Cheetah Mobile Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheetah Mobile Bundle

Cheetah Mobile navigates a dynamic landscape shaped by intense rivalry and evolving user demands, impacting its profitability and growth. Understanding the subtle interplay of buyer power and the threat of substitutes is crucial for any strategic move.

The complete report reveals the real forces shaping Cheetah Mobile’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cheetah Mobile's reliance on dominant app stores like Google Play and Apple App Store significantly increases the bargaining power of these suppliers. These platforms control distribution channels and set crucial terms, including revenue-sharing agreements and content policies.

The sheer scale of these platforms underscores their supplier power. For instance, Apple's App Store alone facilitated an astounding $1.3 trillion in developer billings and sales globally in 2024, highlighting its leverage over developers like Cheetah Mobile.

Advertising networks hold significant sway over Cheetah Mobile due to its reliance on ad revenue. Giants like Google and Meta are projected to capture 81.6% of the digital ad market by 2025, a testament to their market dominance. This concentration of power means these networks dictate terms for ad pricing, audience access, and targeting capabilities, directly impacting publishers like Cheetah Mobile.

Cheetah Mobile's growing focus on AI-driven robotics, including its acquisition of UFACTORY, means it's increasingly dependent on specialized hardware component manufacturers. These suppliers, particularly for advanced robotic arms and AI-specific parts, wield considerable power. The burgeoning AI robotics sector, anticipated to hit $23.12 billion by 2025, underscores the critical nature of these supplier relationships.

Cloud Service Providers

Cloud service providers hold considerable bargaining power over companies like Cheetah Mobile, especially those relying on extensive mobile app portfolios and advanced AI development. Major players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are critical for providing the scalable computing power, vast storage, and specialized AI tools necessary for these operations. The substantial investment and technical integration required to build applications on a specific cloud platform create high switching costs. For instance, in 2023, AWS, Azure, and Google Cloud collectively dominated the global cloud infrastructure market, holding over 65% of market share, underscoring their concentrated influence.

These high switching costs mean that once a company commits to a particular cloud ecosystem, migrating to a competitor becomes a complex and expensive undertaking. This dependence allows major cloud providers to exert significant leverage in pricing and service terms. The ongoing demand for cloud services, projected to grow substantially through 2027, further solidifies their strong position.

- Dominant Market Share: AWS, Azure, and Google Cloud controlled over 65% of the global cloud infrastructure market in 2023, indicating a concentrated supplier base.

- High Switching Costs: Deep integration into a specific cloud provider's ecosystem makes it technically challenging and financially burdensome to migrate services.

- Essential Infrastructure: Cloud services are fundamental for scalable mobile applications and complex AI solutions, creating a critical dependency for companies like Cheetah Mobile.

- Growing Market Demand: The continuous expansion of cloud computing services ensures sustained demand, reinforcing the bargaining power of major providers.

Skilled Talent and Technology Providers

The increasing reliance on AI and advanced technologies significantly amplifies the bargaining power of skilled talent and specialized technology providers for companies like Cheetah Mobile. The demand for AI engineers and software developers, particularly those with expertise in areas like large language models (LLMs), remains exceptionally high, driving up compensation and influencing contract terms.

Access to cutting-edge AI platforms and proprietary algorithms is a key differentiator. Providers of these unique solutions can dictate pricing and service level agreements, as their offerings are essential for innovation and maintaining a competitive edge. For instance, in 2024, the global AI market was valued at approximately $200 billion, with significant growth driven by demand for specialized AI talent and platforms.

- High Demand for AI Expertise: The shortage of skilled AI professionals, particularly in areas like machine learning and natural language processing, gives these individuals considerable leverage.

- Proprietary Technology Advantage: Companies possessing unique AI development tools or exclusive access to advanced AI models can command premium pricing.

- Impact on Innovation: Reliance on external AI expertise and technology means that supplier capabilities directly influence a company's ability to innovate and differentiate its products.

