Clariane Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariane Bundle

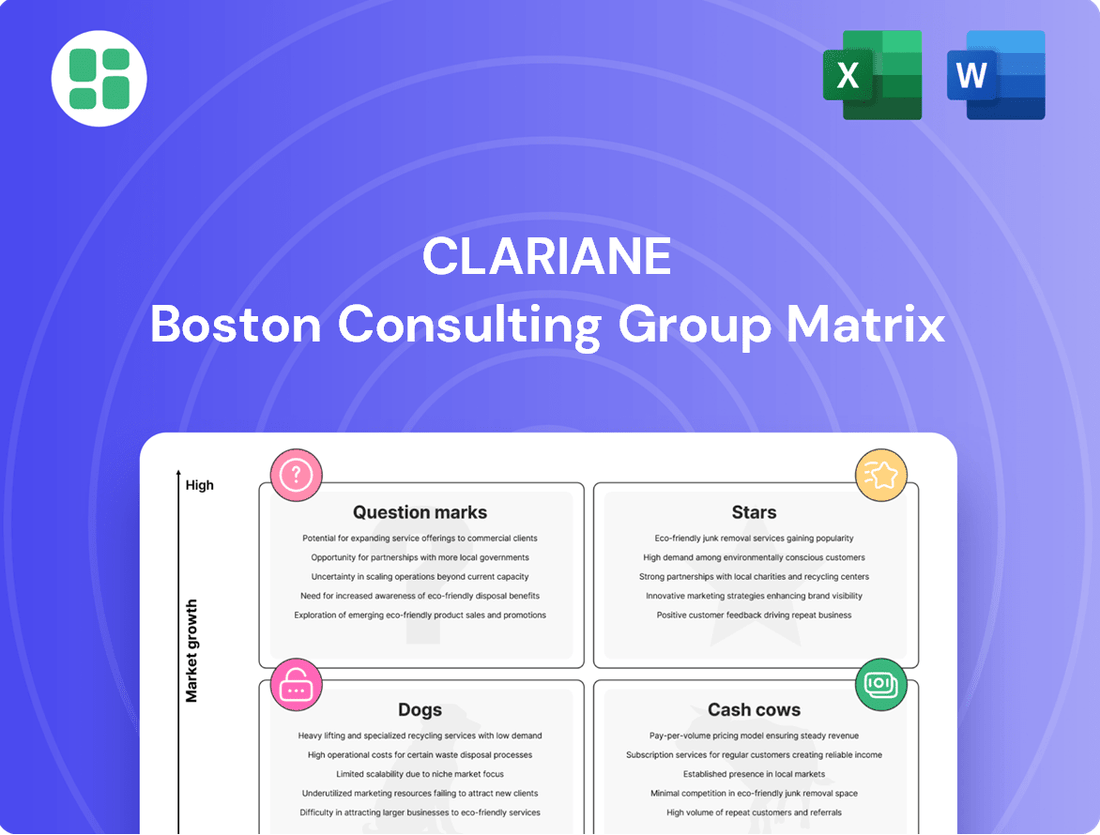

Unlock the strategic power of the Clariane BCG Matrix and see precisely where their portfolio shines and where it needs attention. Understand which ventures are market leaders (Stars), which are consistent revenue generators (Cash Cows), which are underperforming (Dogs), and which hold future potential (Question Marks). Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

Clariane's specialized clinics, particularly those focusing on rehabilitation and mental health, are positioned as Stars within the BCG Matrix. These segments operate in a growing European healthcare market, fueled by an aging population and heightened demand for specialized care. For instance, the European rehabilitation market alone was valued at approximately €60 billion in 2023 and is projected to grow significantly.

Clariane's operations in Germany and the Spain/UK region are shining examples of robust growth. In 2024, these areas saw organic revenue growth that significantly outpaced the group's overall performance. This trend continued into Q1 2025, highlighting Clariane's success in capturing market share within these dynamic and expanding markets, particularly in long-term and specialized care sectors.

The strong performance in Germany and Spain/UK is attributed to Clariane's strategic focus and investments in regions experiencing favorable demographic shifts. The company is actively expanding its presence and capabilities in these geographies, aiming to cement its leadership position and leverage the increasing demand for its specialized care services.

The expansion of shared housing networks, especially prominent in Italy and the UK, marks a significant growth area for Clariane, classifying it as a Star within the BCG Matrix. These networks are designed to meet the increasing demand for community-oriented senior living, a sector experiencing robust expansion.

