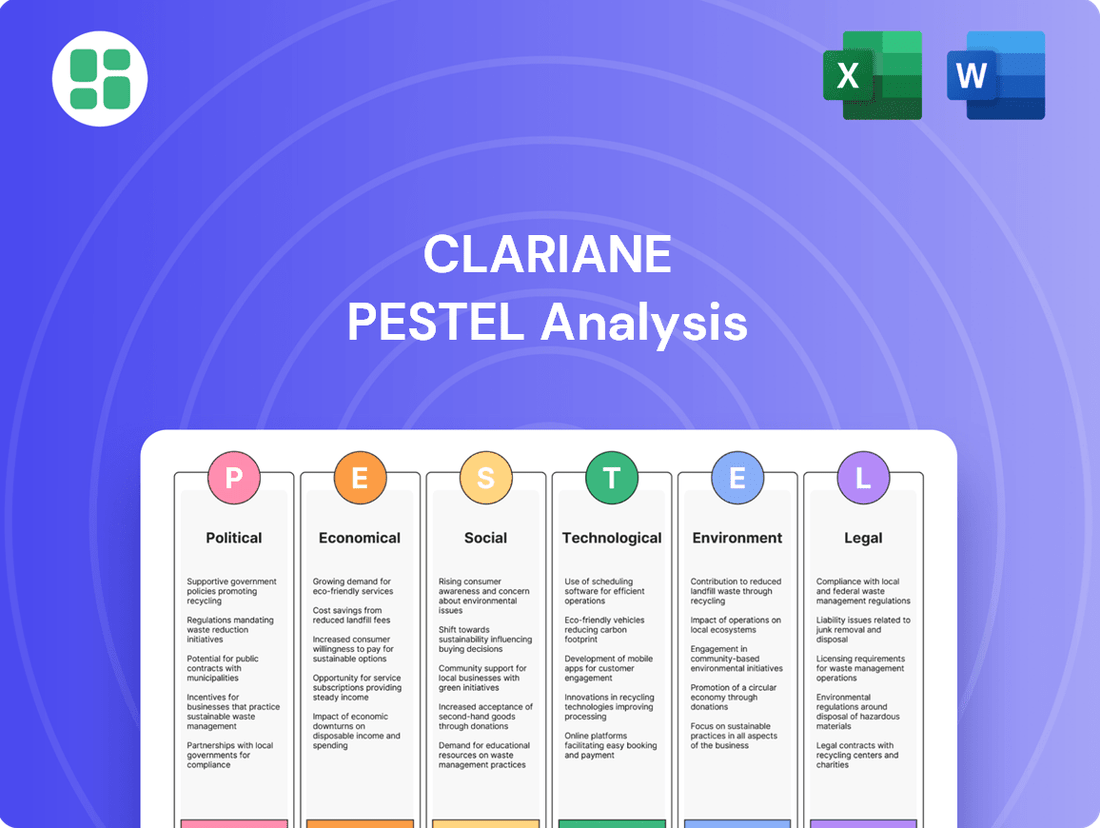

Clariane PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariane Bundle

Navigate the complex external forces shaping Clariane's trajectory with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities.

Gain a critical competitive advantage by leveraging our deep-dive insights into Clariane's operating environment. This comprehensive analysis is your key to informed strategic planning and risk mitigation.

Ready to unlock actionable intelligence? Purchase the full PESTLE analysis of Clariane today and equip yourself with the knowledge to make smarter, data-driven decisions. Don't miss out on crucial market foresight.

Political factors

Clariane's business is significantly shaped by government healthcare policies and public funding for long-term care across its European markets. Fluctuations in government expenditure, reimbursement rates, and subsidy availability directly affect the company's financial performance.

For instance, France's introduction of a new pricing structure for medical, post-acute, and rehabilitation services in H1 2025 necessitated operational adjustments for Clariane, highlighting the immediate impact of policy changes on its revenue streams.

The regulatory environment for senior care facilities, including nursing homes and assisted living, is a critical political factor for Clariane. These regulations, which dictate care quality, staffing levels, and patient rights, are constantly evolving and differ significantly across countries. For instance, in France, where Clariane has a substantial presence, the government has been actively reviewing and updating its healthcare and social care regulations, aiming to improve quality and accessibility. As of early 2024, discussions around new national standards for elderly care facilities were ongoing, potentially impacting operational costs and service delivery models.