- Talent Acquisition Costs: In 2024, average salaries for senior AI engineers in major tech hubs often exceeded $200,000 annually, reflecting intense competition for talent.

Cheetah Mobile faces significant supplier power from dominant app stores like Google Play and Apple App Store, which control distribution and set terms. The sheer scale of these platforms, with Apple's App Store facilitating $1.3 trillion in global developer billings in 2024, highlights their leverage.

Advertising networks also wield substantial power; Google and Meta are expected to capture 81.6% of the digital ad market by 2025, dictating terms for ad pricing and audience access, directly impacting Cheetah Mobile's revenue.

The company's increasing reliance on specialized hardware for AI robotics, a sector projected to reach $23.12 billion by 2025, grants considerable power to component manufacturers.

Furthermore, essential cloud service providers like AWS, Azure, and Google Cloud, which held over 65% of the global cloud infrastructure market in 2023, exert strong influence due to high switching costs and critical infrastructure provision.

| Supplier Category | Key Players | Market Share/Size (2023-2025) | Impact on Cheetah Mobile |

|---|---|---|---|

| App Stores | Google Play, Apple App Store | Apple App Store: $1.3T billings (2024) | Control distribution, set revenue share and policies |

| Advertising Networks | Google, Meta | 81.6% of digital ad market (projected 2025) | Dictate ad pricing, audience access, and targeting |

| AI Robotics Components | Specialized Manufacturers | AI Robotics Market: $23.12B (projected 2025) | Leverage in pricing for advanced AI parts |

| Cloud Services | AWS, Azure, Google Cloud | >65% global cloud infra market (2023) | High switching costs, essential for operations |

