Cheetah Mobile Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheetah Mobile Bundle

Curious about Cheetah Mobile's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings might be positioned as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market dominance and potential growth areas, unlock the full report.

Gain a comprehensive understanding of Cheetah Mobile's product landscape with the complete BCG Matrix. This detailed analysis provides the crucial insights needed to make informed decisions about where to invest and which products to nurture or divest.

Don't miss out on the strategic advantages this full BCG Matrix offers for Cheetah Mobile. Purchase now to receive a complete breakdown, actionable recommendations, and a clear roadmap for optimizing their product portfolio and driving future success.

Stars

Cheetah Mobile's AI and Others segment is a standout performer, showcasing robust expansion. In the first quarter of 2025, this segment saw its revenue climb by a substantial 22.9% compared to the previous year, and even more impressively, it accelerated to a 29.8% growth rate on a quarter-over-quarter basis. This strong financial trajectory underscores the company's strategic commitment to this area.

This segment, which includes their ventures into service robots and enterprise AI tools, represents a critical pillar of Cheetah Mobile's future. The company has set an ambitious goal to be recognized among the top three global service robot providers within the next three years, highlighting their aggressive growth strategy and belief in the potential of AI and robotics.

Cheetah Mobile is making substantial investments in agentic AI, a field focused on AI systems that can independently execute tasks. This strategic direction taps into the growing demand for automation and enhanced efficiency across various industries. For instance, the global AI market was valued at approximately $137 billion in 2022 and is projected to reach over $1.8 trillion by 2030, highlighting the immense growth potential.

The company's upcoming release of AgentOS, a next-generation voice interaction system designed for service robots, is a key indicator of their commitment to this high-growth sector. This initiative leverages Cheetah Mobile's extensive experience in bringing technological innovations to market, positioning them to capitalize on the evolving landscape of AI-powered robotics and customer service solutions.

Cheetah Mobile's strategic acquisition of a controlling stake in Shenzhen UFACTORY Technology Co., Ltd. marks a significant push into the collaborative robotics sector. This move, finalized in early 2024, positions Cheetah Mobile to integrate UFACTORY's lightweight robotic arms into its service robot offerings, targeting a high-growth market segment.

This integration is expected to broaden the operational capabilities of Cheetah Mobile's service robots, allowing them to perform a wider array of physical tasks and navigate diverse environments. The global collaborative robot market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, with UFACTORY being a notable player in this expansion.

AI-Enhanced Ad Targeting

AI-enhanced ad targeting is a significant driver within Cheetah Mobile's Internet business, fueling impressive growth. In the first quarter of 2025, this segment saw a robust 46.0% year-over-year revenue increase, directly attributable to these advanced capabilities.

By harnessing their extensive user data and sophisticated AI algorithms, Cheetah Mobile is effectively capturing a greater portion of the digital advertising market. This strategic focus allows them to offer more valuable solutions to advertisers, leading to improved performance and profitability.

- Revenue Growth: Internet business revenue up 46.0% year-over-year in Q1 2025.

- AI Application: Leverages vast user data with advanced AI for ad targeting.

- Market Position: Capturing larger share of digital advertising market.

- Value Proposition: Offers higher-value ad solutions to clients.

New Mobile Game Titles (High Performing)

If Cheetah Mobile were to introduce a new mobile game that rapidly achieves substantial popularity and market dominance within a burgeoning game category, it would be classified as a Star. This hypothetical game would require ongoing investment in promotion and feature enhancement to sustain its leading status and capitalize on further expansion opportunities.

The company's broader internet services have demonstrated strong performance, indicating a favorable environment for the emergence of new successful game titles. For instance, in the first quarter of 2024, Cheetah Mobile reported continued growth in its user base and engagement metrics across its internet products, underscoring the potential for new ventures to thrive.

- Market Potential: A new hit mobile game could tap into the global mobile gaming market, which is projected to reach over $270 billion by 2025, according to industry analysis from Newzoo.

- Investment Needs: To maintain its Star status, significant resources would be allocated to game updates, new content, and aggressive marketing campaigns to fend off competitors.