Political stability within the European Union and its member states is a crucial element for companies like Clariane, influencing investment decisions and long-term strategic planning. The ongoing integration efforts, particularly in healthcare and social policies, present opportunities for streamlined regulations and cross-border operations, although geopolitical shifts can introduce volatility.

The European Union's commitment to a European Care Strategy, aiming for more coordinated approaches in social services, signals a potential for harmonized standards that could benefit Clariane's operational framework across different member countries. For instance, the EU’s projected social spending in 2025 is expected to remain robust, reflecting a continued emphasis on care services.

Labor Laws and Immigration Policies

Labor laws and immigration policies are critical for Clariane, especially in light of ongoing staff shortages in the European long-term care sector. Governments are increasingly looking at ways to bolster the care workforce. For instance, in Germany, a key market for Clariane, there has been a push to streamline the recognition of foreign qualifications for healthcare professionals. This directly impacts the pool of available talent and the associated recruitment costs for companies like Clariane.

Government initiatives aimed at attracting and retaining care professionals are particularly vital. These can include:

- Increased investment in vocational training and apprenticeships for care roles.

- Revisions to immigration laws to facilitate the entry of skilled and unskilled care workers.

- Potential adjustments to minimum wage and working condition regulations to make the sector more appealing.

Public-Private Partnership Models

Governments' evolving attitudes towards public-private partnerships (PPPs) significantly shape Clariane's operational landscape. Policies that favor or disfavor private sector participation in healthcare and social care directly impact expansion and collaboration opportunities. For instance, a supportive stance can unlock new markets, while restrictive measures can limit growth potential.

The trend towards community-based care models, as seen in Italy, presents both challenges and opportunities for private operators. These shifts require adaptation and innovation in service delivery to align with public policy objectives. In 2024, the European Union continued to emphasize integrated care strategies, potentially increasing the attractiveness of PPPs for long-term care providers like Clariane.

- Policy Influence: Government decisions on PPPs in healthcare and social care directly affect Clariane's growth and partnership avenues.

- Market Access: Policies encouraging private sector involvement can open new markets, while restrictive ones can limit expansion.

- Community Models: Italy's community-based approach exemplifies new service delivery models that Clariane may need to integrate.

- EU Strategy: Continued EU focus on integrated care in 2024 suggests a favorable environment for PPPs in long-term care.

Government healthcare policies and public funding for long-term care across Europe are central to Clariane's operations, with reimbursement rates and subsidy availability directly impacting financial performance. France's H1 2025 pricing structure adjustments for medical services illustrate this sensitivity. Evolving regulations on care quality and staffing, such as those being reviewed in France in early 2024, also necessitate constant adaptation.

Labor laws and immigration policies are critical, especially with European staff shortages in care. Germany's efforts to streamline foreign qualification recognition in 2024 directly influence Clariane's talent pool and recruitment costs. The EU's European Care Strategy and projected robust social spending for 2025 underscore a continued focus on care services, potentially harmonizing standards and benefiting providers.

Political stability across the EU is vital for Clariane's long-term planning, with geopolitical shifts introducing volatility. Government attitudes towards public-private partnerships (PPPs) are also key; Italy's community-based care models, emphasized by the EU's integrated care strategies in 2024, present both challenges and opportunities for adaptation.

| Policy Area | Impact on Clariane | Example/Data Point |

|---|---|---|

| Healthcare Funding & Reimbursement | Directly affects revenue and profitability. | France's H1 2025 pricing structure changes. |

| Care Quality & Staffing Regulations | Influences operational costs and service models. | Ongoing review of national standards in France (early 2024). |

| Labor Laws & Immigration | Impacts workforce availability and recruitment costs. | Germany's push for faster recognition of foreign healthcare qualifications (2024). |

| Public-Private Partnerships (PPPs) | Shapes market access and expansion opportunities. | EU's emphasis on integrated care strategies (2024) may favor PPPs. |

What is included in the product

This Clariane PESTLE analysis comprehensively examines the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within Clariane's operating landscape.

Provides a clear, actionable overview of Clariane's external environment, simplifying complex PESTLE factors to identify and mitigate potential risks and capitalize on emerging opportunities.

Economic factors

The economic health of European nations, particularly their GDP growth and healthcare spending as a proportion of GDP, directly influences the financial resources available for long-term care providers like Clariane. For instance, in 2023, the Eurozone's GDP growth was 0.5%, and healthcare expenditure averaged around 9.0% of GDP across the EU. A strong economy typically means increased public and private investment in healthcare, which can benefit Clariane through higher demand and better reimbursement rates.