What is included in the product

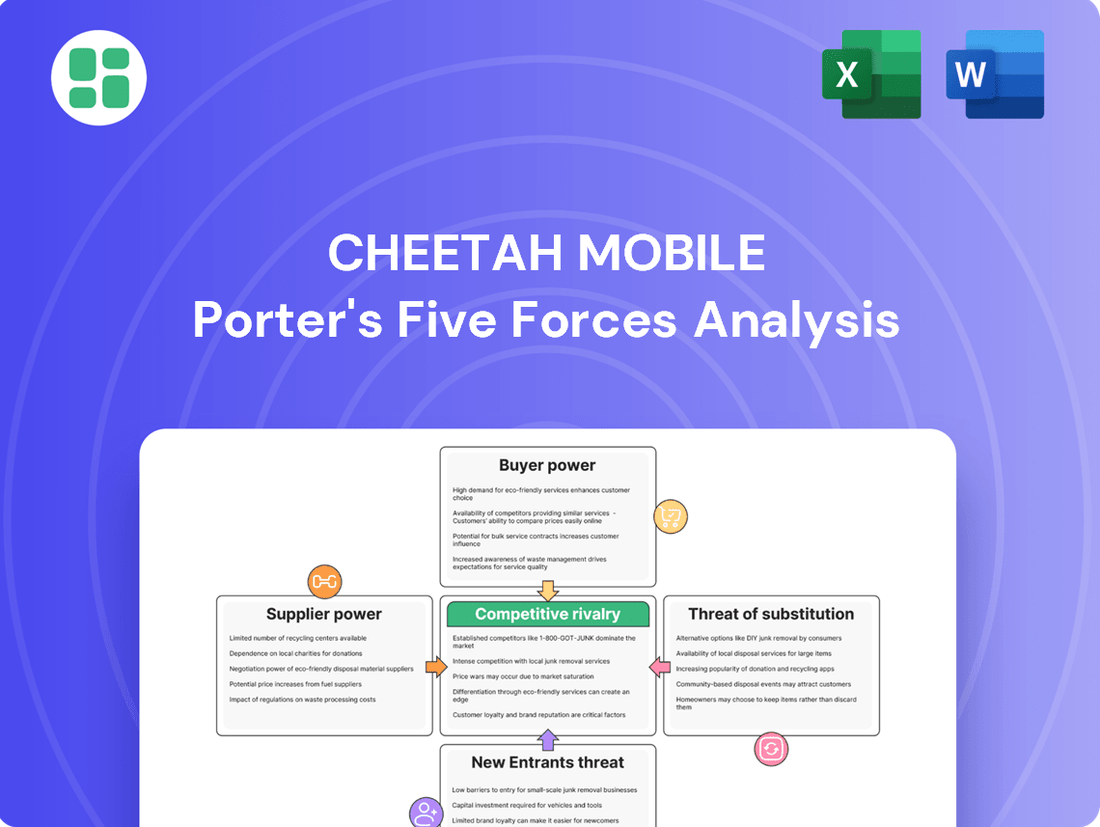

This Porter's Five Forces analysis for Cheetah Mobile dissects the competitive intensity by examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Individual mobile app users wield significant bargaining power over Cheetah Mobile, primarily because switching between utility apps or mobile games is virtually cost-free. With millions of alternatives readily available on platforms like Google Play and the Apple App Store, users can effortlessly move to a competitor if dissatisfied with Cheetah Mobile's offerings, be it performance, privacy concerns, or aggressive advertising.

This high degree of substitutability means users are not locked into any particular app. Their engagement, in essence, is their currency, exchanged for the app's functionality and then monetized by Cheetah Mobile through advertising. In 2024, the sheer volume of app downloads, exceeding 250 billion globally, underscores the ease with which users can explore and adopt new applications, further amplifying their power.

Advertisers are a key customer group for Cheetah Mobile, as advertising revenue forms a significant portion of its income. In the crowded digital ad space, advertisers have many options to reach consumers, giving them leverage.

Major advertisers can often negotiate better pricing for ad placements within Cheetah Mobile's app ecosystem. For instance, in 2023, global digital ad spending was projected to exceed $600 billion, highlighting the immense competition advertisers face and their resulting power.

Enterprise clients for robotics and AI solutions, like those Cheetah Mobile targets, are typically large organizations with sophisticated procurement needs. These clients often negotiate custom solutions and long-term service agreements, reflecting the strategic importance and high volume of their purchases. For instance, in 2024, the global AI market was projected to reach over $200 billion, indicating significant investment by enterprises in these technologies, which amplifies their bargaining leverage.

Content Consumers

For content-driven products from Cheetah Mobile, consumers face a vast landscape of entertainment and information choices. The proliferation of free and subscription-based streaming services, social media platforms, and other digital content providers means customers can readily switch between different entertainment options. This abundance of alternatives grants content consumers considerable leverage to demand high quality and value for their time and money.

In 2024, the global digital content market continued its robust expansion, with user engagement on platforms like TikTok and YouTube reaching unprecedented levels. For instance, YouTube reported over 2 billion logged-in monthly users in early 2024, highlighting the sheer scale of competition for consumer attention. This intense competition directly translates to increased bargaining power for consumers, as they can easily shift their viewership to platforms offering more compelling or cost-effective content.

The bargaining power of content consumers is amplified by several factors:

- Availability of Substitutes: Consumers can easily find alternative sources for news, entertainment, and social interaction, reducing their reliance on any single provider.

- Low Switching Costs: Moving from one content platform to another typically involves minimal effort or expense for the consumer.

- Price Sensitivity: With many free or low-cost options available, consumers are often sensitive to pricing and will seek out the best value.

- Information Availability: Consumers are well-informed about available options through reviews, social media, and word-of-mouth, enabling them to make discerning choices.

Hardware Product Buyers

Hardware product buyers, particularly those seeking robotic devices, wield significant bargaining power. This power is directly tied to how uniquely Cheetah Mobile's offerings stand out, its brand strength, and the presence of alternative robotics solutions in the market. For instance, while Cheetah Mobile emphasizes AI and interactive capabilities, the competitive landscape features numerous established robotics companies alongside emerging innovators, potentially giving buyers more options.