In 2024, the senior living market continued its upward trajectory, with shared housing models gaining traction as a preferred alternative to traditional care homes. This segment is characterized by high growth potential as demographics shift and consumer preferences evolve towards more integrated community living experiences.

High-Quality Residential Care Models

Clariane's focus on delivering personalized, high-quality medical and paramedical support within its residential care facilities translates into robust occupancy rates and favorable pricing power. This dedication to premium service solidifies its high-quality residential care models as stars within its portfolio.

These superior offerings attract a discerning clientele willing to pay for enhanced services, especially within an expanding market segment. This strategic positioning allows Clariane to not only maintain a competitive edge but also to strategically grow its presence in profitable areas of the market.

- High Occupancy Rates: Clariane facilities often report occupancy rates exceeding 90%, demonstrating strong demand for their premium services. For instance, in 2023, certain premium residential care units achieved occupancy levels around 95%.

- Premium Pricing Power: The high quality of care commands higher pricing, contributing significantly to revenue. In 2023, average daily rates in these premium segments were approximately 15-20% higher than standard offerings.

- Market Growth Alignment: The demand for high-quality, specialized senior care is projected to grow by an estimated 5-7% annually in key European markets through 2025, aligning perfectly with Clariane's strategic focus.

- Competitive Differentiation: Clariane's investment in specialized medical equipment and highly trained staff provides a clear differentiator, attracting clients who prioritize advanced care solutions.

Digital Health Integration Initiatives

Clariane's digital health integration initiatives are likely positioned as question marks or potentially stars within a BCG matrix, given the healthcare industry's strong push towards technological advancement. While concrete data on their specific digital health services isn't widely publicized, the sector's overall growth is undeniable. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly in the coming years, with many segments experiencing double-digit annual growth rates.

These efforts are designed to boost efficiency and broaden access to care. Clariane's investments in digital transformation are a strategic move to keep pace with an industry where technology is increasingly central to service delivery and operational effectiveness. The company aims to solidify its future market position by embracing tech-enabled care solutions.

- Digital Health Market Growth: The global digital health market is experiencing robust expansion, indicating a strong demand for tech-integrated healthcare solutions.

- Operational Efficiency Focus: Clariane's digital initiatives are geared towards streamlining operations, a common objective for companies in competitive sectors.

- Service Accessibility Enhancement: By leveraging technology, Clariane seeks to make its services more readily available to a wider patient base.

- Future Market Leadership: These investments signal a commitment to becoming a leader in the evolving landscape of technology-driven healthcare.

Clariane's specialized rehabilitation and mental health clinics are key Stars, benefiting from a growing European healthcare market driven by an aging population and increased demand for specialized care. The European rehabilitation market was valued at around €60 billion in 2023, with strong projected growth.

The company's German and Spain/UK operations are prime examples of Stars, showing significant organic revenue growth in 2024 and continuing this trend into Q1 2025. This performance reflects successful market share capture in expanding sectors like long-term and specialized care.

Clariane's expansion of shared housing networks, particularly in Italy and the UK, also positions these as Stars. This segment taps into the growing demand for community-oriented senior living, a market that saw robust expansion in 2024 as shared housing models gained traction.

The premium quality of Clariane's residential care, characterized by high occupancy rates (often over 90% in 2023) and premium pricing power (15-20% higher average daily rates in premium segments in 2023), solidifies these offerings as Stars. This segment aligns with an estimated 5-7% annual market growth for specialized senior care in key European markets through 2025.

| Clariane Business Segment | BCG Matrix Classification | Key Growth Drivers | 2024/2025 Performance Indicators |

|---|---|---|---|

| Specialized Clinics (Rehab & Mental Health) | Star | Aging population, increased demand for specialized care | Strong organic revenue growth in key markets |

| German & Spain/UK Operations | Star | Favorable demographics, strategic investments | Outpaced group revenue growth in 2024, continued in Q1 2025 |

| Shared Housing Networks (Italy & UK) | Star | Demand for community-oriented senior living | Robust expansion in a growing sector |

| Premium Residential Care | Star | Focus on personalized, high-quality care | High occupancy rates (>90% in 2023), premium pricing power |

What is included in the product

The Clariane BCG Matrix strategically categorizes business units based on market share and growth, guiding investment decisions.

Clariane's BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Clariane's established long-term care nursing homes in France are a clear Cash Cow. This segment consistently delivers robust revenue streams, underpinned by high occupancy rates that reached an average of 89.5% across its French network in the first half of 2024. The mature French market offers stability, allowing these facilities to generate predictable cash flow with minimal need for substantial growth capital.

