Clariane SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariane Bundle

Clariane's market position is shaped by a unique blend of strengths, like its established brand in senior care, and potential weaknesses, such as operational complexities. Understanding these internal dynamics is crucial for navigating the evolving healthcare landscape.

Their opportunities lie in expanding service offerings and leveraging technological advancements, while threats could emerge from increased competition and regulatory changes. Don't miss out on the complete picture; purchase the full SWOT analysis to gain actionable insights and strategic takeaways.

Ready to dive deeper into Clariane's strategic landscape? Our comprehensive SWOT analysis provides the detailed breakdowns and expert commentary you need to inform your planning, pitches, and research. Invest in clarity and unlock your strategic advantage today.

Strengths

Clariane SE stands as a prominent European leader in long-term care, boasting an extensive network of 1,220 facilities and housing nearly 91,000 beds. This significant operational footprint spans key European markets, including France, Germany, Benelux, Italy, and Spain, underscoring its deep regional penetration and established presence.

This broad geographical reach, coupled with a diversified portfolio of services encompassing nursing homes, specialized clinics, and assisted living, provides Clariane with a robust foundation. Such diversification enhances its resilience against localized market downturns and strengthens its overall competitive standing within the European healthcare sector.

Clariane has shown impressive strength in its organic revenue growth. In 2024, the company achieved €5,282 million in revenue, a solid 6.6% increase organically, exceeding its yearly goal. This demonstrates a strong operational recovery and effective management.

The positive trend has carried into the first half of 2025, with organic growth reaching 4.8%. This sustained performance points to consistent demand for Clariane's services and its ability to capitalize on market opportunities.

Looking ahead, Clariane is projecting continued momentum, anticipating approximately 5% organic revenue growth for the entirety of 2025. This outlook underscores the company's robust business model and its capacity for sustained expansion.

Clariane's commitment to superior care and employee welfare is underscored by its 'Top Employer 2025' certification throughout Europe and in six significant nations. This recognition speaks volumes about the company's internal culture and its dedication to fostering a positive work environment.

The company's strong performance in 2024, particularly its non-financial results, directly supports its 2024-2026 CSR roadmap. Achieving a Net Promoter Score (NPS) of +44 demonstrates exceptional satisfaction among patients and residents, a key indicator of high-quality service delivery.

Further reinforcing its responsible approach, Clariane has successfully validated its low-carbon energy roadmap. This initiative highlights the company's proactive stance on sustainability and its integration of environmental considerations into its core operations.

Strengthened Financial Position

Clariane has significantly bolstered its financial standing by completing its €1.5 billion strengthening plan ahead of schedule. This proactive move, finalized in early 2024, has already resulted in a substantial reduction of its net debt by €212 million as of June 2024.

The plan's success was driven by two key components: €1 billion generated from asset disposals and a successful €400 million unsecured bond issuance. The bond offering was particularly strong, being oversubscribed by more than three times, demonstrating robust investor confidence.

These strategic financial maneuvers have markedly improved Clariane's financial leverage ratios. Furthermore, they have secured the company's access to essential funding, thereby enhancing its overall long-term stability and operational resilience.

- €1.5 billion financial strengthening plan completed early.

- Net debt reduced by €212 million (as of June 2024).

- €1 billion from disposals and €400 million bond issuance.

- Bond issue was over 3x oversubscribed.

Improved Occupancy Rates

Clariane has demonstrated a significant upward trend in its nursing home occupancy rates. By the first quarter of 2025, the company achieved an occupancy rate of 90.4%, which then climbed to 90.5% by the first half of the year. This positive momentum continued, with occupancy surpassing 91% by late July 2025.

This consistent improvement highlights robust demand for Clariane's care services and effective management of its facilities. The increasing occupancy directly translates to better revenue generation and operational efficiency across its network.