Key considerations for these customers revolve around price, the specific features offered, and the quality of after-sales support. These elements collectively shape a buyer's ability to negotiate terms. In 2024, the global robotics market was valued at approximately $60 billion, with projections indicating continued growth, suggesting a dynamic environment where customer leverage can be substantial, especially for bulk purchases or in highly competitive segments.

- Product Differentiation: Cheetah Mobile's ability to showcase unique AI and interaction features in its hardware directly impacts buyer power.

- Brand Reputation: A strong, trusted brand can reduce buyer sensitivity to price and alternatives, thereby lessening their bargaining power.

- Availability of Alternatives: The broader AI robotics market, estimated to grow significantly by 2025, presents numerous competing solutions that empower buyers.

- Price Sensitivity: For hardware purchases, price remains a critical negotiation point, especially when comparable products exist.

Cheetah Mobile faces strong customer bargaining power across its diverse product lines. Individual app users can easily switch to competitors due to low switching costs and a vast array of alternatives available globally, as evidenced by over 250 billion app downloads in 2024. Advertisers, a crucial revenue source, leverage the crowded digital ad market, where global ad spending exceeded $600 billion in 2023, to negotiate favorable rates. Enterprise clients for AI and robotics, operating within a projected $200 billion global AI market in 2024, negotiate custom solutions due to the strategic importance and volume of their purchases.

| Customer Segment | Primary Leverage Factor | Supporting Data (2023/2024) |

|---|---|---|

| Individual App Users | Low switching costs, abundant alternatives | >250 billion global app downloads (2024) |

| Advertisers | Highly competitive digital ad market | >$600 billion global digital ad spending (2023) |

| Enterprise Clients (AI/Robotics) | High volume, strategic importance, custom needs | >$200 billion global AI market projection (2024) |

Full Version Awaits

Cheetah Mobile Porter's Five Forces Analysis

This preview displays the complete Cheetah Mobile Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the mobile app industry. You're seeing the actual, professionally crafted document that details the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors, all of which will be yours immediately after purchase.

Rivalry Among Competitors

The mobile utility app sector is incredibly crowded, with a vast number of companies, both local and global, providing very similar services such as phone cleaning, security enhancements, and performance optimization. This fierce competition often results in aggressive advertising campaigns, rapid introduction of new features, and price wars, which makes it difficult for any one company to maintain a leading position for long.

The mobile gaming arena is intensely competitive, characterized by escalating user acquisition costs and swift changes in player tastes. Cheetah Mobile contends with global powerhouses, established game developers boasting strong intellectual property, and a vast array of independent studios, all competing for player engagement and in-app purchase revenue.

In 2023, the global mobile gaming market generated approximately $90 billion in revenue, highlighting the immense scale and fierce competition. This market sees constant innovation, with new titles frequently disrupting established player bases, demanding continuous investment in game development and marketing for companies like Cheetah Mobile to remain relevant.

Cheetah Mobile's move into AI and robotics throws it into a fiercely competitive arena. Companies like Google (with DeepMind), Microsoft, and Amazon are pouring billions into AI research and development, creating sophisticated foundational models that could be leveraged across various industries.

Traditional robotics players, such as ABB and KUKA, are also enhancing their AI integration, while nimble AI startups are emerging with niche, cutting-edge solutions. This means Cheetah Mobile faces a multi-front battle for market share and technological leadership.

Success hinges on Cheetah Mobile's ability to truly differentiate its offerings, perhaps through unique applications of its AgentOS or novel robotic designs. For instance, by Q3 2024, the global AI market was projected to reach over $200 billion, highlighting the immense opportunity but also the intense competition for a significant slice of this pie.

Competition for Digital Advertising Spend

Cheetah Mobile, as a company that relies significantly on advertising for its income, faces fierce competition for digital advertising budgets. It contends with numerous digital platforms, such as major social media networks, search engines, and other content creators, all vying for the same advertiser dollars.