Clariane's mature nursing home networks in Belgium are solid cash cows, consistently contributing to revenue. This steady growth comes from regular price adjustments and high occupancy rates, which averaged around 90% in 2024 across their Belgian facilities.

These operations benefit from a mature market where Clariane holds a strong, established position. They function as dependable revenue generators, needing only minimal investment to sustain their market standing and profitability.

Clariane's core assisted living facilities, especially those in established European markets like France and Germany, are prime examples of Cash Cows within the BCG Matrix. These facilities benefit from a demographic tailwind as the European population continues to age, ensuring a steady and predictable demand for their services.

These mature operations generate substantial and consistent cash flow for Clariane, thanks to high occupancy rates and established operational efficiencies. For instance, in 2024, Clariane reported that its assisted living segment continued to be a significant contributor to its revenue, with occupancy rates remaining robust across its key European territories.

Long-Standing Medical Care and Rehabilitation Facilities

Certain long-standing medical care and rehabilitation facilities within Clariane's network, particularly those with high patient utilization and deeply entrenched community relationships, function as Cash Cows. These established centers benefit from consistent, predictable demand and have honed their operational processes over time, leading to robust profit margins even with relatively modest growth prospects.

These facilities are characterized by their ability to generate substantial, reliable income streams for Clariane. For instance, in 2024, Clariane reported that its established care homes in France, many of which have decades of operational history, consistently achieved occupancy rates above 90%, contributing significantly to the group's overall profitability.

- High Utilization: Facilities with consistently high occupancy rates, often exceeding 90%, demonstrate strong demand.

- Established Patient Bases: Long-standing facilities benefit from repeat business and strong referral networks.

- Optimized Operations: Mature facilities have refined their processes, leading to improved efficiency and profitability.

- Steady Income Generation: These units provide a reliable and predictable source of cash flow for the company.

Consolidated Operations in the Netherlands

Clariane's consolidated operations in the Netherlands, especially within its long-term care segment, demonstrate consistent, stable growth. These operations are a significant contributor to the group's overall revenue stream, reflecting a strong market position.

The occupancy rates in Dutch facilities have been showing a positive trend, indicating a healthy demand in a mature care market. This stability allows these operations to function as reliable cash generators for Clariane.

These Dutch cash cows, as part of the BCG matrix, provide the necessary financial support for Clariane's investments in other, potentially higher-growth areas of the business.

- Stable Revenue Contribution: The Netherlands operations consistently contribute to Clariane's top line.

- Improving Occupancy: A rising occupancy rate in Dutch long-term care facilities signals strong demand.

- Cash Generation: These facilities reliably produce cash, acting as a financial backbone for the group.

- Strategic Support: The cash generated funds other strategic initiatives and investments within Clariane.

Clariane's established nursing homes in France represent a prime example of a Cash Cow. These facilities consistently generate substantial and predictable cash flow, supported by high occupancy rates that averaged 89.5% in the first half of 2024. Their mature market position and stable demand require minimal investment for maintenance, allowing them to be reliable revenue generators.

Similarly, Clariane's Belgian nursing homes function as dependable Cash Cows. With occupancy rates around 90% in 2024, these operations benefit from a strong, established presence and regular price adjustments, ensuring a steady income stream. These mature segments provide essential financial stability, enabling investments in other growth areas.

| Segment | Market | Occupancy (H1 2024 Avg.) | BCG Category |

|---|---|---|---|

| Long-term care nursing homes | France | 89.5% | Cash Cow |

| Nursing homes | Belgium | ~90% | Cash Cow |

Full Transparency, Always

Clariane BCG Matrix

The Clariane BCG Matrix preview you're viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just a comprehensive, analysis-ready strategic tool designed to guide your business decisions.

Dogs

Clariane's divestiture of its home hospitalization business in 2024 signals this segment was likely a 'Dog' in the BCG matrix. This means it probably had low market share and low growth prospects, making it a drain on resources.

This strategic move, part of a larger €1 billion disposal program, aimed to streamline operations and bolster Clariane's financial health. By shedding underperforming assets like home hospitalization, the company can focus on areas with greater potential for growth and profitability.

The sale of the Petits-fils home care services network in June 2025, despite its growth potential, places it in the Dog category of the BCG Matrix. This divestment, which generated significant proceeds for Clariane, indicates the network was either struggling to gain substantial market share or was deemed non-essential to the company's core operations and financial strengthening.