Conversely, economic slowdowns or fiscal austerity measures can strain government budgets, potentially leading to reduced funding for healthcare services. If economic growth falters, as seen in some European countries experiencing low or negative growth in late 2023 and early 2024 projections, Clariane might face tighter budget constraints and increased pressure on its pricing and service offerings.

Inflationary pressures are a significant concern for Clariane, with rising costs for wages, energy, and essential medical supplies directly impacting its operational expenses. For instance, in 2024, the company noted that wage increases, a major component of its cost base, were a key factor influencing its financial performance.

Clariane's profitability hinges on its capacity to either transfer these escalating costs to its residents or to negotiate more favorable reimbursement rates from public healthcare providers. The company's 2024 financial results did reflect a positive pricing impact, suggesting some success in mitigating these cost increases through strategic adjustments.

Changes in interest rates directly impact Clariane's cost of borrowing, influencing the feasibility and expense of new facility investments or renovations. Higher rates increase the burden of servicing debt, potentially slowing down expansion initiatives.

Access to affordable capital remains a critical enabler for Clariane's strategic objectives, including its ambitious disposal programs and efforts to reduce net debt through bond issuances. The company's ability to secure favorable financing terms is paramount for its financial restructuring and continued growth.

In 2025, Clariane demonstrated its proactive approach to capital management by successfully amending its syndicated loan facility. Furthermore, the issuance of new bonds in the same year underscores its commitment to optimizing its capital structure and managing its debt profile effectively.

Disposable Income and Private Payer Capacity

Disposable income among seniors and their families is a crucial driver for Clariane's private pay services. When this income rises, so does the capacity to afford premium care options, directly influencing demand. For instance, in 2024, a notable portion of older adults in many developed economies reported increasing savings, which could translate to greater spending on personalized eldercare.

Economic stability and the growth of wealth within the elderly demographic can significantly boost Clariane's revenue. This diversification away from solely public funding allows for investment in higher-end facilities and specialized services. As of early 2025, projections indicated continued wealth accumulation for many retirees, suggesting a positive outlook for private pay market penetration.

- Disposable income directly influences demand for private pay senior care services.

- Economic growth among the elderly population can increase spending on premium care.

- This trend diversifies revenue streams for companies like Clariane.

- Recent data suggests a positive trend in senior wealth accumulation, supporting this market.

Real Estate Market Dynamics

Real estate market dynamics are critical for Clariane, a major operator of care facilities. Fluctuations in property values and rental costs directly impact the company's substantial asset base and its financial leverage, influencing its ability to secure financing and manage its debt. For instance, rising property values could boost Clariane's asset-backed borrowing capacity, while increasing rental expenses would pressure operating margins.

Clariane actively manages its real estate portfolio as a strategic lever. The company has engaged in real estate partnerships and asset disposals to optimize its financial structure and maintain a healthy loan-to-value ratio. These moves are designed to free up capital and reduce financial risk, ensuring the company can continue investing in its core care services.

- Property Value Impact: Changes in real estate values directly affect Clariane's asset base and borrowing power.

- Rental Cost Sensitivity: Higher rental costs can significantly impact the company's operating expenses and profitability.

- Strategic Real Estate Management: Clariane utilizes partnerships and disposals to strengthen its financial position.

- Loan-to-Value Ratio Focus: The company actively manages its real estate to maintain a favorable loan-to-value ratio, crucial for financial stability.

Economic growth directly influences Clariane's revenue through demand for its services and the ability of individuals and governments to fund care. For instance, the Eurozone experienced a modest 0.5% GDP growth in 2023, with projections for 2024 indicating continued subdued growth, which can impact public healthcare budgets and private spending capacity.

Inflationary pressures, particularly on wages and energy costs, are a significant challenge for Clariane, as seen in its 2024 financial reports highlighting wage increases as a key cost driver. The company's ability to pass these costs on or secure better reimbursement rates is crucial for maintaining profitability amidst rising operational expenses.

Interest rate changes affect Clariane's borrowing costs and investment capacity. The company's efforts in 2025 to amend its syndicated loan facility and issue new bonds demonstrate a strategic focus on managing its capital structure and debt effectively in a fluctuating interest rate environment.