The digital advertising market is substantial, with projections indicating it will reach $1.08 trillion in revenue by 2025. This massive market size, however, also signifies an intensely competitive landscape, directly impacting Cheetah Mobile's ability to secure advertising placements and at favorable rates.

- Intense Rivalry: Cheetah Mobile competes with established giants like Google and Meta, as well as emerging platforms, for limited advertiser budgets.

- Market Growth and Competition: The projected $1.08 trillion global digital ad market for 2025 highlights both opportunity and the crowded nature of the space.

- Pressure on Rates: High competition for ad spend can drive down advertising rates and negatively affect fill rates, impacting revenue.

Global and Local Market Dynamics

Cheetah Mobile navigates a complex competitive landscape, with its global operations exposing it to varied pressures across different regions. The company's position as a service robot provider in Italy, for instance, highlights its international reach but also the need to confront local players. These rivals often possess deeper brand loyalty, a more nuanced understanding of local consumer behavior, and more entrenched distribution networks, posing a significant challenge to market share expansion.

The intensity of rivalry is further shaped by the diverse market dynamics Cheetah Mobile encounters. In emerging markets, competition might be driven by price sensitivity and the ability to quickly adapt to evolving technological demands. Conversely, in more mature markets, differentiation through advanced features, robust after-sales support, and strong partnerships becomes paramount. For example, in 2023, the global robotics market saw significant growth, with reports indicating a compound annual growth rate of over 15%, underscoring the high stakes and active competition in this sector.

- Global Reach, Local Challenges: Cheetah Mobile must balance its worldwide strategy with the need to cater to specific regional preferences and competitive strengths.

- Local Competitor Advantages: Established local players often hold an edge due to brand recognition, cultural affinity, and existing distribution channels, making market entry and growth more challenging.

- Market-Specific Strategies: Success hinges on Cheetah Mobile's ability to tailor its offerings and competitive approaches to the unique conditions of each geographical market it operates in.

- Industry Growth Fuels Rivalry: The burgeoning global robotics market, projected to reach hundreds of billions of dollars by the end of the decade, attracts numerous players, intensifying the competitive rivalry for market dominance.

Cheetah Mobile faces intense competition across its diverse business segments, from mobile utilities and gaming to AI and robotics. In the mobile utility sector, numerous companies offer similar services, leading to aggressive marketing and price wars, making it hard for any single player to dominate. Similarly, the mobile gaming market is a battleground of high user acquisition costs and rapidly changing player preferences, with global giants and independent studios all vying for attention.

The digital advertising space, a key revenue stream for Cheetah Mobile, is also highly contested. The company competes with major social media platforms and search engines for a share of the massive digital ad spend, which was projected to reach $1.08 trillion by 2025. This intense rivalry for advertiser budgets can depress ad rates and impact revenue generation.

In the AI and robotics fields, Cheetah Mobile is up against tech behemoths like Google, Microsoft, and Amazon, as well as specialized startups. The global AI market was expected to exceed $200 billion by Q3 2024, indicating both vast opportunity and fierce competition for technological leadership and market share.

Cheetah Mobile's international operations mean it must also contend with strong local competitors in various regions. These local players often benefit from established brand loyalty, a better grasp of regional consumer behavior, and entrenched distribution networks, presenting significant hurdles for market expansion.

| Market Segment | Key Competitors | Competitive Intensity |

|---|---|---|

| Mobile Utilities | Numerous global and local providers | Very High (price wars, feature races) |

| Mobile Gaming | Global powerhouses, established developers, indie studios | Very High (user acquisition costs, taste shifts) |

| Digital Advertising | Social media platforms, search engines, content creators | Very High (competition for ad budgets) |

| AI & Robotics | Tech giants (Google, Microsoft), specialized startups, traditional robotics firms | High (innovation race, massive R&D investment) |

| Robotics (Global Market) | Various international and local players | High (driven by significant market growth) |

SSubstitutes Threaten

The threat of substitutes for Cheetah Mobile's utility apps is significant, primarily stemming from the robust native features integrated into major mobile operating systems like Android and iOS. These platforms are increasingly equipping users with built-in tools for tasks such as device cleaning, security enhancements, file management, and battery optimization.