- 90.4% occupancy in Q1 2025

- 90.5% occupancy in H1 2025

- Over 91% occupancy by late July 2025

Clariane's strengths lie in its expansive European network, providing a solid foundation for growth and resilience. The company's commitment to quality care is evidenced by its 'Top Employer 2025' certification and a high Net Promoter Score of +44 in 2024, reflecting strong patient and resident satisfaction. Furthermore, its successful €1.5 billion financial strengthening plan, completed ahead of schedule in early 2024, significantly reduced debt and improved financial stability.

The company's operational performance is robust, with organic revenue growth exceeding targets in 2024 (6.6%) and continuing into 2025 (4.8% in H1). Nursing home occupancy rates have steadily increased, surpassing 91% by late July 2025, indicating strong demand and effective facility management.

| Metric | 2024/2025 Data | Significance |

| European Network | 1,220 facilities, ~91,000 beds | Extensive market penetration and scale |

| Organic Revenue Growth (2024) | 6.6% | Exceeded yearly goal, demonstrating operational recovery |

| Organic Revenue Growth (H1 2025) | 4.8% | Sustained performance and market capitalization |

| Net Promoter Score (2024) | +44 | High patient/resident satisfaction, indicative of quality care |

| Occupancy Rate (July 2025) | >91% | Strong demand and efficient facility management |

| Debt Reduction (June 2024) | €212 million | Improved financial leverage and stability |

What is included in the product

Delivers a strategic overview of Clariane’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Clariane's strategic challenges and leverage opportunities.

Weaknesses

Clariane faces a significant hurdle with its persistent net losses, reporting a €55 million deficit in 2024 and a €59 million loss in the first half of 2025. This ongoing profitability pressure, despite robust revenue growth, highlights challenges in converting sales into actual profit.

Further compounding these issues, the company's pro forma EBITDA saw a 4.1% decline in H1 2025. This downward trend in a key profitability metric suggests that operational efficiencies and cost control measures may require more aggressive implementation to improve the bottom line.

Clariane's net financial debt, while reduced, stood at a substantial €3.559 billion as of June 30, 2025. This significant debt burden, even with a deleveraging plan in place, continues to pose a challenge. It necessitates careful financial management and could potentially restrict the company's ability to pursue new investments or expand its operations, especially if economic headwinds or rising interest rates emerge.

The Wholeco leverage ratio, though improved, remains a key focus for further reduction. This ongoing need to decrease leverage highlights the persistent pressure on Clariane's financial structure. Successfully lowering this ratio is crucial for enhancing financial flexibility and strengthening the company's balance sheet for future growth initiatives.

The implementation of a new pricing framework for medical, post-acute, and rehabilitation services in France has created a significant hurdle for Clariane, directly impacting its financial performance. This regulatory shift led to a negative effect on profitability and operating cash flow during the first half of 2025. For instance, the company reported a €15 million impact on EBITDA in H1 2025 due to this pricing adjustment.

This situation highlights Clariane's susceptibility to specific national healthcare policy changes, demonstrating a key weakness in its operational resilience. Such reforms, while intended to reshape the healthcare landscape, can introduce unforeseen financial pressures and require swift adaptation from providers like Clariane.

Impact of Asset Disposals on Operational Scope

Clariane's €1 billion asset disposal program, a key move to bolster its financial health, has inevitably shrunk its operational footprint. This strategic divestment, which included the sale of its home hospitalization business and other facilities, has reduced the number of locations and concentrated the Group's geographical reach and core business activities.

This deliberate reduction in scale, while financially prudent, could potentially constrain Clariane's immediate operational capacity and limit avenues for future organic growth in specific markets or service lines. For instance, the divestment of certain facilities might mean a smaller presence in previously served regions, impacting market share in those areas.

- Reduced Facility Count: The asset disposal program directly led to a decrease in the total number of operational facilities.

- Geographical and Business Refocusing: The sales have narrowed the company's geographical presence and its range of business activities.

- Potential Growth Limitation: The reduction in operational scale might curb immediate organic growth opportunities in divested segments or regions.