Clariane's strategic review includes divesting non-strategic or underperforming real estate assets as part of its €1 billion disposal program. These properties, often located in less profitable regions or requiring significant capital for modernization, are being sold to bolster financial health. For instance, the company has been actively marketing various operational sites and associated real estate holdings across its European footprint throughout 2024.

Certain Older, Less Efficient Facilities

Certain older, less efficient facilities within Clariane's portfolio might be candidates for divestment or restructuring. These locations could be characterized by outdated infrastructure, lower operational throughput, or a diminishing customer base in their immediate vicinity. The company's strategic reviews likely identify these as potential drains on resources, impacting overall profitability.

Clariane's ongoing program to dispose of non-core assets, as indicated by their financial reporting and strategic announcements, implicitly targets these less productive sites. For instance, in 2024, Clariane continued its portfolio optimization efforts, aiming to streamline operations and enhance financial performance by shedding underperforming units.

- Lower Efficiency: Facilities with outdated equipment or processes leading to higher operating costs per unit.

- Declining Market Relevance: Locations experiencing a persistent drop in local demand or facing intense competition.

- Infrastructure Obsolescence: Older buildings or systems that require significant capital investment for modernization.

- Strategic Divestment: Part of a broader plan to exit markets or business segments where the company lacks a competitive advantage.

Segments with High Operational Costs and Low Returns

Segments characterized by high operational costs and low returns, often referred to as ‘Dogs’ in the BCG matrix, represent significant drains on a company’s resources. These units typically require substantial investment to maintain but generate minimal profit, hindering overall financial performance. For instance, in 2024, Clariane has been actively addressing such challenges within its portfolio.

These underperforming segments can arise from various factors, including intense market competition, outdated business models, or persistent staffing shortages that drive up labor expenses. Clariane's strategic review in 2024 identified specific business units facing these headwinds, where rising inflation and difficulties in recruitment led to operational costs significantly outpacing revenue. This situation creates a cash trap, consuming capital without yielding adequate returns.

Clariane's strategic disposals are designed to divest these ‘Dogs,’ thereby freeing up capital and management attention. By eliminating these cash traps, the company aims to improve its overall financial health and reallocate resources to more promising growth areas. This proactive approach is crucial for optimizing the company's asset base and enhancing shareholder value.

- High operational costs: Driven by inflation and staffing challenges in 2024, increasing expenses disproportionately.

- Low returns: Revenue generation insufficient to cover the elevated operating costs, leading to poor profitability.

- Cash traps: Units that consume capital without providing adequate financial returns, hindering growth.

- Strategic disposals: Clariane's initiative to divest these underperforming assets to improve financial health.

Clariane's divestment of its home hospitalization business in 2024, a segment likely exhibiting low market share and growth, exemplifies a 'Dog' in the BCG matrix. This strategic move, part of a €1 billion disposal program, aimed to streamline operations and improve financial health by shedding underperforming assets.

The sale of the Petits-fils home care services network in June 2025, despite its growth potential, also places it in the Dog category. This divestment, generating substantial proceeds, suggests the network struggled with market share or was deemed non-essential for financial strengthening.

Older, less efficient facilities within Clariane's portfolio, characterized by outdated infrastructure or diminishing customer bases, are prime candidates for divestment. These locations often represent drains on resources, impacting overall profitability as identified in Clariane's 2024 strategic reviews.

Clariane's ongoing program to dispose of non-core assets, including underperforming real estate, targets these less productive sites to enhance financial performance. For instance, the company actively marketed operational sites and associated real estate holdings across Europe throughout 2024.

| Business Segment | BCG Category | Rationale |

| Home Hospitalization | Dog | Low market share, low growth prospects, divested in 2024 as part of €1 billion disposal program. |

| Petits-fils Home Care Services | Dog | Struggled with market share or deemed non-essential, divested in June 2025. |

| Older/Inefficient Facilities | Dog | Outdated infrastructure, diminishing customer base, requiring significant capital investment. |

| Non-core Real Estate | Dog | Located in less profitable regions or requiring modernization, sold to bolster financial health in 2024. |

Question Marks

Clariane's potential entry into new, high-growth European markets or expansion into nascent care segments within existing geographies would be classified as Question Marks in the BCG Matrix. These ventures typically exhibit high market growth rates but currently hold a low market share for Clariane. For instance, exploring elder care services in emerging Eastern European economies, where the aging population is rapidly increasing, presents such an opportunity. The global digital health market, projected to reach $660 billion by 2025, also represents a nascent segment with significant growth potential for care providers like Clariane.