For instance, Android's "Files by Google" app offers file management and cleaning capabilities, while iOS provides features like "Low Power Mode" and built-in security scans. This growing self-sufficiency of operating systems reduces the perceived necessity for users to download third-party applications for these common functions, directly impacting Cheetah Mobile's user acquisition and retention.

The threat of substitutes for Cheetah Mobile's offerings in mobile gaming and content is significant. Consumers have a vast array of entertainment and information options readily available, making it easy to shift away from Cheetah's products. For instance, in 2024, global mobile game revenue was projected to reach over $90 billion, but this market competes directly with the $250 billion global video streaming market and the trillions spent on other forms of entertainment.

Users can seamlessly transition to console gaming, PC gaming, or engage with platforms like YouTube and Netflix, which offer extensive libraries of content. Social media platforms also consume a considerable amount of user attention, further fragmenting the entertainment landscape. This intense competition necessitates constant innovation from Cheetah Mobile to maintain user engagement and loyalty in a crowded digital space.

For Cheetah Mobile's robotic products, especially their service robots, the most significant substitute is still human labor and traditional manual processes. While robots can boost efficiency and cut costs, many jobs can still be done by people, or companies might stick with older, less automated ways of working.

The choice to invest in robotics often comes down to a careful comparison of costs versus the benefits of current human-led operations. For instance, in 2024, the average hourly wage for a service worker in many developed nations continued to rise, making the long-term cost savings of automation increasingly attractive, though initial capital expenditure remains a hurdle.

General Purpose AI and Chatbots

As artificial intelligence continues its rapid evolution, general-purpose AI assistants and advanced chatbots are emerging as significant substitutes for some of Cheetah Mobile's specialized AI utility functions. These versatile AI solutions, capable of managing diverse tasks such as scheduling, information retrieval, and content creation, could diminish the demand for niche utility applications. By 2025, the widespread integration of AI across various software platforms is a dominant market trend, potentially impacting the market share of single-function AI tools.

The threat of substitutes is amplified by the increasing accessibility and capability of these broader AI platforms. For instance, by mid-2024, major tech companies have rolled out AI assistants that can perform complex functions previously requiring dedicated apps. This trend suggests that users might consolidate their needs into fewer, more comprehensive AI-powered services, thereby reducing reliance on individual utility applications.

- Broad AI capabilities: General AI can perform multiple tasks, reducing the need for specialized apps.

- User consolidation: Consumers may opt for fewer, more versatile AI services.

- Market trend: AI integration across platforms is a key development for 2025.

Web-based Services and Browser Tools

Web-based services and browser tools present a significant threat of substitution for mobile applications. Many utility functions, from document editing to media consumption, can be seamlessly performed directly within a web browser. This bypasses the need for app downloads and installations, offering a more immediate and often lighter-weight alternative for users.

Cloud-based services and browser extensions further bolster this threat by replicating app functionalities. For instance, services like Google Workspace or Microsoft 365 allow users to create and manage documents entirely through their browser, negating the need for dedicated desktop or mobile apps. Similarly, browser extensions can enhance browsing experiences with features like ad-blocking or password management, substituting for specialized apps.

The accessibility and ubiquity of web browsers mean users can access these functionalities across various devices without being tied to specific app ecosystems. This ease of access and the continuous innovation in web technologies make browser-based solutions a compelling substitute, potentially limiting the market share and growth opportunities for standalone mobile applications.

- Browser-based productivity suites offer alternatives to mobile office applications.

- Cloud storage and file management tools accessed via browsers substitute for dedicated file manager apps.

- Online streaming services accessible through web browsers compete with dedicated video or music apps.