Sensitivity to Macroeconomic Factors

Clariane's financial health is notably susceptible to macroeconomic shifts. The company's 2024 financial strengthening plan was a direct response to a more challenging economic landscape, marked by escalating inflation and increased interest rates.

This sensitivity means that fluctuations in the broader economy can directly affect Clariane's operational costs and its ability to secure favorable financing. For instance, higher interest rates can increase the cost of debt, impacting profitability and investment capacity.

Furthermore, the real estate market, a key component of Clariane's business, is also vulnerable to these economic headwinds. A downturn in the real estate sector, potentially triggered by rising interest rates or reduced consumer spending, could negatively impact the valuation of Clariane's property portfolio and its overall financial standing.

- Inflationary Pressures: Rising inflation directly increases operational expenses for Clariane, from utilities to supplies, squeezing profit margins.

- Interest Rate Sensitivity: Higher interest rates make borrowing more expensive, impacting Clariane's ability to finance new projects or manage existing debt.

- Real Estate Market Volatility: Economic downturns can depress real estate values, potentially affecting the asset base and valuation of Clariane's properties.

Clariane's persistent net losses remain a significant weakness, with the company reporting a €55 million deficit in 2024 and a €59 million loss in the first half of 2025. This indicates ongoing challenges in translating revenue into profitability, further evidenced by a 4.1% decline in pro forma EBITDA in H1 2025. The company's substantial net financial debt, standing at €3.559 billion as of June 30, 2025, also presents a considerable financial burden, potentially limiting strategic flexibility and investment capacity.