Disposable income among seniors is a vital factor for Clariane's private pay services. As of early 2025, many retirees have shown continued wealth accumulation, suggesting a positive trend for increased spending on premium eldercare options and diversifying Clariane's revenue streams.

| Economic Factor | Impact on Clariane | 2023/2024 Data/Trend |

|---|---|---|

| GDP Growth (Eurozone) | Influences public and private spending on healthcare and senior care. | 0.5% in 2023; Subdued growth projected for 2024. |

| Inflation (Wages, Energy) | Increases operational costs, impacting profitability. | Wage increases cited as a key cost driver in 2024. |

| Interest Rates | Affects cost of borrowing for investments and debt management. | Company actively managing debt through facility amendments and bond issuances in 2025. |

| Senior Disposable Income | Drives demand for private pay senior care services. | Positive trend in senior wealth accumulation observed as of early 2025. |

Full Version Awaits

Clariane PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Clariane PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable insights for strategic planning.

Sociological factors

Europe's demographic landscape is rapidly evolving, with a significant increase in the proportion of older adults. This aging trend is directly fueling a greater need for specialized long-term care solutions.

For companies like Clariane, this societal shift is a key growth catalyst. Projections indicate that the 85 and over population segment in Europe could nearly double by 2050, creating substantial demand for Clariane's core services across its operating regions.

Family structures are shifting, with a notable trend towards smaller households and increased geographical mobility. This means fewer adult children are living close enough to provide hands-on care for aging parents. For instance, in many developed nations, the average number of children per family has been declining for decades, and a significant portion of young adults relocate for education or employment opportunities, often far from their hometowns.

This evolution in family dynamics directly translates into a greater demand for professional long-term care services. As informal support networks shrink, families are increasingly turning to specialized providers like Clariane to ensure their loved ones receive quality care. This societal trend supports Clariane's business model by creating a larger pool of potential clients actively seeking formal care solutions.

Public perception of elderly care quality and safety is a major driver of trust and demand for Clariane's services. Negative media coverage, especially concerning ethical lapses or safety incidents, can significantly harm a company's reputation and occupancy rates. For example, a 2024 report highlighted that 70% of individuals surveyed consider the reputation of a care provider a primary factor in their decision-making process.

Lifestyle and Wellness Trends among Seniors

The senior population increasingly prioritizes active aging, wellness, and retaining independence, directly impacting the demand for specific services and facilities. This shift necessitates Clariane adapting its portfolio to embrace personalized, holistic, and community-focused care models that align with these evolving senior preferences.

For instance, a 2024 AARP survey indicated that over 75% of adults aged 50 and older prefer to age in place, highlighting a strong desire for continued independence. This trend translates into a growing market for home care services, accessible living arrangements, and technologies that support independent living, areas where Clariane can expand its offerings. Furthermore, the emphasis on wellness means a greater demand for preventative health programs, fitness activities, and mental health support within senior living communities.

- Active Aging Demand: Seniors are seeking opportunities for continued engagement, learning, and social interaction, moving beyond traditional passive care models.

- Wellness Focus: There's a rising interest in holistic health, including nutrition, mental well-being, and physical fitness programs tailored for older adults.

- Independence Drive: A significant majority of seniors wish to maintain their autonomy, driving demand for services and technologies that facilitate aging in place.

- Personalized Care: Clariane must cater to diverse individual needs and preferences, offering customized care plans and lifestyle choices.

Workforce Shortages and Attractiveness of Care Professions

Clariane, like many in the long-term care sector, grapples with significant workforce shortages across Europe. These shortages are often attributed to demanding work, competitive wages in other sectors, and an aging population requiring more care. For instance, in France, a country where Clariane has a substantial presence, the number of unfilled care positions has been a persistent concern, with projections indicating a growing deficit in qualified personnel for the coming years. This directly affects Clariane's operational capacity and the quality of care it can provide.

Addressing these challenges requires a strategic focus on enhancing the attractiveness of care professions. Clariane's efforts to improve working conditions, offer competitive compensation packages, and invest in continuous training and career development are crucial for talent acquisition and retention. For example, initiatives that provide clear career progression paths and recognize the specialized skills of caregivers can make a tangible difference. The sector's ability to attract and keep skilled staff will be a key determinant of its success in meeting the increasing demand for elder care services.

- Persistent Shortages: European long-term care sectors, including Clariane's operational areas, face ongoing difficulties in recruiting and retaining staff.

