in corporate advertising budgets, directly impacting the company's core internet services revenue stream. For example, during periods of economic contraction, businesses often prioritize essential spending, leading to reduced marketing investments.

Furthermore, economic instability can dampen consumer confidence and discretionary spending. This impacts Cheetah Mobile's ability to generate revenue from its value-added services and hardware products, as consumers may postpone or forgo non-essential purchases. This dual impact on both business and consumer spending creates a challenging operating environment.

- Reduced Advertising Budgets: Businesses facing economic headwinds are likely to scale back marketing expenditures, directly affecting Cheetah Mobile's primary revenue source from its internet segment.

- Lower Consumer Spending: Economic uncertainty can lead consumers to reduce discretionary spending on value-added services and hardware, impacting sales for Cheetah Mobile.

- Impact on Growth: These economic pressures can hinder the company's financial performance and overall growth trajectory, making it harder to achieve strategic objectives.

Cheetah Mobile faces intense competition in the AI and robotics sectors from well-funded giants like Alibaba and Tencent, who are making substantial investments. This crowded market also includes agile startups offering specialized solutions, posing a risk of being outmaneuvered technologically or commercially.

| Competitor | AI/Robotics Investment (Estimated 2024-2025) | Market Focus |

|---|---|---|

| Alibaba | Billions USD | Cloud AI, Logistics Robotics, Smart Retail |

| Tencent | Billions USD | AI Research, Gaming AI, Healthcare AI |

| Various Startups | Millions to Billions USD | Niche AI applications, Specialized Robotics |

SWOT Analysis Data Sources

This Cheetah Mobile SWOT analysis is constructed using a blend of robust data sources, including the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.