- Revenue Generation: Successful games often employ in-app purchases and advertising models, contributing significantly to revenue, especially in genres with high player retention.

- Strategic Importance: A Star title would bolster Cheetah Mobile's portfolio, enhancing its brand reputation and providing a strong foundation for future product development.

A Star in the Cheetah Mobile BCG Matrix represents a product or business unit with high market share in a high-growth industry. If Cheetah Mobile were to launch a new mobile game that quickly gains significant traction and dominates a growing gaming genre, it would fit this category. Such a game would require continuous investment to maintain its leading position and capitalize on further growth opportunities.

The company's existing internet services have shown strong performance, suggesting a fertile ground for new, successful game ventures. For example, Cheetah Mobile reported consistent growth in user base and engagement across its internet products in the first quarter of 2024, highlighting the potential for new initiatives to flourish.

A hypothetical hit mobile game would tap into the expansive global mobile gaming market, which is anticipated to surpass $270 billion by 2025. To sustain its Star status, this game would necessitate substantial investment in updates, new content, and marketing to stay ahead of competitors. Successful games typically generate revenue through in-app purchases and advertising, particularly in genres that foster high player retention.

What is included in the product

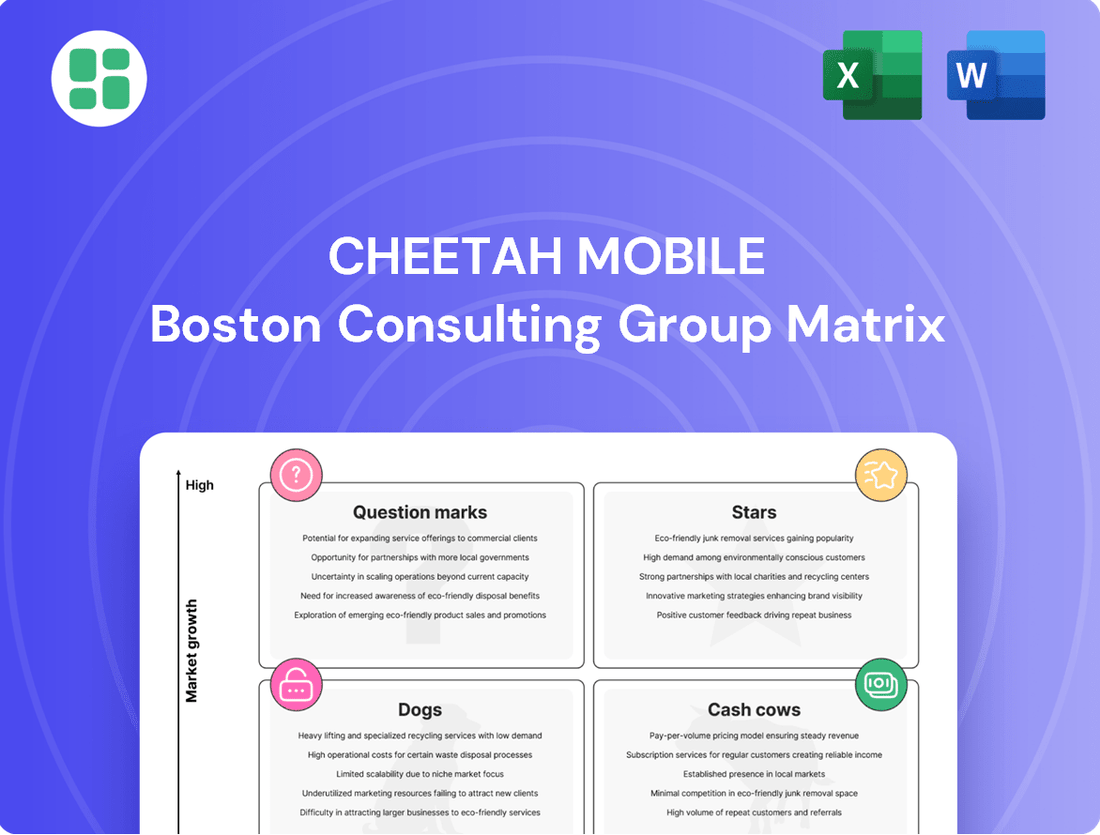

This BCG Matrix analysis identifies Cheetah Mobile's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic recommendations on investment, holding, or divestment for each business unit.