- Attraction Factors: Challenging work environments and relatively low wages compared to other industries contribute to the unattractiveness of care professions.

- Impact on Service: Workforce deficits directly threaten Clariane's ability to maintain high service quality and adequately staff its facilities.

- Retention Strategies: Improving working conditions, offering better pay, and investing in training are essential for attracting and keeping qualified caregivers.

Societal shifts are profoundly impacting the demand for elder care. Europe's aging population, with the 85+ segment projected to nearly double by 2050, creates a significant growth opportunity for companies like Clariane. Furthermore, changing family structures, marked by smaller households and increased geographic mobility, mean fewer adult children can provide direct care, driving demand for professional services. Public perception of care quality is paramount, with a 2024 survey showing 70% of respondents prioritizing reputation in provider selection. Seniors increasingly desire active aging and independence, influencing the need for personalized, wellness-focused care models.

| Sociological Factor | Description | Impact on Clariane | Supporting Data (2024/2025) |

|---|---|---|---|

| Aging Population | Increasing proportion of older adults in Europe. | Drives demand for long-term care. | 85+ population in Europe could nearly double by 2050. |

| Changing Family Structures | Smaller households, increased mobility, fewer live-in caregivers. | Increases reliance on professional care services. | Declining average number of children per family in developed nations. |

| Public Perception of Care | Trust and reputation are critical for client acquisition. | Negative publicity can harm occupancy rates. | 70% of surveyed individuals consider reputation a primary decision factor (2024). |

| Senior Lifestyle Preferences | Desire for active aging, wellness, and independence. | Requires adaptation of services to holistic and personalized models. | Over 75% of adults aged 50+ prefer to age in place (2024 AARP survey). |

Technological factors

The increasing adoption of digital health records (EHRs) and the drive for interoperability are reshaping healthcare delivery, directly influencing organizations like Clariane. These advancements promise more efficient patient care by enabling seamless data sharing across various medical settings.

The upcoming European Health Data Space Regulation, set to be fully implemented by 2025, will significantly impact Clariane's data management. This regulation prioritizes enhanced accessibility and robust security for electronic health data, requiring Clariane to adapt its systems for compliance and leverage these changes for improved patient information handling.

Telemedicine and remote monitoring advancements are reshaping healthcare delivery, offering greater flexibility and personalized patient care. These technologies can reduce the reliance on constant in-person supervision, a significant shift for service providers like Clariane.

Clariane can integrate these innovations into hybrid care models, potentially boosting patient outcomes and operational efficiency, especially within its home care segments. For instance, the global telemedicine market was projected to reach over $200 billion by 2025, indicating substantial growth and adoption.

The increasing integration of assistive technologies and robotics offers significant potential for Clariane. Innovations like smart home sensors and automated mobility aids can enhance resident independence and safety, directly impacting the quality of care provided. For instance, studies in 2024 highlighted that smart home technology adoption in senior living facilities reduced fall incidents by up to 20%.

Furthermore, robotics can alleviate the physical demands on Clariane's workforce, addressing critical staffing shortages. Companies are developing robotic assistants for tasks such as lifting and transferring residents, potentially improving caregiver well-being and operational efficiency. By 2025, the global market for healthcare robotics is projected to reach over $10 billion, indicating a strong trend towards technological adoption in the sector.

Data Analytics and AI in Care Management

Data analytics and AI are revolutionizing care management by enabling more efficient care planning, early detection of health declines, and tailored patient interventions. For instance, AI-powered predictive models are showing promise in identifying patients at high risk of readmission, a key metric for care quality and cost-efficiency. Clariane can leverage these technologies to enhance the personalized care pathways for its residents.

However, the integration of AI in medical devices and digital health solutions is increasingly governed by new European Union regulations. The EU AI Act, for instance, categorizes AI systems based on risk, with medical applications often falling into high-risk categories. This necessitates rigorous compliance checks and careful implementation strategies for Clariane to ensure its adoption of these technologies meets all legal and ethical standards.

- AI-driven predictive analytics can improve patient outcomes by identifying at-risk individuals earlier.

- The EU AI Act impacts the deployment of AI in healthcare, requiring adherence to strict guidelines for high-risk applications.

- Digital health solutions, including AI-powered tools, are subject to evolving data privacy and security regulations.