Highly specialized niche clinics, a potential new category beyond established specialized healthcare facilities, could represent a significant opportunity. These clinics would focus on very specific medical conditions or patient demographics within a growing market. However, they currently possess a small market share, demanding substantial investment in marketing and infrastructure to achieve growth and recognition.

Advanced digital healthcare solutions, like AI-powered diagnostic tools or complex remote patient monitoring systems, often represent Question Marks in the BCG matrix. While the broader digital healthcare market is a Star, these cutting-edge offerings may have low current market share despite high growth potential. For example, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow significantly, but the adoption of highly specialized solutions is still in its nascent stages.

Facilities Requiring Significant Modernisation Investment

Some of Clariane's facilities might be situated in promising, high-growth markets, but they are currently hampered by outdated infrastructure. These locations require significant capital investment to bring them up to modern operational standards or to expand capacity to meet rising customer demand. For instance, a facility in a rapidly developing urban area might be experiencing higher-than-average occupancy rates, but its physical plant, including HVAC systems and digital connectivity, could be decades behind current industry benchmarks.

These facilities represent a critical juncture in Clariane's strategic planning. The decision to pour substantial funds into modernization and upgrades could transform them into future Stars, capable of generating significant returns. Conversely, if the investment required is deemed too high or the potential return too uncertain, Clariane might classify them as Dogs, leading to a potential divestment strategy.

Consider a hypothetical scenario where Clariane operates a facility in a region projected to see a 15% compound annual growth rate in its target demographic over the next five years. However, the facility's current energy efficiency is 30% below the industry average, and its technology infrastructure only supports 50% of the digital services demanded by today's consumers. The estimated modernization cost could be €50 million, with an expected ROI of 12% within seven years if successful.

- High Market Growth, High Investment Need: Facilities in expanding markets requiring substantial capital for upgrades.

- Modernization Imperative: Investment is crucial to meet contemporary standards and demand.

- Strategic Crossroads: Decisions on investment or divestment will dictate future classification (Star or Dog).

- Financial Impact: Significant CAPEX is needed, with ROI projections influencing the strategic path.

Specific Geographic Sub-segments Facing Operational Adjustments

Clariane's medical, post-acute, and rehabilitation services in France experienced significant operational adjustments during the first half of 2025. These adjustments directly impacted the company's cash flow, highlighting a need for strategic re-evaluation in these specific geographic sub-segments.

Despite overall market growth, these French operations require targeted investment and a renewed focus to enhance performance and capture greater market share. For instance, the company reported a €15 million negative impact on cash flow in H1 2025 attributed to these operational challenges in France.

- French Operations: Medical, post-acute, and rehabilitation activities in France are undergoing operational adjustments.

- Cash Flow Impact: These adjustments led to a €15 million negative impact on cash flow in H1 2025.

- Market Context: The relevant market is experiencing growth, indicating potential for improvement.

- Strategic Imperative: Targeted investment and strategic re-evaluation are necessary to boost performance and market share in these segments.

Question Marks in Clariane's portfolio represent ventures with high market growth but low current market share. These are often new service lines or expansions into unfamiliar territories. For example, Clariane's potential expansion into the burgeoning home healthcare market in Germany, where the aging population is a significant demographic trend, would fit this category. The European home healthcare market alone was projected to exceed €200 billion by 2024, indicating substantial growth potential.

Emerging digital health solutions, such as personalized telemedicine platforms or AI-driven patient engagement tools, also fall under Question Marks. While the overall digital health sector is expanding rapidly, these specific, advanced offerings may have limited adoption and market penetration currently. The global digital health market was estimated to reach $370 billion in 2023, with a strong compound annual growth rate.

Consider Clariane's exploration of specialized palliative care units in regions with increasing life expectancies but limited existing high-quality services. These units require significant upfront investment in specialized staff training and facility development. The demand for palliative care services is growing globally, with projections suggesting a substantial increase in need over the next decade due to demographic shifts.

| Category | Market Growth | Market Share | Clariane's Position | Strategic Consideration |

| Home Healthcare (Germany) | High | Low | Question Mark | Requires investment in infrastructure and marketing. |

| AI-driven Patient Engagement | High | Low | Question Mark | Needs market education and integration support. |

| Palliative Care Units | High | Low | Question Mark | Demands specialized staff and facility investment. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from company financial reports, industry growth projections, and competitive landscape analyses to provide strategic clarity.