Quickly identify underperforming Cheetah Mobile business units with a clear BCG Matrix visualization.

Streamline strategic decision-making by instantly pinpointing which Cheetah Mobile products need attention.

Cash Cows

Established Internet Advertising Services, a core component of Cheetah Mobile's business, continues to be a significant revenue generator. This segment, while not experiencing the rapid growth of newer ventures, provides a stable and substantial cash flow. In 2023, Cheetah Mobile reported that its internet advertising and related services continued to be a primary contributor to its overall financial performance, underpinning its strategic pivot towards AI and robotics.

This mature business line leverages Cheetah Mobile's established user base, maintaining a strong market share within its particular advertising niche. The consistent revenue from these services acts as the essential financial backbone, enabling the company to fund its more innovative and future-oriented research and development initiatives. The company's financial disclosures highlight the predictable nature of this income, a hallmark of a successful Cash Cow.

Cheetah Mobile's premium membership offerings, integrated across its diverse application portfolio, represent a significant cash cow. These subscriptions provide a steady stream of recurring revenue with minimal incremental marketing spend, highlighting their role as a stable, cash-generating asset within the company's business structure.

Cheetah Mobile's Multi-Cloud Management Platform Services are a prime example of a Cash Cow within their business portfolio. This B2B offering provides a consistent and dependable revenue stream, catering to businesses worldwide that rely on managing diverse cloud environments.

The platform likely operates in a mature market, characterized by established client relationships and predictable revenue generation. This stability is crucial, offering a solid financial foundation that can support the company's investments in newer, higher-growth areas, such as their AI initiatives. For instance, the global multi-cloud management market was valued at approximately $5.8 billion in 2023 and is projected to reach $15.2 billion by 2028, indicating a steady, albeit not explosive, growth trajectory.

Legacy Content Distribution Channels

Cheetah Mobile's legacy content distribution channels act as its cash cows within the BCG framework. These channels leverage the company's established global network to promote content for business partners, generating steady revenue. While not experiencing rapid expansion, this segment provides a reliable income stream, supported by existing partnerships and the platform's enduring reach.

In 2024, these channels continued to be a significant contributor to Cheetah Mobile's financial stability. For instance, the company reported that its content distribution services consistently generated a substantial portion of its overall revenue, demonstrating their role as dependable income generators. This stability is crucial for funding investments in other areas of the business.

- Consistent Revenue: The content distribution channels provide a predictable and stable income stream for Cheetah Mobile.

- Established Network: These channels benefit from Cheetah Mobile's existing global infrastructure and partner relationships.

- Mature Service: While not a high-growth area, the service is well-established and continues to deliver value.

- Financial Contribution: In 2024, these channels represented a significant and reliable source of the company's revenue.

Existing Service Robot Deployments

Existing service robot deployments represent a significant cash cow for Cheetah Mobile. The revenue generated from these operational units, encompassing service fees, maintenance contracts, and ongoing subscriptions, provides a stable and predictable income stream. This consistent financial inflow is crucial for fueling innovation and further investment in the company's burgeoning AI and robotics initiatives.

For instance, by the end of 2023, Cheetah Mobile's service robot segment reported a substantial contribution to overall revenue, demonstrating the maturity and profitability of these established deployments. These cash cows are vital for underwriting the high costs associated with research and development in cutting-edge fields like artificial intelligence and advanced robotics, areas poised for significant growth in the coming years.

- Predictable Revenue: Established service robot deployments generate consistent income from services, maintenance, and subscriptions.

- Funding for Innovation: Profits from these cash cows are reinvested into AI and robotics development.

- Market Stability: Existing deployments offer a reliable revenue base amidst market fluctuations.

- Operational Efficiency: Mature robot fleets often benefit from economies of scale, further boosting profitability.