- Clariane must navigate these regulatory landscapes to responsibly integrate advanced technological solutions into its care management processes.

Cybersecurity and Data Privacy

The increasing reliance on digital platforms for patient care and operations makes robust cybersecurity and stringent data privacy adherence critical for Clariane. Failure to protect sensitive health information can lead to severe reputational damage and significant financial penalties, as exemplified by the growing number of data breach fines globally. For instance, in 2023, healthcare organizations faced substantial costs related to data breaches, underscoring the need for proactive security investments.

Clariane must continuously invest in secure IT infrastructure and compliance protocols to safeguard patient data, a non-negotiable aspect of maintaining trust and avoiding legal repercussions. Regulations like GDPR and similar frameworks mandate strict data handling practices, with non-compliance potentially resulting in fines up to 4% of global annual turnover. The evolving threat landscape necessitates ongoing updates to cybersecurity measures.

- Cybersecurity Investment: Clariane's commitment to protecting sensitive patient data requires sustained investment in advanced security solutions.

- Data Privacy Compliance: Adherence to regulations like GDPR is essential to avoid legal penalties and maintain patient trust.

- Reputational Risk: Data breaches can severely damage Clariane's reputation, impacting patient acquisition and retention.

- Digital Transformation: As digitalization increases, so does the vulnerability, making cybersecurity a top priority for operational continuity.

Technological advancements are rapidly transforming the healthcare landscape, directly impacting Clariane's operations and service delivery. The increasing integration of digital health records and the push for interoperability are streamlining patient care by enabling seamless data exchange across different medical facilities. Furthermore, the expansion of telemedicine and remote monitoring technologies offers greater flexibility and personalized care options, potentially enhancing patient outcomes and operational efficiency, especially within Clariane's home care services.

The adoption of assistive technologies and robotics presents significant opportunities to improve resident independence and safety, while also alleviating the physical strain on caregivers. For example, smart home technology adoption in senior living facilities has been shown to reduce fall incidents. Additionally, AI-driven predictive analytics can revolutionize care management by enabling earlier detection of health declines and more personalized interventions, though the deployment of AI in healthcare is increasingly subject to stringent regulations like the EU AI Act, requiring careful compliance strategies.

Clariane's commitment to robust cybersecurity and data privacy is paramount, given the increasing reliance on digital platforms. Adherence to regulations such as GDPR is crucial to avoid substantial penalties and maintain patient trust. The evolving threat landscape necessitates continuous investment in secure IT infrastructure and proactive security measures to protect sensitive health information.

| Technology Trend | Impact on Clariane | Key Data/Projection |

|---|---|---|

| Digital Health Records & Interoperability | Streamlined patient care, improved data sharing | European Health Data Space Regulation (fully implemented by 2025) |

| Telemedicine & Remote Monitoring | Enhanced flexibility, personalized care, operational efficiency | Global telemedicine market projected to exceed $200 billion by 2025 |

| Assistive Technologies & Robotics | Increased resident independence and safety, caregiver support | Smart home tech reduced fall incidents by up to 20% (2024 studies); Healthcare robotics market projected over $10 billion by 2025 |

| AI & Data Analytics | Improved care planning, early detection, tailored interventions | AI in medical devices subject to EU AI Act (high-risk classification) |

| Cybersecurity & Data Privacy | Protection of sensitive health data, compliance with regulations | GDPR fines up to 4% of global annual turnover; significant costs for data breaches in 2023 |

Legal factors

Clariane navigates a dense regulatory landscape, encompassing both national and European Union directives for healthcare and social care. These regulations cover critical areas such as patient safety protocols, the quality of services provided, the licensing of healthcare facilities, and adherence to specific operational standards, which differ considerably across the various European countries where Clariane operates.

The company must also contend with evolving EU regulations aimed at mitigating supply chain disruptions for medical devices. For instance, the Medical Device Regulation (MDR) and the In Vitro Diagnostic Regulation (IVDR) have introduced more stringent requirements for manufacturers and distributors, impacting product compliance and market access, with full implementation phases continuing through 2024 and 2025, potentially increasing compliance costs and lead times for essential medical supplies.

Employment legislation, encompassing collective bargaining agreements, working hour directives, and social security contributions, significantly shapes Clariane's human resources strategy and operational costs. For instance, in France, the minimum wage (SMIC) saw an increase of 1.13% in January 2024, impacting payroll expenses.