The threat of substitutes for Cheetah Mobile's utility apps is substantial, as operating systems like Android and iOS increasingly integrate core functionalities. This means users often don't need third-party apps for tasks like cleaning, security, or battery management. For instance, by mid-2024, major tech companies have rolled out AI assistants capable of performing complex functions previously requiring dedicated apps, potentially leading users to consolidate their needs into fewer, more comprehensive AI-powered services.

Web-based services and browser tools also pose a significant threat, allowing users to perform many tasks without downloading apps. Cloud-based productivity suites and online streaming services accessed via browsers offer immediate, often lighter-weight alternatives. This trend is further supported by the continuous innovation in web technologies, making browser-based solutions a compelling substitute.

| Substitute Category | Examples | Impact on Cheetah Mobile |

|---|---|---|

| Native OS Features | Android's Files by Google, iOS Low Power Mode | Reduces demand for specialized utility apps |

| General AI Platforms | Advanced AI assistants, chatbots | Diminishes need for niche AI utility functions |

| Web-Based Services | Google Workspace, Online streaming via browsers | Bypasses app downloads, offering immediate alternatives |

Entrants Threaten

The threat of new entrants for Cheetah Mobile, particularly concerning basic mobile applications, is significant. Developing and launching simple utility apps or casual games requires relatively low capital investment and technical expertise, thanks to readily available development tools and platforms. This accessibility allows new startups and independent developers to enter the market swiftly, often with minimal overhead.

In 2024, the global mobile app market continued to expand, with over 250 billion app downloads anticipated. This sheer volume, coupled with the ease of creating basic applications, means that Cheetah Mobile faces constant pressure from new, often niche, competitors who can quickly replicate successful functionalities or target underserved user segments. The low cost of app development, with some basic apps costing as little as a few thousand dollars to create, further amplifies this threat.

While the technical barrier to app creation is low, the real hurdle for new entrants lies in acquiring and retaining users, then turning that engagement into profit. For instance, in 2024, the average cost to acquire a mobile app user continued to climb, with some categories exceeding $5 per install, making it incredibly expensive for newcomers to gain traction against established players.

The sheer volume of apps available, estimated to be over 3.5 million on the Google Play Store and 2 million on the Apple App Store as of early 2024, means new apps face immense difficulty in simply getting noticed. This saturation demands significant marketing spend and innovative strategies to capture even a small fraction of user attention, further raising the cost of entry.

Furthermore, building a trusted brand that encourages both consistent usage and willingness to pay for services or in-app purchases is a long and costly process. Newcomers must overcome user inertia and demonstrate clear value propositions to break through the noise, a challenge that often requires substantial upfront investment in user experience and customer support.

Entering the advanced AI and robotics arena, a crucial area for Cheetah Mobile, demands immense capital for research and development. Companies need substantial funding to push the boundaries of innovation in areas like large language models and sophisticated hardware.

Beyond financial muscle, specialized technological know-how is paramount. Expertise in machine learning, AI algorithms, and robotics engineering is not easily acquired, posing a significant hurdle for newcomers. This deep technical knowledge is a key differentiator.

Access to a highly skilled talent pool is another critical barrier. The demand for AI and robotics engineers and researchers is intense, with top talent often tied to established players or commanding premium compensation. For instance, in 2024, the average salary for an AI engineer in the US could exceed $150,000, reflecting the scarcity of such expertise.

Established Brand Loyalty and Network Effects

Established brand loyalty and strong network effects present a significant barrier for new entrants looking to challenge companies like Cheetah Mobile, especially within their established app ecosystems. Users tend to remain loyal to familiar and trusted applications, a sentiment that is particularly pronounced in the digital space where switching costs, though often low in monetary terms, can involve a learning curve or perceived risk. This loyalty translates into a substantial hurdle for newcomers seeking to gain traction.