Cheetah Mobile's established internet advertising services continue to be a significant cash cow, providing a stable and substantial revenue stream. This mature segment, while not experiencing explosive growth, underpins the company's financial stability, allowing for investment in newer ventures like AI and robotics. In 2023, these services remained a primary contributor to Cheetah Mobile's overall financial performance.

The company's premium membership offerings across its application portfolio also function as cash cows. These subscriptions generate a consistent, recurring revenue with minimal additional marketing costs, solidifying their role as reliable cash-generating assets. This predictable income is crucial for supporting the company's strategic pivot.

Cheetah Mobile's Multi-Cloud Management Platform Services are a key B2B cash cow, offering a dependable revenue stream to global businesses. Operating in a mature market, this service benefits from established client relationships and predictable income, providing a solid financial foundation. The global multi-cloud management market was valued at approximately $5.8 billion in 2023, with steady projected growth.

Legacy content distribution channels act as vital cash cows, leveraging Cheetah Mobile's established global network. These channels generate steady revenue through content promotion for business partners, providing a reliable income stream supported by existing partnerships. In 2024, these channels significantly contributed to the company's financial stability.

Existing service robot deployments are another crucial cash cow, generating consistent income from service fees, maintenance, and subscriptions. This predictable revenue is vital for funding innovation and investment in the company's AI and robotics initiatives. By the end of 2023, the service robot segment reported a substantial revenue contribution, highlighting its profitability.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Financial Insight |

| Internet Advertising Services | Cash Cow | Stable revenue, mature market, leverages existing user base | Primary contributor to overall financial performance |

| Premium Membership Offerings | Cash Cow | Recurring revenue, low incremental marketing spend, stable asset | Consistent stream of income |

| Multi-Cloud Management Platform Services | Cash Cow | Dependable B2B revenue, established client relationships, mature market | Provided a solid financial foundation; market valued at $5.8B in 2023 |

| Legacy Content Distribution Channels | Cash Cow | Steady revenue, leverages established global network, reliable income | Significant contributor to financial stability in 2024 |

| Existing Service Robot Deployments | Cash Cow | Predictable income from services/maintenance, funds innovation | Substantial revenue contribution by end of 2023 |

What You See Is What You Get

Cheetah Mobile BCG Matrix

The Cheetah Mobile BCG Matrix preview you're seeing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring a professional and ready-to-use strategic tool.

Rest assured, the Cheetah Mobile BCG Matrix document you are previewing is the exact same comprehensive analysis that will be delivered to you upon purchase. It's a complete, market-backed report designed for immediate application in your business strategy, with no hidden surprises.

What you see is precisely the Cheetah Mobile BCG Matrix file you’ll acquire once you complete your purchase. This allows you to immediately access and utilize a professionally designed, analysis-ready document for your strategic planning needs.

Dogs

Cheetah Mobile's once-dominant utility apps like Clean Master and CM Security have fallen into a difficult position. These apps, which were once very popular for optimizing phone performance, were removed from the Google Play Store in 2020 due to policy violations. This significantly limited their availability and user base.

Consequently, these apps now hold a very small market share in a sector that is generally shrinking. The market for standalone phone optimization apps isn't growing like it used to, as many features are now built into operating systems. This makes them less appealing and harder to monetize, essentially becoming cash traps for the company.

Games within Cheetah Mobile's portfolio that haven't captured substantial user interest or are experiencing reduced engagement and income would be categorized in the 'Dogs' quadrant of the BCG Matrix. These titles often struggle in a crowded and rapidly evolving mobile gaming landscape, characterized by limited growth potential and a small market share.

For instance, if a particular game saw its monthly active users drop by over 50% year-over-year in 2024, and its revenue contribution to Cheetah Mobile's gaming segment fell below 1%, it would likely be classified as a 'Dog'. Such games typically require significant investment to maintain, with little prospect of future returns.

Outdated PC internet security products, such as older versions of Duba Anti-virus if not actively updated, would likely fall into the Dogs category of the BCG Matrix. These products operate in a mature or declining market with low growth and a shrinking user base, leading to minimal market share for Cheetah Mobile.