| Metric | Value (H1 2025) | Year End 2024 |

|---|---|---|

| Net Loss | €59 million | €55 million |

| Pro Forma EBITDA | -4.1% Change | N/A |

| Net Financial Debt | €3,559 million (as of June 30, 2025) | N/A |

Preview the Actual Deliverable

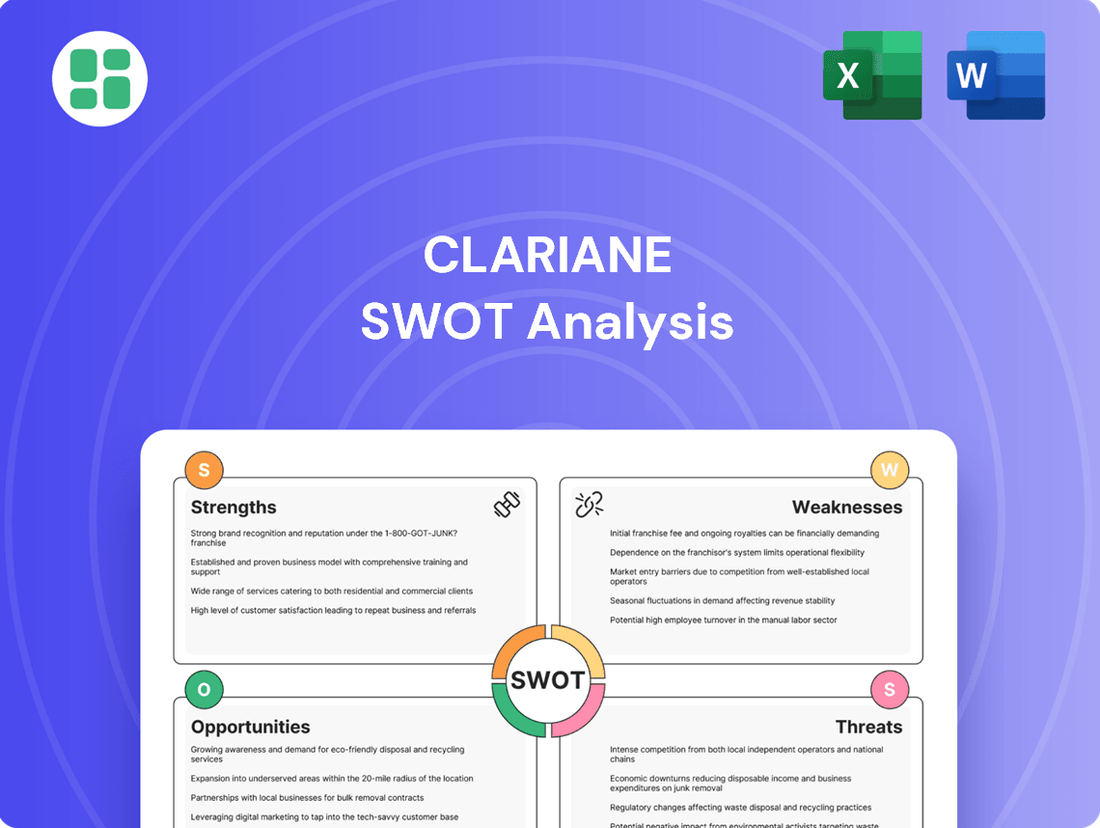

Clariane SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Clariane SWOT analysis, providing a clear understanding of its strengths, weaknesses, opportunities, and threats. The full, detailed report is unlocked immediately upon purchase.

Opportunities

Europe's demographic shift towards an older population presents a substantial opportunity for Clariane. By 2030, the number of people aged 65 and over in the EU is expected to reach 139.7 million, a notable increase that directly translates to higher demand for the long-term care services Clariane specializes in, such as nursing homes and assisted living facilities.

Clariane's established footprint across Europe provides a strategic advantage for tapping into burgeoning long-term care markets. For instance, Italy's aging population is projected to drive significant growth, with the market expected to expand at a compound annual growth rate of approximately 5% between 2024 and 2029, according to recent industry forecasts.

This presents a clear opportunity for Clariane to focus investment on expanding its facility network and enhancing its service offerings in such high-potential regions. By strategically targeting markets like Italy, which anticipates a substantial increase in demand for elder care services, Clariane can solidify its market position and capture increased revenue streams.

Clariane can capitalize on the increasing adoption of technologies like robotics and advanced assistive devices. These innovations offer a significant opportunity to boost productivity, elevate the standard of care provided, and reduce the physical burden on healthcare professionals. For instance, the global market for assistive robots was projected to reach $4.2 billion in 2024, highlighting the growing integration of such technologies in care settings.

By continuing its digital transformation, Clariane is well-positioned to seamlessly integrate these cutting-edge solutions. This strategic move can streamline operational efficiency, contribute to improved patient outcomes, and ultimately solidify its competitive standing in the evolving healthcare landscape.

Diversification into Community and Outpatient Care

The European long-term care market is increasingly shifting towards home healthcare and community-based services, which already constitute the largest revenue segment. Clariane has a significant opportunity to broaden its service portfolio within these burgeoning areas, specifically focusing on community care and outpatient services. This strategic expansion aligns with evolving patient preferences and current market trends, allowing Clariane to diversify its revenue streams beyond its traditional residential care model.

This diversification is supported by market data indicating robust growth in home care. For instance, the European home care market was projected to reach over €100 billion by 2024, with community care services forming a substantial portion of this. By investing in and expanding its community and outpatient offerings, Clariane can capture a larger share of this growing market.

- Market Growth: The European home and community care sector is a significant and expanding market, offering substantial revenue potential.

- Patient Preference: There's a clear trend towards receiving care outside of traditional residential facilities, favoring community and home-based solutions.

- Revenue Diversification: Expanding into these areas reduces reliance on residential care, creating a more resilient business model for Clariane.

- Service Innovation: This move allows Clariane to offer a more comprehensive suite of services, catering to a wider range of patient needs and acuity levels.

Strategic Partnerships and Investment

The nursing home real estate market is seeing renewed interest from institutional investors and specialized funds, drawn by its stable investment profile. This resurgence in liquidity offers Clariane a prime opportunity to cultivate strategic partnerships and attract new investment. For instance, in 2024, the European senior living real estate market saw significant transaction volumes, with a notable portion driven by institutional capital seeking long-term, predictable returns.