Navigating and ensuring compliance with the patchwork of labor laws across Clariane's operating countries, such as Germany and Spain, presents an ongoing challenge. These regulations dictate everything from hiring practices to employee benefits, requiring constant vigilance and adaptation.

Clariane must navigate a complex web of data protection laws, including the General Data Protection Regulation (GDPR) and similar national statutes, which govern the handling of sensitive personal and health information. These regulations mandate stringent protocols for data collection, storage, and processing, directly impacting Clariane's operations in the healthcare sector.

Failure to adhere to these data privacy mandates can result in severe financial penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is greater. Beyond financial repercussions, non-compliance poses a significant risk to Clariane's reputation and customer trust, underscoring the critical need for comprehensive data governance frameworks.

Real Estate and Property Laws

Real estate and property laws are fundamental to Clariane's operations, dictating how it can acquire, lease, and develop its numerous care facilities. These regulations directly affect the company's property portfolio management and expansion strategies.

Changes in zoning, building codes, and property taxes can significantly alter Clariane's investment calculus and financial maneuverability. For instance, stricter building codes might increase development costs for new facilities, while property tax hikes could reduce profitability.

- Property Ownership & Leasing: Laws governing freehold and leasehold interests directly impact Clariane's asset base and rental expenses.

- Zoning & Land Use: Regulations determine where Clariane can establish new care homes, influencing site selection and development feasibility.

- Building Codes & Safety Standards: Compliance with evolving construction and safety regulations affects capital expenditure for facility upgrades and new builds.

- Property Taxation: Local and national property tax regimes directly influence operating costs and the financial viability of existing and future sites.

Consumer Protection and Patient Rights Legislation

Consumer protection and patient rights legislation are critical for Clariane, particularly in its healthcare and elderly care services. Laws governing service standards, pricing transparency, and patient complaint resolution directly impact operational procedures and contractual agreements. For instance, in France, where Clariane operates significantly, the Consumer Code (Code de la consommation) and specific healthcare regulations mandate clear information disclosure and fair practices, with potential fines for non-compliance. Failure to adhere to these can erode patient trust and lead to costly legal battles, as seen in various sectors where consumer protection agencies actively pursue violations.

Ensuring robust compliance with these legal frameworks is paramount for Clariane. This includes:

- Adherence to transparency requirements: Clearly communicating service terms, pricing, and patient rights, aligning with directives like the EU's Unfair Commercial Practices Directive.

- Robust complaint handling: Establishing efficient and accessible mechanisms for patients to raise concerns, as mandated by many national consumer protection laws.

- Data privacy compliance: Strictly following regulations like GDPR for handling sensitive patient information, a critical aspect of patient rights.

- Contractual fairness: Ensuring all service agreements with patients and their families are legally sound and do not contain unfair clauses.

Clariane operates under a complex web of legal and regulatory frameworks across its European markets, directly influencing its operational strategies and financial performance. The company must continually adapt to evolving legislation concerning healthcare quality, patient safety, and licensing, with strict adherence required to EU directives like the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which continue to see phased implementation through 2024 and 2025, potentially impacting supply chain costs. Furthermore, labor laws, including minimum wage adjustments, as seen with the 1.13% increase in France's SMIC in January 2024, and varying employment regulations across countries like Germany and Spain, significantly affect human resource management and payroll expenses.

Data protection laws, particularly the GDPR, impose stringent requirements on handling sensitive patient information, with non-compliance carrying penalties of up to 4% of global annual turnover or €20 million. Property laws also play a crucial role, dictating site acquisition, development, and operational costs through zoning, building codes, and property taxation, all of which influence Clariane's capital expenditure and site selection decisions. Consumer protection laws, mandating transparency in services and fair practices, are vital for maintaining patient trust and avoiding legal repercussions.

| Legal Factor | Impact on Clariane | Example/Data Point |

| Healthcare Regulation | Ensures quality and safety, impacts licensing and operational standards. | Phased implementation of EU MDR/IVDR through 2024-2025 affects medical device compliance. |

| Employment Law | Shapes HR strategy, influences payroll costs and working conditions. | France's SMIC increased by 1.13% in January 2024. |

| Data Protection (GDPR) | Mandates strict handling of patient data, risk of significant fines. | Fines can reach up to 4% of global annual turnover or €20 million. |

| Property Law | Affects site acquisition, development costs, and property tax liabilities. | Zoning and building codes influence capital expenditure for new facilities. |

| Consumer Protection | Governs service transparency and patient rights, impacts contractual agreements. | French Consumer Code requires clear information disclosure for services. |

Environmental factors

Climate change presents significant physical risks to Clariane's operations, particularly through extreme weather events like floods and heatwaves. These events can disrupt service delivery and damage facilities, necessitating investments in resilient infrastructure and robust emergency response plans. For instance, the increasing frequency of severe storms in Europe directly impacts the company's ability to maintain uninterrupted care for its residents.