Such legacy software typically generates very little revenue. Furthermore, the cost to maintain and update these products to remain even minimally competitive would likely outweigh the returns, requiring disproportionate investment for little gain.

Given their low market share and low growth prospects, these products are prime candidates for divestiture. Cheetah Mobile would be better served by focusing resources on more promising areas of its business rather than investing in products that are unlikely to generate significant future value.

Unsuccessful Content-Driven Products

If certain content-driven products launched by Cheetah Mobile failed to attract a substantial audience or generate sufficient advertising revenue, they would be classified as Dogs in the BCG Matrix. These products would consume valuable resources without providing adequate returns, especially in a highly saturated content market. For instance, if a new video platform launched in 2024 by Cheetah Mobile only garnered a few thousand daily active users by mid-year and struggled to secure any significant advertising partnerships, it would likely fall into this category. This situation highlights the challenges of breaking through in a competitive landscape where user attention is fragmented.

These underperforming assets would represent a drain on the company's financial and operational capacity. Consider a scenario where Cheetah Mobile invested heavily in developing and marketing a news aggregation app in early 2024. If, by the third quarter of 2024, this app had a user retention rate below 10% and generated less than $50,000 in ad revenue, it would be a prime example of a Dog. Such products require continuous investment in maintenance and updates but offer little prospect of future growth or profitability.

- Resource Drain: Products in the Dog quadrant consume capital and management attention without contributing meaningfully to revenue or market share.

- Low Growth, Low Share: These offerings typically operate in mature or declining markets with minimal competitive advantage.

- Strategic Review: Companies often consider divesting, discontinuing, or significantly restructuring Dog products to reallocate resources to more promising ventures.

Any Divested or Phased-Out Products

Cheetah Mobile has strategically divested or phased out products that no longer align with its AI-focused growth strategy. This rationalization addresses underperforming assets and low user adoption, allowing the company to concentrate resources on more promising ventures.

For instance, while specific financial data for divested products isn't always publicly detailed, the company's shift away from certain utility apps and games reflects a broader trend of optimizing its portfolio. This move is critical as Cheetah Mobile pivots towards AI-driven services, aiming for higher engagement and revenue streams.

- Divestment of Non-Core Assets: Cheetah Mobile has actively streamlined its product offerings, moving away from legacy applications that showed diminishing returns.

- Focus on AI and Emerging Technologies: The company's strategic direction prioritizes AI-powered tools and services, necessitating the phasing out of older, less relevant products.

- Market Relevance and Performance: Products with declining user bases or those that failed to gain significant traction in competitive markets have been systematically retired.

- Resource Reallocation: By shedding underperforming assets, Cheetah Mobile can better allocate capital and talent towards its AI initiatives, such as its AI-powered content platforms and smart hardware.

Products classified as 'Dogs' within Cheetah Mobile's portfolio represent offerings with low market share and low growth prospects. These are typically legacy products or newer ventures that failed to gain traction. For example, an older PC antivirus software with a shrinking user base and minimal revenue contribution would fit this category. Similarly, a mobile game launched in 2024 that failed to attract a significant player base, perhaps seeing less than 50,000 monthly active users by the end of the year, would also be considered a Dog.

These underperforming assets often consume resources without generating substantial returns, making them candidates for divestment or discontinuation. Cheetah Mobile's strategic shift towards AI-driven services means that products not contributing to this vision are re-evaluated. A content platform launched in early 2024, for instance, if it only managed to secure a few thousand daily active users and minimal advertising revenue by Q3 2024, would be a clear example of a Dog.

The company's approach involves shedding these low-performing products to reallocate capital and management focus to more promising AI-related ventures. This strategic pruning is essential for optimizing the overall business portfolio and driving future growth.

Question Marks

Cheetah Mobile is investing heavily in the development of its own Large Language Models (LLMs). This positions them within a rapidly expanding market, but their LLM products are likely in early development.

Given their newness, these LLMs probably have low current market share and face uncertain customer adoption. This means significant investment is needed to establish their value and market presence in the competitive AI landscape.