Clariane can leverage this market dynamic to explore sale-and-leaseback arrangements. These transactions would allow the company to monetize its existing real estate assets, thereby unlocking capital. This freed-up capital can then be strategically reinvested into enhancing operational capabilities and driving growth across its network of facilities.

The potential benefits for Clariane are substantial:

- Access to Capital: Sale-and-leaseback deals can provide immediate liquidity, bolstering financial flexibility.

- Strategic Alliances: Partnerships with institutional investors can bring not only capital but also operational expertise and market insights.

- Portfolio Optimization: Engaging with investors can lead to a more efficient and performance-driven real estate portfolio.

- Enhanced Growth Funding: The generated capital can fuel expansion, modernization, and service improvements, crucial for staying competitive in the evolving eldercare sector.

Clariane can leverage the increasing demand for specialized care, such as dementia and palliative care, which are experiencing robust growth. The market for specialized elderly care services in Europe is projected to grow by over 7% annually through 2027, presenting a significant opportunity for Clariane to expand its niche offerings and cater to specific, high-need patient populations.

The company can also capitalize on the growing trend of integrated care models, where healthcare providers collaborate more closely. By fostering partnerships with hospitals and community health services, Clariane can create a more seamless patient journey and secure a steadier stream of referrals. For example, pilot programs in Germany in 2024 demonstrated a 15% reduction in hospital readmissions when integrated care pathways were implemented for elderly patients.

This strategic alignment with integrated care initiatives allows Clariane to enhance its value proposition and secure its position within the broader healthcare ecosystem, potentially leading to increased occupancy and service utilization.

Furthermore, Clariane has an opportunity to enhance its service offerings through technological integration, particularly in areas like telehealth and remote patient monitoring. The adoption of these technologies can improve patient engagement and operational efficiency. The European telehealth market alone was valued at approximately €20 billion in 2024, with strong growth expected in the coming years.

| Opportunity Area | Market Trend | Potential Impact for Clariane | Supporting Data (2024-2025) |

|---|---|---|---|

| Specialized Care | Growing demand for dementia and palliative care | Increased revenue and market share in niche segments | Annual growth of over 7% in specialized elderly care services |

| Integrated Care Models | Collaboration between healthcare providers | Improved patient referrals and reduced readmissions | 15% reduction in hospital readmissions in pilot programs |

| Technological Integration | Adoption of telehealth and remote monitoring | Enhanced patient engagement and operational efficiency | European telehealth market valued at €20 billion |

Threats

Clariane operates within a highly regulated long-term care sector, making it susceptible to shifts in national healthcare policies and pricing structures. For instance, recent experiences in France have highlighted how changes in these areas can directly affect the company's revenue and profitability. Unfavorable reforms or delays in tariff adjustments can create significant financial challenges, necessitating swift operational adjustments to mitigate the impact.

Clariane, like many in the European long-term care sector, grapples with ongoing workforce shortages. This is largely due to historically low wages and the inherently demanding nature of the work, making it difficult to attract and retain qualified staff. For instance, in France, a significant portion of healthcare professionals in the sector have expressed dissatisfaction with their compensation and working conditions, contributing to a high turnover rate.

These persistent staffing issues directly translate into rising labor costs as competition for skilled caregivers intensifies. Clariane may need to offer higher salaries and improved benefits to secure adequate staffing levels, potentially impacting its operating margins. Failure to maintain sufficient staffing could also compromise the quality of care provided, posing a risk to resident well-being and the company's reputation.

Economic downturns and persistent high inflation, leading to continued interest rate volatility, present a significant threat to Clariane. For instance, if interest rates remain elevated throughout 2024 and into 2025, Clariane's debt servicing costs would likely increase, impacting profitability. A challenging real estate market, potentially triggered by economic contraction, could also devalue Clariane's property assets and hinder its ability to execute planned disposals, thereby limiting investment capacity.