Furthermore, network effects play a crucial role in reinforcing the dominance of existing players. For Cheetah Mobile, a large and active user base in its legacy apps, such as utility tools or mobile games, naturally attracts more advertisers. This creates a self-perpetuating cycle: more users lead to more advertising revenue, which in turn allows for greater investment in product development and marketing, further solidifying the company's position and making it exceedingly difficult for new entrants to achieve the critical mass of users necessary to compete effectively. For instance, by the end of 2023, Cheetah Mobile reported a significant portion of its revenue still derived from its established utility apps, demonstrating the enduring strength of its user base.

- Brand Loyalty: Users often prefer familiar apps, making it hard for new entrants to attract them.

- Network Effects: Large user bases attract advertisers, creating a virtuous cycle that new players struggle to replicate.

- User Base Critical Mass: Newcomers need to reach a substantial number of users to become viable competitors.

- Advertiser Appeal: Established platforms with high engagement are more attractive to advertisers, providing a revenue advantage.

Regulatory Hurdles and Intellectual Property

As Cheetah Mobile, or any company, delves deeper into advanced fields like artificial intelligence and robotics, the threat of new entrants is amplified by significant regulatory hurdles. For instance, in 2024, global discussions around AI governance intensified, with many nations exploring or implementing stricter regulations concerning data privacy and algorithmic transparency, potentially increasing compliance costs for new players.

Furthermore, the landscape of emerging technologies is often protected by robust intellectual property rights. Established companies, including those in the AI and robotics sectors, typically possess extensive patent portfolios and proprietary algorithms. For example, in 2023, the global AI patent filings saw a substantial increase, with major tech firms leading the charge, creating a formidable barrier for newcomers who would need to navigate or license existing technologies, thereby raising the cost and complexity of market entry.

- Regulatory Scrutiny: New entrants in AI and robotics face increasing compliance burdens related to data privacy, safety, and ethical AI development, as seen in evolving global regulations throughout 2024.

- Intellectual Property Barriers: Extensive patent portfolios and proprietary algorithms held by established firms, evidenced by the surge in AI patent filings in 2023, create significant challenges for new market participants.

- Increased Entry Costs: Navigating complex regulatory frameworks and potentially licensing existing intellectual property significantly raises the financial and operational barriers for new companies entering these advanced technology sectors.

The threat of new entrants for Cheetah Mobile is multifaceted. While basic app development remains accessible, leading to a constant influx of simple utility apps, the real barriers emerge in user acquisition and monetization. For instance, in 2024, the average cost to acquire a mobile app user could exceed $5, making it difficult for newcomers to compete with established players who benefit from brand loyalty and network effects.

In more advanced sectors like AI and robotics, the barriers are substantially higher, demanding significant capital for R&D, specialized technical expertise, and access to a scarce talent pool. For example, the average salary for an AI engineer in the US in 2024 could surpass $150,000, reflecting the high cost of acquiring critical skills.

Furthermore, regulatory scrutiny and intellectual property rights, particularly in AI, create additional hurdles. The surge in AI patent filings in 2023 highlights how established firms protect their innovations, increasing entry costs for new companies needing to navigate or license existing technologies.

| Barrier Category | Description | 2024/2023 Data Point |

|---|---|---|

| Basic App Entry | Low capital and technical requirements for simple apps. | Global app downloads anticipated to exceed 250 billion in 2024. |

| User Acquisition Cost | High cost to attract and retain users against established apps. | Average cost per mobile app install exceeding $5 in some categories. |

| AI/Robotics R&D Investment | Significant capital needed for advanced technology development. | N/A (Industry-wide trend, specific company data not publicly available for R&D spend as a barrier). |

| Talent Acquisition (AI) | High demand and cost for specialized AI engineering talent. | Average US AI engineer salary potentially exceeding $150,000 in 2024. |

| Intellectual Property | Navigating patents and proprietary algorithms in advanced tech. | Substantial increase in global AI patent filings in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cheetah Mobile is built upon a foundation of data from financial statements, analyst reports, and industry-specific market research. We also leverage publicly available company disclosures and news releases to capture competitive dynamics.