Cheetah Mobile's strategic exploration into niche AI-driven solutions represents a bold move into markets with currently limited traction but significant future promise. These ventures, akin to question marks in the BCG matrix, are characterized by substantial research and development investments with uncertain outcomes. For instance, imagine AI solutions tailored for hyper-specific agricultural needs or specialized diagnostic tools for rare medical conditions; these areas demand deep expertise and could be game-changers if successful.

The company is likely channeling significant capital into these nascent AI applications, a common trait of question mark investments. This high expenditure on R&D, without guaranteed returns, is a defining feature. By 2024, the global AI market was projected to reach hundreds of billions of dollars, with specialized AI segments showing even faster growth rates, underscoring the potential rewards for those who can successfully navigate these complex niches.

Early-stage robotics products emerging after UFACTORY integration, especially those venturing into novel sub-markets, would initially be classified as Question Marks within the BCG Matrix. These offerings require substantial investment to foster market acceptance and achieve scalability, with their ultimate success still uncertain. For instance, if Cheetah Mobile launched a new collaborative robot arm designed for intricate micro-assembly tasks in the electronics sector, it would be a prime candidate for this category.

Expansion into New Geographic Markets for AI/Robotics

Cheetah Mobile's strategic push into new geographic markets for its AI and robotics offerings positions these ventures as Question Marks within the BCG Matrix. This classification stems from the significant upfront capital required for adapting products to local needs, establishing distribution channels, and building brand awareness in unfamiliar territories. For instance, entering the European market might necessitate compliance with stringent data privacy regulations like GDPR, adding to initial costs.

The uncertainty surrounding initial market penetration and revenue generation is a hallmark of Question Mark products. While the global service robot market is projected to reach approximately $33.7 billion by 2024, according to Statista, the specific share Cheetah Mobile can capture in each new region remains to be seen. High initial investment in localization, marketing, and infrastructure development, coupled with the challenge of gaining an initial market share, underscores the Question Mark status.

- High Investment: Entering new markets demands substantial expenditure on product localization, regulatory compliance, and building operational infrastructure.

- Uncertain Market Share: Initial adoption rates and competitive responses in new territories are difficult to predict, leading to an unknown market share.

- Potential for Growth: Despite the risks, successful expansion into these markets could lead to significant future growth and market leadership for Cheetah Mobile's AI and robotics solutions.

Unannounced Future AI Ventures

Cheetah Mobile's dedication to AI and robotics development implies exploration of unannounced ventures. These nascent AI projects, likely targeting high-growth markets, currently possess no market share. Consequently, they fit the profile of Question Marks within the BCG Matrix, demanding careful evaluation for continued investment or divestment.

These emerging AI initiatives represent significant future potential but also carry substantial risk. Cheetah Mobile's 2023 financial reports show a continued focus on R&D, with investments in areas like intelligent hardware and AI technologies. The specific allocation to these unannounced ventures is not detailed, but the overall commitment underscores their strategic importance.

- High Growth Potential: Targeting emerging AI applications with significant future market expansion.

- Zero Market Share: Currently unproven in the market, carrying inherent risk.

- High Investment Need: Require substantial R&D funding to reach commercial viability.

- Strategic Decision Point: Future investment levels depend on market validation and competitive landscape analysis.

Cheetah Mobile's investments in nascent AI technologies and new market ventures are prime examples of Question Marks in the BCG Matrix. These initiatives require substantial capital for research, development, and market entry, with uncertain future returns.

For instance, the company's exploration into specialized AI solutions for niche industries, like advanced agricultural analytics or personalized medical diagnostics, represents high-risk, high-reward opportunities. These areas demand significant upfront investment to establish a foothold and prove market viability.

The global AI market was projected to reach over $200 billion in 2024, with specialized segments experiencing even more rapid growth. Cheetah Mobile's strategic positioning in these emerging areas, while currently unproven, highlights a commitment to capturing future market share, albeit with considerable uncertainty.

These ventures are characterized by high investment needs and an unknown market share, making them classic Question Marks. Success hinges on effective R&D, market adoption, and competitive positioning, with the potential to evolve into Stars or Dogs depending on their performance.

BCG Matrix Data Sources

Our Cheetah Mobile BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.