Reputational Risks and Public Scrutiny

Clariane, operating in the sensitive healthcare and elderly care sector, faces significant reputational risks. Public perception is paramount, and any perceived lapse in care quality or operational standards can lead to swift and damaging scrutiny, reminiscent of past 'sectoral turbulence' that impacted the industry.

Maintaining unwavering public trust is not just about good practice; it's a critical business imperative. Failure to uphold stringent quality standards can result in severe consequences, including substantial regulatory fines and a decline in occupancy rates, directly impacting revenue and profitability.

- Reputational Vulnerability: The elderly care sector is inherently susceptible to negative press, with incidents of poor care or operational failures quickly eroding public confidence.

- Impact of Scrutiny: Past 'sectoral turbulence' demonstrates how widespread negative sentiment can lead to decreased demand and increased regulatory oversight.

- Mitigation Strategy: Adherence to the highest quality standards and transparent communication are essential to safeguard Clariane's reputation and maintain occupancy levels, crucial for financial stability.

Intense Competition in European Markets

Clariane faces a fiercely competitive landscape in the European elderly care sector. Major rivals such as DomusVi SAS and Attendo Group AB are significant players, intensifying the pressure on market share and service offerings. This intense rivalry often translates into downward pressure on pricing structures, potentially squeezing profit margins for all operators.

The struggle for residents and qualified staff is a constant challenge in this crowded market. Companies must continually invest in service quality and employee satisfaction to stand out. For instance, Attendo Group reported revenue of SEK 24,982 million (approximately €2.2 billion) in 2023, highlighting the scale of operations and investment required to compete effectively.

- Market Saturation: Key European markets, particularly France and Germany, show high penetration rates, limiting organic growth opportunities.

- Price Sensitivity: Increased competition can lead to price wars, impacting revenue per resident and overall profitability.

- Talent Acquisition: Attracting and retaining skilled caregivers is a significant hurdle, as demand often outstrips supply across the continent.

- Regulatory Differences: Navigating varying regulations across European countries adds complexity and operational costs, creating an advantage for established, adaptable players.

Clariane's operational environment is fraught with regulatory shifts and economic headwinds. Changes in national healthcare policies and tariff adjustments, as seen in France, can directly impact revenue. Furthermore, persistent inflation and interest rate volatility, projected to continue through 2024-2025, increase debt servicing costs and could devalue property assets, limiting investment capacity.

The company faces significant workforce challenges, including shortages of qualified caregivers due to low wages and demanding work, leading to rising labor costs and potential impacts on care quality. Intense competition from major players like DomusVi and Attendo Group (which reported SEK 24,982 million in revenue for 2023) intensifies pressure on pricing and necessitates continuous investment in service and employee satisfaction.

| Threat Category | Specific Risk | Potential Impact | 2024-2025 Data/Context |

|---|---|---|---|

| Regulatory & Policy | Unfavorable healthcare policy changes, tariff adjustments | Reduced revenue, profitability challenges | Recent French policy impacts highlight sensitivity. |

| Economic & Financial | Inflation, interest rate volatility, real estate market downturn | Increased debt servicing costs, asset devaluation, limited investment | Elevated rates through 2024-2025 would raise borrowing costs. |

| Operational & Workforce | Staff shortages, rising labor costs, quality of care decline | Higher operating expenses, reputational damage, lower occupancy | High turnover in France due to compensation issues noted. |

| Competitive Landscape | Market saturation, price wars, talent acquisition challenges | Pressure on profit margins, reduced market share, increased operational costs | Attendo Group's 2023 revenue of ~€2.2 billion indicates scale of competition. |

SWOT Analysis Data Sources

This Clariane SWOT analysis is built upon a robust foundation of data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These sources collectively provide a well-rounded view of Clariane's internal capabilities and external market positioning.