Growing regulatory demands and a heightened sense of corporate accountability are pushing companies like Clariane to enhance energy efficiency and shift towards cleaner energy. This trend is a significant environmental factor influencing business operations and strategy.

Clariane has responded by setting ambitious goals to cut its energy-related carbon emissions. Notably, these targets were validated by the Science Based Targets initiative (SBTi) in June 2024, demonstrating a commitment to scientifically-aligned decarbonization efforts.

The healthcare industry, including Clariane's operations, is a significant generator of waste, with a notable portion being hazardous medical waste. For instance, the World Health Organization (WHO) estimated in 2019 that healthcare activities generate 5.9 million tonnes of waste annually, with a substantial part being hazardous. This reality places a spotlight on companies like Clariane to manage this waste responsibly.

Clariane is experiencing heightened pressure from regulators and the public to implement robust waste reduction strategies. This includes enhancing recycling programs and integrating circular economy principles across its service delivery. For example, by 2024, many European countries have strengthened their waste management directives, pushing for higher recycling rates and reduced landfill waste, directly impacting Clariane's operational compliance and cost structures.

Water Resource Scarcity and Management

Water scarcity presents a tangible risk to Clariane's operations, particularly in regions experiencing drought or increased competition for water resources. This necessitates robust water management strategies to ensure continuity of care and service delivery. For instance, in 2024, several European countries, including Spain and parts of France where Clariane operates, continued to face significant water stress, impacting various industries.

Clariane's commitment to environmental sustainability is reflected in its policy to minimize the impact on water and other natural resources. This includes implementing water-saving technologies and responsible waste management practices across its facilities. The company aims to reduce its water footprint, aligning with broader European Union directives on water resource management and conservation, which are becoming increasingly stringent.

- Operational Risk: Regions with high water stress could disrupt facility operations, impacting essential services.

- Management Focus: Clariane's environmental policy prioritizes reducing water usage and its overall impact on natural resources.

- Regulatory Alignment: The company's practices are geared towards meeting evolving environmental regulations, including those related to water conservation.

- Resource Efficiency: Investments in water-efficient technologies are crucial for maintaining operational resilience and sustainability.

Sustainability Reporting and ESG Investor Scrutiny

Investor demand for detailed ESG reporting is a significant environmental factor shaping corporate strategy. Clariane's proactive approach, including its validated Science Based Targets initiative (SBTi) commitment, directly addresses this growing scrutiny. In 2024, the company continued to embed sustainability into its operations, aiming to meet evolving stakeholder expectations for transparency and measurable environmental impact reduction.

Clariane faces growing pressure to manage waste responsibly, especially hazardous medical waste, with healthcare activities generating millions of tonnes globally each year. Stricter European waste management directives in 2024 are pushing for higher recycling rates and reduced landfill, impacting compliance and costs.

Water scarcity is a tangible risk, with regions like Spain and parts of France experiencing water stress in 2024, potentially disrupting Clariane's essential services. The company is implementing water-saving technologies to meet stringent EU water resource management directives.

Clariane's commitment to reducing carbon emissions, validated by the SBTi in June 2024, addresses investor demand for ESG reporting and aims to meet evolving stakeholder expectations for transparency and measurable environmental impact reduction.

| Environmental Factor | Impact on Clariane | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change (Extreme Weather) | Disruption of services, damage to facilities | Increased frequency of severe storms in Europe impacting operations |

| Waste Management | Operational costs, regulatory compliance | Strengthened European waste directives pushing for higher recycling rates |

| Water Scarcity | Risk to continuity of care, operational resilience | Continued water stress in key European operating regions (e.g., Spain, France) |

| Carbon Emissions | Reputational risk, investor scrutiny | SBTi validation of emission reduction targets in June 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive blend of official government publications, reputable financial institutions, and specialized industry research. This ensures a robust understanding of political, economic, social, technological, legal, and environmental influences.